Decoding Honeywell Intl's Options Activity: What's the Big Picture?

Whales with a lot of money to spend have taken a noticeably bullish stance on Honeywell Intl.

Looking at options history for Honeywell Intl HON we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 58% of the investors opened trades with bullish expectations and 25% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $338,000 and 10, calls, for a total amount of $5,753,035.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $150.0 to $250.0 for Honeywell Intl during the past quarter.

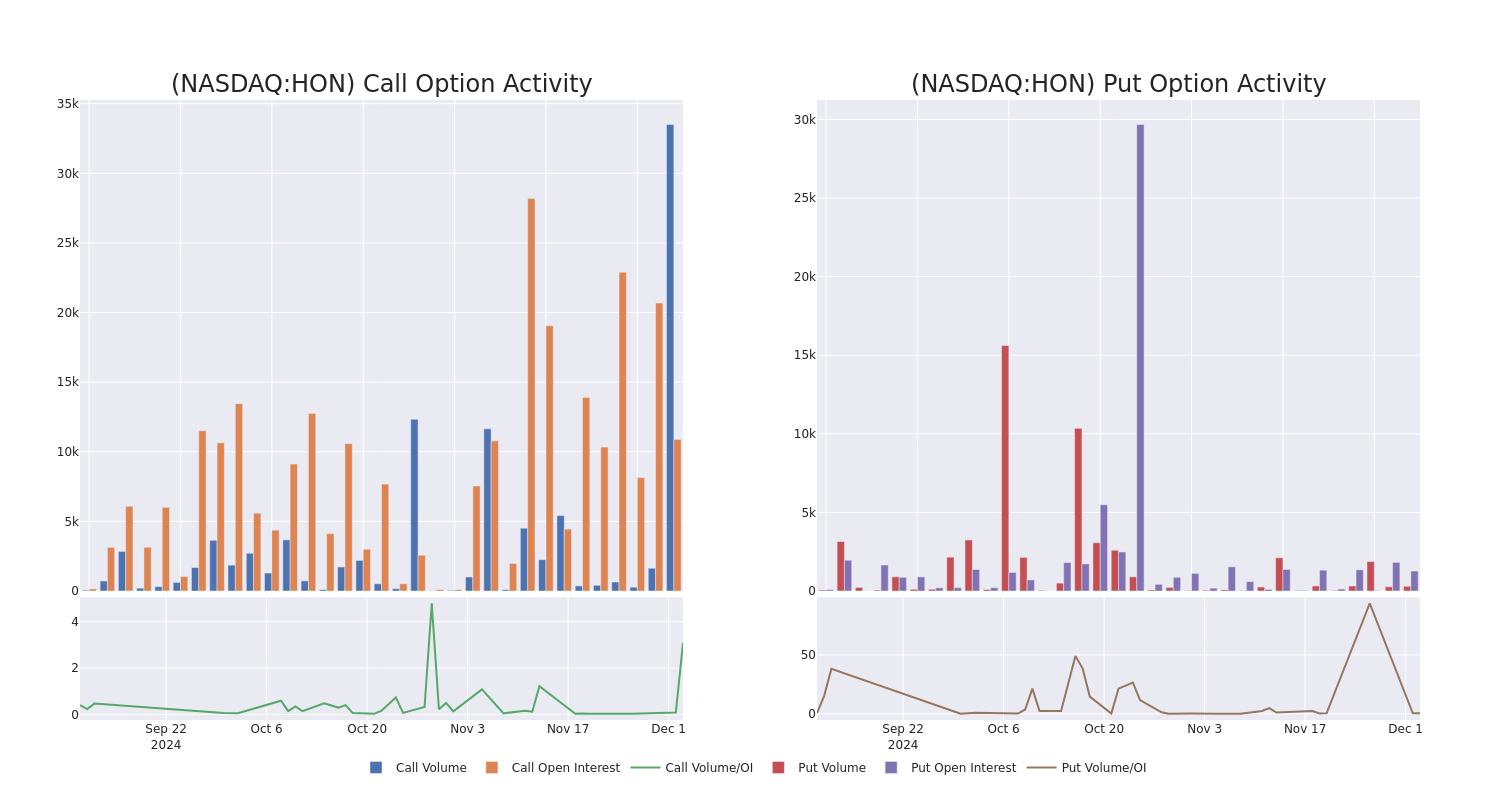

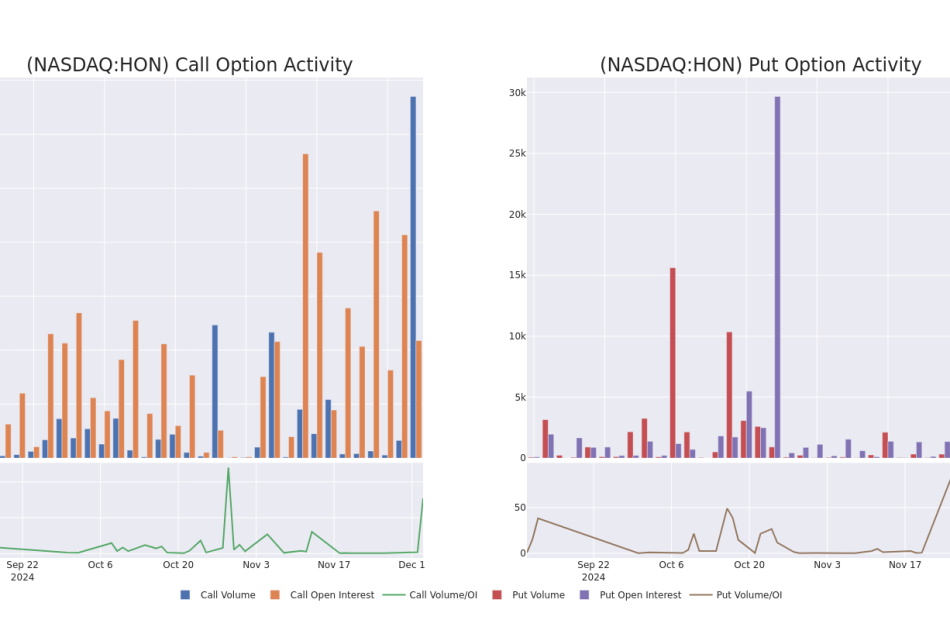

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Honeywell Intl’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Honeywell Intl’s whale trades within a strike price range from $150.0 to $250.0 in the last 30 days.

Honeywell Intl Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HON | CALL | SWEEP | BULLISH | 06/20/25 | $5.8 | $5.3 | $5.8 | $250.00 | $4.8M | 10.8K | 10.0K |

| HON | PUT | TRADE | BULLISH | 01/16/26 | $12.4 | $12.1 | $12.2 | $210.00 | $305.0K | 1.0K | 251 |

| HON | CALL | SWEEP | BULLISH | 06/20/25 | $5.3 | $5.2 | $5.3 | $250.00 | $188.6K | 10.8K | 277 |

| HON | CALL | SWEEP | BULLISH | 06/20/25 | $5.4 | $5.3 | $5.4 | $250.00 | $181.1K | 10.8K | 864 |

| HON | CALL | TRADE | BEARISH | 12/20/24 | $10.0 | $9.2 | $9.5 | $217.50 | $96.9K | 1 | 201 |

About Honeywell Intl

Honeywell traces its roots to 1885 with Albert Butz’s firm, Butz Thermo-Electric Regulator, which produced a predecessor to the modern thermostat. Other inventions by Honeywell include biodegradable detergent and autopilot. Today, Honeywell is a global multi-industry behemoth with one of the largest installed bases of equipment. It operates through four business segments: aerospace technologies (37% of 2023 company revenue), industrial automation (29%), energy and sustainability solutions (17%), and building automation (17%). Recently, Honeywell has made several portfolio changes to focus on fewer end markets and align with a set of secular growth trends. The firm is working diligently to expand its installed base, deriving around 30% of its revenue from recurring aftermarket services.

Following our analysis of the options activities associated with Honeywell Intl, we pivot to a closer look at the company’s own performance.

Present Market Standing of Honeywell Intl

- Trading volume stands at 1,803,625, with HON’s price down by -1.88%, positioned at $225.62.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 58 days.

Expert Opinions on Honeywell Intl

In the last month, 5 experts released ratings on this stock with an average target price of $250.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Neutral rating on Honeywell Intl with a target price of $240.

* An analyst from Barclays persists with their Overweight rating on Honeywell Intl, maintaining a target price of $252.

* An analyst from Wells Fargo persists with their Equal-Weight rating on Honeywell Intl, maintaining a target price of $254.

* Maintaining their stance, an analyst from RBC Capital continues to hold a Sector Perform rating for Honeywell Intl, targeting a price of $253.

* Reflecting concerns, an analyst from RBC Capital lowers its rating to Sector Perform with a new price target of $253.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Honeywell Intl with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply