Deep-pocketed investors have adopted a bearish approach towards NVIDIA NVDA, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in NVDA usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 326 extraordinary options activities for NVIDIA. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 41% leaning bullish and 48% bearish. Among these notable options, 85 are puts, totaling $5,911,568, and 241 are calls, amounting to $22,868,210.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $0.5 to $280.0 for NVIDIA during the past quarter.

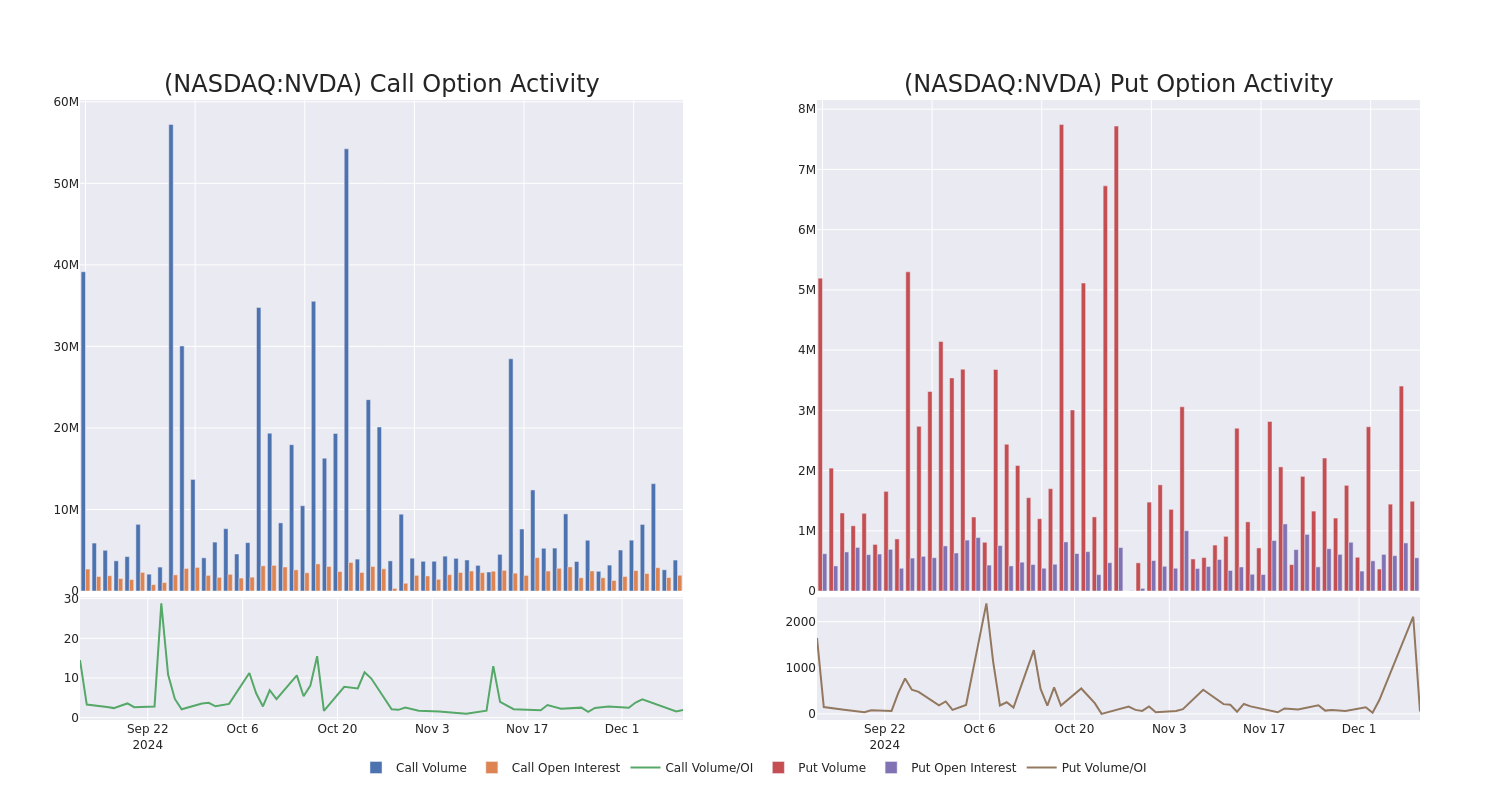

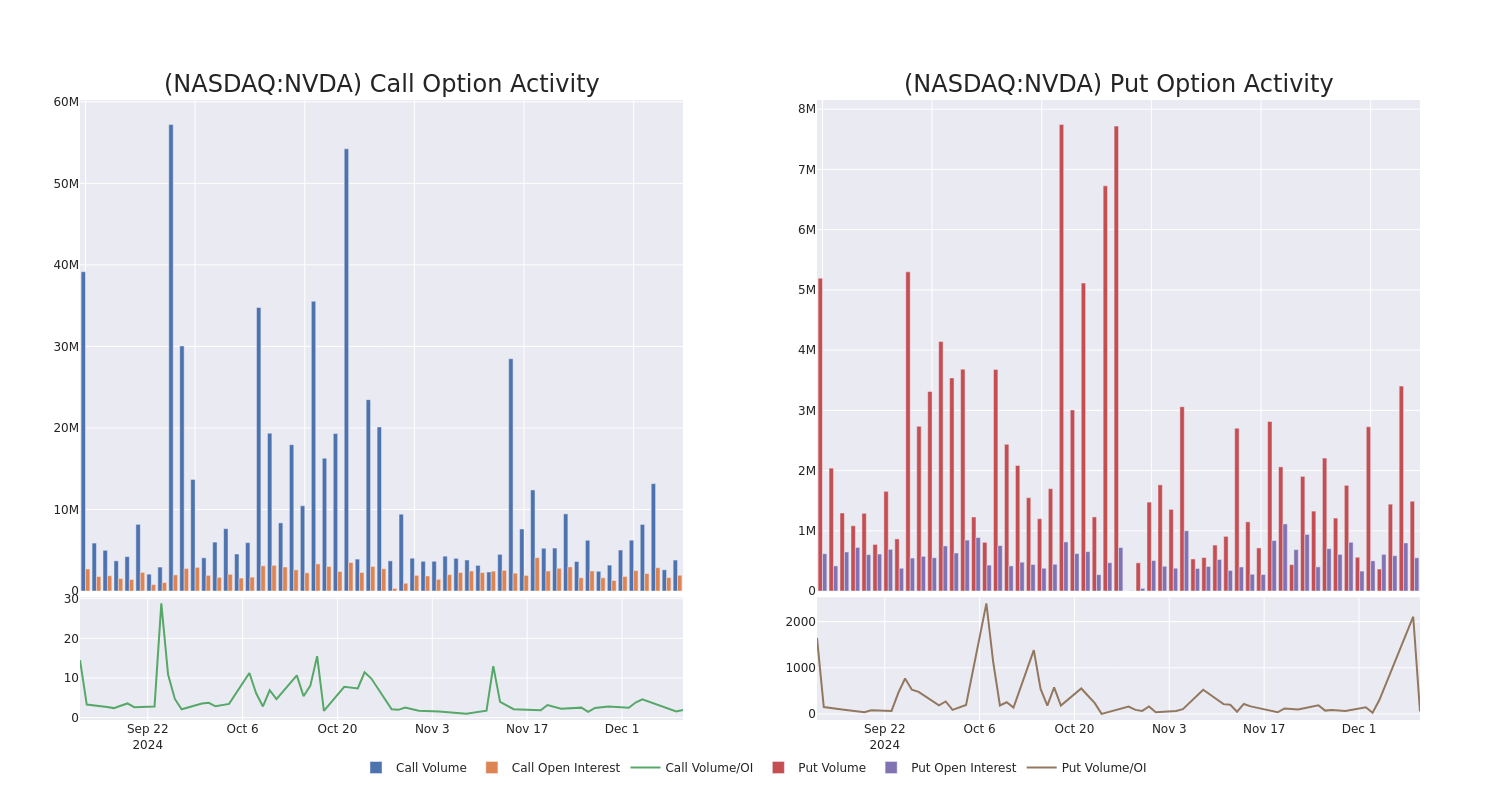

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for NVIDIA's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of NVIDIA's whale trades within a strike price range from $0.5 to $280.0 in the last 30 days.

NVIDIA 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVDA | CALL | SWEEP | BEARISH | 01/15/27 | $38.2 | $38.0 | $38.0 | $150.00 | $266.0K | 6.4K | 453 |

| NVDA | PUT | TRADE | NEUTRAL | 06/20/25 | $26.0 | $25.8 | $25.9 | $150.00 | $246.0K | 6.9K | 163 |

| NVDA | PUT | TRADE | BEARISH | 06/20/25 | $53.7 | $53.6 | $53.7 | $187.00 | $134.2K | 364 | 25 |

| NVDA | PUT | SWEEP | BEARISH | 12/20/24 | $3.55 | $3.5 | $3.55 | $136.00 | $109.6K | 13.5K | 5.7K |

| NVDA | CALL | SWEEP | BULLISH | 06/20/25 | $15.6 | $15.5 | $15.6 | $150.00 | $104.5K | 37.9K | 2.4K |

About NVIDIA

Nvidia is a leading developer of graphics processing units. Traditionally, GPUs were used to enhance the experience on computing platforms, most notably in gaming applications on PCs. GPU use cases have since emerged as important semiconductors used in artificial intelligence. Nvidia not only offers AI GPUs, but also a software platform, Cuda, used for AI model development and training. Nvidia is also expanding its data center networking solutions, helping to tie GPUs together to handle complex workloads.

Having examined the options trading patterns of NVIDIA, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is NVIDIA Standing Right Now?

- Currently trading with a volume of 130,873,605, the NVDA's price is down by -2.09%, now at $135.91.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 71 days.

What The Experts Say On NVIDIA

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $174.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for NVIDIA, targeting a price of $170. * An analyst from Benchmark persists with their Buy rating on NVIDIA, maintaining a target price of $190. * Maintaining their stance, an analyst from Deutsche Bank continues to hold a Hold rating for NVIDIA, targeting a price of $140. * An analyst from Melius Research has decided to maintain their Buy rating on NVIDIA, which currently sits at a price target of $185. * Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on NVIDIA with a target price of $185.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest NVIDIA options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.