Smart Money Is Betting Big In FLR Options

High-rolling investors have positioned themselves bullish on Fluor FLR, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in FLR often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 8 options trades for Fluor. This is not a typical pattern.

The sentiment among these major traders is split, with 62% bullish and 25% bearish. Among all the options we identified, there was one put, amounting to $46,640, and 7 calls, totaling $398,329.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $50.0 to $60.0 for Fluor over the recent three months.

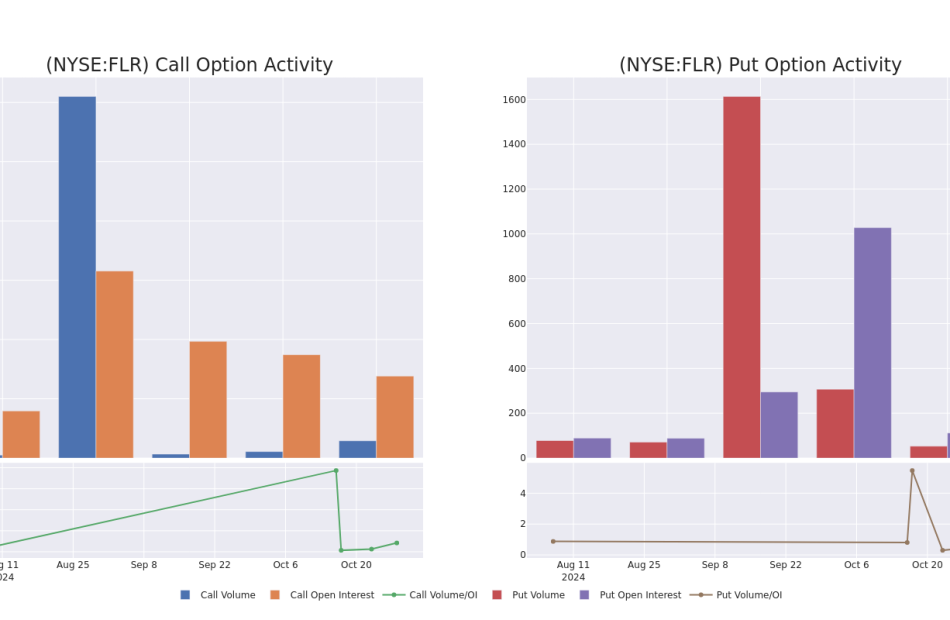

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Fluor’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Fluor’s substantial trades, within a strike price spectrum from $50.0 to $60.0 over the preceding 30 days.

Fluor Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FLR | CALL | SWEEP | BULLISH | 03/21/25 | $4.5 | $4.3 | $4.48 | $55.00 | $102.3K | 5.6K | 250 |

| FLR | CALL | TRADE | BEARISH | 01/16/26 | $13.3 | $11.0 | $11.3 | $50.00 | $90.4K | 421 | 80 |

| FLR | CALL | SWEEP | BULLISH | 03/21/25 | $4.5 | $4.3 | $4.5 | $55.00 | $58.0K | 5.6K | 380 |

| FLR | CALL | SWEEP | BEARISH | 03/21/25 | $2.85 | $2.8 | $2.8 | $60.00 | $49.8K | 7.7K | 254 |

| FLR | PUT | SWEEP | BULLISH | 01/16/26 | $9.0 | $8.8 | $8.8 | $55.00 | $46.6K | 112 | 53 |

About Fluor

Fluor is one of the largest global providers of engineering, procurement, construction, fabrication, operations, and maintenance services. The firm serves a wide range of end markets including oil and gas, chemicals, mining, metals, and transportation. The company’s business is organized into three core segments: urban solutions, mission solutions, and energy solutions. Fluor generated $15.5 billion in revenue in 2023.

Fluor’s Current Market Status

- Trading volume stands at 1,714,947, with FLR’s price up by 2.58%, positioned at $53.63.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 11 days.

Expert Opinions on Fluor

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $64.66666666666667.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Citigroup has elevated its stance to Buy, setting a new price target at $65.

* An analyst from Truist Securities persists with their Buy rating on Fluor, maintaining a target price of $66.

* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Fluor with a target price of $63.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Fluor, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply