Decoding Lowe's Companies's Options Activity: What's the Big Picture?

High-rolling investors have positioned themselves bearish on Lowe’s Companies LOW, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in LOW often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 13 options trades for Lowe’s Companies. This is not a typical pattern.

The sentiment among these major traders is split, with 23% bullish and 76% bearish. Among all the options we identified, there was one put, amounting to $107,900, and 12 calls, totaling $827,556.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $250.0 to $390.0 for Lowe’s Companies over the recent three months.

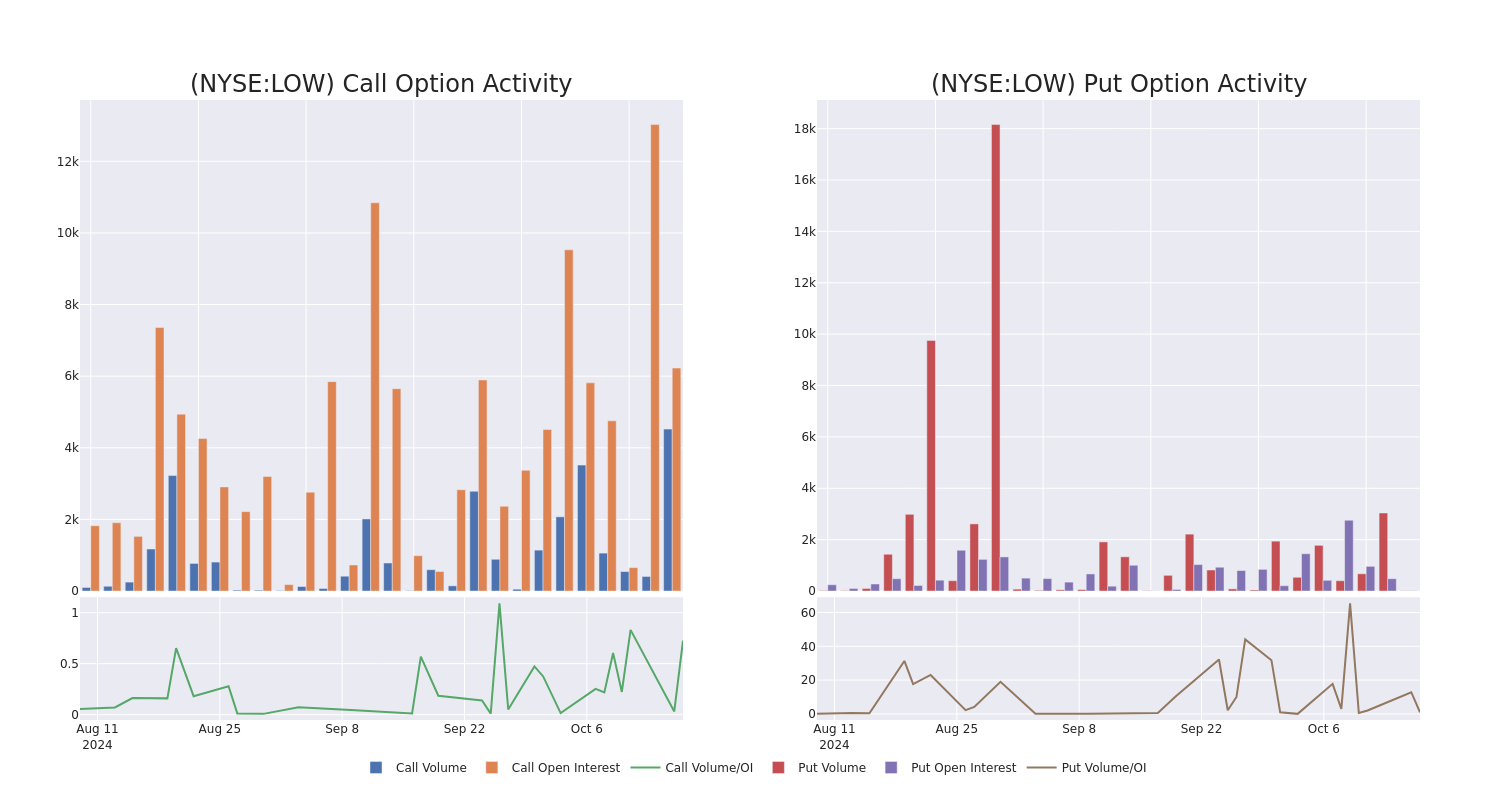

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Lowe’s Companies’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Lowe’s Companies’s whale trades within a strike price range from $250.0 to $390.0 in the last 30 days.

Lowe’s Companies Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LOW | CALL | SWEEP | BEARISH | 03/21/25 | $8.1 | $7.85 | $7.85 | $310.00 | $179.7K | 79 | 229 |

| LOW | CALL | SWEEP | BEARISH | 10/18/24 | $33.4 | $32.75 | $32.75 | $250.00 | $108.0K | 2.9K | 131 |

| LOW | PUT | TRADE | BULLISH | 01/17/25 | $109.45 | $107.9 | $107.9 | $390.00 | $107.9K | 10 | 10 |

| LOW | CALL | SWEEP | BEARISH | 10/18/24 | $32.65 | $32.6 | $32.6 | $250.00 | $94.5K | 2.9K | 73 |

| LOW | CALL | TRADE | BEARISH | 10/18/24 | $33.4 | $32.7 | $32.7 | $250.00 | $85.0K | 2.9K | 157 |

About Lowe’s Companies

Lowe’s is the second-largest home improvement retailer in the world, operating more than 1,700 stores in the United States, after the 2023 divestiture of its Canadian locations (RONA, Lowe’s Canada, Réno-Dépôt, and Dick’s Lumber). The firm’s stores offer products and services for home decorating, maintenance, repair, and remodeling, with maintenance and repair accounting for two thirds of products sold. Lowe’s targets retail do-it-yourself (around 75% of sales) and do-it-for-me customers as well as commercial and professional business clients (around 25% of sales). We estimate Lowe’s captures a high-single-digit share of the domestic home improvement market, based on US Census data and management’s market size estimates.

Following our analysis of the options activities associated with Lowe’s Companies, we pivot to a closer look at the company’s own performance.

Present Market Standing of Lowe’s Companies

- With a trading volume of 530,534, the price of LOW is down by -0.8%, reaching $281.79.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 33 days from now.

What The Experts Say On Lowe’s Companies

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $293.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Reflecting concerns, an analyst from Melius Research lowers its rating to Buy with a new price target of $290.

* An analyst from Truist Securities has decided to maintain their Buy rating on Lowe’s Companies, which currently sits at a price target of $306.

* An analyst from Oppenheimer upgraded its action to Outperform with a price target of $305.

* Maintaining their stance, an analyst from TD Cowen continues to hold a Hold rating for Lowe’s Companies, targeting a price of $265.

* An analyst from Loop Capital has elevated its stance to Buy, setting a new price target at $300.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Lowe’s Companies with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply