IBM lay-offs at China R&D teams send shock waves across local tech community

Chinese employees at US computing giant IBM, once considered a cradle of mainland engineers, have expressed dismay over a terse conference call with the company’s American executives on Monday, as the firm known by the nickname Big Blue cuts hundreds of jobs at two local research labs.

The morning town hall, organised for affected workers, had been scheduled to go for half an hour. It ended up lasting only three minutes, according to an internal meeting transcript seen by the South China Morning Post and confirmed by an employee.

During the meeting, US-based executives told staff that IBM had decided to shift some Chinese operations overseas, citing market dynamics and fierce competition in the infrastructure business on the mainland. They did not take any questions.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

IBM did not immediately respond to a request for comment on Tuesday. A company representative said on Monday that the firm adapts its operations as needed to best serve its clients, adding that “these changes will not impact our ability to support clients across the Greater China region”.

Over the weekend, China-based IBM workers found themselves blocked from accessing the company’s intranet system, before they were told that the IBM China Development Lab and China Systems Lab were shutting down. Over 1,000 employees are being laid off across Beijing, Shanghai and the northern port city of Dalian, according to reports by local news outlets.

One employee, who spoke on condition of anonymity, said many IBM staff in Beijing braved heavy rain to gather in the office for the meeting on Monday, only to be disappointed by how brief it was.

On the call were Jack Hergenrother, vice-president of global enterprise systems development, Ross Mauri, general manager of IBM Z mainframe computers, and Danny Mace, vice-president of storage software engineering.

Hergenrother encouraged affected workers to arrange private discussions with their respective managers, while Mauri and Mace thanked staff for their contributions, the transcript showed.

The employee in Beijing said he spoke with his manager, who was also laid off. Staff have been offered severance packages based on tenure, plus three months’ salary if they sign the termination agreement before September 13.

Their last day on the job will be October 31.

The closure of IBM’s two China research labs has sent shock waves across the local tech community. For years, the tech giant had been considered one of the most desired employers for the nations’ top computing graduates.

A former employee, who goes by the username “Room e” on social media platform Xiaohongshu, said most of his team members at the China Development Lab were graduates from the country’s top 10 universities in the early 2000s.

IBM has been considered a cradle of Chinese engineers. Photo: AFP alt=IBM has been considered a cradle of Chinese engineers. Photo: AFP>

However, US companies have been losing their lustre in recent years, as China intensifies its self-reliance campaign and strives to reduce dependence on foreign technologies amid growing geopolitical tensions.

In 2014, state-owned banking and telecoms enterprises – once major customers of IBM, Oracle and EMC (since merged with Dell) – launched a “de-IOE” campaign to replace US products with domestic alternatives.

IBM is the latest multinational tech giant to shed jobs in China. Sweeping lay-offs this year have affected China-based workers in companies from Ericsson and Tesla to Amazon.com and Intel.

IBM’s sales in China have steadily declined in recent years.

In 2023, IBM’s revenue in the country dropped 19.6 per cent compared to a 1.6 per cent rise in revenue across Asia-Pacific, according to the company’s annual report. Sales in China in the six months ended June 30 this year fell 5 per cent, while revenue in Asia-Pacific increased 4.4 per cent, IBM’s financial statement showed.

Additional reporting by Xinmei Shen.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP’s Facebook and Twitter pages. Copyright © 2024 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2024. South China Morning Post Publishers Ltd. All rights reserved.

Tesla investor Ross Gerber says he's been dumping the stock because no one wants the company's cars or robots

South China Morning Post

IBM lay-offs at China R&D teams send shock waves across local tech community

Chinese employees at US computing giant IBM, once considered a cradle of mainland engineers, have expressed dismay over a terse conference call with the company’s American executives on Monday, as the firm known by the nickname Big Blue cuts hundreds of jobs at two local research labs. The morning town hall, organised for affected workers, had been scheduled to go for half an hour. It ended up lasting only three minutes, according to an internal meeting transcript seen by the South China Morning

IMPERIAL EQUITIES INC. GRANTS STOCK OPTIONS

EDMONTON, AB, Aug. 27, 2024 /CNW/ – Imperial Equities Inc. IEI, through its Board of Directors today announced that effective August 26th, 2024, it has approved a grant of stock options to a Director and Officer of Imperial Equities Inc.

The Director can purchase an aggregate of 200,000 common shares at an exercise price of $4.00 per common share pursuant to its stock option plan. The stock options expire five years from the date of grant, and vest immediately.

About Imperial Equities Inc:

Based in Edmonton, Alberta, Imperial Equities Inc. is a publicly traded company anchored by industrial, agricultural, and commercial real estate properties in its targeted markets throughout Western Canada.

Additional information is available at: www.imperialequities.com. Imperial’s common shares are listed on the TSX Venture Exchange under symbol IEI.

Neither TSX Venture nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE Imperial Equities Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/August2024/27/c3553.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/August2024/27/c3553.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

‘T-Bill and Chill’ Is a Hard Habit for Investors to Break

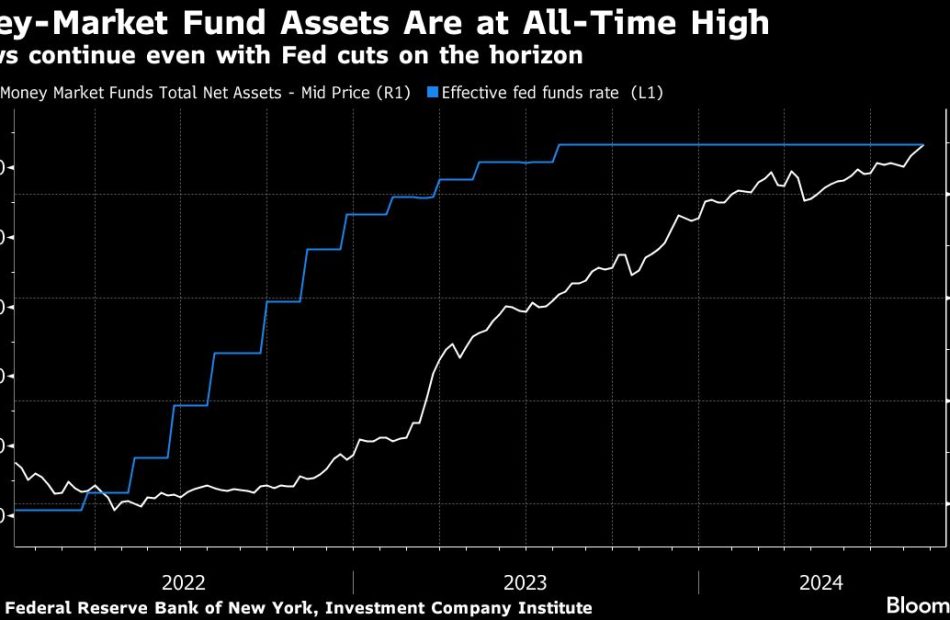

(Bloomberg) — It’s been the ultimate no-brainer for more than a year: Park your money in super-safe Treasury bills, earn yields of more than 5%, rinse and repeat. Or as billionaire bond investor Jeffrey Gundlach put it last October, “T-bill and chill.”

Most Read from Bloomberg

Even now, with Federal Reserve officials poised to ease benchmark interest rates from a two-decade high — a move that would instantly push down yields on bills and other short-term debt — money-market funds are thriving. They raked in $106 billion this month alone and their balances, at $6.24 trillion, have never been higher.

Investors in cash equivalents appear to be perfectly happy to stay where they are for now, despite repeated advice to add exposure to longer-term bonds from the likes of Pimco and BlackRock Inc. — admittedly bond managers themselves. But their point is that while cash returns have nowhere to go but down, debt with longer maturities stands to benefit from capital gains in an environment of deep rate cuts.

“Logically speaking, it doesn’t make a whole lot of sense for $6 trillion-plus to be sitting in money market funds if the yield is going to go down,” Kathy Jones, chief fixed-income strategist at Charles Schwab & Co. “We had a lot of talk about rate cuts and they haven’t happened, so there may be a lot of people who are just actually waiting to see it happen.”

During this year’s bouts of bond volatility, cash has been a good place to be. Money-market rates, which are keyed off of the Fed’s current 5.25%-to-5.5% policy band, have held steady and offered no surprises.

That’s about to change. Fed Chair Jerome Powell signaled last week that rate cuts are coming in September. With inflation ebbing, “the time has come for policy to adjust,” he said, adding that “the direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook and the balance of risks.”

Money markets may continue to appeal, it’s the scope of rate cuts matters. Just 1 percentage point of reductions, for instance, would still leave bill rates in the range of 4%, an appealing return — especially after years of near-zero rates before the most recent tightening cycle, and at a time when longer-term US bonds are yielding far less. This may explain why retail investors are in no hurry to shift their holdings.

“For the first time in recent memory, cash is actually offering some yield and I can understand why people are sort of gravitating to that,” said John Queen, a portfolio manager at Capital Group, which oversees $2.5 trillion in assets. However well that’s worked recently, Queen recommends a classic strategy of diversification, investing in a mix of cash, equities and fixed income.

Of the $6.24 trillion of cash parked in money market funds, roughly 60% of that is from corporations that have been stockpiling cash following the pandemic, while the rest is from mom-and-pop investors who are content to continue earning more yield than what they can earn by merely keeping that money in the bank. Those yields are also significantly higher than what investors can get by moving into longer-term Treasury bonds — though nothing like the stock market’s gains.

Even after the Fed starts lowering borrowing costs, money-market funds should continue to lure at least some cash from retail investors. That’s because they will still offer higher yields than banks and attract institutions that prefer to outsource cash management.

For some investors enjoying high rates on short-term savings, there is a growing recognition that this won’t last forever and they are becoming more attentive to the day when cash returns suddenly drop.

Steven Roge, chief investment officer at R.W. Roge & Co, a private wealth manager with $350 million of assets, says for much of this year the toughest discussions with clients were about teaching them the reinvestment risk of staying too long in a money market fund or high-yield savings account.

“Reinvesting in bond funds over time, that’s been a difficult conversation,” said Roge. “These talks are becoming easier with Fed rate cuts on the horizon.”

The lost opportunity for cash investors is that unlike bills, bonds generate capital gains from price appreciation as interest rates decline.

Bond managers highlight how a 10-year Treasury note yielding less than 4% today has already benefited from capital gains since the benchmark topped 5% less than a year ago. A Bloomberg index of 7 to 10 year Treasuries has gained 13.3% versus a cash return of 4.5% since last October.

Of course, for some the choice isn’t just between bills and longer-term bonds. Warren Buffett’s Berkshire Hathaway Inc. increased its holdings of Treasury bills to $234 billion in the second quarter after cashing in on investments in equities including Apple Inc. For investors like him, holding cash equivalents while rates are still reasonable makes sense until fresh bargains in stocks appear.

But from the perspective of fixed income, the math still works for owning a 10-year Treasury now yielding around 4% versus cash, should the bond market rally towards 3% as the Fed cuts towards a neutral policy setting. Longer-dated Treasuries would enjoy a double-digit return from price appreciation and coupon interest.

“In that scenario, no you’re not better in cash,” said Neil Sutherland, portfolio manager at Schroder Investment Management. “I don’t think it’s unreasonable to think that the 10 year could get down towards 3% and under that environment quite quickly you’re getting up to double-digit returns.”

Digging In

Don’t tell that to Bill Eigen, manager of the $10 billion JPMorgan Strategic Income Opportunities Fund. For him, the idea of moving money into a US 10-year note currently yielding around 3.82% has little appeal. His fund held 54% in cash at the end of July, according to the latest filing.

“You can get mid-5% in cash, get 6% in short-term investment grade floating rate,” Eigen said. “I won’t lend to the government for 10 years and get paid less.”

Eigen has been hoarding cash for a while, a move that has helped the fund return 9% over the past three years, compared with a loss of 6% in the Bloomberg Agg Index. But that was then.

As cash-equivalent rates start moving down — and by all estimates they will — “T-bill and chill” won’t be such a no-brainer anymore.

“Once investors look at what they’re getting, they’ll decide where they are isn’t that attractive anymore,” said Schwab’s Jones.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Meet Wall Street's Safest Dividend Stock: A Small-Cap Company Few Investors Know Exists

Over the last century, Wall Street has sat on a pedestal above all other asset classes. While Treasury bonds, housing, and commodities like gold, silver, and oil, have had their moments in the sun and, in many instances, made investors richer, no asset class has come close to matching the average annual return from stocks over the last century.

One of the best aspects of putting your money to work on Wall Street is there are thousands of publicly traded companies and exchange-traded funds (ETFs) to choose from. It’s a near-certainty that there’s a security or 10 that matches your risk tolerance and/or investment goals

But among the seemingly countless ways money can be made in the stock market, few strategies have been more consistently successful than buying and holding high-quality dividend stocks over an extended period.

Last year, the investment advisors at Hartford Funds released a lengthy report extoling the virtues, and outperformance, of dividend stocks. In particular, The Power of Dividends: Past, Present, and Future compared the performance of dividend-paying stocks to non-payers over the previous half-century.

According to the report, dividend stocks averaged a 9.17% annual return between 1973 and 2023, and did so while being 6% less volatile than the benchmark S&P 500. Meanwhile, public companies that didn’t offer a payout trudged their way to a less-impressive annualized return of 4.27% over the same 50-year stretch, and were, on average, 18% more volatile than the S&P 500.

Companies that regularly share a percentage of their profits with investors — even if these payouts aren’t necessarily growing on an annual basis — tend to be recurringly profitable, time-tested, and are usually able to provide transparent long-term growth outlooks. In short, they’re just the type of businesses we’d expect to increase in value over time.

Wall Street has no shortage of amazing dividend stocks to choose from

Although well over 1,000 stocks currently pay a dividend to their shareholders, no two income stocks are alike. When it comes to consistency and safety, some dividend stocks naturally rise to the top.

A good example is consumer staples colossus Coca-Cola (NYSE: KO). In February, it increased its quarterly dividend for the 62nd consecutive year. Furthermore, the company has paid a continuous dividend, without interruption, since 1920.

Coca-Cola’s secret to success really isn’t a secret at all. It provides a basic necessity (beverages) that’ll be purchased in any economic climate, and is geographically diverse, with operations ongoing in all but three countries (North Korea, Cuba, and Russia).

Coca-Cola also possesses a powerful brand that resonates with shoppers. Kantar’s annual “Brand Footprint” report has labeled Coca-Cola the most-chosen brand from retail shelves for 12 consecutive years.

Healthcare conglomerate Johnson & Johnson (NYSE: JNJ) is another prime example of a top-tier dividend stock that delivers safe, predictable income year after year. In April, J&J’s board matched Coca-Cola by increasing its base annual payout for a 62nd consecutive year.

Regardless of what’s happening with the U.S./global economy or stock market, people still develop ailments and require medical care. This means demand for novel therapeutics and medical devices are going to be consistent, which leads to transparent and predictable operating cash flow.

Johnson & Johnson is also one of only two publicly traded companies that still possesses the highly coveted AAA credit rating from Standard & Poor’s (S&P), a division of S&P Global. This rating, which is one notch higher on the belt than that of the U.S. government, signifies S&P’s utmost faith in J&J servicing and repaying its outstanding debts.

But at the end of the day, neither Coca-Cola, Johnson & Johnson, nor the 1,000-plus other dividend stocks out there can hold a candle, in terms of safety and consistency on the dividend front, to one off-the-radar small-cap stock that few investors know exists.

Say hello to Wall Street’s greatest (and most underappreciated) dividend stock

The mystery stock that can arguably be described as the safest and most-consistent dividend payer is York Water (NASDAQ: YORW), a $548 million market cap water and wastewater utility company that services 56 municipalities spanning four counties in South-Central Pennsylvania.

To say York flies under the radar would be an understatement. Over the last three months, its average daily trading volume is a paltry 58,329 shares. On a given day, a little over $2 million worth of the company’s shares trade hands. But this inconspicuous water utility has quite the rich history of sharing a percentage of its profits with its investors.

Since York Water’s founding in 1816, the company has paid a continuous dividend to its shareholders. Although the company doesn’t increase its payout in consecutive years like Coca-Cola and Johnson & Johnson, its 208-year continuous streak of dividends precisely doubles Coke’s 104-year streak. Based on the research I’ve done, York’s continuous dividend streak is 60 years longer than the next-closest continuous payout streak from a public company in the U.S., Stanley Black & Decker.

The safety of York’s payout can be traced to four factors.

To start with, water and wastewater service are basic necessities. Regardless of whether you own or rent, you’re going to need these services. Further, demand for water and wastewater service doesn’t change much from one year to next, leading to highly predictable operating cash flow.

Secondly, the barrier to entry among utilities is usually sky-high. Most utilities operate as monopolies or duopolies in the regions they service, meaning consumers rarely, if ever, have an opportunity to choose which company provides their service. With initial infrastructure costs often restrictive, York Water doesn’t have to worry about competition for its customers. Once again, this leads to transparent and predictable cash flow.

The third important element to York’s success is that it’s a regulated water utility. “Regulated” utilities must first obtain approval from a state’s public utility commission (in this instance, the Pennsylvania Public Utility Commission, or PPUC) to increase rates on customers. While this might sound inconvenient, it ensures that York doesn’t have to contend with unpredictable wholesale pricing for its services.

In January 2023, the PPUC gave York the thumbs-up to increase rates on approximately 75,000 of its customers to offset $176 million in various system improvements and infrastructure replacements. York’s annual revenue jumped 18% last year in the wake of this increase.

Lastly, York Water hasn’t been shy about making acquisitions to expand its reach. A steady diet of earnings-accretive bolt-on acquisitions ensures that York can maintain its continuous dividend streak.

Though some investors are liable to be critical of York yielding “only” 2.2%, keep in mind that yield is a function of share price. Despite its quarterly payout growing by 164% since the century began, York’s shares have risen by 573% during the same stretch. In other words, the only reason York’s yield is a modest 2.2% is because its share price has significantly risen over time. That’s not something for shareholders to complain about.

While you can find plenty of dividend stocks with higher yields than York Water, you’re not going to find a company with a steadier or safer payout track record.

Should you invest $1,000 in York Water right now?

Before you buy stock in York Water, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and York Water wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends S&P Global. The Motley Fool recommends Johnson & Johnson. The Motley Fool has a disclosure policy.

Meet Wall Street’s Safest Dividend Stock: A Small-Cap Company Few Investors Know Exists was originally published by The Motley Fool

Prediction: Nvidia Will Crush Wall Street Expectations on Aug. 28 — but There's a Catch for the AI Stock

Nvidia (NASDAQ: NVDA) has been 2024’s most influential stock. Rising artificial intelligence (AI) demand spurred enormous sales and earnings growth for the company, and the business momentum translated to incredible valuation gains.

The processing leader’s share price is up 161% across this year’s trading alone, and its incredible performance has been a bullish catalyst for the market at large and other individual players in the AI space. Now, Nvidia stock is on the verge of its next big test.

After the market closes on Wednesday, Aug. 28, the company will publish results for the second quarter of its 2025 fiscal year (which ended July 28). Management will also host a conference call to give investors further insight into the business and its outlook.

The earnings release will likely be one of this year’s most important stock market events, and anticipation on Wall Street is running high. There’s plenty of speculation on whether Nvidia will beat earnings expectations, and I’m predicting that the AI giant will comfortably beat most targets. But buckle up, because this one could get wild.

Nvidia looks poised to crush sales and earnings targets

In its fiscal 2025 first quarter update, Nvidia management guided for roughly $28 billion in sales in the second quarter. If the company hits that target, it would mean delivering annual sales growth of 107%. Management also expects Nvidia’s gross margin to grow to 74.8%. Those numbers are nothing to sneeze at.

Wall Street is even more optimistic, with the average analyst estimate calling for the AI frontrunner to deliver sales of $28.6 billion in the period. Thus far, the company has been building an impressive streak of performance beats. Take a look at the table below, which tracks Nvidia’s revenue against Wall Street’s expectations over the company’s last four reported quarters.

|

Fiscal Quarter |

Wall Street Consensus Revenue Target |

Actual Revenue |

Percentage Beat |

|---|---|---|---|

|

Q2 2024 |

$11.22 billion |

$13.51 billion |

20.4% |

|

Q3 2024 |

$16.18 billion |

$18.12 billion |

12% |

|

Q4 2024 |

$20.62 billion |

$22.1 billion |

7.2% |

|

Q1 2025 |

$24.65 billion |

$26.04 billion |

5.6% |

Data sources: Nvidia and CNBC.

With the company posting fantastic margins, sales beats have also meant that the company’s earnings have crushed Wall Street’s expectations. Across the last year, the company’s quarterly non-GAAP (adjusted) earnings beat the midpoint Wall Street target by an average of 17.3%.

Tech industry capex is flashing signals

There’s a very good chance that Nvidia will manage to beat its own targets and the average Wall Street estimates with its upcoming quarterly report. Here’s why.

With its last quarterly report, Microsoft announced capital expenditures (capex) of $19 billion — with nearly all of the spending going to improving the company’s cloud and AI infrastructure. Capex was up 35% from the previous quarter, and management also announced that spending is poised to continue climbing over the next year. Microsoft is widely believed to be Nvidia’s largest customer, and increased spending on AI infrastructure is a clear bullish indicator.

The software giant wasn’t the only one to deliver encouraging capex news recently. Meta Platforms, another big Nvidia customer, also raised its capital-spending guidance range with the second-quarter results it published at the end of last month.

In general, the sentiment among many leading tech companies appears to be that it’s better to invest heavily in artificial intelligence right now than to risk being left behind or playing catch-up with competitors. Along with promising capex data from technology giants, that bodes well for Nvidia — and I think the company will beat top- and bottom-line expectations in Q2.

But there’s a catch.

Nvidia stock needs more than strong Q2 results for a post-earnings surge

While the average Wall Street target calls for Nvidia to report revenue of $28.6 billion for the second quarter, some analysts have set the target significantly higher. For example, HSBC expects the business to report $30 billion in revenue for the period.

Beating the average Wall Street target is often enough to trigger bullish valuation momentum for a company, but that isn’t always the case. Hot stocks in particular are often held to higher standards — with investors looking for the business to deliver results that match or exceed elevated expectations. It’s also worth noting that Wall Street analysts have gotten more accurate in modeling the company’s performance over the last year of reporting, with Nvidia’s quarterly sales beat going from 20.4% in last year’s second quarter to 5.6% in this year’s first quarter.

Even if Nvidia manages to far exceed the average Wall Street targets, there are other catalysts that could lead to volatile trading after earnings. Investors will also have the company’s guidance for the current quarter and future roadmap under the microscope, and reports have emerged that the AI leader may be delaying the release of its next-generation Blackwell processors. Depending on what Blackwell news Nvidia has to share, the stock could see big moves in either direction.

So even with signs that the AI luminary will deliver strong Q2 results, investors should understand the stage could be set for post-earnings valuation volatility. Rather than trying to time short-term buying and selling moves around what the company’s share price will do soon after earnings, it makes more sense to approach an investment in Nvidia with the company’s long-term outlook in mind. Things generally continue to look quite promising on that front.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

HSBC Holdings is an advertising partner of The Ascent, a Motley Fool company. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends HSBC Holdings and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Prediction: Nvidia Will Crush Wall Street Expectations on Aug. 28 — but There’s a Catch for the AI Stock was originally published by The Motley Fool

Move Over, Nvidia and Broadcom: Wall Street's Next Stock-Split Stock — a 120,000% Gainer Since Its IPO — Is Ready to Take Center Stage

Although artificial intelligence (AI) has been the talk of Wall Street since 2023 began, the return of stock-split euphoria has given AI a run for its money in 2024.

A stock split is a mechanism publicly traded companies can lean on to cosmetically alter their share price and outstanding share count. Its superficial in the sense that adjusting share price and share count by the same magnitude has no impact on market cap or a company’s underlying operating performance.

Splits come in two forms, with one being substantially more popular than the other. Reverse-stock splits are geared toward increasing a company’s share price. This is usually done to ensure it meets the continued minimum listing standards of a major stock exchange.

On the other hand, forward-stock splits reduce a company’s share price. The purpose of a forward split is to make shares more nominally affordable for investors who lack access to fractional-share purchases through their broker. Since forward splits are almost always announced from a position of operating strength, this is the type of split investors gravitate to.

Since 2024 began, 13 time-tested businesses have announced or completed a stock split — all but one of which is of the forward-split variety. While no splits have garnered more attention than AI darlings Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO), there’s another scorching-hot stock-split stock readying for its moment in the spotlight.

According to the analysts at PwC, artificial intelligence is forecast to add $15.7 trillion to the global economy by 2030 through various consumption-side benefits and productivity improvements. With an addressable market this large, it’s not surprising to see Wall Street fall head over heels for AI stocks.

Nvidia has been the runaway face of the AI revolution. Since the start of 2023, Nvidia’s market cap has increased by $2.8 trillion, which is the fastest ascent we’ve ever witnessed from a market-leading business. This was the catalyst that compelled Nvidia’s board to approve a 10-for-1 forward split.

Nvidia’s astronomical gains are a function of its H100 graphics processing units (GPUs) being the undisputed top choice in AI-accelerated data centers. The analysts at semiconductor firm TechInsights note that Nvidia’s GPUs accounted for all but 90,000 of the 3.85 million GPUs shipped in 2023 to data centers.

With overwhelming demand comes the exceptional pricing power that’s sent the company’s adjusted gross margin considerably higher. Nvidia’s H100 sports a price tag ranging from $30,000 to $40,000, which is well above what its competitors are charging for their AI-GPUs.

Don’t overlook Nvidia’s CUDA platform, either. This software kit that helps developers build large language models is working hand-in-hand with the company’s hardware to keep customers within its ecosystem of products and services.

Meanwhile, Broadcom has been a key supplier of networking solutions. Last year, it introduced its Jericho3-AI fabric, which can connect up to 32,000 GPUs in high-compute data centers. The goal of Broadcom’s solutions is to reduce tail latency and maximize the computing potential of GPUs in use.

Although Broadcom’s stock has moved up in a big way because of its AI networking solutions — this sizable move led to its first-ever stock split, 10-for-1, following the close of trading on July 12 — there’s a lot more to this company than just solutions tied to artificial intelligence.

For example, Broadcom is a leader in developing wireless chips and solutions for next-generation smartphones. Telecom companies upgrading their wireless networks to support 5G download speeds have increased demand for the chips and accessories used in next-gen wireless devices.

While Nvidia and Broadcom have had their moment in the sun, another perennial outperformer, which has nothing to do with AI and has gained more than 120,000%, including dividends paid, since its initial public offering (IPO), is ready to step forward and become Wall Street’s newest stock-split stock.

This 120,000%-gainer is two weeks away from becoming Wall Street’s newest stock-split stock

Following the close of trading on September 11, corporate uniform and business services provider Cintas (NASDAQ: CTAS) will complete a 4-for-1 forward split and join the ranks of an elite group of outperforming stock-split stocks in 2024.

This marks the sixth time Cintas will have conducted a forward split since its IPO in August 1983:

-

April 1987: 2-for-1

-

April 1991: 3-for-2

-

April 1992: 2-for-1

-

November 1997: 2-for-1

-

March 2000: 3-for-2

-

September 2024: 4-for-1

How does a company that supplies corporate uniforms, floor mats, towels, and safety kits outperform Wall Street’s benchmark indexes so decisively over a four-decade stretch? History and revenue diversity are the first important puzzle pieces.

Based on the company’s own admission in June, it has “more than 1 million businesses of all types and sizes” that it services. With no single customer accounting for an outsized percentage of sales, Cintas doesn’t have to worry about its proverbial ship sinking because of the struggles of one or more of its customers.

Additionally, Cintas has history on its side. Although recessions are a perfectly normal aspect of the economic cycle, they’re almost always short-lived. Periods of economic growth stick around significantly longer, thusly allowing Cintas’s customers to expand. In turn, this increases demand for corporate uniforms and business services over time.

Another key to the company’s long-term success has been its willingness to grow via acquisition. Since this century began, it’s scooped up Omni Services (2002), Zee Medical (2015), and G&K Services (2017), to name a few. These earnings-accretive deals expand the company’s product portfolio and work to keep existing clients within its network of products and services.

Don’t overlook innovation, either. Cintas has introduced new products to lure in new clients, and leaned on a variety of cross-selling solutions to encourage existing clients to spend more.

The cherry on top is the company’s incredible capital-return program. It’s raised its dividend every year since going public in 1983 and recently added to its share repurchase program, which stood at $1.5 billion, as of July 23, 2024. A company that can raise its payout for four decades without interruption is a business that’s demonstrated it can navigate anything the U.S. economy throws its way.

The one downside with Cintas is its valuation. Though being an industry leader has its perks and comes with some degree of a valuation premium, a forward price-to-earnings ratio of nearly 43 for a company expected to grow its earnings per share by an annual average of 13% through 2028 is difficult to justify.

Should you invest $1,000 in Cintas right now?

Before you buy stock in Cintas, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Cintas wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Broadcom and Cintas. The Motley Fool has a disclosure policy.

Move Over, Nvidia and Broadcom: Wall Street’s Next Stock-Split Stock — a 120,000% Gainer Since Its IPO — Is Ready to Take Center Stage was originally published by The Motley Fool

Why investors should load up on cheap, 'left behind' stocks as the market trades near record highs, Jeremy Grantham's GMO says

-

Investors can best prepare against an eventual market slowdown by buying cheap, unloved stocks, GMO says.

-

The investment firm finds the extreme discounts of deep value stocks attractive.

-

Once bullish sentiment starts to unwind, these valuations should correct, GMO wrote.

It’s time to embrace the market’s cheapest stocks, with the value sector poised to eventually roar back, GMO wrote in a new research note.

The investment firm, led by legendary investor Jeremy Grantham, outlined a high conviction in “deep value” equities — or stocks that are cheap relative to their genuine fundamental worth.

Based on this criteria, the investment firm began targeting the cheapest 20% of stocks in May 2023, steering clear of “deceptively cheap” value traps.

“In a world where many stocks are being driven ever higher by positive sentiment and investor optimism, many of the ones that have been most unloved and left behind are trading at extraordinary discounts,” the firm wrote.

Over the past year, US investment has skewed heavily toward large-cap tech names, helping benchmark indexes notch a series of all-time highs.

Against this backdrop, deep value stocks have become extremely cheap — not only against the broader market but also in comparison to history.

“Outside of the US all value is cheap, but deep value is in the 2nd percentile of its history,” the note said. “Within the US, deep value is similarly sitting at the 10th percentile of its history, while the rest of value should largely be ignorable at current valuations.”

According to GMO, that makes deep value well-positioned to deliver strong returns once investor sentiment toward mega-caps starts to unwind. Earlier this year, GMO projected a 1% decline in US large-caps in the next seven years, predicting that deep value stocks will achieve 7.6% gains.

“The S&P 500 is tech and growth heavy, so an investment in international value is the perfect complement from more than just a regional perspective,” GMO wrote.

Read the original article on Business Insider