High-rolling investors have positioned themselves bullish on Bank of New York Mellon BK, and it's important for retail traders to take note. This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in BK often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 13 options trades for Bank of New York Mellon. This is not a typical pattern.

The sentiment among these major traders is split, with 30% bullish and 30% bearish. Among all the options we identified, there was one put, amounting to $42,320, and 12 calls, totaling $9,530,843.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $55.0 to $85.0 for Bank of New York Mellon over the last 3 months.

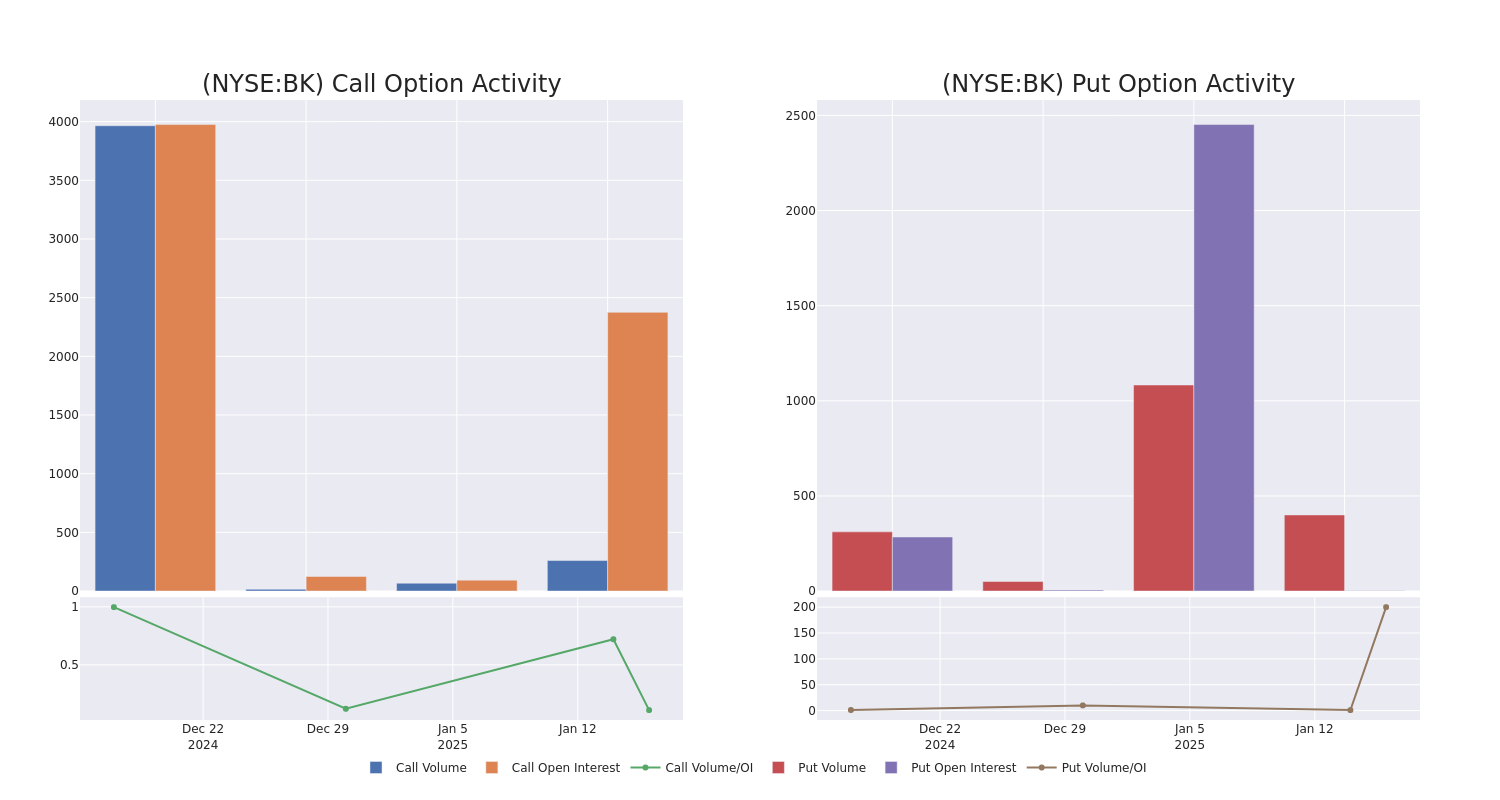

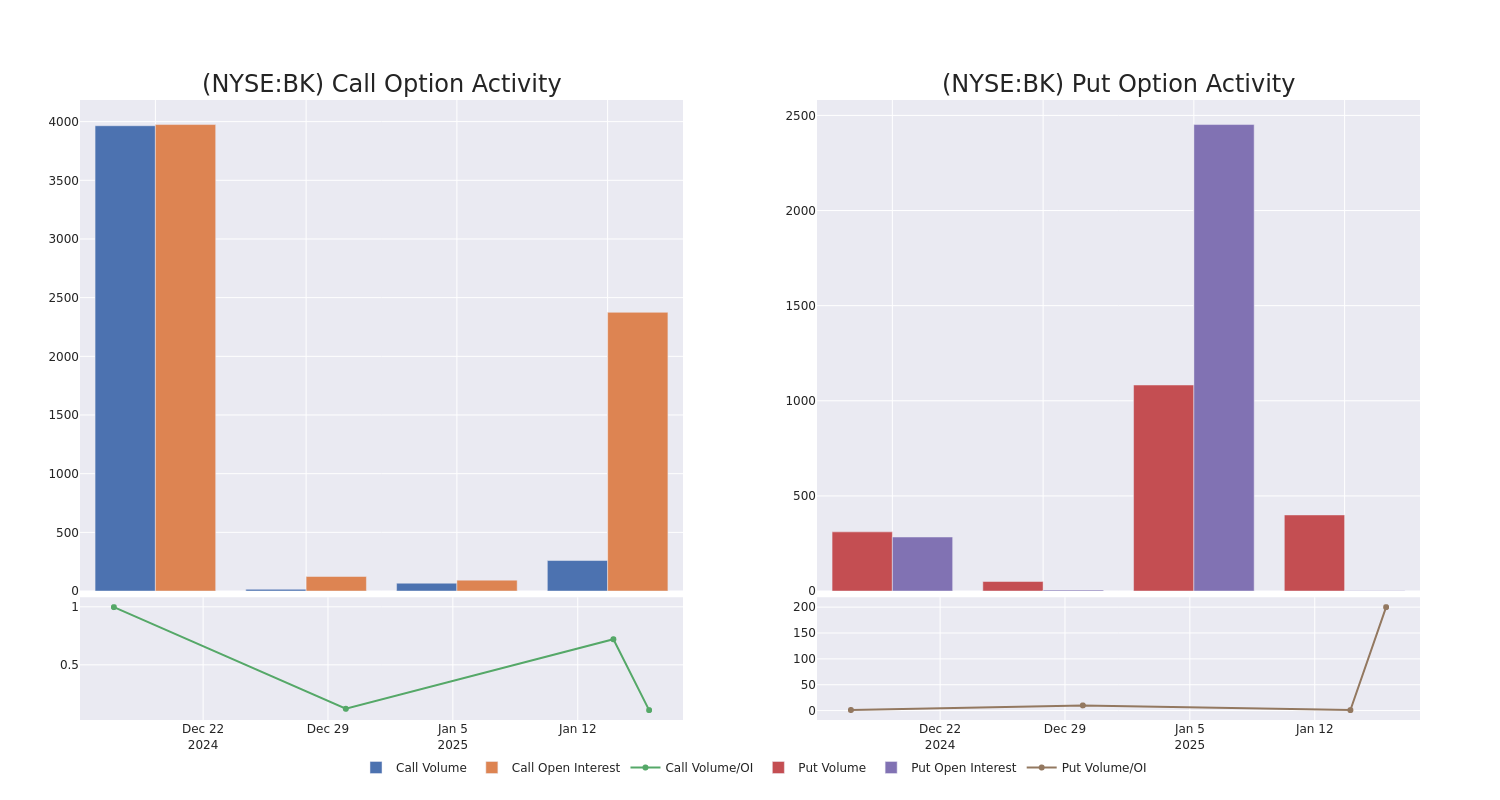

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Bank of New York Mellon's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Bank of New York Mellon's significant trades, within a strike price range of $55.0 to $85.0, over the past month.

Bank of New York Mellon Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BK | CALL | SWEEP | NEUTRAL | 03/21/25 | $29.5 | $29.2 | $29.32 | $55.00 | $1.5M | 3.3K | 948 |

| BK | CALL | SWEEP | NEUTRAL | 03/21/25 | $31.4 | $27.8 | $29.34 | $55.00 | $1.5M | 3.3K | 3.2K |

| BK | CALL | SWEEP | NEUTRAL | 03/21/25 | $29.4 | $29.1 | $29.26 | $55.00 | $1.4M | 3.3K | 2.2K |

| BK | CALL | SWEEP | NEUTRAL | 03/21/25 | $30.9 | $27.8 | $29.28 | $55.00 | $1.3M | 3.3K | 2.6K |

| BK | CALL | SWEEP | BULLISH | 03/21/25 | $29.4 | $28.6 | $29.26 | $55.00 | $1.0M | 3.3K | 1.6K |

About Bank of New York Mellon

BNY Mellon is a global investment company involved in managing and servicing financial assets throughout the investment lifecycle. The bank provides financial services for institutions, corporations, and individual investors and delivers investment management and investment services in 35 countries and more than 100 markets. BNY Mellon is the largest global custody bank in the world, with $52.1 trillion in under custody or administration (as of September 2024), and can act as a single point of contact for clients looking to create, trade, hold, manage, service, distribute, or restructure investments. BNY Mellon's asset-management division manages about $2.1 trillion in assets.

After a thorough review of the options trading surrounding Bank of New York Mellon, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Bank of New York Mellon's Current Market Status

- With a volume of 1,884,543, the price of BK is up 1.48% at $84.52.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 84 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Bank of New York Mellon options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.