How Reuters calculated the Trump Organization’s financial situation

By Tom Bergin

(Reuters) – Reuters sought to estimate the cashflow being generated by former President Donald J. Trump’s various businesses to try to understand how that business has changed over the past decade and the extent to which over $500 million in court judgments against him may put strains on that business.

Reuters used established methodologies and consulted with experts in the different industries in which The Trump Organization operates to establish its estimate of around $80 million in cash after operating expenses from Trump’s businesses in 2024.

With respect to Trump’s interests in real estate – the business on which he built his reputation – Reuters looked at each of the properties in which Trump has an interest individually. For income-yielding properties like his office tower at 40 Wall Street or the retail units at Trump Tower in New York, Reuters worked off net operating income and rental rate figures produced between 2011 and 2021 by The Trump Organization released as part of the New York fraud trial against the group. Reuters also used information about commercial mortgage backed securities in which the group’s mortgages have been packaged, and financial information from property tax appeals.

These were adjusted by Reuters for additional costs such as routine capital expenditure and leasing fees based on expert guidance and historic averages. Reuters also deducted debt costs, which can be ascertained from his Office of Government Ethics (OGE) Candidate financial disclosure, state property records and information released as part of the fraud trial.

Historical net operating income (NOI) figures were checked against tax returns and adjusted to reflect current market conditions, vacancies and other variables, based on expert advice. There’s uncertainty about rental rates and occupancy levels.

In total, Reuters estimated that Trump will generate free cashflow from property rental and sales in New York, San Francisco, Chicago, Las Vegas and Florida of around $3 million in 2024. It would have been higher were it not for the April repayment of an around $12 million loan related to Trump Plaza in New York.

For Trump’s golf and resort properties, Reuters worked off published accounts where these were available, and net operating income figures produced by an expert hired by the New York Attorney General in the fraud case. The expert’s NOI calculations were broadly similar to, if usually somewhat lower than, income figures in valuations produced by a Trump expert in the case. They were also largely consistent with tax return information released by the Ways & Means Committee in 2022.

Reuters adjusted 2021 earnings based on revenue increases at the clubs projected by the Trump expert. Reuters cross-checked the revenue forecasts, produced in 2023, with industry trends and revenue figures Trump reported in his OGE disclosure in August 2024.

Reuters’ forecast excludes major capital expenditure on upgrades. Reuters found no reports of major new upgrades at his properties being planned in 2024, but its estimate that Trump’s clubs may generate around $70 million this year could be too high.

Trump earns money from licensing his name to foreign real estate developers and publishes the revenue received in his OGE financial disclosures. Reuters estimated Trump will receive a similar amount from existing deals in 2024 as in 2023 —a possible over-estimate – and added amounts for each of the two deals announced this year consistent with the payments he received on previous deals.

Reuters estimated $11 million of losses at the Trump Corporation, the entity which provides a centralized management function to the Trump Organization, based on figures in Trump’s tax returns released by the House Ways & Means Committee in 2022.

Reuters excluded the multi-million dollar legal costs related to Trump’s various court proceedings on the basis that much of this is being met by his campaign supporters. Also, Reuters reduced the cost of operating his fleet of aircraft to a fraction of historic levels because his campaign pays to lease aircraft from him.

Reuters also excluded any federal income tax payments.

(Reporting by Tom Bergin in London. Editing by Tom Lasseter, Benjamin Lesser and Claudia Parsons.)

'Sounds Like Murderville To Me': Mark Cuban And Kevin Hart Both Said No To A Startup That Became A Giant. Now They're Kicking Themselves

In an episode of Hart to Heart, Kevin Hart’s talk show, both Hart and billionaire investor Mark Cuban shared a regretful tale that might make any entrepreneur cringe: they both passed on the chance to invest in Uber during its early stages.

Don’t Miss:

Uber, which has since become a global powerhouse, wasn’t always an obvious success story. When pitched to these two stars, it sounded more like a recipe for disaster. Kevin Hart, in his usual comedic style, recalled dismissing the idea as “Murderville,” unable to wrap his head around the concept of strangers getting into cars with other strangers. On the other hand, Cuban was ready to invest but only at a lower valuation. He let the opportunity slip through his fingers when his offer wasn’t accepted.

Troy Carter, music manager turned tech mogul, told Hart, “There’s this thing, man. It’s called Uber. You got to invest in it.” But, “There’s nothing worse than being pitched something that you just can’t see,” Hart told Cuban.

Trending: This new startup venture is the future of automated convenience stores — read more about why these $10 pre-IPO shares are so valuable before the offer closes in less than 24 hours.

“There’s an app, and you say you need a ride, and whoever’s close to you, that is like one of the drivers under our app will come get you,” continued Carter. But Hart simply told him, “Sounds like Murderville to me. This has to be the stupidest shit I ever heard.”

Fast-forward to 2024, and Uber’s success speaks for itself. The company reported revenue of over $37 billion in 2023, with a market cap exceeding $150 billion and a 19% year-over-year increase in gross bookings in the second quarter of 2024 alone. But Uber hasn’t stopped at ride-hailing. The company dominates the food delivery market through Uber Eats and has expanded into freight and other logistics sectors.

Trending: Groundbreaking trading app with a ‘Buy-Now-Pay-Later’ feature for stocks tackles the $644 billion margin lending market – here’s how to get equity in it with just $100

Both Hart and Cuban admit that turning down Uber is a decision they’ll always consider. Uber’s success shows that even the craziest ideas can become huge. “Don’t feel bad,” said Cuban. Still, Hart admitted that “Until this day, I think about it. Until this f***ing day. You know. I kind of avoid seeing Troy Carter, too.”

Of course, there are countless examples of great ideas being turned down by numerous investors. For example, in 2000, Reed Hastings, the co-founder of Netflix, approached Blockbuster with an offer to sell Netflix for $50 million. Blockbuster declined, not seeing the potential in a DVD-by-mail service.

In its early days, Airbnb struggled to find investors who believed in people renting out their homes to strangers. Many saw it as a risky and unprofitable venture. Today, Airbnb is valued at $75 billion.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article ‘Sounds Like Murderville To Me’: Mark Cuban And Kevin Hart Both Said No To A Startup That Became A Giant. Now They’re Kicking Themselves originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Snowflake Gives Outlook That Fails to Calm Investors on AI

(Bloomberg) — Snowflake Inc. (SNOW) gave a sales outlook that failed to reassure investors that the company will gain ground in the market for artificial intelligence software tools. The shares fell in extended trade.

Most Read from Bloomberg

Product revenue, which makes up the bulk of Snowflake’s business, will be $850 million to $855 million in the period ending in October, the company said Wednesday in a statement. Analysts, on average, predicted $848 million, although some estimates exceeded $900 million, according to data compiled by Bloomberg. The company also raised its fiscal year product sales forecast to $3.36 billion from $3.3 billion.

Under Chief Executive Officer Sridhar Ramaswamy, Snowflake has launched products focused on generative AI and other new ways to analyze large sets of data. The strategy is fueled in part by increased pressure from rivals including Databricks Inc. and cloud infrastructure providers like Microsoft Corp. Snowflake offers software that helps customers find, organize and use huge amounts of information from a variety of sources.

Ramaswamy touted “product delivery, and great traction in the early stages of our new AI products.”

Still, Snowflake is navigating a challenging environment between a recent CEO change, security breaches of its customers and some market shift to products outside its traditional wheelhouse, wrote Derrick Wood, an analyst at TD Cowen, ahead of the results.

In the fiscal second quarter, total revenue rose 29% to $868.8 million — coming in under 30% for the first time in Snowflake’s history as a publicly traded company.

The shares declined about 7% in extended trading after closing at $135.06 in New York. The stock has dropped 32% this year, as investors have been concerned about Snowflake’s ability to catch up in AI-oriented tools.

Clients including AT&T Inc., Live Nation Entertainment Inc.’s Ticketmaster and LendingTree Inc. had their Snowflake accounts breached as part of a hacking campaign beginning in May. Snowflake has said its own systems weren’t infiltrated and has added features for customers to implement better security settings.

“We obviously had some rough headlines in the quarter,” Ramaswamy said of the customer breaches during a conference call after the results were released. “The issue wasn’t on the Snowflake side.”

Product revenue increased 30% to $829 million in the quarter, compared with the $813 million expected by analysts. Adjusted profit, excluding some items, was 18 cents a share, just ahead of the average estimate of 16 cents a share.

Snowflake now has 510 customers that spent more than $1 million over a trailing 12-month period, up from 485 the previous quarter. Remaining performance obligations — another key benchmark of growth — were $5.2 billion in the period ended July 31, topping analysts’ average estimate of about $5 billion.

The company has added about 1,000 workers over the last year in a period when many peers were shedding employees or selectively hiring. Snowflake said it had 7,630 employees as of the second quarter.

(Updates with additional context throughout.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Should You Buy Nvidia Stock Before Aug. 28?

It’s been yet another exciting earnings season for investors as megacap tech companies proved that the artificial intelligence (AI) train is moving full steam ahead.

One AI player in particular is yet to publish financial results for the second quarter. On Aug. 28, semiconductor specialist Nvidia (NASDAQ: NVDA) will report earnings, and you can bet that bulls and bears all across Wall Street will be focusing on every last number the company produces.

Let’s dive into what investors should look for and assess if now is a good time to buy shares of Nvidia.

What is Wall Street forecasting for Nvidia earnings?

Nvidia reports revenue in five categories: data centers, gaming, professional visualization, automotive, and original equipment manufacturing (OEM).

Each segment is connected to AI in some form or fashion, but the overwhelming majority of Nvidia’s business stems from data centers. During the company’s first quarter of fiscal 2025 (ended April 28), total revenue was $26 billion. Nearly 87% of that, or $22.7 billion, came from the data center business.

According to consensus analyst estimates, Wall Street is forecasting that second-quarter sales will be around $28.5 billion. Should Nvidia achieve this target, it would represent 111% growth year over year.

In the section below, I’ll break down why I think Nvidia might blow away these estimates and explain some of that tailwinds that could be lifting its important data center operation.

A good proxy for Nvidia

It’s obvious that a common thread stitching the overall fabric of megacap tech right now is AI. But at a more granular level, AI’s integration with cloud computing is a big movement within the technology industry at large.

The cloud computing landscape is dominated by Amazon, Microsoft, and Alphabet.

During the second quarter, each of these “Magnificent Seven” members revealed some interesting features. Namely, each is aggressively increasing investments in capital expenditures (capex).

In the case of Amazon, the company’s big initiative is an $11 billion investment into data centers in Indiana as part of a broader rollout to develop its own AI-powered chips. As for Microsoft, the company hasn’t been shy about new investments in nuclear-powered data centers as the company seeks to double down on AI infrastructure in an energy efficient way.

During Alphabet’s second-quarter earnings call, chief financial officer Ruth Porat said that capex spending was “driven overwhelmingly by investment in our technical infrastructure with the largest component for servers followed by data centers.”

Do you see the theme? All of Nvidia’s cohorts are investing tens of billions of dollars into data center infrastructure, and the trends in the chart above suggest it won’t be slowing down anytime soon.

Considering the bulk of Nvidia’s revenue and profits comes from data center services and the company’s sophisticated graphics processing units (GPU), I see the rising capex patterns from others in big tech as a good proxy for what’s to come for Nvidia.

Should you buy Nvidia stock before Aug. 28?

AI emerged as the hottest ticket in the tech realm toward the end of 2022 when OpenAI released ChatGPT.

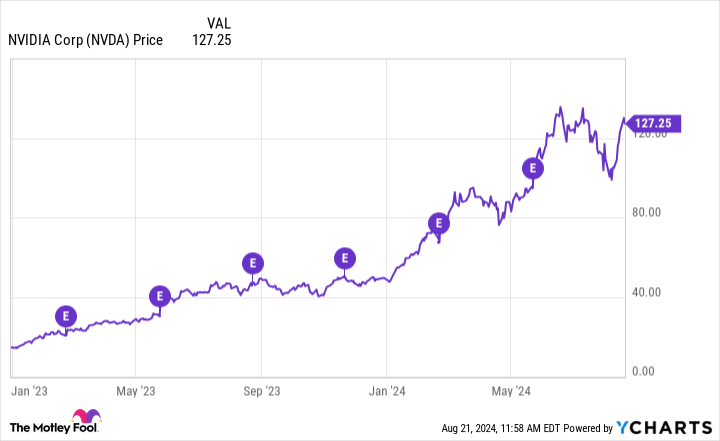

In the chart below, you can see how Nvidia stock reacted following a series of earnings reports since the beginning of last year. The earnings report dates are annotated by the purple circles with “E” in the middle.

It’s clear that Nvidia stock has risen considerably over the last 20 months or so. More specifically, the stock rarely dropped immediately following an earnings report, and when it did, the sell-off was brief.

To me, this helps validate that buying Nvidia stock either before or after its last several earnings reports ended in the same result: gains.

When it comes to valuation, Nvidia stock is less expensive today than it was a year ago on both a price-to-earnings (P/E) and price-to-free-cash-flow (P/FCF) basis. This compression in multiples has occurred because the company’s profits and cash flow are actually rising faster than its sales, a sign of an incredibly healthy and powerful operation.

Given the trends from its Magnificent Seven peers noted above, I’m cautiously optimistic that Nvidia could experience yet another impressive quarter. For these reasons, it might be a good idea to buy some shares now because history suggests Nvidia stock could be headed for further gains.

But I wouldn’t get too caught up in the exact timing. If you prefer to analyze the earnings report first and then decide to buy the stock, perhaps you’ll be investing at a slightly higher valuation. Given the trends in the earnings chart, I’m confident that gains will still be on the horizon for long-term investors whether or not they buy Nvidia stock before Aug. 28.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $779,735!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Should You Buy Nvidia Stock Before Aug. 28? was originally published by The Motley Fool

Aug. 28 Could Be a Massive Day for Nvidia Stock. Is It a Buy Right Now?

Nvidia (NASDAQ: NVDA) has been one of the hottest artificial intelligence (AI) stocks on the market, and for good reason. It has put up incredible growth numbers quarter after quarter lately, and each time, the stock has popped following those reports. With Nvidia’s second-quarter FY 2025 results being announced on Aug. 28 after the markets close, investors may want to consider buying Nvidia stock before that date.

However, these results may differ from some of its previous announcements, as year-over-year comparisons are becoming more difficult.

The growth won’t be as strong as in previous quarters

Nvidia’s rise is tied to its primary product: graphics processing units (GPUs). GPUs were developed by Nvidia back in the ’90s as devices that could process gaming graphics more efficiently than a CPU. While GPUs excelled in this field, other uses were quickly developed for them.

Because a GPU can process multiple calculations in parallel, it is useful for calculation-intensive tasks like engineering simulations, drug discovery, and AI model training. The latter has caused its business to explode, and we’ll get a checkup on demand next week when the company releases its most recent quarterly results.

For Q2, management told investors to expect $28 billion in revenue. Compared to last year’s Q2 sales of $13.5 billion, that represents 107% year over year growth. That would be an impressive jump, but would represent a growth rate slowdown compared to previous quarters.

This slowdown is occurring because we are overlapping the period when AI demand really started to take off. Still, I wouldn’t consider a doubling of revenue a disappointment. Additionally, don’t be surprised if Nvidia beats that target. It has consistently outperformed its guidance over the past year, and Wall Street analysts are starting to catch on to this trend. From an average of 40 analysts, they collectively think Nviida’s Q2 revenue will be $28.5 billion.

While year-over-year revenue growth is an important stat, there are others that I think are more important to consider, with margin at the top of that list.

Nvidia’s margin will be important to examine

Nvidia’s revenue growth has been nothing short of incredible, but its margin expansion has been even more impressive. With a gross margin near 80% and a profit margin approaching 60%, Nvidia has become one of the most profitable companies ever to trade on the public markets.

When the Q2 report comes out, I’ll be looking to see if the company has maintained or expanded these elevated levels. If investors see weakness in these margins, it’s a sign that Nvidia is facing increased competition and needed to adjust the price of its GPUs to stay competitive in the market.

I don’t expect a margin drop, but if one does occur, don’t be surprised if the stock gets slammed immediately after the release of information.

Is the stock a buy now?

With Nvidia expected to report another strong quarter, many investors may wonder if they should invest now, before the report. Investors should first consider that investing success hardly ever comes from trying to time the market and jump in and out at just the right time.

They should also consider how expensive the stock is, trading at nearly 46 times forward earnings estimates.

The stock has a lot of growth baked into it, and Nvidia will need to report a strong Q2 and give impressive Q3 guidance to justify the optimism.

For many investors (including myself), the price is too high. But for others, it may still represent a buying opportunity. At this valuation, Nvidia needs to report another year or two of flawless quarters; otherwise, it could be knocked from its perch. If you believe it can do that, Nvidia’s stock could still be interesting here. But with its history of reporting strong earnings, and being rewarded by investors for doing so, if you’re ready to be a buyer, you might want to buy before Aug. 28.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $779,735!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Aug. 28 Could Be a Massive Day for Nvidia Stock. Is It a Buy Right Now? was originally published by The Motley Fool

Ask an Advisor: I'm 54, a Nurse With $1 Million and a $7k Pension – Am I Ready to Retire?

I’m 54 with 26 years of service as a nurse. We go by the rule of 80 (your age plus years of service = 80) on our retirement plan. It will cover my health insurance. My pension will be around $7,000 per month minus taxes. I have a combined $750,000 in a 403(b) and Roth IRA. I also have $150,000 in stocks that aren’t doing well, $250,000 in real estate property earning $600 per month and $100,000 in cash. Can I retire now?

– Robin

Between your pension, your retirement accounts and your investment property, it looks like you’ve built a strong nest egg for yourself. Whether you can retire now depends on whether the after-tax income from those assets is enough to support your spending needs and wants, so let’s break down what that after-tax income might look like.

Do you need help running your numbers for retirement? Consider working with a financial advisor today.

Initial Assumptions

I need to make a few assumptions to run the numbers and provide an answer. First, I have assumed that the $750,000 in your 403(b) and Roth IRA is split as follows:

-

$550,000 in your 403(b). All of this money is pre-tax.

-

$200,000 in your Roth IRA. This account has been held for at least five years.

Second, I’ve assumed that $100,000 of your stock account is from contributions, that the remaining $50,000 is long-term capital gains, and that your withdrawals from this account are two-thirds basis and one-third capital gains.

Third, for Social Security purposes I have assumed your salary has been $84,000 per year and that you start collecting your benefit at age 62.

Finally, for tax purposes, I’ve assumed that you are single with no dependents. (If you’d like to learn more about building a retirement plan, consider matching with a financial advisor.)

Estimated Income Before 59 ½

With those assumptions in hand, we can use the 4% rule to estimate the amount of money you can safely withdraw from each account, on top of your pension, and run it through TurboTax’s tax estimator to ballpark the after-tax income you’ll have available for your spending needs.

I am going to start by ignoring your 403(b) since you are only 54 and withdrawals from that account would likely be subject to a 10% early withdrawal penalty before age 59 ½. I will add that account in the next section.

I will, however, include your Roth IRA since you are allowed to withdraw up to the amount you’ve contributed at any time and for any reason without penalty. (Keep in mind that if you’re under age 59 ½ and have had the account for less than five years, you would owe taxes and a 10% penalty when withdrawing investment earnings.)

Given all of that, here is your estimated annual pre-tax income from each source before age 59 ½:

-

Pension: $84,000

-

Roth IRA: $8,000 (untaxed)

-

Stock account: $6,000 ($2,000 in long-term capital gains)

-

Investment property: $7,200

That’s a total pre-tax income of $105,200. When I run those numbers through the tax estimator, I get an estimate of $13,138 in taxes owed, which leads to an after-tax income of $92,062 per year or $7,672 per month. (And if you need more help estimating your income and taxes in retirement, consider speaking with a financial advisor.)

Estimated Income After Age 59 ½

Once you reach age 59 ½, you can start taking penalty-free withdrawals from your 403(b). Using the 4% rule, that adds another $22,000 in pre-tax income, bringing your total pre-tax income to $127,200.

When I add that to the tax estimator, your estimated taxes owed are now $18,196. That gives you an after-tax income of $109,004 per year or $9,084 per month.

Adding Social Security

Once you reach age 62, you can start collecting Social Security as well.

I ran your numbers through the Social Security Administration’s Quick Calculator assuming you retire at age 54 and make $84,000 per year. Your estimated benefit at age 62 is $1,564 per month, which equates to $18,768 per year.

Adding that into our tax estimator brings your total pre-tax income to $145,968 and your estimated tax owed to $22,024. That leaves you with an after-tax income of $123,944 per year or $10,329 per month. (Social Security is a crucial source of retirement income and a financial advisor can help you plan for it.)

So, Can You Retire?

One major consideration here is that I don’t know what state you live in and therefore haven’t factored in state income taxes. Depending on where you live, that might reduce your after-tax income by a few percentage points.

With that said, if the after-tax numbers above could comfortably support your needs, you are probably in good shape. If it’s close, you will likely want to dig deeper and possibly work with a financial planner to get a more personalized answer. And if that after-tax income is less than what you need, it is probably a good idea to keep working until the numbers work in your favor.

Retirement Planning Tips

-

A financial advisor can help guide you through the often complex retirement planning process. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

The IRS has announced higher limits for 401(k) and IRA contributions for 2024. Savers with 401(k)s will be able to contribute up to $23,000, while those who are 50 and older will be permitted to save an additional $7,500. The contribution limit for IRAs is also set to increase, rising to $7,000 from 6,500. IRA owners who are 50 and older can save an extra $1,000.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Matt Becker, CFP®, is a SmartAsset financial planning columnist and answers reader questions on personal finance and tax topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Please note that Matt is not a participant in the SmartAsset AMP platform, nor is he an employee of SmartAsset, and he has been compensated for this article.

Photo credit: ©iStock.com/adamkaz, ©iStock.com/eric1513

The post Ask an Advisor: I’m a 54-Year-Old Nurse With $1 Million in Assets and a $7k Monthly Pension. Can I Retire Now? appeared first on SmartReads by SmartAsset.

You've Probably Never Heard Of This City, But Realtor.com Says It's The Hottest ZIP Code In America

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Every year, Realtor.com rolls out its list of the hottest ZIP codes in the United States. This list shows where potential homebuyers are searching and where homes are selling fastest. Realtor.com calculates the list using an algorithm that measures unique viewers per property on Realtor.com and the number of days a listing remains active on Realtor.com. The hottest areas are those that have a lot of views and where homes sell fast. This year’s list shows that affordability rules the day.

Trending Now:

For the first time since the company started the list in 2017, the same city has taken the top spot. The winner for two years in a row is 43230, Gahanna, OH. Gahanna is a suburb of Columbus with a population of over 35,000 people. It has been named one of the ‘Best Hometowns’ by Ohio Magazine. Founded in 1849, it recently celebrated its 175th birthday. It has a high percentage of owner-occupied homes and offers affordability. The median home list price is $345,000, which is around 11% less than the average for the Columbus metro area.

Another report from Realtor.com on the top ten hottest markets put Columbus at number one. While housing affordability and quality of life are strong drivers for the area, the Silicon Heartland phenomenon is another input. Companies like Intel, Amazon, and Alphabet invest heavily in the area. Although the plans for Intel’s new chip factory in nearby New Albany, OH, have been delayed, the region still expects an influx of well-paying jobs.

The rest of the hottest ZIP codes are mainly in the Northeast and Midwest, revealing that affordability is still driving interest. The other top cities include Ballwin, MO; Salem, MO; Basking Ridge, NJ; Rochester, NY; Mount Laurel, NJ; Leominster, MA; Westfield, MA; Highland, IN; and Macungie, PA. Each top 10 has a lower median list price and/or median listing price per square foot than surrounding areas. “This year’s hottest ZIPs reflect the focus on affordability that home shoppers have had over the last few years in the face of high housing costs. Concentrated in larger metros across the Northeast and Midwest, these top 10 ZIPs attracted highly qualified homebuyers seeking more space without relinquishing proximity to urban amenities,” said Realtor.com Chief Economist Danielle Hale.

Read More:

The fact that the South and West did not register on the list may reflect some cooling in markets that have heated up over the last several years. Inventory has risen in many of those markets, and days on the market have increased. Homes in the hottest ZIP codes were on the market for an average of just 13 days. Lower prices in these markets also allowed buyers to put down an average of 16.7% as a down payment compared to the national average of 14.0% in the first half of 2024.

Overall, home sales are still below average, reflecting a market that is out of reach for many buyers. However, the hottest ZIP codes list underlines the idea that the Midwest and lower-priced markets in the Northeast are consistently able to attract buyers. This is good news for many homeowners in these regions whose homes have not appreciated as quickly as in some other coastal and urban areas. However, all this attention may cause prices to rise, so potential buyers looking in these ZIP codes may want to move quickly.

You Can Profit From Real Estate Without Owning Property

The current high-interest-rate environment has created an incredible opportunity for income-seeking investors to earn massive yields and you don’t have to own property to do it…

The Arrived Homes investment platform has created a Private Credit Fund, which provides access to a pool of short-term loans backed by residential real estate with a target 7% to 9% net annual yield paid to investors monthly. The best part? Unlike other private credit funds, this one has a minimum investment of only $100.

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

This article You’ve Probably Never Heard Of This City, But Realtor.com Says It’s The Hottest ZIP Code In America originally appeared on Benzinga.com

47-Year-Old 'Unmotivated' Multimillionaire Doctor Asks Dave Ramsey – Retire Now Or Work 13 More Years To Get Pension And Free Healthcare?

Renee from San Jose recently called into the Dave Ramsey Show, seeking advice on a dilemma many can relate to – finding the motivation to continue working in a career she loves but that is increasingly overwhelming.

Don’t Miss:

At 47, Renee is a successful OB-GYN with an impressive financial portfolio: over $3.7 million in retirement and investment accounts, three paid-off homes, a $200,000 salary, and no debt. But despite her financial security, she’s struggling to see a path forward that keeps her passionate about life and work.

If she sticks it out and keeps working until 60, Renee explains she’ll get her pension at 60 instead of waiting until 65. She’ll also get free health care for the rest of her life, so she’s considering working the additional 13 years.

Renee shared with Dave Ramsey that she loves her job, especially the privilege of seeing patients and delivering babies. However, the demands of her work, especially in the post-COVID landscape, are taking a toll. “Work is overwhelming these days … I always work more than my paid hours,” she admitted. Renee has a dream outside of medicine – attending music school, where she could pursue her passion for playing the piano and violin.

Dave’s response was clear: “You don’t need motivation to work for 13 more years if you love everything about it. What is it you don’t like?” He encouraged Renee to focus on what brings her joy rather than getting bogged down by the demanding aspects of her job.

See Also: The number of ‘401(k)’ Millionaires is up 43% from last year — Here are three ways to join the club.

Dr. John Delony, also on the show, gave key advice: “You don’t need motivation; you need a mission.” He suggested that Renee might be dealing with a sense of lost opportunity. The idea of not pursuing her musical dreams while she’s still able is weighing on her. Delony asked if a sense of guilt or shame was holding her back. Renee didn’t label it as guilt but acknowledged a fear of lost opportunity. “If in the next 13 years I develop arthritis or lose my hearing, will I regret not having taken the chance?” she pondered.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

Dave and John advised Renee to reconsider her practice to create space for her musical pursuits. “Cut your practice in half,” Dave suggested, noting that Renee could afford to scale back without compromising her financial stability. He emphasized the importance of balance: “You get too much joy and satisfaction from your medical career … but it’s eating into what you want to do.”

See Also: Can you guess how many Americans successfully retire with $1,000,000 saved? The percentage may shock you.

John echoed this sentiment, advising her that the decision to reduce her hours doesn’t have to be final. “Guess what, there’s always going to be more babies,” he noted, encouraging her to find a balance that allows her to explore her passion for music without fully stepping away from a career she loves.

Renee’s story reminds us that sometimes the path forward isn’t about choosing between two loves but finding a way to make room for both. By reducing her workload and pursuing her musical dreams, Renee can create a life that fulfills her professionally, financially, and personally. As Dave put it, “The only reason I wouldn’t quit completely is I also think you’ll regret that because I think you get a level of joy out of this.”

This advice is valuable for anyone struggling to balance a demanding career with other life passions. Consulting with a trusted financial advisor can provide clarity and options tailored to your unique circumstances. It’s not only about the numbers – crafting a life that brings fulfillment and purpose, no matter how many years are left on the clock.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article 47-Year-Old ‘Unmotivated’ Multimillionaire Doctor Asks Dave Ramsey – Retire Now Or Work 13 More Years To Get Pension And Free Healthcare? originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Snowflake Reports Widening Losses, Sending Its Stock Lower

Joan Cros / NurPhoto / Getty Images

Key Takeaways

-

Snowflake’s second-quarter revenue grew from the year-ago period and beat analysts’ projections, but losses widened as costs rose.

-

The company’s outlook also missed analysts’ estimates compiled by Visible Alpha.

-

Snowflake CEO Sridhar Ramaswamy highlighted the company’s opportunities related to artificial intelligence.

Snowflake’s (SNOW) second-quarter revenue grew from the year-ago period and beat analysts’ projections, but losses widened as costs rose.

The data cloud company reported second-quarter revenue of $868.82 million, a 30% jump from the year-ago period, and above analysts’ estimates compiled by Visible Alpha. However, Snowflake’s net loss of $317.77 million or 95 cents per share widened from the year prior and represented a more significant loss than analysts projected. Excluding one-time items, adjusted earnings of 18 cents per share beat expectations.

Snowflake’s Outlook Misses Projections

The company said it expects fiscal third-quarter revenue to be between $850 million and $855 million and raised its full-year outlook to $3.36 billion, though both missed analysts’ expectations.

“The quarter was hallmarked by innovation and product delivery, and great traction in the early stages of our new AI products,” Snowflake CEO Sridhar Ramaswamy said in a release, adding that “with the combination of our platform, the network effect of collaboration and our AI innovations, we have a huge opportunity ahead to deliver even greater value to our customers.”

Shares of Snowflake were down about 7% at $125.70 in extended trading Wednesday following the company’s earnings report.

Read the original article on Investopedia.

Is Pfizer Stock A Buy Or A Sell After Covid/Flu Shot Misses Its Mark?

Pfizer (PFE) stock edged close to a sell zone in mid-August after the company’s BioNTech-partnered Covid/flu shot missed its mark in a recent study.

↑

X

How Novo Nordisk, Wegovy And Ozempic Are Changing The Weight-Loss Game For Patients And Investors

On Aug. 16, shares dropped 1.4% after Pfizer said the vaccine outperformed existing shots that protect against influenza. Antibody responses to Covid strains were in line with the current shot, but participants in the final-phase study generated a lower number of antibodies capable of handling influenza B.

The company might now have to adjust its vaccine.

Promisingly, Pfizer posted a beat for its June quarter, helped by heart-disease drug Vyndaqel and cancer treatment Padcev. The latter was acquired alongside Seagen, a developer of antibody drug conjugates, or ADCs. Pfizer also hiked its guidance for the year by $1 billion at the midpoint.

Pfizer says it’s on track to deliver at least $4 billion in net cost savings by the end of the year.

Obesity Treatments In Focus

Investors remain highly focused on Pfizer’s efforts in obesity treatment. The company recently said it plans to advance danuglipron into additional testing. Danuglipron targets GLP-1, a hormone that slows how fast the stomach empties itself and improves markers of blood glucose. Unlike leading injectables Wegovy and Zepbound, danuglipron is an oral medicine.

In a conference call with analysts, Chief Executive Albert Bourla says danuglipron has a “very competitive” profile in terms of tolerability and effectiveness compared with other experimental oral obesity treatments. But Leerink Partners analyst David Risinger remains skeptical. Pfizer plans to have additional test results in the first quarter. He kept his market perform rating on Pfizer stock.

Notably, Pfizer has three clinical and several preclinical candidates for obesity treatment. The company previously scrapped development of a twice-daily version of danuglipron due to high rates of gastrointestinal side effects. Before that, the company stopped developing another once-daily pill that caused elevated liver enzymes.

Pfizer stock broke out on July 17 after Roche (RHHBY) unveiled promising results for its oral weight-loss drug.

But Pfizer also recently shut down a gene therapy study for children with a muscle-wasting disease known as Duchenne muscular dystrophy. Neither the primary goal of the study, nor secondary goals, met the bar for success. The firm did gain approval, however, for a hemophilia B gene therapy.

The company also announced the looming departure of Chief Scientific Officer Mikael Dolsten. Dolsten will stay in his position until the company finds his replacement.

So, is PFE stock a buy or a sell right now?

Pfizer Stock Fundamentals: Vyndaqel, Padcev Upside

During the second quarter, adjusted earnings came in at 60 cents per share, beating expectations for 46 cents, according to FactSet. Earnings declined 11% year over year. Sales rose 3% operationally to $13.3 billion, narrowly above forecasts for $13.03 billion.

Notably, revenue from heart-disease drug Vyndaqel surged 71% to $1.32 billion and topped forecasts for $1.01 billion. Padcev, which Pfizer acquired with Seagen, brought in $394 million, topping calls for $352.6 million.

As expected sales of Covid vaccine Comirnaty, developed with BioNTech (BNTX), fell 87% to $195 million. That missed expectations for $200 million. But Paxlovid, the Covid treatment, brought in $251 million, topping forecasts and soaring 79%.

For the third quarter, Pfizer stock analysts forecast earnings of 59 cents per share and $14.91 billion in sales. Earnings would reverse from a year-earlier decline of 17 cents a share. Sales would rise 12.7% and accelerate from single-digit sales growth in the second quarter.

Investors are encouraged to seek stocks with 20%-25% recent sales and earnings growth. Pfizer is not hitting those marks. Big institutional investors — who account for up to 70% of all market trades — usually look for stocks with accelerating earnings and sales growth.

Pharmaceutical Company’s Annual Metrics

Pfizer’s sales have fallen markedly since hitting a record in 2022. Last year, sales tumbled 42% to nearly $58.5 billion. Top sellers included Comirnaty and Paxlovid, which brought in $11.22 billion and $1.28 billion, though sales tumbled a respective 70% and 93% year over year.

Blood thinner Eliquis generated $6.75 billion in sales, up 4% on a strict, as-reported basis. Prevnar sales inched 2% ahead to $6.44 billion.

But other key products saw downfalls. Revenue from Xeljanz, which treats inflammatory conditions, fell 5% to $1.7 billion. Sales of Enbrel, developed with Amgen (AMGN), toppled 17% to $830 million. Pfizer sells Enbrel outside the U.S. and Canada.

Pfizer just hiked its outlook for 2024 and expects adjusted earnings of $2.45 to $2.65 per share and sales of $59.5 billion to $62.5 billion. At the midpoints, earnings would surge 39% as sales pop more than 4%.

Pfizer Stock And Recent News

The obesity treatment decision puts Pfizer back in the race vs. fellow Big Pharma names like Eli Lilly (LLY), Novo Nordisk (NVO), Roche and Amgen (AMGN). But Leerink’s Risinger doesn’t expect to see any effectiveness and safety results from Pfizer’s tests until 2026, at the earliest.

Further, a recent study of Elrexfio shows “compelling overall survival data,” Roger Dansey said in a written statement. Dansey is Pfizer’s chief development officer for oncology.

Pfizer tested Elrexfio in patients with relapsed or refractory multiple myeloma. This means the cancer has returned following treatment or isn’t susceptible to other treatments. Overall, patients lived for a median of 24.6 months, and their disease didn’t worsen for a median of 17.2 months.

In another study, Pfizer tested its Seagen-acquired drug, Adcetris, in patients with diffuse large B-cell lymphoma. This is the third type of lymphoma in which Adcetris has had an overall survival benefit.

But the gene therapy study was a pockmark for Pfizer stock. The company scrapped its study after the Duchenne muscular dystrophy treatment failed to improve motor function in boys age 4 to 7. Boys are more likely to have Duchenne.

Secondary goals, including 10-meter run/walk and time to rise from the floor also didn’t meet the bar for success. Pfizer’s dropout means Sarepta Therapeutics (SRPT) has one fewer competitor for its newly approved gene therapy, Elevidys.

Technical Analysis: PFE Stock Tops 50-Day Line

Pfizer stock is above its 50-day and 200-day moving averages, and broke out of a flat base with a buy point at 29.73, MarketSurge shows. But shares tiptoed close to a sell zone on Aug. 16, falling 6.3% below their entry. Savvy investors are encouraged to cut their losses when a stock falls 7% to 8% below is entry.

(Related: Keep tabs on chart patterns by visiting IBD’s MarketSurge.)

Shares of Pfizer have a Composite Rating of 43 out of a best-possible 99. The measure weighs a stock’s key growth metrics against all other stocks. Leading stocks tend to have Composite Ratings of 95 or better, according to IBD Digital.

Pfizer stock has a Relative Strength Rating of 27 out of 99. The RS Rating measures a stock’s 12-month running performance against all other stocks. That RS Rating means Pfizer stock ranks in the lowest 27% of all stocks in terms of performance over the last year.

The pharmaceutical company’s EPS Rating, a measure of profitability, is 34 out of 99. The EPS Rating compares a stock’s recent and longer-term earnings growth against all other stocks.

Is PFE Stock A Buy Or A Sell?

Based on savvy rules of investing, PFE stock is no longer a buy. Shares have fallen below their buy zone. The stock could be considered a buy if it returns to the 5% chase zone.

Pfizer stock also isn’t considered a sell. It hasn’t fallen 7% to 8% below its entry — triggering a sell rule that tells investors to cut their losses — nor has it undercut its key moving averages.

But Pfizer stock still has to prove its fundamental and technical merit.

It will be important to watch how Pfizer stock performs as the company shores up its pipeline and seeks new approvals in its efforts to move beyond the astronomical growth it saw at the height of the pandemic. Though it has a booster Covid shot, like rivals Moderna (MRNA) and Novavax (NVAX), analysts don’t expect sales to ever hit their pandemic-era growth.

Instead, the Street is closely watching the adult RSV vaccine, which hit the market at the same time as a competitor from GSK (GSK). Pfizer’s efforts now that it owns Seagen could also be key to future growth.

To find the best stocks to buy and watch, check out IBD Stock Lists. Make sure to also keep tabs on stocks to buy or sell.

Follow Allison Gatlin on Twitter at @IBD_AGatlin.

YOU MAY ALSO LIKE:

Biotech Stocks To Watch And Pharma Industry News

Want To Get Quick Profits And Avoid Big Losses? Try SwingTrader

IBD Stock Of The Day: See How To Find, Track And Buy The Best Stocks

Watch IBD’s Investing Strategies Show For Actionable Market Insights

Best Growth Stocks To Buy And Watch: See Updates To IBD Stock Lists