Greystone Logistics Reports Strong Year-End Earnings

TULSA, Okla., Sept. 13, 2024 (GLOBE NEWSWIRE) — Greystone Logistics, (“Greystone Logistics” or the “Company”) GLGI the leading manufacturer of recycled plastic pallets providing sustainable logistics solutions, is pleased to announce its year-end earnings for the fiscal year ending May 31, 2024. The company has achieved an impressive net income of $5,027,491, with EBITDA of $13,086,091 on sales of $61,780,715. The $.16 per share earnings highlights its resilience and commitment to innovation in a challenging economic climate.

Despite ongoing recessionary pressures and a notable hesitancy among buyers to issue purchase orders, Greystone has continued to excel in the market for its world-class recycled plastic shipping pallets. The company’s focus on sustainability and quality has allowed it to maintain a competitive edge, meeting the growing demand for eco-friendly shipping solutions.

Warren Kruger, President of Greystone Logistics, expressed his pride in the company’s performance. “We’ve had a tremendous year, demonstrating our ability to adapt and thrive even in the face of economic uncertainty. Our new 48×40 warehouse pallet is already generating sales at a pace of $5 million per year in revenue and with over $50 million in our sales pipeline, I anticipate a robust 2025. Cash on hand at year end was $5,798,641 insuring a level of safety and sufficient funds for our previously announced share buyback. We have now received the new tooling for our extruded hollow lumber pallet with product launch in the next 90 days and introduction at Pack Expo in Chicago in November. Our innovative approach to recycling plastic into durable shipping pallets not only supports our clients’ logistics needs but also helps reduce environmental impact. We are committed to providing sustainable solutions that benefit both our customers and the planet.”

Greystone Logistics remains dedicated to expanding its operations and enhancing its product offerings as it looks ahead to the coming year. The company’s strategic initiatives will focus on increasing production on new equipment with existing customers and closing sales in the pipeline.

As Greystone continues to lead the way in the logistics industry, it remains steadfast in its mission to deliver high-quality, sustainable products while navigating the complexities of the current economic landscape.

For more information about Greystone Logistics and its innovative products, please visit www.greystonepallets.com

About Greystone Logistics

Greystone Logistics is a “green” manufacturing company that reprocesses recycled plastic and designs, manufactures and sells high-quality 100% recycled plastic pallets that provide logistical solutions for a wide range of industries such as the food and beverage, automotive, chemical, pharmaceutical and consumer products. The Company’s technology, including a proprietary blend of recycled plastic resins used in the injection molding equipment and patented pallet designs, allows production of high-quality pallets more rapidly and at a lower cost than many other processes. The recycled plastic for Greystone’s pallets helps control material costs while reducing environmental waste and provides cost advantages over users of virgin resin.

Forward-Looking Statements

This press release contains forward-looking statements. All statements other than statements of historical facts included in this press release are forward-looking statements. In some cases, forward-looking statements can be identified by words such as “believe,” “expect,” “anticipate,” “plan,” “potential,” “continue” or similar expressions. Such forward-looking statements include risks and uncertainties, and there are important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors, risks and uncertainties are discussed in the Company’s filings with the Securities and Exchange Commission. Investors should not place any undue reliance on forward-looking statements since they involve known and unknown, uncertainties and other factors which are, in some cases, beyond the Company’s control which could, and likely will, materially affect actual results, levels of activity, performance or achievements. Any forward-looking statement reflects the Company’s current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to operations, results of operations, growth strategy and liquidity. The Company assumes no obligation to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Conference Call-Monday, September 16, 2024, at 1:30 PM ET, hosted by Warren Kruger, President and CEO. Conference ID is Greystone. Participant Dial-in information is Toll-Free Number, 888-999-6281, or Direct or International Number, +1-848-280-6550. A Q&A session will be available.

Non-GAAP Financial Measure

This press release contains disclosure of EBITDA, which is a non-GAAP financial measure within the meaning of Regulation G promulgated by the Securities and Exchange Commission.

Contact

Brendan Hopkins

Investor Relations

Email: investorrelations@greystonelogistics.com

Phone : (407) 645-5295

https://www.greystonepallets.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ROSEN, RECOGNIZED INVESTOR COUNSEL, Encourages GitLab Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action – GTLB

NEW YORK, Sept. 13, 2024 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, announces the filing of a class action lawsuit on behalf of purchasers of securities of GitLab Inc. GTLB between June 6, 2023 and March 4, 2024, both dates inclusive (the “Class Period”). A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than November 4, 2024.

SO WHAT: If you purchased GitLab securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the GitLab class action, go to https://rosenlegal.com/submit-form/?case_id=28700 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than November 4, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources or any meaningful peer recognition. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, during the Class Period, defendants made false and/or misleading statements and/or failed to disclose that: (1) defendants created the false impression that they possessed reliable information pertaining to GitLab’s ability to develop and incorporate artificial intelligence (“AI”) throughout the software development cycle in order to optimize code generation, thereby increasing market demand and making all levels of software development more affordable and properly monetizing GitLab’s AI features; (2) in truth, there was weak market demand for GitLab’s touted AI features and GitLab was incurring an increasing amount of expenses involving JiHu, its joint venture in China, as well as the annual company-wide summit; and (3) defendants misled investors by continually highlighting GitLab’s AI-driven innovations to develop software more efficiently and drive market share demands. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the GitLab class action, go to https://rosenlegal.com/submit-form/?case_id=28700 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

McKesson Rises Yet Lags Behind Market: Some Facts Worth Knowing

The most recent trading session ended with McKesson MCK standing at $511.17, reflecting a +0.14% shift from the previouse trading day’s closing. This change lagged the S&P 500’s 0.75% gain on the day. Elsewhere, the Dow saw an upswing of 0.58%, while the tech-heavy Nasdaq appreciated by 1%.

The prescription drug distributor’s shares have seen a decrease of 7.67% over the last month, not keeping up with the Medical sector’s gain of 3.55% and the S&P 500’s gain of 4.03%.

The investment community will be paying close attention to the earnings performance of McKesson in its upcoming release. It is anticipated that the company will report an EPS of $7.20, marking a 15.57% rise compared to the same quarter of the previous year. Our most recent consensus estimate is calling for quarterly revenue of $89.57 billion, up 16% from the year-ago period.

For the annual period, the Zacks Consensus Estimates anticipate earnings of $32.11 per share and a revenue of $353.29 billion, signifying shifts of +17.02% and +14.35%, respectively, from the last year.

Investors should also take note of any recent adjustments to analyst estimates for McKesson. These revisions help to show the ever-changing nature of near-term business trends. Consequently, upward revisions in estimates express analysts’ positivity towards the company’s business operations and its ability to generate profits.

Our research suggests that these changes in estimates have a direct relationship with upcoming stock price performance. Investors can capitalize on this by using the Zacks Rank. This model considers these estimate changes and provides a simple, actionable rating system.

Ranging from #1 (Strong Buy) to #5 (Strong Sell), the Zacks Rank system has a proven, outside-audited track record of outperformance, with #1 stocks returning an average of +25% annually since 1988. The Zacks Consensus EPS estimate has moved 2.25% higher within the past month. At present, McKesson boasts a Zacks Rank of #3 (Hold).

With respect to valuation, McKesson is currently being traded at a Forward P/E ratio of 15.9. This represents a discount compared to its industry’s average Forward P/E of 18.11.

We can also see that MCK currently has a PEG ratio of 1.18. The PEG ratio bears resemblance to the frequently used P/E ratio, but this parameter also includes the company’s expected earnings growth trajectory. The average PEG ratio for the Medical – Dental Supplies industry stood at 1.88 at the close of the market yesterday.

The Medical – Dental Supplies industry is part of the Medical sector. With its current Zacks Industry Rank of 176, this industry ranks in the bottom 31% of all industries, numbering over 250.

The strength of our individual industry groups is measured by the Zacks Industry Rank, which is calculated based on the average Zacks Rank of the individual stocks within these groups. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

These Are The Five Best Stocks To Buy And Watch Now

Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. So what are the best stocks to buy now or put on a watchlist? Netflix (NFLX), Meta Platforms (META), Freshpet (FRPT), Broadcom (AVGO) and Sea (SE) are prime candidates.

↑

X

Interest Rate Cuts Coming: Implications For Investors Ahead Of The September Fed Meeting

Inflation and the Federal Reserve tightening rates aggressively worried investors last year. But the market confounded expectations for difficulties and turned in an outstanding performance in 2023. More moderate gains were expected for 2024, but the benchmark S&P 500 turned in very strong gains for the first half of the year amid growing confidence that the Fed will reach its goal of a soft landing.

Best Stocks To Buy: The Crucial Ingredients

Remember, there are thousands of stocks trading on the NYSE and Nasdaq. But you want to find the very best stocks right now to generate massive gains.

The IBD Methodology offers clear guidelines on what you should be looking for. Invest in stocks with recent quarterly and annual earnings growth of at least 25%. Look for companies that have new, game-changing products and services. Also consider not-yet-profitable companies, often recent IPOs, that are generating tremendous revenue growth.

Using such an approach can help give you an edge over the benchmark S&P 500. Outdoing this industry benchmark is key to generating exceptional returns over the long term.

In addition, keep an eye on supply and demand for the stock itself, focus on leading stocks in top industry groups, and aim for stocks with strong institutional support.

Once you have found a stock that fits the criteria, it is then time to turn to stock charts to plot a good entry point. You should wait for a stock to form a base, and then buy it once it reaches a buy point, ideally in heavy volume. In many cases, a stock reaches a proper buy point when it breaks above the original high on the left side of the base. More information on what a base is, and how charts can be used to win big on the stock market, can be found here.

Don’t Forget The Stock Market Direction When Buying Stocks

A key part of investing is to keep track of the market. Most stocks, even the very best, follow the market direction. Invest when the stock market is in a confirmed uptrend and move to cash when the stock market goes into a correction.

The stock market turned in stunning gains in 2023 and had been building on those gains so far this year. The S&P 500 and the Nasdaq got smacked below the key 50-day moving average after July’s jobs report spooked investors. While there was more choppy action at the start of September, the Nasdaq and the S&P 500 have now recaptured the important technical benchmark.

The stock market is looking bullish again despite recent wobbles. Investors should be looking to buy high-quality issues with good growth prospects. The selections below are among the best stocks to buy or watch now. The IBD 50 is also a rich hunting ground.

Nevertheless, it remains crucial to stay on top of sell signals. Any stock that falls 7% or 8% from your purchase price should be jettisoned. Also beware of sharp breaks below the 50-day or 10-week moving average.

Things can change quickly when it comes to the stock market. Make sure to keep a close eye on the market trend page here.

Best Stocks To Buy Or Watch

- Netflix

- Meta Platforms

- Freshpet

- Broadcom

- Sea

Now let’s look at Netflix stock, Meta Platforms, Freshpet, Broadcom and Sea in more detail. An important consideration is that these best stocks to buy and watch all boast impressive relative strength.

Netflix Stock

Netflix stock is currently just below a cup-base buy point of 697.49, according to MarketSurge analysis. It is actionable as high as 732.36. It is currently breaking a downtrend, which offers an early entry.

NFLX has been getting support at the 21-day exponential moving average as well as the 50-day line. In addition, the relative strength line sits near fresh highs, a bullish sign. It had been bending higher as it formed the right side of the pattern.

Overall performance is strong, which is reflected in its near-perfect IBD Composite Rating of 98. Earnings performance is also mighty, with its EPS Rating also standing at 98.

Indeed, earnings have grown by an average of 597% over the past three quarters, impressive performance by any standard. EPS is seen rising 59% in 2024 and then slowing to 20% growth in 2025.

Revenue growth has accelerated for four straight quarters.

Institutional sponsorship has been steady of late, with the stock’s Accumulation/Distribution Rating coming in at C.

NFLX stock has been benefiting from the company’s moves to crack down on password sharing and to offer a cheaper ad-supported tier of service.

Netflix has grown tremendously from its roots as a subscription DVD-by-mail service. It is now the leader in digital streaming, offering subscription video-on-demand service in over 190 countries.

It produces its own content, with hits including “Stranger Things,” “The Crown,” “Squid Game” and “Bridgerton.” But content costs are coming down as rivals license more shows to Netflix once again.

Also, the firm is moving beyond its wheelhouse of movies and shows and into the live events arena.

Earlier this year it announced a deal with TKO Group (TKO) to carry the WWE’s flagship pro wrestling program “Raw” starting in January 2025. The 10-year deal is worth over $5 billion.

Netflix has also announced that it will stream two NFL games on Christmas Day this year. Plus, it will stream at least one Christmas Day football game in 2025 and in 2026.

The addition of live content will help attract advertisers to Netflix, Argus Research analyst Joseph Bonner said.

Netflix stock currently sits at the summit of the competitive Leisure-Movies & Related industry group.

Meta Platforms Stock

The social media stock is offering an early entry as it clears its 50-day and 21-day lines and breaks a downtrend.

It has also formed a consolidation with an ideal entry point of 542.81, MarketSurge analysis shows. Additionally, a three-weeks-tight pattern has also formed, which offers a slightly higher buy point of 544.23.

Overall performance for META is very strong, earnings it an IBD Composite Rating of 93 out of 99. Meta stock has spiked more than 48% so far this year.

Earnings performance is strong at the moment for the Facebook parent, netting it an EPS Rating of 96 out of 99. EPS has grown by an average of 114% over the past three quarters, easily above the growth levels sought by investors following The IBD Methodology.

Wall Street expects improvement in 2024, with full-year earnings per share seen rising 37%. EPS growth is seen slowing to 14% growth in 2025.

Meta stock is showing leadership, with shares currently sitting in first place in the competitive Internet-Content industry group.

In total, 47% of META stock is currently held by funds, according to MarketSurge data. A number of noteworthy funds are backers, including the Fidelity Contrafund (FCNTX) and the MFS Growth Fund (MFEGX).

Meta Platforms has a robust roster of social media properties including Facebook, Instagram and WhatsApp.

The firm is betting big on the nascent space of artificial intelligence. The firm told investors it expected to spend between $37 billion and $40 billion on capital expenditures this year, up from its previous range of $35 billion to $40 billion. The company also said it expects “significant capital expenditures growth” for 2025.

Those investments will focus mostly on building advanced data center capacity to support training and deploying AI algorithms.

Looking For The Next Big Stock Market Winners? Start With These 3 Steps

Freshpet Stock

FRPT stock is back in the buy zone above a consolidation buy point of 136.35, MarketSurge analysis shows. It is buyable as high as 143.17 from this entry.

This is a second-stage pattern for FRPT. This is a bonus as early-stage bases are more likely to post good gains.

The pet food stock dug in amid recent broader volatility and got support at its 21-day line. Its relative strength line is near recent highs.

The Bedminster, N.J.-based pet food specialist makes steam-cooked, grain-free and antioxidant-rich meals for dogs and cats. Freshpet exclusively focuses on “fresh” pet food made with fresh meat, vegetables and fruits.

Freshpet has clawed its way to the top of the Packaged Food industry group. Stock market performance is particularly strong, with the stock up about 62% so far in 2024. This means it is comfortably outperforming the benchmark S&P 500.

The animal play is also in the top 5% of issues in terms of price performance over the past 12 months.

The stock holds a very strong IBD Composite Rating of 92. Earnings performance is the weakest part of the picture, with FPRT stock holding an EPS Rating of 73 out of a best-possible 99.

Wall Street expects significant improvement on this front, though. Freshpet is seen swinging from a full-year loss of 62 cents per share to a profit of 73 cents in 2024. EPS is then seen popping 80% next year.

Big Money is a strong backer of Freshpet. In total, 75% of shares are held by funds, according to MarketSurge data. An additional 4% is held by management.

Institutions have been net buyers of late, with the stock’s Accumulation/Distribution Rating coming in at A-. Noteworthy holders include the well-respected Virtus KAR Mid-Cap Growth Fund Class A Fund (PHSKX).

FRPT stock is a member of the IBD Leaderboard list of top stocks.

Broadcom Stock

The chip stock is offering an early entry as it breaks a trendline and clears the 50-day line. If it can clear resistance at 172.42 this serve as another buying opportunity.

In addition, the stock is shooting for a consolidation pattern entry point of 185.16, according to MarketSurge analysis. This is a third-stage base, which counts as mid-stage.

The stock is is seeing its relative strength line bend upward, though it remains off recent highs.

Shares plunged on Sept. 6 following its fiscal Q3 earnings report, but has roared back after finding support at the 200-day line.

Excellent all-around performance is reflected in AVGO’s near-perfect IBD Composite Rating of 98. Earnings performance is excellent here, with Broadcom holding an EPS Rating of 93 out of 99

Tyler’s earnings have grown by an average of just over 19% over the past three quarters. Analysts are predicting ongoing gains on this front. Full-year EPS is seen popping 14% in 2024 before accelerating to 27% growth next year.

Its stock price has swollen by a more than 47% so far this year. This is easily above the benchmark S&P 500’s lift.

Institutions have been net buyers of AVGO stock of late, with its Accumulation/Distribution Rating coming in at C+. Currently, 48% of its shares are held by funds, according to MarketSurge data.

Broadcom serves as an alternative artificial intelligence play for those who believe Nvidia (NVDA) is overvalued. It is a leader in custom chips that companies also need to implement all the power that AI brings to data centers, networks and even connected devices like smartphones.

Bernstein analyst Stacy Rasgon is rating AVGO as one of his top picks in the semiconductor sector. He said that, while, sentiment around AI chip stocks “has taken a pause,” that “demand clearly has not,” Rasgon said. He has a price target of 195 on Broadcom stock.

As if that wasn’t enough, Broadcom is on two different exclusive IBD lists, the Big Cap 20 as well as Tech Leaders.

Market Gives Go Signal; Nvidia Leads 7 New Buys

Sea Stock

E-commerce play Sea is breaking a downtrend and is also trading in the 5% buy zone above a consolidation buy point of 76.60.

This is a first-stage pattern. Such early stage bases are more likely to net big gains for investors. Its latest pattern was formed in just over one month.

Sea stock is above all its moving averages after finding support at the 21-day exponential moving average.

The stock’s relative strength line is just off recent highs. However it is starting to bend higher once again, an encouraging sign.

Overall performance is solid, but not ideal. This is reflected in Sea stock holding a strong IBD Composite Rating of 79 out of 99.

Earnings performance is currently the Achille’s heel for the firm, with its EPS Rating coming in at a poor 5 out of 99.

This is in stark contrast to its outstanding price price performance. Indeed, SE is among the top 4% of issues in terms of price performance over the past 12 months.

But Wall Street is expecting big improvements going forward. The firm turned in its first full-year profit in 2023, with EPS of 25 cents, and this year earnings are expected to surge 453%. Further growth of 90% is expected in 2025, according to MarketSurge data.

There has been more buying than selling of Sea stock among institutions of late. This is reflected in its Accumulation/Distribution Rating of B+. Overall ownership is solid, with funds owning 44% of the firm’s shares.

The lauded Harbor Disruptive Innovation Institutional Class Fund (HAMGX) is among the noteworthy holders. The Fidelity Contrafund also owns shares.

Singapore-based internet services company Sea’s holdings include the e-commerce focused Shopee, which services Southeast Asia and Taiwan. The company also owns digital-payments provider SeaMoney and Garena, a global online games developer.

Shopee is the largest business, contributing $9 billion out of Sea’s $13.1 billion in 2023 sales.

Please follow Michael Larkin on X, formerly known as Twitter, at @IBD_MLarkin for more analysis of growth stocks.

YOU MIGHT ALSO LIKE:

7 Best Stocks For Magnificent Earnings Growth Next Year

Join IBD Live Each Morning For Stock Tips Before The Open

MarketSurge: Research, Charts, Data And Coaching All In One Place

This Is The Ultimate Warren Buffett Stock, But Should You Buy It?

Should You Buy Super Micro Computer Stock Before Oct. 1?

When a stock is in the midst of a free fall, it can be a risky time to buy in. That’s because it’s hard to know if it has bottomed out or if it’s still heading further down. It can seem like a cheap buy, but if the business is in trouble, it still may not be worth investing in it.

Super Micro Computer (NASDAQ: SMCI) was once seen as a top artificial intelligence (AI) stock. Its servers have been in high demand for companies looking to upgrade their tech capabilities, and it also provides businesses with crucial IT infrastructure. But in just the past six months, the stock, which is also known as just Supermicro, has nosedived more than 60%. Investors appear as though they can’t get rid of the stock fast enough.

But could Supermicro’s upcoming stock split help reverse its fortunes, and get its shares rallying again?

What Supermicro’s 10-for-1 split means for investors

Last month, Supermicro announced it would split its shares on a 10-for-1 basis. And Oct. 1 is when the stock will trade on a post-split basis. That means rather than trading at $400 or so per share, the stock price will be around $40 — assuming it doesn’t move a whole lot from where it is right now.

For investors, that’s about the main difference they’ll see. In your portfolio, your total investment value will remain unchanged, you’ll simply have 10 times as many shares and the price will be one-tenth of what it was before the split.

But at a lower price, some investors may be more inclined to buy shares of the company, if for instance, they aren’t able to own fractional shares, or if they just prefer not to. Beyond that, however, there isn’t an obvious benefit to a stock split — it’s just a superficial change that shouldn’t impact your decision to buy or sell Supermicro stock. Unless there’s some drastically significant news that comes out on Oct. 1, the AI stock will be just as good or bad of a buy as it was the previous trading day.

Investors should focus on the fundamentals

For investors, what should always remain the focus are the fundamentals. Whether the business is growing at a fast rate, if it is profitable, and how strong its cash flow is are some of the more crucial things to look at.

Even the recent short report about the company isn’t important. Those reports can be biased, misleading, and are often wrong on many if not all counts. While stock splits and short reports can have temporary impacts on a stock’s price, they aren’t likely to determine how it performs in the long run.

Supermicro has been a strong growth stock to own this year due to the strength of its business and high demand for its servers and other IT infrastructure. One area of concern, however, has been its low gross margin. Without higher margins, Supermicro’s revenue growth may not result in a much stronger bottom line, and that could make the stock look expensive if its share price rises but its earnings per share doesn’t increase significantly.

It’s those types of things investors should factor into their decision-making process, as opposed to stock splits or short reports.

Should you buy Supermicro stock?

Investors shouldn’t be down on Supermicro stock because of the recent short report, but they also shouldn’t be terribly excited about a stock split, either. Although business has been booming with Supermicro’s sales doubling in recent periods, I would wait a few quarters to see how the company is doing and if its margins are improving before making a decision on the stock. If they aren’t improving, I would take a pass on the stock as a low gross margin can be a cause for concern.

But if you’re willing to take on some risk and trust that the company can fix those issues, it may be worth adding the stock to your portfolio as it does trade at a fairly low 11 times its estimated future profits. That’s an incredibly low multiple for a tech stock, and it could justify taking on the risk as the upside could be massive if Supermicro proves its doubters wrong. This isn’t a stock that is going to be suitable for risk-averse investors, but if you have a high risk tolerance, it could be worth buying today — there’s no need to wait for October.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Should You Buy Super Micro Computer Stock Before Oct. 1? was originally published by The Motley Fool

VALE S.A. Outpaces Stock Market Gains: What You Should Know

The most recent trading session ended with VALE S.A. VALE standing at $10.37, reflecting a +1.47% shift from the previouse trading day’s closing. The stock outperformed the S&P 500, which registered a daily gain of 0.75%. On the other hand, the Dow registered a gain of 0.58%, and the technology-centric Nasdaq increased by 1%.

Shares of the company have appreciated by 0.59% over the course of the past month, outperforming the Basic Materials sector’s gain of 0.53% and lagging the S&P 500’s gain of 4.03%.

The upcoming earnings release of VALE S.A. will be of great interest to investors. On that day, VALE S.A. is projected to report earnings of $0.54 per share, which would represent a year-over-year decline of 18.18%. In the meantime, our current consensus estimate forecasts the revenue to be $10.56 billion, indicating a 0.62% decline compared to the corresponding quarter of the prior year.

Looking at the full year, the Zacks Consensus Estimates suggest analysts are expecting earnings of $2.13 per share and revenue of $40.12 billion. These totals would mark changes of +16.39% and -3.98%, respectively, from last year.

It is also important to note the recent changes to analyst estimates for VALE S.A. These revisions help to show the ever-changing nature of near-term business trends. With this in mind, we can consider positive estimate revisions a sign of optimism about the company’s business outlook.

Our research shows that these estimate changes are directly correlated with near-term stock prices. To utilize this, we have created the Zacks Rank, a proprietary model that integrates these estimate changes and provides a functional rating system.

The Zacks Rank system, which varies between #1 (Strong Buy) and #5 (Strong Sell), carries an impressive track record of exceeding expectations, confirmed by external audits, with stocks at #1 delivering an average annual return of +25% since 1988. Over the last 30 days, the Zacks Consensus EPS estimate has witnessed an unchanged state. As of now, VALE S.A. holds a Zacks Rank of #3 (Hold).

From a valuation perspective, VALE S.A. is currently exchanging hands at a Forward P/E ratio of 4.8. This signifies no noticeable deviation in comparison to the average Forward P/E of 4.8 for its industry.

Also, we should mention that VALE has a PEG ratio of 3.48. The PEG ratio is similar to the widely-used P/E ratio, but this metric also takes the company’s expected earnings growth rate into account. The Mining – Iron was holding an average PEG ratio of 3.48 at yesterday’s closing price.

The Mining – Iron industry is part of the Basic Materials sector. This industry, currently bearing a Zacks Industry Rank of 95, finds itself in the top 38% echelons of all 250+ industries.

The Zacks Industry Rank assesses the vigor of our specific industry groups by computing the average Zacks Rank of the individual stocks incorporated in the groups. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

KBW Announces Index Rebalancing for Third-Quarter 2024

NEW YORK, Sept. 13, 2024 (GLOBE NEWSWIRE) — Keefe, Bruyette & Woods, Inc., a leading specialist investment bank to the financial services and fintech sectors, and a wholly owned subsidiary of Stifel Financial Corp. SF, announces the upcoming index rebalancing for the third quarter of 2024.

This quarter, there are constituent changes within three of our indexes: the KBW Nasdaq Financial Technology Index (Index Ticker: KFTX, ETF Ticker: FTEK.LN), KBW Nasdaq Financial Sector Dividend Yield Index (Index Ticker: KDX, ETF Ticker: KBWD), and KBW Nasdaq Premium Yield Equity REIT Index (Index Ticker: KYX, ETF Ticker: KBWY).

These changes will be effective prior to the opening of business on Monday, September 23, 2024.

As part of this rebalancing, below are the component-level changes across impacted indices:

KBW Nasdaq Financial Technology Index (Index Ticker: KFTX, ETF Ticker: FTEK.LN)

Add (1):

Appfolio, Inc. APPF

Drop (1):

Envestnet, Inc. ENV

KBW Nasdaq Financial Sector Dividend Yield Index (Index Ticker: KDX; ETF Ticker: KBWD)

Drop (1):

B Riley Financial Inc. RILY

KBW Nasdaq Premium Yield Equity REIT Index (Index Ticker: KYX; ETF Ticker: KBWY)

Drop (1):

Uniti Group Inc. UNIT

Several of the KBW Nasdaq indexes have tradable exchange‐traded funds licensed: KBW Nasdaq Bank Index (Index Ticker: BKXSM, ETF Ticker: KBWBSM); KBW Nasdaq Capital Markets Index (Index Ticker: KSXSM); KBW Nasdaq Insurance Index (Index Ticker: KIXSM); KBW Nasdaq Regional Banking Index (Index Ticker: KRXSM, ETF Ticker: KBWRSM); KBW Nasdaq Financial Sector Dividend Yield Index (Index Ticker: KDXSM, ETF Ticker: KBWDSM); KBW Nasdaq Premium Yield Equity REIT Index (Index Ticker: KYXSM, ETF Ticker: KBWYSM); KBW Nasdaq Property and Casualty Insurance Index (Index Ticker: KPXSM, ETF Ticker: KBWPSM); KBW Nasdaq Global Bank Index (Index Ticker: GBKXSM); KBW Nasdaq Financial Technology Index (Index Ticker: KFTXSM, ETF Ticker: FTEK.LNSM).

Not all of the listed securities may be suitable for retail investors; in addition, not all of the listed securities may be available to U.S. investors. European investors interested in FTEK LN can contact Invesco at https://etf.invesco.com/gb/private/en/product/invesco-kbw-nasdaq-fintech-ucits-etf-acc/trading-information. U.S. investors cannot buy or hold FTEK LN. An investor cannot invest directly in an index.

About KBW

KBW (Keefe, Bruyette & Woods, Inc., operating in the U.S., and Stifel Nicolaus Europe Limited, also trading as Keefe, Bruyette & Woods Europe, operating in Europe) is a Stifel company. Over the years, KBW has established itself as a leading independent authority in the banking, insurance, brokerage, asset management, mortgage banking and specialty finance sectors. Founded in 1962, the firm maintains industry‐leading positions in the areas of research, corporate finance, mergers and acquisitions as well as sales and trading in equities securities of financial services companies.

Media Contact

Neil Shapiro, (212) 271-3447

shapiron@stifel.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ask an Advisor: I'm 68 and Have $2.4M in Assets – Is Retiring at 70 Realistic?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

I‘m a 68-year-old single man in good health and I plan to work until I am 70. As of now, I have $400,000 in CDs, about $1 million in stocks, and about $1 million in my 401(k) and IRA combined. When I retire, I will get about $4,200 in Social Security and I have $4,000 rental income. (This can be somewhat insecure because the properties are in a hurricane state). I live in a rental apartment in the San Francisco area. If I stop working right now, can I retire comfortably? And does it make sense to buy a property?

– Roger

In pretty much any reasonable context it’s safe to say you’ve done a good job of saving and setting yourself up for a financially secure retirement. However, to know whether you can retire comfortably today, in two years when you’re 70, or even at age 80, you need to think more specifically about the expenses you’d need to cover to maintain your desired lifestyle. I’ll explain why I say that, and hopefully do so in a way that helps you arrive at an answer.

If you need additional help evaluating whether you can afford to retire at a certain age, consider speaking with a financial advisor.

Can You Cover Your Expenses?

What do people mean when they ask “Can I retire comfortably?” Generally, people are asking if they can reasonably expect to be able to cover the expenses required to maintain their desired lifestyle without running out of money given the assets they have available. There’s more to be said about each of the concepts contained in that broader question, but let’s focus on two parts: assets and expenses.

Assess Your Assets

You’ve laid out the assets and income sources you’ll have in retirement. I can comfortably say that there are a lot of people enjoying perfectly secure, comfortable and happy retirements on a lot less. A lot of those people will even continue to see their assets grow throughout retirement despite spending from them. Factors like composition of your assets and the investment returns they generate, in addition to how much you withdraw from them, will dictate how long they can last which brings us to the next point.

Review Your Expenses

While the scope of this is limited since I don’t have information about the expenses you need to cover in retirement, I can walk you through an example for how to approach it, which we will do momentarily.

To be blunt, I haven’t met anyone yet who is similarly situated as you that I thought was in any danger of running out of money. However, that doesn’t mean I can definitively say that about you without having more information about your personal cost of living. You may have a casual lifestyle that requires little income or an extravagant one that will take considerable planning and assets to support. We can’t know if the equation balances if we only know one side of it.

If we were sitting down and having this conversation in real time I’m sure you’d quickly say “Oh yeah, my monthly expenses are about $X.” So, keep that number in mind as we go through the example.

(A financial advisor can help you review your assets and expenses to build a retirement income plan that fits your needs.)

Consider Your Emotions

But math isn’t the only consideration. We need to understand your personality and comfort level as it relates to dealing with the different risks of retirement. For example, if you are very conservative with your investments because you want very little volatility in your portfolio then you’d need to plan for a lower rate of return than you might expect with a portfolio that holds a little more equity.

Maybe you aren’t comfortable with withdrawing from your principal in years when the market is down. Or perhaps you are worried about the future of Social Security and plan to withdraw less than expected from your savings. The list could go on, but you get the idea. There are a lot of things that don’t fit onto a spreadsheet that you’ll want to consider. (A financial advisor can help you take all of this into account as you plan for retirement.)

Putting It All Together

With all that said, let’s consider how you might approach this with some relatively ordinary assumptions. Let’s assume that you have an average retiree risk tolerance that allows you to comfortably hold a diversified portfolio of between 50% and 75% in equities and the remainder in bonds. From there, it’s a matter of determining the amount you are comfortable withdrawing from your portfolio each year. It’s helpful to think about the withdrawal rate as a percentage of your total portfolio (such as the classic “4% rule”).

Depending on the factors I mentioned, as well as your life expectancy and time horizon, let’s assume you decide that a 6% initial withdrawal rate works for you. With about $2.4 million in distributable assets, that would allow you to withdraw $144,000 in the first year and then adjust your subsequent withdrawals for inflation. Add the $50,400 you expect from Social Security, $48,000 in rental income, and you’ve got $242,400. Then, you need to compare that amount against your expenses.

Keep in mind that “expenses” means more than just your monthly living expenses. Don’t forget to account for taxes, your plan to address long-term care, and whether or not you want to designate any specific amount to leave for your heirs since all of these factors pull on your assets.

Of course, this is only a hypothetical to illustrate an approach to income planning. Sometimes there’s a lot more that goes into deciding things like a reasonable withdrawal rate and how you feel about different risks. (If you need additional help with your withdrawal rate and retirement income plan, consider matching with a financial advisor.)

Bottom Line

When thinking about whether or not you can comfortably retire, it’s important to consider your expenses, risk tolerance and psychology. It’s not uncommon for people to think of retirement planning as hitting some specific savings number and calling it a day. However, consider the relative balance between savings, expenses and other variables to determine the approach that fits you and your needs best.

Retirement Planning Tips

-

As you plan for your golden years, it’s important to get an accurate estimate of how much money you’ll have saved up by the time you retire. Luckily, SmartAsset’s retirement calculator can help you project how much money you may need to retire and whether you’re on track to hit this target.

-

A financial advisor can help you navigate the sometimes complex world of retirement planning. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/Drazen_, ©iStock.com/fizkes

The post Ask an Advisor: I’m 68 With $1.4 Million in Savings and Another $1 Million in Stocks. Can I Retire at 70? appeared first on SmartReads by SmartAsset.

What the Options Market Tells Us About Apple

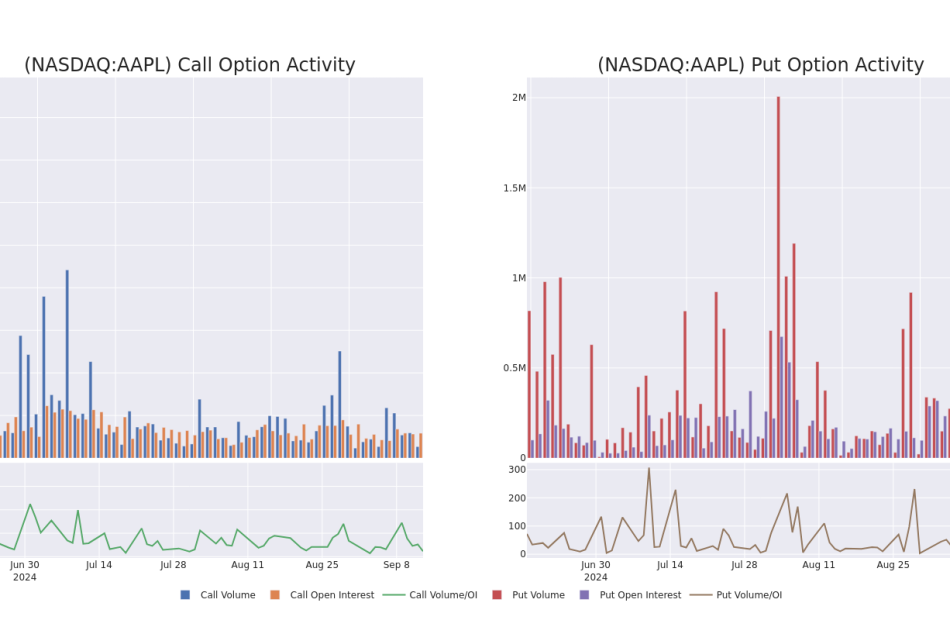

Financial giants have made a conspicuous bearish move on Apple. Our analysis of options history for Apple AAPL revealed 68 unusual trades.

Delving into the details, we found 36% of traders were bullish, while 41% showed bearish tendencies. Out of all the trades we spotted, 13 were puts, with a value of $1,230,050, and 55 were calls, valued at $3,957,417.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $165.0 and $240.0 for Apple, spanning the last three months.

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Apple’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Apple’s significant trades, within a strike price range of $165.0 to $240.0, over the past month.

Apple Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AAPL | PUT | SWEEP | BEARISH | 09/20/24 | $3.7 | $3.6 | $3.7 | $225.00 | $665.8K | 22.1K | 2.9K |

| AAPL | CALL | SWEEP | BEARISH | 09/20/24 | $2.46 | $2.44 | $2.44 | $225.00 | $504.5K | 42.7K | 21.8K |

| AAPL | CALL | TRADE | BULLISH | 01/17/25 | $39.25 | $39.1 | $39.25 | $190.00 | $196.2K | 57.8K | 64 |

| AAPL | CALL | SWEEP | BULLISH | 01/17/25 | $23.15 | $22.95 | $23.15 | $210.00 | $166.6K | 25.0K | 185 |

| AAPL | CALL | TRADE | BULLISH | 09/20/24 | $4.6 | $4.55 | $4.6 | $220.00 | $106.7K | 58.8K | 5.6K |

About Apple

Apple is among the largest companies in the world, with a broad portfolio of hardware and software products targeted at consumers and businesses. Apple’s iPhone makes up a majority of the firm sales, and Apple’s other products like Mac, iPad, and Watch are designed around the iPhone as the focal point of an expansive software ecosystem. Apple has progressively worked to add new applications, like streaming video, subscription bundles, and augmented reality. The firm designs its own software and semiconductors while working with subcontractors like Foxconn and TSMC to build its products and chips. Slightly less than half of Apple’s sales come directly through its flagship stores, with a majority of sales coming indirectly through partnerships and distribution.

After a thorough review of the options trading surrounding Apple, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Apple

- With a volume of 35,417,754, the price of AAPL is down -0.16% at $222.41.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 48 days.

What The Experts Say On Apple

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $274.4.

- An analyst from Tigress Financial persists with their Strong Buy rating on Apple, maintaining a target price of $295.

- An analyst from JP Morgan persists with their Overweight rating on Apple, maintaining a target price of $265.

- Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Apple with a target price of $256.

- Consistent in their evaluation, an analyst from Wedbush keeps a Outperform rating on Apple with a target price of $300.

- An analyst from B of A Securities has decided to maintain their Buy rating on Apple, which currently sits at a price target of $256.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Apple with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Walgreens to pay $106M to settle allegations it submitted false payment claims for prescriptions

WASHINGTON (AP) — Walgreens has agreed to pay $106 million to settle lawsuits that alleged the pharmacy chain submitted false payment claims with government health care programs for prescriptions that were never dispensed.

The settlement announced on Friday resolves lawsuits filed in New Mexico, Texas and Florida on behalf of three people who had worked in Walgreens’ pharmacy operation. The lawsuits were filed under a whistleblower provision of the False Claims Act that lets private parties file case on behalf of the United States government and share in the recovery of money, the U.S. Justice Department said. The pharmacy chain was accused of submitting false payment claims to Medicare, Medicaid and other federal health care programs between 2009 and 2020 for prescriptions that were processed but never picked up.

Settlement documents say Walgreens cooperated in the investigation and has improved its electronic management system to prevent such problems from occurring again.

In a statement, Walgreens said that because of a software error, the chain inadvertently billed some government programs for a relatively small number of prescriptions that patients submitted but never picked up.

“We corrected the error, reported the issue to the government and voluntarily refunded all overpayments,” the statement by Walgreens said.

In reaching the settlement, the chain didn’t acknowledge legal liability in the cases. ____ This story has been corrected to say the lawsuits were filed by private parties, not by the U.S. Justice Department.