Nvidia stock can climb for the next 12 months, S&P Global analyst says

-

Nvidia’s stock rally has another 12-18 months left to go, according to S&P Global’s Andrew Chang.

-

The stock has at least another year of “strong runaway” amid big demand for its chips, Chang said.

-

He aired concerns over AI investment pulling back in future quarters, which could impact shares.

Nvidia stock has a lot more room to climb — and shares of the market’s most popular chip maker are bound to soar for at least another year, according to Andrew Chang, a technology director at S&P Global Ratings.

The banking veteran pointed to recent comments from Jensen Huang, who sparked a sharp rally in NVDA shares this week after speaking at a Goldman Sachs conference in San Francisco. The Nvidia CEO issued more guidance on consumer demand and, in particular, demand for Blackwell, the company’s next-gen GPU.

His comments bolster predictions of continued upside for Nvidia, Chang said in an interview with Schwab Network on Friday.

“It just confirms our view that we have strong runway for at least the next 12 months,” Chang said.

Nvidia’s partners are also showing signs of strong chip demand. Oracle, which has an ongoing partnership with Nvidia, bumped up its revenue forecasts after beating earnings for the first quarter. The software firm also doubled its planned capital expenditures for the fiscal year — which are all bullish signs for Nvidia.

“All of these are great data points that, at least for the next 12 to 18 months, things look great,” Chang said of the Jensen Huang-led firm.

Still, he acknowledged some concerns investors have been airing. Some have floated worries that Nvidia’s growth is unsustainable, given the stock’s monster 2,514% gain over the last five years.

Some analysts have warned demand for Nvidia’s chips may not hold strong in the coming years, as the firm’s largest customers could eventually turn into competitors. Apple and Microsoft, two huge customers of Nvidia’s GPUs, are reportedly working on their own AI chips.

“Ultimately, if Oracle, if Microsoft, if Amazon don’t see the ROI that they expect, they’re going to cut orders. So hyperscale, demand volatility is something that really concerns us,” Chang said. “But, you know, these data center players have been known to order a bunch and then pause for several quarters. That’s what we’re looking out for.”

Investors will also need to be on the lookout for tighter regulation of AI. Nvidia was recently targeted by the Department of Justice in a fresh antitrust probe, Bloomberg reported, and it’s just a “matter of time” before other countries follow suit and try to regulate the technology, Chang said.

Nvidia stock sold off in the weeks following its earnings report at the end of August, but the stock staged a fresh rally this week alongside other tech stalwarts including Oracle and Super Micro Computer.

Wall Street remains generally bullish on Nvidia. According to Nasdaq data, analysts have issued an average price target of $153 a share, implying a 29% upside from current levels.

Read the original article on Business Insider

These 2 Biotech Stocks Are Set to Soar

Investing in biotech companies, especially relatively small ones, can be a double-edged sword. Their shares often soar on strong clinical trial or regulatory news, but they can lose much of their value overnight if a study’s results don’t go their way. That makes many biotech stocks somewhat risky investments, but some could deliver excellent results for those who can stomach the risk.

Two biotech companies whose shares could gain significant traction in the months and years ahead are Viking Therapeutics (NASDAQ: VKTX) and Sarepta Therapeutics (NASDAQ: SRPT).

1. Viking Therapeutics

Viking Therapeutics is a clinical-stage biotech whose stock rose significantly this year. The drugmaker owes that run-up to its leading candidate, VK2735, a potential GLP-1 weight loss therapy that produced strong results in a phase 2 study. At least two scenarios could lead to Viking’s shares soaring even more in the coming months and years.

The first scenario involves Viking Therapeutics advancing VK2735 to late-stage studies and the medicine proving safe and effective. The biotech could then get a foothold in the fast-growing weight loss market. It’s hard to come up with accurate estimates years before a drug might hit the market, but William Blair analyst Andy Hsieh has projected that VK2735 could generate about $21.6 billion in annual sales at its peak. If this prediction is anywhere close to the truth, Viking’s shares could maintain their momentum for a while. The stock could also skyrocket if the company becomes an acquisition target.

Many prominent drugmakers are racing to join the lucrative market for effective new weight loss treatments. Yet few have produced the kinds of clinical trial results this mid-cap company has. Buying out Viking Therapeutics would be a quick way for one of them to acquire a promising pipeline candidate in this niche and the team that developed it.

Viking is also working on an oral version of VK2735. And elsewhere in its pipeline, a phase 2 clinical trial of VK2809 produced positive results as a potential therapy for metabolic dysfunction-associated steatohepatitis (MASH), another condition with a high unmet need. The Food and Drug Administration (FDA) approved the first MASH therapy earlier this year, but there is room in the marketplace for more.

If Viking Therapeutics can make steady progress with its leading candidates, the stock could produce further outsized returns. However, this biotech stock is somewhat risky: If VK2735’s clinical results fail to impress, its share price could fall off a cliff. Invest accordingly.

2. Sarepta Therapeutics

Sarepta Therapeutics specializes in developing medicines for Duchenne muscular dystrophy, a rare, pediatric, progressive neuromuscular disorder.

The company’s most important product is Elevidys, a gene therapy for Duchenne muscular dystrophy. Elevidys recently earned traditional FDA approval for ambulatory patients and accelerated approval for non-ambulatory patients. This means that Sarepta Therapeutics will have to prove its efficacy in non-ambulatory patients in a post-marketing study to get the full blessing of regulators.

So far, Elevidys is performing well and helping Sarepta deliver strong results. In the second quarter, its total revenue increased by 39% year over year to $362.9 million. Earnings per share of $0.07 were much better than its loss per share of $0.27 in the prior-year period. The company’s shares have performed better than the broader market so far in 2024, but things could get even better if it does earn full approval for Elevidys for non-ambulatory Duchenne muscular dystrophy patients. Elevidys is already contributing significantly to strong financial results.

But this regulatory win could improve things. It’s also worth noting that Sarepta is looking to diversify its lineup. All four of its approved therapies treat Duchenne muscular dystrophy, but in January it started a phase 3 study for a potential therapy for Limb-Girdle muscular dystrophy. Overall, Sarepta Therapeutics has more than 40 candidates for conditions across the rare disease spectrum — not bad for a biotech worth just under $13 billion.

The company’s shares could deliver above-average returns if it keeps developing innovative therapies for diseases with high unmet needs.

Should you invest $1,000 in Viking Therapeutics right now?

Before you buy stock in Viking Therapeutics, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Viking Therapeutics wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

These 2 Biotech Stocks Are Set to Soar was originally published by The Motley Fool

Digital Health Market Size on Track to Reach USD 1.1 Trillion by 2031, Driven by 13.1% CAGR Growth| Exclusive Research Report by Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Sept. 13, 2024 (GLOBE NEWSWIRE) — As per the report published by Transparency Market Research, the global digital health market (mercado de salud digital) was worth US$ 382.5 Billion in 2022 and is expected to reach US$ 1.1 Tn by the year 2031 at a CAGR of 13.1 % between 2023 and 2031.

Digital health is a comprehensive concept that merges the latest technological advancements with healthcare practices to empower individuals to take control of their health and well-being. From wearable devices that monitor vital signs to ingestible sensors that provide real-time data on bodily functions, digital health represents the future of personalized healthcare.

Digital health represents a transformative shift in the healthcare industry, utilizing advanced technologies to improve health outcomes, enhance patient care, and streamline healthcare delivery.

For Complete Report Details, Request Sample Copy from Here: https://www.transparencymarketresearch.com/digital-health-market.html

Digital Health Market Outline

Digital health encompasses a range of innovations including wearable devices, mobile health applications, artificial intelligence (AI), telemedicine, electronic health records (EHRs), and more. As the global healthcare landscape evolves, the digital health market is poised for significant growth, driven by the increasing demand for personalized care, rise of chronic diseases, and the push for more efficient healthcare systems.

The rapid technological advancements in both – developed and developing nations have led to surge in smartphone usage. With improved internet connectivity and a global shift towards digitalization, digital health services have become increasingly accessible.

Research states that in 2023, healthcare accounted for approximately 10% of the global GDP, a figure that is anticipated to grow annually as health remains a top priority for governments worldwide. Rising awareness and an emphasis on healthcare infrastructure have driven significant increases in spending in this sector.

Moreover, modern lifestyles marked by hectic schedules and increased pollution have contributed to various health challenges, particularly among millennials. The growing prevalence of chronic diseases, exacerbated by urban living, is prompting both – individuals and organizations to adopt proactive health measures. By 2031, global spending on diabetes alone is projected to rise by USD 1 trillion.

Digital health services are addressing these healthcare needs by offering solutions such as virtual consultations, digital prescriptions, and advanced healthcare analytics, thereby making healthcare more accessible and efficient. Mobile applications like Practo and CardMedic enable users to consult doctors virtually via chat or video calls, eliminating the need for in-person clinic visits.

Additionally, apps like MyFitnessPal and Lifesum support users in maintaining proper nutrition and staying fit, helping to promote overall wellness.

Digital Health Market Regional Insights?

- North America generated the largest market value during the projected period. The region is also expected to maintain its dominance during the forecast period.

The digital health market in North America is experiencing significant growth, driven by a combination of technological advancements, changing consumer behaviors, and a supportive regulatory environment. One of the primary factors is the widespread adoption of advanced technologies such as artificial intelligence (AI), machine learning, and big data analytics. These technologies are enhancing the capabilities of digital health solutions, enabling more accurate diagnoses, personalized treatment plans, and predictive analytics. The integration of these technologies into healthcare is not only improving patient outcomes but also driving the demand for digital health tools across the region.

Another key driver is the increasing prevalence of chronic diseases, such as diabetes, cardiovascular conditions, and obesity, which are particularly common in North America. The growing burden of these diseases has led to a greater emphasis on preventive care and chronic disease management. Digital health solutions, including remote monitoring devices, telemedicine, and mobile health applications, are being increasingly adopted to manage these conditions effectively. This shift towards proactive health management is contributing to the expansion of the digital health market.

Recent Key Developments

In August 2024, Pfizer launched a new digital platform, PfizerForAll, aimed at simplifying the process of accessing healthcare for millions of Americans. This platform provides an integrated experience for managing health and wellness, particularly for those affected by common illnesses and seeking adult vaccinations.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=12473<ype=S

Market Segmentation

Product

- Healthcare Information Systems

- EHR/EMR

- Clinical Decision Support System (CDSS)

- mHealth

- Connected Medical Devices

- mHealth Applications

- Fitness App

- Medical Reference

- Wellness

- Medical Condition Management

- Nutrition

- Remote Consultation

- Reminders and Alerts

- Diagnostics

- Others

- Telehealth

- Population Health Management

- Others

Wearable Devices

- Diagnostic and Monitoring Devices

- Digital Therapeutic Devices

- Pain Management Devices

- Rehabilitation Devices

- Respiratory Therapy Devices

- Insulin Pumps

Component

End-user

- B2C

- B2B

- Provides

- Payers

- Employers

- Pharmaceutical Companies

- Others

More Trending Reports by Transparency Market Research –

- Infant Resuscitators Market – The global infant resuscitators market (mercado de reanimadores infantiles) was valued at US$ 253.1 million in 2022. It is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2031, reaching over US$ 401.4 million by the end of 2031.

- Mechanical Thrombectomy Devices Market – The mechanical thrombectomy devices market (Mercado de dispositivos de trombectomía mecánica.) was valued at US$ 1.1 billion in 2022. It is expected to grow at a CAGR of 6.4% from 2023 to 2031, reaching over US$ 1.8 billion by the end of 2031.

- Sanitization Robots Market – The sanitization robots market (mercado de robots de higienización) was valued at US$ 927.3 million in 2022. It is projected to advance at an impressive CAGR of 19.2% from 2023 to 2031, reaching over US$ 4.8 billion by 2031.

- Microcatheter Market – The global microcatheter market (mercado de microcatéteres) was valued at US$ 799.7 million in 2022. It is estimated to grow at a CAGR of 5.3% from 2023 to 2031, reaching approximately US$ 1.3 billion by the end of 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Carrier Global's Options: A Look at What the Big Money is Thinking

Investors with a lot of money to spend have taken a bullish stance on Carrier Global CARR.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with CARR, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 9 uncommon options trades for Carrier Global.

This isn’t normal.

The overall sentiment of these big-money traders is split between 44% bullish and 33%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $415,927, and 5 are calls, for a total amount of $230,990.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $57.5 to $80.0 for Carrier Global over the last 3 months.

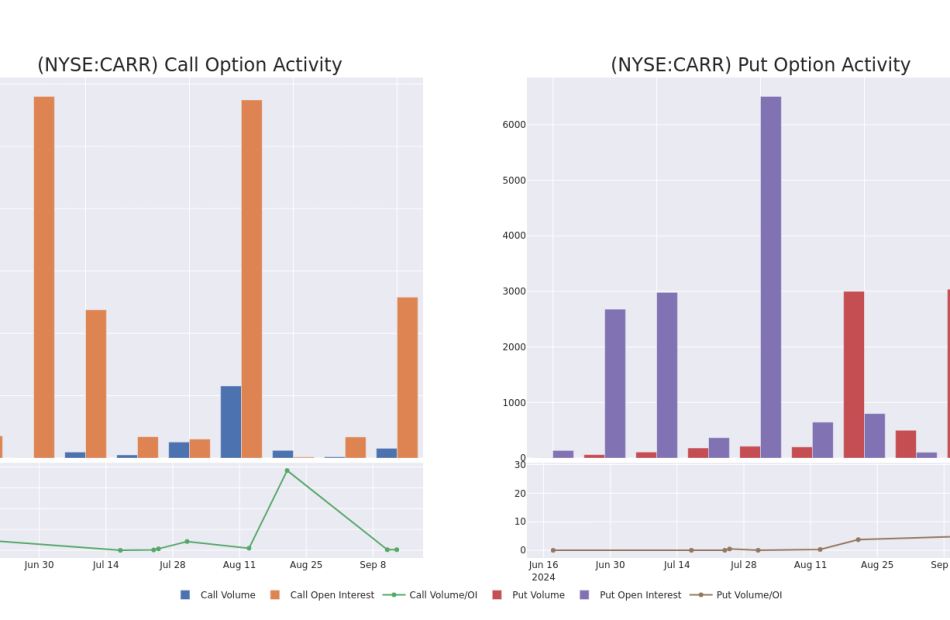

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of Carrier Global stands at 707.38, with a total volume reaching 3,348.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Carrier Global, situated within the strike price corridor from $57.5 to $80.0, throughout the last 30 days.

Carrier Global 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CARR | PUT | SWEEP | BEARISH | 12/20/24 | $6.7 | $5.2 | $6.4 | $80.00 | $277.5K | 29 | 432 |

| CARR | CALL | TRADE | BULLISH | 01/17/25 | $21.1 | $20.7 | $21.1 | $57.50 | $101.2K | 227 | 51 |

| CARR | PUT | SWEEP | BEARISH | 10/18/24 | $1.8 | $1.7 | $1.7 | $75.00 | $62.8K | 76 | 601 |

| CARR | PUT | TRADE | NEUTRAL | 10/18/24 | $1.05 | $0.95 | $1.0 | $72.50 | $50.0K | 391 | 1.7K |

| CARR | CALL | TRADE | NEUTRAL | 01/17/25 | $6.9 | $6.7 | $6.79 | $75.00 | $33.9K | 695 | 2 |

About Carrier Global

Carrier Global manufactures heating, ventilation, and air conditioning, refrigeration, and fire and security products. The HVAC business serves both residential and commercial markets (HVAC segment sales mix is 60% commercial and 40% residential). Carrier’s refrigeration segment consists of its transportation refrigeration, Sensitech supply chain monitoring, and commercial refrigeration businesses. The firm’s fire and security business manufactures fire detection and suppression, access controls, and intrusion detection products. In April 2023, Carrier announced that it plans to divest its fire and security and commercial refrigeration businesses. The firm also acquired Germany-based Viessmann for approximately $13 billion.

Current Position of Carrier Global

- With a trading volume of 4,870,063, the price of CARR is up by 1.51%, reaching $76.51.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 41 days from now.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Carrier Global options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CEO of JPMorgan warns US of economic fate worse than recession: 'The worst outcome'

JPMorgan Chase CEO has laid out the “worst outcome” for America’s economic future, beyond recession.

“The worst outcome is stagflation,” said Dimon. “And by the way, I wouldn’t take it off the table.”

68-year-old Jamie Dimon made his remarks on Tuesday at the Council of Institutional Investors in New York.

INFLATION RISES 2.5% IN AUGUST, LESS THAN EXPECTED

JPMorgan Chase is the largest bank in the United States according to Bankrate, with $3.4T in assets.

Stagflation, a portmanteau of stagnation and inflation, refers to a state where economic growth slows while inflation and unemployment rise.

The economic consequences of stagflation may cause retirement savings to go down as well as the stock market to crash; it was last seen in the U.S. during the 1970s, according to Investopedia.

While inflation in August grew less than expected at 2.5%, the outlook for the federal debt is bleak, with the growing number measuring $35,309,184,612,870.00 as of September 12.

CONSUMERS SEE INFLATION EASING, ANXIOUS ABOUT JOB MARKET, PERSONAL DEBT: NY FED SURVEY

Interest payments due in October on the national debt now exceed the costs of both Medicare and the national defense budget. National debt may contribute to further inflation on the horizon.

This is the first time in American history that interest payments on the national debt have risen above $1T.

“So, it’s hard to look at [it] and say, ‘Well, no, we’re out of the woods.’ I don’t think so,” said Dimon.

JPMorgan shares have gained over 18% this year, inline with the S&P 500’s rise.

Original article source: CEO of JPMorgan warns US of economic fate worse than recession: ‘The worst outcome’

Affirm's Survey Reveals 0% APR Option Impact, CEO Outlines Growth Plan

Affirm Holdings, Inc. AFRM recently unveiled results from its latest survey, highlighting consumer shopping behaviors before the holiday season of 2024. The study of 2,000 Americans unveiled how the 0% annual percentage rate (APR) options would influence consumers while making purchase decisions and how confident they are about budgeting. This bodes well for a company like Affirm, offering flexible and transparent payment solutions.

The survey revealed that 48% of respondents are influenced by the availability of 0% APR. Benefits of 0% APR include saving on interest costs, the ability to afford bigger purchases, and greater ease while budgeting, according to 28%, 19%, and 17% of respondents, respectively.

Additionally, 42%, 28% and 25% of consumers view 0% APR offers as suitable for purchasing furniture or appliances, electronics, and everyday items, respectively. This highlights the growing inclination toward AFRM’s solutions, poising it well for the future. The survey also highlighted that despite current macroeconomic concerns, 70% of Americans feel more confident in their ability to manage finances compared to the previous year.

In a recent Goldman Sachs Communacopia and Tech Conference, AFRM’s CEO Max Levchin emphasized the company’s evolution beyond its origin as a buy now, pay later solution to a broader payments company. Levchin also mentioned that Affirm aims to become a modern alternative to American Express Company AXP with a “pro-consumer attitude.” Affirm aims to leverage artificial intelligence to enhance employee productivity rather than reduce jobs.

Leveraging its expanded network with more merchants, customers and enhanced offerings should aid AFRM in achieving its goal of being profitable for the first time in the fourth quarter of fiscal 2024. AFRM also raised its outlook for fiscal 2025 GMV to be more than $33.5 billion, highlighting confidence in its prospects.

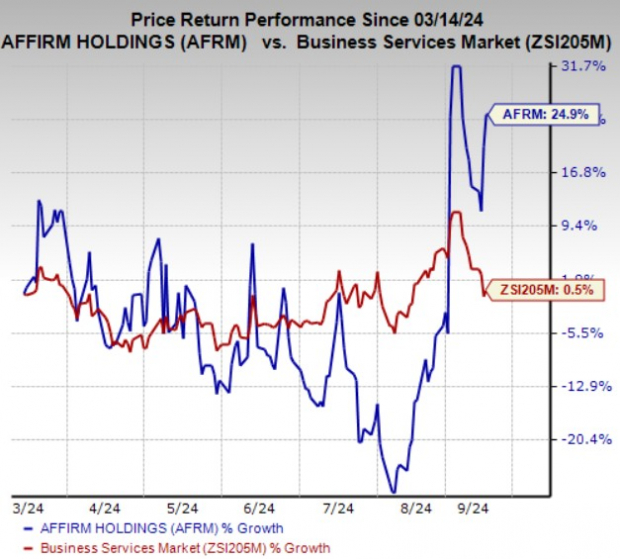

AFRM’s Zacks Rank and Price Performance

Affirm currently has a Zacks Rank #2 (Buy). In the past six months, shares of Affirm have gained 24.9% compared with 0.5% growth of the industry it belongs to.

Image Source: Zacks Investment Research

Other Stocks to Consider

Investors can look at some other top-ranked stocks from the broader Business Services space like Fidelity National Information Services, Inc. FIS and Paysign, Inc. PAYS. Each stock presently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Fidelity National’s current-year earnings indicates a 50.5% year-over-year jump. FIS beat earnings estimates in two of the trailing four quarters and missed twice. The consensus estimate for current-year revenues is pegged at $10.2 billion.

The Zacks Consensus Estimate for Paysign’s current-year bottom line indicates 75% year-over-year growth. The consensus estimate for PAYS’ current-year revenues is pegged at $58 million, suggesting 22.6% year-over-year growth.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What Is the Dividend Payout for Berkshire Hathaway?

If you’re in the market for dividend income, good for you! It’s hard to beat the power of dividend investing. Not only do you get a regular stock that will, ideally, grow in value over time, but it will also regularly plunk extra dollars into your investment account.

If you’re retired, that retirement income can come in very handy — without requiring you to shave off any shares. If you’re a pre-retiree, you might just reinvest those dividends into more shares of stock. Better still, healthy and growing dividend-paying companies will generally increase their payouts over time.

It’s reasonable to wonder whether Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) would be a good dividend-paying stock for you. It’s certainly a terrific stock to own. It specializes in insurance, energy, and transportation, and encompasses many businesses owned outright (such as GEICO, Benjamin Moore, Dairy Queen, McLane, and the entire BNSF railroad), along with sizable chunks of other companies (such as Apple, American Express, Coca-Cola, and Bank of America).

Here’s the catch, though: Berkshire doesn’t pay a dividend!

Buffett does love dividends, though. Thanks to the shares of stock owned by Berkshire, the company collects more than $5 billion in dividend income annually. So why no dividends from the company? Well, remember that when a company earns income, it can do many things with it. It might use that money to fuel growth — and that’s why many young, faster-growing companies opt not to pay dividends. It might alternatively pay down debts, acquire other companies, buy investments, or repurchase shares. Buffett does like to repurchase shares when they seem undervalued to him, and he’s famous for buying other businesses when he finds ones he likes available at a great or good price.

Buffett has explained that, essentially, when Berkshire has more cash than can be deployed in useful ways, it might initiate a dividend. But that might not happen for a long time. For now, the company was recently sitting on about $277 billion in cash!

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. American Express is an advertising partner of The Ascent, a Motley Fool company. Selena Maranjian has positions in American Express, Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

What Is the Dividend Payout for Berkshire Hathaway? was originally published by The Motley Fool

Transgene and BioInvent's Oncolytic Virus BT-001 Shows Promising Antitumor Activity in Ongoing Phase I/IIa Trial in Solid Tumors that Failed Previous Treatments

Preliminary data presented at ESMO 2024 demonstrate that BT-001 induces tumor regression in patients who failed previous anti-PD(L)-1 treatment

In a patient with a heavily pretreated leiomyosarcoma, BT-001 was able to modulate the tumor microenvironment, turning a “cold” tumor to “hot”, enhancing the potential of T cell infiltration and a shift to PD(L)-1 positivity

Early signs of efficacy with clinical responses observed with BT-001 in combination with KEYTRUDA® (pembrolizumab), in 2 of 6 patients who failed previous treatment

Strasbourg, France, and Lund, Sweden, September 14, 2024, 9:05 a.m. CET – Transgene TNG, a biotech company that designs and develops virus-based immunotherapies for the treatment of cancer, and BioInvent International AB (“BioInvent”) (Nasdaq Stockholm: BINV), a biotech company focused on the discovery and development of novel and first-in-class immune-modulatory antibodies for cancer immunotherapy, today announce new initial data from their ongoing Phase I/IIa study on the multifunctional oncolytic virus BT-001, demonstrating antitumor activity in patients who failed previous treatments.

The data presented today at the 2024 European Society for Medical Oncology (ESMO) Annual Meeting, show that BT-001 induced tumor regression in patients unresponsive to prior anti PD(L)-1 treatment, both as a monotherapy and in combination with MSD’s (Merck & Co., Inc., Rahway, NJ, USA) anti-PD-1 therapy KEYTRUDA® (pembrolizumab).

Preliminary translational data suggest that BT-001 replicates in the tumor where the payloads are expressed with undetectable systemic exposure. BT-001 alone or in combination with pembrolizumab was well tolerated and showed first signs of efficacy with clinical responses in 2 of 6 patients who failed previous treatments, when given in combination with pembrolizumab. BT-001 treatment turned “cold” tumors to “hot” inducing T cell infiltration, a higher M1/M2 ratio, and a shift to PD(L)-1 positivity in the tumor microenvironment.

Dr. Stéphane Champiat, Medical Oncologist, Head of the Inpatient Unit, Drug Development Department (DITEP) at Institut Gustave Roussy, commented: “The immunological data generated by BT-001 suggest that, as hoped, BT-001 is replicating in the tumor and its payload of transgenes is expressed with very limited exposure outside of the tumor thereby limiting systemic toxicity. I look forward to additional results from this ongoing study which will provide further evidence of the safety and clinical activity of BT-001 and its potential role as a new therapy for cancer patients with solid tumors.”

Transgene and BioInvent are co-developing BT-001, an oncolytic virus developed using Transgene’s Invir.IO® platform armed to express GM-CSF and BioInvent’s full-length anti-CTLA-4 monoclonal antibody, to elicit a strong and effective anti-tumoral response in solid tumors.

Dr. Alessandro Riva, Chairman and CEO of Transgene, said: “We are pleased to present the first promising clinical data on BT-001 at ESMO 2024, which confirm its mechanism of action as a single agent injected intratumorally and importantly demonstrate first signs of anti-tumor activity. Added to its good safety profile alone and in combination with pembrolizumab, BT-001 has the potential to shrink lesions and induce stable disease in refractory patients who may have few other treatment options. We will further explore the safety and efficacy of BT-001 in this development program with our partner BioInvent, and report additional data when it becomes available.”

Andres McAllister, MD, PhD, Chief Medical Officer at BioInvent International AB, concluded: “We are encouraged by the early clinical results presented at ESMO for BT-001, which encodes a potent Treg-depleting recombinant human anti-CTLA-4 antibody generated by our proprietary n-CoDeR® and F.I.R.S.T™ platforms. This clinical proof of concept confirms our ability to identify antibodies that bind to a selected target but exhibit a differentiated activity, allowing the development of promising new drug candidates such as BT-001.”

The abstract and poster titled: “Initial clinical results of BT-001, an oncolytic virus expressing an anti-CTLA4 mAb, administered as single agent and in combination with pembrolizumab in patients with advanced solid tumors.”, can be accessed on the ESMO and Transgene websites.

KEYTRUDA® is a registered trademark of Merck Sharp & Dohme LLC, a subsidiary of Merck & Co., Inc., Rahway, NJ, USA.

***

Contacts

| Transgene Contacts: | Transgene Media Contact: |

| Media: | MEDiSTRAVA |

| Caroline Tosch | Frazer Hall/Sylvie Berrebi |

| Corporate Communications Manager | + 44 (0) 203 928 6900 |

| +33 (0)3 68 33 27 38 | transgene@medistrava.com |

| communication@transgene.fr | |

| Lucie Larguier | |

| Chief Financial Officer | |

| Nadege Bartoli | |

| IR Analyst & Financial Communications Officer | |

| +33 (0)3 88 27 91 03 /00 | |

| investorrelations@transgene.fr |

About the trial

The ongoing Phase I/IIa (NCT: 04725331) study is a multicenter, open label, dose-escalation trial evaluating BT-001 as a single agent and in combination with pembrolizumab (anti-PD-1 treatment). Patient inclusions are ongoing in Europe (France, Belgium) and the trial has been authorized in the US.

This Phase I is divided into two parts. In part A, patients with metastatic/advanced tumors receive single agent, intra-tumoral administrations of BT-001. Part B explores the combination of intra-tumoral injections of BT-001 with pembrolizumab. In this part, KEYTRUDA® (pembrolizumab) is provided to the trial by MSD (Merck & Co).

The Phase IIa will evaluate the combination regimen in several patient cohorts with selected tumor types. These expansion cohorts will offer the possibility of exploring the activity of this approach to treat other malignancies not traditionally addressed with this type of treatment.

About BT-001

BT-001 is an oncolytic virus generated using Transgene’s Invir. IO® platform and its patented large-capacity VVcopTK–RR– oncolytic virus, which has been engineered to encode both a Treg-depleting human recombinant anti-CTLA-4 antibody generated by BioInvent’s proprietary n-CoDeR®/F.I.R.S.T™ platforms, and the human GM-CSF cytokine. By selectively targeting the tumor microenvironment, BT-001 is expected to elicit a much stronger and more effective antitumoral response. As a consequence, by reducing systemic exposure, the safety and tolerability profile of the anti-CTLA-4 antibody may be greatly improved.

BT-001 is being co-developed as part of a 50/50 collaboration on oncolytic viruses between Transgene and BioInvent. To know more on BT-001, watch our video here.

About Transgene

Transgene TNG is a biotechnology company focused on designing and developing targeted immunotherapies for the treatment of cancer. Transgene’s programs utilize viral vector technology with the goal of indirectly or directly killing cancer cells.

The Company’s clinical-stage programs consist of a portfolio of therapeutic vaccines and oncolytic viruses: TG4050, the first individualized therapeutic vaccine based on the myvac® platform, TG4001 for the treatment of HPV-positive cancers, as well as BT-001 and TG6050, two oncolytic viruses based on the Invir. IO® viral backbone.

With Transgene’s myvac® platform, therapeutic vaccination enters the field of precision medicine with a novel immunotherapy that is fully tailored to each individual. The myvac® approach allows the generation of a virus-based immunotherapy that encodes patient-specific mutations identified and selected by Artificial Intelligence capabilities provided by its partner NEC.

With its proprietary platform Invir. IO®, Transgene is building on its viral vector engineering expertise to design a new generation of multifunctional oncolytic viruses.

Additional information about Transgene is available at: www.transgene.fr

Follow us on social media: X (formerly Twitter): @TransgeneSA – LinkedIn: @Transgene

About BioInvent

BioInvent International AB (Nasdaq Stockholm: BINV) is a clinical-stage biotech company that discovers and develops novel and first-in-class immuno-modulatory antibodies for cancer therapy, with currently four drug candidates in five ongoing clinical programs in Phase 1/2 trials for the treatment of hematological cancer and solid tumors, respectively. The Company’s validated, proprietary F.I.R.S.T™ technology platform identifies both targets and the antibodies that bind to them, generating many promising new drug candidates to fuel the Company’s own clinical development pipeline and providing licensing and partnering opportunities.

The Company generates revenues from research collaborations and license agreements with multiple top-tier pharmaceutical companies, as well as from producing antibodies for third parties in the Company’s fully integrated manufacturing unit. More information is available at www.bioinvent.com. Follow on Twitter: @BioInvent.

More information is available at www.bioinvent.com.

Follow us on Twitter: @BioInvent

Transgene disclaimer

This press release contains forward-looking statements, which are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those anticipated. The occurrence of any of these risks could have a significant negative outcome for the Company’s activities, perspectives, financial situation, results, regulatory authorities’ agreement with development phases, and development. The Company’s ability to commercialize its products depends on but is not limited to the following factors: positive pre-clinical data may not be predictive of human clinical results, the success of clinical studies, the ability to obtain financing and/or partnerships for product manufacturing, development and commercialization, and marketing approval by government regulatory authorities. For a discussion of risks and uncertainties which could cause the Company’s actual results, financial condition, performance or achievements to differ from those contained in the forward-looking statements, please refer to the Risk Factors (“Facteurs de Risque”) section of the Universal Registration Document, available on the AMF website (http://www.amf-france.org) or on Transgene’s website (www.transgene.fr). Forward-looking statements speak only as of the date on which they are made, and Transgene undertakes no obligation to update these forward-looking statements, even if new information becomes available in the future.

BioInvent disclaimer

The press release contains statements about the future, consisting of subjective assumptions and forecasts for future scenarios. Predictions for the future only apply as the date they are made and are, by their very nature, in the same way as research and development work in the biotech segment, associated with risk and uncertainty. With this in mind, the actual outcome may deviate significantly from the scenarios described in this press release.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How Much Would It Take To Earn $1,000 A Month In Dividends With Just Four Stocks?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Many investors dream of passive income. Not relying only on a paycheck can free you up to pursue your dreams, get you closer to retirement, or provide a solid safety cushion for potential times of trouble.

Dividend investing can be a way to build a nest egg and let your money work for you. Getting to $1,000 in monthly income means you would have to generate $12,000 in dividends annually. To do that, you must have stocks meeting a few criteria. They have to provide a consistent and stable dividend payment. Some high-yield stocks can be tempting, but peering at the dividend history may reveal dividend cuts or pauses. The company’s health, the sector it is in, and the strength of the balance sheet all help determine which stocks can go the distance.

Trending Now:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Can you generate $1,000 in monthly income using just four dividend-paying stocks? This portfolio would aim for yield and reliability, focusing on industry diversification. Assuming an average dividend yield across four stocks is around 4%, the total investment needed would be around $300,000 to generate $12,000 annually at a 4% yield.

Choosing The Right Stocks

A mix of stocks from different sectors can balance risk while targeting high and stable dividend yields. These might include:

1. Altria Group, Inc. (NYSE:MO)

-

Sector: Consumer Staples (Tobacco)

-

Dividend Yield: 7.6%

-

Why: Altria has a long history of paying high dividends despite operating in a declining industry. Its high yield helps meet income goals faster.

-

Watch For: Revenue for the company’s smokeable products declined by 5.6% in the second quarter of 2024. The company is transitioning toward more smoke-free offerings. Investors will want to keep tabs on the company’s progress in that area. “We’re confident in the long-term outlook for our smoke-free portfolio, and we have a significant opportunity to responsibly lead the transition of adult smokers to a smoke-free future,” said Billy Gifford, Altria’s CEO, during the second-quarter earnings call.

2. AT&T Inc. (NYSE:T)

-

Sector: Telecommunications

-

Dividend Yield: 5.29%

-

Why: While AT&T has faced challenges, it maintains a strong dividend. It operates in a cash flow-heavy industry, which supports stable dividends over time.

-

Watch For: As one analyst said, AT&T needs to manage “growth and profitability.” That means expanding the mobility business and preparing for the broadband future. “This story is about growing customers and profitability as our consumer wireline business delivered more than 7% EBITDA growth during the second quarter. This was driven by approximately 18% growth in fiber revenues and improved operating leverage as we transition from legacy networks to advanced broadband infrastructure,” said AT&T CEO John Stankey on the second-quarter earnings call.

3. Realty Income Corporation (NYSE:O)

-

Sector: Real Estate (REIT)

-

Dividend Yield: 5.06%

-

Why: Realty Income is a REIT known for paying monthly dividends, offering stability and regular income. It’s a strong choice for consistent cash flow.

-

Watch For: Investors will want to track how Realty Income handles debt. In August, it announced a $500 million public offering of 5.375% senior unsecured notes due 2054, with an effective yield of 5.486%. The company has also signaled it may be quicker to sell some properties. “As we continue to calibrate and hone our predictive analytic tools, advancing our investment pieces on each property in our portfolio, we may be more active on dispositions than in the past,” said Realty Income CEO Sumit Roy on the second-quarter earnings call.

4. Johnson & Johnson (NYSE:JNJ)

-

Sector: Healthcare

-

Dividend Yield: 3.02%

-

Why: Though it has a lower yield than the others, J&J is highly stable and has a strong record of dividend growth, making it a good defensive stock.

-

Watch For: Johnson & Johnson is deepening its exposure to medtech through strategic acquisitions. Last month, it announced paying $1.7 billion for V-Wave, a medical device company focused on cardiovascular issues. “We continue to advance our pipeline, launch new commercial products, and integrate strategic acquisitions that broaden and further differentiate our portfolio,” said Joseph Wolk, the company’s Chief Financial Officer, on the most recent earnings call.

Read More:

Adjusting The Allocation

Given the different yields, we would allocate more capital to lower-yielding but more stable stocks like Johnson & Johnson and Realty Income. Higher-yielding stocks like Altria and AT&T could require less capital. The combined yield of these four stocks is 5.2%, meaning it could take less than $300,000 to reach that $12,000 yearly goal.

These are just assumptions, and investors will want to remember that high-yield stocks like Altria and AT&T come with more risk, while J&J provides stability but a lower yield. Each stock’s dividend payout ratio and financial health must be monitored to ensure sustainable dividends. Although this portfolio is diversified across sectors, it’s still important to review it regularly. Diversifying into other stocks, bonds, and real estate can provide additional income and safety against broader downturns.

Another Way To Build Wealth

The current high-interest-rate environment has created an incredible opportunity for income-seeking investors to earn massive yields, but not through dividend stocks… Certain private market real estate investments are giving retail investors the opportunity to capitalize on these high-yield opportunities and Benzinga has identified some of the most attractive options for you to consider.

For instance, the Ascent Income Fund from EquityMultiple targets stable income from senior commercial real estate debt positions and has a historical distribution yield of 12.1% backed by real assets. With payment priority and flexible liquidity options, the Ascent Income Fund is a cornerstone investment vehicle for income-focused investors. First-time investors with EquityMultiple can now invest in the Ascent Income Fund with a reduced minimum of just $5,000. Benzinga Readers: Earn a 1% return boost on your first EquityMultiple investment when you sign up here (accredited investors only).

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

This article How Much Would It Take To Earn $1,000 A Month In Dividends With Just Four Stocks? originally appeared on Benzinga.com

DarioHealth And 2 Other Stocks Under $5 Executives Are Buying

The Dow Jones index closed higher by more than 200 points on Thursday. When insiders purchase or sell shares, it indicates their confidence or concern around the company’s prospects. Investors and traders interested in penny stocks can consider this a factor in their overall investment or trading decision.

Below is a look at a few recent notable insider transactions for penny stocks. For more, check out Benzinga’s insider transactions platform.

Red Robin

- The Trade: Red Robin Gourmet Burgers, Inc. RRGB President and CEO Gerard Johan Hart bought a total of 10,000 shares at an average price of $3.15. To acquire these shares, it cost around $31,526.

- What’s Happening: On Aug. 22, Red Robin reported downbeat earnings for its second quarter and lowered its FY24 revenue guidance.

- What Red Robin Does: Red Robin Gourmet Burgers Inc is a restaurant operator. The company develops, operates, and franchises casual-dining restaurants and fast-casual restaurants in North America.

DarioHealth

- The Trade: DarioHealth Corp DRIO Chief Commercial Officer Steven Charles Nelson acquired a total of 10,000 shares at an average price of $0.82. To acquire these shares, it cost around $8,244.

- What’s Happening: On Aug. 8, DarioHealth posted second-quarter GAAP earnings of 8 cents per share.

- What DarioHealth Does: DarioHealth Corp is a digital therapeutics (DTx) company delivering personalized evidence-based interventions that are driven by precision data analytics, software, and personalized coaching.

Nerdy

- The Trade: Nerdy Inc NRDY Director Abigail Blunt acquired a total of 49,045 shares at an average price of $0.91. The insider spent around $44,631 to buy those shares.

- What’s Happening: On Aug. 8, Nerdy reported worse-than-expected second-quarter revenue.

- What Nerdy Does: Nerdy Inc is a curated direct-to-consumer platform for live online learning. Its purpose-built proprietary platform leverages technology, including AI, to connect learners of all ages to experts, delivering superior value on both sides of the network.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.