What the Options Market Tells Us About Enterprise Prods Partners

High-rolling investors have positioned themselves bearish on Enterprise Prods Partners EPD, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in EPD often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 9 options trades for Enterprise Prods Partners. This is not a typical pattern.

The sentiment among these major traders is split, with 11% bullish and 44% bearish. Among all the options we identified, there was one put, amounting to $33,550, and 8 calls, totaling $915,741.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $30.0 to $37.0 for Enterprise Prods Partners during the past quarter.

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Enterprise Prods Partners options trades today is 3014.2 with a total volume of 8,774.00.

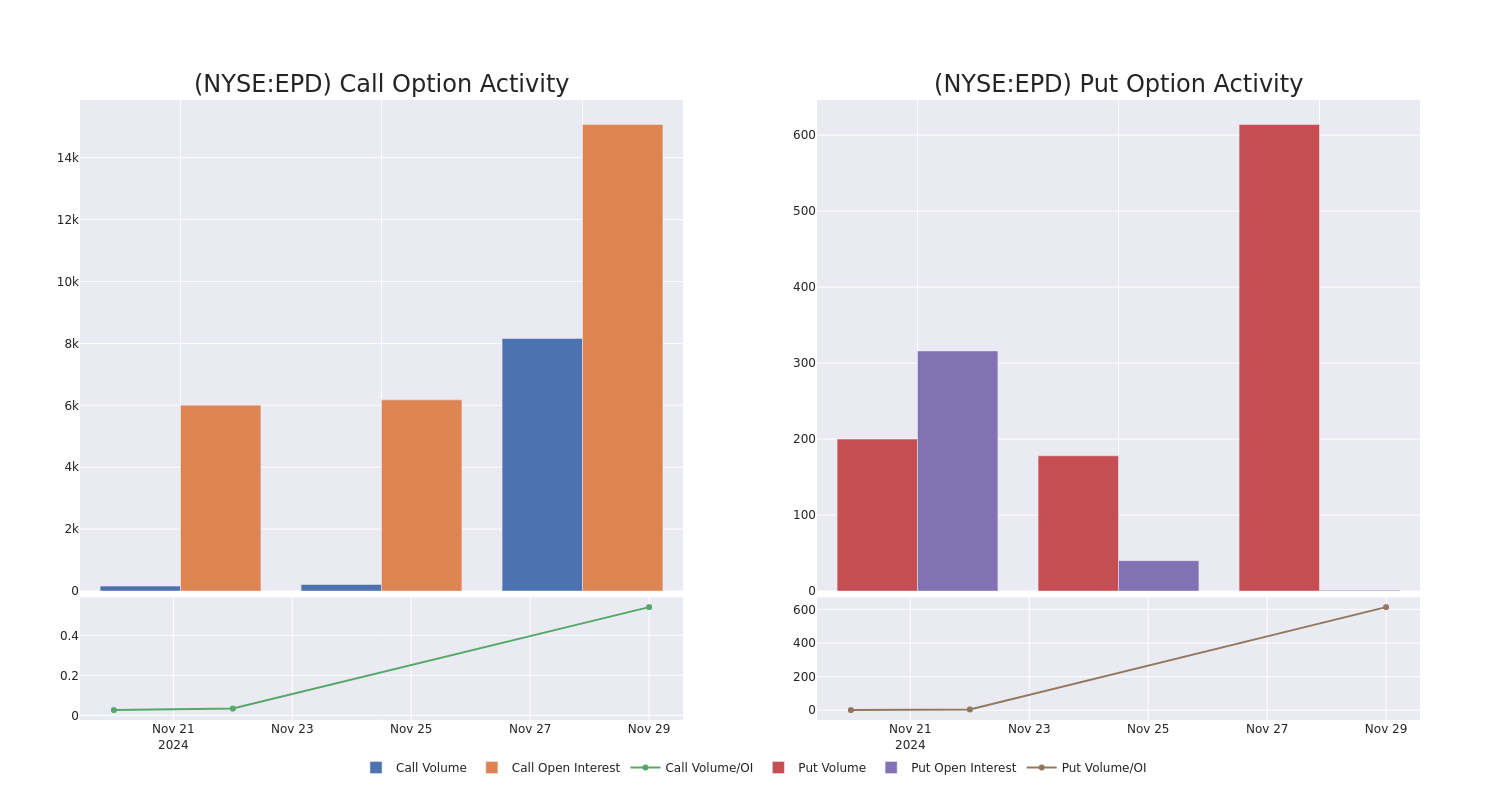

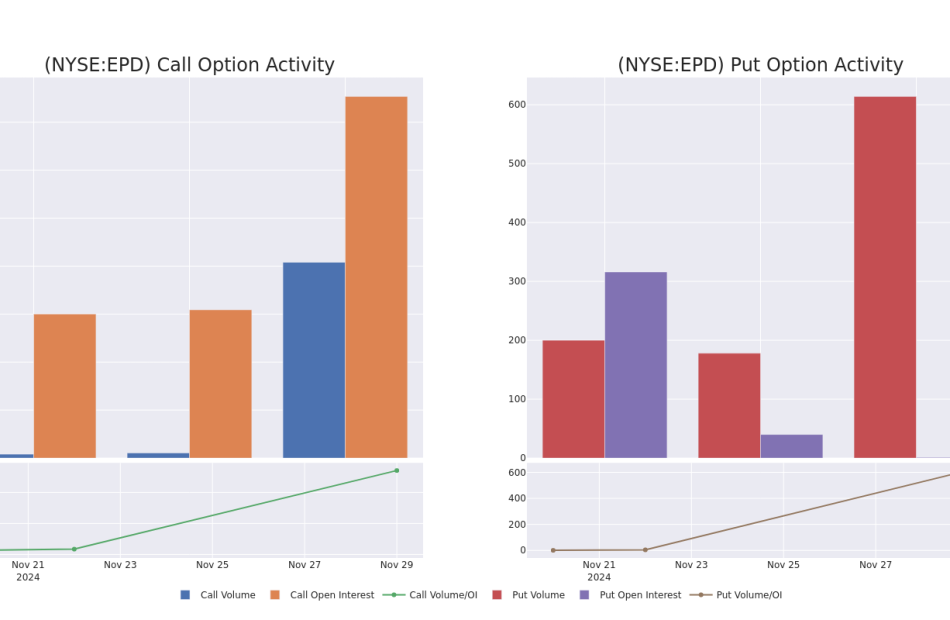

In the following chart, we are able to follow the development of volume and open interest of call and put options for Enterprise Prods Partners’s big money trades within a strike price range of $30.0 to $37.0 over the last 30 days.

Enterprise Prods Partners Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EPD | CALL | TRADE | BEARISH | 12/20/24 | $4.65 | $4.55 | $4.55 | $30.00 | $455.0K | 8.3K | 1.2K |

| EPD | CALL | SWEEP | BEARISH | 06/20/25 | $1.38 | $1.22 | $1.25 | $36.00 | $182.0K | 1.0K | 3.1K |

| EPD | CALL | SWEEP | BEARISH | 06/20/25 | $1.33 | $1.27 | $1.27 | $36.00 | $103.3K | 1.0K | 1.0K |

| EPD | CALL | SWEEP | BEARISH | 06/20/25 | $1.27 | $1.26 | $1.27 | $36.00 | $46.8K | 1.0K | 1.3K |

| EPD | CALL | SWEEP | NEUTRAL | 12/20/24 | $4.65 | $4.65 | $4.66 | $30.00 | $34.8K | 8.3K | 214 |

About Enterprise Prods Partners

Enterprise Products Partners is a master limited partnership that transports and processes natural gas, natural gas liquids, crude oil, refined products, and petrochemicals. It is one of the largest midstream companies, with operations servicing most producing regions in the Lower 48 states. Enterprise is particularly dominant in the NGL market and is one of the few MLPs that provide midstream services across the full hydrocarbon value chain.

After a thorough review of the options trading surrounding Enterprise Prods Partners, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Enterprise Prods Partners Standing Right Now?

- Trading volume stands at 2,927,549, with EPD’s price up by 2.02%, positioned at $34.33.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 62 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Enterprise Prods Partners options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply