Gold Hits Record Highs, Defies Market Gravity: Why The Precious Metal Is Decoupling From Treasury Yields

Gold prices surged 1% on Tuesday, hitting a new all-time high of $2,770 per ounce, as investors pour into the commodity amid mounting concerns over ballooning deficits and political uncertainty.

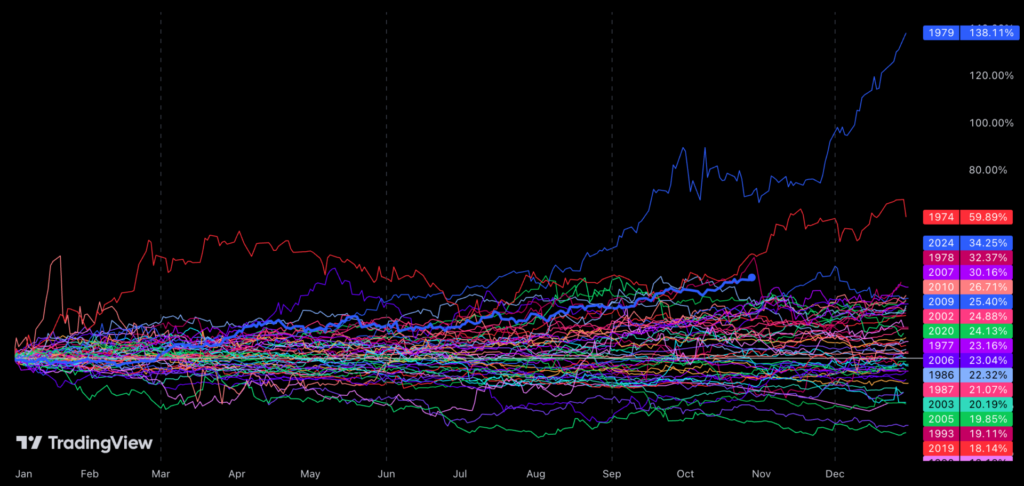

Up 34.2% year-to-date, gold is on track for its strongest annual performance since 1979, the third best gain in the last half a century.

Gold has outperformed traditional asset classes, such as stocks — the S&P 500 has climbed 23% this year — and bonds, with the iShares 20+ Year Treasury Bond ETF TLT, a benchmark for long-dated U.S. Treasury bonds, down 7%.

The precious metal, as tracked by the SPDR Gold Trust GLD, is on pace to close its fourth consecutive month — and seventh of the last eight weeks — in positive territory, underscoring the strong bullish momentum driving investors.

Chart: 2024 Shapes Up To Be Gold’s Third Best Year In The Last 50

Gold’s Break From Traditional Correlations

Gold’s recent rally has diverged from its usual relationship with both the U.S. dollar and Treasury yields.

Typically, a stronger dollar or rising Treasury yields put downward pressure on gold prices. The logic is straightforward: as a non-yielding asset, gold becomes less attractive when risk-free U.S. Treasury bonds start offering higher real returns. In such environments, investors usually favor bonds over gold, reducing demand for the precious metal.

Lately, however, the opposite has occurred. Despite a stronger dollar and rising Treasury yields, gold prices have continued to climb, defying the usual negative correlation.

In October alone, gold rose 5.1%, while the U.S. Dollar Index (DXY) climbed 3.6% and the 10-year Treasury yield jumped more than 50 basis points to 4.35%.

This decoupling suggests that investors are turning to gold for reasons beyond the traditional factors.

Otavio Costa, a macro strategist at Crescat Capital, indicated that gold is now signaling potential future inflation risks that could complicate the Federal Reserve’s policy options.

“Gold is rising as the market begins to price in the likelihood of a Fed forced to cut rates further, despite persistent inflation,” Costa said.

“Gold is also signaling the potential for another wave of inflation ahead, making the Fed’s job even harder as interest payments for federal and local governments are already nearing 5% of GDP,” he said.

According to Costa, “the genie has been out of the bottle since late 2020, and inflationary trends remain deeply rooted in the economy.”

Deficit Concerns Add Fuel To Gold’s Rally

A major driving factor behind the recent surge in gold: mounting fiscal concerns, particularly in the United States.

With trillion-dollar annual deficits becoming the new norm, economists warn that government spending is becoming unsustainable.

Michael Gayed, CFA, said: “I don’t think there’s much question that trillion-plus dollar annual deficits are becoming the norm more than the exception.”

Further complicating the fiscal outlook are political developments, with neither Democrats nor Republicans showing a strong commitment to reducing the national debt.

Analysts predict that increased spending on defense, climate adaptation and demographic challenges will push budgets even further into the red.

Bank of America analyst Michael Widmer recently wrote: “Gold may be the last perceived safe haven asset standing” given the reluctance of governments to curb spending.

Global Policy And Gold As The Last ‘Safe Haven’

Widmer’s view reflects a broader consensus among analysts that gold is becoming the preferred safe-haven asset amid escalating debt and global policy trends favoring fiscal expansion.

The IMF estimates that new spending requirements across advanced economies could reach 7%-8% of GDP annually by 2030.

U.S. budget deficits are not forecasted to fall below 6% of the GDP in any year for the remainder of the decade, as per the latest IMF Fiscal Monitor estimates.

Should markets start questioning the sustainability of these deficits, gold could attract even more investment as a reliable store of value.

Read Next:

Photo via Shutterstock.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply