Cannabis Experts Say Weed Reform Is A Race Against Time, Is The DEA Delaying Biden's Rescheduling Proposal?

Investors in the cannabis sector are closely watching the potential rescheduling of cannabis by the DEA—a decision that could reshape the industry and unlock significant tax relief. As experts at a recent webinar discussed, the path forward hinges on a key Administrative Law Judge (ALJ) hearing scheduled for December 2, 2024, which could determine how quickly these changes will come and how much the market might shift.

Why Cannabis Reform Is Not A Priority In 2024

On September 11, 2024, Zuanic & Associates hosted a comprehensive webinar focused on the ongoing process of cannabis rescheduling in the United States. Moderated by senior analyst Pablo Zuanic and Anthony Coniglio, CEO of NLCP, the panel featured industry experts Kelly Fair, a partner at Dentons, and Morgan Fox, the political director of the National Organization for the Reform of Marijuana Laws (NORML), the oldest cannabis reform organization in the U.S., founded in 1970.

Both panelists highlighted that while cannabis policy reform has gained traction among presidential candidates, it remains a secondary issue for the majority of voters.

Fox emphasized that although rescheduling is a step in the right direction, NORML’s ultimate goal is full descheduling. Fox suggested that descheduling would allow Congress to take meaningful steps toward regulating cannabis effectively, unlike the rescheduling process, which he deemed prone to political delays.

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Who Gets To Speak At The Cannabis Hearing?

A significant portion of the discussion revolved around the technical aspects of the upcoming ALJ hearing. Fair clarified the procedural steps, noting that those wishing to speak must apply by September 30 with final speaker lists expected by November 2024.

Fair highlighted the importance of this hearing in shaping the final rescheduling rule, as it provides a platform for both proponents and opponents of the rescheduling proposal to present evidence. However, the panel agreed that the DEA retains substantial discretion in deciding the scope of the hearing and final rule.

Evidence and expert testimony presented during the ALJ hearing will play a pivotal role in shaping the DEA’s final decision on cannabis rescheduling. Both proponents and opponents of rescheduling will need to provide compelling arguments, as the DEA’s interpretation of this evidence could determine the outcome of the entire process.

Potential Delays And Challenges

Both Fox and Fair acknowledged that procedural hurdles and potential judicial challenges could prolong the timeline. Fox noted that any final ruling would likely face legal opposition, which could further delay implementation. Fair added that while the ALJ’s findings are essential, the DEA is not obligated to follow those recommendations, which adds another layer of uncertainty.

The webinar concluded with cautious optimism.

While rescheduling could provide some immediate relief, particularly by eliminating the 280E tax burden, the path forward remains uncertain due to potential political changes and judicial challenges. The panelists agreed that rescheduling is a step in the right direction but emphasized that descheduling remains the ultimate goal for meaningful cannabis reform.

Read Next: What Trump Learned About Marijuana That DeSantis Did Not And Why The GOP Might Become Weed-Friendly

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

These 5 parts of the stock market are most at risk if Trump wins the election and implements wide-reaching tariffs, Barclays says

-

Trump’s proposed tariffs would lower S&P 500 earnings as much as 4.7% next year, Barclays said.

-

The presidential candidate has pledged to unleash universal tariffs on all US trade if elected.

-

The firm outlined which five sectors are the most exposed to losses if Trump wins and implements tariffs.

Donald Trump’s plan to tax virtually all US imports would take a big toll on 2025 earnings, according to Barclays research.

Current outlooks view the election as a coin toss between Trump and Kamala Harris, his Democratic rival. But the outcome has high stakes for trade policy, as the former president has committed to unleashing trade barriers around the US.

“Other countries are going to finally, after 75 years, pay us back for all that we’ve done for the world. And the tariff will be substantial in some cases,” Trump said during the presidential debate on Tuesday.

He previously said that if elected president, all countries could face a 10% universal tariff, while duties on Chinese products would reach as high as 60%. A 100% tariff on cars imported through Mexico could also be in store, Barclays cited him as saying.

If implemented, the bank expects these policies to cut into the S&P 500’s earnings.

To be sure, US firms have some way of navigating higher costs associated with tariffs, Barclays said. That includes shifting supply chains or passing prices on to consumers.

But import duties will hit profit margins to a degree, as companies risk losing market share if they don’t absorb some of the costs.

“We find that SPX earnings would be negatively impacted by 3.2% if the new Trump tariffs are enacted and another 1.5% if those countries were to retaliate with similar measures,” analysts wrote on Thursday.

Companies that rely more heavily on supply chains are especially at risk, with five sectors in most danger: materials, discretionary, industrials, technology, and healthcare, Barclays said.

Discretionary stocks would suffer the largest earnings-per-share impact from import tariffs alone — sector earnings would fall around 10%, Barclays data showed.

Meanwhile, materials is most impacted by retaliatory tariffs on exports. Sector earnings here would drop close to 8%.

Other economists have loudly criticized Trump’s tariff idea as fuel for inflation, given that prices will rise amid a pullback in foreign products.

According to Barclays, inflation would climb 0.09 percentage points in the short run, and US GDP could take a 1.2% hit in the first 12 months.

“While the new proposed tariffs would have a modest direct negative impact on corporate earnings if implemented, the second order effects from higher cost inflation and slowing economic growth would be an incremental headwind to corporate earnings, and cause further pain,” the bank said.

Read the original article on Business Insider

Gold Reaches Record High As Dollar Weakens On Soft Producer Inflation Data; Wall Street Eyes Fourth Day Of Gains

A broadly softer-than-expected U.S. producer inflation report triggered market shifts on Thursday, driving down the value of the dollar and Treasury yields while boosting gold prices to a new all-time high.

Meanwhile, U.S. equity futures ticked upward, signaling a potential fourth consecutive session of gains for U.S. stocks.

Economic data released Thursday showed the headline Producer Price Index (PPI) for final demand slowing to 1.7% year-over-year in August, below market expectations of 1.8% and down from July’s downwardly revised 2.1%. On a monthly basis, PPI increased by 0.2%, surpassing the forecasted 0.1% and improving from the revised flat reading for July.

Core PPI, which excludes volatile food and energy prices, remained stable at 2.4% year-over-year, slightly underperforming the expected 2.5%. On a month-to-month basis, core PPI rebounded with a 0.3% rise, up from the previous month’s 0.2% decline and surpassing expectations of a 0.2% increase.

In parallel, weekly initial jobless claims came in at 230,000, in line with market forecasts, signaling stable labor market conditions.

Across the Atlantic, the European Central Bank (ECB) cut its key policy rate by 25 basis points, marking the second reduction since June. The ECB justified the move as part of its efforts to moderate monetary policy.

The ECB kept its inflation outlook steady but revised its growth forecasts downward. The central bank emphasized a data-dependent approach for future decisions, with no commitment to further rate cuts.

Market Reactions

Market reactions to the U.S. data were relatively muted. Rate-cut expectations for the Federal Reserve’s meeting next week remained stable, with the probability of a 25-basis-point cut holding firm at 85%.

- U.S. Treasury yields softened, with the iShares 20+ Year Treasury Bond ETF TLT down 0.2% as yields slightly decreased.

- The U.S. dollar, as tracked by the Invesco DB USD Index Bullish Fund ETF UUP, slipped 0.1%.

- The S&P 500, as tracked by the SPDR S&P 500 ETF Trust SPY, traded 0.2% higher in the premarket, as of 9:05 a.m. ET.

- Tech stocks, followed by the Invesco QQQ Trust, Series 1 QQQ, were 0.1% higher.

- Small caps, as tracked by the iShares Russell 2000 ETF IWM, rose 0.4%.

- The Energy Select Sector SPDR Fund XLE was the top-performing S&P 500 sector in the premarket, up 0.6%.

- Gold prices, monitored through the SPDR Gold Trust GLD, rose by 1.1% to 2,538 per ounce.

- Bitcoin BTC/USD rose 1.3%.

Read now:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

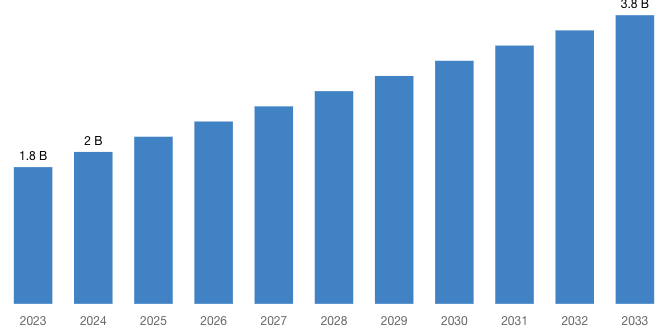

[Latest] Global Hydraulic Breaker Market Size/Share Worth USD 3.8 Billion by 2033 at a 5.6% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

Austin, TX, USA, Sept. 12, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Hydraulic Breaker Market Size, Trends and Insights By Type (Premium, Non-Premium), By Application (Breaking Oversized Material, Trenching, Demolition, Others), By End-use Industry (Construction, Mining, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

“According to the latest research study, the demand of global Hydraulic Breaker Market size & share was valued at approximately USD 1.8 Billion in 2023 and is expected to reach USD 2 Billion in 2024 and is expected to reach a value of around USD 3.8 Billion by 2033, at a compound annual growth rate (CAGR) of about 5.6% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Hydraulic Breaker Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=51819

Hydraulic Breaker Market: Overview

A hydraulic breaker is a type of construction equipment used to break through hard rocks and structures. It is equipped with a strong breaker that is mounted to an excavator. It is run by the excavator’s auxiliary hydraulic system, which has a foot-operated valve for that reason.

The growing need for new roads, bridges, tunnels, and other constructions has resulted in a rising demand for handheld hydraulic breakers. With the help of hydraulic breakers, new construction operations require the demolition of older structures.

A rise in pipeline and subterranean electric transmission infrastructure projects is anticipated to fuel the industry’s growth. Moreover, the mining sector has to use enormous hydraulic breakers in rock mines due to the rising aggregate demand needed for growing infrastructure projects.

The hydraulic breaker industry is expanding as a result. One of the main factors propelling the worldwide market for handheld hydraulic breakers is the growth of the building and infrastructure sectors. Moreover, a rise in the need for the most productivity in the quickest amount of time at the lowest cost is anticipated to propel the hydraulic breaker market.

Because of their high productivity, hydraulic breaks are anticipated to grow the hydraulic breaker market over the forecast period.

Request a Customized Copy of the Hydraulic Breaker Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=51819

By type, the premium segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. The premium segment can be attributed to the growing need for robust and high-performing hydraulic breakers in large-scale mining and construction projects, where clients are prepared to pay more for increased efficiency and productivity.

By application, the breaking oversized material segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. Hydraulic breakers used in this segment contribute to increased productivity, enhanced safety, and improved precision when dealing with sizable materials.

By end-use industry, the mining segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. The mining industry relies heavily on hydraulic breakers for rock excavation and is anticipated to drive market growth.

North America is a prominent trend in the Hydraulic Breaker Market mostly due to demand from the mining and construction sectors. The need for hydraulic breakers for excavation and demolition operations is being driven by the region’s expanding construction industry.

Epiroc AB is a leading position in the global hydraulic breaker market firm launched its new hydraulic breaker, HB 7000 DP, which is designed for carriers in the 70-85 ton range to improve their position in the market, businesses are concentrating on strategic alliances, product innovation, and mergers and acquisitions.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 2 Billion |

| Projected Market Size in 2033 | USD 3.8 Billion |

| Market Size in 2023 | USD 1.8 Billion |

| CAGR Growth Rate | 5.6% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Type, Application, End-use Industry and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Hydraulic Breaker report is available upon request; please contact us for more information.)

Request a Customized Copy of the Hydraulic Breaker Market Report @ https://www.custommarketinsights.com/report/hydraulic-breaker-market/

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Hydraulic Breaker report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Hydraulic Breaker Market Report @ https://www.custommarketinsights.com/report/hydraulic-breaker-market/

CMI has comprehensively analyzed the Global Hydraulic Breaker market. The driving forces, restraints, challenges, opportunities, and key trends have been explained in depth to depict the in-depth scenario of the market. Segment wise market size and market share during the forecast period are duly addressed to portray the probable picture of this Global Blister Packaging industry.

The competitive landscape includes key innovators, after market service providers, market giants as well as niche players are studied and analyzed extensively concerning their strengths, weaknesses as well as value addition prospects. In addition, this report covers key players profiling, market shares, mergers and acquisitions, consequent market fragmentation, new trends and dynamics in partnerships.

Key questions answered in this report:

- What is the size of the Hydraulic Breaker market and what is its expected growth rate?

- What are the primary driving factors that push the Hydraulic Breaker market forward?

- What are the Hydraulic Breaker Industry’s top companies?

- What are the different categories that the Hydraulic Breaker Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Hydraulic Breaker market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Hydraulic Breaker Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/hydraulic-breaker-market/

Hydraulic Breaker Market: Regional Analysis

By region, Hydraulic Breaker Market is segmented into North America, Europe, Asia-Pacific, Latin America, the Middle East & Africa. The Asia-Pacific dominated the Hydraulic Breaker Market in 2023 with a market share of 43.6% and is expected to keep its dominance during the forecast period 2024-2033.

The Asia-Pacific region is a driving force in the hydraulic breaker market due to robust infrastructure development and construction activities. Countries like China, India, Japan, and South Korea are experiencing rapid urbanization, leading to increased demand for hydraulic breakers in various applications such as demolition, quarrying, mining, and road construction.

The growing emphasis on infrastructure projects, including highways, railways, bridges, and tunnels, further fuels the demand for hydraulic breakers to facilitate excavation and rock breaking tasks efficiently.

Additionally, initiatives aimed at improving construction efficiency and productivity are encouraging the adoption of advanced hydraulic breaker technologies in the region. For instance, in January 2023, The Federal Highway Administration (FHWA) declared that it would invest USD 2.1 billion in infrastructure upgrades for bridges.

Request a Customized Copy of the Hydraulic Breaker Market Report @ https://www.custommarketinsights.com/report/hydraulic-breaker-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Hydraulic Breaker Market Size, Trends and Insights By Type (Premium, Non-Premium), By Application (Breaking Oversized Material, Trenching, Demolition, Others), By End-use Industry (Construction, Mining, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/hydraulic-breaker-market/

List of the prominent players in the Hydraulic Breaker Market:

- Atlas Copco ABC

- aterpillar Inc.

- Doosan Infracore Co. Ltd.

- Epiroc AB

- Furukawa Rock Drill Co. Ltd.

- Hitachi Construction Machinery Co. Ltd.

- JCB Service

- Komatsu Ltd.

- Montabert SASNPK

- Construction Equipment Inc.

- Sandvik AB

- Soosan Corporation Co. Ltd

- Indeco North America

- NPK Construction Equipment Inc.

- DAEMO ENGINEERING CO. LTD.

- Msat Msb corporation

- Caterpillar Inc

- Others

Click Here to Access a Free Sample Report of the Global Hydraulic Breaker Market @ https://www.custommarketinsights.com/report/hydraulic-breaker-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Warehouse Robotics Market: Warehouse Robotics Market Size, Trends and Insights By Product Type (Fixed Robotics, Mobile Robotics), By Function (Pick & Place, Palletizing & Depalletizing, Transportation), By Application (E-commerce, Automotive, Food & Beverage), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Parking Vending Machine Market: Parking Vending Machine Market Size, Trends and Insights By Payment Method (Cash Payment, Credit/Debit Card Payment, Mobile Payment, Contactless Payment), By End-User Industry (Commercial, Residential, Transportation, Government, Hospitality, Others), By Type of Parking (On-Street Parking, Off-Street Parking, Automated Parking Systems, Others), By Technology (Coin-Operated Machines, Ticket Dispensing Machines, License Plate Recognition Systems, Pay-by-Plate Systems, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Industrial Hydraulic Equipment Market: Industrial Hydraulic Equipment Market Size, Trends and Insights By Component (Motors, Pumps, Cylinders, Valves, Filters, Others), By End User (Aerospace, Agriculture, Automotive, Construction, Metal & Machinery Manufacturing, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Blast Monitoring Equipment Market: Blast Monitoring Equipment Market Size, Trends and Insights By Type (Blast Monitors, Real Time Dust Monitors, Dust Samplers, Visibility Monitors), By Application (Detonation, Rock Blasting, Underground Mines, Surface Mining, Demolition, Others), By End-use Industry (Defense, Chemicals, Mining and construction, Oil and Gas, Others(Tunnels Roads) and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Industrial Ethernet Connector Market: Industrial Ethernet Connector Market Size, Trends and Insights By Type (RJ45 Connectors, M12 Connectors, M8 Connectors, iX Industrial Interface), By Application (Control Cabinets, Robotics, Motor Controls, Machinery, Others), By Cables Type (Standard Cables, Robot Cables, Shield Strengthening Cables) and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Ventilation System Market: Ventilation System Market Size, Trends and Insights By Type (Exhaust Ventilation System, Energy Recovery Ventilation System, Balanced Ventilation System, Supply Ventilation System), By End User (Residential, Commercial, Industrial), By Product Type (Data Center Cooling. Centralized Ventilation, Decentralized Ventilation, Range Hood) and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Weatherization Service Market: Weatherization Service Market Size, Trends and Insights By Type (Retrofit, New Construction), By Application (Attic Insulation, Sidewall Insulation, Floor Insulation, HVAC, Doors & Windows Frame, Others), By End Use (Residential, Commercial) and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Plasma Cutting Machine Market: Plasma Cutting Machine Market Size, Trends and Insights By Type (Single Flow, Dual Flow), By Control (Automatic, Manual), By End User (Manufacturing Sector, Automotive Sectors, Industrial Constructions, Electric Equipment, Aerospace and Defense), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Hydraulic Breaker Market is segmented as follows:

By Type

By Application

- Breaking Oversized Material

- Trenching

- Demolition

- Others

By End-use Industry

Click Here to Get a Free Sample Report of the Global Hydraulic Breaker Market @ https://www.custommarketinsights.com/report/hydraulic-breaker-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Hydraulic Breaker Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Hydraulic Breaker Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Hydraulic Breaker Market? What Was the Capacity, Production Value, Cost and PROFIT of the Hydraulic Breaker Market?

- What Is the Current Market Status of the Hydraulic Breaker Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Hydraulic Breaker Market by Considering Applications and Types?

- What Are Projections of the Global Hydraulic Breaker Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Hydraulic Breaker Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Hydraulic Breaker Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Hydraulic Breaker Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Hydraulic Breaker Industry?

Click Here to Access a Free Sample Report of the Global Hydraulic Breaker Market @ https://www.custommarketinsights.com/report/hydraulic-breaker-market/

Reasons to Purchase Hydraulic Breaker Market Report

- Hydraulic Breaker Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Hydraulic Breaker Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Hydraulic Breaker Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Hydraulic Breaker Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Hydraulic Breaker market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Hydraulic Breaker Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/hydraulic-breaker-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Hydraulic Breaker market analysis.

- The competitive environment of current and potential participants in the Hydraulic Breaker market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Hydraulic Breaker market should find this report useful. The research will be useful to all market participants in the Hydraulic Breaker industry.

- Managers in the Hydraulic Breaker sector are interested in publishing up-to-date and projected data about the worldwide Hydraulic Breaker market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Hydraulic Breaker products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Hydraulic Breaker Market Report @ https://www.custommarketinsights.com/report/hydraulic-breaker-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Hydraulic Breaker Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/hydraulic-breaker-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Medical Properties Trust Rallied Today

Shares of Medical Properties Trust (NYSE: MPW) were rallying 16.8% in Thursday trading as of 12:45 p.m. ET.

The medical property real estate investment trust (REIT) has a depressed stock price, as rising interest rates and problems with its largest tenant, Steward Health Care, forced the company to slash its dividend nearly in half over the summer — the second 50% dividend cut in a year.

But with the stock beaten down, news of a final legal settlement with Steward sent the stock rebounding today.

New operators taking over for Steward

The most important part of the settlement agreement for shareholders was MPT reaching new lease deals with four hospital operators that will take over 15 of Steward’s 23 troubled sites.

MPT won’t collect rent from the new operators this year, but will start receiving lease payments in Q1 2025, then ramping up to fully stabilized rent of $160 million annually by Q4 2026. Of note, MPT said that would amount to 95% of what it would have gotten from Steward in 2026 based on the original lease deal with escalators.

Management also noted it was in active discussions with other parties regarding two under-construction hospitals and six other closed or impaired hospitals. MPT has agreed to sell three of the troubled hospitals in Florida, with most of the proceeds going to Steward. But after that, Steward will relinquish all rights to claims on any value from the other facilities. Steward sued MPT in August accusing it of blocking Steward’s attempted sales of the hospitals. Of note, MPT actually owns the land for most of these facilities, while Steward owned the facilities themselves.

A relief rally

Hopefully, these new operators will be superior to Steward, which got into trouble after its former private equity owner saddled it with debt and high lease obligations.

At its current reduced dividend, Medical Properties stock yields about 5.8% after today’s rally. But as the company gets closer to putting the Steward Health fiasco behind it and new operators get ready to pay their leases next year, hopefully there won’t be any more cuts to the payout.

Should you invest $1,000 in Medical Properties Trust right now?

Before you buy stock in Medical Properties Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Medical Properties Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Billy Duberstein and/or his clients have no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why Medical Properties Trust Rallied Today was originally published by The Motley Fool

Empty Nesters: Don't Fall Into This Common Retirement Trap

Saving for retirement is a lifelong undertaking. It involves keeping your retirement goals in mind as you have children, get different jobs and move from place to place. However, a recent study from the Center for Retirement Research at Boston College shows that many parents may not be keeping up with their retirement savings goals after their children leave home. Parents who consistently fall short of retirement savings goals may be unable to cover regular expenses. The study suggests a number of reasons why empty-nester parents neglect retirement savings, including the fact that such parents tend to work slightly less. Because retirement saving is a marathon, not a sprint, it’s important to make sure you’re staying on top of your retirement savings goals even after your children have left home. A financial advisor can help keep you stay on track.

Empty Nesters Are Falling Behind: Report Findings

The report done by the Center for Retirement Research at Boston College examined how empty nester parents adjust their savings, consumption and earnings after children leave the house. The report aims to reconcile the fact that some studies have shown that empty nester parents reduce consumption and increase savings while others have shown that savings don’t increase.

The authors of the study offered up three possible explanations to reconcile these inconsistencies:

-

Empty nester parents could pay down debts after children leave home

-

Parents could continue to provide financial support to children after they’ve left

-

Empty nesters tend to adjust their earnings and work hours after children leave home

Surprisingly, the study found that overall, parents don’t tend to pay down debts and parents typically don’t continue to provide meaningful financial support to their children after they’ve left home. What they did find was significant evidence to show that empty-nester parents reduce their working hours and earn about $2,000 less per year after children no longer live with them.

This study also found that consumption, relative to income, decreased by about 6% for empty-nester parents. However, net worth remained unchanged, leaving a question mark as to why such parents aren’t saving more.

Why Do Empty Nesters Save Less For Retirement?

There are a number of possible explanations when it comes to figuring out why empty-nester parents don’t seem to be saving as much as they should. A consistent finding of the study was that empty-nester parents tend to work less and therefore earn less. Despite the fact that consumption is also lower, a change in nominal income has the potential to throw off savings targets and goals. If someone who normally contributes $2,000 per year to retirement begins earning $2,000 less annually, it’s easy to see how he may forgo saving that $2,000 altogether, even if he’s consuming less overall.

It’s also important to note that the findings of the study aren’t a foregone conclusion. Empty-nester parents who decide to work less and still support children who left home will have less money to save for retirement. The same goes for parents who decide to pay down debts more quickly after their children have left.

What Can You Do?

There isn’t one single reason why empty-nester parents tend to save less for retirement after their children have left home, so it’s not necessarily an easy fix for anyone. However, there are always steps you can take to make sure that you as an empty nester keep up with your retirement goals.

First of all, it could be a good idea to work with a financial advisor to help you stay on track when it comes to retirement saving goals, even when big life changes happen, like kids leaving the house or a reduction in your working hours and income.

It’s also a good idea to be meticulous about your retirement savings. For many, a big event like children leaving home can cause you to focus your attention elsewhere, and retirement savings can fall by the wayside. By keeping your finances in line in a spreadsheet or with another financial organization app, you can make sure that you’re hitting your retirement saving goals on a monthly and yearly basis.

Empty nesters can also try these strategies:

Maximize your IRA or 401(k). Retirement planning often starts at work. If you have access to a 401(k) or similar workplace retirement plan, use it. A recent study from Vanguard says that roughly one-third (34%) of Americans are leaving free money on the table by saving below the employee match. Empty nesters over 50 can make catch-up contributions.

Put money into a health savings account. An HSA lets you invest money for future medical expenses, while getting special tax breaks – your contributions reduce your taxable income and your money grows tax-free. In January 2021, there were January 2021, $82.2 billion was invested in 30 million HSA accounts. This was a 25% year-over-year jump in assets and a 6% jump in total accounts.

Guarantee an additional income stream with an annuity. Annuities are insurance products that pay out the full amount of principal and interest over a specific period of time. You can delay taxes on earnings and sometimes extend it to beneficiaries. An annuity could also allow you to take Social Security benefits at a later age and therefore maximize your benefit. A financial advisor could help you invest in an annuity later in life as you continue working and if you have other retirement income.

Delay your Social Security benefits until age 70. Waiting until full retirement age will allow you to get 100% of your retirement benefits. However, by retiring at age 70, you could get 132% or your regular monthly benefit amount. So while you will get fewer Social Security benefit checks in your lifetime, they would be one-third larger.

Hire a financial advisor. A financial advisor can help you with the numerous aspects of your retirement, from Social Security to taxes to income streams. Get matched with up to three financial advisors for free with SmartAsset’s free tool.

Bottom Line

There are a number of very real reasons why empty nesters tend to save less for retirement. The financial burden and stress of raising a family can often make saving for the future seem like more of an afterthought. However, it’s important not to forgo saving for retirement entirely after your children leave the house. Even if you decide to work less or pay down debts, make sure that you’re keeping your retirement savings goals in mind so that you don’t end up in a situation where you don’t have enough to support yourself during retirement.

Tips for Saving for Retirement

-

Saving for retirement through the ups and downs of life isn’t always an easy task. A financial advisor may be able to help guide you through difficult choices. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Going about saving for retirement on your own is always an option. If you’re planning by yourself, SmartAsset has you covered with a number of free online retirement resources. Check out our free retirement calculator today.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/BraunS, ©iStock.com/TheKoRp, ©iStock.com/Ridofranz

The post Empty Nester? This Avoidable Mistake Could Jeopardize Your Retirement appeared first on SmartAsset Blog.

Boeing Worker's 'Strike At Midnight' Threatens Aircraft Production As Financial Risks Loom After 30,000 Workers Vote For Industrial Action

Boeing Co. BA faces potential disruptions in its aircraft production as workers decide on a strike.

What Happened: Over 30,000 Boeing employees are set to strike on Friday after rejecting a proposed labor contract, reported CNBC.

Workers in Seattle and Oregon voted 94.6% against the tentative agreement, which was presented by Boeing and the International Association of Machinists and Aerospace Workers. The vote to strike was even higher, at 96%, far surpassing the two-thirds majority needed for a work stoppage.

“We strike at midnight,” declared IAM District 751 President Jon Holden during a press conference. He described the action as an “unfair labor practice strike,” citing issues such as “discriminatory conduct, coercive questioning, unlawful surveillance, and unlawful promise of benefits.”

The rejected proposal included a 25% wage increase and enhancements to health-care and retirement benefits. However, the union had aimed for approximately 40% raises, arguing that the offer did not adequately address the rising cost of living.

Boeing CEO Kelly Ortberg, who has been in his role for only five weeks, had urged workers to accept the contract to avoid jeopardizing the company’s recovery efforts.

The financial impact of the strike will depend on its duration, with Jefferies aerospace analyst Sheila Kahyaoglu estimating a 30-day strike could cost Boeing $1.5 billion.

Why It Matters: The strike comes at a critical time for Boeing, which has been grappling with production delays and quality control issues. On Wednesday, Boeing reported that it delivered 40 commercial jets in August, an improvement from the same month last year. However, the company is still dealing with the aftermath of a manufacturing defect that affected its 737 MAX production.

Moreover, on Tuesday, Boeing informed suppliers of a six-month delay in reaching a key production milestone for its 737 MAX. The new target is to achieve a monthly output of 42 jets by March 2025, instead of the previous goal of September.

The labor unrest adds another layer of complexity to Boeing’s challenges. On Monday, union workers expressed dissatisfaction with the tentative labor agreement, hoping for higher wage increases and better pensions. This sentiment was reflected in the overwhelming rejection of the contract and the high vote to strike.

Price Action: Boeing’s stock closed at $162.77 on Thursday, up 0.89%. In after-hours trading, the stock dipped 0.17%. Year-to-date, Boeing’s stock has decreased significantly by 35.35%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Empire Company Reports Voting Results

STELLARTON, NS, Sept. 12, 2024 /CNW/ – Empire Company Limited (“Empire” or the “Company”) EMP announced the voting results for the election of its directors at its Annual General Meeting (the “Meeting”) held today.

There were 98,121,279 Class B shares (over 99.9% of outstanding Class B shares) represented by proxy at the Meeting of which 100% of the Class B shares were voted in favour of each director nominee, and no Class B shares were withheld from voting on any nominee.

In addition to the election of directors, the Class B shareholders also voted on fixing the maximum number of directors at 18, on the remuneration of directors, on the appointment of PricewaterhouseCoopers LLP as auditors for fiscal 2024 and to authorize the Board of Directors to fix the auditors’ remuneration. 100% of the Class B shares represented at the Meeting were voted in favour of these motions.

The advisory resolution on the Company’s approach to executive compensation was voted on by both Non-Voting Class A and Class B shareholders. There were 111,408,916 Non-Voting Class A shares (78.10% of the Non-Voting Class A shares outstanding) represented by proxy at the Meeting of which 95.90% were voted in favour of the motion. 100% of the Class B shares represented at the Meeting were voted in favour of the advisory resolution.

Additionally, Empire shareholders voted Lisa Lisson to the Board of Directors for the first time. Ms. Lisson, who was appointed to the Board in June 2024, has had a distinguished career with Federal Express Corporation since joining the company in 1992, including as the first female President of FedEx Express Canada. She currently serves as President of Air Operations for Federal Express Corporation.

ABOUT EMPIRE

Empire Company Limited EMP is a Canadian company headquartered in Stellarton, Nova Scotia. Empire’s key businesses are food retailing, through wholly-owned subsidiary Sobeys Inc., and related real estate. With approximately $31.5 billion in annual sales and $16.9 billion in assets, Empire and its subsidiaries, franchisees and affiliates employ approximately 128,000 people.

Additional financial information relating to Empire, including the Company’s Annual Information Form, can be found on the Company’s website at www.empireco.ca or at www.sedarplus.ca.

SOURCE Empire Company Limited

![]() View original content: http://www.newswire.ca/en/releases/archive/September2024/12/c5263.html

View original content: http://www.newswire.ca/en/releases/archive/September2024/12/c5263.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sam-Altman Founded Worldcoin Soars On OpenAI's o1 Announcement, XRP Rides On Grayscale Trust Launch

Worldcoin WLD/USD and XRP XRP/USD were among the biggest gainers Thursday even as the broader market moved sideways.

What happened: WLD, the native currency of the blockchain-based identity verification project, popped more than 9%, emerging as the best-performing cryptocurrency in the last 24 hours.

The coin’s trading volume jumped 86% to $$182 million, reflecting huge demand from investors.

The rally followed the launch of a new model, ‘o1′, by OpenAI, marking a step toward the company’s goal of achieving human-like artificial intelligence. Recall that OpenAI CEO Sam Altman launched the Worldcoin project last year.

Apart from Worldcoin, XRP recorded healthy gains, jumping 4.42% in the last 24 hours. The seventh-largest cryptocurrency was the market’s biggest large-cap gainer in this period.

The positive momentum came on the heels of asset management giant Grayscale Investments launching a new XRP Trust. The trust aimed to expose accredited investors to the price moves of XRP.

Grayscale dissolved its earlier XRP trust in January 2021 after the SEC filed a lawsuit against Ripple Labs, the firm using XRP for its product offerings.

Price Action: At the time of writing, WLD was exchanging hands at $1.53, while XRP was valued at $0.562, according to data from Benzinga Pro.

Photo via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Farmer Brothers reports fourth quarter and full year fiscal 2024 financial results

Fiscal year 2024 gross margin increase of 560 basis points year-over-year to 39.3%

Reported full year net loss of $3.9 million, increased full year adjusted EBITDA1 to $558,000

Fiscal 2024 net sales of $341.1 million

FORT WORTH, Texas, Sept. 12, 2024 (GLOBE NEWSWIRE) — Farmer Bros. Co. FARM today reported its fourth quarter and full year fiscal 2024 financial results for the period ended June 30, 2024. The company filed its Form 10-K, which can be found on the Investor Relations section of the company’s website.

“This past year was a transformative one for Farmer Brothers,” said President and Chief Executive Officer John Moore. “The decision to sell our direct ship business and focus on our more profitable DSD business helped significantly improve our gross margins and drive adjusted EBITDA profitability and overall operational efficiency. While we are proud of the significant progress we have made to date, there is still much more to be done as we complete our SKU rationalization and brand pyramid efforts, further streamline our operations and focus on driving customer growth and retention. We remain confident we are building a foundation which will generate long-term, sustainable growth and value creation for our shareholders.”

Fiscal 2024 business highlights

- Strengthened executive team with appointments of President and Chief Executive Officer John Moore and Chief Financial Officer Vance Fisher.

- Concluded its co-manufacturing agreement with TreeHouse Foods as part of the sale of its direct ship business and made significant progress on transition to focus on direct store delivery (DSD) business.

- Streamlined operations by restructuring sales organization, reducing SKU redundancies and centralizing production in Portland, Oregon.

- Upgraded technology infrastructure to enhance customer service, pricing approach and inventory management capabilities.

Fourth quarter fiscal 2024 financial results

- Net sales were $84.4 million for the fourth quarter of fiscal 2024, a decrease of $1.1 million, or 1%, compared to the fourth quarter of fiscal 2023.

- Gross profit for the fourth quarter of fiscal 2024 was $32.8 million, or 38.8%, compared to gross profit of $27.8 million, or 32.5%, for the fourth quarter of fiscal 2023.

- Net loss for the fourth quarter of fiscal 2024 was $4.6 million, compared to a net loss of $16.9 million for the fourth quarter of fiscal 2023. The $4.6 million net loss for the fourth quarter of fiscal 2024 included a $1.1 million of gain from the sale of assets and $400,000 of non-cash stock compensation. The $16.9 million net loss for the fourth quarter of fiscal 2023 included a $2.5 million loss from the sale of assets and $2.1 million of non-cash stock compensation.

- Adjusted EBITDA was a loss of $1.6 million for the fourth quarter of fiscal 2024, an increase of $5.6 million, compared to the fourth quarter of fiscal 2023.

1 This is a non-GAAP financial measure. See “non-GAAP financial measures” and “reconciliation of net loss to non-GAAP adjusted EBITDA loss” below.

Full year fiscal 2024 financial results

- Net sales for fiscal 2024 were $341.1 million, an increase of $1.1 million, or 0.3%, compared to fiscal 2023.

- Gross profit for fiscal 2024 was $133.9 million compared to $114.6 million in fiscal 2023. Gross margin increased 560 basis points in fiscal 2024 to 39.3%, compared to 33.7% in fiscal 2023.

- Net loss for fiscal 2024 was $3.9 million, compared to a net loss of $34 million for fiscal 2023. The $3.9 million net loss for fiscal 2024 included a $18.1 million gain from sale of assets, $3.8 million of non-cash stock compensation, $3 million of severance costs and a $1.2 million loss related to sale of business. The $34 million net loss for fiscal 2023 included a $5.1 million gain from the sale of assets, $8.2 million of non-cash stock compensation, $1.6 million of severance costs and $1.9 million of gain related to the settlement of the Boyd’s acquisition.

- Adjusted EBITDA was $558,000 for fiscal 2024, an increase of $14.7 million compared to fiscal 2023.

Balance Sheet and Liquidity

As of June 30, 2024, the company had $5.8 million of unrestricted cash and cash equivalents, $23.3 million in outstanding borrowings and $27.8 million of borrowing availability under its revolving credit facility.

Investor Conference Call

Farmer Brothers will publish its fourth quarter and full year fiscal 2024 financial results for the period ended June 30, 2024, with the filing of its Form 10-K, which will be posted on the Investor Relations section of the company’s website after the close of market Thursday, Sept. 12.

The company will host an audio-only investor conference call and webcast at 5 p.m. Eastern on Thursday, Sept. 12 to provide a review of the quarter and full fiscal year, as well as a business update. Callers who pre-register will be emailed dial-in details and a unique PIN to gain immediate access to the call and bypass the live operator. An audio-only replay of the webcast will be archived for at least 30 days on the Investor Relations section of the company’s website and will be available approximately two hours after the end of the live webcast.

About Farmer Brothers

Founded in 1912, Farmer Brothers Coffee Co. is a national coffee roaster, wholesaler, equipment servicer and distributor of coffee, tea and culinary products. The company’s product lines include organic, Direct Trade and sustainably produced coffee, as well as tea, cappuccino mixes, spices and baking/biscuit mixes.

Farmer Brothers Coffee Co. delivers extensive beverage planning services and culinary products to a wide variety of U.S.-based customers, ranging from small independent restaurants and foodservice operators to large institutional buyers, such as restaurant, department and convenience store chains, hotels, casinos, healthcare facilities and gourmet coffee houses, as well as grocery chains with private brand coffee and consumer branded coffee and tea products and foodservice distributors. The company’s primary brands include Farmer Brothers, Boyd’s, Cain’s, China Mist and West Coast Coffee.

Forward-looking Statements

This press release and other documents we file with the Securities and Exchange Commission (the “SEC”) contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, that are based on current expectations, estimates, forecasts and projections about us, our future performance, our financial condition, our products, our business strategy, our beliefs and our management’s assumptions. In addition, we, or others on our behalf, may make forward-looking statements in press releases or written statements, or in our communications and discussions with investors and analysts in the normal course of business through meetings, webcasts, phone calls and conference calls. These forward-looking statements can be identified by the use of words, like “anticipates,” “estimates,” “projects,” “expects,” “plans,” “believes,” “intends,” “will,” “could,” “may,” “assumes” and other words of similar meaning. These statements are based on management’s beliefs, assumptions, estimates and observations of future events based on information available to our management at the time the statements are made and include any statements that do not relate to any historical or current fact. These statements are not guarantees of future performance and they involve certain risks, uncertainties and assumptions that are difficult to predict. Actual outcomes and results may differ materially from what is expressed, implied or forecast by our forward-looking statements due in part to the risks, uncertainties and assumptions set forth in this press release and Part I, Item 1A. Risk Factors as well as Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, of our annual report on Form 10-K for the fiscal year ended June 30, 2023, filed with the SEC on Sept. 12, 2023, as amended by the Form 10-K/A filed with the SEC on Oct. 27, 2023 (as amended, the 2023 Form 10-K), as well as those discussed elsewhere in this press release and other factors described from time to time in our filings with the SEC.

Factors that could cause actual results to differ materially from those in forward-looking statements include, but are not limited to, severe weather, levels of consumer confidence in national and local economic business conditions, developments related to pricing cycles and volumes, the impact of labor market shortages, the increase of costs due to inflation, an economic downturn caused by any pandemic, epidemic or other disease outbreak, the success of our turnaround strategy, the impact of capital improvement projects, the adequacy and availability of capital resources to fund our existing and planned business operations and our capital expenditure requirements, our ability to meet financial covenant requirements in our credit facility, which could impact, among other things, our liquidity, the relative effectiveness of compensation-based employee incentives in causing improvements in our performance, the capacity to meet the demands of our customers, the extent of execution of plans for the growth of our business and achievement of financial metrics related to those plans, our success in retaining and/or attracting qualified employees, our success in adapting to technology and new commerce channels, the effect of the capital markets, as well as other external factors on stockholder value, fluctuations in availability and cost of green coffee, competition, organizational changes, the effectiveness of our hedging strategies in reducing price and interest rate risk, changes in consumer preferences, our ability to provide sustainability in ways that do not materially impair profitability, changes in the strength of the economy, including any effects from inflation, business conditions in the coffee industry and food industry in general, our continued success in attracting new customers, variances from budgeted sales mix and growth rates, weather and special or unusual events, as well as other risks, uncertainties and assumptions described in the 2023 Form 10-K and other factors described from time to time in our filings with the SEC.

Given these risks and uncertainties, you should not rely on forward-looking statements as a prediction of actual results. Any or all of the forward-looking statements contained in this press release and any other public statement made by us, including by our management, may turn out to be incorrect. We are including this cautionary note to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise, except as required under federal securities laws and the rules and regulations of the SEC.

Investor Relations Contact

Ellipsis

Investor.relations@farmerbros.com

646-776-0886

Media contact

Brandi Wessel

Director of Communications

405-885-5176

bwessel@farmerbros.com

| FARMER BROS. CO. CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) (In thousands, except share and per share data) |

|||||||||||||||

| Three Months Ended June 30, | Twelve Months Ended June 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net sales | $ | 84,396 | $ | 85,496 | $ | 341,094 | $ | 339,964 | |||||||

| Cost of goods sold | 51,630 | 57,679 | 207,201 | 225,351 | |||||||||||

| Gross profit | 32,766 | 27,817 | 133,893 | 114,613 | |||||||||||

| Selling expenses | 28,401 | 25,072 | 111,371 | 103,151 | |||||||||||

| General and administrative expenses | 9,583 | 10,324 | 41,649 | 37,561 | |||||||||||

| Net gains from sale of assets | (1,071 | ) | 2,544 | (16,877 | ) | (5,140 | ) | ||||||||

| Operating expenses | 36,913 | 37,940 | 136,143 | 135,572 | |||||||||||

| Loss from operations | (4,147 | ) | (10,123 | ) | (2,250 | ) | (20,959 | ) | |||||||

| Other (expense) income: | |||||||||||||||

| Interest expense | (1,857 | ) | (3,007 | ) | (7,835 | ) | (9,162 | ) | |||||||

| Other, net | 1,394 | (4,160 | ) | 6,224 | (4,242 | ) | |||||||||

| Total other (expense) income | (463 | ) | (7,167 | ) | (1,611 | ) | (13,404 | ) | |||||||

| Loss from continuing operations before taxes | (4,610 | ) | (17,290 | ) | (3,861 | ) | (34,363 | ) | |||||||

| Income tax expense (benefit) | (18 | ) | (438 | ) | 14 | (325 | ) | ||||||||

| Loss from continuing operations | $ | (4,592 | ) | $ | (16,852 | ) | $ | (3,875 | ) | $ | (34,038 | ) | |||

| Loss from discontinued operations, net of income taxes | $ | — | $ | (29,925 | ) | $ | — | $ | (45,142 | ) | |||||

| Net loss | $ | (4,592 | ) | $ | (46,777 | ) | $ | (3,875 | ) | $ | (79,180 | ) | |||

| Net loss available to common stockholders | $ | (4,592 | ) | $ | (46,777 | ) | $ | (3,875 | ) | $ | (79,180 | ) | |||

| Loss from continuing operations available to common stockholders per common share, basic and diluted | $ | (0.22 | ) | $ | (0.84 | ) | $ | (0.19 | ) | $ | (1.74 | ) | |||

| Loss from discontinued operations available to common stockholders per common share, basic and diluted | $ | — | $ | (1.49 | ) | $ | — | $ | (2.30 | ) | |||||

| Net loss available to common stockholders per common share, basic and diluted | $ | (0.22 | ) | $ | (2.33 | ) | $ | (0.19 | ) | $ | (4.04 | ) | |||

| Weighted average common shares outstanding—basic and diluted | 20,793,956 | 20,088,604 | 20,873,266 | 19,621,992 | |||||||||||

| FARMER BROS. CO. CONSOLIDATED BALANCE SHEETS (UNAUDITED) (In thousands, except share and per share data) |

|||||||||||||

| June 30, | |||||||||||||

| 2024 | 2023 | ||||||||||||

| ASSETS | |||||||||||||

| Current assets: | |||||||||||||

| Cash and cash equivalents | $ | 5,830 | $ | 5,244 | |||||||||

| Restricted cash | 175 | 175 | |||||||||||

| Accounts and notes receivable, net of allowance for credit losses of $710 and $416, respectively | 35,147 | 45,129 | |||||||||||

| Inventories | 57,230 | 49,276 | |||||||||||

| Short-term derivative assets | 11 | 68 | |||||||||||

| Prepaid expenses | 4,236 | 5,334 | |||||||||||

| Assets held for sale | 352 | 7,770 | |||||||||||

| Total current assets | 102,981 | 112,996 | |||||||||||

| Property, plant and equipment, net | 34,002 | 33,782 | |||||||||||

| Intangible assets, net | 11,233 | 13,493 | |||||||||||

| Right-of-use operating lease assets | 35,241 | 24,593 | |||||||||||

| Other assets | 1,756 | 2,917 | |||||||||||

| Total assets | $ | 185,213 | $ | 187,781 | |||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||||

| Current liabilities: | |||||||||||||

| Accounts payable | 48,478 | 60,088 | |||||||||||

| Accrued payroll expenses | 10,782 | 10,082 | |||||||||||

| Right-of-use operating lease liabilities – current | 14,046 | 8,040 | |||||||||||

| Short-term derivative liability | 730 | 2,636 | |||||||||||

| Other current liabilities | 2,997 | 4,519 | |||||||||||

| Total current liabilities | 77,033 | 85,365 | |||||||||||

| Long-term borrowings under revolving credit facility | 23,300 | 23,021 | |||||||||||

| Accrued pension liabilities | 12,287 | 19,761 | |||||||||||

| Accrued postretirement benefits | 789 | 763 | |||||||||||

| Accrued workers’ compensation liabilities | 2,378 | 3,065 | |||||||||||

| Right-of-use operating lease liabilities | 21,766 | 17,157 | |||||||||||

| Other long-term liabilities | 2,111 | 537 | |||||||||||

| Total liabilities | $ | 139,664 | $ | 149,669 | |||||||||

| Commitments and contingencies (Note 19) | |||||||||||||

| Stockholders’ equity: | |||||||||||||

| Common stock, $1.00 par value, 50,000,000 shares authorized; 21,264,327 and 20,142,973 shares issued and outstanding at June 30, 2024 and 2023, respectively | 21,265 | 20,144 | |||||||||||

| Additional paid-in capital | 79,963 | 77,278 | |||||||||||

| Accumulated deficit | (30,354 | ) | (26,479 | ) | |||||||||

| Accumulated other comprehensive loss | (25,325 | ) | (32,831 | ) | |||||||||

| Total stockholders’ equity | $ | 45,549 | $ | 38,112 | |||||||||

| Total liabilities and stockholders’ equity | $ | 185,213 | $ | 187,781 | |||||||||

| FARMER BROS. CO. | |||||||

| CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||

| (In thousands) | |||||||

| For the Years Ended June 30, | |||||||

| 2024 | 2023 | ||||||

| Cash flows from operating activities: | |||||||

| Net loss | $ | (3,875 | ) | $ | (79,180 | ) | |

| Adjustments to reconcile net loss to net cash used in operating activities | |||||||

| Depreciation and amortization | 11,588 | 22,168 | |||||

| Gain on settlement related to Boyd’s acquisition | — | (1,917 | ) | ||||

| Deferred income taxes | — | (735 | ) | ||||

| Net (gains) losses from sale of assets | (18,091 | ) | 22,275 | ||||

| Net losses (gains) on derivative instruments | 113 | 7,504 | |||||

| ESOP and share-based compensation expense | 3,806 | 8,311 | |||||

| Provision for credit losses | 748 | 743 | |||||

| Change in operating assets and liabilities: | |||||||

| Accounts receivable, net | 10,448 | (939 | ) | ||||

| Inventories | (7,954 | ) | 19,785 | ||||

| Derivative assets, net | 565 | (6,235 | ) | ||||

| Other assets | 2,335 | (945 | ) | ||||

| Accounts payable | (11,777 | ) | 7,087 | ||||

| Accrued expenses and other | (2,053 | ) | (4,802 | ) | |||

| Net cash used in operating activities | $ | (14,147 | ) | $ | (6,880 | ) | |

| Cash flows from investing activities: | |||||||

| Sale of business | (1,214 | ) | 92,226 | ||||

| Purchases of property, plant and equipment | (13,843 | ) | (15,016 | ) | |||

| Proceeds from sales of property, plant and equipment | 29,780 | 11,235 | |||||

| Net cash provided by investing activities | $ | 14,723 | $ | 88,445 | |||

| Cash flows from financing activities: | |||||||

| Proceeds from Credit Facilities | 6,279 | 54,000 | |||||

| Repayments on Credit Facilities | (6,000 | ) | (139,579 | ) | |||

| Payment of financing costs | (76 | ) | (368 | ) | |||

| Payments of finance lease obligations | (193 | ) | (193 | ) | |||

| Net cash provided by (used in) financing activities | $ | 10 | $ | (86,140 | ) | ||

| Net increase (decrease) in cash and cash equivalents and restricted cash | $ | 586 | $ | (4,575 | ) | ||

| Cash and cash equivalents and restricted cash at beginning of period | $ | 5,419 | $ | 9,994 | |||

| Cash and cash equivalents and restricted cash at end of period | $ | 6,005 | $ | 5,419 | |||

| Supplemental disclosure of cash flow information: | |||||||

| Cash paid for interest | $ | 2,803 | $ | 11,760 | |||

| Cash paid for income taxes | 164 | 177 | |||||

| Supplemental disclosure of non-cash investing and financing activities: | |||||||

| Non-cash additions to property, plant and equipment | 167 | 124 | |||||

| Non-cash issuance of ESOP and 401(K) common stock | 595 | 938 | |||||

| Right-of-use assets obtained in exchange for new operating lease liabilities | 13,508 | 3,517 | |||||

| Conversion of preferred shares | — | 399 | |||||

Non-GAAP Financial Measures

Non-GAAP Financial Measures

In addition to net loss determined in accordance with U.S. generally accepted accounting principles (“GAAP”), we use the following non-GAAP financial measures in assessing our operating performance:

“EBITDA” is defined as loss from continuing operations excluding the impact of:

- income tax expense (benefit);

- interest expense; and

- depreciation and amortization expense.

“EBITDA Margin” is defined as EBITDA expressed as a percentage of net sales.

“Adjusted EBITDA” is defined as loss from continuing operations excluding the impact of:

- income tax expense (benefit);

- interest expense;

- depreciation and amortization expense;

- 401(k) and share-based compensation expense;

- net gains from sales of assets;

- severance costs;

- loss related to sale of business; and

- gain on settlement with Boyd’s sellers.

“Adjusted EBITDA Margin” is defined as Adjusted EBITDA expressed as a percentage of net sales.

For purposes of calculating EBITDA and EBITDA Margin, Adjusted EBITDA and Adjusted EBITDA Margin, we have excluded the impact of interest expense resulting from non-cash pretax pension and postretirement benefits. For purposes of calculating Adjusted EBITDA and Adjusted EBITDA Margin, we are also excluding the impact of severance and the loss related to sale of business as these items are not reflective of our ongoing operating results.

We believe these non-GAAP financial measures provide a useful measure of the Company’s operating results, a meaningful comparison with historical results and with the results of other companies, and insight into the Company’s ongoing operating performance. Further, management utilizes these measures, in addition to GAAP measures, when evaluating and comparing the Company’s operating performance against internal financial forecasts and budgets.

We believe that EBITDA facilitates operating performance comparisons from period to period by isolating the effects of certain items that vary from period to period without any correlation to core operating performance or that vary widely among similar companies. These potential differences may be caused by variations in capital structures (affecting interest expense), tax positions (such as the impact on periods or companies of changes in effective tax rates or net operating losses) and the age and book depreciation of facilities and equipment (affecting relative depreciation expense). We also present EBITDA and EBITDA Margin because (i) we believe that these measures are frequently used by securities analysts, investors and other interested parties to evaluate companies in our industry, (ii) we believe that investors will find these measures useful in assessing our ability to service or incur indebtedness, and (iii) we use these measures internally as benchmarks to compare our performance to that of our competitors.

EBITDA, EBITDA Margin, Adjusted EBITDA and Adjusted EBITDA Margin, as defined by us, may not be comparable to similarly titled measures reported by other companies. We do not intend for non-GAAP financial measures to be considered in isolation or as a substitute for other measures prepared in accordance with GAAP. This calculation is for continuing operations only.

Set forth below is a reconciliation of loss from continuing operations to EBITDA (non-GAAP):

| Three Months Ended June 30, | Twelve Months Ended June 30, | ||||||||||||||

| (In thousands) | 2024 | 2023 | 2024 | 2023 | |||||||||||

| Loss from continuing operations | $ | (4,592 | ) | $ | (16,852 | ) | $ | (3,875 | ) | $ | (34,038 | ) | |||

| Income tax expense (benefit) | (18 | ) | (438 | ) | 14 | (325 | ) | ||||||||

| Interest expense (1) | 657 | 1,841 | 2,991 | 4,499 | |||||||||||

| Depreciation and amortization expense | 2,913 | 3,412 | 11,588 | 12,939 | |||||||||||

| EBITDA | $ | (1,040 | ) | $ | (12,037 | ) | $ | 10,718 | $ | (16,925 | ) | ||||

| EBITDA Margin | (1.2 | )% | (14.1 | )% | 3.1 | % | (5.0 | )% | |||||||

_______________

(1) Excludes interest expense related to pension plans and postretirement benefits.

Set forth below is a reconciliation of loss from continuing operations to Adjusted EBITDA (non-GAAP):

| Three Months Ended June 30, | Twelve Months Ended June 30, | ||||||||||||||

| (In thousands) | 2024 | 2023 | 2024 | 2023 | |||||||||||

| Loss from continuing operations | $ | (4,592 | ) | $ | (16,852 | ) | $ | (3,875 | ) | $ | (34,038 | ) | |||

| Income tax expense (benefit) | (18 | ) | (438 | ) | 14 | (325 | ) | ||||||||

| Interest expense (1) | 657 | 1,841 | 2,991 | 4,499 | |||||||||||

| Depreciation and amortization expense | 2,913 | 3,412 | 11,588 | 12,939 | |||||||||||

| 401(k) and share-based compensation expense | 438 | 2,141 | 3,762 | 8,212 | |||||||||||

| Net (gains) loss from sale of assets | (1,071 | ) | 2,544 | (18,091 | ) | (5,140 | ) | ||||||||

| Severance costs | 99 | 177 | 2,955 | 1,617 | |||||||||||

| Loss related to sale of business (3) | — | — | 1,214 | — | |||||||||||

| Gain on settlement with Boyd’s sellers (2) | — | — | — | (1,917 | ) | ||||||||||

| Adjusted EBITDA | $ | (1,574 | ) | $ | (7,175 | ) | $ | 558 | $ | (14,153 | ) | ||||

| Adjusted EBITDA Margin | (1.9)% | (8.4)% | 0.2 | % | (4.2)% | ||||||||||

_______________

(1) Excludes interest expense related to pension plans and postretirement benefits.

(2) Result of the settlement related to the acquisition of Boyd Coffee Company which included the cancellation of shares of Series A Preferred Stock and settlement of liabilities.

(3) Result of the settlements related to the sale of the company’s direct ship business, which included gains related to coffee hedges and settlement of liabilities.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.