Why ChargePoint Stock Is Crashing Today

ChargePoint Holdings (NYSE: CHPT) stock slumped this morning, plunging 23.1% at its lowest point in trading through 11:20 a.m. ET Thursday. ChargePoint operates the largest electric vehicle (EV) charging network in the U.S., but demand has failed to keep up with the company’s expectations. The evidence lies in ChargePoint’s latest quarterly numbers, released yesterday.

Although ChargePoint’s net loss shrank in the second quarter, the company’s guidance has left investors in the lurch.

ChargePoint’s revenue continues to fall

Here are some key numbers from ChargePoint’s second-quarter earnings report:

-

Revenue: Down 28% year over year to $108.5 million

-

Gross margin: 24% versus 1% in the year-ago quarter

-

Net loss: Improved to $68.9 million from $125.3 million in the year-ago period

The improvement in ChargePoint’s gross margin and losses looks impressive. Still, management primarily credited it to year-over-year comparisons, having booked inventory impairment charges in Q2 last year that hit its bottom line.

More importantly, ChargePoint’s top line is showing no signs of a recovery yet, with revenue from its primary business of networked charging systems slumping 44% year over year in the second quarter. Although its subscription revenue rose 21%, it wasn’t enough to offset weak demand for ChargePoint’s charging systems.

Is there any hope left for ChargePoint stock?

There’s no point in mincing words when it comes to ChargePoint. The truth is that ChargePoint is facing plenty of challenges. On the one hand, demand for EVs has softened globally, and on the other, competition in EV charging is heating up.

ChargePoint knows these are tough times and it must save money to slow down its cash burn, which is why it has also announced plans to lay off 15% of its global workforce. With the company also projecting revenue of only $85 million to $95 million for the third quarter — meaning an 18% drop year over year — ChargePoint stock will need a really solid catalyst to rebound.

Should you invest $1,000 in ChargePoint right now?

Before you buy stock in ChargePoint, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ChargePoint wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $650,810!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why ChargePoint Stock Is Crashing Today was originally published by The Motley Fool

Stocks could see a 10% correction by early October on a trifecta of bearish factors, strategist says

-

Renaissance Macro’s Jeff DeGraaf predicts a 10% stock market drop amid three bearish factors.

-

Tech stocks may underperform after rate cuts, impacting market stability, according to DeGraaf.

-

“There’s still a little longer fuse on this correction that’s likely to take place before we’re done,” DeGraaf said.

A trifecta of bearish factors could send stocks lower by about 10% within the next few weeks, according to Renaissance Macro Research founder and technical strategist Jeff DeGraaf.

In an interview with CNBC on Wednesday, DeGraaf said the Nasdaq 100 could trade to 17,000, a key technical level he is monitoring which represents 10% downside from current levels.

For the S&P 500, DeGraaf is closely watching the early August low of 5,120 for a potential retest of support. That level represents about 7% downside from current levels.

DeGraaf is concerned that sentiment remains in bullish territory, which isn’t typically seen when the market is at or near a bottom.

“When we look at where the sentiment is in terms of small speculators on the NDX futures, they’re still very very net long. In other words, they’ve been using this weakness as a buying opportunity. And that’s not usually the right behavior to create some kind of low,” DeGraaf said.

The S&P 500 is about 3% below its record high, while the Nasdaq 100 is down about 8%.

The bullish sentiment among traders is also contrasted by the fact that September has historically been a bad month for stocks.

Finally, DeGraaf said that technology stocks, which have been leading the market higher since the bull market started in October 2022, typically underperform in the three months following the Federal Reserve’s first interest rate cut.

“When we look particularly at technology, it does not fare well after the first rate cut. It’s very pro-cyclical, cyclicals tend to underperform for at least three months after the first Fed rate cut,” DeGraaf said.

“So even though it feels like the calvary is on the way and good things are likely to happen, the data probably continues to be weaker and I think that’s one of the things that’s kind of piling up on us here.”

As to how the decline plays out, DeGraaf said there could be further weakness toward the end of September, spilling over into early October.

Such a decline would create a two-month window of stocks seeing little movement, which can “become pretty disheartening for people,” DeGraaf said.

Another potential decline could come in the form of a quick flush of positioning among trend followers and “sheer panic” among investors, similar to what happened in early August amid the yen carry trade blowup.

Until one of those two things happens, DeGraaf sees short-term stock market risks skewed to the downside.

“Neither one of those have we seen yet and that’s why we think there’s still a little longer fuse on this correction that’s likely to take place before we’re done,” DeGraaf said.

Read the original article on Business Insider

Compass CEO & Founder Robert Reffkin to Speak at Zelman Housing Summit

NEW YORK, Sept. 4, 2024 /PRNewswire/ — Compass, Inc. COMP (“Compass” or “the Company”), the largest residential real estate company in the United States by sales volume1, announces that its CEO & Founder Robert Reffkin will speak at the Zelman Housing Summit on Thursday, September 12, 2024, at the InterContinental Hotel in Boston.

Reffkin’s interview will be broadcast via a public webcast at https://walkerdunlop.zoom.us/webinar/register/WN_UiJjrHB7QX-xVIRNX0heaw#/registration and will be available for replay under the “Events & Presentations” section on the Compass Investor Relations website: https://investors.compass.com.

About Compass

Compass is the largest residential real estate brokerage in the United States by sales volume. Founded in 2012 and based in New York City, Compass provides an end-to-end platform that empowers its residential real estate agents to deliver exceptional service to seller and buyer clients. The platform includes an integrated suite of cloud-based software for customer relationship management, marketing, client service, brokerage services and other critical functionality, all custom-built for the real estate industry. Compass agents utilize the platform to grow their business, save time and manage their business more effectively. For more information on how Compass empowers real estate agents, one of the largest groups of small business owners in the country, please visit www.compass.com.

1 RealTrends, Online, “Top Real Estate Brokerages By Volume in 2024”, https://www.realtrends.com/500-by-volume/

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/compass-ceo–founder-robert-reffkin-to-speak-at-zelman-housing-summit-302238565.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/compass-ceo–founder-robert-reffkin-to-speak-at-zelman-housing-summit-302238565.html

SOURCE COMPASS

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

10th Annual Glow Ride for Cystic Fibrosis: Claire's Place Foundation Shines Brighter Than Ever

Los Angeles, CA, Sept. 05, 2024 (GLOBE NEWSWIRE) — Claire’s Place Foundation, a non-profit organization providing support to children and families affected by cystic fibrosis (CF), is excited to announce its milestone 10th Annual Glow Ride for CF, set to light up Hermosa Beach on September 21, 2024.

Celebrated as a finalist for “Fundraiser of the Year” by the Los Angeles Business Journal, the 2024 Glow Ride for CF will once again transform the iconic Hermosa Beach Pier into a radiant celebration of community and hope. Participants of all ages are invited to deck out their bikes in brilliant glowing decor, lace up their skates or hop on their skateboards, creating an unforgettable evening of vibrant energy. The event will feature electrifying beats from three DJs, a silent disco and dazzling moments under the gigantic rainbow arch, perfect for capturing those Instagram-worthy memories. By joining the Glow Ride, you’ll not only experience the joy of a luminous beachside party, but also play a vital role in supporting families battling CF.

“Our Glow Ride for CF has grown into a beloved tradition—a night where joy and purpose converge,” said Claire’s Place Foundation Executive Director Melissa Yeager. “As we celebrate the 10th anniversary of this incredible event, I’m filled with pride and emotion, reflecting on how my daughter Claire’s vision has blossomed into something truly special. Her unwavering passion for helping others is her legacy, and it continues to inspire us through every Glow Ride and every grant we provide. This year’s Glow Ride will be extra special with unique attractions to mark this momentous occasion.”

Claire’s Place Foundation has been a steadfast source of hope and assistance for CF families. The Glow Ride for CF directly supports the Claire’s Place Foundation Extended Hospital Stay Grant Program, which covers essential living expenses for CF patients and their families during prolonged hospitalizations.

“This year, the CF community faces unprecedented financial challenges,” said Melissa. “The funds we raise at the Glow Ride are crucial in helping families keep a roof over their heads and their lights on during extended hospital stays due to this life-threatening illness. We need your support more than ever! Please join us on September 21st, light up the night with us, and help make a difference in the lives of those who need it most.”

EVENT REGISTRATION DETAILS

The 10th annual Glow Ride for CF on Saturday, September 21, 2024, promises an evening of excitement, unity and compassion. Each ticket includes a limited edition glow-in-the-dark t-shirt, a glow wristband and glow goodies to decorate your wheels for the 3.4-mile ride. Can’t make it to Hermosa Beach? Sign up as a virtual participant. Communities worldwide can unite and fundraise in their neighborhoods. Register here for all options. The CF community needs your glowing support!

EVENT SPONSORS

The 2024 Annual Glow Ride welcomes Vertex Pharmaceuticals, NorthStar Moving Company, Hermosa Cyclery, Athens Services, Withum, Western Truck Insurance Company, Southbay Lexus, UCLA Health and Manhattan Dermatology, as event sponsors.

About Claire’s Place Foundation, Inc.

Claire’s Place Foundation, Inc. is a 501(c)(3) non-profit organization providing support to children and families affected by cystic fibrosis (CF). Claire’s Place Foundation is named in honor of Claire Wineland who lived with CF her entire life and died at the age of 21. Claire was an activist, author, TEDx Speaker, social media star and received numerous awards. Claire’s foundation was a way for her to assure that others living with CF enjoyed the same hope, strength and joy that she enjoyed. Recipient of Los Angeles Business Journal’s “Small Nonprofit of the Year” and “Fundraiser of the Year Finalist” for its annual Glow Ride, the foundation provides grants to families affected by CF, offering both emotional and financial support. Today, Claire’s Place Foundation continues to carry on Claire’s legacy. For more information and make a donation, please visit www.clairesplacefoundation.org.

Carrie N Callahan Claire's Place Foundation 6174134589 carrie@nashcallahan.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

TDFO Hospitality Welcomes Shiah Goldberg to Executive Leadership Team

MELBOURNE, Fla., Sept. 4, 2024 /PRNewswire/ — TDFO Hospitality, operating as Blend and Barrel, a Community Champion Company and subsidiary of TDFO Holdings, is thrilled to announce the addition of Shiah Goldberg to its Executive Leadership team. Mr. Goldberg joins TDFO Hospitality as a new partner and will assume the role of Director of Operations.

In his new role, Mr. Goldberg will oversee the rebranding of the flagship retail location, Executive Cigar Shop and Lounge, situated on the picturesque Lake Monroe in Sanford, FL, to the new Blend and Barrel brand. Additionally, he will spearhead brand and product development in coordination with Blend’s second location in Cocoa Beach, FL, known as “The Office,” managed by partner Micah Rose. “The Office” recently celebrated a successful grand opening on August 17th, and the executive team is enthusiastic about its new beachside location.

Mr. Goldberg’s extensive background in hospitality encompasses every position within the service industry. His journey began with a passion for service, hospitality, and the culinary arts, leading him to culinary school post-university. “An early mentor of mine ingrained in me the importance of proficiency and respect for each role within the industry. It was this philosophy that helped to shape my parallel paths through the luxury hospitality and premium cigar arenas,” Shiah explains. His evolution has taken him through various roles in both front and back-of-house to General Manager. At an early age, he became an operating partner in his first upscale cigar retail operation, where he also served as General Manager and Business Development Lead for a sister speakeasy-themed lounge. This experience solidified his lifelong connection to the cigar industry.

Leveraging his comprehensive hospitality experience, Mr. Goldberg transitioned to roles such as Sales Director and VP of Sales for two emerging cigar manufacturers, significantly growing their core accounts and customer development. In September 2016, he joined Prime Cigar in Boca Raton, FL, as a manager, evolving to General Manager of the Brickell location in downtown Miami. This Casa De Montecristo co-branded entity became one of the most sought-after cigar lounges in the country during this period and the flagship for Prime Cigar’s brand evolution into Empire Social.

Amid the COVID-19 pandemic, Davidoff of Geneva recruited Mr. Goldberg for the US Brand Ambassador position. During his tenure, he led Brand Activation, Training, and Education initiatives both internally and within their Appointed Merchant Network, while also managing internal and external communications. Reflecting on his time with Davidoff, Mr. Goldberg states, “My tenure at Davidoff was as educational towards the marketplace and business of premium cigars as my previous 12 years combined.” He adds, “It feels like my entire working life has been leading me to this point. From the desire to anticipate and exceed customer expectations, to the operations of acclaimed companies such as Hillstone and Davidoff of Geneva, as well as the experiential emphasis from Empire Social, I am thrilled and honored to be able to bring this to TDFO Hospitality and Blend and Barrel. From the very first time we met, Tom Darnell and I aligned personally and professionally. Our appreciation for the finer things and the entities who excel at delivering exceptional products and experiences had us talking, brainstorming, and building excitement from the starting line. With each step closer to this partnership, our excitement and passion for the present and what we will bring in the future reinforced our collective drive. I look forward to working with the incredible team already in place and propelling us to the pinnacle of this beloved industry. Customer experience is the single most important aspect, and we will always keep this focused in the crosshairs.”

Contact:

Thomas Darnell

1321-508-0992

tdarnell@govcompanion.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/tdfo-hospitality-welcomes-shiah-goldberg-to-executive-leadership-team-302238601.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/tdfo-hospitality-welcomes-shiah-goldberg-to-executive-leadership-team-302238601.html

SOURCE Community Solutions Partner, CSP dba/ Community Champions

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Electric Vehicle (EV) Stocks That Could Make You a Millionaire

There’s no denying electric vehicles (EVs) aren’t quite as common as the world initially expected them to be by this point in time. Although they exist and have a place within the automobile industry, the International Energy Administration reports that a little less than 1-in-5 vehicles sold in 2023 are powered by an electrically driven motor (including plug-in hybrids). In the meantime, consumer interest in EVs is waning here and abroad, with many people citing a combination of range concerns and sheer cost as their chief purchase roadblocks. Far too many electric vehicle stocks have performed far too poorly as a result.

While it has fallen short of early expectations, the EV industry is still growing. Bloomberg Intelligence predicts last year’s worldwide EV sales of around 14 million will swell sales of 30 million in 2027, en route to 73 million EV sales in 2040. With trends working in their favor, several unprofitable EV manufacturers could grow their way out of the red and into the black, pushing their underperforming stocks much higher as a result. It’s this projected growth that has investors excited about the potential for millionaire-making returns.

Here’s a closer look at three potential millionaire-making EV stocks that risk-tolerant investors might want to consider.

1. Nikola

The discussion around EVs tends to focus on passenger vehicles, and for good reason — the world buys more than 70 million such automobiles every year. EVs’ underlying technology, however, isn’t limited to passenger-first automobiles. In many ways, are well suited to the hauling and logistics market. That’s mostly class-8 tractor-trailers (or “big rigs”) which are on the road for several hours per day for several days a week. Averaging just 6 mpg of diesel fuel, one truck can burn through tens of thousands of gallons of fuel every single year.

Enter Nikola (NASDAQ: NKLA). It makes battery-powered class-8 tractors — as well as hydrogen-powered versions of these haulers — that are proving efficient, and marketable. They’re on par with diesel in terms of total pulling power, trip distance, and operating costs, but markedly cleaner to operate, meaning they’re already meeting ever-rising emission standards. That’s why the company sold another 72 of its hydrogen fuel cell trucks last quarter, bringing total unit sales to 147 after just three quarters’ worth of availability. Buyers include outfits like Walmart. For perspective, roughly a quarter-of-a-million of these heavy haulers are sold every year in the United States alone, and the U.S. is only a fraction of the global market.

Oh, Nikola also monetizes the tech by supplying the hydrogen needed to power its rigs. This network of fueling stations is expanding as well, as usage of its trucks grows.

The company isn’t yet profitable, which is perhaps the key reason its stock has dished out more frustration than gains since soaring in 2020 during the COVID-19 pandemic. With revenue growth this year and next year expected to exceed 200%, the losses are shrinking fast.

Analysts expect this trend to matter. Their current consensus price target over the next 12 months of $16.80 is more than 150% above the stock’s present price. Keep in mind though that Nikola is dealing with some serious capital (or lack thereof) problems of late. That means there’s above-average risk to consider here as well for investors.

2. Rivian Automotive

To be sure, ordinary passenger vehicles present a tremendous EV opportunity as well.

Tesla (NASDAQ: TSLA) mainstreamed the idea and, for years, was the only major player in the EV space. But good business ideas eventually draw newcomers. Founded as EV sports car maker Mainstream Motors back in 2009, the company became Rivian Automotive (NASDAQ: RIVN) a couple of years later and officially entered the EV market at scale in 2021 with all-electric pickup trucks, sports utility vehicles, and thousands of battery-powered delivery vans made for e-commerce giant Amazon.

Rivian’s product focus is savvy. Conventional sedans are marketable, but consumers love their trucks and SUVs. The National Automobile Dealers Association estimates about 80% of last year’s vehicle sales in the United States were light trucks — a category that includes SUVs and pickups. These bigger vehicles also sell surprisingly well in Europe, and increasingly, even in China. For now, Rivian only manufactures and markets its vehicles in North America, but it intends to enter Europe in the foreseeable future. China and other parts of Asia have been on the radar for some time as well.

Like Nikola, Rivian isn’t profitable. It probably won’t be profitable in the near future either.

It is making progress to that end though, and is positioned to capitalize on the EV industry’s long-term growth.

3. Toyota

Last but not least, add Toyota Motor (NYSE: TM) to your list of electric vehicle stocks that could help you eventually become a millionaire.

If it seems like Toyota hasn’t shown much focus on EVs in the past, you’re not imagining things. It hasn’t. While it does make battery-powered and hybrid vehicles, it’s not invested a ton of time and money in them. It’s instead remained largely focused on traditional combustion-powered vehicles while allowing other carmakers to go to the trouble and expense of blazing the EV trail.

Now that’s finally changing. With EV technology (mostly) optimized and charging infrastructure now falling into place, the company’s turning up the heat. Last year’s sales of Toyota EVs jumped 35%. That’s huge progress even if these vehicles still only account for about one-third of Toyota’s total unit sales.

However, there’s a twist here. Recognizing that car owners are increasingly worried a vehicle solely powered by charged batteries just doesn’t or won’t meet their needs, Toyota is doubling down on hybrid vehicles that also run on conventional gasoline once their battery’s charge has been depleted.

The plan seems to be working too. At a time when sales growth of conventional battery-powered EVs is slowing, Toyota saw accelerating growth from hybrid vehicles that already make up the vast majority of its EV production (up 24% last quarter). As it turns out, at least some drivers are comfortable with the idea of a vehicle that’s capable of burning gas when necessary.

This stock’s potential upside as an EV investment, though, isn’t rooted in Toyota’s capacity to pivot. It lies in the fact that Toyota is already a known and trusted name here and abroad. America’s best-selling cars in 2023 (and in prior years too) include its Camry, Rav4, Tacoma, and Corolla. While some consumers might be hesitant to purchase an EV from a newer company like Rivian or even Tesla, they’re more likely to be comfortable buying one from a manufacturer that’s seemingly been around forever.

Should you invest $1,000 in Rivian Automotive right now?

Before you buy stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Tesla, and Walmart. The Motley Fool has a disclosure policy.

3 Electric Vehicle (EV) Stocks That Could Make You a Millionaire was originally published by The Motley Fool

One Stop Systems to Participate at the Lake Street Best Ideas Growth Conference on September 12

ESCONDIDO, Calif., Sept. 05, 2024 (GLOBE NEWSWIRE) — One Stop Systems, Inc. (“OSS” or the “Company”) OSS, a leader in rugged Enterprise Class compute for artificial intelligence (AI), machine learning (ML) and sensor processing at the Edge, today announced that Mike Knowles, President and CEO, and John Morrison, CFO will participate in the Lake Street Capital Markets’ Best Ideas Growth “Big8” Conference on September 12, 2024, at The Yale Club in New York City.

Management is scheduled to host one-on-one meetings with investors during the conference. Investors interested in arranging one-on-one meetings should contact their Lake Street conference representative.

About One Stop Systems

One Stop Systems, Inc. OSS is a leader in AI enabled solutions for the demanding ‘edge’. OSS designs and manufactures Enterprise Class compute and storage products that enable rugged AI, sensor fusion and autonomous capabilities without compromise. These hardware and software platforms bring the latest data center performance to harsh and challenging applications, whether they are on land, sea or in the air.

OSS products include ruggedized servers, compute accelerators, flash storage arrays, and storage acceleration software. These specialized compact products are used across multiple industries and applications, including autonomous trucking and farming, as well as aircraft, drones, ships and vehicles within the defense industry.

OSS solutions address the entire AI workflow, from high-speed data acquisition to deep learning, training and large-scale inference, and have delivered many industry firsts for industrial OEM and government customers.

As the fastest growing segment of the multi-billion-dollar edge computing market, AI enabled solutions require-and OSS delivers-the highest level of performance in the most challenging environments without compromise.

OSS products are available directly or through global distributors. For more information, go to www.onestopsystems.com. You can also follow OSS on X, YouTube, and LinkedIn.

Forward-Looking Statements

One Stop Systems cautions you that statements in this press release that are not a description of historical facts are forward-looking statements. These statements are based on the company’s current beliefs and expectations. The inclusion of forward-looking statements should not be regarded as a representation by One Stop Systems or its partners that any of our plans or expectations will be achieved, including but not limited to, management’s expectation for new market opportunities, the Company’s penetration of the Defense and Commercial sectors, future changes to our business objectives, and other future financial projections. Actual results may differ from those set forth in this press release due to the risk and uncertainties inherent in our business, including risks described in our prior press releases and in our filings with the Securities and Exchange Commission (SEC), including under the heading “Risk Factors” in our latest Annual Report on Form 10-K and any subsequent filings with the SEC. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and the company undertakes no obligation to revise or update this press release to reflect events or circumstances after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

About the Lake Street “Big8” Conference

Lake Street Capital Markets is a research-powered investment bank focused on growth companies. The Best Ideas Growth Conference is Lake Street’s annual invitation-only event, featuring dynamic, small-cap companies interacting with top institutional investors. The format has been designed to give attendees direct access to senior management via one-on-one & group meeting formats. Learn more about Lake Street at www.lakestreetcapitalmarkets.com.

Media Contacts:

Robert Kalebaugh

One Stop Systems, Inc.

Tel (858) 518-6154

Email contact

Investor Relations:

Andrew Berger

Managing Director

SM Berger & Company, Inc.

Tel (216) 464-6400

Email contact

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Celsius Stock Suddenly Plunged Today

It started out as a calm morning for shares of Celsius Holdings (NASDAQ: CELH). But around noon, management made an appearance at Barclays‘ 17th Annual Global Consumer Staples Conference. During the chat, management said something that sparked fear in investors: In the current quarter, sales to PepsiCo (NASDAQ: PEP) are down $100 million to $120 million compared to last year.

Investors took action, and that’s why Celsius stock was down a painful 12% as of 3:15 p.m. ET.

How does Celsius generate revenue?

Pepsi became the primary distribution partner for Celsius in August 2022. For Celsius, it now recognizes revenue when it delivers inventory to Pepsi. From there, Pepsi distributes it to retail channels where it’s purchased by consumers. And for this reason, there’s a different between when Celsius generates revenue and when its products actually sell in stores.

In 2023, Celsius’ revenue was up an impressive 102% year over year and well ahead of expectations from analysts. But it’s now clear that this outperformance was because Pepsi ordered too much product. It’s a misstep that Pepsi is now correcting by ordering less from Celsius while it sells inventory it has on hand.

For the current third quarter of 2024, Celsius management estimates that Pepsi will order between $100 million and $120 million less than it ordered in the third quarter of 2023. To be sure, this will be a huge drag on Q3 results and it’s why the stock plunged today.

What should investors do now?

There are cases where the financials don’t clearly reflect the health of the business, and I believe this is one of those cases. During its chat today, Celsius management pointed out that Q3 sales for its products are up 10% so far. This won’t be reflected in its revenue, because it generates revenue when it supplies inventory to Pepsi. But sales to consumers are growing nevertheless.

Moreover, Celsius management believes it’s gained another whole point of market share in the energy drink space. And market share is huge for a beverage stock.

I’ll stop short of calling the bottom for Celsius stock. But I believe the explanation of what’s happening with the business is reasonable. And I consequently believe that investors are overreacting to today’s news.

Should you invest $1,000 in Celsius right now?

Before you buy stock in Celsius, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Celsius wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Jon Quast has positions in Celsius. The Motley Fool has positions in and recommends Celsius. The Motley Fool recommends Barclays Plc. The Motley Fool has a disclosure policy.

Why Celsius Stock Suddenly Plunged Today was originally published by The Motley Fool

Where Will Palantir Technologies Stock Be in 1 Year?

Palantir Technologies (NYSE: PLTR) stock shot up 110% in the past year, as investors bought shares of this software platform provider hand over fist, thanks to the rapidly growing demand for its artificial intelligence (AI) offerings. And yet, because it has already rallied so far, Wall Street doesn’t anticipate more gains in the coming year.

Palantir stock carries a median 12-month price target of $28 (per 24 analysts covering it). That implies an 11% drop from its current price. A third of those analysts recommend selling Palantir, with 38% rating it as a buy and the rest as a hold.

Does this divided analyst sentiment mean it’s time for investors to book profits in Palantir? Or can this high-flying AI stock sustain the rally and deliver more gains in the coming year? Let’s check if Palantir has what it takes to defy Wall Street’s expectations.

Palantir’s growth profile continues to improve

Palantir’s expensive valuation looks like a key reason why analysts are doubtful it can deliver more upside over the next 12 months. The stock’s price-to-sales ratio of 29 is admittedly expensive. It nearly quadruples the U.S. technology sector index’s average sales multiple of 7.7. Palantir’s trailing price-to-earnings ratio is also very expensive at 178. Its forward earnings multiple of 86 points toward a nice bump in its earnings over the next year, but it is still on the expensive side.

One way to justify buying Palantir stock despite its rich valuation is the acceleration in the company’s growth. In the second quarter, the company’s revenue increased 27% from the same period last year to $678 million. That was better than the 21% year-over-year growth Palantir reported in the first quarter of the year. The company’s top-line growth in the first half of the year indicates that it is well on track to exceed the 17% full-year revenue jump it delivered in 2023 to $2.2 billion.

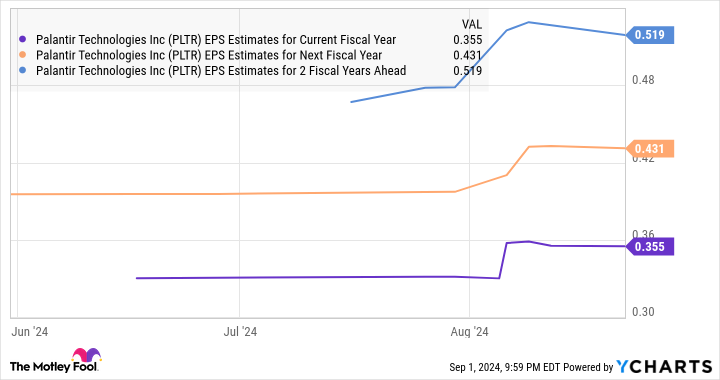

The company expects to finish 2024 with almost $2.75 billion in revenue. That would be a 25% increase over last year. Analysts forecast its earnings will increase by 44% in 2024 to $0.36 per share. But it is worth noting that analysts have been raising their expectations of late.

Stronger-than-expected growth could send Palantir stock higher

Another thing worth noting in the chart is that despite a bump in Palantir’s revenue estimates for the next couple of years, analysts expect it to grow at a slower pace in 2025 and 2026. However, that may not be the case, as the recent acceleration in the company’s growth seems sustainable in the coming year.

In simpler words, Palantir’s top-line growth could be much stronger than what analysts expect in 2025. That’s because its Artificial Intelligence Platform (AIP) is leading to robust growth in its revenue pipeline. The company’s remaining performance obligations (RPO) increased 41% year over year in Q2 to $1.37 billion.

Palantir’s RPO reflects the value of contracts that the company entered into with customers, which means that it is an indicator of its future revenue growth. However, Palantir points out that its RPO mainly consists of commercial contracts. The remaining deal value (RDV) is the metric to look at to get an idea of the potential top-line growth that Palantir could deliver. RDV is the total remaining value of all the company’s contracts at the end of a quarter. This metric was worth $4.3 billion in Q2, jumping 26% from the same quarter last year. It remains to be seen how quickly Palantir can translate those contracts into actual revenue, but it is worth noting that its RDV is significantly higher than its trailing-12-month revenue of $2.5 billion.

So there is a strong possibility of Palantir’s growth being better than expected in the next year, especially considering that it could continue to attract new customers toward its AI software offerings in light of the huge end-market opportunity available in this market. Market research firm IDC forecasts the market for AI software platforms that Palantir offers could clock a compound annual growth rate of 41% through 2028, generating $153 billion in annual revenue at the end of the forecast period.

Palantir is in a solid position to make the most of this opportunity. According to research firm Forrester, Palantir has been ranked as the No. 1 provider of AI software platforms. This is also evident from the fact that the company’s deal count has been increasing rapidly. For instance, it struck 123 deals with U.S. commercial customers in Q2, which was a 98% jump from the year-ago period.

More importantly, Palantir’s deal sizes are getting bigger, with the company closing 96 deals worth $1 million or more in the previous quarter, up from 66 such deals in the same period last year. What’s more, the number of $10 million-plus deals increased by 50% year over year to 27. So, as the adoption of Palantir’s AI platforms increases, its growth rate should also pick up.

Moreover, Palantir’s price/earnings-to-growth ratio (PEG ratio) is well below 1.

The PEG ratio is a forward-looking valuation metric calculated by dividing a company’s trailing P/E by its projected earnings growth. A reading of less than 1 means that a stock is undervalued in light of its potential growth. So, growth investors can still consider buying Palantir stock, as there is a good chance that its stronger-than-expected performance in the coming year could be rewarded with more gains on the market.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

Where Will Palantir Technologies Stock Be in 1 Year? was originally published by The Motley Fool

C3.ai Analysts Cut Their Forecasts After Q1 Earnings Results

C3.ai Inc AI posted upbeat earnings and sales results for its first quarter on Wednesday.

C3.ai reported first-quarter revenue of $87.2 million, up 21% year-over-year. The revenue figure beat a Street consensus estimate of $86.9 million, according to data from Benzinga Pro.

Subscription revenue was $73.5 million in the first quarter, up 20%. Subscription revenue made up 84% of the company’s total revenue in the first quarter.

The company reported a loss of 5 cents per share in the first quarter, beating a Street consensus estimate of a loss of 13 cents per share.

“We had a solid start to the fiscal year, with rising demand for Enterprise AI driving our sixth consecutive quarter of accelerating revenue growth,” C3.ai CEO Thomas Siebel said.

The company is guiding for second-quarter revenue in a range of $88.6 million to $93.6 million. Full fiscal-year revenue is guided to be in a range of $370 million to $395 million.

C3.ai shares fell 1.9% to close at $23.01 on Wednesday.

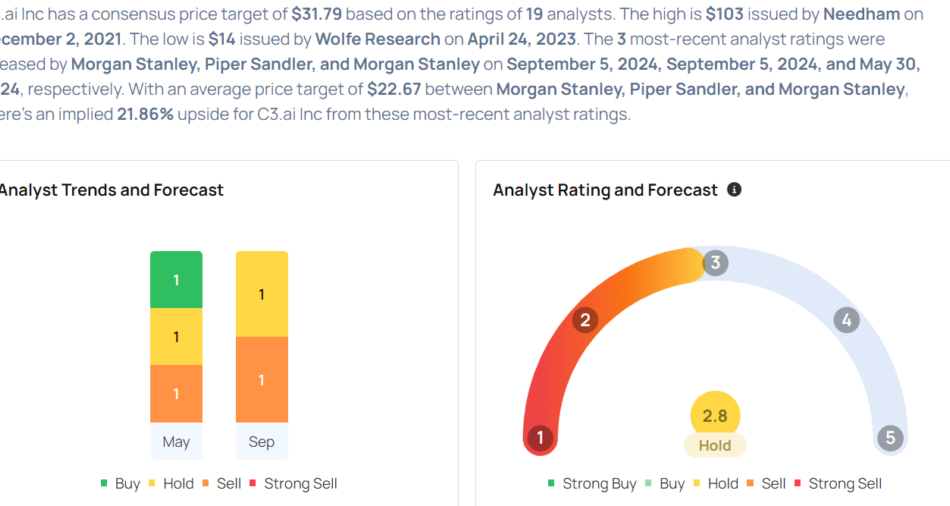

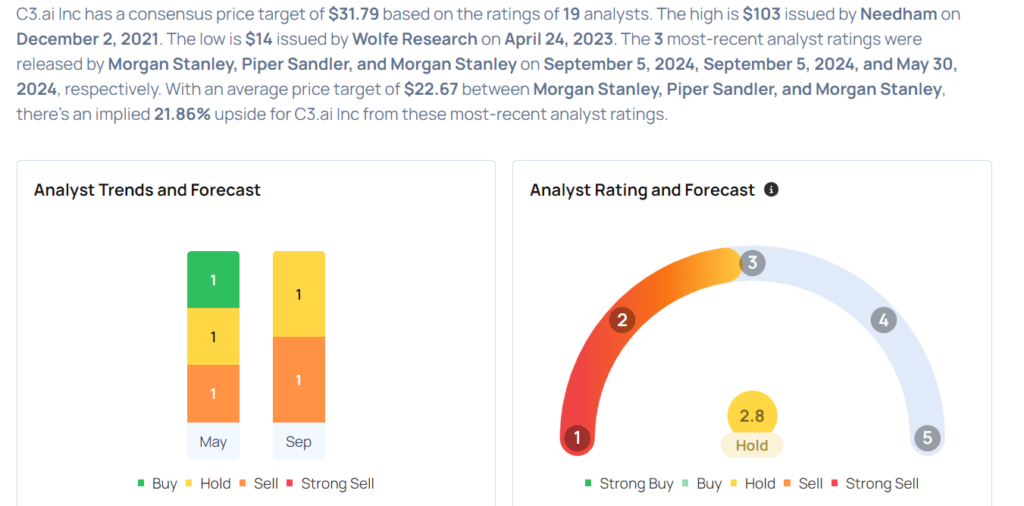

These analysts made changes to their price targets on C3.ai following earnings announcement.

Considering buying AI stock? Here’s what analysts think:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.