Whales with a lot of money to spend have taken a noticeably bullish stance on Astera Labs.

Looking at options history for Astera Labs ALAB we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 33% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $175,633 and 6, calls, for a total amount of $291,290.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $60.0 to $155.0 for Astera Labs over the last 3 months.

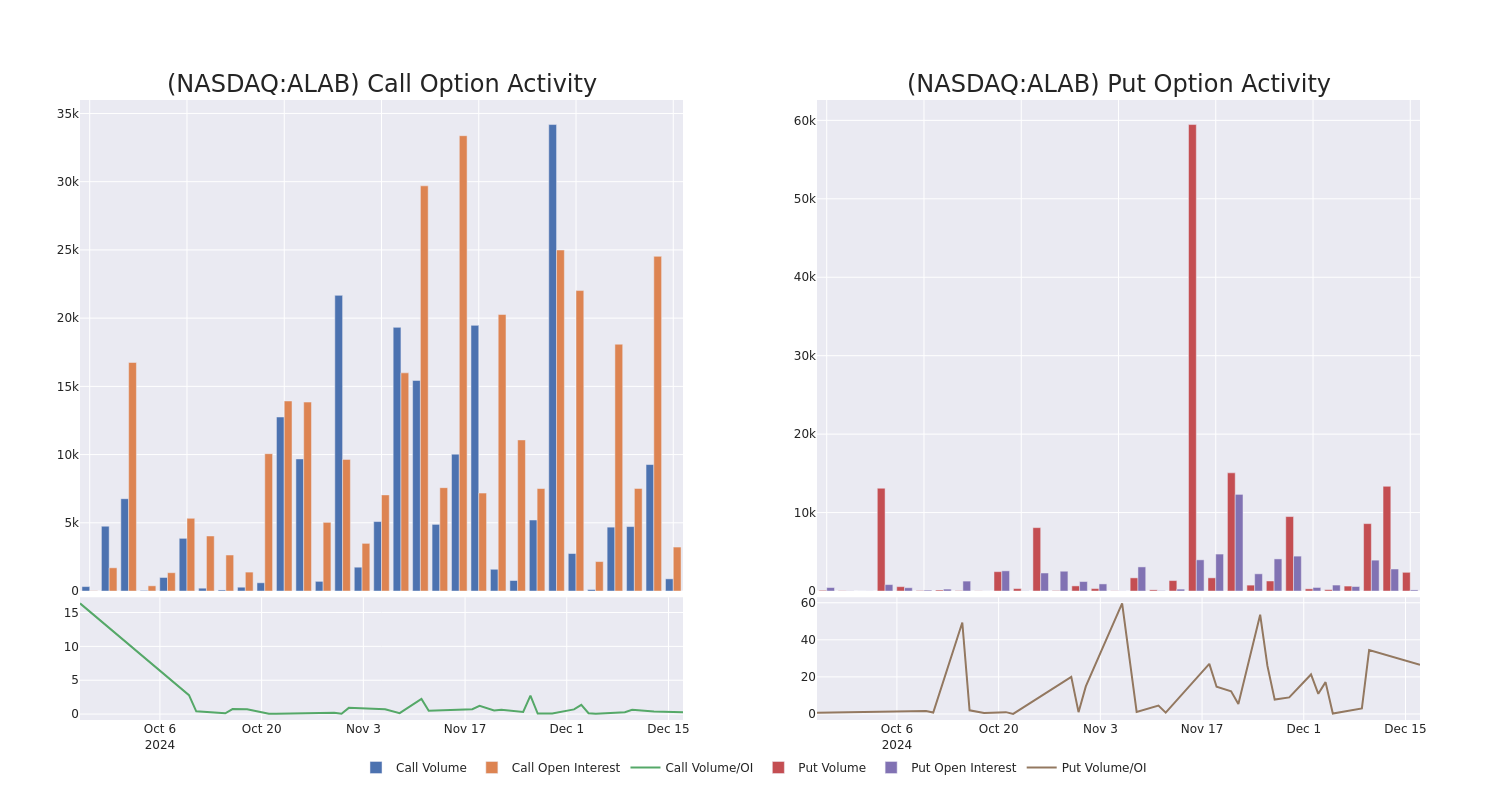

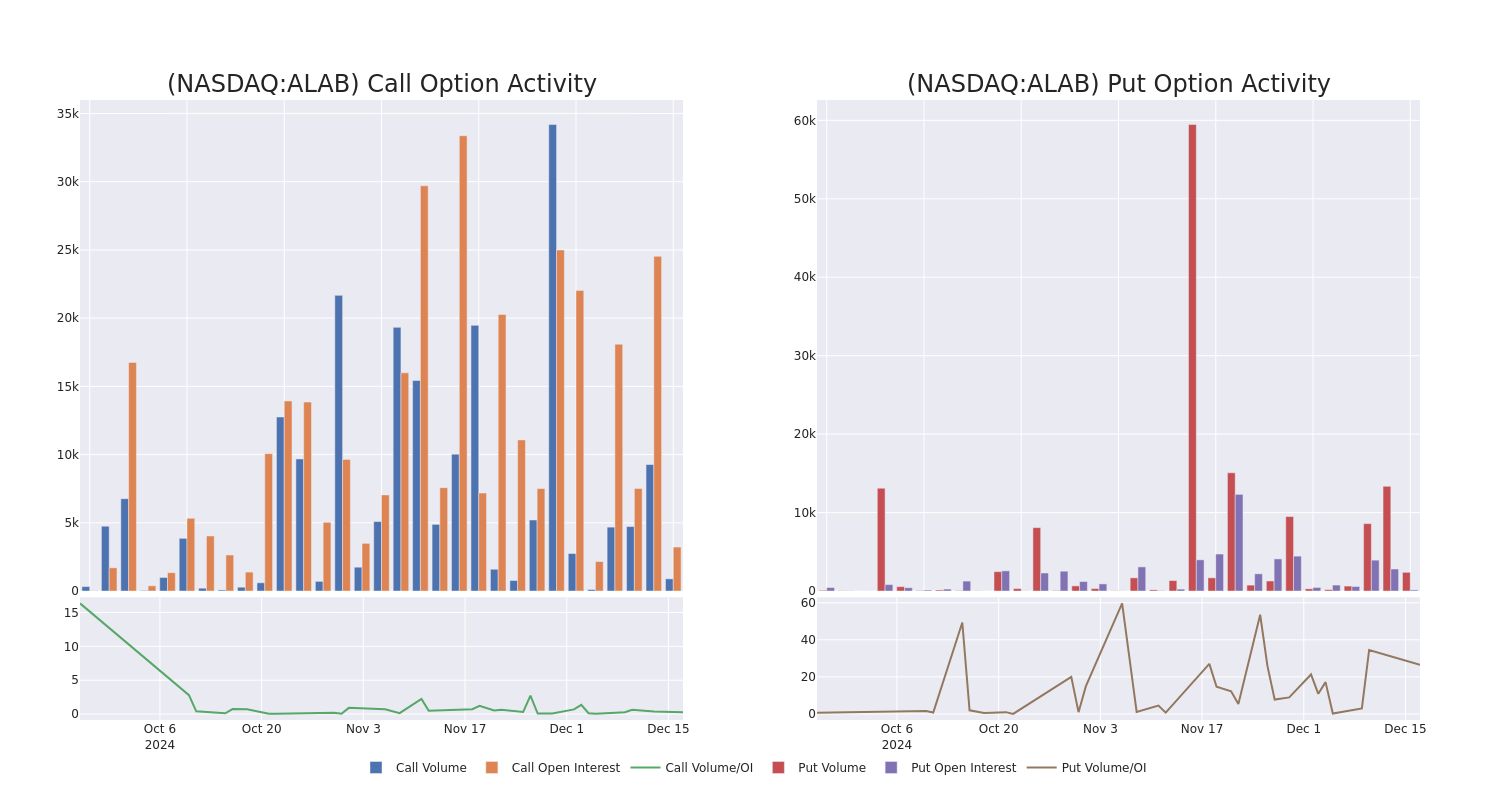

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Astera Labs's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Astera Labs's whale activity within a strike price range from $60.0 to $155.0 in the last 30 days.

Astera Labs Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ALAB | CALL | SWEEP | BEARISH | 01/17/25 | $4.2 | $4.1 | $4.1 | $150.00 | $123.1K | 504 | 789 |

| ALAB | PUT | SWEEP | BEARISH | 04/17/25 | $1.25 | $0.95 | $1.2 | $60.00 | $114.6K | 108 | 2.3K |

| ALAB | CALL | TRADE | BULLISH | 01/17/25 | $15.2 | $15.0 | $15.2 | $120.00 | $38.0K | 1.8K | 72 |

| ALAB | CALL | TRADE | NEUTRAL | 01/16/26 | $32.7 | $31.3 | $32.11 | $150.00 | $35.3K | 15 | 11 |

| ALAB | PUT | SWEEP | BULLISH | 01/15/27 | $36.5 | $34.9 | $34.9 | $115.00 | $35.0K | 31 | 10 |

About Astera Labs

Astera Labs Inc is a company that offers an Intelligent Connectivity Platform, comprised of Semiconductor-based, high-speed mixed-signal connectivity products that integrate a matrix of microcontrollers and sensors. COSMOS, their software suite which is embedded in its connectivity products and integrated into their customers' systems. The Company delivers critical connectivity performance, enables flexibility and customization, and supports observability and predictive analytics. This approach addresses the data, network, and memory bottlenecks, scalability, and other infrastructure requirements of hyperscalers and system original equipment manufacturers.

Current Position of Astera Labs

- Currently trading with a volume of 2,769,496, the ALAB's price is down by -1.0%, now at $129.17.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 97 days.

What The Experts Say On Astera Labs

In the last month, 1 experts released ratings on this stock with an average target price of $120.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Reflecting concerns, an analyst from Citigroup lowers its rating to Buy with a new price target of $120.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Astera Labs options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.