Unpacking the Latest Options Trading Trends in Freeport-McMoRan

Benzinga’s options scanner just detected over 8 options trades for Freeport-McMoRan FCX summing a total amount of $246,685.

At the same time, our algo caught 4 for a total amount of 193,380.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $40.0 to $65.0 for Freeport-McMoRan over the last 3 months.

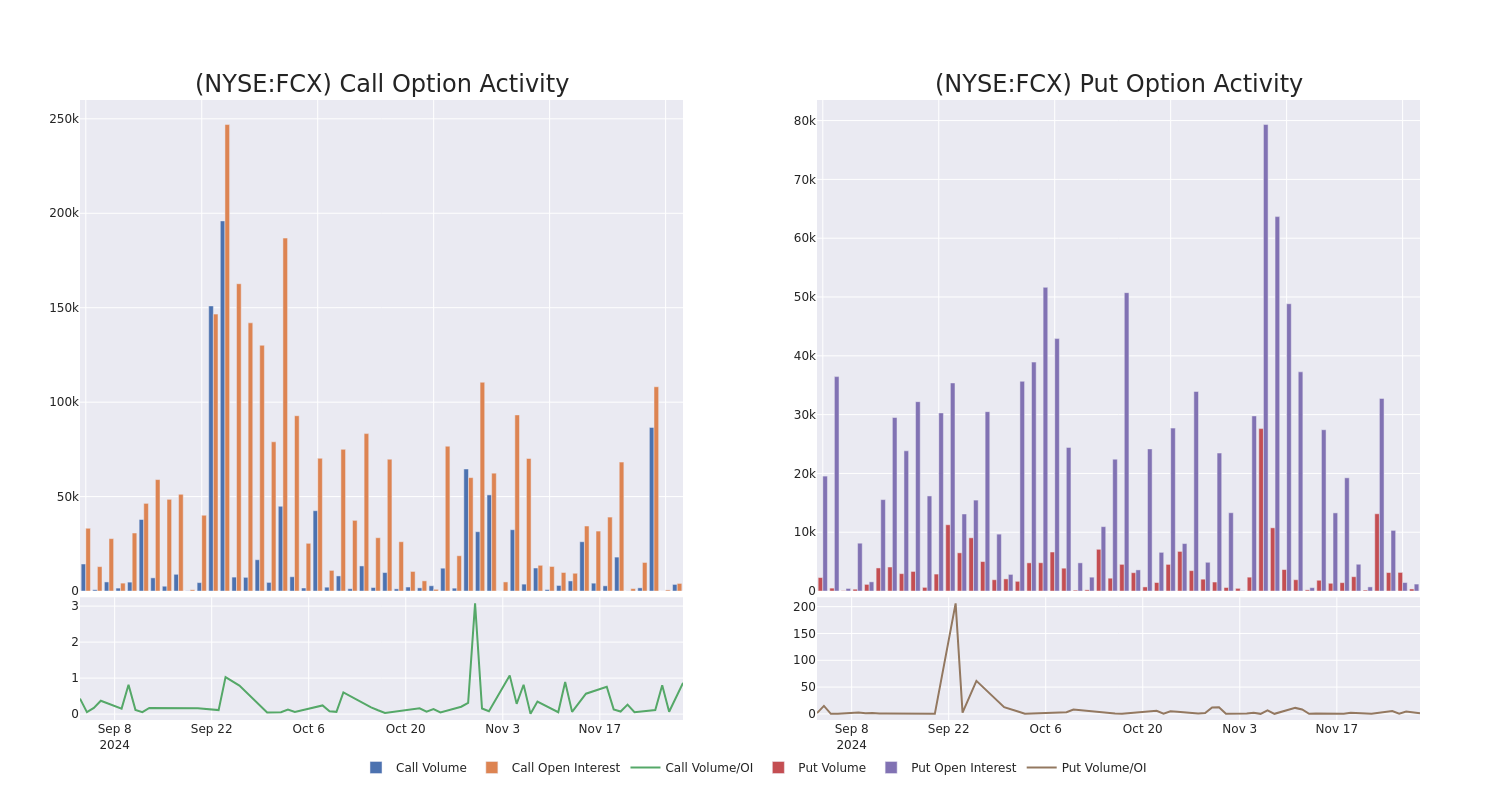

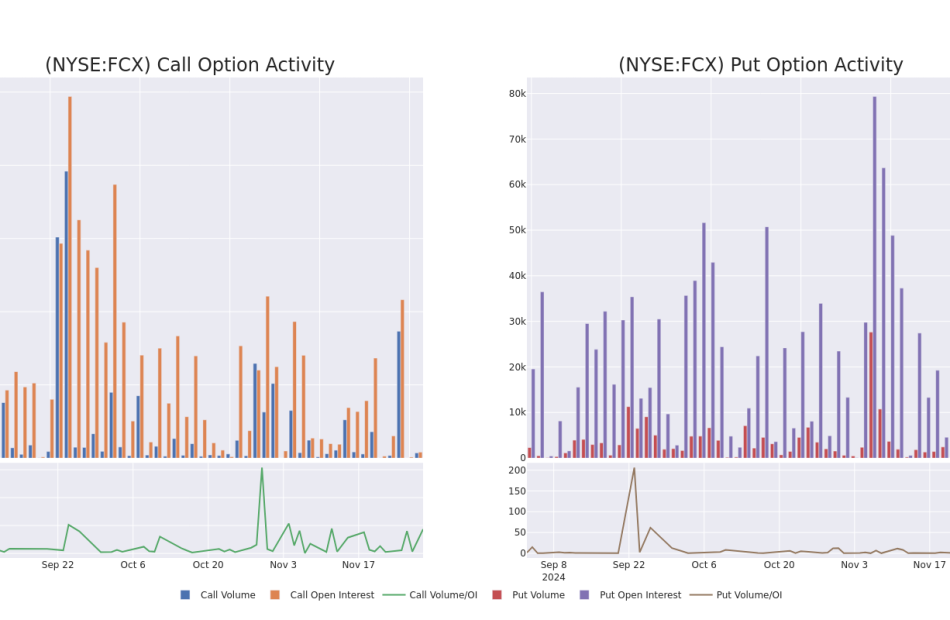

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of Freeport-McMoRan stands at 746.43, with a total volume reaching 3,859.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Freeport-McMoRan, situated within the strike price corridor from $40.0 to $65.0, throughout the last 30 days.

Freeport-McMoRan Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FCX | PUT | TRADE | BEARISH | 08/15/25 | $6.3 | $6.15 | $6.3 | $47.00 | $79.3K | 182 | 126 |

| FCX | PUT | SWEEP | BULLISH | 05/16/25 | $4.2 | $4.0 | $4.0 | $44.00 | $50.8K | 463 | 127 |

| FCX | CALL | SWEEP | BULLISH | 01/16/26 | $7.3 | $7.25 | $7.3 | $45.00 | $40.8K | 1.9K | 504 |

| FCX | CALL | SWEEP | BULLISH | 01/16/26 | $7.25 | $7.2 | $7.25 | $45.00 | $35.5K | 1.9K | 370 |

| FCX | PUT | SWEEP | BULLISH | 09/19/25 | $21.35 | $21.25 | $21.25 | $65.00 | $34.0K | 152 | 16 |

About Freeport-McMoRan

Freeport-McMoRan owns stakes in 10 copper mines, led by its 49% ownership of the Grasberg copper and gold operations in Indonesia, 55% of the Cerro Verde mine in Peru, and 72% of Morenci in Arizona. It sold around 1.2 million metric tons of copper (its share) in 2023, making it the one of the world’s largest copper miners by volume. It also sold about 900,000 ounces of gold, mostly from Grasberg, and 70 million pounds of molybdenum. About 75% of 2023 revenue was from copper, with a further 15% from gold and about 10% from molybdenum. It had about 25 years of copper reserves at end December 2023. We expect it to sell similar amounts of copper midcycle in 2028, though we expect gold volumes to decline to about 700,000 ounces then due to falling production at Grasberg.

Having examined the options trading patterns of Freeport-McMoRan, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Freeport-McMoRan

- Trading volume stands at 6,511,840, with FCX’s price up by 1.27%, positioned at $44.31.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 54 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Freeport-McMoRan, Benzinga Pro gives you real-time options trades alerts.

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply