Alibaba's $71M Bet On Ably Corp Turns It Into South Korea's First Unicorn of 2024

Chinese e-commerce company Alibaba Group Holding Ltd BABA has invested $71.4 million or 100 billion Korean won in the South Korean apparel brand Ably Corp.

What Happened: Ably is now South Korea’s first unicorn of 2024, with the deal valuing the company at over $1 billion, as per a report by The Korean Economic Daily.

Following the investment, Ably’s valuation has soared to around 3 trillion won (approx. $2.1 billion), a significant increase from its 900 billion won valuation during its 67 billion won pre-Series C fundraising round in January 2022.

Why It Matters: This deal marks the first equity investment by China-based Alibaba in any Korean shopping app.

Ably is the first Korean startup to reach a valuation of over $1 billion this year, following Naver Corp.’s Kream Corp., which achieved a 1 trillion won valuation in December 2023 after completing a bridge round financing.

As per its 13F filings for the third quarter, Alibaba holds stakes in XPeng Inc. XPEV, Weibo Corp. WB, Perfect Corp. PERF, and Best Inc. BEST in the U.S.

Alibaba increased its stake in XPeng by 371% in the September 2024 quarter compared to the June 2024 quarter. During the same period, it reduced its stake in Perfect by 2%, while its Weibo and Best stakes remained unchanged.

See Also: Alibaba Co-Founder Jack Ma Makes Rare Appearance At Company Campus

Price Action: Shares of Alibaba Group Holdings’ ADR closed 0.90% higher at $87.37 per share on Friday as compared to a 0.31% advance in the NYSE Composite Index.

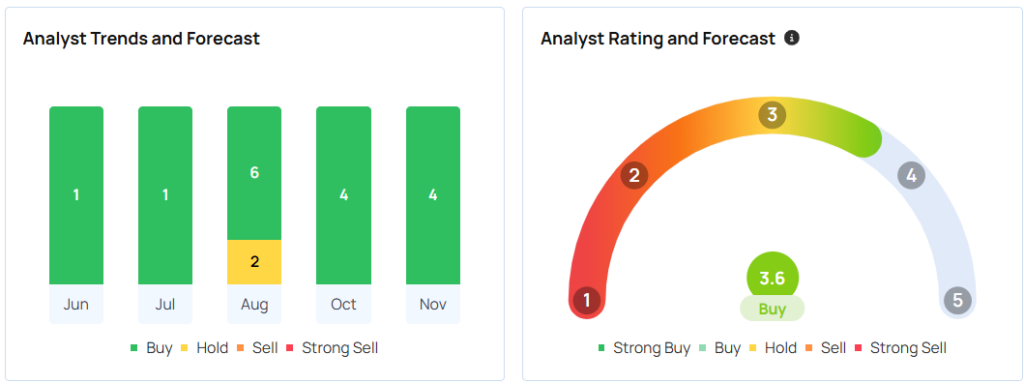

According to Benzinga Pro data, Alibaba has a consensus price target of $119.82 apiece based on the ratings of 23 analysts, but a consensus rating of “Buy.” The highest price target among all the analysts tracked by Benzinga is $155 per share issued by Deutsche Bank on Jan. 13, 2023, whereas the lowest price target is $85 apiece issued by Bernstein on Aug. 16.

The average price target of $122 per share between Barclays, Benchmark, and Mizuho implies a 39.64% upside for Alibaba.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply