Financial giants have made a conspicuous bullish move on Cleanspark. Our analysis of options history for Cleanspark CLSK revealed 25 unusual trades.

Delving into the details, we found 52% of traders were bullish, while 48% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $319,250, and 21 were calls, valued at $2,006,438.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $10.0 to $37.0 for Cleanspark over the recent three months.

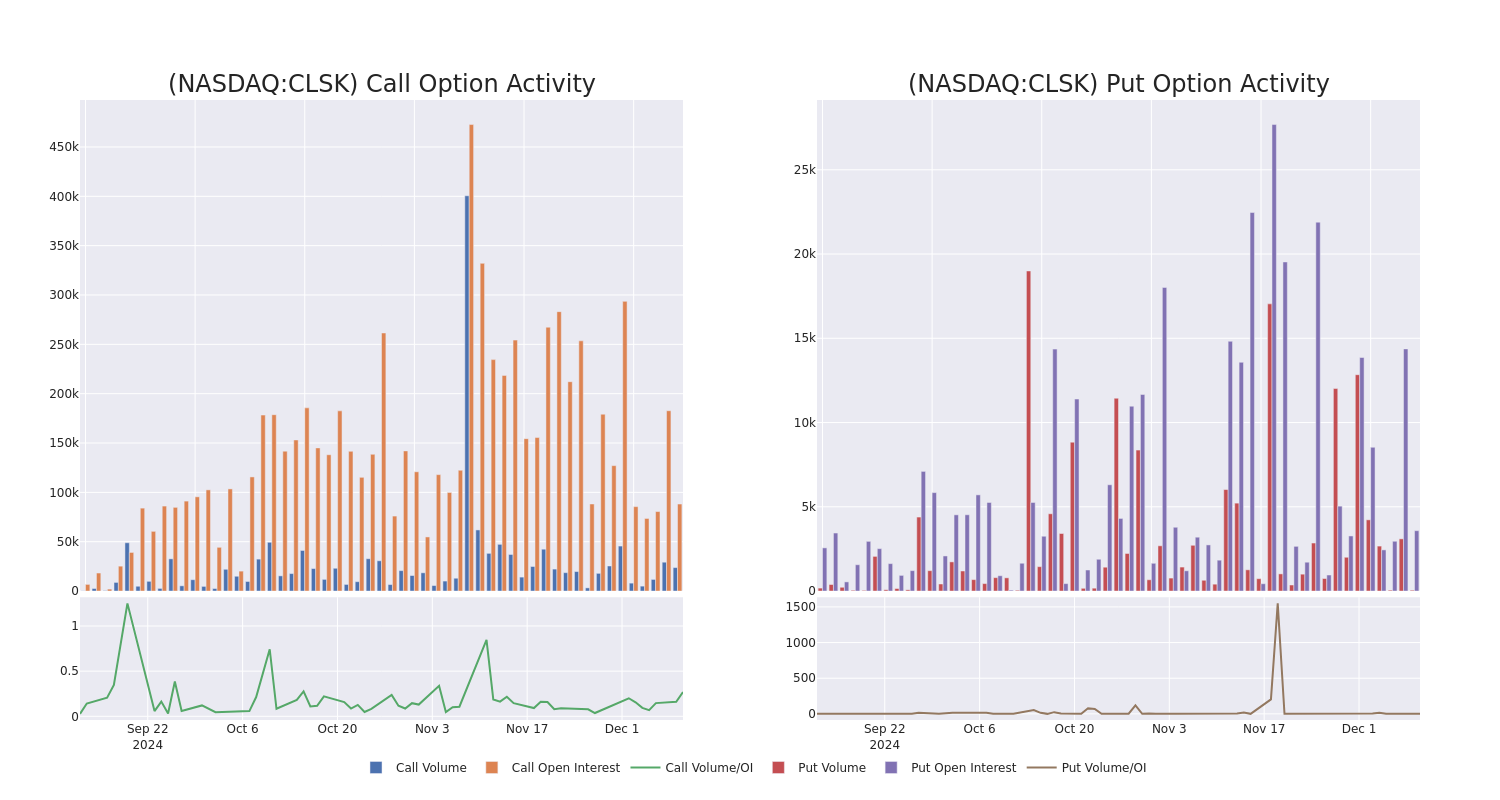

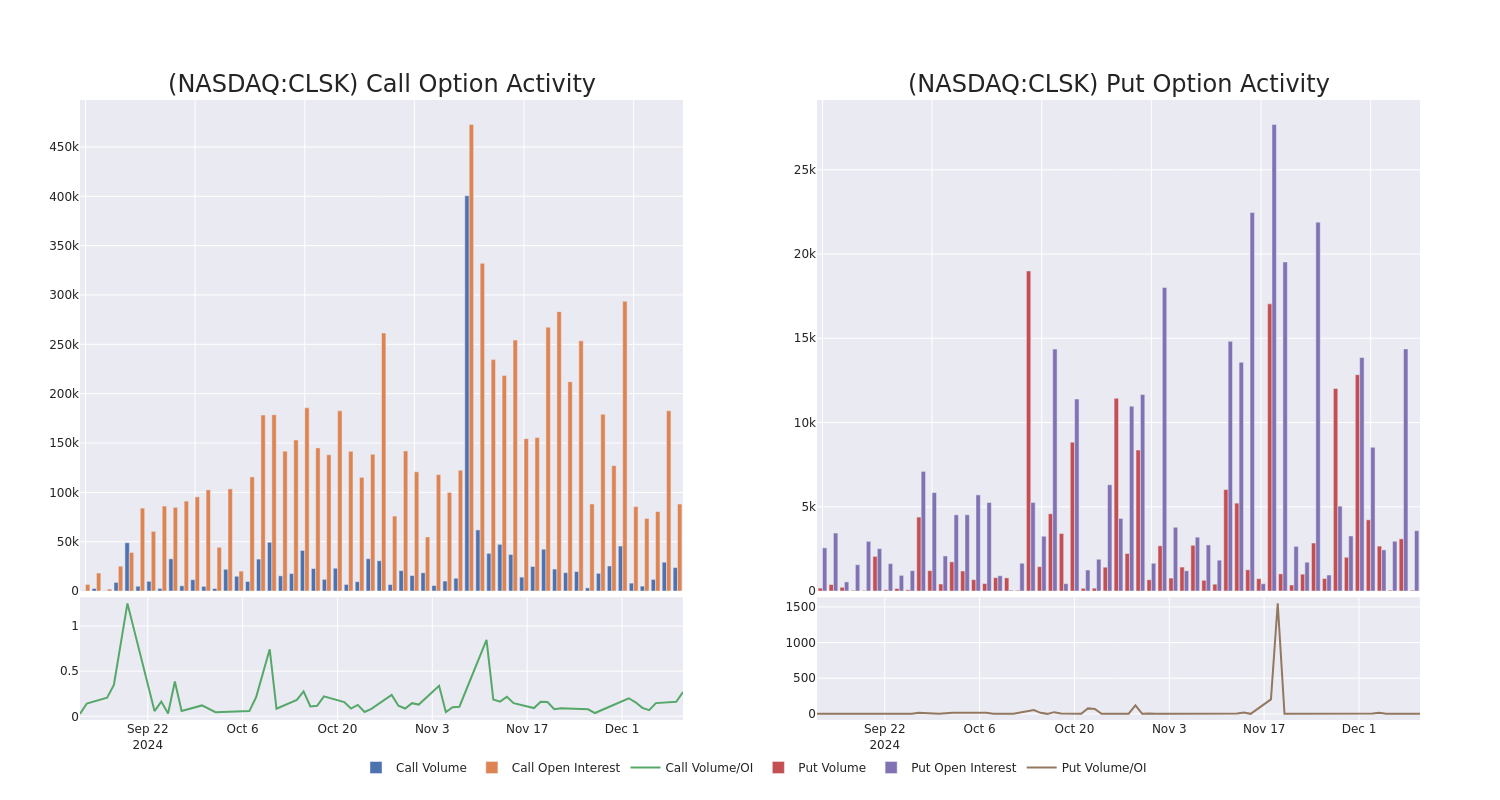

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Cleanspark's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Cleanspark's substantial trades, within a strike price spectrum from $10.0 to $37.0 over the preceding 30 days.

Cleanspark Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CLSK | CALL | SWEEP | BEARISH | 03/21/25 | $5.3 | $5.2 | $5.2 | $10.00 | $623.9K | 5.3K | 2.1K |

| CLSK | CALL | TRADE | BULLISH | 03/21/25 | $5.2 | $5.05 | $5.2 | $10.00 | $416.0K | 5.3K | 111 |

| CLSK | PUT | TRADE | BEARISH | 01/15/27 | $13.55 | $12.15 | $13.0 | $20.00 | $130.0K | 105 | 0 |

| CLSK | CALL | SWEEP | BULLISH | 12/13/24 | $0.6 | $0.59 | $0.6 | $13.00 | $120.0K | 746 | 6.1K |

| CLSK | CALL | SWEEP | BULLISH | 12/13/24 | $0.79 | $0.76 | $0.8 | $13.00 | $117.2K | 746 | 1.6K |

About Cleanspark

Cleanspark Inc is a bitcoin mining company. Through CleanSpark, Inc., and the Company's wholly owned subsidiaries, the company mines bitcoin. The company entered the bitcoin mining industry through its acquisition of ATL. Bitcoin mining is the sole reportable segment of the company.

After a thorough review of the options trading surrounding Cleanspark, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Cleanspark

- With a volume of 22,920,353, the price of CLSK is up 2.8% at $13.94.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 58 days.

Professional Analyst Ratings for Cleanspark

3 market experts have recently issued ratings for this stock, with a consensus target price of $22.666666666666668.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from JP Morgan has elevated its stance to Overweight, setting a new price target at $17. * Consistent in their evaluation, an analyst from Macquarie keeps a Outperform rating on Cleanspark with a target price of $24. * An analyst from HC Wainwright & Co. downgraded its action to Buy with a price target of $27.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Cleanspark with Benzinga Pro for real-time alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.