These Analysts Boost Their Forecasts On Credo Technology Group After Upbeat Results

Credo Technology Group Holding Ltd CRDO reported better-than-expected second-quarter financial results and issued strong guidance on Monday.

Credo Technology reported quarterly earnings of 7 cents per share which beat the analyst consensus estimate of 5 cents per share. The company reported quarterly sales of $72.000 million which beat the analyst consensus estimate of $66.789 million.

Bill Brennan, Credo’s President and Chief Executive Officer, stated, “In the fiscal second quarter ended November 2, 2024 Credo generated record revenue of $72.0 million, up 21% sequentially and 64% year over year. The second quarter was our most successful to date across our three main product lines and Credo delivered total product revenue of $69.1 million. For the past few quarters, we have anticipated an inflection point in our revenues during the second half of fiscal 2025. I am pleased to share that this turning point has arrived, and we are experiencing even greater demand than initially projected, driven by AI deployments and deepening customer relationships.”

Credo Technology Group said it sees third-quarter revenue of $115 million to $125 million, versus market estimates of $86.042 million.

Credo Technology Group shares gained 46.1% to trade at $69.82 on Tuesday.

These analysts made changes to their price targets on Credo Technology Group following earnings announcement.

- Needham analyst Quinn Bolton maintained Credo Technology with a Buy and raised the price target from $43 to $70.

- B of A Securities analyst Vivek Arya upgraded the stock from Underperform to Buy and boosted the price target from $27 to $80.

- Barclays analyst Thomas O’Malley maintained Credo Technology with an Overweight rating and raised the price target from $32 to $80.

- Stifel analyst Tore Svanberg reiterated Credo Technology with a Buy and increased the price target from $50 to $75.

- Craig-Hallum analyst Richard Shannon maintained the stock with a Buy and raised the price target from $38 to $75.

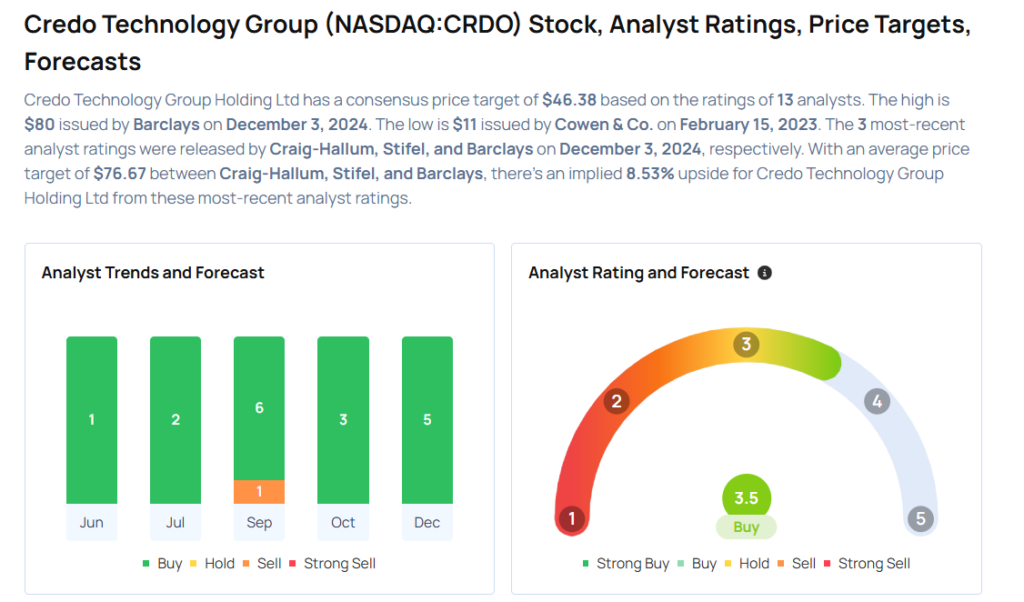

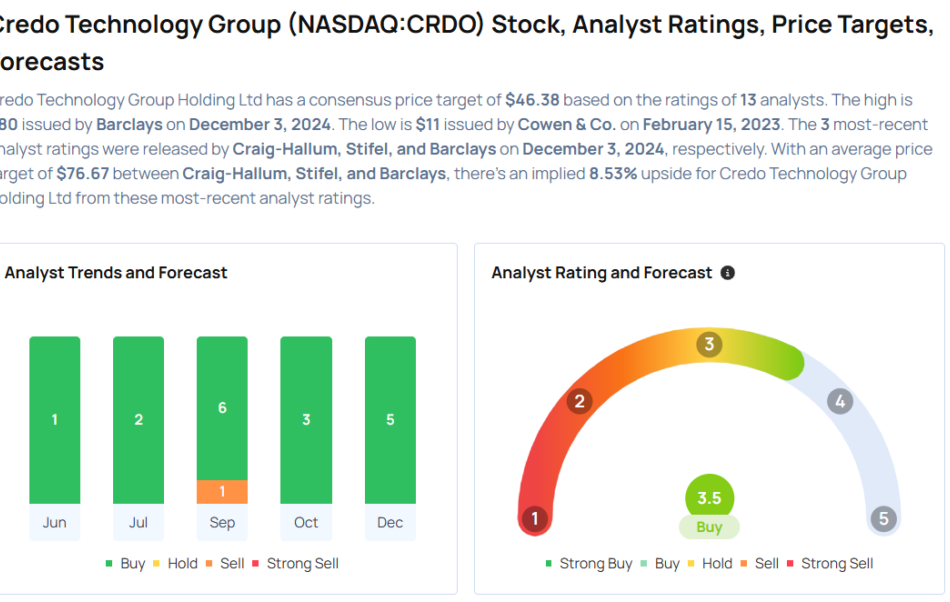

Considering buying CRDO stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply