What's Going On With Super Micro Computer Stock On Thursday?

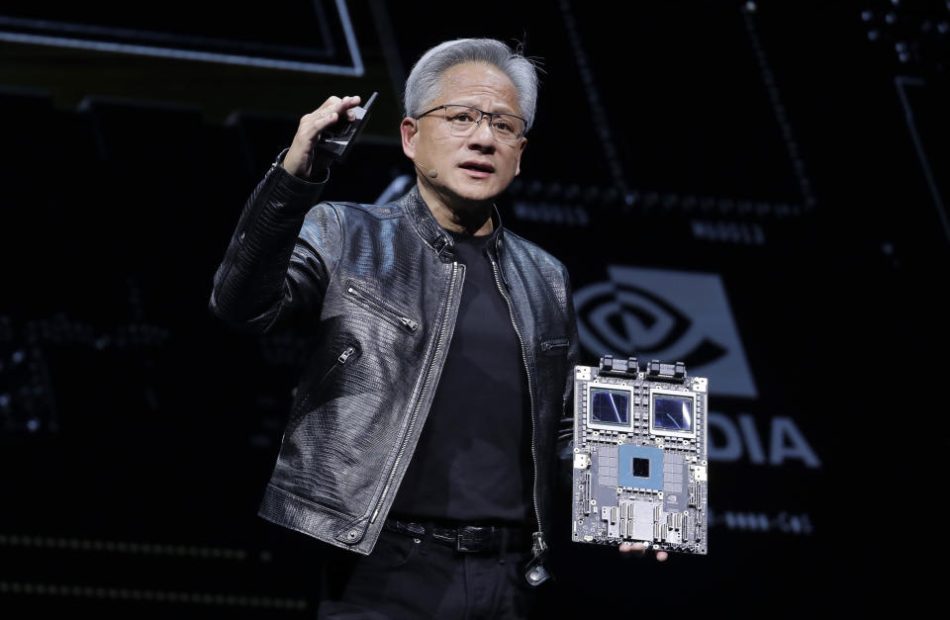

Artificial intelligence server company Super Micro Computer, Inc (NASDAQ:SMCI) stock is trading lower Thursday in sympathy with the broader semiconductor selloff led by its clients, including Nvidia Corp (NASDAQ:NVDA) and Advanced Micro Devices, Inc (NASDAQ:AMD).

Despite the selloff, analysts continue to hail Nvidia as the critical AI play, implying the continued potential for the AI frenzy. The selloff has rendered the valuation of the semiconductor companies as more attractive entry points.

Super Micro Computer stock has increased 136% in the last 12 months and is currently trading at a price-to-earnings multiple of 13.73x. Nvidia, up 176%, is currently trading at a 33.16 PE multiple.

Recently, Taiwanese rail kit supplier Nan Juen International Co, a Super Micro Computer partner, inked a deal with Nvidia to ramp up rail kit production for GB200 AI servers.

The market value of AI servers has the potential to surpass $187 billion in 2024, implying a growth rate of 69% driven by the demand for advanced AI servers from major CSPs and brand clients, as per TrendForce.

The market potential for AI servers backed by demand from Big Tech giants, including Nvidia, AMD, Amazon.Com Inc (NASDAQ:AMZN), Amazon Web Services, and Meta Platforms Inc (NASDAQ:META) explains Super Micro Computer’s stock price trajectory.

Super Micro Computer reported a topline growth of 144% in the fourth quarter. Analysts expected the AI server company’s margin weakness to recover by fiscal 2025, easing the competitive pricing environment.

Investors can gain exposure to Super Micro Computer through Invesco QQQ Trust, Series 1 (NASDAQ:QQQ), and SPDR S&P 500 (NYSE:SPY).

Price Action: SMCI shares traded lower by 2.77% at $606.50 at the last check on Thursday.

Photo via Company

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article What’s Going On With Super Micro Computer Stock On Thursday? originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia stock slips ahead of earnings release as Wall Street reiterates bullish outlook

Nvidia (NVDA) stock fell more than 3% on Thursday as Wall Street analysts reiterated their bullish views of the chip giant ahead of its highly anticipated earnings report next week.

Nvidia shares have gained more than 25% since early August.

KeyBanc’s John Vinh was among the latest Wall Street analysts to outline why the company should be poised to beat lofty forecasts in its report on Aug. 28.

“We believe modest expectations for Blackwell shipments in FQ3 have been backfilled with higher Hopper bookings,” Vinh wrote in a recent note.

“We expect NVDA to report beat/raise results, in which upside will be driven by strong demand for Hopper GPUs.”

The analyst reiterated a Buy rating on the stock with a price target of $180.

Nvidia’s next-generation Blackwell chips were reported to be facing delays of up to three months, potentially pushing out future orders and weighing on plans from key customers like Microsoft, (MSFT) Meta (META), Google (GOOG, GOOGL), and Amazon (AMZN), which collectively account for about 40% of the company’s revenue.

Citi analysts also reiterated their Buy rating on the stock this week, writing that they expect “Blackwell comments [from Nvidia] to reassure investors on a strong 2025 outlook, and [the] stock to make fresh 52 week high.” The firm’s analysts have a $150 price target on the stock.

Goldman Sachs analysts also restated their Buy rating on Nvidia, which also sits on the firm’s “Conviction List.”

Wall Street remains positive on Big Tech’s AI infrastructure spending, with Goldman Sachs recently saying it believes “customer demand across the large Cloud Service Providers and enterprises is strong and Nvidia’s robust competitive position in AI/accelerated computing remains intact.”

Analyst forecasts have Nvidia’s revenue set to grow 112% in its latest quarter, though this would mark a slowdown from the over 250% growth seen by the company in the same quarter last year.

Nvidia shares have been a major driver of the August market rebound, as the stock roared back roughly from its August low, when it fell below $100.

Shares last touched an intraday high north of $140 in June, closing at an all-time high of $135.58 on June 18. The majority of analysts are bullish on the AI chip heavyweight, with 66 Buy recommendations, eight Hold ratings, and zero Sell recommendations.

Ines Ferre is a senior business reporter for Yahoo Finance. Follow her on X at @ines_ferre.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Ask an Advisor: I Inherited $200k in an IRA, but I'm in the 35% Tax Bracket-What's the Best Way to Withdraw

I was left $200,000 in an IRA Beneficiary Distribution Account (BDA) when my father passed. I have 10 years to withdraw this money. I’m at the 35% federal tax rate currently and plan to make a similar annual income over the next 10 years. Taking the money out in one lump sum would not change my federal tax rate but neither would taking it out over 10 years. Is there a benefit to keeping this money in the IRA vs. withdrawing now, paying the taxes and then using it to invest in other financial instruments?

– Brad

At first blush, it may seem like the answer would be to withdraw it all now. The logic is that it would be better to have the compound growth occur in an environment in which the long-term capital gains tax rate would apply instead of ordinary income taxes. This is often the case when you expect your marginal tax rate to change. I don’t think this applies in your case since you anticipate being in the 35% tax bracket going forward.

Leaving the money invested in the IRA, on the other hand, can reduce tax drag and potentially leave you with more money at the end of 10 years. But like so much in financial planning, the answer to your question may depend on whether tax laws change in the future. (And if you need more help exploring questions like this one, consider working with a financial advisor.)

Evaluating Your Options

To evaluate the two approaches, we’ll want to compare the after-tax value of the $200,000 at the end of 10 years in both scenarios. We can do this by comparing the extreme ends: withdrawing it all now or all of it at the end of 10 years. If either outcome is better – and we hold the same assumptions (return, taxes) constant over the 10-year periods – a variation of either option would produce a similar result, just to a lesser degree.

A range of withdrawal options may be available to you depending on whether or not your dad had already begun taking required minimum distributions (RMDs). If he had, be mindful that you are likely subject to an annual RMD requirement as well unless you meet one of the exceptions.

So, let’s get started.

Measuring the Outcomes

First, we need to understand how much you would have to invest in each scenario. If you withdraw $200,000 and 35% goes to taxes, you’re left with $130,000 to reinvest. Of course, if you just leave it in the inherited IRA, all $200,000 remains invested.

Next, we need to project how much the money is expected to grow over the next 10 years. We can pick any random annual return to use as long as we use the same for each. I picked 10% simply because it’s a round number.

In the first scenario, $130,000 would grow to about $337,000 in 10 years, assuming a 10% annual rate of return. On the other hand, leaving the $200,000 in the IRA and seeing it grow 10% per year would leave you with approximately $519,000 before taxes.

Lastly, we must calculate the after-tax value of the money in each scenario.

Since you would have already paid taxes on the original $200,000 withdrawal in the first scenario, we’ll just have to calculate the capital gains tax you’d pay on the investment earnings. If we simplistically and generously assume the $207,000 gain from the first scenario is treated entirely as a long-term capital gain, you’d owe about $41,000 in taxes when you withdraw the money in 10 years. That would leave you with about $296,000, including the $130,000 principal. I used the 20% long-term capital rate here, although some of it may only be subject to the 15% rate (Even if all of it were, it wouldn’t change the outcome.)

In the second scenario, withdrawing $519,000 at the end of the 10 years would mean paying a 35% income tax on the entire balance, leaving you with $337,000 – $40,000 more than scenario 1.

Purely from a tax perspective, there may be cause for leaving it in the IRA for 10 years. (And if you need help running the numbers to answer similar questions, consider matching with a financial advisor.)

Leave It in the IRA?

Not necessarily. You always want to think about how a certain approach fits within your overall financial plan. You also may want to consider possible variations to the assumptions we made in the above scenarios. Examples of such variations might include:

-

Your returns in each scenario may not be the same. There will likely be some tax drag on the money invested outside of the IRA. Of course, you may also have the opportunity to harvest losses.

-

Tax rates may go up in the future. You might decide to leave the money in the IRA only to find out that you’re in some new 70% tax bracket 10 years from now. You’d also have to consider how capital gains taxes might change.

-

Your tax situation could change. You might change jobs, face a layoff or go through some other experience that causes your income to drop, and with it, your tax rate to change.

The point here isn’t to introduce unnecessary complexity. Instead, I’m pointing out that regardless of what the numbers on the spreadsheet say, circumstances might change. You have to decide how you want to handle those prospects. (And if you need a financial advisor to walk you through, this tool can help you match with one.)

Bottom Line

Tax-advantaged accounts like an IRA Beneficiary Distribution Account provide some clear benefits for long-term savings. The best way to use them can vary and depend on individual circumstances. This includes current and future tax rates, but also preferences and assumptions about your income needs in the future.

Tips for Finding a Financial Advisor

-

Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

When hiring a financial advisor there are some important bits of information you should obtain before making your final decision. Here are 10 vital questions to ask a financial advisor before hiring one.

Brandon Renfro, CFP®, is a SmartAsset financial planning columnist and answers reader questions on personal finance and tax topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Please note that Brandon is not a participant in the SmartAdvisor Match platform, and he has been compensated for this article. Questions may be edited for clarity or length.

Photo credit: ©iStock.com/Dean Mitchell, ©iStock.com/Dean Mitchell

The post Ask an Advisor: My Dad Left Me $200k in an IRA, but I’m in the 35% Tax Bracket. How Should I Structure My Withdrawals? appeared first on SmartReads by SmartAsset.

Warren Buffett Just Bought Another $345 Million Worth of His Favorite Stock

Warren Buffett is the chairman and CEO of the Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) investment company. He has overseen a 19.8% compound annual return in Berkshire stock since 1965, which would have been enough to turn an investment of $1,000 back then into over $42.5 million today.

The same investment in the S&P 500 index would be worth just $327,400 today, so it’s no surprise that investors closely monitor Buffett’s every move.

According to Berkshire’s 13-F filing for the second quarter of 2024 (ended June 30), the conglomerate just sold a substantial amount of stock, which implies Buffett might be feeling cautious about the broader market. However, Berkshire’s Q2 financials suggest there is still one stock he appears to absolutely love.

Berkshire slashed its largest position by half

Berkshire spent around $38 billion acquiring shares in iPhone maker Apple between 2016 and 2023. It’s the most money the conglomerate has invested in any company since Buffett took the helm in 1965.

Berkshire’s position in Apple was worth over $170 billion earlier this year, which meant it was sitting on a whopping $130 billion gain. It accounted for almost half of the value of the conglomerate’s entire stock portfolio. Berkshire periodically sold small parcels of Apple stock over the years to lock in gains, but it really ramped up its selling in recent months.

In the first quarter of 2024 (ended March 31), Berkshire sold around 13% of its Apple stake for tax reasons (according to Buffett). It followed that up by selling 49% of its remaining shares during the second quarter. Berkshire is still holding $90 billion worth of Apple stock — and it’s still the conglomerate’s largest position — but many investors are worried that Buffett’s recent activity reflects a negative view on the stock market overall.

That’s because in addition to selling Apple, Berkshire offloaded its entire stakes in Paramount Global and Snowflake, and it trimmed its positions in Chevron, Capital One Financial, and T-Mobile (to name just a few moves).

In fact, as my colleague Sean Williams points out, Q2 was the seventh consecutive quarter in which Berkshire was a net seller of stocks. Berkshire is now sitting on a record $277 billion in cash and equivalents, which implies Buffett is struggling to find opportunities in this market that represent a good value.

The S&P 500 trades at a price-to-earnings (P/E) ratio of 27.4 as of this writing, which is far more expensive than its average P/E of 18.1 going back to when the index was established in the 1950s. Since Buffett’s time-tested strategy involves buying great companies at a fair price, perhaps it’s no surprise that he isn’t enthusiastic about putting money to work right now.

But there is one stock Buffett continues to buy

Although Buffett is adopting a cautious stance toward the broader market right now, there was one stock Berkshire continued to buy in Q2 — except you won’t find it in the conglomerate’s 13-F, because the stock is… Berkshire Hathaway!

That’s right, Buffett authorized the repurchase of $345 million worth of Berkshire stock in the recent quarter. Buybacks are a popular way for companies to return money to their shareholders. Simply put, they reduce the total number of shares in circulation, which organically increases the price per share by a proportionate amount.

Berkshire has now spent $2.9 billion on buybacks in 2024, and a whopping $77.8 billion since 2018! That’s more than double the amount Buffett spent investing in Apple, and it’s a vote of confidence in the conglomerate’s ability to generate a higher return than most other stocks it could be buying instead.

Berkshire can repurchase stock at its discretion as long as the total value of its cash, equivalents, and holdings in U.S. Treasury Bills remains above $30 billion. Since the conglomerate is sitting on $277 billion in dry powder right now, it’s unlikely the buybacks will stop anytime soon.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $779,735!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, Chevron, and Snowflake. The Motley Fool recommends T-Mobile US. The Motley Fool has a disclosure policy.

Warren Buffett Just Bought Another $345 Million Worth of His Favorite Stock was originally published by The Motley Fool

Elon Musk was just forced to reveal who really owns X. Here’s the list

Bill Ackman and Sean “Diddy” Combs are among the list of owners of Elon Musk’s X, the social media site formerly known as Twitter.

The platform has been forced to disclose its investors as part of a lawsuit brought by former employees, who are seeking payment of arbitration fees incurred following Musk’s purchase of the site.

Previously, X has argued that its investors were confidential as a matter of “routine practice and policy,” but this week, a federal judge in California ruled to unseal the list of the site’s owners.

Among the nearly 100 owners of the social media giant are some familiar names, both from the world of investment and within the X universe.

Previously, high-profile investors like Fidelity have been connected with X, most notably because the investment vehicle’s filings implied a 72% drop in the company’s value since Musk took it over.

However, the latest filing reveals the investment behemoth’s backing of the platform, with almost 30 separate Fidelity-linked entities holding stakes in the brand.

This week’s unsealed documents also lay bare the lesser-known stakeholders in the company.

The list seen by Fortune reveals the Pershing Square Foundation owns a stake in X. If the name sounds familiar, that’s because of its link to Pershing Square Holdings, founded by billionaire investor Bill Ackman 20 years ago.

Although the foundation of the same name is led by an independent senior leadership team, Ackman and his wife, Neri Oxman, are co-trustees.

Ackman is a vocal user of X and frequently uses the platform to address other high-profile individuals and entities. He has used it to debate Shark Tank star Mark Cuban and raise questions about the leadership of his alma mater, Harvard University.

Elsewhere on the list of owners is Oracle founder Larry Ellison. The stake in X comes via the Lawrence J. Ellison Revocable Trust, the principal business of which, per an SEC report filed in 2008 and seen by Fortune, is to “hold the assets and estate of Mr. Ellison.”

The interests of the trust and Oracle bear no relation to each other, the SEC filing adds.

Unlike Ackman, Ellison is not an avid user of the site. Despite having more than 130,000 followers, Ellison has posted twice—once in 2012 and once in 2023.

Another notable name on the list is Sean Combs Capital.

While SEC filings show no matches for the company, the business has previously been linked to the American rapper Diddy—previously known as Puff Daddy—who has launched a number of businesses under his birth name.

These have included the Sean Combs Foundation, Combs Investments, and more recently the umbrella brand for his holdings, Combs Global.

Musk has also managed to attract some royal attention for his endeavor, with HRH Prince Alwaleed Bin Talal Bin Abdulaziz Alsaud also featured on the list.

The Saudi prince has a net worth just shy of $19 billion, per Forbes, and also has holdings in the likes of luxury hotels the Four Seasons and the Savoy, as well as other technology firms like ride-sharing company Lyft.

It also seems that despite his criticism of Musk’s leadership, Jack Dorsey still owns shares in the platform he founded via the Jack Dorsey Remainder LLC.

The Twitter cofounder previously backed the Tesla CEO in his takeover of the company but walked back his support earlier this year, telling a member on rival social media platform Bluesky, “It all went south.”

Doubling down on investments

Among the less eminent names are some organizations that not only hold stakes in X as a business but have also seen senior leaders pitch in.

Take the likes of Danilo Kawasaki and Ross Gerber.

According to the filing, the pair are named as individual investors in X but also have a stake in the business they lead, the wealth and investment management firm Gerber Kawasaki.

Elsewhere on the list are the Silicon Valley VCs one might expect: 8VC, Andreessen Horowitz, and Sequoia.

The list, of course, also features Musk himself. Via the Elon Musk Revocable Trust, the SpaceX founder is also listed.

Musk purchased the site for $44 billion in 2022, though the filing did not make clear the proportion of his investment versus that of others. Since then, the business has been beleaguered by departing advertisers, mass layoffs, and criticism of Musk’s strategy.

X did not immediately respond to Fortune‘s request for comment.

The full list

-

8VC Opportunities Fund II, L.P.

-

ADREM X LLC

-

ADREM Y LLC

-

Afshar Partners, LP

-

Andrea Stroppa

-

Andreessen Horowitz LSV Fund III, L.P.

-

Anthem Ventures, LLC

-

ARK Venture Private Holdings LLC

-

BAMCO, Inc.

-

Bandera Fund LLC

-

Baron Opportunity Fund

-

Baron Partners Fund

-

Binance Capital Management Co., Ltd

-

Brookfield Project X L.P.•CCM 2020 Investments LLC

-

Cheng and Chen Family Trust

-

CNK Fund IV, L.P.

-

Danilo Kawasaki

-

Dayton Family Enterprises, LLC

-

Dayton Family Investments, LLC

-

DFJ GROWTH IV, L.P.

-

DFJ GROWTH IV PARALLEL FUND, LLC

-

DFJ GROWTH X-I, L.P.

-

Eden Relationship Capital L.P.

-

Elon Musk as Trustee of the Elon Musk Revocable Trust dated July 22, 2003

-

FIAM Target Date Blue Chip Growth Commingled Pool By: Fidelity InstitutionalAsset Management Trust Company as Trustee

-

Fidelity Blue Chip Growth Commingled Pool By: Fidelity Management TrustCompany, as Trustee

-

Fidelity Blue Chip Growth Institutional Trust By its manager Fidelity InvestmentsCanada ULC

-

Fidelity Canadian Growth Company Fund by its manager Fidelity InvestmentsCanada ULC

-

Fidelity Central Investment Portfolios LLC: Fidelity U.S. Equity Central Fund -Communication Services Sub

-

Fidelity Contrafund: Fidelity Advisor New Insights Fund – Sub A

-

Fidelity Contrafund: Fidelity Advisor New Insights Fund – Sub B

-

Fidelity Contrafund: Fidelity Contrafund•Fidelity Contrafund: Fidelity Contrafund K6

-

Fidelity Contrafund: Fidelity Series Opportunistic Insights Fund

-

Fidelity Contrafund Commingled Pool By: Fidelity Management Trust Company,as Trustee

-

Fidelity Destiny Portfolios: Fidelity Advisor Diversified Stock Fund

-

Fidelity Global Growth and Value Investment Trust – Sub A By its manager Fidelity Investments Canada

-

Fidelity Global Innovators Investment Trust by its manager Fidelity InvestmentsCanada ULC

-

Fidelity Growth Company Commingled Pool By: Fidelity Management TrustCompany, as Trustee

-

Fidelity Insights Investment Trust By its manager Fidelity Investments CanadaULC

-

Fidelity Mt. Vernon Street Trust: Fidelity Growth Company Fund

-

Fidelity Mt. Vernon Street Trust : Fidelity Growth Company K6 Fund

-

Fidelity Mt. Vernon Street Trust: Fidelity Series Growth Company Fund

-

Fidelity OTC Commingled Pool By: Fidelity Management Trust Company, as Trustee

-

Fidelity Puritan Trust: Fidelity Puritan Fund – Equity Sub B

-

Fidelity Puritan Trust: Puritan K6 Fund – Equity Subportfolio•Fidelity Securities Fund: Fidelity Blue Chip Growth Fund

-

Fidelity Securities Fund: Fidelity Blue Chip Growth K6 Fund

-

Fidelity Securities Fund: Fidelity OTC K6 Portfolio

-

Fidelity Securities Fund: Fidelity OTC Portfolio

-

Fidelity Select Portfolios : Select Communication Services Portfolio•G64 Ventures LLC

-

Gerber Kawasaki Inc.

-

GFNCI LLC

-

Gigafund 0.21, LP

-

Glacier Ventures LLC

-

Go Mav, LLC

-

HRH Prince Alwaleed Bin Talal Bin Abdulaziz Alsaud

-

HRH Prince Alwaleed Bin Talal Bin Abdulaziz Alsaud

-

IMG US, LLC

-

Jack Dorsey Remainder LLC

-

Jack Dorsey Tr Ua 12/08/2010 Jack Dorsey Revocable Trust

-

Kingdom Holding Company

-

Lawrence J. Ellison Revocable Trust

-

Linda Ye and Robin Ren Family Foundation

-

Litani Ventures•Luchi Fiduciaria SR POS. 365

-

Manhattan Venture Partners X LLC

-

Mirae Asset Innovation X ONE, LLC

-

Mirae Asset Project X Fund I, LP•Olivier Janssens

-

Q Tetris Holding LLC

-

Ross Gerber

-

Santo Lira LLC

-

SC CDA1 LLC

-

SCGE Fund, L.P.•SCGGF III – U.S./India Management, L.P.

-

SCHF (M) PV, L.P.

-

Scott Nolan

-

SC US/E Expansion Fund I Management, L.P.

-

Sean Combs Capital, LLC

-

Sequent (Schweiz) AG as Trustee of the Debala Trust

-

Sequioa Capital Fund, L.P.

-

Series N Dis, a series of Atreides Special Circumstances Fund, LLC

-

Shahidi Tactic Group, LLC

-

Steve Davis

-

T. One Holdings LLC

-

The Pershing Square Foundation

-

TM33 Partner Holdings

-

Tresser Blvd 402 LLC

-

UnipolSai S.P.A.

-

Variable Insurance Products Fund II: VIP Contrafund Portfolio – Subportfolio A

-

VYC25 Limited

-

X Holdings I Investment, LLC

This story was originally featured on Fortune.com

New Starbucks CEO to commute from California home to Seattle HQ

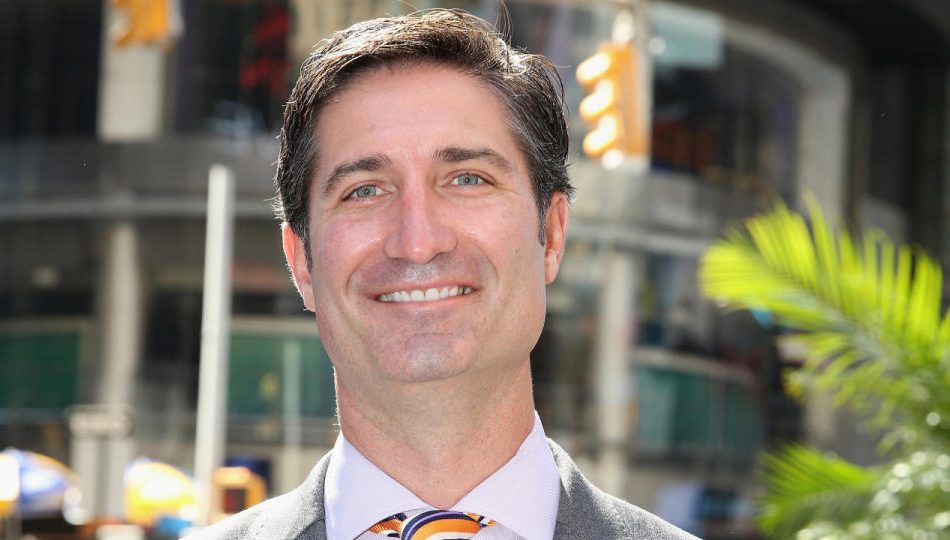

Starbucks is allowing its incoming CEO Brian Niccol to commute to work from his Southern California home — and he will have the option to fly on the company’s corporate jet.

The coffee chain said in a filing with the Securities and Exchange Commission that Niccol “will not be required to relocate” to Seattle and has agreed to “commute from your residence to the Company’s headquarters (and engage in other business travel) as is required to perform your duties and responsibilities.”

Niccol, the former chief executive at Chipotle, will take over as Starbucks CEO and chairman on Sept. 9, replacing Laxman Narasimhan.

INCOMING STARBUCKS CEO BRIAN NICCOL POISED TO GET SIZABLE COMPENSATION

When he steps into the job, he will be eligible to use Starbucks’ plane to “travel between your city of residence and the Company’s headquarters” in Seattle, the filing said.

Where Niccol currently lives and Seattle are over 1,100 miles apart from each other by car.

Niccol will be allowed to fly on the company plane for “business-related travel in accordance with the Company’s travel policy” and “your personal travel in accordance with the Company’s policies, up to a maximum amount of $250,000 per year,” too, according to the filing.

Starbucks told FOX Business that Niccol will use the company’s Seattle headquarters as his main office and work out of that location three days per week other than when he is away for work-related travel. That time in-office will be in line with the company’s hybrid work rules.

STARBUCKS CEO OUSTED: WHAT BRIAN NICCOL FACES AS NEW TOP BOSS

Niccol will have a “small remote office” in Newport Beach, California, which the company will work with him to get up and running, according to Starbucks’ SEC filing.

The company also told FOX Business that Niccol will be on the road visiting stores and other locations related to Starbucks’ business or at its headquarters most of the time. He also plans to maintain a home in the city, according to Starbucks.

Prior to being tapped as Starbucks CEO, Niccol helmed Chipotle, which is headquartered in Newport Beach, for about six years. Last week, as Starbucks announced his upcoming appointment, he expressed excitement about joining the company.

STARBUCKS NAMES CHIPOTLE CHIEF BRIAN NICCOL AS NEW CEO

“I have long-admired Starbucks’ iconic brand, unique culture and commitment to enhancing human connections around the globe,” Niccol said. “As I embark upon this journey, I am energized by the tremendous potential to drive growth and further enhance the Starbucks experience for our customers and partners, while staying true to our mission and values.”

Chipotle has selected COO Scott Boatwright to become its interim CEO.

Original article source: New Starbucks CEO to commute from California home to Seattle HQ

This Company Just Became Warren Buffett's Second-Biggest Stock Holding. Is It a Buy Today?

Warren Buffett was making headlines for some of his recent trades even before his 13F filing last week, which detailed all of Berkshire Hathaway‘s trades in the second quarter. But that latest Securities and Exchange Commission filing brought even more news, and not just about stocks he bought and sold. One of his best-loved stocks has climbed into the No. 2 spot in the Berkshire Hathaway portfolio, and it’s a name Buffett-watchers know well.

What happened in the second quarter

Even before the 13F was released, investors already knew that Buffett had sold a chunk of Berkshire’s top holding, Apple. Apple remains the largest position in the portfolio, but instead of accounting for almost half of its value, the tech giant now makes up just under 29%. That’s still an outsized percentage, and no one should think that Buffett has lost faith in Apple, which he recently added to the list of stocks he would never completely sell.

The other stock sale investors already knew about was Bank of America, which is Buffett’s favorite bank stock. Previously, it had been the portfolio’s second-largest position, but he reduced the size of that stake in Q2. He also opened new positions in Heico and Ulta Beauty, and bought and sold smaller amounts of stock from several of his existing positions.

However, after that sale of Bank of America shares, American Express (NYSE: AXP) — a position that Buffett hasn’t touched in about 30 years — is now his second-largest holding.

Why Buffett loves it

American Express is a classic Buffett stock, and he often sings its praises. He has long said that he would never sell American Express or his other favorite, Coca-Cola.

Buffett freely shares his investing wisdom and often talks about what he looks for in a stock. The first part of his formula is that he doesn’t look for great stocks — he looks for great businesses. According to his paradigm, a great company’s stock is likely to appreciate over time while the business grows steadily and profitably.

The next thing he looks for are businesses with durable, long-term competitive advantages. American Express is an established company with a niche target market, rigorous credit management, and a top rewards program.

It has always targeted an upscale, resilient consumer demographic, and in recent years, it has successfully pivoted to focus on a younger cohort, which is driving new membership and should be a reliable growth driver for decades. Management anticipates revenue growth of about 10% this year with a strong increase in earnings per share, and it is targeting similar results for the long term.

Buffett mentioned American Express’ “worldwide” brand as its moat. He often talks about businesses that participate in the American story, and American Express plays an important role in the U.S. economy.

Buffett also loves bank stocks. American Express isn’t a classic bank stock, but it does operate using a closed-loop model, which means it underwrites its own loans, unlike rival credit card networks Visa and Mastercard. These are also Buffett stocks, for similar reasons, but he doesn’t talk about them the same way he does about American Express. Banks have lots of cash, which gives them flexibility and opportunities, and they drive spending and the economy.

He has long said that he, along with Charlie Munger, who passed away last year, look for four things in an investment: A business that is understandable, has favorable long-term economics, able and trustworthy management, and a sensible price tag.

American Express has the kind of business Buffett understands, and its model leads to favorable long-term economics, which it has demonstrated over the decades that Berkshire Hathaway has owned its shares. Able and trustworthy management is how the company has been able to refresh itself to appeal to a new and different cadre of customers, and to grow revenues and increase profits despite periods of inflation and economic volatility.

It has also shown its commitment to creating shareholder value through dividend hikes and share buybacks — common behaviors for companies Buffett invests in.

Finally, American Express usually trades at a discount to the S&P 500 average. Today, it trades at a price-to-earnings ratio of 19, while the S&P 500 average is 27.

Is American Express a good stock pick for you?

Buffett rarely ventures past value stocks, and American Express is very much a value stock. So if you’re looking to add a high-growth stock to your portfolio now, the financial giant might not fit the bill. However, it does have a reliable record of growing sales and profits at a steady pace, and it has plenty of growth drivers to keep its business running smoothly.

As such, it’s a great pick for value investors or any investor looking for an anchor stock to add to a diversified portfolio. You can expect more growth from American Express for the foreseeable future, as well as an increasing dividend.

Should you invest $1,000 in American Express right now?

Before you buy stock in American Express, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and American Express wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $787,394!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. American Express is an advertising partner of The Ascent, a Motley Fool company. Jennifer Saibil has positions in American Express and Apple. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, Mastercard, Ulta Beauty, and Visa. The Motley Fool recommends Heico and recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

This Company Just Became Warren Buffett’s Second-Biggest Stock Holding. Is It a Buy Today? was originally published by The Motley Fool

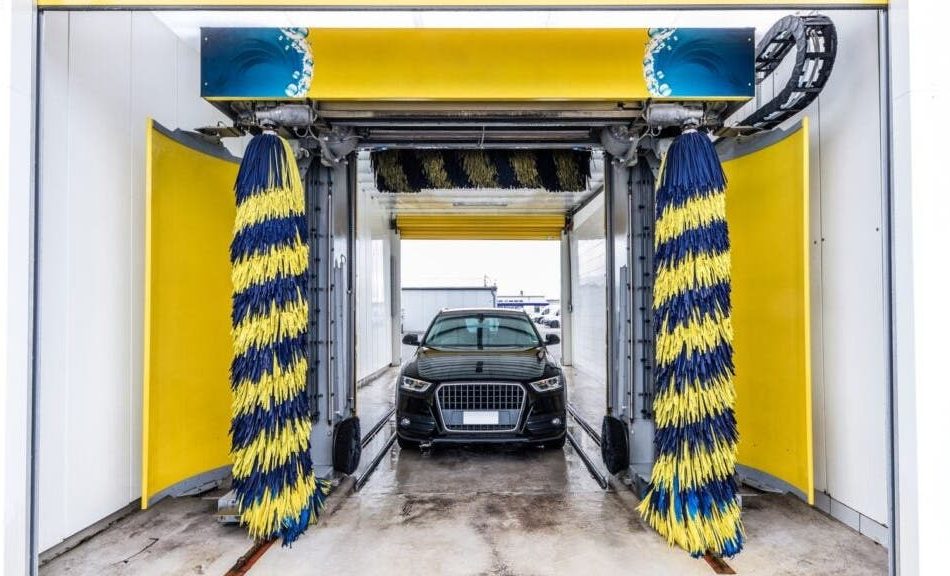

'Self-Run' Car Wash Sells For 140K, New Owner Profits $5K A Month, Only Stops By To Mix Soap And Collect Cash

When it comes to successful car wash ventures and pop culture references, Walter White’s A1A from “Breaking Bad” comes to mind. But for one young entrepreneur, her scrub stop is no cover-up — it’s bringing in truckloads of money and pretty much runs itself.

What To Know: According to a Business Insider report, 22-year-old Hannah Ingram purchased a coin-operated car wash in Tennessee in 2021 for $140,000. It brings in approximately $5,500 a month in profit and requires almost zero work.

Don’t Miss:

When she purchased the almost entirely automated car wash about three years ago, it was already active and profitable. After contacting the owners who had listed the business for sale and taking a quick look at the books, Ingram saw several areas where she could cut costs and grow the company’s bottom line.

“For example, they were paying a few hundred dollars a month for a radio advertisement that I knew I could lose and replace with social media marketing. Doing those calculations, I could see a clear way forward where I’d be able to stay in the green, and that gave me confidence in the investment,” she told Business Insider.

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

Ingram was able to get around having to come up with a large down payment by buying the business using seller financing, which is a real estate agreement that allows the buyer to make incremental payments to the seller on the purchase. In this case, she actually took over the owner’s existing bank loan.

When Ingram finally acquired the car wash she replaced many of the brushes, vacuums and soap dispensers. She also invested in new signs to put a new shine on the business. Ingram noted that she made a decent profit in her first month of ownership.

Trending: Commercial real estate has historically outperformed the stock market, and this platform allows individuals to invest in commercial real estate with as little as $5,000 offering a 12% target yield with a bonus 1% return boost today!

Later on, she added machines that accepted credit cards and made a few other improvements. All in, she invested an extra $7,500 into the business on top of the purchase price and the car wash now profits $5,500 each month on average.

Ingram used to spend about 30 minutes each day taking out trash and doing small preventative maintenance tasks at the location, but she hired someone to take over her minimal maintenance routine.

“These days, I basically just stop by to mix the soap and take care of the money … Otherwise, it’s entirely self-run — and I still make thousands a month,” she told Business Insider.

Read Next:

Photo: Robert Wilkos from Pixabay.

This story is part of a new series of features on the subject of success, Benzinga Inspire.

Some elements of this story were previously reported by Benzinga and it has been updated.

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article ‘Self-Run’ Car Wash Sells For 140K, New Owner Profits $5K A Month, Only Stops By To Mix Soap And Collect Cash originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

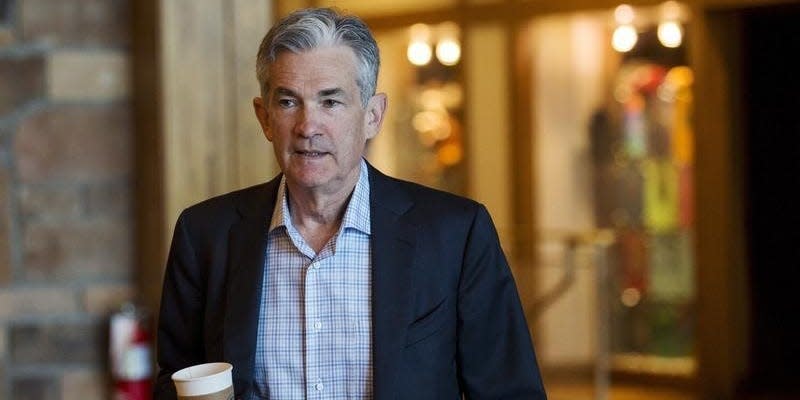

Stock market today: Stocks rise as traders await Jackson Hole and payroll adjustment locks in rate bets

-

Stocks ended higher Wednesday as traders took in jobs data and awaited the start of the Jackon Hole conference.

-

Revised jobs data show that the economy added 818,000 fewer jobs than initially forecast.

-

Investors are waiting for Powell to issue more guidance on Fed policy at Jackson Hole on Friday.

US stocks gained on Wednesday as traders awaited the start of the Federal Reserve’s Jackson Hole economic conference and took in revised jobs data from the past year.

Major stock indexes traded higher, while Treasury yields dropped through Wednesday’s session.

The Bureau of Labor Statistics issued revised job figures from April 2023 through March 2024, which showed that the US economy added 818,000 fewer jobs during that timeframe than initially reported.

The new figures, which reflect a weaker job market in that period, have bolstered confidence that the Fed is poised to loosen monetary policy and issue potentially steeper rate cuts than previously thought.

Markets are eyeing a 39% chance the Fed could cut rates 50 basis points in September, up from less than 30% earlier this week, according to the CME FedWatch tool.

“If you are in the rate cut in September camp, these data all but seal the deal on what [the] Fed needed to cut rates,” Jamie Cox, a managing partner at Harris Financial Group, said in a statement.

Investors were also soothed by the Fed’s latest meeting minutes, which showed that the majority of FOMC members believed it would “likely be appropriate” to begin cutting interest rates in September, so long as economic data continues “to come in about as expected,” the minutes said.

That’s considerably more dovish than the tone central bankers have struck all year, with Fed Chair Powell previously stating that the central bank needed more confidence that inflation was back on track before easing policy.

“Still, overall the FOMC appears comfortable enough — and concerned enough — that initiating the easing cycle will help ensure that the economic backdrop, particularly the labor market, won’t deteriorate at a marked pace,” Quincy Krosby, the chief global strategist at LPL Financial, added.

Investors are waiting for Powell to speak at the Fed’s annual Jackson Hole retreat on Friday, where the central bank chief is expected to deliver more guidance on policy through the end of the year.

Here’s where US indexes stood at the 4:00 p.m. closing bell on Wednesday:

Here’s what else is going on today:

In commodities, bonds, and crypto:

-

Oil futures dropped. West Texas Intermediate crude oil fell 1.7% to $71.93 a barrel. Brent crude, the international benchmark, fell 1.45% to $76.09.

-

Gold was up slightly to $2,552 an ounce.

-

The 10-year Treasury yield dropped two basis points to 3.795%.

-

Bitcoin jumped 3.4% to $61.563.

Read the original article on Business Insider

Jim Cramer Says People are Drinking 'Dramatically Less' Because of Weight Loss Drugs – Alcohol Dividend Stocks in Trouble?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Analysts are beginning to zero in on the potential impact of weight loss drugs like Ozempic and Zepbound on the food and beverage industry. These drugs work by cutting cravings for crunchy snacks and sugary drinks. No cravings mean no temptations to fill carts with those snacks and sugary drinks. It’s a win for health-conscious consumers but a major threat for the food and beverage industry, valued at trillions.

Jim Cramer didn’t hold back on his CNBC show, grilling food and beverage companies for not accepting the impact and growing influence of GLP-1 weight loss drugs. According to Cramer, these drugs are already making a noticeable dent in the industry’s bottom line.

Trending Now:

“Despite the fact that roughly 20 million Americans are said to be taking GLP-1 weight loss diabetes drugs, no, none of the food and beverage companies are willing to admit that these drugs have hurt them at all. They won’t even hint at it,” Cramer said on his show ‘Mad Money’ on CNBC.

Cramer emphasized that these drugs are incredibly “powerful,” and it’s “insane” to think they won’t affect snack food companies and liquor businesses.

He said that about 20 million people eating and drinking “dramatically less” than before is affecting these companies and their price/earnings multiples are “shrinking.”

Cramer called out a couple of liquor companies, too.

Can GLP-1 weight loss drugs topple these billion-dollar liquor giants that easily? Should the investors of dividend-paying beverage companies be worried? Let’s dive into some key stocks, check out their recent performance, and analyze what they’ve been saying in their latest earnings reports.

Diageo

Jim Cramer highlighted Diageo PLC (NYSE:DEO) on CNBC, noting that the company, which owns popular liquor brands like Johnnie Walker whiskey, Casamigos tequila, and Guinness beer, is experiencing sales declines but does not mention the reason behind this slump.

“Why is Casamigos down 20%? No one will say anything,” Cramer said.

Cramer was referring to the 20% sales decline for tequila company Casamigos, which Diageo bought back in 2017, during the year ending June 30.

Diageo saw its sales dip for the first time since the pandemic during the quarter. The company pointed to “unfavorable” currency impacts and a more “cautious” consumer environment as the reasons behind the slump. But what’s driving this caution? Is it inflation concerns, or could it be that GLP-1 drugs are curbing people’s cravings for alcohol? Time will tell. Meanwhile, Diageo still offers a decent 3.18% yield and has an impressive 25-year history of growing its dividends.

Constellation Brands

Constellation Brands, Inc. (NYSE:STZ), behind Corona and Modelo, reported fiscal first quarter results last month. Overall revenue jumped 6% from last year, with the beer business seeing high single-digit net sales growth and double-digit operating income growth. However, Constellation’s wine and spirits net sales plummeted 7%.

Wall Street was positive on the stock after the results. Goldman Sachs’ Bonnie Herzog pointed to Constellation’s underlying business strength and visibility on growth targets. He has a $300 price target and a Buy rating on the stock.

For 2025, Constellation continues to see sales growth of 7% to 9% for its beer business and operating income growth of 10% to 12%. That means at least Constellation’s beer business is not facing any short-term problems from weight-loss drugs.

Brown Forman

Cramer also targeted Jack Daniels maker Brown-Forman Corporation Class B (NYSE:BF), calling its sales “horrendous.”

“When you drink Jack Daniels, it is filled with sugar, ok? And that is really being impacted, but they won’t say what is hurting it,” Cramer said.

Brown-Forman has a dividend yield of about 1.9%. It has increased its dividend payouts for 40 straight years. In fiscal 2024, the company saw higher sales for Jack Daniel’s Tennessee Apple and reported a 150 basis point expansion in gross margin. Looking ahead to fiscal 2025, Brown-Forman expects the business environment to stay “volatile,” citing global macroeconomic and geopolitical uncertainties.

With a portfolio of several famous brands, Brown-Forman is better equipped to manage the risks that GLP-1 drugs might pose.

Read More:

-

When today’s AI startups go public, most of the rapid growth will be behind them — here’s how not to get left out.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Innovation Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

You don’t have to own a property to make money from fix-and-flip investments. Get started with only $10.

Molson Coors Beverage

Molson Coors Beverage Co Class B (NYSE:TAP), known for beer brands like Coors Light and Miller Lite, recently reported its second-quarter results. Profits increased 7.9% last year, though revenue dipped by 0.6%. For the full year, the company expects revenue to increase in the low single digits.

With a dividend yield of about 3.2%, Molson Coors isn’t just about beer – it also sells spirits and nonalcoholic beverages. Earlier this year, it raised its dividend for the third year in a row.

Molson Coors acknowledged inflation-related challenges and a slowdown, but not for the reasons Jim Cramer mentioned.

Here is what the company’s CFO said during the call:

“While this guidance implies slower trends for the second half the year, it’s important to remember that this is driven by shipment timing this year, and it does not alter our confidence in our long-term growth expectations.”

Looking For Higher-Yield Opportunities?

The current high-interest-rate environment has created an incredible opportunity for income-seeking investors to earn massive yields, but not through dividend stocks… Certain private market real estate investments are giving retail investors the opportunity to capitalize on these high-yield opportunities and Benzinga has identified some of the most attractive options for you to consider.

For instance, the Ascent Income Fund from EquityMultiple targets stable income from senior commercial real estate debt positions and has a historical distribution yield of 12.1% backed by real assets. With payment priority and flexible liquidity options, the Ascent Income Fund is a cornerstone investment vehicle for income-focused investors. First-time investors with EquityMultiple can now invest in the Ascent Income Fund with a reduced minimum of just $5,000. Benzinga Readers: Earn a 1% return boost on your first EquityMultiple investment when you sign up here (accredited investors only).

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

This article Jim Cramer Says People are Drinking ‘Dramatically Less’ Because of Weight Loss Drugs – Alcohol Dividend Stocks in Trouble? originally appeared on Benzinga.com