Decoding Stellantis's Options Activity: What's the Big Picture?

Investors with significant funds have taken a bullish position in Stellantis STLA, a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in STLA usually indicates foreknowledge of upcoming events.

Today, Benzinga’s options scanner identified 10 options transactions for Stellantis. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 50% being bullish and 50% bearish. Of all the options we discovered, 9 are puts, valued at $703,125, and there was a single call, worth $27,200.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $11.0 to $20.0 for Stellantis during the past quarter.

Volume & Open Interest Trends

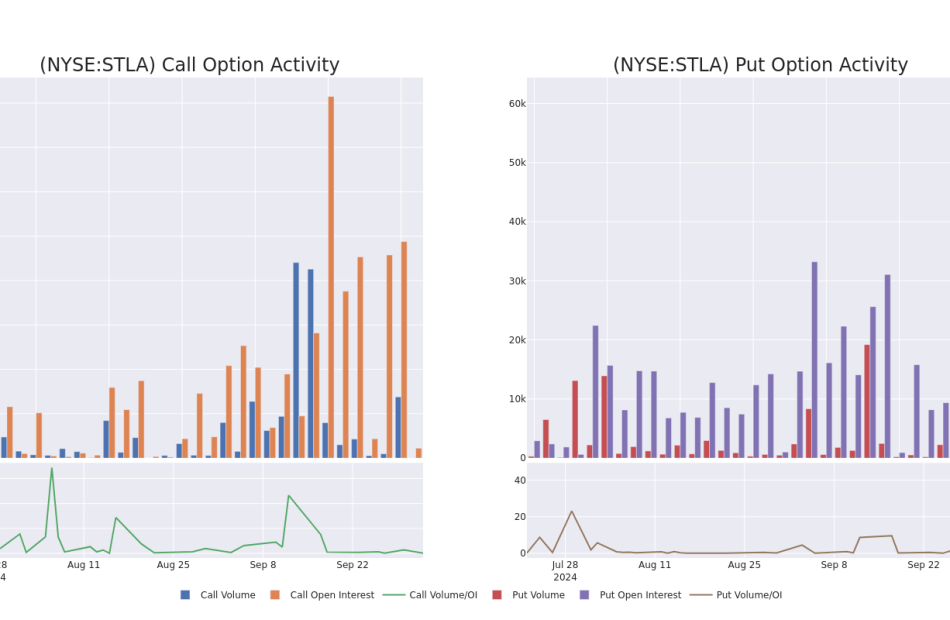

In today’s trading context, the average open interest for options of Stellantis stands at 3287.75, with a total volume reaching 4,506.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Stellantis, situated within the strike price corridor from $11.0 to $20.0, throughout the last 30 days.

Stellantis Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| STLA | PUT | SWEEP | BULLISH | 01/15/27 | $7.3 | $7.1 | $7.2 | $20.00 | $144.0K | 550 | 250 |

| STLA | PUT | TRADE | BEARISH | 06/20/25 | $7.2 | $6.9 | $7.2 | $20.00 | $144.0K | 6.3K | 200 |

| STLA | PUT | TRADE | BULLISH | 01/15/27 | $7.3 | $7.2 | $7.2 | $20.00 | $120.9K | 550 | 418 |

| STLA | PUT | SWEEP | BULLISH | 06/20/25 | $4.4 | $4.2 | $4.2 | $17.00 | $99.1K | 9.6K | 236 |

| STLA | PUT | SWEEP | BEARISH | 03/21/25 | $1.6 | $1.55 | $1.6 | $14.00 | $48.0K | 1.0K | 77 |

About Stellantis

Stellantis was created out of the merger of US-based Fiat Chrysler Automobiles, or FCA, and French-based Peugeot, or PSA, in January 2021, resulting in the fourth-largest automotive original equipment manufacturer, or OEM, by vehicle sales. In 2023 it sold 6.4 million vehicles, 44% and 30% in Europe and North America, respectively. North America is the most profitable region, contributing 53% of operating income. Its brands include Fiat, Jeep, Chrysler, Ram, Peugeot, Citroen, Opel, Alfa Romeo, and Maserati.

After a thorough review of the options trading surrounding Stellantis, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Stellantis Standing Right Now?

- With a trading volume of 5,918,441, the price of STLA is down by -4.48%, reaching $13.02.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 133 days from now.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Stellantis options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply