Logitech International S.A. LOGI reported better-than-expected second-quarter FY25 results on Tuesday.

Revenue rose 6% (both reported and constant currencies) to $1.116 billion, marginally exceeding the consensus of $1.11 billion. Adjusted EPS of $1.20 beat the consensus of $0.99.

The company raised its FY25 sales outlook to $4.39 billion -$4.47 billion, up 2% – 4% (from the previously expected $4.34 billion – $4.43 billion) versus the consensus of $4.512 billion. Logitech now sees an adjusted operating income of $720 million – $750 million (versus $700 million – $730 million prior view).

Hanneke Faber, chief executive officer, said, "Growth was broad-based, across regions, categories, and both our consumer and business customers. We launched a terrific set of innovations in the quarter and we are ready for the holidays."

Logitech shares fell 4.4% to trade at $80.26 on Wednesday.

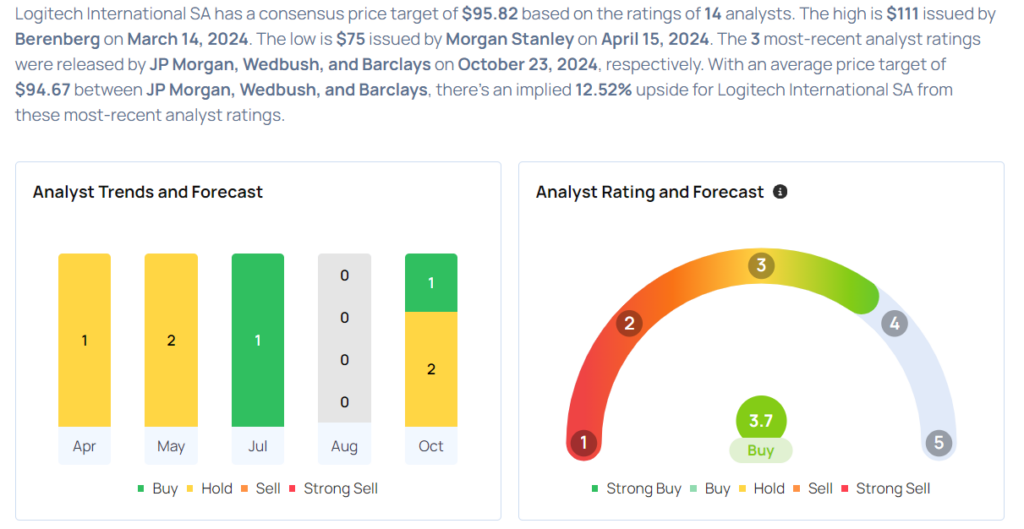

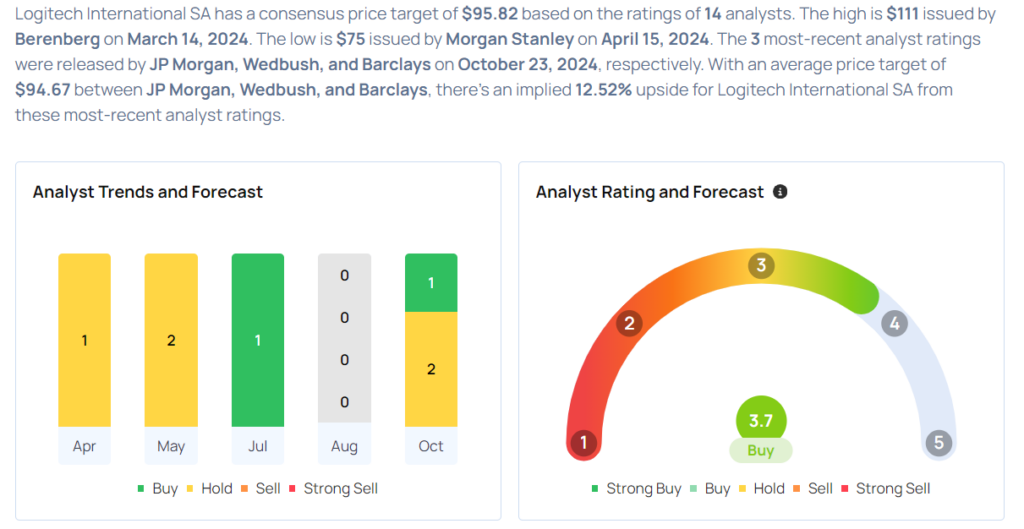

These analysts made changes to their price targets on Logitech following earnings announcement.

- Barclays analyst Tim Long maintained Logitech International with an Overweight and lowered the price target from $105 to $103.

- JP Morgan analyst Samik Chatterjee maintained the stock with a Neutral and lowered the price target from $98 to $93.

- Wedbush analyst Alicia Reese reiterated Logitech International with a Neutral and maintained a price target of $88.

Considering buying LOGI stock? Here’s what analysts think:

Read Next:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.