Prominent Billionaires Just Bought the Dip With These 3 Stocks

Hedge funds and investment firms with over $100 million in assets are required to disclose their stock portfolios throughout the year. The updates for the second quarter of 2024 are rolling in now, and this includes updates from the financial vehicles managed by prominent billionaires Warren Buffett and Bill Ackman, as well as by multimillionaire Michael Burry.

This wealthy trio has been busily buying the dips for three value stocks: Ulta Beauty (NASDAQ: ULTA), Nike (NYSE: NKE), and Shift4 Payments (NYSE: FOUR). Here’s why these bargains were too good for these investors to pass up.

1. Ulta Beauty: Down 33%

As of this writing, Ulta Beauty stock is down 33% from its all-time high and down 22% in 2024. Shares started sliding after management warned of slowing sales for cosmetic products, leading it to lower the company’s full-year financial guidance.

It was a dip too good for Warren Buffett to pass up. His Berkshire Hathaway opened a roughly $260 million position in Ulta Beauty stock during Q2. Granted, that’s a small position for a company as big as Berkshire, but it’s still noteworthy nonetheless.

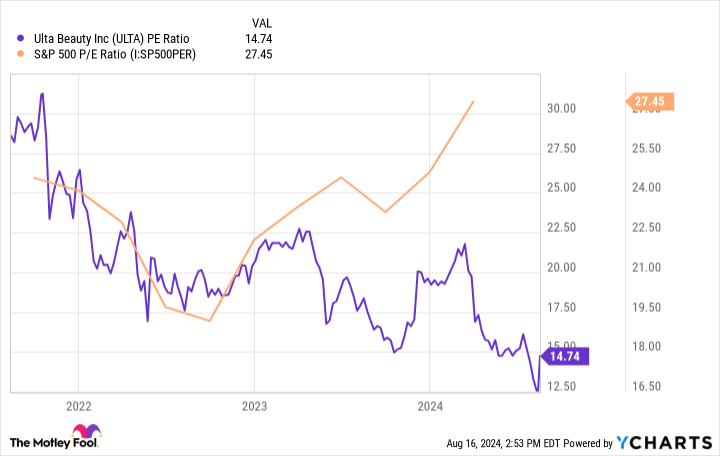

Buffett is a renowned value investor, and he likely sees potential in Ulta Beauty. The stock trades at less than 15 times earnings, which is significantly cheaper than the average price-to-earnings (P/E) ratio for the S&P 500, as seen below.

Sales growth may be slow. However, Ulta Beauty still expects to earn over $1.5 billion in operating profit in 2024, and it plans to return $1 billion to shareholders via share repurchases. Given the stable demand for cosmetic products, I expect strong profits and share repurchases to continue for years to come, providing high chances of positive long-term returns for Ulta Beauty stock from here.

2. Nike: Down 53%

In Q2, Bill Ackman’s Pershing Square bought more than 3 million shares of athletic apparel company Nike — a position worth roughly $229 million. It’s the smallest position in Ackman’s portfolio, but with only eight stocks in the total portfolio, any addition is noteworthy.

Ackman is a value investor who studied Warren Buffett’s style before getting his own start. Nike indeed looks like a value stock, considering it has been trading at its cheapest valuation since 2012.

In short, Nike stock is down because sales are slumping and profits are contracting. The company’s fiscal 2025 started in June, and management is calling it a “transition year.” Management expects its revenue to be down single digits compared to fiscal 2024, but profits could be down more than that.

Ackman is likely betting that a consumer brand as strong as Nike will find its way eventually, making the stock a strong candidate for a rebound once its business stabilizes.

3. Shift4 Payments: Down 20%

Like Ackman, Michael Burry manages a concentrated portfolio of just 10 stocks through his Scion Asset Management. The investor famously made his fortune by shorting the U.S. housing market during the Great Recession. Judging by his portfolio today, I’d say he’s still not very bullish on America.

Three of Burry’s top five positions are Chinese stocks, showing his preference for those companies. However, in Q2, he took a big swing at financial technology (fintech) company Shift4 Payments, making it nearly 14% of the portfolio.

Shift4 stock may not be down as much as the other two in this article. However, shares have gone nowhere for the last three years as the chart below shows, even though its profitable growth during this time has been impressive.

Shift4 has focused on winning large, high-volume customers, which has provided strong revenue growth. Adjusting for network fees (a common adjustment for fintech companies), the company expects to grow its revenue by at least 44% this year. And it expects to generate free cash flow of nearly $400 million.

For perspective, Shift4’s market cap is only $5.4 billion as of this writing, meaning it trades at a cheap forward price-to-free-cash-flow valuation of about 14. Coupled with its impressive top-line growth, I believe Shift4 Payments stock might be the best buy of these three stocks.

To be clear, Ulta Beauty and Nike are cheap based on multiple valuation metrics, which is good. But they’re also more mature companies with limited top-line growth potential. Either stock could have upside, but Shift4 is still growing at a fast pace, in addition to being cheaply valued. That may carry it to bigger gains in the coming years.

Should you invest $1,000 in Ulta Beauty right now?

Before you buy stock in Ulta Beauty, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ulta Beauty wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $779,735!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Jon Quast has positions in Shift4 Payments. The Motley Fool has positions in and recommends Berkshire Hathaway, Nike, and Ulta Beauty. The Motley Fool recommends Shift4 Payments and recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.

Prominent Billionaires Just Bought the Dip With These 3 Stocks was originally published by The Motley Fool

Is the Stock Market Going to Crash? I Don't Know. That's Why I Own This Recession-Resistant Stock.

The stock market has rebounded nicely from the 2022 bear market lows, and most major indexes are within striking distance of their all-time highs. With expectations of falling interest rates, and the continued strength of megacap technology stocks, things have been going quite well for stock investors.

However, it’s important for all investors to know that the stock market will crash again — it’s just a question of when. A crash could come next month, next year, in five years, or it could come tomorrow. We have no idea, and there are many potential factors that could cause a crash. But stock market crashes are a normal part of being a long-term investor.

I aim to fill my own portfolio with stocks that should do well over the long term, regardless of whether the market crashes or not. But there’s one in particular that I’d be confident to own during a market crash, and that’s Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B).

A collection of recession-proof businesses

First, there are three major components to Berkshire’s business: its operating businesses, its stock portfolio, and its cash. The stock portfolio is clearly not immune from a stock market crash (although the types of stocks Berkshire owns tend to hold up better than most).

When it comes to the operating businesses, there are over 60 different subsidiary businesses. Some of them could be vulnerable to market crashes and recessions, but the largest Berkshire subsidiaries should be just fine. GEICO and Berkshire’s other insurance operations are a big business and are very close to being truly recession-proof. After all, people still pay their auto insurance when times get tough.

Berkshire Hathaway Energy is another massive component of the company and is also very recession-proof. Even in tough times, electric and gas bills still need to get paid. I could go on — BNSF Railroad, Pilot Travel Centers, and Duracell are also great examples of businesses that should perform well no matter what.

Berkshire’s cash is the key differentiator

To be fair, there are plenty of recession- and crash-resistant businesses you can invest in. There is no shortage of utilities stocks, for example. But what makes Berkshire different is its unmatched financial flexibility.

At the end of the second quarter, Berkshire had a staggering $277 billion in cash and short-term investments on its balance sheet. For the time being, the bulk of this is in Treasury securities that pay Berkshire about 5% annually.

However, if a market crash or prolonged recession comes, this cash stockpile gives Warren Buffett and his team a massive war chest to take advantage of bargains. Berkshire can use it to buy stocks that have plunged or can negotiate unique investment deals. In fact, Berkshire’s Bank of America investment can be traced back to a $5 billion preferred stock deal with warrants that Buffett negotiated in the wake of the financial crisis.

Berkshire in a market crash

Berkshire’s stock portfolio can become volatile in a crash, but its operating businesses should stay profitable, and its cash can actually allow Berkshire to emerge from a market crash even stronger than it went in.

I’m not saying that Berkshire’s stock price won’t fall in a market crash. It can, and it has in previous crashes. But the point is that the business is in a better position than that of any other large-cap company to make it through a market crash largely unscathed.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $787,394!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Matt Frankel has positions in Bank of America and Berkshire Hathaway. The Motley Fool has positions in and recommends Bank of America and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Is the Stock Market Going to Crash? I Don’t Know. That’s Why I Own This Recession-Resistant Stock. was originally published by The Motley Fool

Here's how Jerome Powell could surprise markets with his Jackson Hole speech

-

Goldman Sachs says Jerome Powell’s speech at Jackson Hole on Friday could deliver some surprises.

-

It wouldn’t be the first time he used the event as an opportunity to reset investors’ expectations.

-

Markets are eyeing rate cuts of 100 basis points between now and the end of the year.

All eyes are on Jerome Powell’s speech at the Federal Reserve’s Jackson Hole Symposium on Friday, and Goldman Sachs says the central bank’s chairman could still surprise investors despite their confidence in the Fed’s path for the rest of the year.

It wouldn’t be the first time Powell used his Jackson Hole speech as an opportunity to reset the market’s expectations.

In 2022, when inflation was hitting a 40-year high, Powell delivered a short but direct eight-minute speech that reinforced the Fed’s path to raising interest rates to combat inflation even though the stock market was in the middle of a painful bear market.

Bond yields surged, and the S&P 500 lost nearly 8% in the week after Powell’s hawkish Jackson Hole speech.

But with inflation almost under control and the labor market showing signs of deterioration, Powell could strike a much different tone on Friday.

And according to Goldman Sachs, there are a few ways the Fed boss could catch markets off guard.

“Possible dovish surprises could include a more concerned take on the labor market or any suggestion that the high level of the fed funds rate is inappropriate in light of the progress made on inflation,” David Mericle, a Goldman economist, said in a note on Tuesday.

Such an event would likely be bullish for the stock market, as it would reinforce the idea that the Fed will start to cut interest rates at its Federal Open Market Committee meeting in September and that the bar for a cut of more than 25 basis points or a string of consecutive cuts is lower than most expect.

The CME FedWatch tool suggests investors see 100 basis points of rate cuts through the rest of this year.

On the other hand, Powell could shock markets to the downside if he adopts a more hawkish tone than investors expect.

“A possible hawkish surprise might be highlighting instead that broad financial conditions are still quite easy, which could imply that the high level of the funds rate, while perhaps unnecessary, is not an urgent problem,” Mericle said.

Mericle ultimately expects Powell to be more dovish in his Jackson Hole speech, given the weak July jobs report and recent data that indicates inflation is falling closer to the Fed’s long-term target of 2%.

The recent downward revision to employment growth of 818,000 jobs also doesn’t help the Fed’s case for remaining hawkish.

“This might mean expressing a bit more confidence in the inflation outlook and putting a bit more emphasis on downside risks in the labor market,” the note said. “Powell might also reiterate that the FOMC is watching the labor market data carefully and is well positioned to support the economy if necessary.”

Goldman Sachs also gave a rundown of Powell’s Jackson Hole speeches and their impact on Treasury yields since he became the Fed chairman in 2018.

Read the original article on Business Insider

How Much Money Do You Need To Be Considered Wealthy?

Most Americans dream of being rich. But how much does it take to be considered wealthy? A net worth of $2.5 million is what Americans think it takes to earn the wealthy moniker, according to Charles Schwab’s annual Modern Wealth survey.

↑

X

How To Become A Stock Market Millionaire – And The Fastest Way To Get There

That seven-figure sum is up 14% from a year ago, when survey respondents thought amassing $2.2 million was enough.

The good news: You don’t have to be wealthy to fund a good lifestyle and stay out of financial trouble. Americans say the average net worth required to be “financially comfortable” is $778,000, according to the Charles Schwab (SCHW) survey.

Breaking Down What’s “Wealthy”

When it comes to being wealthy, Baby Boomers think it takes a net worth of $2.8 million. Gen Xers say $2.7 million. Millennials think it takes $2.2 million to be wealthy. And the Gen Z generation comes in low at $1.2 million.

Where you live can skew the numbers, too. People who live in expensive locales like San Francisco and New York City say it takes $4.4 million and $2.9 million, respectively, to be considered wealthy. Whereas the magic number dips to $2.3 million for Americans living in Phoenix and $2.2 million for folks living in Dallas.

Only 21% of Americans responding to Schwab’s survey think they will be wealthy within their lifetimes.

These numbers, of course, are just guesses. Still, getting a ballpark number of how big an account balance is needed to reach one’s financial goals has its benefits, says Rob Williams, managing director of financial planning at Charles Schwab.

“When you pull numbers out of thin air, it’s kind of an abstract concept,” said Williams. “A lot of Americans say, I want to be a millionaire. Well, let’s connect that to the reality of the financial plan, the investments you’re making. Let’s put some discipline around that and take ownership of the steps required to achieve those goals.”

What’s more, everybody’s magic number to feel wealthy or financially comfortable is different. And not having to worry about money isn’t a guarantee even for folks with a lot of money socked away, says Jason Grover, founder and financial planning specialist at Grover Financial Services in Pittsford, N.Y.

“It comes down to not how much money you have, but how much you spend,” said Grover. “I have clients that can retire comfortably with $200,000 in savings because they have pensions, they’ve saved well and they’re not spendthrifts. And there are people with $2.5 million dollars that can’t fathom retiring because of their lifestyle.”

There are many sources of wealth. Cash in the bank is only part of it. There’s also the value of stocks, bonds, mutual funds and ETFs. Home equity is key, too, as are 401(k) and IRA account balances. Even the antique painting hanging in the living room, the cars and boats parked in the garage and cryptocurrencies count as wealth.

And wealth means different things to different people, says Williams. For some people, wealth means financial freedom. For others wealth is all about dollars and what they can buy. Some view the upside of wealth in the financial confidence it conveys.

So, what are the building blocks to generate enough money to join the ranks of the wealthy?

Commit To Saving

Saving and investing sounds easy. “But not everyone does that,” said Williams.

It’s about the basics. Start saving early to allow your money to grow and benefit from compounding. “Compound interest can really be a springboard towards building wealth,” said Grover.

It’s vital that you also invest in your 401(k) at work or set up an individual retirement account (IRA). And diversify your investments in a broad basket of stocks in a fund or ETF that tracks a broad equity index like the S&P 500.

Grow Your Portfolio

Invest in stocks and growth-oriented assets to keep expanding your wealth. Investing is different from saving. You can’t grow wealth stashing your cash under the mattress and earning 0% interest. You must invest for growth. That means owning stocks.

“Investing is an act of optimism, an act of ownership in the U.S. economy,” said Williams. “And the most upside comes from owning equities. (Historically), stocks have been the most powerful wealth-building tool.”

Profit From Your 401(k)

Employer-sponsored retirement accounts are the road to a secure retirement. With traditional pensions virtually extinct, having money deducted from your paycheck and contributing to your 401(k) is a key step to building wealth and a secure retirement.

“Get the most out of your 401(k),” said Grover. That means contributing enough of your own money to take advantage of your company’s match. And make sure you are investing in growth-oriented assets like stocks, as well as fixed-income assets like bonds. Your risk tolerance and time horizon before retirement should match.

A big plus today is new employees don’t have to do anything to start saving. A growing number or 401(k) plans sign you up on day one with automatic enrollment. “More companies are forcing their employees to save right away, unless they opt out,” said Grover. “That’s a huge benefit to the average person saving for retirement.”

And starting next year, thanks to the Secure Act 2.0, employers will be required to automatically enroll eligible new employees in the 401(k) plan.

Investing in a Roth 401(k), which is funded with already taxed dollars but comes with tax-free withdrawals, is a good option for younger workers. They are in lower tax brackets early in their careers.

Build Equity Via Homeownership

A house is a place to call home. But it’s also a place to build wealth, says Williams. Every mortgage payment pays off a part of the loan and builds home equity.

Homes, like stocks and other assets, can also rise in value over time. In the second quarter of 2024, 89% of homes in measured metro areas registered price gains, according to the National Association of Realtors. The national median single-family home price at the end of June was $422,100, up 4.9% from a year ago.

Put A Financial Plan In Place

You can’t get to where you are going unless you map out a plan to get there.

Just 18% of Americans responding to Schwab’s survey said, “I’m on top of my finances now.” So, reaching out to a financial advisor for help is something savers might think about.

Don’t live and spend just for today, says Williams. It’s important to acknowledge that you have future financial goals. “A financial plan is a living, breathing, ongoing road map” for your financial future, said Williams. Setting up a financial plan “helps you take action.”

And barring an unforeseen life change, such as death, divorce, the birth of a child and other curveballs life throws you, stick to your plan, adds Grover.

“What we do have control over is how much we spend, save and invest. And the financial plan is crucial to helping us manage our emotions,” Grover said. “That’s what a financial plan is really about: protecting ourselves from ourselves.”

Not everyone can accumulate $2.5 million and be deemed wealthy. But most people who are regular savers can come up with the $778,000 Americans feel they need to be financially comfortable, Williams says.

“That may look like a large number, but it’s achievable with relatively simple, straightforward discipline savings steps,” said Williams.

YOU MAY ALSO LIKE:

Look Out Below If You Own 9 Stocks That Did This

8 Hot Big Stocks Aren’t In The S&P 500 – But You’ll Wish They Were

Intel Director Lip-Bu Tan Leaves Board of Ailing Chipmaker

(Bloomberg) — Intel Corp. director Lip-Bu Tan, a semiconductor industry veteran brought in two years ago to help with the chipmaker’s comeback effort, has stepped down from the board.

Most Read from Bloomberg

Tan informed the board on Aug. 19 that he would be leaving, effective immediately, Intel said in a filing on Thursday, confirming an earlier report by Bloomberg News. The director, a former chief executive officer of Cadence Design Systems Inc. who also runs an investment firm, cited “demands on his time” for driving the move.

“This is a personal decision based on a need to reprioritize various commitments and I remain supportive of the company and its important work,” he said in the filing.

The move follows a disastrous quarterly report earlier this month, which sent Intel shares on their worst rout in decades. The once-dominant chipmaker gave a dour forecast, suspended its longstanding dividend and announced plans to slash more than 15% of its workers.

CEO Pat Gelsinger has been trying to restore Intel’s standing in the chip industry by pouring money into new factories and technologies, but rivals like Nvidia Corp. and Advanced Micro Devices Inc. have only made further gains.

Tan was elected to the board in September 2022 and appointed to Intel’s mergers and acquisitions committee.

When Tan joined the board, he praised Gelsinger’s bold leadership and said the company was “undergoing a massive transformation to capitalize on the tremendous opportunities that lie ahead.”

More recently, Intel has been focused on making cutbacks. In addition to efforts to pare jobs and expenses, the chipmaker scrapped plans for its annual Innovation event. It also recently sold its stake in chip technology creator Arm Holdings Plc.

–With assistance from Debby Wu.

(Updates with Intel confirmation in second paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

10 Reasons to Buy Nvidia Stock Like There's No Tomorrow

One of the biggest investing developments of the past couple of years has been the opportunity represented by artificial intelligence (AI), and arguably no company is better positioned to profit from this secular tailwind than Nvidia (NASDAQ: NVDA). The chipmaker has become the poster child for the AI revolution, giving it the pole position in a large and growing opportunity.

Generative AI is expected to add between $2.6 trillion and $4.4 trillion to the global economy over the coming decade, according to McKinsey & Company, and Nvidia is at the leading edge of the trend. That massive opportunity is one of many reasons that investors should be buying Nvidia stock like there’s no tomorrow. Let’s look at a few others.

1. Nvidia dominates the data center market

There’s little argument that Nvidia has the inside track when it comes to graphics processing units (GPUs) in data centers, but some investors may not realize the extent of the company’s dominance.

Nvidia controls an estimated 92% of the market for data center GPUs, according to IoT Analytics, though that estimate may be conservative. TechInsights goes further, claiming Nvidia controlled 98% of the data center GPU market in 2023. While estimates vary, the indication is clear.

The competition is intent on chipping away at its dominance. However, given Nvidia’s early lead and sustained momentum, it should remain the clear leader for years to come.

2. It’s the undisputed leader powering earlier versions of AI

While generative AI has made a splash since early last year, AI has been around for decades, and Nvidia has been helping to power those advanced algorithms. For example, Nvidia controls 95% of the market for GPUs used in machine learning — an earlier version of AI — according to estimates provided by New Street Research. This experience would soon come in handy.

3. The inside track for generative AI

Nvidia’s wealth of expertise in the field and dominance in earlier versions of AI made it the clear choice for developers when generative AI exploded onto the scene. Developments in the space are moving at warp speed, so it is even more difficult to pin down Nvidia’s market share. Analysts from Mizuho suggest it’s somewhere between 70% and 95% for AI models. That aligns with an estimate by Fortune, which puts Nvidia’s market share at 80%.

4. The platform factor

Nvidia’s dominance in the AI and data center markets was years in the making, but it isn’t just the result of the company’s chip process. In 2007, Nvidia launched Compute Unified Device Architecture (CUDA), an architectural framework and parallel computing platform that helps developers by dramatically accelerating computing applications built on its GPUs.

According to Nvidia, CUDA provides developers with more than 300 libraries and 600 AI models, and supports more than 3,700 GPU-accelerated applications. This ecosystem includes more than 5 million developers at 40,000 companies, which helps explain why it will be so difficult to “chip” away at Nvidia’s dominance, given that it’s developers’ preferred development platform of choice.

5. It isn’t just about chips anymore

While its processors form the foundation of Nvidia’s empire, it isn’t just about chips anymore. The company has been gradually expanding into adjacent markets and also provides ancillary products that help its GPUs perform even better. These other opportunities could help fuel the next leg of Nvidia’s growth.

For example, Nvidia supplies InfiniBand networking solutions, including switches and adapters that reduce latency and help speed network connections. Then there’s the NVLink and NVLink Switch, used to connect multiple GPUs in a daisy chain, accelerating the resulting connections to unleash their full power. The company also offers its own line of turnkey AI servers and supercomputers.

6. Robust research and development (R&D) spending

It’s no accident that Nvidia has maintained its position atop the AI chip heap. The company has a long track record of spending heavily on the research and development (R&D) necessary to maintain its technological lead. For its fiscal 2024 (ended Jan. 28), Nvidia spent nearly $8.7 billion on R&D, up 18% and amounting to 14% of the company’s total revenue.

Besides maintaining its technological edge, increased spending has also helped the company innovate faster. Earlier this year, Nvidia announced that it would no longer keep to its historical two-year cadence for unveiling new processors, but rather release new chips every year.

It was already difficult for rivals to keep up with Nvidia’s frantic development pace, but it will be even harder now.

7. Let’s not forget gaming

At this point, it almost seems like a footnote, but Nvidia began its journey as a pioneer in video games. It was parallel processing, or the ability to conduct a magnitude of complex calculations simultaneously, that revolutionized the gaming industry, turning boxy figures into lifelike images.

Nvidia is still the undisputed leader, with an 88% share of the discrete desktop GPU market, according to industry analyst Jon Peddie Research. This leaves scraps for the competition. Don’t expect that to change anytime soon.

8. An explosion of profitability

The advent of generative AI early last year and the resulting rapid adoption has been a boon to Nvidia. For fiscal 2024, revenue of $60 billion surged 126% year over year. This brought with it a flood of increasing profitability, as diluted earnings per share (EPS) of $11.93 soared 586%.

That trend continued into the current year. In its fiscal 2025 first quarter (ended April 28), revenue of $26 billion grew 262% year over year, while EPS of $5.98 surged 629%.

Management is forecasting that its growth streak will continue. The company is guiding for second-quarter revenue of $28 billion when Nvidia reports on Aug. 28. Analysts’ consensus estimates are even higher, expecting revenue of $28.6 billion. In either case, that’s phenomenal sales growth, and profits will likely follow suit.

9. Returns to shareholders are increasing

Nvidia’s recent run has been a windfall for shareholders, as the stock has skyrocketed more than 500% over the past three years, as of this writing. Yet there have been other benefits for investors.

In conjunction with the company’s quarterly report and 10-for-1 stock split revelation in May, Nvidia announced that it was increasing its dividend by 150% from $0.04 to $0.10. The dividend hasn’t been a priority for the company until now, as growth has taken center stage. However, given its newfound wealth, I wouldn’t be surprised if there were additional increases on the horizon.

10. It isn’t as expensive as you might think

Nvidia’s skyrocketing stock price has brought with it a commensurate increase in its valuation, causing some investors to keep their distance. That’s understandable, given the stock is currently selling for 74 times earnings and 39 times sales, but that only tells part of the story. While the price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio are among the most widely used valuation metrics, they also have their limitations. They tend to label most high-growth stocks as expensive or overvalued by default.

However, Nvidia’s forward price/earnings-to-growth (PEG) ratio, which takes into account its impressive growth trajectory, clocks in at 0.7, when any number lower than 1 indicates an undervalued stock. So the stock isn’t as expensive as it appears at first glance.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $787,394!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Danny Vena has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

10 Reasons to Buy Nvidia Stock Like There’s No Tomorrow was originally published by The Motley Fool

Column: No, folks, Harris isn't planning to tax your unrealized capital gains — but a wealth tax is still a good idea

That fetid gust of hot air you may have detected wafting from Republican and conservative social media postings over the last day or two was a fabricated claim that Kamala Harris is plotting to tax everyone’s unrealized capital gains if she becomes president.

That would be a departure from current law, which taxes capital gains only when the underlying assets are sold, or “realized.”

That it’s a mythical allegation hasn’t stopped right-wingers and GOP functionaries from hand-wringing over the economic implications of any such change, and over the purportedly horrible impact on average Americans.

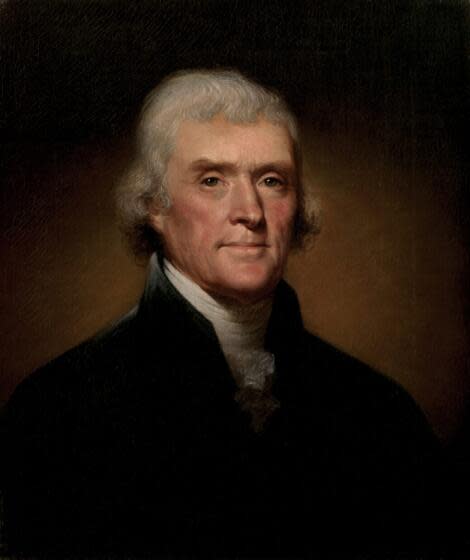

Whenever there is in any country, uncultivated lands and unemployed poor, it is clear that the laws of property have been so far extended as to violate natural right.

Thomas Jefferson

Here, for instance, is the far-right blowhard Mike Cernovich, in tweeting Tuesday on X: “If you own a house, subtract what you paid for it from the Zillow estimate. Be prepared to pay 25% of that in a check to the IRS. That’s your unrealized capital gains taxed owed under the Kamala Harris proposal.”

And Chicago venture investor Robert Nelson: “Taxing unrealized gains is truly the most insane, economy destroying, innovation killing, market crashing, retirement fund decimating, unconstitutional idea, which was probably planted by Russia or China to destroy the economy. Dems need to run away from this wildly stupid idea.”

All right, guys, take a deep breath. Harris hasn’t proposed taxing your unrealized capital gains, or mine. What she has said, as the Harris campaign told me, is that she “supports the revenue raisers in the FY25 Biden-Harris [administration] budget. Nothing beyond that.”

So what’s in that Biden-Harris administration budget for fiscal year 2025?

The budget plan does indeed call for taxation of unrealized capital gains held by the country’s uber-rich. That’s part of its proposal for a 25% minimum tax on the annual income of taxpayers with wealth of more than $100 million — a wealth tax. If you’re a member of that cohort, lucky you. But at that level of affluence you don’t have grounds to complain about paying a minimum 25% of your annual income.

Anyway, there aren’t very many of you “centi-millionaires,” as the category is known—10,660 in the U.S., according to a 2023 estimate. That includes a handful of centi-billionaires such as Elon Musk ($249 billion, according to Forbes), Jeff Bezos ($198.5 billion) and Mark Zuckerberg ($185.3 billion). It’s doubtful that anyone in this category is poring over Zillow estimates to calculate the sale value of his or her house (or houses).

Several other proposals in the budget plan are relevant to taxes on the wealthy. One would restore the top income tax rate of 39.6%, which was cut to 37% in the Republicans’ 2017 Tax Cut and Jobs Act; Biden proposed to allow that cut to expire as scheduled next year. The restored top rate would apply to income over $731,200 for couples, $609,350 for singles, starting with this year’s income.

Another provision would raise the tax rate on capital gains and dividends to the same rate charged on ordinary income — but only on annual income exceeding $1 million for couples ($500,000 for single filers). Under current law, capital gains and dividends get a huge break: The top rate is 20%, though it’s zero for couples with income of $89,250 or less ($44,625 for singles), and 15% for those with income more than that but less than $553,850 ($492,300 for singles).

The preferential rates on cap gains “disproportionately benefit high-income taxpayers and provide many high-income taxpayers with a lower tax rate than many low- and middle-income taxpayers,” the White House explains. They also “disproportionately benefit White taxpayers, who receive the overwhelming majority of the benefits of the reduced rates.”

The proposal would also eliminate the notorious step-up in basis enjoyed by heirs. Currently, if those inheriting stocks, bonds, real estate or other capital assets sell those assets, they’re taxed only on the difference between what they were worth at the time of the original owner’s death and their value upon the subsequent sale — not the difference between what they cost when purchased (the “basis”) and what they were worth when ultimately sold.

This process turns the capital gains tax into what the late Ed Kleinbard, the tax expert at USC, called America’s only voluntary tax. Since owners of capital assets don’t pay tax on their appreciation in value until they’re sold, they can defer the tax indefinitely by simply not selling. When they die, the step-up in basis extinguishes the prior capital gains liability forever, leaving only a tax on any gains for the heirs reaped starting from the date of their inheritance.

And rich families can enjoy the benefits of their capital portfolio by borrowing against it, never having to sell. That’s an option seldom available to the ordinary taxpayer, who may have to sell to make ends meet. This is how those families perpetuate their fortunes without paying their fair share of income tax.

The Biden plan would repeal the step-up for heirs by levying the capital gains tax on the bequeathed asset, calculated from the original purchase and charged to the decedent’s estate. Inheritances by spouses would be exempt, and the existing exemption of $250,000 in gains per person on the transfer of a principal residence would remain in effect.

Read more: Column: Something for Biden to brag about — his IRS funding more than pays for itself

Biden’s plan also would increase the net investment income tax and Medicare tax rates to 5% each from the current 3.8% on income over $400,000. That would bring the top capital gains rate to 44.6%.

Is that a lot? Too much? Not enough? It’s true that the capital gains tax has typically been lower than the tax on ordinary income, reaching as high as 40% only briefly in the 1970s. Overall, however, it’s a relative pittance in postwar terms: The top tax rate on ordinary income was 90% or higher from 1944 through 1963, 70% from 1965 through 1981, and 50% from 1981 through 1986. Americans enjoyed unexampled prosperity throughout most of that time span.

That brings us back to the wealth tax idea, which terrifies the rich and their water-carriers in the press and punditocracy. Noah Rothman of the right-wing National Review, for example, got especially exercised over Michelle Obama’s critique of “the affirmative action of generational wealth” in her speech at the Democratic convention Tuesday night.

“The idea that accumulating material wealth and bequeathing it to your offspring with the hope that they build on it and do the same for their children is one of the fundaments of the American social compact,” Rothman grumbled. “Trying to make that sense of industry into a source of shame is absurd.”

The idea that the offspring of millionaires and billionaires are building on their inherited wealth is pretty, but in practice rare. As the wealth management firm UBS reported, last year for the first time in the nine years that it had been tracking extreme wealth, billionaires “accumulated more wealth through inheritance than entrepreneurship.” This “great wealth transfer,” it added, “is gaining momentum.”

As I’ve written before, the concentration of wealth in America has reached levels that make the gilt of the 19th century Gilded Age look like dross. In the U.S. there were 66 billionaires in 1990, and about 750 in 2023.

Read more: Column: Is America cheating its children to subsidize old people? Refuting a common falsehood

Critics of a wealth tax often assert that it’s unworkable because it’s hard to value non-tradable assets — think artworks, or almost anything other than stocks, bonds and real estate, which can be valued at a market price. The Biden plan has an answer to that. Non-tradable assets would be valued at their purchase price or their value the last time they were borrowed against or invested in, with an annual increase based on Treasury interest rates.

As for those who think there’s something un-American in a wealth tax, they can take up the issue with the Founding Fathers, who considered generationally accumulated wealth to be inimical to a free republic.

“Whenever there is in any country, uncultivated lands and unemployed poor,” Thomas Jefferson wrote to James Madison in October 1785, “it is clear that the laws of property have been so far extended as to violate natural right.”

Madison in 1792 viewed the duty of political parties as acting to combat “the inequality of property, by an immoderate, and especially an unmerited, accumulation of riches.” Benjamin Franklin urged the Constitutional Convention in Philadelphia, albeit unsuccessfully, to declare that “the state has the right to discourage large concentrations of property as a danger to the happiness of mankind.”

They didn’t seem concerned that fighting the immoderate accumulation of riches would be complicated or unnecessary. Quite the opposite: They would appear to agree, were they with us today, with the line beloved of equality advocates that “every billionaire is a policy failure.”

Put it all together, and it sounds almost as if Michelle Obama was channeling the Founders. And if Kamala Harris supports the provisions in the Biden budget plan aimed at requiring the super-rich to pay their fair share of taxes — as her campaign confirms — she’s channeling them too.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

Sign me up.

This story originally appeared in Los Angeles Times.

How Did 'Actual Billionaire' Illinois Governor JB Pritzker Get His Fortune?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Illinois Governor JB Pritzker made waves during his speech at the Democratic National Convention on Tuesday. Pritzker, a billionaire family member behind the Hyatt hotel chain, said, “Take it from an actual billionaire, Trump is rich in only one thing: stupidity.”

According to Forbes, Pritzker is worth approximately $3.5 billion. Before becoming Illinois’s governor, he ran the Pritzker Group with his brother Anthony. Pritzker Group is a private equity firm that invests in middle-market businesses, including PathGroup, PLZ Aeroscience Corporation, and Technimark. The venture capital side of the business has invested in various emerging companies, with exits including Bird, Casper, Coinbase, and The Honest Company. The company is an active investor in HopSkipDrive, Cameo, SpotHero, and other private companies.

Trending Now:

-

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Don’t miss out on the next NVIDIA – you can invest in the future of AI for only $10.

**This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Innovation Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Pritzker Private Capital, founded by JB Pritzker and his brother Anthony in 2002, was originally a family office but now invests family and third-party institutional capital in midmarket buyouts. It has 17 investments, including Heartland, a commercial landscaping services provider, and food products company Sugar Foods Corp. Pritzker Private Capital is raising $3 billion for its fourth buyout fund. JB Pritzker left the company when he became governor in 2019.

Most of the Pritzker family fortune comes from Hyatt Hotels (NYSE:H). Jay Pritzker and his brother Donald, JB Pritzker’s father, started the business in the 1950s. It became a public company in 1962, was later taken private, and went public again in 2009. The Pritzker family has also owned a significant stake in Royal Caribbean Cruises (NYSE:RCL). Another major investment for the family was Marmon Group, which later became part of Berkshire Hathaway. They also owned Ticketmaster at one point before selling to the late billionaire Paul Allen in 1993.

Pritzker’s personal holdings have been a matter of some controversy. When he took office, Pritzker pledged to divest his personal portfolio of companies holding state contracts. In 2022, an investigation by A Better Government Association found that a blind trust associated with Pritzker bought Centene Corp (NYSE:CNC), a managed care company with contracts with the state of Illinois. The purchase was made by trustees at Northern Trust, appointed by Pritzker to manage his portfolio. At the time, Pritzker’s campaign said, “Gov. Pritzker does not personally make any investments, nor has he been involved in any discussions at any time regarding any investments since taking office.”

Don’t miss the real AI boom – here’s how to use just $10 to invest in high growth private tech companies.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Innovation Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

In addition to his other holdings, Pritzker also has some pricey real estate. His primary residence is on Astor Street in Chicago, but he also owns property in Wisconsin, including a vacation retreat in Lake Geneva. In 2018, a Chicago-based company linked to Pritzker bought a 6.44-acre property in Wellington, FL, for $12.1 million. Wellington is the equestrian playground of the elite, with Bill Gates, Michael Bloomberg, and Bruce Springsteen all owning property in the area.

He is also a philanthropist. The J.B. and M.K. Pritzker Family Foundation has donated to various causes, with a focus on educational endowments. The biggest donation was in 2015 when the foundation donated $100 million to the now-renamed Northwestern Pritzker School of Law. The funding supports several social justice initiatives at the school.

Although JB Pritzker’s wealth is substantial, according to Forbes, former President Donald Trump may still have the upper hand. The news outlet puts Trump’s current net worth at $4.5 billion. Trump has a long-standing feud with Pritzker and posted in June on Truth Social that “Unless a change is made at the Governor’s level, Illinois can never be Great Again!”

Read More:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

When today’s AI startups go public, most of the rapid growth will be behind them — here’s how not to get left out.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Innovation Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

This article How Did ‘Actual Billionaire’ Illinois Governor JB Pritzker Get His Fortune? originally appeared on Benzinga.com

Prediction: Wall Street's Next Stock Split Announcement Will Come From a Company That's Gained 150,000% Since Its IPO

Despite historically hot trends like artificial intelligence (AI) dominating headlines on Wall Street, it’s stock-split euphoria that’s played an equally impressive role in sending the broader market higher in 2024.

Put simply, a stock split is a tool publicly traded companies can lean on to adjust their share price and outstanding share count by the same factor. The beauty of stock splits is they’re entirely cosmetic and have no effect on a company’s market cap or underlying operating performance.

There are two types of stock splits — forward and reverse — with the former being far more popular than the latter among the investing community.

Reverse splits are enacted to increase a company’s share price, often with the goal of maintaining continued listing standards for a major stock exchange. Since most reverse-stock splits are conducted from a position of operating weakness, investors tend to keep their distance from this variety of split.

Meanwhile, forward-stock splits are designed to reduce a company’s share price to make it more nominally affordable for retail investors who lack access to fractional-share purchases through their broker. Companies with high-flying stocks that require a forward split to make their shares more “nominally affordable” are usually out-executing and out-innovating their competition.

Since the curtain opened on 2024, 13 phenomenal businesses have announced or completed stock splits — none of which have been more anticipated than that of AI juggernaut Nvidia (NASDAQ: NVDA). Given that companies conducting forward splits have, since 1980, more than doubled the return of the benchmark S&P 500 in the 12 months following their split announcement, investors are eager to guess which top-tier stock will be next to unveil a forward-stock split.

Nvidia had all the hallmarks of a Wall Street stock-split stock

Prior to Nvidia announcing its largest-ever forward split (10-for-1) on May 22, there were more than enough clues to suggest that a stock split was imminent.

The obvious clue with Nvidia was that its stock had increased by 550% between the start of 2023 and the day it released its fiscal first-quarter operating results, where it revealed its historic split. No one on Wall Street has ever witnessed a market-leading company add around $2.8 trillion in market cap in what feels like the blink of an eye.

To build on this point, Nvidia’s jaw-dropping returns have made it particularly popular with everyday investors. It’s become the fourth most-held security (including exchange-traded funds) on retail investor-dominated online trading platform Robinhood. Not requiring retail investors to save $1,300 to purchase a single share of Nvidia might help sustain the euphoria behind its near-parabolic climb.

Nvidia’s market-leading status among graphics processing unit (GPU) developers for AI-accelerated data centers also made it a logical candidate to conduct a stock split. Semiconductor analysis firm TechInsights estimates that of the 2.67 million data-center GPU shipments in 2022 and 3.85 million GPU shipments in 2023, Nvidia accounted for all but 30,000 GPUs shipped in 2022 and 90,000 GPUs shipped in 2023. It’s grabbed a stranglehold of the GPU market share that’s powering generative AI solutions and training large language models (LLMs) in enterprise data centers.

The company’s CUDA computing platform provides yet another reason Nvidia splitting its stock made sense. CUDA is the toolkit that helps developers build LLMs and speed up computing applications. The key point is that Nvidia’s software is working in tandem with its top-tier hardware to keep businesses loyal to its myriads of products and services.

With Nvidia laying the blueprint for what to look for in future stock-split stocks, there’s one logical candidate that stands out.

Prediction: This 150,000% gainer will be the next high-profile stock split announcement on Wall Street

In terms of brand-name, time-tested, dominant companies, I’d expect Wall Street’s next high-level stock split announcement to come from warehouse club Costco Wholesale (NASDAQ: COST).

Although no stock goes up every year, Costco has come very close to breaking the mold. Including dividends paid, Costco has delivered a positive total return to its shareholders in 20 of the last 23 years. More impressively, its shares have increased in value by 150,000%, including dividends, since its initial public offering (IPO) in December 1985.

It’s been close to a quarter of a century since Costco last conducted a stock split, with its three prior splits occurring in January 2000 (2-for-1), March 1992 (3-for-2), and May 1991 (2-for-1). With shares of the company approaching $900, it’s fair to assume that some everyday investors without access to fractional-share purchases are being forced to stay on the sidelines.

One of Costco’s biggest and clearest competitive advantages is its size. The company’s deep pockets allow it to purchase goods in bulk, which lowers the per-unit cost of each item. With price being such an important concern for shoppers, buying in bulk has consistently helped Costco undercut traditional grocery chains and mom-and-pop shops on cost.

It’s important to note that Costco’s warehouses sell a mix of discretionary goods and consumer staples. Regardless of how well the U.S. economy is performing or what the prevailing rate of inflation is, consumers still need to purchase groceries and basic household necessities. In other words, Costco is drawing in consumers in all economic climates, which typically leads to highly predictable sales and operating cash flow.

Another identifiable edge Costco brings to the table is its membership-driven operating model. Annual membership fees generate high margins and can be used to offset the low prices and razor-thin margins for groceries that help the company court new members. Plus, paying an annual fee to shop at Costco is liable to encourage consumers to get as much out of their membership as possible. In short, they’re going to choose Costco over other shopping destinations when making large purchases.

The final piece of the puzzle for Costco is its exceptional pricing power. Beginning on Sept. 1, the annual fees for its Gold Star and Business memberships will increase $5 to $65, while Executive memberships will jump $10 to $130 per year. The first increase in membership fees since 2017 isn’t going to scare away this warehouse club’s fiercely loyal customers.

So when Costco lifts the hood on its fiscal fourth-quarter operating results on Sept. 26, don’t be surprised if it also unveils its first stock split since January 2000.

Should you invest $1,000 in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $787,394!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale and Nvidia. The Motley Fool has a disclosure policy.

Prediction: Wall Street’s Next Stock Split Announcement Will Come From a Company That’s Gained 150,000% Since Its IPO was originally published by The Motley Fool

Billionaire Ken Griffin Sold 79% of Citadel's Stake in Artificial Intelligence (AI) Titan Nvidia and Piled Into These 3 High-Octane Growth Stocks Instead

What can easily be described as the most important data release of the third quarter occurred last week — and a lot of investors probably missed it.

Every quarter, institutional investors with at least $100 million in assets under management are required to file Form 13F with the Securities and Exchange Commission. In simple terms, a 13F allows investors to see what Wall Street’s most-successful investors purchased and sold in the most recent quarter (in this instance, the June-ended quarter).

Among the many anticipated 13F filings from billionaire asset managers is that of Ken Griffin’s hedge fund, Citadel Advisors. Since its inception, no hedge fund has been more profitable than Citadel, which often hedges its common stock positions with various put and call options.

What’s noteworthy about Citadel’s latest 13F is that Griffin and his investment team were big-time sellers of artificial intelligence (AI) leader Nvidia (NASDAQ: NVDA) and avid buyers of three other high-octane growth stocks.

Ken Griffin’s Citadel sold more than 9.2 million shares of Nvidia

Since the start of 2023, Nvidia has been virtually unstoppable. Shares are up more than 700% and the company’s market cap has increased by north of $2.7 trillion.

Nvidia’s hardware and software have fueled this historic gain. The company’s H100 graphics processing unit (GPU) has quickly become the standard in AI-accelerated data centers running generative AI solutions and training large language models (LLMs). Meanwhile, Nvidia’s CUDA software platform is the toolkit developers use to build LLMs. The company’s hardware and software are working in-tandem to keep AI-driven businesses loyal to Nvidia’s ecosystem of products and services.

Despite these first-mover advantages, Griffin’s Citadel sold 9,282,018 shares of Nvidia during the June-ended quarter, ultimately reducing its stake by 79.3%.

Although profit-taking might explain some of this selling activity, history may be playing a meaningful role in this decision.

Over the previous 30 years, there hasn’t been a high-profile innovation, technology, or trend that’s escaped an early innings bubble-bursting event. Investors are always overly optimistic with regard to how quickly they expect a new technology or innovation to take hold. Should AI follow the path of previous next-big-thing innovations, no company would be hit harder by the AI bubble bursting than Nvidia.

There’s also a high likelihood of Nvidia shedding its monopoly like market share in high-compute data centers, as well as losing its pristine pricing power on AI-GPUs, over time. Its inability to meet overwhelming enterprise demand for GPUs, coupled with many of its top customers developing chips for their data centers, makes it likely that Nvidia will lose out on precious data center “real estate.”

But while Ken Griffin and his investment crew were sending shares of Nvidia packing, they were busy piling into three supercharged growth stocks.

Palantir Technologies (5,222,682 shares purchased)

The first fast-paced stock that had the investment team at Citadel’s hedge fund mashing the buy button with regularity during the second quarter is cloud-based data-mining specialist Palantir Technologies (NYSE: PLTR). The more than 5.22 million shares purchased increased Citadel’s stake in Palantir by 1,140% over where things stood on March 31, 2024.

The primary lure of Palantir as an investment is the company’s irreplaceability. Though other businesses offer bits and pieces of the services it supports, no company at scale comes close to matching what Palantir offers as a whole. Wall Street typically places a hearty valuation premium on businesses that can sustain their unique moats.

For quite some time, the bulk of Palantir’s sustained double-digit sales growth has come from its AI-fueled Gotham platform. This is the cloud-based infrastructure that helps governments plan missions and gather data.

However, Gotham’s long-term growth ceiling is somewhat limited. Since Palantir’s management team isn’t going to let certain governments access its platform for national security reasons (e.g., China), it’s the company’s Foundry platform that’s likely to drive significant growth in sales and cash flow in the years to come.

Foundry is Palantir’s relatively new AI-inspired platform focused on businesses. It’s designed to, among other things, help businesses better understand their data so they can streamline their operations. Over the trailing year, ended June 30, Palantir’s commercial customer count surged 55% to 467. Since it’s still in its very early stages of expansion, it should have no trouble supporting double-digit sales growth.

Pinterest (4,472,384 shares purchased)

A second supercharged growth stock that Ken Griffin’s Citadel hedge fund was a buyer of as it was disposing of the lion’s share of its Nvidia stake during the June-ended quarter is social media platform Pinterest (NYSE: PINS). To offer some context on just how much this position grew, Citadel only held 12,909 shares of Pinterest at the end of March.

Although Pinterest’s third-quarter sales guidance left a lot to be desired among Wall Street analysts who had been expecting a big upside revenue guide, there’s no denying that this company is picking up momentum as it adds to its monthly active user (MAU) count.

When the June quarter came to a close, Pinterest had increased its global MAUs by a cool 12% to 522 million from the previous year. The more active users Pinterest has on its platform, the more likely it is to command strong ad-pricing power with businesses. After all, Pinterest’s users are often potential shoppers looking for ideas and inspiration.

Another reason Pinterest is such a success story is the way its social media platform is set up. Users are willingly and (most importantly!) freely sharing the things, places, and services that interest them. With app developers giving consumers the option to remove data-tracking tools, the premise of Pinterest’s site ensures that it’ll be able to provide relevant data to merchants to help them target users with their message(s).

Pinterest is also swimming with available capital. As of the midpoint of 2024, it had more than $2.7 billion in cash, cash equivalents, and marketable securities, and no debt. This treasure chest of cash, coupled with a $1 billion share repurchase program, gives the company the ability to navigate challenging economic climates with ease.

Broadcom (1,880,740 shares purchased)

Perhaps the biggest surprise of all is that Ken Griffin’s Citadel hedge fund was busy scooping up shares of AI networking solutions specialist Broadcom (NASDAQ: AVGO) while sending 79% of its position in Nvidia to the chopping block. The 1,880,740 shares of Broadcom purchased by Griffin’s fund increased its stake by nearly 64% from the sequential quarter.

On one hand, Broadcom would presumably be exposed to some degree of downside if the AI bubble were to burst. Though its AI networking solutions, which are used to reduce tail latency and maximize the computing capability of GPUs in enterprise data centers, are in high demand, a bubble-bursting event would, undoubtedly, weigh on growth in AI networking sales.

On the other hand, there’s a lot more going on with Broadcom than just artificial intelligence-related solutions. It’s one of the largest suppliers of 5G wireless solutions used in next-generation smartphones. Telecom companies upgrading their networks to support faster 5G download speeds have created a steady device replacement cycle that’s fueled demand for Broadcom’s products.

Broadcom also makes an assortment of solutions for next-gen vehicles, including products for advanced driver assistance systems, infotainment systems, and various LED lights. In other words, as the automotive industry and industrial sector, in general, become more reliant on technology, Broadcom’s products are only going to grow more popular.

Acquisitions have been important to Broadcom’s ascent, as well. The $69 billion purchase of cloud virtualization software company VMware, which closed in November 2023, provides an important path for Broadcom to expand its reach within private and hybrid enterprise clouds.

Long story short, Broadcom looks to be better positioned than Nvidia if and when the AI bubble bursts.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $779,735!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Sean Williams has positions in Pinterest. The Motley Fool has positions in and recommends Nvidia, Palantir Technologies, and Pinterest. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Billionaire Ken Griffin Sold 79% of Citadel’s Stake in Artificial Intelligence (AI) Titan Nvidia and Piled Into These 3 High-Octane Growth Stocks Instead was originally published by The Motley Fool