Alibaba to upgrade Hong Kong listing in a bid to attract Chinese investment

(Reuters) — Shareholders of Chinese e-commerce giant Alibaba (BABA, 9988.HK) have approved a plan to upgrade its Hong Kong listing to primary status, the company said on Friday, a move that is expected to attract huge investments from mainland China.

The Jack Ma founded firm had originally proposed the idea a couple of years ago at a time when there was heightened geopolitical tensions between China and the U.S.

The listing status upgrade allows Alibaba to be part of a program which would connect the respective bourses in Shenzhen and Shanghai to the Hong Kong stock exchange.

The decision was expected to be approved by the company’s investors who have long been concerned over the firm’s growth prospects as it faces new market rivals such as PDD Holdings.

The conversion to dual primary listing does not involve any issue of new shares or even raising of funds by the company, Alibaba said.

Hong Kong-listed shares of the company gained as much as 0.7% to HK$82.2 in early trade.

(Reporting by Rishav Chatterjee in Bengaluru; Editing by Rashmi Aich)

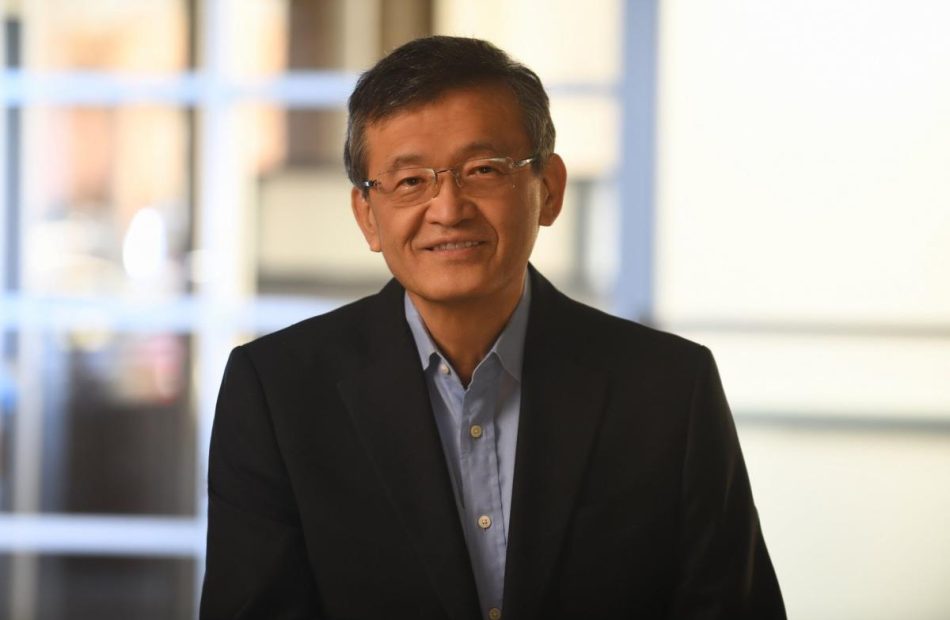

Semiconductor veteran Lip-Bu Tan exits Intel's board

(Reuters) -Intel’s director Lip-Bu Tan, a semiconductor industry veteran brought in two years ago to help with the chipmaker’s comeback effort, has stepped down from its board, the chipmaker disclosed in a filing on Thursday.

Tan informed the company on Monday that he was resigning from the board effective immediately.

The news of Tan’s departure comes at a challenging time for Intel, which recently forecast third-quarter revenue below market estimates and announced plans to cut more than 15% of its workforce, approximately 17,500 employees, and suspend its dividend starting in the fourth quarter.

“This is a personal decision based on a need to reprioritize various commitments, and I remain supportive of the company and its important work,” Tan said in a statement.

Tan, who has served as executive chair and CEO of Cadence Design Systems Inc, joined Intel’s board in Sept. 2022.

Shares of the company were slightly up in extended trading. They closed down 6.1% at $20.10 on Thursday.

Bloomberg News first reported on the departure of Tan.

(Reporting by Juby Babu in Mexico City and Jaspreet Singh in Bengaluru; Editing by Tasim Zahid)

Here Are My Top 5 Dividend Stocks to Buy in August

After a spectacular performance in 2023 and a roaring start to 2024, the capital markets have started to cool down as of late.

Naturally, the recent selling activity can be attributed to a variety of factors including mixed job data, the Federal Reserve’s monetary policy outlook, and of course the upcoming presidential election. During times like these investors may opt to exit more growth-oriented opportunities and seek safer, steadier positions.

Let’s explore five dividend stocks that I think look like screaming buys right now. Investors interested in reliable passive income don’t want to miss out on these stocks.

1. Hercules Capital

Hercules Capital (NYSE: HTGC) is a business development company (BDC) that specializes in high-yield loans to venture-backed companies. BDCs are required to pay out at least 90% of their taxable income each year in the form of a dividend, hence they can be lucrative sources of passive income.

Generally speaking, a bank may avoid making a loan to a young company. And if it does, it likely won’t be a material enough amount to provide adequate runway.

Hercules differentiates itself from banks due to the way it structures deals. For example, while a bank may have a dollar threshold, Hercules generally offers larger term loan sizes but at a higher interest rate. Moreover, Hercules also generally attaches warrants to its deals, which act as a sweetener if a portfolio company ends up getting acquired or goes public.

A good measure of a BDC’s health is to look at its non-accrual investments. Essentially, these are investments that the company sees as highly unlikely to pay back principal and interest.

For the quarter ended June 30, only 2.5% of Hercules’ $3.6 billion portfolio was categorized as non-accrual status.

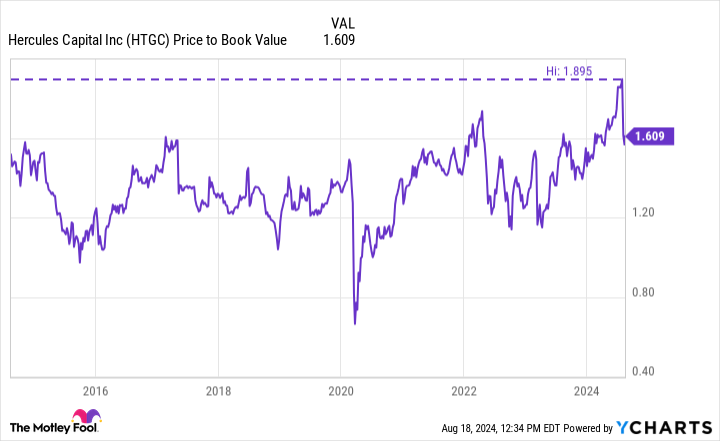

Right now, Hercules trades at a price-to-book (P/B) ratio of 1.6, which is close to its highest level in 10 years. Its total return over the last decade is 229%, handily outperforming the S&P 500‘s total return of 184%. So even though Hercules stock isn’t exactly cheap, I think the premium is well deserved.

With shares trading at a 10.4% dividend yield, I think now is as good a time as ever to load up on Hercules and prepare to hold for the long run.

2. Ares Capital

Another BDC on my list is Ares Capital (NASDAQ: ARCC). Ares is quite different than Hercules, however, as the company has wider industry coverage and offers more sophisticated financial products.

Furthermore, with 50% of its total portfolio allocated toward first lien senior secured loans, investors can rest easy that Ares is well positioned even in downside scenarios.

Per the chart above, investors can see that Ares has handily outperformed the S&P 500 as well as leading BDC-focused exchange-traded funds (ETFs) over the last couple of years. Considering how strong the S&P 500 has been since its massive sell-off in 2022, it’s impressive just how much Ares has outperformed its peers and the broader market.

While it may not be as attractive as a high-growth AI stock, Ares has quietly been a multibagger opportunity for its shareholders. Investors may want to consider augmenting their gains with this passive income player, as shares yield around 9.3% right now.

3. AT&T

I’ll admit right off the bat that telecom businesses aren’t overly exciting, and AT&T (NYSE: T) is no exception. The telecom industry is pretty commoditized, which essentially forces the big players to compete on price.

When you’re in the business of offering the lowest-cost solution, it can be hard to grow. As the chart above illustrates, AT&T’s revenue has dropped considerably over the last decade. Again, an overcrowded market coupled with ongoing churn dynamics plaguing the communications sector isn’t exactly a recipe for hypergrowth.

Nevertheless, AT&T has demonstrated a disciplined approach to costs during this time of decelerating sales. For that reason, the company has been able to actually increase its free cash flow despite some dramatic ebbs and flows in the top line.

It is important to note that some of this cash flow was augmented by AT&T slashing its dividend nearly in half back in 2022. Although that’s not overly encouraging, I’ll give AT&T’s management some credit.

As of the end of the second quarter, AT&T’s net debt was $127 billion. This was an improvement of about $5 billion compared to the second quarter of 2023. Should AT&T remain focused on strengthening its balance sheet, I see little reason for the company to cut its dividend again.

So while AT&T isn’t going to supercharge your portfolio by any means, I think the stock offers a compelling turnaround opportunity. Moreover, AT&T’s current price-to-earnings (P/E) ratio of 11.1 is hovering near all-time lows. While some may have soured on AT&T for good, I think now is a good opportunity to scoop up shares at dirt cheap levels and take advantage of the 5.7% yield.

4. Verizon

Next up on my list is one of AT&T’s biggest competitors, Verizon Communications (NYSE: VZ). The bulk of my thesis for investing in Verizon is illustrated in the graphic below.

Last September marked 17 consecutive years of dividend raises for Verizon. Moreover, when speaking about commitment to subsequent dividend raises, Verizon’s CEO Hans Vestberg said that he wants to “continue to put the Board in a position to do that” during the company’s second-quarter earnings call.

To me, Verizon is not only a reliable dividend opportunity; I think a raise could be on the horizon next month. Such action could inspire a little jolt in the stock, so I’d be a buyer right now. Verizon’s P/E of just 15.2 pales in comparison to the S&P 500’s P/E of 27.5. With shares yielding about 6.5%, now looks like a terrific opportunity to invest at a steep discount to the broader market.

5. Altria

In my opinion, I’ve saved the best for last. Altria (NYSE: MO) is the tobacco company behind notable cigarette brands such as Marlboro and Black & Mild, and is also notably a Dividend King. The tobacco industry is no doubt experiencing an existential crisis. A larger cohort of consumers are becoming more mindful of health and wellness, making tobacco products a tough sell.

But like all great companies, Altria has found ways to navigate this challenge. Management has stated that Altria’s next phase hinges on “moving beyond smoking.”

Namely, the company is focusing more attention on vaping products as well as oral nicotine pouches as opposed to traditional smoking products. Although this transition is in its early stages, there are strong indications that this pivot is working.

Last June, Altria acquired vaping company NJOY. At the time, NJOY products could be found in roughly 35,000 stores nationwide. Per Altria’s second-quarter earnings presentation, NJOY’s footprint has almost tripled to 100,000 stores.

Although the aggressive expansion efforts might suggest NJOY is in high demand, the brand currently only owns about 5% of U.S. retail share. To me, this bodes well for NJOY’s long-run momentum and validates Altria’s investments and focus on smokeless tobacco.

Another reason why I love Altria stock is that the company has been actively buying back shares for some time now. Through the first six months of 2024, Altria repurchased $2.4 billion of stock at an average price of $44.50.

Companies may opt to buy back shares when management thinks the stock is undervalued. Considering Altria currently trades at about $51 per share, the company’s repurchase program is looking pretty savvy right about now.

Given its consistent history of raising its dividend, coupled with an exciting new chapter featuring the next frontier of the tobacco industry, I see Altria as an outstanding opportunity for investors seeking a combination of gains and reliable passive income.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $787,394!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

Here Are My Top 5 Dividend Stocks to Buy in August was originally published by The Motley Fool

A bullish signal in the stock market is pointing to double-digit gains for the S&P 500 next year, research firm says

-

The stock market flashed a bullish technical indicator on Monday, according to Ned Davis Research.

-

NDR strategist Ed Clissold noted the market is its the fourth stage of bottoming as it approaches record highs.

-

Since July, three breadth thrust signals have flashed, indicating a strong market recovery.

The stock market just flashed a bullish technical indicator that suggests double-digit gains are in store for the S&P 500 over the next year.

That’s according to a Wednesday note from Ned Davis Research strategist Ed Clissold, who said the stock market has entered the fourth stage of its bottoming process following its early August sell-off.

The stock market fell more than 5% in early August amid a confluence of risks, including a weak July jobs report, a yen carry-trade unwind, and Warren Buffett slashing his stake in Apple.

But since then, the S&P 500 has rallied nearly 10% and is just 1% shy of record highs.

“New breadth thrust signals confirm that the market is in step four of the bottoming process and moving past the recent pullback,” Clissold explained, adding that the four stages of a stock market bottom are oversold, rally, retest, and breadth thrusts.

On August 19, a new breadth thrust signal flashed, which occurs when the stock market swiftly transitions from very few stocks participating in the upside to many stocks moving higher at the same time.

“The rationale is that if a few stocks run into trouble, others can propel the popular averages higher,” Clissold said. “The beginning of major moves is often marked by breadth thrusts, or an extremely high percentage of stocks rallying together.”

A breadth thrust “fired” on Monday when over 90% of stocks in NDR’s internal Multi-Cap Equity Series jumped above their 10-day moving average.

Since 1980, there have been 42 such instances, and stocks were higher 95% of the time one-year later with an average gain of 10%.

Such a gain from current levels would put the S&P 500 at just above 6,100, which is nearly in-line with one Wall Street bull’s 2025 price target.

Another breadth thrust flashed on August 8 when stocks saw an “11:1 up day,” which occurs when volume in advancing stocks is 11 times that of the cumulative volume in declining stocks.

Ultimately, Clissold wants to see at least five breadth thrust signals flash in a three-month period to be certain that the stock market has more upside ahead.

So far three signals have flashed since July 16, but even if two more don’t flash by the middle of October, stocks are likely still in a good spot thanks to the expected decline in interest rates, according to the note.

“We may not get five breadth thrust signals, but additional trend indicators are turning bullish,” Clissold said. “Falling rates are another check in the bulls’ favor.”

Read the original article on Business Insider

Prominent Billionaires Just Bought the Dip With These 3 Stocks

Hedge funds and investment firms with over $100 million in assets are required to disclose their stock portfolios throughout the year. The updates for the second quarter of 2024 are rolling in now, and this includes updates from the financial vehicles managed by prominent billionaires Warren Buffett and Bill Ackman, as well as by multimillionaire Michael Burry.

This wealthy trio has been busily buying the dips for three value stocks: Ulta Beauty (NASDAQ: ULTA), Nike (NYSE: NKE), and Shift4 Payments (NYSE: FOUR). Here’s why these bargains were too good for these investors to pass up.

1. Ulta Beauty: Down 33%

As of this writing, Ulta Beauty stock is down 33% from its all-time high and down 22% in 2024. Shares started sliding after management warned of slowing sales for cosmetic products, leading it to lower the company’s full-year financial guidance.

It was a dip too good for Warren Buffett to pass up. His Berkshire Hathaway opened a roughly $260 million position in Ulta Beauty stock during Q2. Granted, that’s a small position for a company as big as Berkshire, but it’s still noteworthy nonetheless.

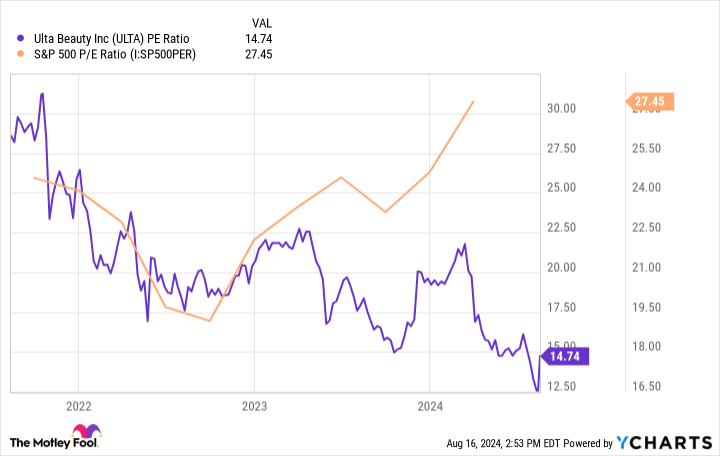

Buffett is a renowned value investor, and he likely sees potential in Ulta Beauty. The stock trades at less than 15 times earnings, which is significantly cheaper than the average price-to-earnings (P/E) ratio for the S&P 500, as seen below.

Sales growth may be slow. However, Ulta Beauty still expects to earn over $1.5 billion in operating profit in 2024, and it plans to return $1 billion to shareholders via share repurchases. Given the stable demand for cosmetic products, I expect strong profits and share repurchases to continue for years to come, providing high chances of positive long-term returns for Ulta Beauty stock from here.

2. Nike: Down 53%

In Q2, Bill Ackman’s Pershing Square bought more than 3 million shares of athletic apparel company Nike — a position worth roughly $229 million. It’s the smallest position in Ackman’s portfolio, but with only eight stocks in the total portfolio, any addition is noteworthy.

Ackman is a value investor who studied Warren Buffett’s style before getting his own start. Nike indeed looks like a value stock, considering it has been trading at its cheapest valuation since 2012.

In short, Nike stock is down because sales are slumping and profits are contracting. The company’s fiscal 2025 started in June, and management is calling it a “transition year.” Management expects its revenue to be down single digits compared to fiscal 2024, but profits could be down more than that.

Ackman is likely betting that a consumer brand as strong as Nike will find its way eventually, making the stock a strong candidate for a rebound once its business stabilizes.

3. Shift4 Payments: Down 20%

Like Ackman, Michael Burry manages a concentrated portfolio of just 10 stocks through his Scion Asset Management. The investor famously made his fortune by shorting the U.S. housing market during the Great Recession. Judging by his portfolio today, I’d say he’s still not very bullish on America.

Three of Burry’s top five positions are Chinese stocks, showing his preference for those companies. However, in Q2, he took a big swing at financial technology (fintech) company Shift4 Payments, making it nearly 14% of the portfolio.

Shift4 stock may not be down as much as the other two in this article. However, shares have gone nowhere for the last three years as the chart below shows, even though its profitable growth during this time has been impressive.

Shift4 has focused on winning large, high-volume customers, which has provided strong revenue growth. Adjusting for network fees (a common adjustment for fintech companies), the company expects to grow its revenue by at least 44% this year. And it expects to generate free cash flow of nearly $400 million.

For perspective, Shift4’s market cap is only $5.4 billion as of this writing, meaning it trades at a cheap forward price-to-free-cash-flow valuation of about 14. Coupled with its impressive top-line growth, I believe Shift4 Payments stock might be the best buy of these three stocks.

To be clear, Ulta Beauty and Nike are cheap based on multiple valuation metrics, which is good. But they’re also more mature companies with limited top-line growth potential. Either stock could have upside, but Shift4 is still growing at a fast pace, in addition to being cheaply valued. That may carry it to bigger gains in the coming years.

Should you invest $1,000 in Ulta Beauty right now?

Before you buy stock in Ulta Beauty, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ulta Beauty wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $779,735!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Jon Quast has positions in Shift4 Payments. The Motley Fool has positions in and recommends Berkshire Hathaway, Nike, and Ulta Beauty. The Motley Fool recommends Shift4 Payments and recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.

Prominent Billionaires Just Bought the Dip With These 3 Stocks was originally published by The Motley Fool

Is the Stock Market Going to Crash? I Don't Know. That's Why I Own This Recession-Resistant Stock.

The stock market has rebounded nicely from the 2022 bear market lows, and most major indexes are within striking distance of their all-time highs. With expectations of falling interest rates, and the continued strength of megacap technology stocks, things have been going quite well for stock investors.

However, it’s important for all investors to know that the stock market will crash again — it’s just a question of when. A crash could come next month, next year, in five years, or it could come tomorrow. We have no idea, and there are many potential factors that could cause a crash. But stock market crashes are a normal part of being a long-term investor.

I aim to fill my own portfolio with stocks that should do well over the long term, regardless of whether the market crashes or not. But there’s one in particular that I’d be confident to own during a market crash, and that’s Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B).

A collection of recession-proof businesses

First, there are three major components to Berkshire’s business: its operating businesses, its stock portfolio, and its cash. The stock portfolio is clearly not immune from a stock market crash (although the types of stocks Berkshire owns tend to hold up better than most).

When it comes to the operating businesses, there are over 60 different subsidiary businesses. Some of them could be vulnerable to market crashes and recessions, but the largest Berkshire subsidiaries should be just fine. GEICO and Berkshire’s other insurance operations are a big business and are very close to being truly recession-proof. After all, people still pay their auto insurance when times get tough.

Berkshire Hathaway Energy is another massive component of the company and is also very recession-proof. Even in tough times, electric and gas bills still need to get paid. I could go on — BNSF Railroad, Pilot Travel Centers, and Duracell are also great examples of businesses that should perform well no matter what.

Berkshire’s cash is the key differentiator

To be fair, there are plenty of recession- and crash-resistant businesses you can invest in. There is no shortage of utilities stocks, for example. But what makes Berkshire different is its unmatched financial flexibility.

At the end of the second quarter, Berkshire had a staggering $277 billion in cash and short-term investments on its balance sheet. For the time being, the bulk of this is in Treasury securities that pay Berkshire about 5% annually.

However, if a market crash or prolonged recession comes, this cash stockpile gives Warren Buffett and his team a massive war chest to take advantage of bargains. Berkshire can use it to buy stocks that have plunged or can negotiate unique investment deals. In fact, Berkshire’s Bank of America investment can be traced back to a $5 billion preferred stock deal with warrants that Buffett negotiated in the wake of the financial crisis.

Berkshire in a market crash

Berkshire’s stock portfolio can become volatile in a crash, but its operating businesses should stay profitable, and its cash can actually allow Berkshire to emerge from a market crash even stronger than it went in.

I’m not saying that Berkshire’s stock price won’t fall in a market crash. It can, and it has in previous crashes. But the point is that the business is in a better position than that of any other large-cap company to make it through a market crash largely unscathed.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $787,394!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Matt Frankel has positions in Bank of America and Berkshire Hathaway. The Motley Fool has positions in and recommends Bank of America and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Is the Stock Market Going to Crash? I Don’t Know. That’s Why I Own This Recession-Resistant Stock. was originally published by The Motley Fool

Here's how Jerome Powell could surprise markets with his Jackson Hole speech

-

Goldman Sachs says Jerome Powell’s speech at Jackson Hole on Friday could deliver some surprises.

-

It wouldn’t be the first time he used the event as an opportunity to reset investors’ expectations.

-

Markets are eyeing rate cuts of 100 basis points between now and the end of the year.

All eyes are on Jerome Powell’s speech at the Federal Reserve’s Jackson Hole Symposium on Friday, and Goldman Sachs says the central bank’s chairman could still surprise investors despite their confidence in the Fed’s path for the rest of the year.

It wouldn’t be the first time Powell used his Jackson Hole speech as an opportunity to reset the market’s expectations.

In 2022, when inflation was hitting a 40-year high, Powell delivered a short but direct eight-minute speech that reinforced the Fed’s path to raising interest rates to combat inflation even though the stock market was in the middle of a painful bear market.

Bond yields surged, and the S&P 500 lost nearly 8% in the week after Powell’s hawkish Jackson Hole speech.

But with inflation almost under control and the labor market showing signs of deterioration, Powell could strike a much different tone on Friday.

And according to Goldman Sachs, there are a few ways the Fed boss could catch markets off guard.

“Possible dovish surprises could include a more concerned take on the labor market or any suggestion that the high level of the fed funds rate is inappropriate in light of the progress made on inflation,” David Mericle, a Goldman economist, said in a note on Tuesday.

Such an event would likely be bullish for the stock market, as it would reinforce the idea that the Fed will start to cut interest rates at its Federal Open Market Committee meeting in September and that the bar for a cut of more than 25 basis points or a string of consecutive cuts is lower than most expect.

The CME FedWatch tool suggests investors see 100 basis points of rate cuts through the rest of this year.

On the other hand, Powell could shock markets to the downside if he adopts a more hawkish tone than investors expect.

“A possible hawkish surprise might be highlighting instead that broad financial conditions are still quite easy, which could imply that the high level of the funds rate, while perhaps unnecessary, is not an urgent problem,” Mericle said.

Mericle ultimately expects Powell to be more dovish in his Jackson Hole speech, given the weak July jobs report and recent data that indicates inflation is falling closer to the Fed’s long-term target of 2%.

The recent downward revision to employment growth of 818,000 jobs also doesn’t help the Fed’s case for remaining hawkish.

“This might mean expressing a bit more confidence in the inflation outlook and putting a bit more emphasis on downside risks in the labor market,” the note said. “Powell might also reiterate that the FOMC is watching the labor market data carefully and is well positioned to support the economy if necessary.”

Goldman Sachs also gave a rundown of Powell’s Jackson Hole speeches and their impact on Treasury yields since he became the Fed chairman in 2018.

Read the original article on Business Insider

How Much Money Do You Need To Be Considered Wealthy?

Most Americans dream of being rich. But how much does it take to be considered wealthy? A net worth of $2.5 million is what Americans think it takes to earn the wealthy moniker, according to Charles Schwab’s annual Modern Wealth survey.

↑

X

How To Become A Stock Market Millionaire – And The Fastest Way To Get There

That seven-figure sum is up 14% from a year ago, when survey respondents thought amassing $2.2 million was enough.

The good news: You don’t have to be wealthy to fund a good lifestyle and stay out of financial trouble. Americans say the average net worth required to be “financially comfortable” is $778,000, according to the Charles Schwab (SCHW) survey.

Breaking Down What’s “Wealthy”

When it comes to being wealthy, Baby Boomers think it takes a net worth of $2.8 million. Gen Xers say $2.7 million. Millennials think it takes $2.2 million to be wealthy. And the Gen Z generation comes in low at $1.2 million.

Where you live can skew the numbers, too. People who live in expensive locales like San Francisco and New York City say it takes $4.4 million and $2.9 million, respectively, to be considered wealthy. Whereas the magic number dips to $2.3 million for Americans living in Phoenix and $2.2 million for folks living in Dallas.

Only 21% of Americans responding to Schwab’s survey think they will be wealthy within their lifetimes.

These numbers, of course, are just guesses. Still, getting a ballpark number of how big an account balance is needed to reach one’s financial goals has its benefits, says Rob Williams, managing director of financial planning at Charles Schwab.

“When you pull numbers out of thin air, it’s kind of an abstract concept,” said Williams. “A lot of Americans say, I want to be a millionaire. Well, let’s connect that to the reality of the financial plan, the investments you’re making. Let’s put some discipline around that and take ownership of the steps required to achieve those goals.”

What’s more, everybody’s magic number to feel wealthy or financially comfortable is different. And not having to worry about money isn’t a guarantee even for folks with a lot of money socked away, says Jason Grover, founder and financial planning specialist at Grover Financial Services in Pittsford, N.Y.

“It comes down to not how much money you have, but how much you spend,” said Grover. “I have clients that can retire comfortably with $200,000 in savings because they have pensions, they’ve saved well and they’re not spendthrifts. And there are people with $2.5 million dollars that can’t fathom retiring because of their lifestyle.”

There are many sources of wealth. Cash in the bank is only part of it. There’s also the value of stocks, bonds, mutual funds and ETFs. Home equity is key, too, as are 401(k) and IRA account balances. Even the antique painting hanging in the living room, the cars and boats parked in the garage and cryptocurrencies count as wealth.

And wealth means different things to different people, says Williams. For some people, wealth means financial freedom. For others wealth is all about dollars and what they can buy. Some view the upside of wealth in the financial confidence it conveys.

So, what are the building blocks to generate enough money to join the ranks of the wealthy?

Commit To Saving

Saving and investing sounds easy. “But not everyone does that,” said Williams.

It’s about the basics. Start saving early to allow your money to grow and benefit from compounding. “Compound interest can really be a springboard towards building wealth,” said Grover.

It’s vital that you also invest in your 401(k) at work or set up an individual retirement account (IRA). And diversify your investments in a broad basket of stocks in a fund or ETF that tracks a broad equity index like the S&P 500.

Grow Your Portfolio

Invest in stocks and growth-oriented assets to keep expanding your wealth. Investing is different from saving. You can’t grow wealth stashing your cash under the mattress and earning 0% interest. You must invest for growth. That means owning stocks.

“Investing is an act of optimism, an act of ownership in the U.S. economy,” said Williams. “And the most upside comes from owning equities. (Historically), stocks have been the most powerful wealth-building tool.”

Profit From Your 401(k)

Employer-sponsored retirement accounts are the road to a secure retirement. With traditional pensions virtually extinct, having money deducted from your paycheck and contributing to your 401(k) is a key step to building wealth and a secure retirement.

“Get the most out of your 401(k),” said Grover. That means contributing enough of your own money to take advantage of your company’s match. And make sure you are investing in growth-oriented assets like stocks, as well as fixed-income assets like bonds. Your risk tolerance and time horizon before retirement should match.

A big plus today is new employees don’t have to do anything to start saving. A growing number or 401(k) plans sign you up on day one with automatic enrollment. “More companies are forcing their employees to save right away, unless they opt out,” said Grover. “That’s a huge benefit to the average person saving for retirement.”

And starting next year, thanks to the Secure Act 2.0, employers will be required to automatically enroll eligible new employees in the 401(k) plan.

Investing in a Roth 401(k), which is funded with already taxed dollars but comes with tax-free withdrawals, is a good option for younger workers. They are in lower tax brackets early in their careers.

Build Equity Via Homeownership

A house is a place to call home. But it’s also a place to build wealth, says Williams. Every mortgage payment pays off a part of the loan and builds home equity.

Homes, like stocks and other assets, can also rise in value over time. In the second quarter of 2024, 89% of homes in measured metro areas registered price gains, according to the National Association of Realtors. The national median single-family home price at the end of June was $422,100, up 4.9% from a year ago.

Put A Financial Plan In Place

You can’t get to where you are going unless you map out a plan to get there.

Just 18% of Americans responding to Schwab’s survey said, “I’m on top of my finances now.” So, reaching out to a financial advisor for help is something savers might think about.

Don’t live and spend just for today, says Williams. It’s important to acknowledge that you have future financial goals. “A financial plan is a living, breathing, ongoing road map” for your financial future, said Williams. Setting up a financial plan “helps you take action.”

And barring an unforeseen life change, such as death, divorce, the birth of a child and other curveballs life throws you, stick to your plan, adds Grover.

“What we do have control over is how much we spend, save and invest. And the financial plan is crucial to helping us manage our emotions,” Grover said. “That’s what a financial plan is really about: protecting ourselves from ourselves.”

Not everyone can accumulate $2.5 million and be deemed wealthy. But most people who are regular savers can come up with the $778,000 Americans feel they need to be financially comfortable, Williams says.

“That may look like a large number, but it’s achievable with relatively simple, straightforward discipline savings steps,” said Williams.

YOU MAY ALSO LIKE:

Look Out Below If You Own 9 Stocks That Did This

8 Hot Big Stocks Aren’t In The S&P 500 – But You’ll Wish They Were

Intel Director Lip-Bu Tan Leaves Board of Ailing Chipmaker

(Bloomberg) — Intel Corp. director Lip-Bu Tan, a semiconductor industry veteran brought in two years ago to help with the chipmaker’s comeback effort, has stepped down from the board.

Most Read from Bloomberg

Tan informed the board on Aug. 19 that he would be leaving, effective immediately, Intel said in a filing on Thursday, confirming an earlier report by Bloomberg News. The director, a former chief executive officer of Cadence Design Systems Inc. who also runs an investment firm, cited “demands on his time” for driving the move.

“This is a personal decision based on a need to reprioritize various commitments and I remain supportive of the company and its important work,” he said in the filing.

The move follows a disastrous quarterly report earlier this month, which sent Intel shares on their worst rout in decades. The once-dominant chipmaker gave a dour forecast, suspended its longstanding dividend and announced plans to slash more than 15% of its workers.

CEO Pat Gelsinger has been trying to restore Intel’s standing in the chip industry by pouring money into new factories and technologies, but rivals like Nvidia Corp. and Advanced Micro Devices Inc. have only made further gains.

Tan was elected to the board in September 2022 and appointed to Intel’s mergers and acquisitions committee.

When Tan joined the board, he praised Gelsinger’s bold leadership and said the company was “undergoing a massive transformation to capitalize on the tremendous opportunities that lie ahead.”

More recently, Intel has been focused on making cutbacks. In addition to efforts to pare jobs and expenses, the chipmaker scrapped plans for its annual Innovation event. It also recently sold its stake in chip technology creator Arm Holdings Plc.

–With assistance from Debby Wu.

(Updates with Intel confirmation in second paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

10 Reasons to Buy Nvidia Stock Like There's No Tomorrow

One of the biggest investing developments of the past couple of years has been the opportunity represented by artificial intelligence (AI), and arguably no company is better positioned to profit from this secular tailwind than Nvidia (NASDAQ: NVDA). The chipmaker has become the poster child for the AI revolution, giving it the pole position in a large and growing opportunity.

Generative AI is expected to add between $2.6 trillion and $4.4 trillion to the global economy over the coming decade, according to McKinsey & Company, and Nvidia is at the leading edge of the trend. That massive opportunity is one of many reasons that investors should be buying Nvidia stock like there’s no tomorrow. Let’s look at a few others.

1. Nvidia dominates the data center market

There’s little argument that Nvidia has the inside track when it comes to graphics processing units (GPUs) in data centers, but some investors may not realize the extent of the company’s dominance.

Nvidia controls an estimated 92% of the market for data center GPUs, according to IoT Analytics, though that estimate may be conservative. TechInsights goes further, claiming Nvidia controlled 98% of the data center GPU market in 2023. While estimates vary, the indication is clear.

The competition is intent on chipping away at its dominance. However, given Nvidia’s early lead and sustained momentum, it should remain the clear leader for years to come.

2. It’s the undisputed leader powering earlier versions of AI

While generative AI has made a splash since early last year, AI has been around for decades, and Nvidia has been helping to power those advanced algorithms. For example, Nvidia controls 95% of the market for GPUs used in machine learning — an earlier version of AI — according to estimates provided by New Street Research. This experience would soon come in handy.

3. The inside track for generative AI

Nvidia’s wealth of expertise in the field and dominance in earlier versions of AI made it the clear choice for developers when generative AI exploded onto the scene. Developments in the space are moving at warp speed, so it is even more difficult to pin down Nvidia’s market share. Analysts from Mizuho suggest it’s somewhere between 70% and 95% for AI models. That aligns with an estimate by Fortune, which puts Nvidia’s market share at 80%.

4. The platform factor

Nvidia’s dominance in the AI and data center markets was years in the making, but it isn’t just the result of the company’s chip process. In 2007, Nvidia launched Compute Unified Device Architecture (CUDA), an architectural framework and parallel computing platform that helps developers by dramatically accelerating computing applications built on its GPUs.

According to Nvidia, CUDA provides developers with more than 300 libraries and 600 AI models, and supports more than 3,700 GPU-accelerated applications. This ecosystem includes more than 5 million developers at 40,000 companies, which helps explain why it will be so difficult to “chip” away at Nvidia’s dominance, given that it’s developers’ preferred development platform of choice.

5. It isn’t just about chips anymore

While its processors form the foundation of Nvidia’s empire, it isn’t just about chips anymore. The company has been gradually expanding into adjacent markets and also provides ancillary products that help its GPUs perform even better. These other opportunities could help fuel the next leg of Nvidia’s growth.

For example, Nvidia supplies InfiniBand networking solutions, including switches and adapters that reduce latency and help speed network connections. Then there’s the NVLink and NVLink Switch, used to connect multiple GPUs in a daisy chain, accelerating the resulting connections to unleash their full power. The company also offers its own line of turnkey AI servers and supercomputers.

6. Robust research and development (R&D) spending

It’s no accident that Nvidia has maintained its position atop the AI chip heap. The company has a long track record of spending heavily on the research and development (R&D) necessary to maintain its technological lead. For its fiscal 2024 (ended Jan. 28), Nvidia spent nearly $8.7 billion on R&D, up 18% and amounting to 14% of the company’s total revenue.

Besides maintaining its technological edge, increased spending has also helped the company innovate faster. Earlier this year, Nvidia announced that it would no longer keep to its historical two-year cadence for unveiling new processors, but rather release new chips every year.

It was already difficult for rivals to keep up with Nvidia’s frantic development pace, but it will be even harder now.

7. Let’s not forget gaming

At this point, it almost seems like a footnote, but Nvidia began its journey as a pioneer in video games. It was parallel processing, or the ability to conduct a magnitude of complex calculations simultaneously, that revolutionized the gaming industry, turning boxy figures into lifelike images.

Nvidia is still the undisputed leader, with an 88% share of the discrete desktop GPU market, according to industry analyst Jon Peddie Research. This leaves scraps for the competition. Don’t expect that to change anytime soon.

8. An explosion of profitability

The advent of generative AI early last year and the resulting rapid adoption has been a boon to Nvidia. For fiscal 2024, revenue of $60 billion surged 126% year over year. This brought with it a flood of increasing profitability, as diluted earnings per share (EPS) of $11.93 soared 586%.

That trend continued into the current year. In its fiscal 2025 first quarter (ended April 28), revenue of $26 billion grew 262% year over year, while EPS of $5.98 surged 629%.

Management is forecasting that its growth streak will continue. The company is guiding for second-quarter revenue of $28 billion when Nvidia reports on Aug. 28. Analysts’ consensus estimates are even higher, expecting revenue of $28.6 billion. In either case, that’s phenomenal sales growth, and profits will likely follow suit.

9. Returns to shareholders are increasing

Nvidia’s recent run has been a windfall for shareholders, as the stock has skyrocketed more than 500% over the past three years, as of this writing. Yet there have been other benefits for investors.

In conjunction with the company’s quarterly report and 10-for-1 stock split revelation in May, Nvidia announced that it was increasing its dividend by 150% from $0.04 to $0.10. The dividend hasn’t been a priority for the company until now, as growth has taken center stage. However, given its newfound wealth, I wouldn’t be surprised if there were additional increases on the horizon.

10. It isn’t as expensive as you might think

Nvidia’s skyrocketing stock price has brought with it a commensurate increase in its valuation, causing some investors to keep their distance. That’s understandable, given the stock is currently selling for 74 times earnings and 39 times sales, but that only tells part of the story. While the price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio are among the most widely used valuation metrics, they also have their limitations. They tend to label most high-growth stocks as expensive or overvalued by default.

However, Nvidia’s forward price/earnings-to-growth (PEG) ratio, which takes into account its impressive growth trajectory, clocks in at 0.7, when any number lower than 1 indicates an undervalued stock. So the stock isn’t as expensive as it appears at first glance.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $787,394!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Danny Vena has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

10 Reasons to Buy Nvidia Stock Like There’s No Tomorrow was originally published by The Motley Fool