Super Micro Computer Says It's Shipping 100,000 GPUs Per Quarter. Time to Buy the Stock?

The artificial intelligence (AI) competition is in full swing, and each company is racing to build the best AI model possible and capture a potentially huge market. This parallels events like the California gold rush.

Not every prospector found gold, and many lost everything searching for it. However, one industry boomed during this time: picks and shovels. This gives rise to an investing strategy that looks for companies that sell modern-day picks and shovels to businesses that are competing in a category like AI.

Super Micro Computer (NASDAQ: SMCI) fits this description. It recently announced that it shipped more than 100,000 graphics processing units (GPUs, the main piece of hardware that does AI computing) in a quarter. That’s an unreal amount, but does it add up to a stock that’s worth buying?

Supermicro’s technology sets it apart from the competition

Supermicro (as it’s commonly called) provides parts and full-scale solutions for computing servers that can be customized to any size and tailored to specific workload types. This flexibility sets it apart from competitors, as does its liquid-cooled technology.

These servers consume a lot of power. That power is converted to heat, which must be dealt with; otherwise, the server would overheat and ruin millions of dollars worth of GPUs.

The standard solution is to cool the room with air conditioning, but that’s costly. Instead, Supermicro uses liquid-cooling technology, which eliminates the need for these giant air conditioning units specifically tailored for server rooms.

According to Supermicro, its cooling technology saves 40% on energy costs and provides 80% space savings because airflow is not required. With AI leaders building up their computing power, space becomes a premium, which is why Supermicro’s solution has risen to the top as a best-in-class option, even if its products cost more than its competitors’.

With Supermicro shipping racks filled with more than 100,000 GPUs per quarter, it’s clear the demand is high. But does that make the stock worth buying?

The stock is incredibly cheap, but there’s risk involved

While business appears to be booming, some other issues under the hood must be discussed.

In August, famed short-seller Hindenburg Research released a report on Supermicro claiming that the company is involved in accounting malpractice, something it was fined for by the Securities and Exchange Commission for issues that occurred in 2018.

Although Supermicro denied these allegations, it announced it was delaying filing its end-of-year Form 10-K report to assess the “effectiveness of internal controls over financial reporting.” That’s not a great look.

The Department of Justice also launched a probe into the company’s accounting practices, but it will be some time before we know the results.

Because there are a lot of unknowns with the company, you would be forgiven if you don’t want to invest in it. There are plenty of fine companies out there and taking a risk on Supermicro, considering all the controversy about its accounting, might not be worth it for you.

However, if it doesn’t bother you, the stock has real value.

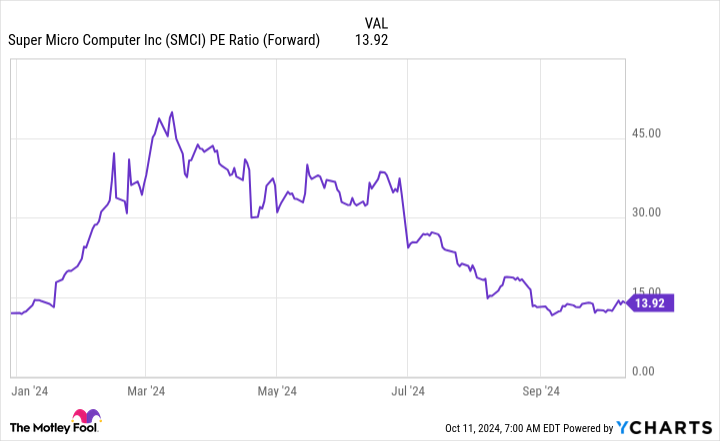

Super Micro Computer trades for a dirt-cheap 13.9 times forward earnings right now. Compared to the S&P 500, which trades at 23.5 times forward earnings, it’s a massive discount to the broader market.

Management also expects its growth to continue for some time, because it believes it’s on a path to $50 billion in annual revenue. It expects $26 billion to $30 billion for fiscal year 2025 (ending June 30, 2025), which is significant growth from 2024’s $14.9 billion total.

Whether Supermicro stock is a buy right now is about risk tolerance. If you’re OK with some risk on the table, then there are many compelling reasons to buy the stock. But if you’re not, there are still plenty of great companies out there with market-beating potential.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,139!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,239!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $380,729!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Keithen Drury has positions in Super Micro Computer. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Super Micro Computer Says It’s Shipping 100,000 GPUs Per Quarter. Time to Buy the Stock? was originally published by The Motley Fool

Leave a Reply