Jessica Hopfield At Insulet Decides to Exercises Options Worth $1.53M

In a new SEC filing on September 12, it was revealed that Hopfield, Board Member at Insulet PODD, executed a significant exercise of company stock options.

What Happened: Hopfield, Board Member at Insulet, made a strategic move by exercising stock options for 7,628 shares of PODD as detailed in a Form 4 filing on Thursday with the U.S. Securities and Exchange Commission. The transaction value amounted to $1,533,151.

The Friday morning market activity shows Insulet shares up by 0.18%, trading at $230.86. This implies a total value of $1,533,151 for Hopfield’s 7,628 shares.

All You Need to Know About Insulet

Insulet was founded in 2000 with the goal of making continuous subcutaneous insulin infusion therapy for diabetes easier to use. The result was the Omnipod system, which consists of a small disposable insulin infusion device and that can be operated through a smartphone to control dosage. Since the Omnipod was approved by the U.S. Food and Drug Administration in 2005, approximately 425,000 insulin-dependent diabetics are using it worldwide.

Unraveling the Financial Story of Insulet

Revenue Growth: Insulet’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 23.2%. This indicates a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Health Care sector.

Navigating Financial Profits:

-

Gross Margin: The company excels with a remarkable gross margin of 67.74%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Insulet’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 2.69.

Debt Management: Insulet’s debt-to-equity ratio stands notably higher than the industry average, reaching 1.4. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Analyzing Market Valuation:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 41.68 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 9.29 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Indicated by a lower-than-industry-average EV/EBITDA ratio of 43.84, the company suggests a potential undervaluation, which might be advantageous for value-focused investors.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

A Closer Look at Important Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Insulet’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's Why You Should Retain Wingstop Stock in Your Portfolio Now

Wingstop Inc. WING is likely to benefit from unit expansion, franchise model and technological initiatives. The company’s focus on enhancing shareholder value bodes well. However, a challenging macroeconomic environment and elevated costs are concerns.

Growth Catalysts for Wingstop Stock

Wingstop focuses on unit expansion to drive growth. Over the last 12 months, the company has opened more than 300 net new restaurants, demonstrating its ability to grow both domestically and internationally at a rapid pace. In the second quarter of 2024, WING opened 73 new restaurants. The company has revised its outlook for 2024, projecting the opening of between 285 and 300 new restaurants, up from the previous guidance of 275 to 295. These expansion efforts signal strong future revenue potential, as Wingstop continues to penetrate new markets and grow its global footprint.

Wingstop’s franchise model continues to generate strong returns. The company’s average unit volume has grown from $1.5 million (two years ago) to over $2 million. This growth is fueling record demand for new restaurants. Wingstop’s franchisees are reporting unlevered cash-on-cash returns of over 70%, making it an attractive investment for current and potential brand partners.

Increased focus on digitalization bode well. During the second quarter, digital sales accounted for 68.3% of Wingstop’s total sales, thereby showcasing strength in leveraging technology to enhance the customer experience. With over 45 million digital users, Wingstop is capitalizing on its proprietary MyWingstop platform to improve engagement and conversion rates through hyper-personalization. The company’s investment in data-driven marketing and digital transformation is setting the stage for sustained long-term growth. As more transactions shift to digital platforms, Wingstop is well-positioned to capture a larger market share while enhancing operational efficiency.

Wingstop’s focus on enhancing shareholder value is evident through its stock repurchase program and dividend policy. In the second quarter, the company repurchased 75,862 shares at an average price of $381.29. As of the end of the second quarter, WING reported $96.1 million remaining under the current repurchase authorization. Additionally, Wingstop increased its quarterly dividend by 23%, further underscoring its commitment to returning capital to shareholders. The combination of repurchase programs and dividend payouts makes it an attractive option for investors seeking both growth and income.

Concerns for WING Stock

Image Source: Zacks Investment Research

In the past three months, Wingstop’s shares have lost 0.8% against the industry’s 4.8% growth. The downside was driven by macroeconomic headwinds.

WING has been grappling with rising costs. Its selling, general and administrative (SG&A) expenses have been rising significantly, increasing by $6 million year over year to a total of $28.1 million in the second quarter. While some of this increase can be attributed to long-term investments in digital platforms like MyWingstop, the rapid rise in short-term incentive compensation and stock-based compensation is concerning. With the company’s total SG&A expenses projected to reach up to $116 million by 2024-end, up from $111 million, cost control could become an issue. If growth stalls, Wingstop may find itself burdened by these escalating expenses.

Conclusion

Wingstop’s ability to open new restaurants at a record pace, combined with its high franchisee returns and increasing digital sales, underscores its long-term growth potential. Moreover, its focus on shareholder value through stock buybacks and dividend increases enhances its appeal for investors seeking both capital appreciation and income.

However, investors should be mindful of the challenges posed by rising operational costs and a challenging macroeconomic environment. As the company continues to invest heavily in technology and expansion, cost management will be crucial to sustaining profitability. The company’s growth drivers and strategic initiatives make it a compelling stock to retain for now, as it navigates the headwinds and capitalizes on future opportunities.

Zacks Rank & Key Picks

Wingstop currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Retail-Wholesale sector include Texas Roadhouse, Inc. TXRH, Potbelly Corporation PBPB and El Pollo Loco Holdings, Inc. LOCO, each carrying a Zacks Rank #2 (Buy).

Texas Roadhouse has a trailing four-quarter earnings surprise of 0.4%, on average. TXRH shares have gained 58.7% in the past year. The Zacks Consensus Estimate for TXRH’s 2024 sales and EPS indicates 15.6% and 39.2% growth, respectively, from the year-earlier actuals.

Potbelly Corporation has a trailing four-quarter earnings surprise of 77.5%, on average. The stock has dropped 3.6% in the past year. The Zacks Consensus Estimate for PBPB’s fiscal 2024 EPS implies 33.3% growth on 6.5% lower revenues from the year-ago levels.

El Pollo Loco Holdings has a trailing four-quarter earnings surprise of 21.6%, on average. LOCO shares have gained 44.3% in the past year. The Zacks Consensus Estimate for LOCO’s fiscal 2024 sales and EPS indicates 2% and 12.7% growth, respectively, from the prior-year figures.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Step Aside, Nvidia: Billionaires Are Selling It in Favor of 2 Other High-Growth Stock-Split Stocks

Although artificial intelligence (AI) has been all the rage on Wall Street since 2023 began, excitement surrounding stock splits has given AI a run for its money this year.

A stock split gives publicly traded companies the ability to superficially alter their share price and outstanding share count by the same magnitude. Splits are surface-scratching in the sense that they don’t change a company’s market cap or in any way affect underlying operating performance.

Although there are two types of stock splits — forward and reverse — investors usually gravitate to companies conducting forward splits. This type of split is designed to lower a company’s share price to make it more nominally affordable for investors who are unable to purchase fractional shares through their broker. Companies enacting forward splits are usually outpacing their competition from an execution and innovation standpoint.

Since 2024 began, a little over a dozen leading businesses have announced or completed a stock split — all but one of which was of the forward-split variety.

However, the outlook for some of these premier stock-split stocks is mixed among Wall Street’s brightest and richest investors. Based on the latest round of form 13F filings with the Securities and Exchange Commission, billionaires were decisive sellers of cutting-edge AI stock Nvidia (NASDAQ: NVDA) in the second quarter, but were avid buyers of two other high-growth stock-split stocks.

Billionaires continue to reduce their stakes in Wall Street’s AI darling

For three consecutive quarters, dating back to the start of October 2023, no fewer than seven billionaire money managers have reduced their respective stakes in Nvidia. The June-ended quarter featured seven billionaire sellers, including (total shares sold in parenthesis):

-

Ken Griffin of Citadel (9,282,018 shares)

-

David Tepper of Appaloosa Management (3,730,000 shares)

-

Stanley Druckenmiller of Duquesne Family Office (1,545,370 shares)

-

Cliff Asness of AQR Capital Management (1,360,215 shares)

-

Israel Englander of Millennium Management (676,242 shares)

-

Steven Cohen of Point72 Asset Management (409,042 shares)

-

Philippe Laffont of Coatue Management (96,963 shares)

With Nvidia completing its largest-ever forward split (10 for 1) in June, these billionaires might have chosen to ring the register and diversify their respective portfolios. But there looks to be more to this story than simple profit taking.

Although Nvidia has undeniably benefited from its first-mover advantages as the standout supplier of AI graphics processing units (GPUs), competition is now coming at it from all angles.

With the debut of Nvidia’s Blackwell chip delayed by at least three months due to reported design flaws and supply chain issues, and the company’s prized H100 GPU backlogged, it should be relatively easy for external competitors like Advanced Micro Devices to find strong demand for their AI GPUs.

Moreover, Nvidia’s top customers are signaling an eventual reduced reliance on the AI kingpin. Its four largest clients by net sales are all developing AI GPUs that they plan to use in their data centers. Even with Nvidia’s chips maintaining their computing advantage, the writing is on the wall that these customers intend to use their cheaper internally developed hardware.

Billionaires might also be spooked by the persistent insider selling at Nvidia. While not all insider selling is necessarily nefarious (e.g., insiders sometimes sell stock to pay their tax bill), it is noteworthy that not one executive or board member has purchased shares on the open market since December 2020.

Lastly, billionaire asset managers might be concerned about what history tells us. Since the advent of the internet roughly three decades ago, every next-big-thing trend has worked its way through an early-stage bubble. It’s unlikely that AI is going to be the exception.

But while billionaires were showing Nvidia to the door, they were busy scooping up shares of two other high-growth stock-split stocks.

Super Micro Computer

The first stock-split stock that struck the fancy of six billionaire money managers during the second quarter is Super Micro Computer (NASDAQ: SMCI), a specialist in customizable rack server and storage solutions. These billionaire buyers were:

-

Israel Englander of Millennium Management (553,323 shares)

-

Jeff Yass of Susquehanna International Group (508,814 shares)

-

Ken Griffin of Citadel (98,752 shares)

-

Steven Cohen of Point72 Asset Management (45,066 shares)

-

Ray Dalio of Bridgewater Associates (15,777 shares)

-

Cliff Asness of AQR Capital Management (1,040 shares)

With the stock catapulting to north of $1,200 during the first quarter, it’s not in the least bit surprising to see Supermicro’s board approving a 10-for-1 forward split, to take effect after trading ends on Sept. 30.

However, the prospect of a stock split isn’t the primary draw for billionaires to Supermicro. The lure is the seemingly insatiable demand from businesses wanting to be among the first to capitalize on the AI revolution by training large language models and running generative Ai solutions. To do so, they’ll need the necessary infrastructure in place, which Supermicro can provide.

The company’s operating results have also given billionaires reason to be excited. Net sales jumped 110% to $14.9 billion in fiscal 2024 (the company’s fiscal year ends on June 30), and the midpoint of its guidance calls for $28 billion in net revenue for the current year. This forecast screams that demand is exceptional at the moment.

But it won’t be an easy ride. With its use of Nvidia’s H100 GPUs in its customizable data-center rack servers, and the H100 backlogged, Supermicro finds itself at the mercy of its suppliers.

Furthermore, the company is the target of a short-seller report from Hindenburg Research, which has alleged accounting manipulation. Despite denying these allegations, management did delay the annual filing of its operating results, which did little to soothe investor concerns.

Despite its relatively inexpensive valuation, Super Micro Computer has a lot to prove to Wall Street and investors.

Broadcom

The other stock-split stock that billionaires very clearly favored over Nvidia in the June-ended quarter is AI networking solutions and services providers Broadcom (NASDAQ: AVGO). Seven billionaire investors took the plunge in the second quarter, including:

-

Ole Andreas Halvorsen of Viking Global Investors (2,930,970 shares)

-

Jeff Yass of Susquehanna International Group (2,347,500 shares)

-

Israel Englander of Millennium Management (2,096,440 shares)

-

Ken Griffin of Citadel (1,880,740 shares)

-

John Overdeck and David Siegel of Two Sigma Investments (1,332,230 shares)

-

Ken Fisher of Fisher Investments (865,090 shares)

Keeping with the theme of this list, Broadcom also announced a 10-for-1 forward split (the first in the company’s history), which was completed in mid-July.

Broadcom’s AI ties have certainly been the fuel behind its recent uptick in growth. In particular, the company’s networking solutions are responsible for connecting large numbers of AI GPUs in order to reduce tail latency and maximize the computing potential of AI-accelerating hardware. Presumably, demand for its AI networking solutions will remain robust as long as businesses keep gobbling up AI GPUs.

However, billionaires might be equally excited about Broadcom having a solid foundation that extends well beyond artificial intelligence. It generates a significant amount of revenue and profits from the wireless chips and accessories it provides for next-generation smartphones. And it’s a key provider of optical components used in automated industrial equipment, as well as networking solutions for next-gen vehicles.

Lastly, billionaires might be impressed with the company’s track record of earnings-accretive acquisitions. For example, the $69 billion purchase of cloud-based virtualization software company VMware in November 2023 perfectly positions Broadcom to be an important player in helping businesses with their private- and hybrid-cloud needs.

With a more diverse revenue stream than Nvidia or Super Micro Computer, Broadcom would be best-positioned to navigate an AI bubble-bursting event, should one occur.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Step Aside, Nvidia: Billionaires Are Selling It in Favor of 2 Other High-Growth Stock-Split Stocks was originally published by The Motley Fool

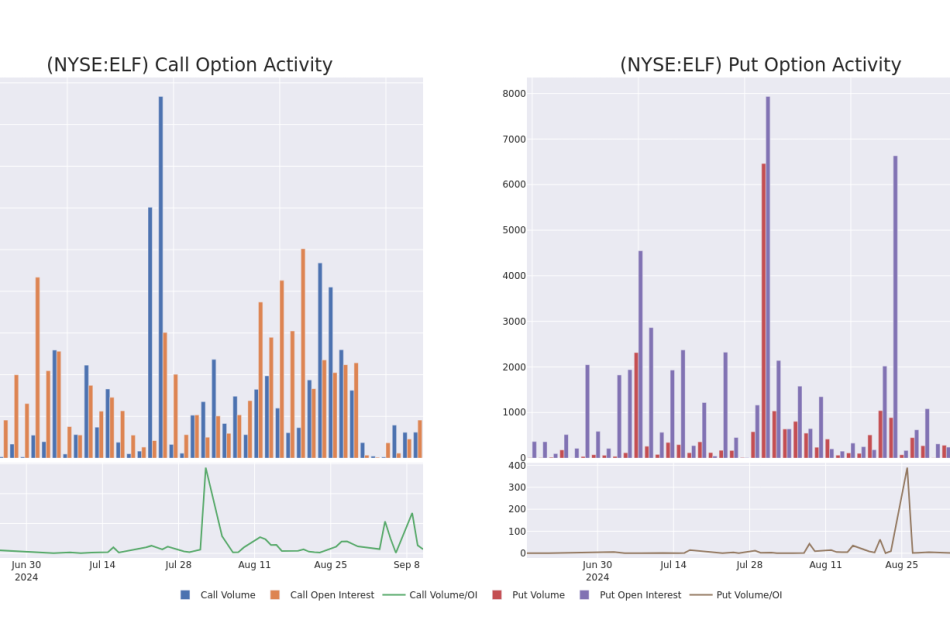

What the Options Market Tells Us About e.l.f. Beauty

Investors with a lot of money to spend have taken a bearish stance on e.l.f. Beauty ELF.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ELF, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 8 uncommon options trades for e.l.f. Beauty.

This isn’t normal.

The overall sentiment of these big-money traders is split between 25% bullish and 62%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $85,560, and 6 are calls, for a total amount of $205,694.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $110.0 to $240.0 for e.l.f. Beauty over the recent three months.

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for e.l.f. Beauty’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across e.l.f. Beauty’s significant trades, within a strike price range of $110.0 to $240.0, over the past month.

e.l.f. Beauty Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ELF | PUT | TRADE | BULLISH | 04/17/25 | $122.3 | $120.2 | $121.0 | $240.00 | $60.5K | 5 | 5 |

| ELF | CALL | TRADE | BEARISH | 11/15/24 | $16.7 | $15.5 | $15.85 | $120.00 | $55.4K | 235 | 48 |

| ELF | CALL | SWEEP | BEARISH | 01/17/25 | $22.0 | $21.5 | $21.5 | $115.00 | $32.2K | 91 | 18 |

| ELF | CALL | SWEEP | BULLISH | 10/18/24 | $1.55 | $1.45 | $1.5 | $155.00 | $31.8K | 166 | 233 |

| ELF | CALL | TRADE | BEARISH | 09/19/25 | $28.8 | $28.0 | $28.08 | $125.00 | $30.8K | 4 | 11 |

About e.l.f. Beauty

e.l.f. Beauty Inc is a multi-brand beauty company that offers inclusive, accessible, clean, vegan and cruelty-free cosmetics and skin care products. The Company’s mission is to make the best of beauty accessible to every eye, lip, face, and skin concern. The company offers cosmetic accessories for women which include eyeliner, mascara, false eyelashes, lipstick, the foundation for the face, moisturizer, cleanser, and other tools through its stores and e-commerce channels. The products that the company sells are marketed under the e.l.f. Cosmetics, W3LL PEOPLE and Keys Soulcare brands. It carries out sales within the US and internationally, out of which maximum revenue is generated from the US.

Having examined the options trading patterns of e.l.f. Beauty, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of e.l.f. Beauty

- Trading volume stands at 1,630,815, with ELF’s price down by -1.08%, positioned at $113.43.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 47 days.

What The Experts Say On e.l.f. Beauty

5 market experts have recently issued ratings for this stock, with a consensus target price of $192.2.

- Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for e.l.f. Beauty, targeting a price of $190.

- Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on e.l.f. Beauty with a target price of $150.

- An analyst from B. Riley Securities downgraded its action to Buy with a price target of $175.

- Maintaining their stance, an analyst from DA Davidson continues to hold a Buy rating for e.l.f. Beauty, targeting a price of $223.

- An analyst from DA Davidson persists with their Buy rating on e.l.f. Beauty, maintaining a target price of $223.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest e.l.f. Beauty options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meet the 15 members of the $100 billion club — who are jointly worth more than Amazon or Google

-

The elite group worth more than $100 billion includes Elon Musk, Jeff Bezos, and Bill Gates.

-

The 15 members have grown about $280 billion richer this year and are jointly worth $2.2 trillion.

-

Walmart heir Jim Walton joined the club this week and his siblings could soon follow.

Elon Musk, Jeff Bezos, and Mark Zuckerberg are among the handful of people on the planet with a net worth above $100 billion.

Members of this elite group have amassed 12-digit fortunes by owning huge amounts of stock in some of the world’s most valuable companies. Most are founders and either current or former CEOs, and some, such as Warren Buffett, would be much richer if they didn’t give billions to charity.

There may be only 15 centibillionaires, but their combined wealth is around $2.2 trillion, according to the Bloomberg Billionaires Index. That’s more than the $1.9 trillion market capitalizations of Amazon and Google’s parent company, Alphabet.

All but one of them have grown richer this year, adding a net $280 billion or so to their collective fortunes. Adobe ($257 billion), Chevron ($250 billion), and PepsiCo ($241 billion) are all worth less than that.

Walmart heir Jim Walton joined the exclusive group this week thanks to a $28 billion increase in his net worth this year. His siblings, Rob and Alice, could soon follow given their respective net worths of $98.3 billion and $97.7 billion.

Here’s the list of individuals worth at least $100 billion, showing Bloomberg’s estimate of their net worth at the time of publication, how much it’s changed this calendar year, and the source of their wealth.

All figures are correct as of September 12, 2024.

1. Elon Musk

Net worth: $248 billion

YTD change in wealth: +$18.8 billion

Source of wealth: Tesla and SpaceX stock

Musk is the CEO of the electric-vehicle maker Tesla and the spacecraft manufacturer SpaceX. He’s also the owner of X, the social network formerly known as Twitter.

His other businesses include The Boring Company, Neuralink, and xAI.

2. Jeff Bezos

Net worth: $202 billion

YTD change in wealth: +$25.4 billion

Source of wealth: Amazon stock

Bezos is the founder, executive chairman, and former CEO of Amazon, the e-commerce and cloud-computing giant.

He also founded the space company Blue Origin and owns The Washington Post.

3. Bernard Arnault

Net worth: $180 billion

YTD change in wealth: -$27.8 billion

Source of wealth: LVMH stock

Bernard Arnault is the founder, chairman, and CEO of LVMH Moët Hennessy Louis Vuitton. His conglomerate owns a bevy of luxury brands, including Dior, Fendi, Dom Pérignon, Sephora, and Tiffany & Co.

4. Mark Zuckerberg

Net worth: $179 billion

YTD change in wealth: +$51.4 billion

Source of wealth: Meta stock

Zuckerberg is the cofounder, chairman, and CEO of Meta Platforms, the social-media titan behind Facebook, Instagram, WhatsApp, and Threads.

Meta’s Reality Labs division makes virtual-reality and augmented-reality headsets and experiences.

5. Larry Ellison

Net worth: $168 billion

YTD change in wealth: +$45.1 billion

Source of wealth: Oracle and Tesla stock

Larry Ellison is the cofounder, chief technology officer, and former CEO of Oracle, an enterprise software company specializing in cloud computing and database platforms.

He invested in Tesla prior to joining the automaker’s board in 2018 and made more than 10 times his money on paper by the time his term as a director ended in August 2022.

6. Bill Gates

Net worth: $158 billion

YTD change in wealth: +$17.2 billion

Source of wealth: Microsoft stock

Bill Gates is the cofounder and former CEO of Microsoft, which makes the Office application suite, the cloud-computing platform Microsoft Azure, and Xbox consoles.

He’s renowned for his philanthropic work at the helm of the Bill & Melinda Gates Foundation, one of the world’s largest charitable entities.

7. Warren Buffett

Net worth: $145 billion

YTD change in wealth: +$24.8 billion

Source of wealth: Berkshire Hathaway stock

Warren Buffett acquired Berkshire Hathaway when it was a failing textile mill in 1965 and has since grown it into one of the world’s largest companies. His nearly 15% stake is worth around $145 billion.

The famed investor’s conglomerate owns scores of businesses, including GEICO, See’s Candies, and BNSF Railway, and holds multibillion-dollar stakes in public companies such as Apple and Coca-Cola.

Buffett has gifted around half of his Berkshire shares to the Gates Foundation and four family foundations since 2006. All else being equal, if he’d retained all his stock he would be the world’s wealthiest person with a net worth over $300 billion.

8. Steve Ballmer

Net worth: $144 billion

YTD change in wealth: +$12.9 billion

Source of wealth: Microsoft stock

Steve Ballmer served as Microsoft’s CEO between 2000 and 2014. He joined the company in 1980 as Bill Gates’ assistant, initially negotiating a profit share which he later swapped for an equity stake when it became excessively large.

Ballmer retired as CEO in 2014 with a 4% stake — a position worth over $120 billion today. He promptly bought the Los Angeles Clippers for $2 billion and remains the basketball team’s owner.

9. Larry Page

Net worth: $136 billion

YTD change in wealth: +$9.13 billion

Source of wealth: Alphabet stock

Larry Page cofounded Google with his Stanford University classmate Sergey Brin in a friend’s garage in 1998 and served as CEO until 2001.

He took the reins again between 2011 and 2015 after Google was restructured as a subsidiary of Alphabet alongside other businesses such as YouTube and Waymo.

10. Sergey Brin

Net worth: $128 billion

YTD change in wealth: +$7.81 billion

Source of wealth: Alphabet stock

Sergey Brin cofounded Google with Page in 1998 and served as the search-and-advertising titan’s first president.

He and Page stepped down from their respective roles as Alphabet’s president and CEO in 2019.

11. Mukesh Ambani

Net worth: $111 billion

YTD change in wealth: +$14.4 billion

Source of wealth: Reliance Industries stock

Mukesh Ambani is the chairman and managing director of Reliance Industries and Asia’s richest man.

His father, Dhirubhai Ambani, founded Reliance and trusted Mukesh to grow the conglomerate’s petrochemicals business and expand into new areas such as telecommunications.

Mukesh threw a star-studded, multi-event wedding ceremony for his son Anant Ambani this summer.

12. Amancio Ortega

Net worth: $102 billion

YTD change in wealth: +$14.7 billion

Source of wealth: Inditex stock

Amancio Ortega is the founder and former chairman of Inditex, a fashion retail group home to brands such as Zara, Bershka, and Massimo Dutti.

The billionaire philanthropist and real-estate investor stopped running Inditex in 2011. His daughter Marta Ortega Pérez was appointed chair at the end of 2021.

13. Jim Walton

Net worth: $101 billion

YTD change in wealth: +$28.1 billion

Source of wealth: Walmart stock

Jim Walton is the youngest son of Walmart founder Sam Walton, who gave each of his four children a 20% stake in the budding retail business over 70 years ago. Jim and his two surviving siblings, Rob and Alice, each still own over 11% of the company.

Jim’s net worth crossed $100 billion this week thanks to the retailer’s stock soaring 50% this year. Rob and Alice are worth $98.3 and $97.7 billion respectively, meaning they could soon join him in the $100 billion club.

14. Michael Dell

Net worth: $100 billion

YTD change in wealth: +$21.9 billion

Source of wealth: Dell stock

Michael Dell is the founder, chairman, and CEO of the eponymous computer maker. Dell stock has ballooned from below $40 in March last year to around $110, valuing the company at over $75 billion, as investors wager it will be a key beneficiary from the AI boom.

Dell owns about 46% of his company, and pocketed well over $10 billion from the sale of Dell-backed VMware to Broadcom last year.

15. Gautam Adani

Net worth: $100 billion

YTD change in wealth: +$15.7 billion

Source of wealth: Adani Group stock

Gautam Adani is the founder and chairman of the Adani Group. His conglomerate is a leading developer of infrastructure such as ports and power plants in India.

Read the original article on Business Insider

China’s First Retirement Age Hike Since 1978 Triggers Discontent

(Bloomberg) — China will raise the retirement age for the first time since 1978, a move that could stem a decline in the labor force but risk angering workers already wrestling with a slowing economy.

Most Read from Bloomberg

Top lawmakers endorsed a plan to delay retirement for employees by as long as five years, Xinhua News Agency reported Friday. Men will retire at 63 instead of 60. Women will retire at 55 instead of 50 for ordinary workers, and 58 instead of 55 for those in management positions.

The change will take place over 15 years starting January, and will allow more people to work longer. This could boost productivity to address the challenges of an aging population, although it risks adding to public discontent with the economy growing at the worst pace in five quarters.

“The timeline of raising the retirement age is pretty gradual. Policymakers probably have taken into account the potential negative impact and calibrated that carefully,” said Michelle Lam, Greater China economist at Societe Generale SA.

Shares of companies providing health and elderly care jumped, with Shanghai Everjoy Health Group Co. rising by the daily limit of 10%. Chalkis Health Industry Co. and Youngy Health Co. gained more than 6%.

“People may face more health problems if the retirement age is raised. And the pressure of supporting parents may require more elderly care institutions to share the burden,” said Shen Meng, a director at Beijing-based investment bank Chanson & Co.

China’s retirement age is among the world’s lowest despite significantly increased life expectancy over the decades. A bigger tax base and delayed access to benefits will relieve the pressure on the government to fund pensions as the elderly population rapidly expands.

The hike is aimed at “adapting to the new situation of demographic development in China, and fully developing and utilizing human resources,” according to the decision by the Standing Committee of the National People’s Congress.

The approval followed a July announcement by the ruling Communist Party that the retirement age will rise in a “voluntary, flexible manner.” Previous efforts to raise the threshold had failed in the face of public opposition.

What Bloomberg Economics Says…

“This is a big step toward countering a key drag on long-term growth — a shrinking working-age population. But it won’t turn the tide. Our long-term projections, which already factor in a bump in the retirement age, point to growth going down to about 1% by 2050.”

Eric Zhu, economist

Read the full note here

The Friday decision has left some people fuming over working into an older age, as well as those who fear greater competition in the job market.

“Are you asking me, when I’m 60, to compete with young people for jobs?” a Weibo user said on the X-like social media platform, where the news was the top trending item and garnered more than 530 million views as of Friday afternoon.

Some also complained about employers’ discrimination against older job candidates, a problem that the government has long vowed to address.

Authorities acknowledged the potential short-term pressure on the job market at a press briefing on Friday. Li Zhong, vice minister at the Ministry of Human Resources and Social Security, said the gradual pace of the change should lead to a “muted” effect on youth employment.

The top legislative body also ruled that starting 2030, workers will need to contribute to their pension accounts for a longer period before they’re eligible to receive payout. This requirement will increase gradually from 15 to 20 years.

“The sustainability of the pension system may be the main consideration behind the move,” said Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered. “Even though the move will increase pressure for the job market, in the long term it helps mitigate the impact from declines in the working-age population.”

Lawmakers also called on officials to actively respond to the aging population, protect workers’ rights and improve elderly care. Additionally, it empowered the State Council, China’s cabinet, to adjust these measures as needed.

As China’s life expectancy has risen, delaying retirement has become more important to offset the demographic challenges from its decades-long enforcement of a one-child policy, which left a generation of single children supporting a large elderly population. Today, the average Chinese lives to 78 from 66 four decades ago.

People aged 65 and older are expected to make up 30% of the population by around 2035 from 14.2% in 2021, according to a report by state broadcaster CCTV on Tuesday. Authorities’ efforts to encourage births have so far done little to reverse the demographic shift, with birth rate falling to a record last year.

“When I was born they said there were too many. When I gave birth they said there were too few. When I wanted to work they said I was too old. And when I retire they say I’m too young,” another Weibo user said.

–With assistance from Fran Wang, Yujing Liu and Catherine Ngai.

(Updates with more comments, details throughout)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Wall Street Eyes Strong Finish To The Week Despite Futures Suggesting Moderation In Tech Buying: Strategist Cautions Against Factoring Rapid, Steep Cuts Ahead Of Next Week's Fed Meeting

Now that the twin inflation reports are in the rearview mirror, U.S. stocks are hanging onto the slender optimism as traders look ahead to the Federal Reserve’s rate-setting meeting. The numbers did little to belie expectations of a cut at next week’s meeting, although they did pour cold water on a bigger cut. The major index futures are little changed in early trading. Tidings from the tech sector has been mixed, potentially triggering caution amid the week’s runup.

A consumer sentiment report with a few forward inflation expectations readings could be on traders’ radar. Some profit-taking can not be ruled out as traders digest the week’s big gains.

Looking ahead to the Fed meeting, fund manager Louis Navellier said, “The Fed cut on Wednesday is the big news of the month.” “There may be some repositioning going in, but most of the action will come afterward, especially if there is a surprise 50bps cut,” he added.

| Futures | Performance (+/-) |

| Nasdaq 100 | +0.08% |

| S&P 500 | +0.21% |

| Dow | +0.18% |

| R2K | +0.87% |

In premarket trading on Friday, the SPDR S&P 500 ETF Trust (NYSE: SPY gained 0.25% to $560.48 and the Invesco QQQ ETF (NASDAQ: QQQ) rose 0.15% to $473.95, according to Benzinga Pro data.

Cues From Last Session:

Wall Street advanced on Thursday, thanks to a second-half recovery after stocks initially showed muted reaction to the fairly in-line August producer price inflation report and the weekly jobless claims data. After opening slightly higher, the major indices moved back and forth across the unchanged line in a narrow range in the morning session.

Sustained buying in technology stocks, especially those from the communications sector, and the rebound by energy stocks lifted the indices higher in the afternoon. The S&P 500 and the Nasdaq Composite indices closed higher for a fourth straight session, both ending at their highest level since Aug. 27.

The 30-stock, blue-chip Dow Industrials Average has advanced for a second straight day, ending at its best level in September.

Small-caps outperformed, potentially getting ahead of the curve, as the market awaits a Fed rate cut.

All 11 S&P 500 sectors finished in the green, with communication services, consumer discretionary and energy stocks pacing the gains.

| Index | Performance (+/) | Value |

| Nasdaq Composite | +1.00% | 17,569.68 |

| S&P 500 Index | +0.75% | 5,595.76 |

| Dow Industrials | +0.58% | 41,096.77 |

| Russell 2000 | +1.22% | 2,129.43 |

With a session to go, the S&P 500 is up about 3.5% for the week, and the Nasdaq Composite a steeper 5.3%. The indices remain on track to rebound from the sharp pullback seen in the week ended Sept. 6.

Insights From Analysts:

Morgan Stanley Chief Investment Officer Lisa Shalett warns against investors hoping for steeper and more rapid rate cuts. The strategist said the Fed will likely be able to achieve the widely hoped-for “soft landing” of not-too-fast and not-too-slow economic growth and subdued inflation. “This scenario likely calls for slow and shallow rate reductions, in quarter-point increments toward 3.5% by the end of 2025,” she said, adding that this could disappoint investors hoping for deeper and faster cuts that could take the Fed funds rate below 3% by the end of the year.

Shalett said the recent labor, economic and financial-market signals have been mixed, warranting cautious optimism from investors. She recommended investors consider owning the equal-weighted version of the index as a better risk-adjusted exposure than the cap-weighted version, and also find compelling trends in financials, industrials, energy, materials and healthcare, plus certain parts of technology like software, and more defensive ideas in residential real-estate investment trusts and utilities.

See also: Best Futures Trading Software

Upcoming Economic Data:

- The Labor Department will release its export and import prices report for August at 8:30 a.m. EDT. The consensus estimates call for a 0.1% month-over-month dip in export prices and a steeper 0.2% fall in import prices. This compares to the 0.7% and 0.1% increases, respectively, recorded for July.

- The University of Michigan is due to announce the results of its preliminary consumer sentiment survey for September at 10 a.m. EDT. Economists, on average, expect the headline consumer sentiment index to come in at 68.4, up from 67.9 in August. Traders may also focus on the forward inflation expectations readings from the survey.

Stocks In Focus:

- Adobe Inc. ADBE shares fell over 8% in premarket trading after the documents management software and systems provider’s fourth-quarter guidance failed to satiate the Street.

- RH RH soared about 20% following the home furnishing retailers’ earnings report.

- Oracle Corp. ORCL shares rose about 6% after the artificial intelligence-levered database management software company raised its 2026 revenue guidance at an analyst meeting coinciding with the Oracle CloudWorld conference in Las Vegas.

- Boeing Company BA shed nearly 4% after the International Association of Machinists and Aerospace Workers said 94.6% of voting workers rejected the contract put forward by the company recently, thereby opting to go on strike, beginning on Friday.

- Moderna, Inc. MRNA shares saw follow-through selling after analysts tempered their expectations concerning the vaccine maker. The vaccine maker’s shares slumped over 12% Thursday after it announced sub-par guidance for 2025 and also some cost-cutting measures.

Commodities, Bonds And Global Equity Markets:

Crude oil futures saw additional strength in the early U.S. session, positioning the commodity to record gains for a fourth straight session. Black gold is inching toward the psychological barrier of $70 a barrel. It remains on track to snap a streak of third straight weekly declines, as Hurricane Francine disrupted oil production in the U.S. Gulf Coast.

After scaling the $2,600 intraday Thursday and settling off the highs, gold futures headed higher yet again Friday.

Bitcoin BTC/USD traded flattish but held above the $58K level as traders looked ahead to next week’s Fed meeting.

The yield on the 10-year Treasury note slid 3.4 basis points to 3.646%.

Most major Asian markets, save the Japanese, Chinese and Indian markets, closed higher on Friday, tracking the buoyancy on Wall Street overnight. The Japanese market continued to suffer from the yen’s strength, given the key Nikkei 225 average is heavily weighted with export stocks.

European stocks extended their gains, with most major averages in the region firmer in early trading. The European Central Bank on Thursday cut rates, in line with expectations, as growth sags. The central bank also reduced its growth forecast for the region.

Read Next:

Image Created Using Midjourney

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EL Trading Near 52-Week Low: How Should Investors Approach the Stock?

The Estee Lauder Companies Inc. EL exhibited a volatile stock trajectory in recent months, driven by weak consumer sentiment amid high inflation and rising interest rates. The company is also grappling with issues such as market instability in mainland China and Asia travel retail, lower conversion rates, and negative foreign currency impacts.

As a result, shares of this New York-based provider of skincare, makeup, fragrance and hair care products have plunged 42.4% year to date compared with a 37.7% drop in the broader industry. In contrast, the Consumer Staple sector and the S&P 500 have posted increases of 9.4% and 16.3%, respectively, during the same period. Closing the trading session at $84.20 on Thursday, shares of EL stand close to its recently reached 52-week low of $82.39.

Image Source: Zacks Investment Research

EL is trading below its 50 and 200-day moving averages, indicating a bearish outlook and challenges in sustaining the recent performance levels.

EL Stock Trades Below 50 and 200-Day Moving Average

Image Source: Zacks Investment Research

Decoding Challenges Faced by EL

In the fiscal 2024, The Estee Lauder Companies faced significant challenges in the Asia-Pacific region, particularly in mainland China, due to a broader slowdown in the prestige beauty sector. Sales in the Asia-Pacific region fell 7% to $1,205 million during the fiscal fourth quarter. The downtick was largely caused by weakness in mainland China. Consumer confidence remained low and cautious spending behavior contributed to a decline in prestige beauty retail sales, which worsened from mid-single digits in the third quarter to low-double digits. The Asia travel retail market also struggled, with sales in Hainan plunging more than 40% in the fiscal fourth quarter. Weaker consumer sentiment, smaller basket sizes and a shift toward spending on experiences played a key role in these declines. Looking ahead to fiscal year 2025, the recovery in China and Asia travel retail is expected to be slow, which might limit sales growth and profitability in these key markets.

Another concerning point is the contraction in adjusted operating margins, which contracted 120 basis points to 10.2% in the fiscal 2024. While there was a modest recovery in the later part of the fiscal 2024, the outlook for fiscal 2025 indicates a slower-than-expected pace of margin expansion. This delay is partially attributed to continued pressure from high-margin categories like skin care, which are still facing declines in sales.

The company is losing market share in channels that are growing more slowly, such as traditional retail, despite some gains in high-growth platforms like Amazon. However, these gains are not enough to offset losses in brick-and-mortar stores, particularly in North America, where competition is fierce.

The Estee Lauder Companies faces significant financial pressure due to unfavorable currency rates. Currency fluctuations, particularly in regions like Israel and the Middle East, compounded by business disruptions, further impacted the company’s profitability in the fiscal 2024. These currency headwinds are expected to continue affecting earnings, potentially reducing earnings per share by approximately 3 cents in the fiscal 2025.

What to Expect From The Estee Lauder Companies in FY25?

The company continues to face a challenging macroeconomic environment, with ongoing volatility in the global prestige beauty market, especially in mainland China and Asia travel retail. For fiscal year 2025, management expects a more modest performance compared to industry averages, primarily due to its strong presence in these regions. Weak consumer sentiment and changing traveler behavior, with more spending on experiences over products, are impacting Asia travel retail. Additionally, risks such as retailer destocking and intense competition, particularly in North America, are further complicating the company’s outlook.

In the first quarter of fiscal 2025, the company anticipates continued pressure from these challenges, projecting a 3-5% year-over-year decline in reported and organic net sales. Adjusted EPS are expected to fall sharply, ranging between 1 and 9 cents and suggesting a decline of 17-89% on a constant-currency basis.

Analysts Downgrade EL’s Earnings Estimates

EL appears to be in a troubled spot. The Zacks Consensus Estimate for the current and next fiscal year EPS has moved downward by 2.9% and 4.3% to $2.97 and $4.03, respectively, in the past seven days. This downward adjustment reflects a negative sentiment among analysts and suggests potential challenges in achieving projected profitability.

Image Source: Zacks Investment Research

EL’s Valuation Premium Raises Questions

The Estee Lauder Companies valuation remains a point of contention. Despite the pullback in the stock price, EL is trading at a premium relative to industry peers like Coty Inc. COTY and Inter Parfums, Inc. IPAR, which seems increasingly difficult to justify. EL is currently trading at a forward 12-month P/E of 25.99, higher than the industry’s 21.89. This valuation discrepancy indicates that while investors have high expectations for the company’s future growth, the stock’s current performance and the broader market challenges could pose risks.

Can Growth Strategies Turn the Tide?

Despite several challenges, The Estee Lauder Companies is making significant strides with its Profit Recovery and Growth Plan (PRGP). This initiative focuses on three core areas — accelerating margin expansion, targeted growth investments, and simplifying processes for greater agility. For the fiscal 2025, the PRGP is expected to deliver substantial benefits, with around 80% of gains improving gross profit through optimized pricing, reduced discounts and enhanced precision marketing. The remaining 20% aims to cut operating expenses by streamlining operations and expanding shared services. These efforts are projected to generate $1.1-$1.4 billion in net savings by the fiscal 2026.

The company is also leveraging its strengths in high-growth areas, including its global prestige skin care portfolio and luxury fragrance brands such as Jo Malone London, TOM FORD and Le Labo. Its focus on digital transformation is another key growth driver, with strong online sales growth across nearly 50 markets. Digital initiatives, combined with precision marketing using AI and consumer profiles, position the company for sustained growth and future market leadership.

While EL is resorting to restructuring, the fiscal 2025 forecast reveals more conservative sales growth and profitability improvements than originally anticipated. This suggests that the company’s recovery will take longer than planned, leaving investors wary of future profitability in the near term.

What’s Next for Investors?

The Estee Lauder Companies is facing significant challenges, including weak consumer sentiment, declining sales in key markets like China, and currency headwinds. Its reliance on Asia travel retail and luxury beauty has led to pressure on margins and overall profitability. The stock is trading below key moving averages, signaling a bearish trend. While the profit recovery plan aims to improve margins and streamline operations, the road to recovery might be longer than anticipated. With a lofty valuation and analysts downgrading earnings estimates, investors should approach EL stock with caution. EL currently carries a Zacks Rank #5 (Strong Sell).

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Marjorie Taylor Greene Is Loading Up on Stocks Again; Here Are the 6 Stocks She Just Bought

While election season is keeping politicians occupied along with their regular legislative duties, Rep. Marjorie Taylor Greene, a Republican from Georgia, hasn’t lost focus on adding to her stock portfolio. The representative from the Peach State steadfastly picked up new positions throughout the past few months, demonstrating interest in everything from artificial intelligence (AI) stocks to Vanguard funds.

In the latest go-round, Greene, increased her AI exposure in a variety of ways, picking up shares of Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG), Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL), CrowdStrike (NASDAQ: CRWD), Nvidia (NASDAQ: NVDA), and Tesla (NASDAQ: TSLA). While Greene didn’t disclose the exact amount that she invested in each of the stocks, her regulatory filing reveals that each transaction was valued between $1,001 and $15,000.

More of the same magnificent (and other) names

Reviewing her stock purchases over the past few months, investors will find that Greene clearly has a penchant for artificial intelligence stocks — in particular, “Magnificent Seven” stocks. In fact, in her latest round of buying activity, Greene was building larger positions in stocks she had already purchased. Greene scooped up shares of Alphabet, Amazon, and Nvidia on Sept. 3, having bought the same stocks on Aug. 21. Greene didn’t disclose her motivation for the move, but it’s possible that she sensed a buying opportunity. Alphabet, Amazon, and Nvidia fell 5%, 2%, and 16%, respectively, between Aug. 21 and Sept. 3.

While there’s no clear explanation for the sell-off in Alphabet stock at that time, it may simply be an extension of the market’s skepticism regarding Alphabet’s future after it lost an important antitrust case over the summer. With regard to Amazon, investors may have been bearish in reaction to Reuters reporting on Aug. 29 that some Amazon workers would join a Teamsters strike against unfair labor practices that had extended into several states. And investors were likely clicking the sell button on Nvidia stock after the company failed to meet the market’s sky-high expectations for its second-quarter 2025 financial results.

Apple represents another Magnificent Seven stock that found its way to Greene’s buy list again. Previously, Greene had bought the tech superstar’s stock in May, and it’s possible that she chose to increase her position in September after a slight sell-off following news that Warren Buffett pared the Berkshire Hathaway position in Apple.

Although it’s not a Magnificent Seven stock, CrowdStrike is another repeat-buy stock that Greene had bought previously — this one in in June. Perhaps sensing another bargain, Greene may have seen value in the cybersecurity specialist, whose stock took a nosedive, after it was found to be largely responsible for causing global internet outages in July.

Driving in a new direction

Hitching a ride with an electric vehicle (EV) stalwart for the first time, Greene added shares of Tesla to her portfolio — a stock that provides even more exposure the burgeoning field of AI. In addition to providing Tesla drivers with the option for autonomous driving capability with its AI-powered full self-driving mode, Tesla has committed to developing humanoid robots that are embedded with AI.

Despite its stock falling in late July and into August, Tesla electrified the hopes of some investors in August when they learned that the company’s Cybertruck sales were strong in July — an auspicious sign for a stock that many had maligned after the company reported second-quarter 2024 financial results.

What’s a Main Street investor to do?

Smart as it may be to dig into politicians’ stock buys and sales, it’s never a wise move to blindly follow their actions. Instead, investors should resolve to use the knowledge of politicians’ stock moves as starting points for engaging in further research. Nonetheless, Greene’s recent stock picks are all worthwhile considerations at the moment, as all six stocks are industry leaders that provide investors with varying types of exposure to AI.

For those looking to strengthen their holdings with a leader in cybersecurity, CrowdStrike is a worthy consideration even after the July incident. Similarly, with bearish sentiment surrounding Alphabet from its lost antitrust case, now may be a good time to pick up shares for those with long-term investing horizons who don’t find near-term volatility daunting. And with regard to Amazon, the company continues to report strong financials thanks to its Amazon Web Services business along with its other offerings, even inspiring billionaires to click the buy button.

Apple, Nvidia, and Tesla, on the other hand, are three AI powerhouses that continue to dominate their respective fields and are well worth strong consideration from investors with varying types of investing goals.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, CrowdStrike, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

Marjorie Taylor Greene Is Loading Up on Stocks Again; Here Are the 6 Stocks She Just Bought was originally published by The Motley Fool

Fed Rate Cuts And S&P 500: The 'Why' Matters Most, Data Shows

The performance of the S&P 500 following the Federal Reserve’s rate cuts largely hinges on whether the economy is in a recession or not.

According to a detailed analysis by Vickie Chang, an analyst at Goldman Sachs, historical data reveals a sharp contrast in how equities react to rate cuts during recessions compared to other economic phases.

Chang noted that in recessionary periods, stock markets typically experienced meaningful declines after the Fed’s initial rate cut. In contrast, during “growth scares” or “normalization” periods, equities have rallied strongly.

“History tells us that why the Fed is cutting matters—asset performance around the start of the easing cycle has differed depending on what motivated Fed cuts,” Chang explained.

Goldman Sachs analyzed 10 Fed rate-cutting cycles starting from 1984, four of which were associated with recessions (1990, 2001, 2007, and 2020). The remaining six non-recessionary episodes were categorized as either “growth scare” periods (1987, 1998, 2019) or “normalization” periods (1984, 1989, 1995).

| First cut date | Type of episode |

|---|---|

| September 1984 | Normalization |

| October 1987 | Growth Scare |

| June 1989 | Normalization |

| July 1990 | Recession |

| July 1995 | Normalization |

| September 1998 | Growth Scare |

| January 2001 | Recession |

| September 2007 | Recession |

| July 2019 | Growth Scare |

| March 2020 | Recession |

How Equities, Bonds, And Volatility Behave After The First Fed Cut

The S&P 500’s performance diverges sharply between recessionary and non-recessionary episodes.

The S&P 500, as tracked by the SPDR S&P 500 ETF Trust SPY, gained 11% three months after the first cut during “growth scare” periods – which involve economic slowdowns that don’t escalate into full recessions – and it continued to rally, reaching a 15% gain over six months.

In “normalization” periods, where the Fed cuts rates to bring them back to lower, more sustainable levels after previously hiking them during expansionary times, the S&P 500 also showed positive performance, rising by 5% after three months and 7% after six months.

During recessions, the stock market tells a very different story.

The S&P 500 experienced sharp declines of 11% three months after the first rate cut and remained in the red, down 10% after six months.

This underscores the fact that rate cuts, while intended to stimulate the economy, often come too late to stop the downward momentum in recessions, and stocks struggle as corporate earnings decline and economic activity contracts.

The VIX, a measure of stock market volatility, also reacts differently depending on the economic backdrop. In growth scare scenarios, volatility tends to decrease significantly after rate cuts. In normalization periods, the VIX initially spikes by 17% three months after the first rate cut, but this increase is short-lived. Volatility stabilizes, dropping to -1% six months after the first cut.

In stark contrast, during recessions, the VIX tends to rise following rate cuts. Volatility surged by 21% three months after the first cut and remained elevated, still up 9% after six months.

Regarding the performance of bonds in recessionary periods, the yield on the 2-year Treasury fell on average by 65 basis points (bps) three months after the first cut and continued to decline, dropping by 82 bps six months in.

Similarly, the 10-year Treasury yield fell by 23 bps three months after the first cut and dropped by 30 bps six months later.

| Asset | Normalization (3m) | Normalization (6m) | Growth Scare (3m) | Growth Scare (6m) | Recession (3m) | Recession (6m) |

|---|---|---|---|---|---|---|

| S&P 500 | +5% | +7% | +11% | +15% | -11% | -10% |

| VIX | +17% | -1% | -39% | -35% | +21% | +9% |

| UST 2Y Yield | -10 bps | -65 bps | -37 bps | -56 bps | -65 bps | -82 bps |

| UST 10Y Yield | -19 bps | -37 bps | -33 bps | -51 bps | -23 bps | -30 bps |

The ‘Why’ Behind Fed Cuts Drives Market Behavior

The data clearly shows that asset performance diverges sharply based on the economic context in which the Federal Reserve initiates rate cuts.

- In recessionary periods, rate cuts often coincide with significant declines in both equities and bond yields, accompanied by a spike in volatility.

- In growth scare or normalization periods, equities tend to rally, bond yields fall more moderately, and volatility subsides as market participants regain confidence.

As Chang highlighted, “settling the ‘recession question’ is probably what matters most.”

Investors should closely watch not only the Fed’s actions but also the reasons behind the rate cuts, as the broader economic context will determine how markets react.

Read Next:

Image created using artificial intelligence via Midjourney.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.