Beyond Nvidia: These 2 Companies Could Make Waves With Big Stock Splits

Nvidia‘s stock split earlier this year was followed up by a period of strong valuation gains for the company, and the artificial intelligence (AI) leader is far from the first to benefit from post-split momentum.

While stock splits don’t do anything to change the fundamentals of a business, there are reasons why investors like them. By breaking its share count down into a larger number of shares, a company makes its stock potentially more accessible and attractive to a wider range of investors. A stock split can also be a reflection that a business is performing well.

With Nvidia’s stock split now in the rearview mirror, some investors may be looking for the next worthwhile split plays. If that’s you, read on to see why two Motley Fool contributors think these companies should be on your radar. One has already announced an upcoming split, and the other could be on the verge of making this move.

This Nvidia customer is getting ready for a 10-for-1 split

Keith Noonan: Super Micro Computer (NASDAQ: SMCI) makes high-performance servers that include Nvidia’s graphics processing units (GPUs) as central hardware components. Demand for the company’s rack servers soared in conjunction with the deployment and training of artificial intelligence (AI) services.

In turn, explosive sales and earnings growth have helped to push the company’s share price up 158% over the last year. Even after a recent post-earnings pullback, the company’s stock is still priced above $600 per share.

On Aug. 6, Supermicro (as it’s commonly known) published results for the fourth quarter of its last fiscal year, which ended June 30. While the company managed to increase sales 143% year over year and earnings 78% in the quarter, the profit for the period fell short of Wall Street’s expectations due to weaker-than-expected gross margins.

In conjunction with the quarterly results that it published in August, Supermicro announced that it will carry out a 10-for-1 stock split on Oct. 1. Shares initially fell following the Q4 report due to the earnings miss, but the company’s share price has bounced back — and excitement for its upcoming split could pick up in the near future.

Notably, Supermicro stock has often made trading moves that have mirrored moves for Nvidia. While part of that is due to the AI leader’s overall impact on sentiment in the AI space, Nvidia’s earnings reports provide a meaningful bellwether for Supermicro’s business performance. If Nvidia publishes strong results on Aug. 28, there’s a very good chance that Supermicro stock will see an increase in bullish sentiment.

Nvidia will also likely provide an update on the timeline for the release of its upcoming Blackwell processors. While some commentary from Supermicro suggested that the next-generation processors could be delayed, subsequent reports have suggested that any postponement could be relatively minor. If so, that would likely be a bullish catalyst for both AI stocks.

On the heels of some turbulent trading, Supermicro is down roughly 47% from its high. Ultimately, sales and earnings performance will play a much bigger role in the stock’s performance than the upcoming split, but the conditions could be set for a comeback rally. With Supermicro poised for a split a little more than a month after Nvidia publishes its much-anticipated earnings, excitement for the server specialist could be kicked back into overdrive.

Creating value for shoppers and shareholders

Jennifer Saibil: Costco Wholesale (NASDAQ: COST) has already caught investor attention over the past few months with its largest special dividend ever, management changes, and most recently, a highly anticipated membership-fee hike. It has demonstrated fabulous performance despite inflation, and its stock is up 57% over the past year.

It’s also getting closer to a four-digit price tag. It’s nearing record highs and hasn’t split its stock since 1992.

Management constantly talks about creating value for its customers. That mission drives everything it does, from delaying its fee hike to its recent crackdown on membership sharing. It stands to reason that it wants to make sure it’s driving value for shareholders and potential shareholders, and that often means making the stock accessible to investors who see a high-priced stock as out of reach.

As Costco stock rises, a stock split is looking more like a possibility. And don’t expect the company’s stock to slow down anytime soon. It has many growth drivers and has been reliable for steady growth throughout its lifetime. It’s been resilient under inflation, and growth could accelerate as inflation stabilizes. Sales increased 9.1% in the 2024 fiscal third quarter (ended May 12), with a 6.6% increase in comparable sales. E-commerce, which is growing as a percentage of overall retail, was strong with a 20.7% jump.

More people are shopping at Costco, and they’re shopping there more often. Member households increased 7.8% year over year in the quarter, and traffic was up 6.1%. Average ticket price was roughly flat, but that should change when shoppers feel more comfortable spending on larger, more expensive items, which should drive higher sales.

Investors shouldn’t overlook Costco’s expansion opportunities, both domestic and international. Management has said that in some high-traffic areas, shoppers would avoid the company’s warehouses because they were too crowded, leading to lost sales. Adding stores in dense areas created more sales opportunities rather than cannibalizing existing stores. On top of that, there are regions throughout the U.S. that are underpenetrated, and international is still wide open.

Expect Costco stock to keep climbing. As it does, there could well be a stock split coming sometime soon.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Jennifer Saibil has no position in any of the stocks mentioned. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale and Nvidia. The Motley Fool has a disclosure policy.

Beyond Nvidia: These 2 Companies Could Make Waves With Big Stock Splits was originally published by The Motley Fool

Should You Buy Super Micro Computer Before the Stock Split?

Super Micro Computer (NASDAQ: SMCI) has been one of the biggest winners of the artificial intelligence (AI) boom.

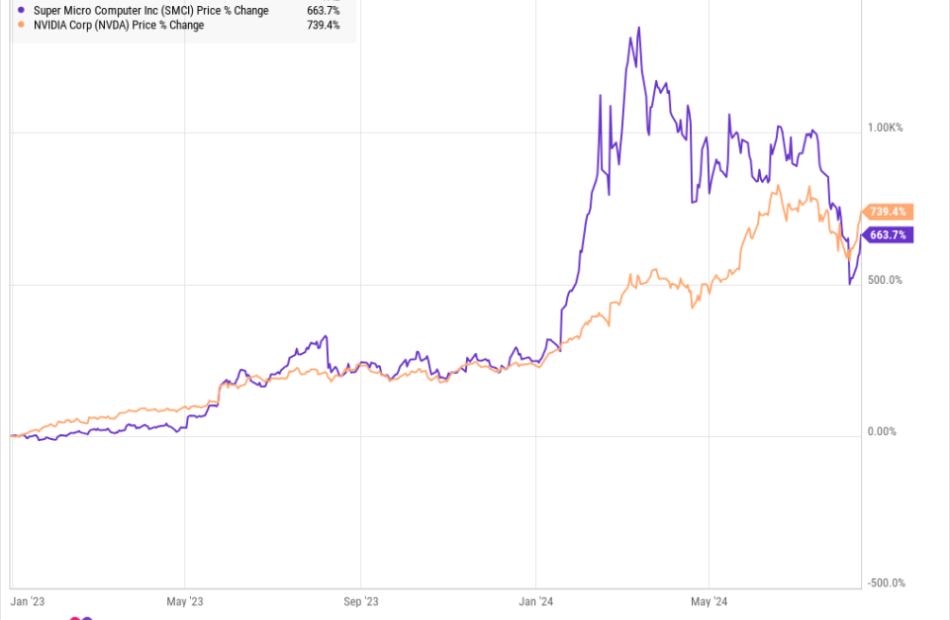

Even after the pullback in recent months, Supermicro, as the company is also known, is still up nearly 700% from the start of 2023, nearly matching Nvidia as the chart below shows.

The company, which makes high-density servers that are particularly well suited to running AI applications, has accomplished that by putting up Nvidia-like growth numbers with revenue jumping 144% in its recently reported fiscal-fourth quarter.

In response to the stock surge, Supermicro recently decided to reward investors with a 10-for-1 stock split, which goes into effect on Oct. 1. The company said it was splitting the stock to make it more accessible.

Should you buy Super Micro Computer before the stock split? Let’s take a look at the evidence.

Recent performance is mixed

There’s no question that Supermicro is experiencing surging growth, but there’s been a blemish on the company’s record, and it’s one reason the stock tumbled after the recent earnings report. Gross margin has been falling even as revenue has surged. In the fourth quarter, the company reported a gross margin of just 11.2%, down from 17% in the quarter a year ago. That translated into lower operating margins for Supermicro as well, falling to 6.5% from 10.3%.

The good news is that the company expects gross margin to recover, saying that supply chain bottlenecks have driven up prices for new components, but that should recede over the next year. Management also said that long-term gross margins will benefit from lower manufacturing costs in production in Malaysia and Taiwan. It also plans to expand in the Americas and in Europe.

If margins recover next year, the stock should move higher.

Will the stock split help?

Investors should understand that a stock split doesn’t do anything to change the fundamental value of a stock; it just divides the proverbial pie into more pieces, making individual shares cheaper.

There’s also some evidence that stocks have outperformed the S&P 500 in the 12 months following their stock splits, according to research from Bank of America, which found that stocks that split gain 25% on average compared to just a 9% gain for the S&P 500. That could be because stock splits tend to follow strong momentum in the share price and result in part from management’s confidence in the business.

However, at least some evidence seems to contradict those findings. Nvidia, for example, the stock leading the AI boom and a close partner of Supermicro, issued a 10-for-1 stock split on June 7. Since then, the stock is up just 1.5%, slightly behind the S&P 500’s 3.5%.

Chipotle stock peaked just before its 50-for-1 stock split on June 26 and has since fallen 21%.

Celsius Holdings, the energy drink maker, is down 20% since its 3-for-1 split last November, and Broadcom, the networking chip specialist, is down 3% since its July 15 10-for-1 split, compared to a 0.5% dip for the S&P 500 during that same timeframe.

Clearly, a stock split isn’t a guarantee of outperformance even if stock splits have outperformed historically on average.

Should you buy Supermicro before Oct. 1?

Whether you’re an AI stock investor or a stock-split investor, the good news is that Supermicro’s pullback creates an attractive opportunity to buy the stock as it’s down nearly 50% from its peak in March when it was admitted to the S&P 500.

Super Micro Computer now trades at a price-to-earnings ratio (P/E) of 31, which looks like a bargain for a stock that still has a ton of growth potential and expects to see margins expand over the coming years.

Supermicro has a number of competitive advantages that should help it continue to thrive in the AI server market, including a close relationship with Nvidia and expertise with high-density servers. Plus, the company is a leader in direct liquid cooling (DLC), a key technology for optimizing hardware performance. CEO Charles Liang recently said, “We are targeting 25% to 30% of the new global datacenter deployments to use DLC solutions in the next 12 months, with most deployments coming from Super Micro.”

The stock split alone isn’t a good reason to buy the stock, but with Supermicro’s strong growth prospects, attractive valuation, and larger, long-term opportunity in AI, buying before the stock split looks like a brilliant move.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Jeremy Bowman has positions in Bank of America, Broadcom, and Chipotle Mexican Grill. The Motley Fool has positions in and recommends Bank of America, Celsius, Chipotle Mexican Grill, and Nvidia. The Motley Fool recommends Broadcom and recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

Should You Buy Super Micro Computer Before the Stock Split? was originally published by The Motley Fool

Down 30%, Now Is a Great Time to Buy This Artificial Intelligence (AI) Growth Stock While It Is Incredibly Cheap

The stock market hasn’t rewarded Micron Technology (NASDAQ: MU) enough for the outstanding growth that it has been delivering in 2024, which is evident from the 26% jump in the shares of the memory specialist so far this year.

It is also worth noting that Micron stock has retreated nearly 30% since hitting a 52-week high two months ago. However, this is good news for savvy investors looking to add a company that’s well on its way to capitalizing on the fast-growing adoption of artificial intelligence (AI) hardware in multiple end markets such as data centers, smartphones, and personal computers (PCs).

Here’s a closer look at the reasons why buying Micron Technology right now looks like a no-brainer.

Micron Technology could sustain its impressive growth in the long run

The memory industry in which Micron Technology operates has been a cyclical one in the past, going through boom-and-bust cycles based on demand-supply dynamics. When demand for memory chips used to jump, chipmakers such as Micron usually ramped up production to meet the same. However, a dip in demand meant that they were left with more supply on their hands, leading to a sharp decline in prices that crushed their revenue and margins.

The good news is that the memory industry’s boom and bust cycles are likely over. Grand View Research estimates that the global memory market’s annual revenue could increase from $111 billion in 2024 to $240 billion in 2030. AI is all set to play an important role in this market’s growth, as demand for high-bandwidth memory (HBM) that’s used in making AI chips is growing at a much faster pace.

More specifically, the HBM market is estimated to hit annual revenue of almost $86 billion in 2030 compared to $1.8 billion last year, clocking a compound annual growth rate of 68% through this period. Even better, this is not the only market where AI is set to drive a big jump in memory consumption.

According to Micron, AI-enabled PCs that are powered by neural processing units to tackle AI workloads are expected to carry 40% to 80% more dynamic random access memory (DRAM) to enable faster computing. Similarly, Micron points out that flagship Android smartphones are sporting a 50% to 100% increase in DRAM content over last year’s models to support generative AI applications.

If we take a closer look at the potential growth these three markets are slated to clock in the long run, it will become evident that Micron is at the beginning of a big growth curve. The global data center market, for instance, is expected to triple in revenue between 2024 and 2034, generating an annual revenue of $776 billion after a decade.

The market for AI-capable smartphones, on the other hand, is expected to grow at an annual pace of 28% through 2030. Also, the global PC market is expected to see a healthy annual growth rate of 8% through 2030 and generate nearly $257 billion in annual revenue. So, Micron’s business has multiple growth drivers that could keep the memory industry from going bust once again.

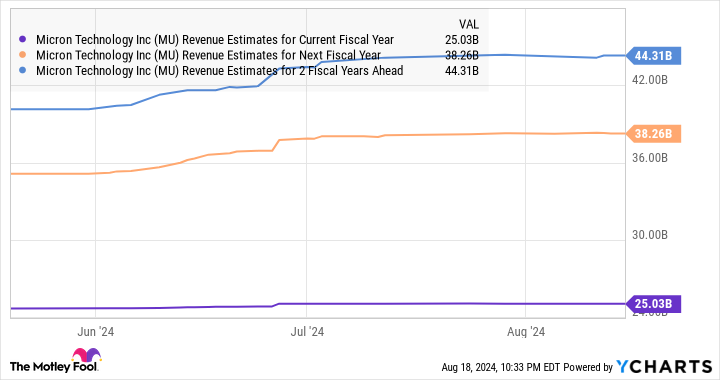

That’s why analysts are expecting the company to sustain its impressive growth over the next couple of fiscal years, following this year’s estimated increase of 61% in its top line to $25 billion.

The valuation and potential upside make the stock a no-brainer

We have already seen that Micron is delivering outstanding top-line growth. More importantly, that’s set to drive a meaningful increase in its bottom line as well. The company made a loss of $4.45 per share last year, and the chart tells us that it will be back in the black in the current fiscal year. More importantly, Micron’s earnings growth forecast for the next couple of years is quite solid as well.

Considering the outstanding growth that this semiconductor stock is likely to deliver, buying it right now is a no-brainer. That’s because Micron is currently trading at just 11.7 times forward earnings, a huge discount to the Nasdaq-100 index’s forward earnings multiple of 27 (using the index as a proxy for tech stocks).

Citigroup recently reiterated a $175 price target on Micron and reaffirmed its buy rating on the stock, pointing toward a 62% increase from current levels. Meanwhile, the stock has a median 12-month price target of $165 as per 41 analysts covering Micron (of which 93% rate it as a buy). That would be a 54% increase from current levels.

So, investors would do well to buy Micron Technology before its stock market recovery gathers momentum, considering its hugely attractive valuation and terrific growth prospects.

Should you invest $1,000 in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Down 30%, Now Is a Great Time to Buy This Artificial Intelligence (AI) Growth Stock While It Is Incredibly Cheap was originally published by The Motley Fool

Prediction: On Aug. 28, This Figure From Nvidia Will Confirm an Artificial Intelligence (AI) Bubble That's in the Early Stages of Bursting

Since 2023 began, no trend has been more responsible for lifting Wall Street’s major stock indexes to new heights than the rise of artificial intelligence (AI).

The allure of AI is the long-term capacity for software and systems to learn without human intervention. This gives AI-driven software and systems the ability to become more efficient at their tasks, and potentially evolve to learn new skills. With an addressable market that spans most sectors and industries, the analysts at PwC believe AI can add a jaw-dropping $15.7 trillion to the global economy come 2030.

Although dozens of companies have benefited from the AI revolution, none has been the poster child of success more so than semiconductor giant Nvidia (NASDAQ: NVDA).

Nvidia is leading the next supposed leap forward in business innovation

In short order, Nvidia’s H100 graphics processing unit (GPU) became the go-to chip used by businesses to run generative AI solutions and train large language models (LLMs). With demand swamping supply, Nvidia has had no trouble meaningfully increasing the price of its H100 GPUs to between $30,000 and $40,000 per chip, or roughly two to three times what key rivals are charging for their AI-data center hardware.

The beauty of higher price points is that they have directly benefited Nvidia’s bottom line. Over the previous five reported fiscal quarters, ended April 28, 2024, the company’s adjusted gross margin has increased by close to 14 percentage points to 78.35%.

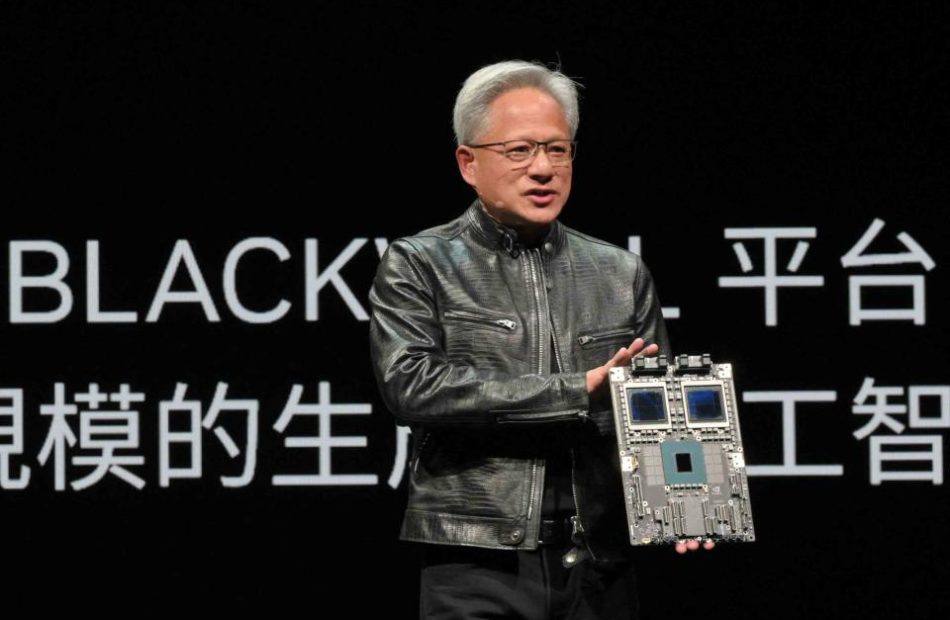

Nvidia hasn’t been shy about investing for the future, either. Its next-generation Blackwell platform, which is slated to hit the market next year, will accelerate computing capacity in six areas, including quantum computing and generative AI, and be more energy efficient than its predecessor. Meanwhile, in June, CEO Jensen Huang briefly teased the all-new Rubin GPU architecture, which will run on a different processor (known as Vera) and debut in 2026.

The final piece of the puzzle that’s helped Nvidia’s market cap grow by more than $2.8 trillion since the start of 2023 is its CUDA platform. This is the software platform developers use to build LLMs, and it’s working hand-in-hand with the company’s leading hardware to keep enterprise clients loyal to its ecosystem of solutions.

Although it’s been a seemingly perfect operating ramp, Wall Street is liable to see just how fallible Nvidia and AI as a technology are as a whole on Aug. 28.

This all-important figure from Nvidia could signal the bursting of the AI bubble

This coming Wednesday, Aug. 28, Wall Street’s AI darling will lift the hood on its fiscal second-quarter operating results.

Over the previous five quarters, Nvidia has done nothing short of obliterate even the loftiest analyst expectations. A combination of strong enterprise demand for its AI-GPUs, exceptional pricing power, and limited competition, has allowed the company to build up a backlog that would make any tech company envious.

However, headline revenue and profit figures aren’t going to tell the complete story come Aug. 28. Even if sales and profits sail past the consensus of analysts, another key figure can portend the end to AI euphoria. I’m talking about Nvidia’s adjusted gross margin. Nvidia’s “adjusted” gross margin excludes the impact of stock-based compensation, acquisition-related expenses, and a few other costs.

Following the release of Nvidia’s fiscal first-quarter results, Huang and his team offered adjusted gross margin guidance for the fiscal second quarter of 75.5% (+/- 50 basis points). This guidance implies a 235- to 335-basis-point decline from the first quarter.

While a median expected drop of 285 basis points in adjusted gross margin might sound like much ado about nothing considering the roughly 1,370 basis points Nvidia’s adjusted gross margin expanded by over the prior five quarters, it’s the reasons behind this forecast decline that are the real concern.

Nvidia’s compute advantages are unlikely to save it from the inevitable

Although demand has been undeniably strong for Nvidia’s H100 GPU, it’s the company’s pricing power that’s done most of the heavy lifting. Sales growth has handily outpaced an increase in cost of revenue, signaling that pricing power, fueled by persistent AI-GPU scarcity, is the company’s core driver.

The problem for Nvidia is that it’s not the only show in town. Advanced Micro Devices (NASDAQ: AMD) is ramping up production of its MI300X AI-GPUs, which are, on average, 50% to 75% cheaper than Nvidia’s H100. AMD also hasn’t been hindered by early stage chip fabrication supplier issues in the same way Nvidia has.

Furthermore, Nvidia’s four-largest customers by net sales — Microsoft, Meta Platforms (NASDAQ: META), Amazon, and Alphabet — are all internally developing AI-GPUs for their data centers. Even with these internally developed chips destined for complementary roles, they’re ultimately cheaper and more easily accessible than Nvidia’s hardware. These companies represent about 40% of Nvidia’s sales, and they’re all signaling a reduced future reliance on Wall Street’s AI darling.

To make matters worse, reports emerged a little over two weeks ago that Nvidia’s prized Blackwell chip would be delayed by “at least three months” due to design flaws and supplier constraints. Nvidia not being able to meet enterprise demand in a timely manner opens the door for AMD, Samsung, and Huawei to steal share.

Nvidia’s biggest gross margin lift has come from AI-GPUs being extremely scarce. But as new chips hit the market, and the company’s own top customers fill their valuable data center “real estate” with in-house chips, Nvidia will inevitably find that its pristine pricing power is eroding. The company’s median forecast of a 285-basis-point sequential-quarter drop in adjusted gross margin is evidence that AI euphoria is fading.

When the AI bubble bursts, no company will likely be hit harder than Nvidia

Looking beyond Nvidia’s Aug. 28 report, history is another monkey wrench for the AI revolution.

Since the advent of the internet three decades ago, there hasn’t been a single innovation, technology, or buzzy trend with a mammoth addressable market that’s avoided an early stage bubble-bursting event. Without exception, investors always overestimate the use case(s) and consumer/enterprise uptake of a new technology or trend, which eventually leads to disappointment, euphoria fading, and a bubble-bursting event.

Including the internet, we’ve watched this play out with genome decoding, business-to-business commerce and networking, housing, China stocks, nanotechnology, 3D printing, cryptocurrency, cannabis, blockchain technology, virtual/augmented reality, and the metaverse.

To add to the point, you’ll find that few of the companies building out AI data centers have definitive plans for how they’re going to use the technology to increase sales and profits. For instance, Meta Platforms is investing more than $10 billion in Nvidia’s H100 GPUs, but has no immediate plans to profit from these investments in its AI data center.

The simple fact that most businesses lack a clear game plan when it comes to AI makes it crystal clear that we’re dealing with the next in a long line of bubbles.

This isn’t to say that artificial intelligence can’t, eventually (key word!), change the growth arc in a big way for corporate America — but there’s little question that the technology will need time to mature.

If the AI bubble does burst, as history suggests it will, there isn’t a company that’ll be hit harder than Nvidia. It’s adjusted gross margin in the coming week should provide confirmation that the beginning of this bubble-bursting event is underway.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet, Amazon, and Meta Platforms. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Prediction: On Aug. 28, This Figure From Nvidia Will Confirm an Artificial Intelligence (AI) Bubble That’s in the Early Stages of Bursting was originally published by The Motley Fool

3 Stock-Split Stocks to Buy Before They Soar as Much as 148%, According to Select Wall Street Analysts

One of the more interesting developments in the investing space over the past several years is the reemergence of stock splits. The once-common practice had diminished in popularity but has experienced a renaissance in recent years. Companies will generally take this path after years of strong results make the stock price less accessible to everyday investors. A stock split creates more shares trading at a lower price; it doesn’t change a company’s market cap.

Newton’s first law of motion states that an object in motion tends to stay in motion unless acted upon by an outside force. That same principle could easily be applied to investing in successful companies. Those that enact stock splits see share price increases of 25%, on average, in the year following the announcement, compared with 12% gains for the S&P 500, according to data compiled by Bank of America analyst Jared Woodard.

Here are three stock-split stocks with as much as 148% upside ahead, according to certain Wall Street analysts.

Nvidia: Implied upside 62%

Arguably, the most celebrated stock-split stock in recent memory is Nvidia (NASDAQ: NVDA), and the chipmaker still has a boatload of potential. It’s the leading supplier of graphics processing units (GPUs) used to zip data through the ether for data centers, cloud computing, and artificial intelligence (AI). This business has eclipsed its humble roots generating lifelike images in video games.

For its fiscal 2025 first quarter (ended April 28), Nvidia generated record revenue that surged 262% year over year to $26 billion, resulting in diluted earnings per share (EPS) that soared 629% to $5.98. The results were driven by data center revenue — which includes cloud and AI chips — as revenue for the segment rose 427% to $22.6 billion. That marked the fourth consecutive quarter of triple-digit sales and profit gains.

It’s little wonder that results of that magnitude have supercharged Nvidia’s stock price, which has gained nearly 800% since the start of 2023, resulting in its high-profile 10-for-1 stock split in June. However, some on Wall Street believe that’s just the tip of the iceberg. Rosenblatt analyst Hans Mosesmann maintains a buy rating on Nvidia and a Street-high price target of $200, which represents potential upside of 62% compared to Thursday’s closing price.

The analyst cites Nvidia’s accelerated development cycle and track record of innovation as evidence there’s more upside to come. “We see Nvidia’s Hopper, Blackwell, and Rubin series driving ‘value’ market share in one of Silicon Valley’s most successful silicon/platform product cycles,” Mosesmann wrote in a note to clients.

He isn’t alone in his bullish outlook. Of the 59 analysts who offered an opinion in July, 54 rated the stock a buy or strong buy, and none recommended selling.

I believe the analyst hit the nail on the head. Nvidia’s customers have reported they’re ramping up capital expenditure spending on AI, which directly benefits Nvidia. Furthermore, partners have reported bullish results, which suggests the AI revolution is ongoing. To me, this is compelling evidence that Nvidia stock has further to climb.

MicroStrategy: Implied upside 61%

The second stock-split stock with significant upside is MicroStrategy (NASDAQ: MSTR), which split its stock earlier this month. The company provides subscription-based AI-fueled business analytics software that allows non-technical users to gain actionable insights from their data. MicroStrategy also provides cloud-based services to government entities.

What sets the company apart, however, is its Bitcoin strategy, which is really turning heads. MicroStrategy bills itself as “the largest corporate holder of Bitcoin and the world’s first Bitcoin development company.”

For the second quarter, subscription services revenue climbed 21% year over year, though total revenue declined by 7%, and its operating loss increased more than sevenfold. However, MicroStrategy made much more progress on the Bitcoin front, increasing its holdings to 226,500 Bitcoins, worth more than $13 billion as of this writing, well ahead of its cost basis of $8.3 billion.

Despite the company’s risky strategy, some on Wall Street remain bullish. Benchmark analyst Mark Palmer has a buy rating on MicroStrategy, with a split-adjusted, Street-high price target of $215. That represents potential upside of 61% compared to Thursday’s closing price. The analyst says that while the company has its detractors, since adopting its Bitcoin strategy four years ago, MicroStrategy’s stock price has soared nearly 1,000%, far outpacing the returns of Bitcoin itself, which has gained 413%. This no doubt played into the company’s 10-for-1 stock split earlier this month.

Wall Street is clearly in agreement. Of the seven analysts who covered the stock in July, every one rated it a buy or strong buy, and none recommended selling.

For investors who believe that Bitcoin will hold its value and continue to gain ground over time, MicroStrategy’s strategy is sheer brilliance. However, it’s important to remember that as recently as late 2022, Bitcoin lost as much as 75% of its value. An investment in MicroStrategy could be equally volatile.

I believe MicroStrategy offers a compelling opportunity for investors with an appetite for some volatility and a long investing time horizon. That said, I also believe there’s a certain degree of risk and that MicroStrategy should represent a small part of a balanced portfolio.

Super Micro Computer: Implied upside 148%

The last of my trio of stock-split stocks with a boatload of potential is Super Micro Computer (NASDAQ: SMCI), also known as Supermicro. The company is one of the premier providers of custom servers in the industry, backed by more than three decades of experience.

Supermicro made the jump to the big leagues thanks to robust demand from those wanting to join the AI revolution. However, it was the company’s building-block architecture, energy efficiency, and direct liquid cooling that boosted demand for its rack-scale servers, as the devices could be customized to the user’s needs while still providing power efficiency and withstanding the harsh demands needed to run AI models.

In its fiscal 2024 fourth quarter (ended June 30), Supermicro reported record revenue that soared 143% year over year to $5.3 billion, which marked an increase of 38% sequentially. This generated adjusted earnings per share (EPS) that jumped 78% to $6.25. This marked the company’s third consecutive quarter of triple-digit gains.

Supermicro’s consistently robust growth has sent its stock price into the stratosphere, delivering gains of 637% since early last year, which likely factored into the company’s decision to announce a 10-for-1 stock split earlier this month.

Wall Street believes there’s more upside ahead. Loop Capital analyst Ananda Baruah is among the biggest bulls, with a buy rating on the stock and a Street high price target of $1,500. That represents potential gains for investors of 148% compared to Thursday’s closing price.

The analyst believes Supermicro has much greater sales potential than Wall Street is giving the company credit for, estimating its revenue run rate will climb to $40 billion by the end of fiscal 2026. For context, Supermicro generated revenue of less than $15 billion in fiscal 2024. The analyst’s forecast also aligns closely with management’s guidance, which calls for net sales of roughly $28 billion for fiscal 2025.

Wall Street seems to agree. Of the 17 analysts who covered the stock in July, 11 rated the stock a buy or strong buy, and none recommended selling.

I’m completely on board with this analyst’s take. The company continues to take market share from its larger rivals, further accelerating its growth, and has a pole position in the AI revolution.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Danny Vena has positions in Bitcoin, Nvidia, and Super Micro Computer. The Motley Fool has positions in and recommends Bank of America, Bitcoin, and Nvidia. The Motley Fool has a disclosure policy.

3 Stock-Split Stocks to Buy Before They Soar as Much as 148%, According to Select Wall Street Analysts was originally published by The Motley Fool

A Bull Market Is Here: 2 Artificial Intelligence (AI) Stocks Down 18% and 41% to Buy Right Now

Even with a few stretches of volatility, stocks are seeing strong bullish momentum in 2024. The S&P 500 index is already up roughly 18% year to date, and much of the impressive rally continues to be driven by gains for high-profile artificial intelligence (AI) players.

But while mega-cap companies including Nvidia, Microsoft, and Apple have surged to new valuation highs this year, there are still some fantastic AI stocks trading at substantial discounts compared to previous valuation peaks.

With that in mind, read on to see why two Motley Fool contributors think you should pounce on these tech companies that have what it takes to be winners.

Palantir’s growth engine is only getting stronger

Keith Noonan: A quick jump in interest rates and some slowed growth caused Palantir Technologies (NYSE: PLTR) stock to fall to a low of roughly $6 per share in December 2022, but it has since come roaring back. The share price is up 86% across this year’s trading alone, and it’s far from low risk, trading at 90 times this year’s expected earnings.

On the other hand, Palantir stock is still down 18% from its peak, and the stage could be set for the analytics and intelligence software company to hit new highs.

Palantir has posted reliable profits since 2023, and the company’s sales growth returned to accelerating at an eye-catching pace. With its second-quarter report, the business delivered 27% year-over-year sales growth and an 80% jump in adjusted earnings per share (EPS).

The big-data analytics leader has been racking up wins in both the government and private sector, and it looks like the business will continue to post impressive margins and see its growth climb even higher.

Palantir got its start as a provider of analytics and information software services to government customers, but the company’s private-sector business has been a rising star over the last couple of years. Revenue from commercial customers rose 33% in the second quarter, and the segment accounted for 45% of total sales in the period.

Aided by strong demand for the company’s Artificial Intelligence Platform (AIP) software suite, the commercial segment will soon be Palantir’s largest. Given that private-sector growth has consistently outpaced public-sector customers in recent years, that paints an encouraging outlook. And it’s even better when you break down trends within the commercial-customer segment.

Sales to U.S. commercial customers grew 55% year over year to hit $159 million in the second quarter, accounting for roughly 52% of total commercial segment revenue. Sales to U.S. businesses now make up more than half of overall segment revenue and are growing at a rate far above the overall category. In other words, growth for the commercial segment should continue to accelerate and help push overall revenue higher.

And as exciting as things look for the private sector, Palantir’s public sector growth is strong as well. Sales to government customers increased 23% year over year last quarter, up from 16% in this year’s first quarter.

The company’s growth engine has never looked stronger. With the business posting impressive margins and still managing to expand rapidly, Palantir stock has real potential to outperform.

The market is underestimating Trimble’s growth potential

Lee Samaha: Workflow technology company Trimble (NASDAQ: TRMB) posted second-quarter earnings recently that were well received, but the stock continues to trade almost 41% off its all-time high. The company provides the hardware for precise positioning and the software and services to plan and model daily workflows while using advanced data analytics to optimize operations.

The productivity improvement provided by its technology makes it attractive to customers at any stage of the cycle. Still, it has faced some challenging end markets this year, not least in transportation, where significant overcapacity in the freight market is slowing down end demand.

It’s a different story in its core architects, engineers, construction, and owners (AECO) segment, where its annualized recurring revenue (ARR) grew 18% year over year in the second quarter. Two-thirds of the growth came from existing customers, and one-third came from new customers, as its solutions help reduce waste and maximize execution in construction projects.

With Trimble increasingly selling software and subscription services on a recurring basis, the company’s profit margins and cash flow conversion keep growing. This trend is highly likely to continue as data analytics improvements (Trimble is incorporating AI capability into its products, for example) mean more value added for its customers.

As such, it’s becoming an increasingly important part of its customers’ daily workflows, which should provide the opportunity to sell more services to them. Trimble is set to grow its ARR by 11% to 13% in 2024, and with a potentially more robust economy in 2025, that could increase even more for a company with a bright future.

Trading at a significant discount, Trimble stock looks like a smart buy right now.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Keith Noonan has no position in any of the stocks mentioned. Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, and Palantir Technologies. The Motley Fool recommends Trimble and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

A Bull Market Is Here: 2 Artificial Intelligence (AI) Stocks Down 18% and 41% to Buy Right Now was originally published by The Motley Fool

Trump will soon be free to tank his own stock

Donald Trump will soon be free to start selling off more than $2 billion in shares he holds in the company that controls his social media platform, Truth Social—but doing so could send the stock price plummeting.

When Truth Social’s parent company, Trump Media & Technology Group, went public in March by merging with a special purpose acquisition company, the former president was granted about 114.75 million shares, which amounts to about 59% ownership. That stake makes up over half of his $4.5 billion net worth, according to Forbes, but so far he hasn’t been able to profit from his shares.

This is due to a lockup period that prevents company insiders from off-loading shares for approximately 180 days. While he hasn’t said that he intends on selling any of his Trump Media (DJT) stock, he will get the green light to do so as early as Sept. 20, when the lockup period is set to expire. If Trump sells shares, he will have to report it in a filing with the SEC within two days.

The Trump campaign and Trump Media & Technology Group did not immediately respond to a request for comment. When asked about Trump selling his shares, a Trump Media spokesperson told Bloomberg on Tuesday that there’s no “conceivable sign anywhere that he plans to do so.”

The opportunity to off-load shares could be a boon for Trump, whose mounting legal costs have set him back by about $100 million, according to the New York Times. The lockup period will expire right around the time when Trump is set to be sentenced by a judge after being found guilty of 34 criminal counts in a much publicized hush-money trial. Trump could also use the proceeds of his stock sale to fund his campaign, which he previously said he might be willing to do.

If he does start off-loading his shares, Trump Media’s stock could sink thanks to the dilutive effect of increased supply. The company’s stock price closed up less than 1% at $22.81 on Friday.

The stock has already been on a wild ride this year. Shares skyrocketed 30% after the former president survived an assassination attempt in July. Yet Trump Media shares have plummeted about 70% from their high of nearly $80 in March, owing in part to the company’s falling revenue and a $16 million loss in its most recent quarter.

Trump’s return to rival social media platform X also hasn’t helped the stock. After being suspended indefinitely in 2021, when X was known as Twitter, Trump has since been invited back by new owner and supporter Elon Musk.

Financial experts have said DJT shares serve as a way for investors to bet on Trump’s chances of winning the presidential election in November. But the stock has fallen consistently since President Joe Biden ended his reelection campaign and Vice President Kamala Harris stepped up as the nominee. Harris accepted the Democratic nomination for president Thursday. She is closing the gap with Trump in national polls and prediction markets.

This story was originally featured on Fortune.com

Nvidia's Stock Has Soared 30% Since It Announced Its 10-for-1 Stock Split. History Says This Will Happen Next.

The artificial intelligence (AI) craze has powered the stock market higher this year, and few companies have benefited from that more than Nvidia (NASDAQ: NVDA). In the months since ChatGPT launched in November 2022, eliciting a tidal wave of demand for AI-capable hardware, the chipmaker’s share price has surged by 800%

Nvidia was the best-performing stock in the S&P 500 in 2023, and it could deliver a repeat performance in 2024. It is once again leading the S&P 500, and its gains year-to-date exceed those of second-place Vistra by 34 percentage points.

Nvidia announced a 10-for-1 stock split in May and completed it in June to “make stock ownership more accessible for employees and investors.” But based on historical patterns, Nvidia shares could decline in the coming months.

Historically, stock-split stocks have outperformed the S&P 500

Stocks that split typically outperform the S&P 500, at least temporarily. Since 2010, such companies’ shares have appreciated by 18% on average during the 12-month period after their stock split announcements, according to Bank of America. Meanwhile, the S&P 500 returned an average of 13% annually during the same period.

We can apply that information to Nvidia to speculate about its future performance. Specifically, its shares have advanced by 30% since Nvidia announced in May that a stock split was coming. So based on the broad averages, that leaves it with implied downside of 12% through May 2025. However, the outlook is considerably worse if we use company-specific data.

Historically, Nvidia shares have performed poorly following stock splits

Prior to the most recent one, Nvidia conducted five stock splits since it went public at $12 per share on Jan. 22, 1999. Generally speaking, those events were bad news for shareholders in the short term, as detailed in the table below.

|

Stock Split Date |

12-Month Return |

24-Month Return |

|---|---|---|

|

June 2000 |

28% |

(52%) |

|

September 2001 |

(72%) |

(49%) |

|

April 2006 |

1% |

(6%) |

|

September 2007 |

(70%) |

(53%) |

|

July 2021 |

(4%) |

145% |

|

Average |

(23%) |

(3%) |

Data source: YCharts.

Nvidia shares have declined by an average of 23% during the 12-month periods following past stock splits, and shares were still down by 3% on average 24 months after.

The chipmaker completed its most recent split after the market closed on June 7, and shares began trading at a split-adjusted price of $120.37 on June 10. The stock has returned 2% since then, leaving it with an implied downside of 25% through June 2025, and implied downside of 5% through June 2026.

Past performance is never a guarantee of future results, but investors should be especially cautious about extrapolating historical data in this situation. I say that because most of Nvidia’s past stock splits took place within 12 months of a recession, and all of them took place within 24 months of a recession. Few stocks generate positive returns during economic downturns.

Nvidia’s second-quarter earnings release will be a high-stakes event

Nvidia is best known for its graphics processing units (GPUs), powerful chips that can perform many types of calculations faster and more efficiently than central processing units (CPUs). GPUs are particularly well suited to computing tasks like rendering graphics, training machine learning models, and running artificial intelligence (AI) applications.

Nvidia dominates those markets. According to a study by the analysts at TechInsights, it accounted for 98% of data center GPU shipments last year, and its market share in AI processors ranges from 70% to 95%, according to analysts. But the company is truly formidable because it offers a full-stack computing platform that spans hardware, software, and services. That makes Nvidia a one-stop shop for AI.

It reported excellent financial results in its fiscal 2025 first quarter (which ended April 28). Revenue increased 262% year over year to $26 billion amid unprecedented demand for generative AI chips and networking hardware. Meanwhile, non-GAAP earnings surged by 461% to $6.12 per diluted share. Those numbers soundly beat Wall Street’s estimates.

The company will report second-quarter results on Aug. 28, and Wall Street’s expectations are sky-high. Analysts anticipate revenue and non-GAAP earnings increases of 112% and 137%, respectively. That would make Q2 its fifth consecutive quarter of triple-digit percentage growth on the top and bottom lines. Additionally, management will likely address rumors that shipments of its next-generation Blackwell GPUs will be delayed.

The combination of elevated expectations and uncertainty surrounding the Blackwell GPUs means the upcoming earnings release will be a high-stakes event for Nvidia shareholders. Indeed, options pricing data implies 11% price action, meaning that data suggests the share price could increase or decrease by that much in the trading session that follows the report.

That puts investors in a tricky position. Would they be smarter to buy shares now and risk losses, or buy shares later and risk missing gains? The most prudent course of action would be to split the difference. Investors interested in adding Nvidia shares to their portfolios can buy a small position today, provided they are comfortable with volatility. Then, if shares decline substantially post-earnings, they can consider adding to their position.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Trevor Jennewine has positions in Nvidia. The Motley Fool has positions in and recommends Bank of America and Nvidia. The Motley Fool has a disclosure policy.

Nvidia’s Stock Has Soared 30% Since It Announced Its 10-for-1 Stock Split. History Says This Will Happen Next. was originally published by The Motley Fool

Nvidia Stock Surges as Earnings Expectations Grow

Chipmaker Could Give ‘Another Drop the Mic Performance,’ Wedbush Analysts Say

Sam Yeh / AFP / Getty Images

Nvidia CEO Jensen Huang delivers his keystone speech ahead of Computex 2024 in Taipei on June 2, 2024.

Key Takeaways

-

Expectations for Nvidia’s earnings release Wednesday are on the rise, in what could make it harder for the AI chipmaker to impress investors.

-

Consensus estimates for Nvidia’s second-quarter revenue and earnings climbed by hundreds of millions of dollars within the last 48 hours alone.

-

Nvidia shares gained more than 4% Friday and have risen about 160% since the start of the year.

Expectations for Nvidia’s (NVDA) earnings release Wednesday are on the rise, in what could make it harder for the artificial intelligence (AI) darling to impress investors.

Consensus estimates for Nvidia’s second-quarter revenue rose by $170 million to $28.84 billion in the last 48 hours alone, according to estimates compiled by Visible Alpha, while net income projections rose $120 million to $14.95 billion.

Whisper numbers could be even higher, with some analysts having long voiced concerns about investors’ expectations exceeding Wall Street projections.

Expecting Another ‘Drop the Mic Performance’

Wedbush analysts said Thursday they expect “another drop the mic performance from Nvidia,” citing signs of “massive enterprise AI demand” and spending by cloud giants such as Amazon (AMZN) and Alphabet’s Google (GOOGL), all trends that would benefit the chipmaker.

They’re not alone, as analysts from Raymond James, KeyBanc, and elsewhere recently said they expect a strong quarter from the chipmaker as well, despite concerns about a reported delay in Nvidia’s Blackwell AI chip.

Over 95% of analysts tracked by Visible Alpha have a “buy” rating for the stock, with a consensus price target of $144.83, 12% above Friday’s closing price.

Nvidia shares gained 4.6% Friday to close at $129.37. The stock has gained about 160% since beginning of the year.

Read the original article on Investopedia.

Why Altcoins Surged Ahead by Double Digits This Week

As we entered the last weeks of summer, the crypto market began to heat up as if it was mid-July. Numerous news developments and trends that have powered rallies in digital coins and tokens in the past started to boost the market again. As a result, many were rising at comfortable, double-digit rates over the course of this week.

There was plenty of variety in that surge, too, data compiled by S&P Global Market Intelligence reveal. Smart contract platform anchor coin Tron (CRYPTO: TRX) was up by almost 19% across the period, with utility token Chainlink (CRYPTO: LINK) not far behind with a 17% gain. Everything-but-the-kitchen-sink chain BNB‘s (CRYPTO: BNB) native cryptocurrency advanced by nearly 13%, and holders of meme crypto Pepe (CRYPTO: PEPE) were surely pleased with its almost 18% rise.

A very pleasant late summer bounce-back

Cryptocurrencies experienced a slide — well, let’s call it a “correction” — at the beginning of this month. U.S. economic data releases brought on fears of a looming recession, and that kind of environment isn’t good for most financial assets. It’s especially threatening for assets considered to be high risk, and even after all this time most cryptos (save for possibly Bitcoin and, at a stretch, Ethereum) are slotted into this category.

Compounding this growing fear, the Federal Reserve (Fed) resolutely stuck to its policy of leaving interest rates unchanged. All things being equal, lower rates tend to encourage market players to chase riskier investments, hence the crypto world’s thirst for a Fed rate cut or several.

The situation changed notably in the middle of the month. Last week the inflation readout showed that the current macroeconomic bogeyman seemed to be fading considerably. The year-over-year rise in the consumer price index (CPI) was 2.9%, which was the first time it’s landed below 3% since the pandemic month of March 2021. That figure was also well below many economists’ projections.

That good news was compounded by this week’s analysis from influential research organization the Conference Board. Its leading economic indicators (LEI), considered by many to be reliable signals of potential economic distress, fell by 2.1% over the six months ending in July. This compared favorably to the drop of 3.1% in the preceding half-year stretch. According to the board, this sort of trajectory “no longer signals recession ahead.” While economic growth is expected to slow, this shouldn’t be as drastic as some worry it might be.

It’s almost time for cuts!

Meanwhile, on Friday crypto investors — and the rest of the financial world — received their surest signal yet that the Fed is about to grab the scissors. Chair Jerome Powell talked about rate cuts as if they were an event soon to be realized, rather than a hazy possibility or rank speculation.

“The time has come for policy to adjust,” he said in his keynote speech at the organization’s annual retreat. “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

Should you invest $1,000 in TRON right now?

Before you buy stock in TRON, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and TRON wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Eric Volkman has positions in Bitcoin and Ethereum. The Motley Fool has positions in and recommends Bitcoin, Chainlink, and Ethereum. The Motley Fool has a disclosure policy.

Why Altcoins Surged Ahead by Double Digits This Week was originally published by The Motley Fool