A Peek at Janus Intl Gr's Future Earnings

Janus Intl Gr JBI is set to give its latest quarterly earnings report on Tuesday, 2024-10-29. Here’s what investors need to know before the announcement.

Analysts estimate that Janus Intl Gr will report an earnings per share (EPS) of $0.20.

Janus Intl Gr bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

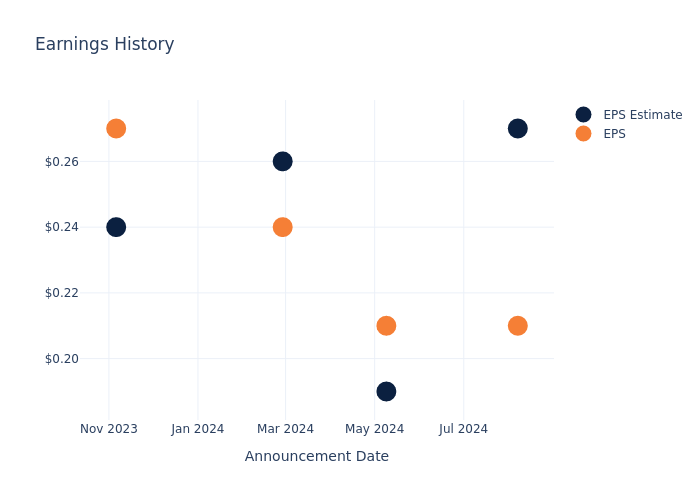

Earnings History Snapshot

During the last quarter, the company reported an EPS missed by $0.06, leading to a 6.58% drop in the share price on the subsequent day.

Here’s a look at Janus Intl Gr’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.27 | 0.19 | 0.26 | 0.24 |

| EPS Actual | 0.21 | 0.21 | 0.24 | 0.27 |

| Price Change % | -7.000000000000001% | -2.0% | 1.0% | 1.0% |

Performance of Janus Intl Gr Shares

Shares of Janus Intl Gr were trading at $10.01 as of October 25. Over the last 52-week period, shares are up 9.94%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Take on Janus Intl Gr

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Janus Intl Gr.

A total of 5 analyst ratings have been received for Janus Intl Gr, with the consensus rating being Buy. The average one-year price target stands at $13.2, suggesting a potential 31.87% upside.

Analyzing Analyst Ratings Among Peers

The analysis below examines the analyst ratings and average 1-year price targets of American Woodmark, Quanex Building Prods and Apogee Enterprises, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Outperform trajectory for American Woodmark, with an average 1-year price target of $110.8, indicating a potential 1006.89% upside.

- The consensus among analysts is an Buy trajectory for Quanex Building Prods, with an average 1-year price target of $38.0, indicating a potential 279.62% upside.

- The prevailing sentiment among analysts is an Neutral trajectory for Apogee Enterprises, with an average 1-year price target of $75.0, implying a potential 649.25% upside.

Key Findings: Peer Analysis Summary

The peer analysis summary provides a snapshot of key metrics for American Woodmark, Quanex Building Prods and Apogee Enterprises, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Janus Intl Gr | Buy | -8.20% | $109M | 5.06% |

| American Woodmark | Outperform | -7.85% | $92.87M | 3.25% |

| Quanex Building Prods | Buy | -6.44% | $70.90M | 4.37% |

| Apogee Enterprises | Neutral | -3.18% | $97.32M | 6.20% |

Key Takeaway:

Janus Intl Gr ranks at the bottom for Revenue Growth among its peers. It is also at the bottom for Gross Profit. However, it is in the middle for Return on Equity.

About Janus Intl Gr

Janus International Group Inc is a manufacturer and supplier of turnkey solutions for self-storage, commercial, and industrial building Solutions. The company provides products that include roll-up and swing doors, hallway systems, relocatable storage MASS (Moveable Additional Storage Structures) units, and technologies for automating facility and door operation. It is operated through two geographic regions; Janus North America and Janus International. . The Janus International segment is comprised of Janus International Europe Holdings Ltd whose production and sales are largely in Europe and Australia. The Janus North America segment is comprised of all the other entities including Janus Core together with each of its operating subsidiaries, Betco, Inc.

Key Indicators: Janus Intl Gr’s Financial Health

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3 months period, Janus Intl Gr faced challenges, resulting in a decline of approximately -8.2% in revenue growth as of 30 June, 2024. This signifies a reduction in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: Janus Intl Gr’s net margin surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 11.11% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Janus Intl Gr’s financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 5.06%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): The company’s ROA is a standout performer, exceeding industry averages. With an impressive ROA of 2.06%, the company showcases effective utilization of assets.

Debt Management: With a high debt-to-equity ratio of 1.08, Janus Intl Gr faces challenges in effectively managing its debt levels, indicating potential financial strain.

To track all earnings releases for Janus Intl Gr visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply