Ciena Q3 Earnings: Revenue And EPS Beat, Operating Margin Decline, CFO Retirement And More

Ciena Corp CIEN reported a fiscal third-quarter 2024 revenue decline of 11.8% year-on-year to $942.3 million, beating the analyst consensus estimate of $927.2 million.

The American telecommunications networking equipment and software services supplier reported an adjusted EPS of $0.35, beating the analyst consensus estimate of $0.26.

Segments: Total Networking Platforms revenue declined by 17.4% Y/Y to $699.5 million, and Total Global Services increased by 3.5% Y/Y to $133.8 million.

Margins: The adjusted gross margin climbed by 100 bps to 43.7%. Adjusted operating margin decreased by 400 bps to 8.0%.

Two 10%-plus customers represented a total of 26.6% of revenue.

Ciena held $1.2 billion in cash and equivalents and used $(159.4) million in operating cash flow.

“We delivered strong results for the fiscal third quarter that reflect growing momentum with cloud providers and continued gradual recovery with service providers,” CEO Gary Smith said.

CFO Transition: Ciena announced that CFO James E. Moylan, Jr., plans to retire in twelve months, effective August 28, 2025. The company will commence a search process to identify a successor. Moylan will continue to serve as CFO until a successor is in place and will assist in transitioning his responsibilities.

Ciena stock gained over 15% in the last 12 months.

Price Action: CIEN stock traded higher by 1.36% at $56.10 premarket at the last check on Wednesday.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hooker Furnishings Declares Quarterly Dividend

MARTINSVILLE, Va., Sept. 03, 2024 (GLOBE NEWSWIRE) — Hooker Furnishings Corporation (Nasdaq-GS: HOFT) announced that on September 3, 2024, its board of directors declared a quarterly cash dividend of $0.23 per share, payable on September 30, 2024, to shareholders of record on September 13, 2024.

Hooker Furnishings Corporation, in its 100th year of business, is a designer, marketer and importer of casegoods (wooden and metal furniture), leather furniture, fabric-upholstered furniture, lighting, accessories, and home décor for the residential, hospitality and contract markets. The Company also domestically manufactures premium residential custom leather and custom fabric-upholstered furniture and outdoor furniture. Major casegoods product categories include home entertainment, home office, accent, dining, and bedroom furniture in the upper-medium price points sold under the Hooker Furniture brand. Hooker’s residential upholstered seating product lines include Bradington-Young, a specialist in upscale motion and stationary leather furniture, HF Custom (formerly Sam Moore), a specialist in fashion forward custom upholstery offering a selection of chairs, sofas, sectionals, recliners and a variety of accent upholstery pieces, Hooker Upholstery, imported upholstered furniture targeted at the upper-medium price-range and Shenandoah Furniture, an upscale upholstered furniture company specializing in private label sectionals, modulars, sofas, chairs, ottomans, benches, beds and dining chairs in the upper-medium price points for lifestyle specialty retailers. The H Contract product line supplies upholstered seating and casegoods to upscale senior living facilities. The Home Meridian division addresses more moderate price points and channels of distribution not currently served by other Hooker Furnishings divisions or brands. Home Meridian’s brands include Pulaski Furniture, casegoods covering the complete design spectrum in a wide range of bedroom, dining room, accent and display cabinets at medium price points, Samuel Lawrence Furniture, value-conscious offerings in bedroom, dining room, home office and youth furnishings, Prime Resources International, value-conscious imported leather upholstered furniture, and Samuel Lawrence Hospitality, a designer and supplier of hotel furnishings. The Sunset West division is a designer and manufacturer of comfortable, stylish and high-quality outdoor furniture. Hooker Furnishings Corporation’s corporate offices and upholstery manufacturing facilities are located in Virginia, North Carolina and California, with showrooms in High Point, NC, Las Vegas, NV, Atlanta, GA and Ho Chi Minh City, Vietnam. The company operates distribution centers in Virginia, Georgia, and Vietnam. Please visit our websites hookerfurnishings.com, hookerfurniture.com, bradington-young.com, hfcustomfurniture.com, hcontractfurniture.com, homemeridian.com, pulaskifurniture.com, slh-co.com, and sunsetwestusa.com.

For more information, contact:

Paul A. Huckfeldt, Senior Vice President-Finance and CFO

Hooker Furnishings Corporation, 276.666.3949

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MAA Announces Regular Quarterly Preferred Dividend

GERMANTOWN, Tenn., Sept. 3, 2024 /PRNewswire/ — Mid-America Apartment Communities, Inc., or MAA MAA, today announced a full quarterly dividend of $1.0625 per outstanding share of its 8.50% Series I Cumulative Redeemable Preferred Stock. The dividend is payable on September 30, 2024, to shareholders of record on September 13, 2024.

About MAA

MAA is a self-administered real estate investment trust (REIT) and member of the S&P 500. MAA owns or has ownership interest in apartment communities primarily throughout the Southeast, Southwest and Mid-Atlantic regions of the U.S. focused on delivering strong, full-cycle investment performance. For further details, please refer to the “For Investors” page at www.maac.com or contact Investor Relations at investor.relations@maac.com.

Forward-Looking Statements

Certain matters in this press release may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended with respect to our expectations for future periods. Such statements include statements made about the payment of preferred dividends. The ability to meet the payment of preferred dividends in or contemplated by the forward-looking statements could differ materially from the projection due to a number of factors, including a downturn in general economic conditions or the capital markets, changes in interest rates and other items that are difficult to control such as increases in real estate taxes in many of our markets, as well as the other general risks inherent in the apartment and real estate businesses. Reference is hereby made to the filings of Mid-America Apartment Communities, Inc. with the Securities and Exchange Commission, including quarterly reports on Form 10-Q, reports on Form 8-K, and its annual report on Form 10-K, particularly including the risk factors contained in the latter filing.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/maa-announces-regular-quarterly-preferred-dividend-302237041.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/maa-announces-regular-quarterly-preferred-dividend-302237041.html

SOURCE MAA

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Dividend King Could Be a No-Brainer Buy If Kamala Harris Beats Donald Trump in November

Presidential elections matter. Candidates usually have competing visions for the country. Those visions can create winners in some areas — and losers in others. As a result, prudent investors watch elections closely.

It isn’t too soon to begin thinking about which stocks could be winners depending on which presidential candidate wins. And there’s one Dividend King that could be a no-brainer buy if Kamala Harris beats Donald Trump in November.

Go high, go Lowe’s

Most Americans are probably quite familiar with Lowe’s Companies (NYSE: LOW). The company ranks as the second-largest home improvement retailer in the world. Its market cap hovers around $140 billion.

Lowe’s operates more than 1,700 home improvement stores throughout the U.S. It serves individuals performing do-it-yourself fixer-upper projects. The company also targets professionals, including skilled tradespeople, remodelers, and property managers.

Although Lowe’s stock is lagging behind the S&P 500 so far in 2024, it’s beaten the market over the long term. For example, Lowe’s more than doubled the return of the S&P 500 over the last 10 years.

Lowe’s has also been a favorite for income investors. The company has paid a dividend every quarter since it went public in 1961. Lowe’s has increased its dividend for 51 consecutive years.

Why a Harris victory could benefit Lowe’s

In August, Vice President Harris unveiled her plan to lower housing costs. She wants to provide up to $25,000 to first-time homebuyers to help with their down payments. First-time homebuyers would also receive a $10,000 tax credit. Harris’ plan also features tax incentives to promote the construction of starter homes and affordable rental housing.

How could this plan help Lowe’s? For one thing, Lowe’s caters to homebuilders. It even has a strategic alliance with the National Association of Home Builders that offers discounts to the organization’s members. Lowe’s should have an opportunity to profit from any federal initiative that boosts the construction of new houses.

But Harris’ plan doesn’t just foster the building of new homes. It should also promote a frenzy of fixing up existing homes, especially those that are attractive to first-time homebuyers. Again, Lowe’s would likely be a key beneficiary from a surge in home improvement projects.

Of course, a Harris victory in November by itself might not be enough. If she’s elected as the next president, she’ll need support in Congress to pass her housing plan.

A good pick regardless of which candidate wins

Lowe’s could be a no-brainer buy if Harris beats Trump. However, the stock could be a good pick regardless of which candidate wins.

Over the short term, lower interest rates could provide a catalyst for Lowe’s stock. Federal Reserve Chairman Jerome Powell has strongly hinted that rate cuts will be coming soon. When interest rates fall, mortgage rates usually do too. This spurs home buying — and home improvement projects for existing homeowners looking to move into a new home.

Lowe’s should also have great long-term prospects. The median age of homes in the U.S. is over 40 years old. Home improvement projects will needed for decades to come. And Lowe’s will be there to meet those needs.

Should you invest $1,000 in Lowe’s Companies right now?

Before you buy stock in Lowe’s Companies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lowe’s Companies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Keith Speights has positions in Lowe’s Companies. The Motley Fool recommends Lowe’s Companies. The Motley Fool has a disclosure policy.

This Dividend King Could Be a No-Brainer Buy If Kamala Harris Beats Donald Trump in November was originally published by The Motley Fool

Toll Brothers Announces New Luxury Condominium Community Coming Soon to Chantilly, Virginia

CHANTILLY, Va., Sept. 03, 2024 (GLOBE NEWSWIRE) — Toll Brothers, Inc. TOL, the nation’s leading builder of luxury homes, today announced a new community, Commonwealth Place at Westfields – The Belle Haven Collection, is coming soon to Chantilly, Virginia. The newest collection at this exclusive Toll Brothers community will include townhome-style luxury condos ideally located within walking distance to Westfields Center. Site work is underway, and the community is anticipated to open for sale in late fall 2024.

The Belle Haven Collection at Commonwealth Place at Westfields will feature a selection of floor plans ranging from 1,342 to 1,767+ square feet with distinct architecture. One- and two-story condominium home designs will offer two bedrooms, open concept floor plans, balconies, 2-car tandem garages, and professionally selected finishes. Homes will be priced from the upper $500,000s.

“Our new collection at Commonwealth Place at Westfields will offer residents the rare opportunity to own a luxury condo in the highly desirable Chantilly area,” said Nimita Shah, Division President of Toll Brothers in D.C. Metro. “With meticulously designed floor plans and an unrivaled location just steps away from dining and shopping at Westfields Center, this community will set a new standard for luxury low-maintenance living in Chantilly.”

Chantilly was recently named among the top three 2024 Best Places to Live for Families by Fortune magazine. The community is conveniently located near highly ranked Fairfax County Public Schools and Dulles International Airport. Commuters will enjoy proximity to Routes 50 and 28, Interstate 66, and Dulles Toll Road/Route 267, offering easy access to the greater D.C. Metro area.

Shopping, dining, and entertainment at Westfields Center is within walking distance, offering Wegmans, Mellow Mushroom, Cava, Chipotle, South Block, and more. Nearby, residents can explore bountiful parks and golf courses including Chantilly National Golf & Country Club, Pleasant Valley Golf Club, Flatlick Stream Valley Park, Ellanor C. Lawrence Park, and Richard W. Jones Park.

Homeowners at Commonwealth Place at Westfields enjoy a relaxed low-maintenance lifestyle with snow removal, lawn mowing, and exterior maintenance included.

For more information and to join the Toll Brothers interest list for Commonwealth Place at Westfields – The Belle Haven Collection, call (855) 298-0316 or visit TollBrothers.com/Virginia.

About Toll Brothers

Toll Brothers, Inc., a Fortune 500 Company, is the nation’s leading builder of luxury homes. The Company was founded 57 years ago in 1967 and became a public company in 1986. Its common stock is listed on the New York Stock Exchange under the symbol “TOL.” The Company serves first-time, move-up, empty-nester, active-adult, and second-home buyers, as well as urban and suburban renters. Toll Brothers builds in over 60 markets in 24 states: Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Indiana, Maryland, Massachusetts, Michigan, Nevada, New Jersey, New York, North Carolina, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia, and Washington, as well as in the District of Columbia. The Company operates its own architectural, engineering, mortgage, title, land development, smart home technology, and landscape subsidiaries. The Company also develops master-planned and golf course communities as well as operates its own lumber distribution, house component assembly, and manufacturing operations.

In 2024, Toll Brothers marked 10 years in a row being named to the Fortune World’s Most Admired Companies™ list and the Company’s Chairman and CEO Douglas C. Yearley, Jr. was named one of 25 Top CEOs by Barron’s magazine. Toll Brothers has also been named Builder of the Year by Builder magazine and is the first two-time recipient of Builder of the Year from Professional Builder magazine. For more information visit TollBrothers.com.

From Fortune, ©2024 Fortune Media IP Limited. All rights reserved. Used under license.

Contact: Andrea Meck | Toll Brothers, Director, Public Relations & Social Media | 215-938-8169 | ameck@tollbrothers.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/be3e0e0d-80b0-40f6-b699-77f61d9375aa

Sent by Toll Brothers via Regional Globe Newswire (TOLL-REG)

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JPMorgan says Fed rate cuts won't be the rocket fuel for stocks some expect

-

Blowout equity momentum isn’t guaranteed after the Fed cuts rates, JPMorgan said.

-

If the Fed cuts in reaction to weaker growth, the positive impact may be muted, the firm wrote.

-

Other analysts are more bullish on the economy and the equity-positive effect of rate cuts.

Interest-rate cuts are on the horizon, but investors who think this will generate a fresh dose of equity momentum could be mistaken, JPMorgan said.

In a new research note, JPMorgan strategists led Mislav Matejka said the Federal Reserve’s eventual rate cuts will be at least partially in response to a slowing economy, which could neutralize the positive effect on stocks.

“Fed will start easing, but more in a reactive way and as a response to weakening growth — this might not be enough to drive a next leg higher,” strategists led by Mislav Matejka wrote on Monday.

Additionally, JPMorgan wrote: “We are not out of the woods yet, September has seasonally been a challenging month for equities.”

The firm’s view stands in contrast to more bullish forecasts held by those who think a post-rate-cut rally is in the cards.

For instance, one Wells Fargo analyst recently indicated that equities are bound for a rally not seen in three decades once Fed policy eases.

According to Paul Christopher, head of global investment strategy, today’s market has strong parallels with that of 1995 — and with the Fed cutting proactively amid stable GDP strength, further upside looks likely.

Meanwhile, veteran strategist Jim Paulson suggested that the Fed’s pivot would open the door to a “brand new bull market.”

“They opened up a lot more positive forces for the stock market that just haven’t been there,” he said, speaking after Fed Chairman Jerome Powell confirmed that interest rate cuts were likely during last month’s Jackson Hole Symposium.

Once the Fed cuts, these forces include accelerating monetary growth and falling bond yields, propelling private sector confidence higher, Paulson said.

Friday’s nonfarm payrolls report will be the next major input for the Fed, which is currently expected to cut rates by 25 basis points at its late-September policy meeting.

An especially weak report could revive cries for a deeper rate cut in September — possibly 50 basis points — as well as an accelerated pace of cuts heading into the November election and year-end.

Read the original article on Business Insider

Mystery Option Buyer Nets Fast $12 Million Gain on Stock Slide

(Bloomberg) — The sense of calm in the US stock market was disrupted Tuesday as the S&P 500 Index plunged more than 2% and the VIX exploded higher. That’s rewarded a late-Friday options buyer with some $12 million in paper gains.

Most Read from Bloomberg

The spike in volatility came as the S&P 500 index was dragged down by a selloff in technology stocks with AI giant Nvidia Corp.’s market capitalization dropping by the equivalent of Chevron Corp.

Late Friday, an investor or investors spent almost $9 million buying 350,000 call spreads on the Cboe Volatility Index, or VIX, to protect against a September jump in the gauge, which measures volatility on S&P 500 options.

At the time, those spreads — buying the 22 call, selling the 30 call expiring Sept. 18 — cost 25 cents each. On Tuesday, with the VIX jumping from less than 16 to almost 22 before the close, almost as many spreads traded, this time with many of them going for around 60 cents.

It appears that Friday’s buyer turned around and sold the position, according to market participants, though it’s hard to know for sure. In any case, the potential profit comes to about $12.25 million.

–With assistance from Alyce Andres.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

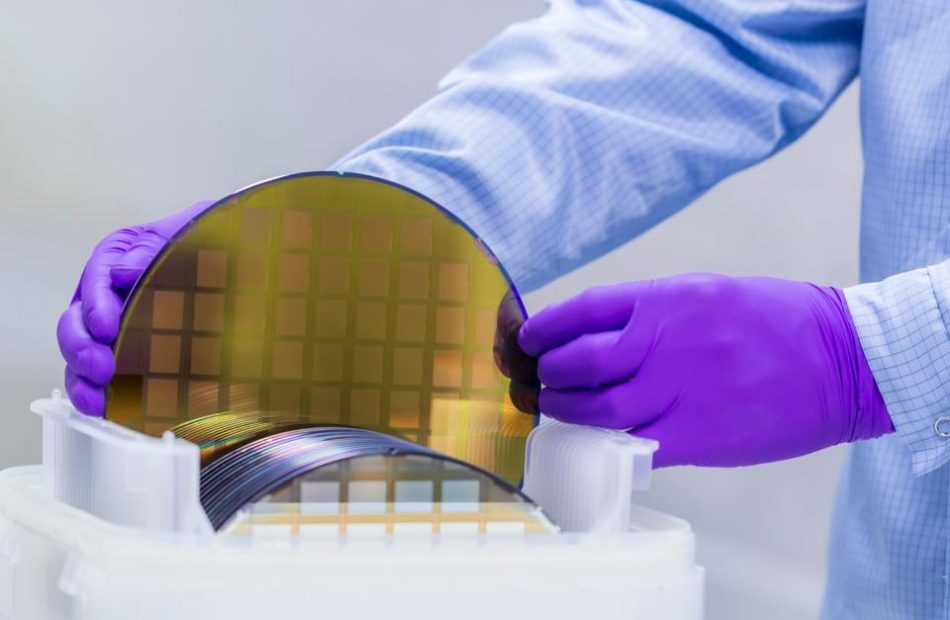

Why Micron, Arm Holdings, and ASML Holdings Crashed Today

Shares of semiconductor sector favorites Micron Technology (NASDAQ: MU), Arm Holdings (NASDAQ: ARM), and ASML Holdings (NASDAQ: ASML) fell hard to start off September, down 8%, 6.9%, and 6.5%, respectively, as of the close of trading Tuesday.

Weaker-than-expected macroeconomic data sent the entire chip sector down hard, and ASML drew attention in a trade war spat regarding China over the weekend. But is this pullback a buying opportunity?

Weaker-than-expected manufacturing sends chips into a tailspin

Coming into Tuesday, each of these three stocks had good-to-great results in the market year to date, which perhaps set them up for more pronounced sell-offs on bad news. As of Friday’s close, Arm Holdings had soared 77% in 2024 as AI enthusiasm took hold for its newer data center and PC solutions. ASML, which is the dominant provider of the EUV lithography machines that are crucial for the production of cutting-edge chips and memory for AI, was up by 20%, despite a July swoon. And Micron was up by just 13% as earlier enthusiasm for its AI prospects had moderated amid soft economic readings for the highly cyclical memory player.

While these three companies have benefited from the optimism around the future of AI, each is also somewhat cyclical, and their results can ebb and flow with the economy.

On that front, there was pessimistic news regarding U.S. and Chinese manufacturing. On Tuesday morning, the Institute for Supply Management released its Manufacturing Purchasing Managers’ Index for August, which came in weaker than analysts expected. The August reading was 47.2. While that was up from 46.8 in July, it was below the Dow Jones analyst consensus expectation of 47.9.

But some details were more worrying. The New Orders Index was worse than the overall reading at 44.6, down from 47.4 in July. But the Prices Index actually rose to 54 from last month’s 52.9 reading. And the Inventories Index rose 5.8 points to 50.3.

The combination of lower orders, rising inventories, and still-rising labor and freight costs points to the worst of all possible worlds: a stagflationary setup. That could hamstring the Fed’s ability to cut rates aggressively, despite Tuesday’s downward lurch in the manufacturing sector.

Of note, there was also trouble with China over the weekend: A report showed that its manufacturing activity fell to a six-month low of 49.1 in July, marking its fourth straight reading below 50. China’s economy has been mired in a slump for some time, and doesn’t appear to be coming out of it anytime soon. Of note, China is a big purchaser of semiconductors, so weak economic activity there could have an effect on all three of these companies.

In addition, China threatened Monday to stop buying ASML’s equipment. Last week, it was reported that the Netherlands may restrict ASML’s sales and service even for certain older deep ultraviolet lithography machines in China. But on Monday, an article in China’s government-backed Global Times said that China could cut off ASML “permanently” from the country if the Dutch government went ahead with those restrictions.

ASML is the outright global leader in lithography, so it’s unclear how China could replace all those machines. Still, losing that country as a market would be a bad scenario for ASML — it got 49% of its revenue from China last quarter. While some of the machines that would have gone there would likely be sold to companies in other geographies if China couldn’t make its own chips, ASML might not recover 100% of those lost sales, and that kind of move would be highly disruptive.

But it may not be all bad news

August’s manufacturing reading was certainly not great, which fueled fears that the Federal Reserve has fallen behind the curve on its fiscal policy pivot, which could potentially lead to lower U.S. economic growth or even recession in the coming quarters.

However, there were a couple of things for semiconductor bulls to hold onto. First, while a reading below 50 indicates a contraction for the manufacturing sector, the threshold of 42.5 is the level that indicates a broader economic downturn overall, and the U.S. is still well above that.

Second, delving into the quotes from purchasing managers included in the report, the electronics industry manager’s quote was actually bullish: “Business outlook is good. Recovery from the electronics slowdown is strong for the second half of the year.” Furthermore, the institute reported that out of the six largest manufacturing sectors, only the computer and electronics segment reported growth in new orders and increased production.

The personal electronics industry entered its downturn in late 2022 and appears to be recovering, while industrials and autos are now mired in the middle of their own downturns. So while higher benchmark interest rates appear to have contributed to a slowdown across most manufacturing sectors, the computer and electronics sector appears to be a strong outlier — at least for now.

Since the chip sector is largely selling off on Tuesday’s bad economic headlines, investors may want to take the opportunity to add to their positions in their favorite chip stocks.

Should you invest $1,000 in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Billy Duberstein and/or his clients have positions in ASML and Micron Technology. The Motley Fool has positions in and recommends ASML. The Motley Fool has a disclosure policy.

Why Micron, Arm Holdings, and ASML Holdings Crashed Today was originally published by The Motley Fool

Why Verizon Stock Topped the Market on Tuesday

On a down Tuesday for U.S. equities, incumbent telecom stock Verizon (NYSE: VZ) managed to land well in positive territory. On speculation that the company is about to raise its already considerable dividend, investors snapped up its shares. This pushed its stock price nearly 3% higher, on a day when the S&P 500 index was in the red with a more than 2% decline.

Dividend raise on the way, say analysts

That morning, an analyst team at white-shoe investment bank Morgan Stanley opined that Verizon is days away from declaring a dividend raise. The prognosticators said that such an announcement is likely to occur this Thursday, Sept. 5. Morgan Stanley anticipates a $0.05-per-share annual hike to the big telecom‘s quarterly common stock payout, putting the next quarterly distribution at nearly $0.68 per share.

If realized, such an increase would be in line with Verizon’s recent dividend raises. While the company is a frequent lifter, consistently adding to its payout every year, its bumps tend to be small. On a quarterly basis, the most recent one, declared last September, was barely over $0.01 per share.

Although Verizon is an effective, very profitable telecom services provider and has good fundamentals, its shareholder distribution is clearly a major part of its appeal for many investors. It is a high-yield dividend at a rate of nearly 6.3%; this rate would remain unchanged with a $0.05 annual increase.

The company can afford it

Verizon’s cash flow is thick and heavy, as it operates a business with millions of regularly paying subscribers. This means it has plenty of financial muscle helping it flex that high dividend. At the moment, its cash dividend payout ratio is under 80%, which indicates the distribution is well-funded and sustainable, barring any sudden catastrophe with the company.

Should you invest $1,000 in Verizon Communications right now?

Before you buy stock in Verizon Communications, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Verizon Communications wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

Why Verizon Stock Topped the Market on Tuesday was originally published by The Motley Fool

Charlie Munger Predicted Inflation Surge Was 'Inevitable' Because of Democracies and Told How to Protect Against It – 'Most People are Going to Suffer'

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Charlie Munger passed away last year, but his broad outlook on life and decades of experience in the financial markets continue to guide millions worldwide. There is hardly a problem in the economic arena about which Munger didn’t talk. As inflation remains a hot topic in America amid elevated costs of living, we decided to dig deeper into Charlie Munger’s archives of his letters to shareholders and transcripts of his speeches to see what he predicted about the phenomenon.

Trending Now:

‘More Inflation is Inevitable’ Over the Next 100 Years

During a Q&A session at a Daily Journal Corporation shareholder meeting in 2023, Charlie Munger was asked about the inflation crisis. Munger made some prescient comments in response:

“I think more inflation over the next 100 years is inevitable with – given the nature of democratic politics – politics in a democracy. So I think we’ll have more inflation.”

Munger also said that the Daily Journal owns securities instead of government bonds because of inflation.

According to Charlie Munger archives compiled by The Inoculated Investor, the billionaire was asked about inflation during a conversation at the Pasadena Convention Center in 2011.

Munger replied that it was “pretty likely” that we’d have inflation over the next 50 to 100 years. However, he said that inflation did not halt civilization’s success. At another point, Munger reiterated this point:

“I remember buying ice cream cones and hamburgers for a nickel. On the other hand, after inflation, the country has done wonderfully. Many of the people who were the Jeremiahs of that age have been proven wrong; the country could stand as much inflation as it got.”

‘Most People Are Going to Suffer’ Due to Inflation

In 2022, while speaking at an event for the Singleton Foundation for Financial Literacy and Entrepreneurship, Munger predicted that life would become harder for common people because of inflation.

“I don’t think most people are going to do really well with inflation. I think most people are going to be way better off, at least the people that have any money will be way better off, if there weren’t any inflation. And so it’s just a question of how most of them aren’t going to profit. Most people are going to suffer.”

The Relationship Between Democratic Governments and Inflation According to Charlie Munger

During his talk, Munger said that he believed inflation would rise because “democratically elected politicians” would “eventually” print too much money.

Whitney Tilson, the Editor of Stansberry Investment Advisory and founder of Empire Financial Research, has been a close follower of Charlie Munger’s life. He’s compiled vast archives of transcripts of Charlie Munger’s speeches, dating back to when no recordings were allowed during Berkshire Hathaway’s meetings.

According to Tilson’s notes, Charlie Munger once said the following about inflation and its strange relationship to democratic governments:

“I think democracies are prone to inflation because politicians will naturally spend [excessively] – they have the power to print money and will use money to get votes.”

Munger said that while inflation continues to tick up in the long term, it increases more under democracies. He said there was “no inflation” in the U.S. from 1860 through 1914, which saw “strong growth.”

“I don’t think we’ll get deflation. The bias is way more pro-inflation than it was between 1860-1914. But I don’t think other forms of government will necessarily do better. Some of the worst excesses occur under tyrannies,” Munger said.

Read More:

-

With returns as high as 300%, it’s no wonder this asset is the investment choice of many billionaires. Uncover the secret.

-

You don’t have to own a property to make money from fix-and-flip investments. Get started with only $10.

Munger Believed There Is No ‘Perfect Correlation’ Between Inflation and Interest Rates

According to the archives, Charlie Munger once said that he had never believed there was a “perfect correlation” between interest rates and inflation.

“I think there’s some relation, but it’s complex and not easily quantifiable.”

High-Quality Businesses During Inflation

Charlie Munger thought companies making high-quality products for a specific niche of customers who can afford higher prices are better positioned to raise prices. He gave the example of ISCAR, the metal-cutting tools company that Warren Buffett’s Berkshire acquired in 2006.

“Iscar is so good at delivering good products, it is hard for me to imagine them not selling more to customers who are making more money.”

How to Protect Against Inflation According to Charlie Munger

At a WESCO annual meeting in 2009, Munger was asked by multiple people about the inflation problem and how to protect against it. Here’s what he said:

“I remember 2c stamps, 5c hamburgers, and the minimum wage of 30c/hr. In 80 years since those prices, there has been lots of inflation. Did it ruin investment opportunities? No. It isn’t easy, there are always huge risks, and of course, there will be inflation.”

Munger also mentioned buying government bonds as a hedge against inflation.

“We bought utility bonds to yield nine or 10%. What about inflation, you might ask? Well, government bonds are yielding 3%, so 9% isn’t bad. We don’t have one size fits all.”

Lock In High Rates Now With A Short-Term Commitment

Leaving your cash where it is earning nothing is like wasting money. There are ways you can take advantage of the current high interest rate environment through private market real estate investments.

EquityMultiple’s Basecamp Alpine Notes is the perfect solution for first-time investors. It offers a target APY of 9% with a term of only three months, making it a powerful short-term cash management tool with incredible flexibility. EquityMultiple has issued 61 Alpine Notes Series and has met all payment and funding obligations with no missed or late interest payments. With a minimum investment of $5,000, Basecamp Alpine Notes makes it easier than ever to start building a high-yield portfolio.

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

This article Charlie Munger Predicted Inflation Surge Was ‘Inevitable’ Because of Democracies and Told How to Protect Against It – ‘Most People are Going to Suffer’ originally appeared on Benzinga.com