Dow Jones Futures Rise As Market Revives, 25 Stocks In Buy Zones; Will Fed Go Big On Rate Cut

Dow Jones futures rose slightly Monday morning. S&P 500 futures tilted lower while Nasdaq futures fell, led by Apple (AAPL). The Federal Reserve meeting takes center stage this week, with policymakers set to cut rates for the first time since the Covid crisis in 2020.

The stock market rally had a dramatic revival, with the S&P 500 and Nasdaq composite posting their best weekly gains of the year to reclaim their 50-day lines after selling off in the prior week. The S&P 500 and Dow Jones are close to all-time highs. A large number of leading stocks flashed buy signals.

↑

X

How Battleground Turned In Bulls’ Favor; Zillow, Wheaton, AppLovin In Focus

Investors are upbeat about Fed rate cuts and artificial intelligence, the two big catalysts for the stock market rally this year.

Nvidia (NVDA) CEO Jensen Huang said last week that demand for the company’s AI chips is “incredible” and said production of its next-generation Blackwell chips is in full swing. Nvidia stock surged for the week lifting other AI plays and the broader market.

Arista Networks (ANET), Interactive Brokers (IBKR), Shift4 (FOUR), DoorDash (DASH), Royal Caribbean (RCL), Meta Platforms (META), Sea (SE) and Microsoft (MSFT) are flashing buy signals. All have peers that are also actionable or close to being so, for a combined total of 25 stocks in buy areas highlighted in this article.

It’s been a time for investors to be making buys, though the Fed meeting bears watching.

Nvidia, DoorDash and Meta stock are on IBD Leaderboard. Interactive Brokers stock is on SwingTrader. Microsoft stock is on IBD Long-Term Leaders. Nvidia, Arista Networks, Meta Platforms and Royal Caribbean stock are on the IBD 50. Arista stock is on the IBD Big Cap 20. Shift4 stock is on IBD Sector Leaders.

Interactive Brokers was Friday’s IBD Stock Of The Day. DoorDash stock was Thursday’s pick. Sea stock was the Sept. 6 selection.

Apple iPhone 16 Pre-Orders

Apple iPhone 16 preorders after the first weekend are around 37 million, according to Ming-Chi Kuo, an analyst at TF International Securities. But the Pro and Pro Max variants underwhelmed.

Apple stock fell modestly from near the 50-day line on reports.

Dow Jones Futures

Dow Jones futures rose 0.2% vs. fair value. S&P 500 futures lost 0.1% and Nasdaq 100 futures declined 0.45%. Apple stock is a Dow Jones, S&P 500 and Nasdaq 100 giant. Nvidia was a slight drag on the S&P 500 and Nasdaq.

Crude oil futures climbed nearly 1%.

The 10-year Treasury yield nudged down to 3.63%.

China economic data over the weekend signaled further slowdown in August. Industrial production rose 4.5% vs. a year earlier, down from July’s 5.1% and just below estimates. Retail sales growth slowed to 2.1% from July’s 2.7%, below consensus for 2.3%. Year-to-date fixed asset investment came in at 3.4%, below the Jan.-July reading of 3.6%. But that also revived hope that China will finally return to big stimulus.

Remember that overnight action in Dow futures and elsewhere doesn’t necessarily translate into actual trading in the next regular stock market session.

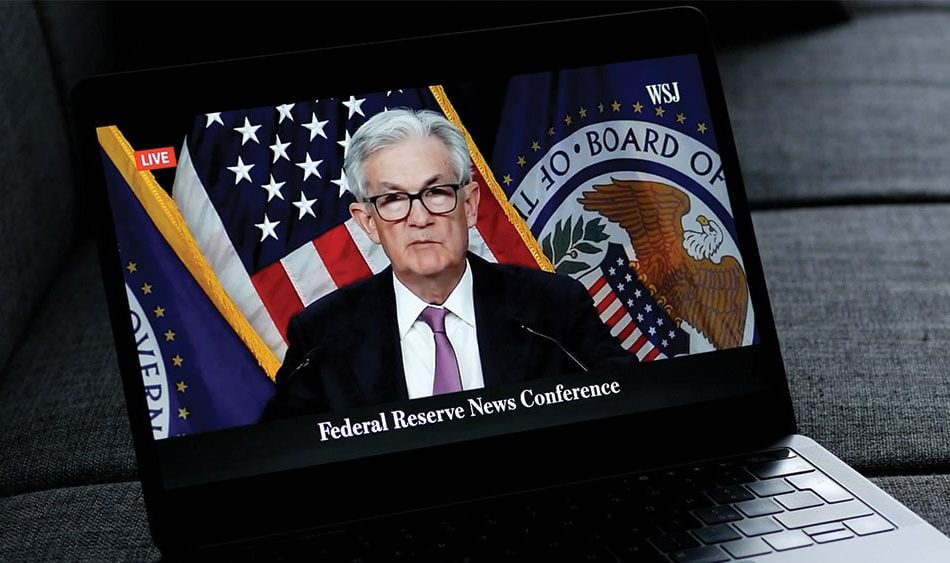

Fed Meeting Sept. 17-18: How Much Will Powell Cut Rates?

The Federal Reserve meets on Tuesday-Wednesday. An official statement is due at 2 p.m. ET on Wednesday. Fed chief Jerome Powell will speak at 2:30 p.m. ET.

It’s a foregone conclusion that the Fed will cut interest rates. But markets have been split on whether the first Fed rate cut will be 25 basis points or 50, so it’s going to be a semi-surprise either way. However, the odds for a larger move rose to 63% early Monday.

Markets have almost fully priced in 100 basis points of cuts by year-end, with over 50% odds of 125 basis points.

Fed policymakers will release an updated “dot plot” indicating where they think rates are headed, along with economic projections. Investors will pay close attention to Powell’s comments for clues about the pace of future Fed rate cuts.

A small Fed rate cut or Powell signaling that future moves will be gradual could disappoint markets.

Join IBD experts as they analyze leading stocks and the market on IBD Live

Stock Market Rally

The stock market rally was a positive expectations breaker this past week after the prior week’s ugly, expectations-breaker sell-off.

The Dow Jones Industrial Average popped 2.6% in last week’s stock market trading. The S&P 500 index leapt 4% and the Nasdaq composite vaulted 5.95%, their best weekly gains of the year. The small-cap Russell 2000 jumped 4.4%.

On Friday, Sept. 6, the Nasdaq closed decisively below the low of its Aug. 13 follow-through day, a highly bearish sign. The S&P 500 did not, but wasn’t far off.

Stocks bounced back this past week, but Wednesday was the turning point. After selling off to start the session, the indexes reversed higher powerfully, with the S&P 500 closing above its 50-day. The Nasdaq followed Thursday.

On Friday, the Dow and S&P 500 moved to just below record highs. The Russell 2000 and S&P MidCap 400 gapped above that key level after nearly touching their 200-day lines Wednesday morning.

A large number of leading stocks, including a number of tech names, raced into buy areas during the week

The 10-year Treasury yield fell 6 basis points to 3.65%. U.S. crude oil futures rose 1.45% to $68.65 a barrel after hitting a 52-week low on Tuesday.

ETFs

Among growth ETFs, the Innovator IBD 50 ETF (FFTY) soared 6.95% last week. The iShares Expanded Tech-Software Sector ETF (IGV) jumped 4.8%, with Microsoft stock a major holding. The VanEck Vectors Semiconductor ETF (SMH) spiked 10.2%, with Nvidia stock the dominant component.

SPDR S&P Metals & Mining ETF (XME) rebounded 8.2%. The U.S. Global Jets ETF (JETS) ascended 3.7%. SPDR S&P Homebuilders ETF (XHB) rallied 6.5%. The Energy Select SPDR ETF (XLE) gained 3.7% and the Health Care Select Sector SPDR Fund (XLV) added 1.4%.

The Industrial Select Sector SPDR Fund (XLI) advanced 3.7%. The Financial Select SPDR ETF (XLF) edged up 0.5%.

Time The Market With IBD’s ETF Market Strategy

Arista Stock

Arista Networks stock surged 14.5% last week to 359.76. On Wednesday, its shares cleared the 50-day line, and they offered an early entry Thursday by clearing a trendline. On Friday, ANET stock topped a 358.68 buy point from an awkward handle.

Related stocks: Fellow AI hardware plays Broadcom (AVGO) and Taiwan Semiconductor (TSM) have cleared early entries. Nvidia stock vaulted 15.8% last week, offering an aggressive entry above the 50-day, but shares were testing that key level early Monday.

Meta Stock

Meta stock gained 4.9% last week to 524.62. Shares rebounded from their 50-day on Wednesday, then became actionable as they cleared the 21-day line and short downtrend. Meta stock has a 542.81 buy point. Investors also could use 544.23 as an alternate entry.

Related stocks: Online ad play Trade Desk (TTD) rebounded bullishly from the 10-week line last week and reclaimed a buy point from a very V-shaped consolidation.

Interactive Brokers Stock

Interactive Brokers stock popped 4.5% to 128.07. Shares briefly cleared a 128.98 handle buy point on Friday, backing off but still offering an early entry. IBKR stock found support at the 50-day on Wednesday.

Related stocks: Stifel Financial (SF) and Piper Sandler (PIPR) offer early entries, while Robinhood Markets (HOOD) has broken out.

Shift4 Stock

Shift4 stock leapt 9.5% to 82.92, rebounding from the 10-week line. Shares broke the downtrend of a handle on Thursday. On Friday, FOUR stock topped the 84.26 cup-with-handle buy point intraday.

Related stocks: Restaurant payments rival Toast (TOST) and buy now, pay later specialist Affirm Holdings (AFRM) are actionable. Mastercard (MA) is in a traditional buy zone.

DoorDash Stock

DoorDash stock climbed 6.3% to 131.35 last week, just clearing a 131.21 cup-with-handle buy point on Friday, according to MarketSurge. Shares were already actionable after rebounding from the 21-day line and breaking the downtrend of the handle.

Related stocks: Instacart parent Maplebear (CART) is just below a handle buy point and arguably actionable. Uber (UBER) gapped above its 50-day and 200-day lines on Friday, offering an aggressive entry.

Royal Caribbean Stock

Royal Caribbean stock rose 7.3% to 167.96, teasing a 169.47 cup-with-handle buy point on Friday. RCL stock is actionable from breaking trendlines from the top of the base and the handle. The cruise line giant reclaimed its 21-day and 50-day lines on Wednesday.

Related stocks: Online travel giant Booking Holdings (BKNG) is on the cusp of a breakout. United Airlines (UAL) is in a buy zone.

Sea Stock

Sea stock gained 5.2% to 81.18. The Southeast Asian e-commerce and gaming giant held its 76.60 buy point and 21-day line in the prior week. This week, shares rose off the 21-day line and broke a short downtrend. Technically, Sea stock is slightly extended, but is still actionable.

Related stocks: South Korean e-commerce giant Coupang (CPNG) is in a buy zone.

Microsoft Stock

Microsoft stock rebounded 7.2% to 430.59, back above the 200-day line and then the 50-day, as well as a short-term high. While well below the 468.35 consolidation buy point, MSFT stock is actionable here as a Long-Term Leader. The relative strength line, though still recovering, is above its 50-day moving average.

Related stocks: ServiceNow (NOW), another software giant with generative AI offerings for end users, is in a buy zone. Amazon.com (AMZN), a Microsoft Azure rival with Amazon Web Services, is actionable after clearing the 50-day.

These Bitcoin Miners Are Moving Into AI. They Have A Big Advantage.

What To Do Now

The stock market rally is back on track. The major indexes look strong and leading stocks look better.

Investors should have been taking advantage of buying opportunities, especially in the past few days. Continue to do so if the market and your holdings act well.

While AI and other tech growth stocks are back in play, many other sectors continue to look strong. That should be reflected in your watchlists and your portfolio.

The Fed meeting and Powell’s comments are a big risk event, however.

Read The Big Picture every day to stay in sync with the market direction and leading stocks and sectors.

Please follow Ed Carson on Threads at @edcarson1971 and X/Twitter at @IBD_ECarson for stock market updates and more.

YOU MIGHT ALSO LIKE:

Best Growth Stocks To Buy And Watch

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

How To Invest: Rules For When To Buy And Sell Stocks In Bull And Bear Markets

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

Inotiv, Inc. Amends Its Credit Agreement and Secures Additional Liquidity

WEST LAFAYETTE, Ind., Sept. 16, 2024 (GLOBE NEWSWIRE) — Inotiv, Inc. NOTV (the “Company” or “Inotiv”), a leading contract research organization specializing in nonclinical and analytical drug discovery and development services and research models and related products and services, has amended certain terms of its Credit Agreement. In addition, Inotiv has closed the sale of $22.6 million aggregate principal amount of 15% Senior Secured Second Lien PIK Notes due February 2027 (the “Second Lien Notes”), and warrants to purchase common shares, to certain investors in a private offering.

Robert Leasure Jr., President and Chief Executive Officer, commented, “In order to increase our liquidity and to begin strengthening Inotiv’s balance sheet, the Company has amended its Credit Agreement and has issued $22.6 million in Second Lien Notes for $17.0 million in cash and the cancellation of approximately $8.3 million of our existing convertible senior notes. Among other items, the amendment to the Credit Agreement provides financial covenant relief through the quarter ending June 30, 2025, and establishes new financial covenant tests for the fiscal quarters starting June 30, 2025 and thereafter. We believe this will give us additional flexibility and time to see the results from our recently completed site optimization plans, the recovery and strengthening of the NHP market, and efforts to grow market share and cashflow.”

Mr. Leasure continued, “We have been building our business over the last 5 years through acquisitions and initiating new services to provide our biopharma customers with an end-to-end product and services solution to help them discover and develop new medicines. We have been focused on improving, integrating and optimizing the acquisitions while at the same time transforming to an organization to meet our customers’ expectations and delivering solutions for our customers who are focused on drug discovery and development.”

“Inotiv will continue to focus on providing a superior customer experience, in an effort to improve customer acquisition and retention and organic revenue growth. We will also continue to evaluate opportunities to improve our balance sheet as we work to capture market share and improve cashflow going into 2025 as outlined in prior updates.”

Second Lien Note Offering

The Second Lien Notes accrue interest at a rate of 15% per annum and are payable in kind, and are fully and unconditionally guaranteed on a senior secured second lien basis by certain of Inotiv’s subsidiaries. As a part of this transaction, the investors also received warrants to purchase 3,946,250 shares of the Company’s common stock. The warrants have an exercise price of $1.57 per share and are exercisable at any time until September 13, 2034. The Second Lien Notes will mature on February 4, 2027, unless earlier repurchased or redeemed. In addition to other related fees and expenses, the Company is paying the structuring agent a 2.5% fee in the form of $0.6 million of Second Lien Notes, which is included in the $22.6 million aggregate principal amount of Second Lien Notes discussed above, and warrants to purchase 200,000 common shares, which are in addition to the warrants to purchase 3,946,250 common shares discussed above.

The Second Lien Notes were not registered under the Securities Act of 1933, as amended (the “Securities Act”) or the securities laws of any state or other jurisdictions, and the Second Lien Notes may not be offered or sold in the United States absent registration under the Securities Act or an applicable exemption from the registration requirements of the Securities Act. This press release shall not constitute an offer to sell or a solicitation of an offer to buy the Second Lien Notes, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale of these securities would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

About the Company

Inotiv, Inc. is a leading contract research organization dedicated to providing nonclinical and analytical drug discovery and development services and research models and related products and services. The Company’s products and services focus on bringing new drugs and medical devices through the discovery and preclinical phases of development, all while increasing efficiency, improving data, and reducing the cost of taking new drugs to market. Inotiv is committed to supporting discovery and development objectives as well as helping researchers realize the full potential of their critical R&D projects, all while working together to build a healthier and safer world. Further information about Inotiv can be found here: https://www.inotivco.com/.

This release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve substantial risks and uncertainties. All statements, other than statements of historical fact included in this release, are forward-looking statements, including, but not limited to, statements about the use and potential impact of the additional capital on the Company’s business, operations and financial condition, and the progress and results of operational initiatives by the Company, including recent site optimization and other plans, and efforts to transform the business, advance customer acquisition and retention, grow revenue, capture market share and improve cashflow. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. All forward-looking statements are subject to significant risks, uncertainties and changes in circumstances that could cause actual results and outcomes to differ materially from the forward-looking statements. These forward-looking statements are not guarantees of future performance and involve risks, assumptions and uncertainties, including, without limitation, those that are described in the Company’s most recent Annual Report on Form 10-K, in the Company’s Quarterly Reports on Form 10-Q, and in other documents that the Company files or furnishes with the Securities and Exchange Commission. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those indicated or anticipated by such forward-looking statements. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. Except to the extent required by law, the Company does not undertake, and expressly disclaims, any duty or obligation to update publicly any forward-looking statement after the date of this filing, whether as a result of new information, future events, changes in assumptions or otherwise.

| Company Contact | Investor Relations |

| Inotiv, Inc. | LifeSci Advisors |

| Beth A. Taylor, Chief Financial Officer | Bob Yedid |

| (765) 497-8381 | (516) 428-8577 |

| beth.taylor@inotiv.com | bob@lifesciadvisors.com |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chinese Stocks in Hong Kong Swing to Gain as Stimulus Calls Grow

(Bloomberg) — A gauge of Chinese stocks listed in Hong Kong swung to a gain in volatile trading as investors debated whether weaker macro data will prompt the government to bolster stimulus.

Most Read from Bloomberg

The Hang Seng China Enterprises Index closed up 0.3% after earlier sliding as much as 1.3%. Property shares were among the biggest decliners, with a gauge of the sector dropping as much as 1.8%, while utility stocks rose. Mainland markets are shut until Wednesday for holidays.

Disappointing economic data over the weekend is adding pressure on the authorities to ramp up fiscal and monetary stimulus if the nation is to reach this year’s growth target. As deflation gets entrenched, investors are hoping the government will boost fiscal spending and or even try to directly help the consumer.

“Support from fiscal policy, which has lagged throughout 2024, could step up,” Wei He, an economist at Gavekal Research, wrote in a client note. “The government will probably introduce some additional stimulus measures in coming months.”

“Still, those measures are unlikely to convince market participants that nominal growth prospects are improving,” he said.

Failure to achieve the annual growth target may further undermine investor confidence, with overseas funds already pulling a record amount of money out of the country in the second quarter. A rebound in the nation’s equities earlier this year has lost momentum, with the CSI 300 Index closing at its lowest since 2019 last week. Declines may increase in absence of a forceful stimulus.

China’s central bank indicated late last week that it will step up its fight against deflation and prepare additional policies to revive the economy, after credit data showed private confidence remained weak despite previous interest-rate cuts. The nation is poised to cut interest rates on more than $5 trillion of outstanding mortgages as early as this month in a bid to spur consumption, Bloomberg News reported last week, citing people familiar with the matter.

“The recent Chinese economic data paints a grim picture, with key indicators missing expectations and signaling heightened uncertainty for China equities,” said Manish Bhargava, chief executive officer at Straits Investment Management.

While aggressive stimulus may offer a short-term boost to equities, the authorities’ incremental measures to date have raised “doubts about the potential scale and effectiveness of future intervention,” he said.

Macro conditions in China have now turned so weak they are challenging the argument about owning Chinese equities due to their ultra-cheap valuations. The HSCEI currently trades at 7.1 times its 12-month forward earnings estimate, compared with its five-year average of 8.4 times, according to data compiled by Bloomberg.

Valuations look tempting, but “when you look at macro, it is not there,” Ecaterina Bigos, chief investment officer for Asia excluding Japan at AXA Investment Managers, said in a Bloomberg TV interview. “Macro elements are very weak across the board.”

Concern over slowing economic growth has seen investors pile into the nation’s sovereign debt, pushing 10-year yields to the lowest level since Bloomberg began tracking the data more than 20 years ago. Analysts have called for strong stimulus measures to help break this cycle.

Policymakers have a window to loosen monetary policy this month when the medium-term lending facility rate and liquidity decision both come due. All but two analysts surveyed by Bloomberg predict the central bank will keep the one-year policy rate at 2.3%, though some see a potential reduction in the reserve requirement ratio.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Fed interest rate decision looms in critical week for markets: What to know this week

Stocks managed to secure solid wins ahead of a critical monetary policy decision from the Federal Reserve, which has investors on edge over how aggressively the central bank will bring down interest rates.

The tech-heavy Nasdaq Composite (^IXIC) led markets higher to nab its best week of the year, up about 6%. That weekly best was echoed by the benchmark S&P 500 (^GSPC), which saw an uptick of 4% as both gauges notched their fifth straight day of gains on Friday. The Dow Jones Industrial Average (^DJI) also ended the week in the green, up around 3%.

The positive swings come as traders have flip-flopped on whether the Federal Reserve will cut rates by 25 basis points or opt for a more robust 50 basis point cut at the end of its two-day policy meeting on Wednesday. No matter the size, it will be the first rate cut from the Fed since early 2020.

Former New York Fed president Bill Dudley said there’s a “strong case” for a deeper cut as FOMC members attempt to maneuver a “soft landing” of the economy. That, along with reports from the Financial Times and the Wall Street Journal that suggested policymakers were struggling to come to a decision, have fueled expectations for a jumbo rate cut.

Outside of the Fed decision, investors will also be monitoring the health of the consumer, with retail sales for the month of August on the docket for Tuesday. The housing market will also be top of mind after mortgage rates dropped to their lowest level since February 2023.

A weekly update on jobless claims is also on the schedule, as well as activity checks from the manufacturing sector.

In corporate news, quarterly reports from FedEx (FDX), General Mills (GIS), Lennar Corporation (LEN), and Darden Restaurants (DRI) will headline the earnings calendar.

FedEx will be in particular focus, as earnings from the delivery conglomerate are often viewed as a bellwether for the state of the broader US economy.

The Fed’s big decision

The Fed will announce its next monetary policy decision on Wednesday. Markets are largely split on whether the central bank will cut rates by 25 basis points to a range of 5.0% to 5.25% or by 50 basis points to a range of 4.75% to 5.0%.

Friday saw a significant jump in expectations for a 50 basis point cut, according to the CME FedWatch Tool. As of Friday afternoon, traders had placed a roughly 49% probability policymakers would commit to that larger rate cut, compared to just a 28% chance one day prior.

There’s a case to be made for both. On the one hand, inflation has remained above the Federal Reserve’s 2% target on an annual basis with hotter-than-expected readings on monthly “core” inflation suggesting the Fed should err on the side of caution and cut by just 25 basis points.

“With core inflation coming in higher than expected, the Fed’s path to a 50 basis point cut has become more complicated,” Seema Shah, chief global strategist at Principal Asset Management, wrote following Wednesday’s CPI report for the month of August.

“The number is certainly not an obstacle to policy action next week, but the hawks on the committee will likely seize on [the] CPI report as evidence that the last mile of inflation needs to be handled with care and caution — a formidable reason to default to a 25 basis points reduction.”

But other economic data points, including a jobs report that indicated a weakening labor market, suggest the central bank may already be behind the curve.

“We believe what the Fed should do next week is clear: recalibrate the policy rate 50bp lower to adjust for the shifting balance of risks,” JPMorgan economist Michael Feroli wrote in a note to clients on Friday. “What the FOMC will do is less clear, but we’re sticking with our call that they will do the ‘right’ thing and cut 50bp.”

Along with its policy announcement, the Fed will also release updated economic forecasts in its Summary of Economic Projections (SEP), including its “dot plot,” which maps out policymakers’ expectations for where interest rates could be headed in the future.

In June, Fed officials saw the fed funds rate peaking at 5.1% in 2024, suggesting just one 25 basis point cut to come this year. But the narrative has shifted quite considerably since that time. And with markets now pricing in 100 basis points’ worth of cuts through the end of 2024, Wednesday’s dot plot will show investors whether or not central bank leaders agree.

“Our baseline still assumes 25bp cuts at every other meeting, but the odds of a faster pace has increased given the Fed’s goal to prevent more weakness in the labor market,” Oxford Economics lead US economist Nancy Vanden Houten wrote on Friday.

Overall, stocks could turn volatile no matter which direction the Fed takes. That makes Fed Chair Jerome Powell’s post-decision press conference all the more important.

“Powell’s task at 2:30pm next Wednesday will very much depend on what the Committee chooses to do at 2:00pm,” Feroli said. “If it decides to cut 50bp, Powell will need to convey that the action is intended to support the outlook for sustained expansion in an environment of low inflation. If instead the FOMC opts for a 25bp cut he will need to indicate that the Fed stands ready to ease more aggressively on any sign of labor market softness.”

Consumer check

A fresh reading on retail sales will also be closely tracked on Tuesday as investors wait to see whether or not July’s robust rebound in sales can be sustained.

Economists expect that retail sales declined 0.2% in August from the prior month, which would mark a significant deceleration from the 1% sales growth surprise seen in July. Excluding gas and autos, expectations are for a 0.3% increase.

“The already-reported decline in vehicle sales will weigh on headline retail sales in August, but we anticipate a modest increase in core and control group sales, which will keep real consumption on track for a small gain in August,” Oxford Economics’ Vanden Houten said. “Real disposable incomes growth is proving resilient, and high-frequency indicators suggest consumer spending is continuing to steadily rise.”

She added, “There are still no signs that weakening in the jobs market is feeding through to slower growth in consumer spending.”

Weekly calendar

Monday

Economic data: Empire Manufacturing, September (-3.7 expected, -4.7 prior)

Earnings: No notable earnings

Tuesday:

Economic data: Retail sales, month over month, August (-0.2% expected, +1% previously); Retail sales ex-auto and gas, August (+0.3% expected, +0.4% previously); Industrial production, month over month, August (0.2% expected, -0.6% previously); Manufacturing (SIC) production, August (0.0% expected, -0.3% previously); NAHB Housing Market Index, September (41 expected, 39 previously)

Earnings: Ferguson Enterprises (FERG)

Wednesday

Economic data: Federal Reserve monetary policy decision (expected interest rate cut to range of 5.0% to 5.25% from range of 5.25% to 5.5%); MBA Mortgage Applications, week ending Sept. 13 (1.4% previously); Building permits month over month, August (+1.1% expected, -3.3% previously); Housing starts month over month, August (+5.8% expected, -6.8% previously)

Earnings: General Mills (GIS), Steelcase (SCS)

Thursday

Economic data: Initial jobless claims, week ending Sept. 14 (230,000 previously); Continuing claims, week ending Sept. 7 (1.85 million previously); Existing home sales month over month, August (-1.3% expected, 1.3% previously)

Earnings: FedEx (FDX), Lennar (LEN), Darden Restaurants (DRI), FactSet Research (FDS), Cracker Barrel (CBRL), Endava (DAVA), MillerKnoll (MLKN)

Friday

Economic data: No notable economic releases.

Earnings: Tamboran Resources Corporation (TBN)

Alexandra Canal is a Senior Reporter at Yahoo Finance. Follow her on X @allie_canal, LinkedIn, and email her at alexandra.canal@yahoofinance.com.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance.

Fed Wagers Weaken Dollar and Fuel More Bond Gains: Markets Wrap

(Bloomberg) — The dollar weakened and bonds rose as traders prepared for the Federal Reserve to reduce interest rates, with the market divided on how big this week’s cut will be.

Most Read from Bloomberg

Bloomberg’s dollar index slipped to the lowest in more than eight months, while expectations of a narrowing rate differential between the US and Japan boosted the yen. Treasuries extended their gains, with the yield on the policy-sensitive two-year note falling to the lowest since September 2022.

Stocks kicked off a crucial few days with muted moves, as S&P 500 futures kept to a narrow range. Apple Inc. dragged tech shares lower in the premarket as some analysis of iPhone 16 pre-orders suggested weaker demand. There was little reaction in markets to the news of a second assassination attempt on former President Donald Trump.

The start of a long-anticipated US easing cycle takes center stage this week, part of a 36-hour monetary roller coaster that includes policy decisions in Brazil, South Africa the UK and Japan. It’s come down to a virtual coin toss for traders on whether the Fed will go for a 25 or 50 basis-point cut.

“There has rarely been so much uncertainty over central bank intentions,” analysts at Edmond de Rothschild wrote in a note. “They are caught between signs of economic weakness and inflation which is stubbornly resisting a return to the 2% target.”

For Joyce Chang, chair of global research at JPMorgan, the Fed has scope to make the bigger move and doing more now would probably send the right signal.

“We are still sticking with a 50 basis-point call, but it is a debate, internally and within the broader market,” Chang said on Bloomberg TV. “When I talk to investors, 25 versus 50 isn’t so much the debate, but really how does the US growth story look.”

That view was echoed by top Wall Street strategists, who suggested that the health of the US economy could have more bearing on stocks than the size of the Fed’s rate cut.

“If the labor data weaken from here, markets can trade with a risk-off tone regardless of whether the Fed’s first move is 25 or 50 basis points,” Morgan Stanley’s Mike Wilson wrote in a note. On the other hand, if jobs were to strengthen, a series of 25 basis-point reductions into mid-2025 could prop up equity valuations further, he said.

Forecasters at Goldman Sachs Group Inc. and JPMorgan Chase & Co. also warned that rates alone were less important for stocks, given the uncertain outlook for the economy.

The Bank of Japan, meanwhile, is expected to keep rates on hold after roiling global financial markets with an increase at its last meeting.

“The communication from the BOJ will be critical to let market participants know exactly, as clear as they can be, what the next move and the particular timings of the next moves will be,” Katrina Ell, director of economic research Moody’s Analytics, told Bloomberg Television.

Trump is safe after his Secret Service detail opened fire at a man who was wielding an assault rifle at his West Palm Beach, Florida, golf course Sunday, in what the Federal Bureau of Investigation called an apparent assassination attempt.

According to law enforcement officials, Secret Service officers clearing the golf course ahead of Trump spotted a man in the woods with a gun. The suspect — later identified as 58-year-old Ryan Routh, according to federal officials who requested anonymity to discuss an ongoing investigation — fled in a black car but was later detained after a chase.

In Asia, a string of poor Chinese data left traders wondering if authorities would initiate forceful stimulus to buttress the economy. Factory output, consumption and investment all slowed more than forecast for August, while the jobless rate unexpectedly hit a six-month high.

Markets in Japan, South Korea and mainland China were closed for a holiday.

In commodities, gold rose to a fresh record high as markets waited for the Fed easing. Elsewhere, oil steadied after its first weekly gain in a month as a drop in Libyan exports was offset by China’s economic woes.

Key events this week:

-

ECB speakers including Vice President Luis de Guindos and chief economist Philip Lane, Monday

-

US empire manufacturing, Monday

-

Singapore trade, Tuesday

-

Federal Reserve begins two-day meeting, Tuesday

-

US business inventories, industrial production, retail sales, Tuesday

-

Canada CPI, Tuesday

-

Indonesia rate decision, Wednesday

-

South Africa retail sales, CPI, Wednesday

-

UK CPI, Wednesday

-

Eurozone CPI, Wednesday

-

US rate decision, Wednesday

-

Brazil rate decision, Wednesday

-

Australia unemployment, Thursday

-

New Zealand GDP, Thursday

-

Taiwan rate decision, Thursday

-

Norway rate decision, Thursday

-

UK rate decision, Thursday

-

South Africa rate decision, Thursday

-

China loan prime rates, Friday

-

Japan CPI, interest rate decision, Friday

-

ECB President Christine Lagarde speaks, Friday

-

Bank of Canada Governor Tiff Macklem speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 7:34 a.m. New York time

-

Nasdaq 100 futures fell 0.4%

-

Futures on the Dow Jones Industrial Average rose 0.2%

-

The Stoxx Europe 600 was little changed

-

The MSCI World Index was little changed

Currencies

-

The Bloomberg Dollar Spot Index fell 0.3%

-

The euro rose 0.4% to $1.1122

-

The British pound rose 0.6% to $1.3197

-

The Japanese yen rose 0.5% to 140.09 per dollar

Cryptocurrencies

-

Bitcoin fell 1.8% to $58,740.14

-

Ether fell 2.4% to $2,306.92

Bonds

-

The yield on 10-year Treasuries was little changed at 3.64%

-

Germany’s 10-year yield was little changed at 2.14%

-

Britain’s 10-year yield was little changed at 3.77%

Commodities

-

West Texas Intermediate crude rose 1% to $69.36 a barrel

-

Spot gold rose 0.1% to $2,581.42 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Matthew Burgess, Sujata Rao, Catherine Bosley and Sagarika Jaisinghani.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Research Shows Most People Should Take Social Security at 70. Here's Why That May Not Be the Best Move.

Choosing your Social Security filing age is perhaps the most important retirement decision you’ll make, as it can affect your benefit amount by hundreds of dollars per month.

You can begin claiming as early as age 62, but that comes at a steep price: a permanent benefit reduction of up to 30%. Waiting until age 70 will earn you the maximum possible payments based on your work history, with a bonus of at least 24% on top of your full benefit.

Despite the reduction in benefits, 62 is one of the most popular filing ages. According to 2023 data from the Social Security Administration, roughly one-quarter of both men and women file at 62, while fewer than one in 10 wait until age 70.

When it comes to the ideal age to take Social Security, though, the data is clear: Age 70 is far and away the best time for the majority of retirees. While the data is compelling, here’s why that may not be the best move for your retirement.

Research shows filing at 70 is a no-brainer

Taking Social Security benefits at age 70 can maximize your monthly income, sometimes increasing your benefit amount by several hundred dollars per month. But for most older adults, it can maximize your lifetime income, too.

In a 2019 report from United Income, researchers used data from the Social Security Administration to examine retirees’ claiming decisions and how those decisions affected their lifetime income. They then determined how many retirees made the ideal claiming choice to maximize their income and at what age older adults should file to earn as much as possible.

They found that claiming before age 64 is the ideal choice for only 6.5% of retirees, while a whopping 57% could have earned more in total by filing at age 70. Furthermore, filing at a less-than-optimal age costs the average retired household around $111,000 in total income over a lifetime.

A separate, similar study from the National Bureau of Economic Research found that a staggering 99.4% of retired households could maximize their lifetime income by waiting until at least age 65 to file, while 91.6% would be best off financially by claiming at age 70.

Additionally, the study revealed that for those aged 55 to 62, specifically, claiming Social Security at the financially optimal age could result in lifetime gains of around $181,623.

When it pays to take benefits sooner

The data may be clear that taking benefits at 70 can maximize your total lifetime income. However, finances are only one part of the equation when it comes to deciding on a filing age. Other factors, like health and marital status, can play an equally important role in this decision.

If your health takes a turn for the worse in your 70s, filing for benefits sooner could give you more time to enjoy retirement. Nobody can predict the future, of course, but life can throw curveballs in an instant. Filing early will reduce your monthly payments, but it could also help you make the most of every moment in case the unthinkable happens.

Also, if you’re married to someone who is also entitled to Social Security, it can be a good idea to coordinate your claiming ages. For example, one person may wait until age 70 to earn the maximum payment, while the other files at 62 to make it a little more affordable to retire early.

Finally, filing early can be a smart option if you’re on the fence about when to claim. If you change your mind within 12 months of taking benefits, you can withdraw your application and file again later. But if you delay benefits from the start and regret your decision, you can’t go back in time for a do-over.

No matter your situation, finances will play only one part in your decision. If your primary goal is to earn as much as possible in retirement, delaying claiming until age 70 is likely your best bet. But if you’re aiming to retire earlier for health reasons or otherwise, it sometimes pays to file early. You may need to make some financial sacrifices, but there’s more to retirement than just money.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

Research Shows Most People Should Take Social Security at 70. Here’s Why That May Not Be the Best Move. was originally published by The Motley Fool

2 AI Stocks That Can Crush the S&P 500 Through 2030

The S&P 500 has delivered outstanding returns over the last year and is currently up around 23%. However, the index has returned an average annual return of about 10% going back decades, so if you want to find market-beating stocks, you need to look for companies that can sustain high double-digit growth for several years.

The artificial intelligence (AI) market is a promising field to look for growth stocks. Statista estimates spending on AI technology to increase from $184 billion this year to $826 billion by 2030.

Here are two AI stocks that have crushed the S&P 500 over the last year and can outpace the index through the end of the decade.

1. Palantir Technologies

Shares of Palantir Technologies (NYSE: PLTR) have soared to new highs as the AI software provider reported accelerating growth this year. The company has primarily depended on government deals. However, it’s starting to see an increasing number of corporations invest in its software, which could catapult the stock to market-crushing returns over the next six years.

In the second quarter, Palantir reported a robust 27% year-over-year increase in total revenue. The company closed 10 deals worth more than $10 million. These results are impressive, considering the headwinds many software companies are experiencing this year due to tightening enterprise spending.

Companies seem to be prioritizing investment in AI. After using Palantir, these companies are seeing positive returns, such as faster completion of tasks and better price optimization for products, which can help a business boost profit margins.

An important advantage for Palantir is the use of its software engineers as part of the sales process. The engineers work with customers to set up the software and show them ways to get more out of it. This gives Palantir an enormous advantage in driving higher sales from customers.

Palantir’s high-margin software business should create outstanding shareholder returns in the coming years. Wall Street analysts are projecting Palantir’s annualized earnings to grow 85% over the next five years, which implies a substantial increase in the company’s margins. There will be ups and downs, but investors should expect Palantir stock to at least double in value from current share prices by 2030 and outperform the market averages.

2. Nvidia

Nvidia (NASDAQ: NVDA) is estimated to control at least 70% of the AI chip market. It has long dominated the market for graphics processing units (GPUs), which have the processing bandwidth to handle the demands of AI training. Nvidia’s lead in GPUs has translated to phenomenal returns for shareholders in recent years as companies continue to invest in building more data centers.

Nvidia’s data center revenue more than doubled year over year last quarter to $26 billion, and the expanding opportunities beyond the U.S. should allow the company to maintain its momentum into next year. While it prepares to launch the next-generation Blackwell AI computing platform, management also continues to emphasize the burgeoning opportunity to supply AI infrastructure for countries worldwide.

Foreign nations want to use their own language and culture with generative AI tools, and they are turning to Nvidia to help them build the infrastructure to make this happen. For example, Japan’s National Institute of Advanced Industrial Science and Technology uses thousands of Nvidia H200 GPUs for its AI Bridging Cloud Infrastructure 3.0 supercomputer.

While Nvidia continues to cash in on the enterprise wave, sovereign AI infrastructure could be the next tidal wave that creates significant growth opportunities for the GPU leader. Management believes its sovereign AI business will surpass $10 billion this year.

Nvidia’s share price has soared 160% over the last year, but that has been completely driven by its data center growth. The stock still trades at an attractive forward price-to-earnings ratio of 29 using next year’s consensus earnings estimates. With analysts forecasting annualized earnings growth of 52% over the next five years, Nvidia stock could significantly outpace the return of the average stock.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Ballard has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

2 AI Stocks That Can Crush the S&P 500 Through 2030 was originally published by The Motley Fool

The Fed Is Set to Cut Interest Rates — the Time to Be Fearful When Others Are Greedy Has Arrived

For the better part of the last two years, it’s been all systems go for bulls on Wall Street. Since the start of 2023, the iconic Dow Jones Industrial Average (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and growth stock-powered Nasdaq Composite (NASDAQINDEX: ^IXIC) are higher by 25%, 47%, and 69%, respectively, as of the closing bell on Sept. 13, 2024, and have all hit multiple record-closing highs this year.

While there’s little question that a resilient U.S. economy, along with investor euphoria surrounding artificial intelligence (AI) and stock splits, have driven equities higher, it’s important to understand that stocks can and do move in both directions.

According to investing great Warren Buffett, “Be fearful when others are greedy. Be greedy when others are fearful.” The time to be fearful has officially arrived for Wall Street and investors.

The Federal Reserve is about to cut interest rates, and that’s historically bad news for stocks

On the surface, things appear to be going swimmingly for the U.S. economy. Gross domestic product is expanding, the unemployment rate is still near historic lows, and the prevailing rate of inflation is inching closer to the Federal Reserve’s long-term target of 2%.

But logic doesn’t always play out as you’d expect on Wall Street.

On the surface, a rising-rate environment would be viewed as bad for businesses and economic growth since it makes borrowing costlier. Conversely, a rate-easing cycle is typically seen as a positive for companies, with lower rates reducing the cost to service debt. But if you take a step back and look at the bigger picture, you’ll often find that the reaction of stocks is opposite to this thought process.

The nation’s central bank doesn’t alter monetary policy on a whim. It typically does so in response to changes in a multitude of economic data points. When the Fed raised its federal funds rate by 525 basis points beginning in March 2022, it did so to keep the U.S. inflation rate from getting out of hand with the U.S. economy firing on all cylinders.

On the other hand, rate-easing cycles are often undertaken by the Fed when one or more data points are amiss with the U.S. economy. The Federal Open Market Committee is widely expected to reduce its federal funds target rate when it meets later this week.

Since this century began, the Federal Reserve has kicked off three rate-easing cycles. Following the start of each cycle, the Dow, S&P 500, and Nasdaq Composite have swooned.

-

Jan. 3, 2001: Beginning in early 2001, the nation’s central bank began a roughly 11-month easing cycle that moved the federal funds rate from 6.5% to 1.75%. Unfortunately, equities didn’t find a bottom during the dot-com bubble until Oct. 9, 2002, some 645 calendar days later.

-

Sept. 18, 2007: With the financial crisis taking shape, the Fed began cutting rates on Sept. 18, 2007. Despite reducing the federal funds rate from 5% to a historically low range of 0%-0.25%, the stock market didn’t bottom until March 9, 2009, which is 538 calendar days after the first rate cut.

-

July 31, 2019: The third rate-easing cycle began shortly before the COVID-19 pandemic took hold. The fed funds rate was quickly chopped from a range of 2%-2.25% to, once again, a historically low range of 0%-0.25%. A total of 236 calendar days elapsed from the first rate cut to market bottom.

During the above rate-easing cycles, the benchmark S&P 500 endured three bear markets that resulted in respective losses of 49%, 57%, and 33% of its value, with the growth-fueled Nasdaq being hit even harder.

What’s more, since this century began, it’s taken an average — I repeat, an average — of 473 calendar days (roughly 15.5 months) following an initial rate cut for the stock market to find its bottom.

Rate-hiking cycles have a history of front-running recessions

In addition to rate-easing cycles leading to poor results for Wall Street, rate-hiking cycles have usually front-run downturns in the U.S. economy.

As you can see in the table below, the nation’s central bank has overseen 13 rate-hiking cycles over the last 70 years.

|

Hiking Cycle |

Total Fed Funds Rate Increase |

Followed by a Recession? |

|---|---|---|

|

Nov. 1954 to Oct. 1957 |

2.70% |

Yes |

|

May 1958 to Nov. 1959 |

3.40% |

Yes |

|

July 1961 to Aug. 1969 |

8% |

Yes |

|

Feb. 1972 to July 1974 |

8.70% |

Yes |

|

Jan. 1977 to April 1980 |

13% |

Yes |

|

July 1980 to Jan. 1981 |

10% |

Yes |

|

Feb. 1982 to Aug. 1984 |

3.10% |

No |

|

Oct. 1986 to March 1989 |

4% |

Yes |

|

Dec. 1993 to April 1995 |

3.10% |

No |

|

Jan. 1999 to June 2000 |

1.90% |

Yes |

|

June 2004 to July 2006 |

4.30% |

Yes |

|

Nov. 2015 to Jan. 2019 |

2.40% |

Yes |

|

Feb. 2022 to July 2023 |

5.25% |

To be determined… |

Data source: Board of Governors of the Federal Reserve. Table by author.

The standout data point from the above table is that 10 of the previous 12 rate-hiking cycles were followed by a U.S. recession. The only exceptions were two increases of 3.1 percentage points in the fed funds rate in 1982-1984 and 1993-1995.

Put another way, any increase above 310 basis points in the federal funds target rate by the Fed since 1954 has eventually (key word!) been followed by a recession. The latest rate-hiking cycle saw the nation’s central bank hike by 525 basis points.

Although the stock market and the U.S. economy aren’t linked at the hip, a shrinking economy does have a strong tendency to adversely impact stock valuations. If the unemployment rate rises and economic activity slows, it’s eventually going to translate into weaker earnings growth, if not a profit plunge, for corporate America.

Historically speaking, roughly two-thirds of the S&P 500’s drawdowns since 1929 have occurred during, not prior to, a U.S. recession.

Be fearful when others are greedy, but maintain perspective

While nothing is guaranteed on Wall Street, the historic correlation between the stock market and rate-hiking/rate-easing cycles would appear to point to meaningful downside to come for equities. Tack on the fact that the stock market has been this pricey on only two other occasions since January 1871, and you have a strong case that a bear market awaits.

Although having a healthy cash position at the ready to take advantage of eventual price dislocations can be a smart move, it’s important to maintain perspective if you’re a long-term investor.

For example, as much as working Americans and investors might dislike recessions, they’re ultimately a normal and inevitable part of the economic cycle. More importantly, they’ve historically resolved quickly. Out of the 12 recessions since the end of World War II, only three lasted at least 12 months, and none surpassed 18 months.

Comparatively, most economic expansions have endured multiple years, with two periods of growth surpassing 10 years. There’s little doubt that optimists have spent far more time in the sun than under gray clouds over the last eight decades.

This same non-linearity to cycles is seen in the stock market.

In June 2023, when the S&P 500 was confirmed to be in a new bull market, the researchers at Bespoke Investment Group released the data set you see above on X, the social platform formerly known as Twitter. Bespoke calculated the calendar-day length of every bear and bull market in the S&P 500, dating back to the start of the Great Depression in September 1929.

Based on Bespoke’s analysis, the average bear market for the S&P 500 has lasted only 286 calendar days, or about 9.5 months, over a 94-year stretch. On the other hand, the typical S&P 500 bull market has endured for 1,011 calendar days, or 3.5 times as long.

You’ll also note that close to half (13 out of 27) of the S&P 500 bull markets have lasted longer than the lengthiest bear market, which stuck around for 630 calendar days, from Jan. 11, 1973, to Oct. 3, 1974.

Although history is quite clear that notable downside is expected for the Dow Jones, S&P 500, and Nasdaq Composite, it’s important to maintain perspective and take a wide-lens approach. Over time, optimism eventually wins out on Wall Street.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 755% — a market-crushing outperformance compared to 165% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now…

*Stock Advisor returns as of September 9, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The Fed Is Set to Cut Interest Rates — the Time to Be Fearful When Others Are Greedy Has Arrived was originally published by The Motley Fool

Move Over, Bank of America! You're No Longer Warren Buffett's Top Dividend Stock — This Company Is…

If you’ve ever wondered why professional and everyday investors pay such close attention to what stocks Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett is buying and selling, look no further than his track record. Since taking over as CEO in the mid-1960s, he’s presided over an aggregate return in his company’s Class A shares of almost 5,470,000%, as of the closing bell on Sept. 12.

The Oracle of Omaha’s “recipe” for success has involved buying time-tested businesses with sustainable competitive advantages and hanging onto these investments for extended periods. Core holdings Coca-Cola and American Express, which Buffett’s company has owned since 1988 and 1991, respectively, are perfect examples of brand-name businesses with sustainable moats.

However, dividend stocks have played an equally important role in Buffett’s long-term success. Companies that regularly share a percentage of their profits with investors tend to be profitable on a recurring basis and time-tested.

More importantly, dividend stocks have demonstrably outperformed non-payers over the last half-century. In The Power of Dividends: Past, Present, and Future, the investment advisors at Hartford Funds note that dividend stocks more than doubled up the average annual return of non-payers over the last 50 years (1973-2023): 9.17% vs. 4.27%.

Based on Berkshire Hathaway’s existing portfolio, Buffett and his investment team should oversee the collection of well over $5 billion in dividend income over the next 12 months. But most of this dividend income can be traced back to just a few top holdings.

Although Bank of America (NYSE: BAC) had been Buffett’s top dividend stock, his recent selling activity in the money-center bank has allowed another income stock to take this honor.

Move over, Bank of America: You’re no longer Warren Buffett’s top dividend stock

On July 24, roughly four weeks after the latest round of annual stress tests by the Federal Reserve were published, Bank of America’s board announced plans to increase its quarterly payout by 8% to $0.26 per share, as well as return as much as $25 billion to its shareholders via buybacks. With Berkshire entering the third quarter with more than 1.03 billion shares of BofA in its portfolio, this position alone would have delivered north of $1.07 billion in dividend income over the coming 12 months.

But on July 17, the Oracle of Omaha began hitting the brakes on Bank of America stock and pretty much hasn’t stopped since then. Between July 17 and Sept. 10, a span of 39 trading days, Buffett has been a seller of BofA stock in 27 of these sessions. All told, Berkshire’s stake in Buffett’s once-favorite bank stock has been reduced by close to 174 million shares, as of this writing.

One possible reason behind this selling is Buffett’s desire to lock in gains ahead of an expected rate-easing cycle by the nation’s central bank. No money-center bank is more interest-sensitive than Bank of America. When interest rates decline, its net interest income will feel the pinch more than other large banks.

Buffett might also be selling for tax purposes. He proclaimed during Berkshire Hathaway’s annual shareholder meeting in early May that it’s likely corporate tax rates head higher. Thus, locking in sizable unrealized gains now will, in hindsight, be a smart move.

It’s also possible the Oracle of Omaha simply wants little to do with a historically pricey stock market.

Regardless of the reasons behind his active selling in BofA stock, Berkshire Hathaway still held 858,180,506 shares, as of the closing bell on Sept. 10. With Bank of America doling out a base annual payout of $1.04 per share, this stake would yield a hearty $892,507,726 in dividend income over the next 12 months, assuming no more selling activity.

But $892.5 million isn’t good enough to take the top spot among dividend stocks in Warren Buffett’s portfolio.

The Oracle of Omaha’s top dividend stock will generate almost $904 million each year

The latest round of selling in BofA has vaulted one of Buffett’s favorite stocks to buy over the last two-plus years, energy juggernaut Occidental Petroleum (NYSE: OXY), on to the pedestal in terms of dividend income.

Since 2022 began, Berkshire’s brightest minds have purchased 255,281,524 shares of oil and gas stock Occidental. With Occidental dishing out a $0.22-per-share dividend each quarter, Buffett’s common stock position is expected to generate $224,647,741 in dividend income over the next 12 months.

However, Buffett’s company also holds $8.489 billion in Occidental Petroleum preferred stock that yields 8% annually. This works out to an additional $679,120,000 that, in combination with the income received from Berkshire’s common-stock stake in Occidental, increases the 12-month dividend “haul” to $903,767,741!

One of the primary reasons Buffett can’t stop buying shares of Occidental Petroleum is the belief that the spot price of oil will remain elevated or head even higher. In addition to being an in-demand global resource, the supply of crude oil has been constrained by Russia’s invasion of Ukraine and multiple years of reduced capital spending by global energy majors during the COVID-19 pandemic. When the supply of a key commodity is tight, it’s not uncommon for its price to receive a boost.

Although a higher spot price for crude oil helps all drillers, it’s an outsized positive for Occidental, which generates the lion’s share of its revenue from its upstream drilling operations. If the price of oil rises, Occidental enjoys a greater increase to its operating cash flow than other integrated energy companies. Just be warned that the opposite holds true, too. If the spot price of crude oil declines, Occidental’s operating cash flow can take it on the chin more than other integrated oil and gas operators.

Furthermore, Berkshire Hathaway holds warrants to 83,858,848.81 common shares of Occidental stock that can be exercised at $59.624 per share. It’s in Buffett’s and Berkshire’s best interest that Occidental’s share price remains above this exercise price.

In mid-2017, the Oracle of Omaha exercised warrants to purchase 700 million shares of BofA at just $7.14 per share. When executed, Bank of America’s stock was trading in the neighborhood of $24 per share, which led to a sizable gain for Buffett and his company. He’d love for a repeat of this success with Occidental.

But even if these warrants aren’t exercised, it doesn’t change the fact that Occidental Petroleum is now Warren Buffett’s top dividend stock.

Should you invest $1,000 in Occidental Petroleum right now?

Before you buy stock in Occidental Petroleum, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Occidental Petroleum wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

American Express and Bank of America are advertising partners of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Bank of America and Berkshire Hathaway. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Move Over, Bank of America! You’re No Longer Warren Buffett’s Top Dividend Stock — This Company Is… was originally published by The Motley Fool

Warren Buffett Is Doing This for the 1st Time in 20 Years. Should Investors Be Worried?

Warren Buffett follows a routine. He gets plenty of sleep each night. He wakes up at the same time each morning. He drinks a can of Coca-Cola to kick off the day. He reads voraciously, including newspapers and companies’ financial reports.

But Buffett is now doing something for the first time in 20 years. And it could be concerning to many investors.

Hoarding cash

It’s not unusual for Buffett to keep a large amount of cash on hand for Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B). The company’s policy is to maintain at least $30 billion in cash, cash equivalents, and U.S. Treasuries.

However, Buffett is currently hoarding cash like never before. Berkshire’s cash position, including cash equivalents and short-term investments, totaled nearly $277 billion as of June 30. That’s the highest level ever.

Granted, Berkshire Hathaway is generating greater earnings than it has in the past. It has more money to sock away. Also, inflation has eroded the buying power of the U.S. dollar so a larger cash position makes sense to some extent.

But there’s another sign that Buffett’s current level of cash stockpiling is unusual. Berkshire’s cash position has increased more than 65% so far in 2024. It grew over 30% in 2023. The last time the conglomerate’s cash, cash equivalents, and U.S. Treasuries rose by 30% or more in back-to-back years was in 2003 and 2004.

Time to worry?

It’s not hard to figure out why Buffett is holding on to so much cash. He prefers to be more heavily invested in stocks but will buy stocks only when they’re attractively valued. The fact that Buffett has built Berkshire’s cash position to such a large level reflects his belief that most stocks are not valued attractively.

Buffett is almost certainly right that many stocks trade at a premium. One of his favorite valuation metrics, known as the Buffett indicator — the ratio of the total U.S. stock market value divided by GDP — is near its all-time high. In 2001, Buffett wrote in a Fortune essay, “[N]early two years ago the ratio rose to an unprecedented level. That should have been a very strong warning signal.”

Should investors worry? I think that’s too strong of a word to use. Buffett’s increase in Berkshire’s cash position by 30% or more in back-to-back years two decades ago didn’t lead to a near-term market meltdown. The S&P 500 rose over the next two years.

Also, the Buffett indicator is arguably less useful now than it was in the past, with technological innovations making it more challenging to accurately assess what their valuations should be. We should note as well that Buffett is still buying some stocks in the current environment.

Follow Buffett’s lead

I think the best thing for investors to do right now is to follow Buffett’s lead. When you find stocks of well-run companies that are available at a reasonable price, buy them. Build a solid cash position if you don’t already have one. Having plenty of dry powder on hand will enable you to buy stocks at a discount when the stock market inevitably pulls back.

Most importantly, maintain a long-term perspective. Buffett’s success is due in large part to his mindset. Thinking long-term is a part of his routine that every investor should adopt.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Keith Speights has positions in Berkshire Hathaway. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

Warren Buffett Is Doing This for the 1st Time in 20 Years. Should Investors Be Worried? was originally published by The Motley Fool