Palantir's YTD Returns Surge 298%: Here's How ETFs With Exposure To Alex Karp's Company Have Performed

Palantir Technologies Inc. PLTR has experienced a remarkable rise, achieving a 298.37% year-to-date return as of Thursday morning. This surge has sparked interest in ETFs with significant exposure to Palantir.

According to Benzinga Pro, the Global X Defense Tech ETF SHLD holds 7.82% of its portfolio in Palantir stock, amounting to $51.85 million across 1.24 million shares. SHLD, which combines Palantir’s defense and intelligence sector presence with other aerospace and defense players, has seen a 40.86% YTD return.

Meanwhile, ARK Innovation ETF ARKK has allocated nearly 5% of its portfolio to Palantir, with over $273 million invested in 6.53 million shares. Known for backing high-growth companies, ARKK boasts over $6 billion in assets under management and has achieved a 13.17% YTD return.

On the other hand, the REX AI Equity Premium Income ETF AIPI holds 9.46% exposure to Palantir, translating to a $9.24 million position. However, its YTD returns have declined by 0.61%. AIPI’s strategy involves selling out-of-the-money covered call options, which can generate income but may limit capital appreciation.

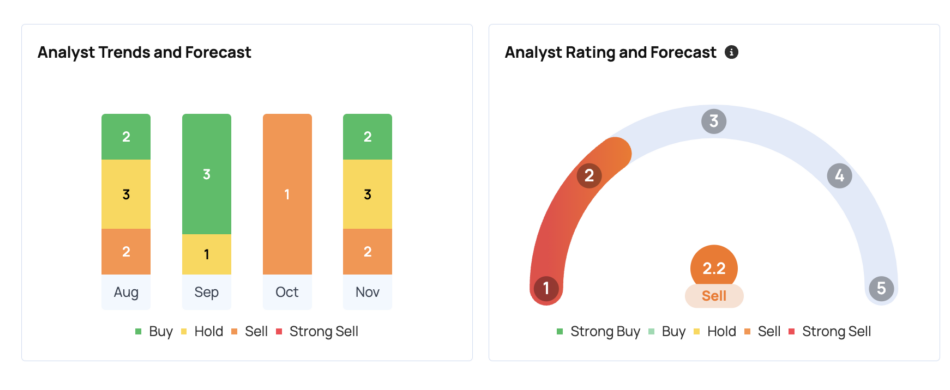

At the time of writing, Palantir’s stock was up by 0.23%. The three most recent analyst ratings for Palantir. were issued by BofA Securities, Wedbush, and Goldman Sachs on Nov. 25 and Nov, 7, with an average price target of $63.67 from these firms.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image via Flickr

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply