Investors with significant funds have taken a bearish position in Cintas CTAS, a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in CTAS usually indicates foreknowledge of upcoming events.

Today, Benzinga's options scanner identified 18 options transactions for Cintas. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 44% being bullish and 55% bearish. Of all the options we discovered, 17 are puts, valued at $5,259,592, and there was a single call, worth $109,208.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $155.0 and $225.0 for Cintas, spanning the last three months.

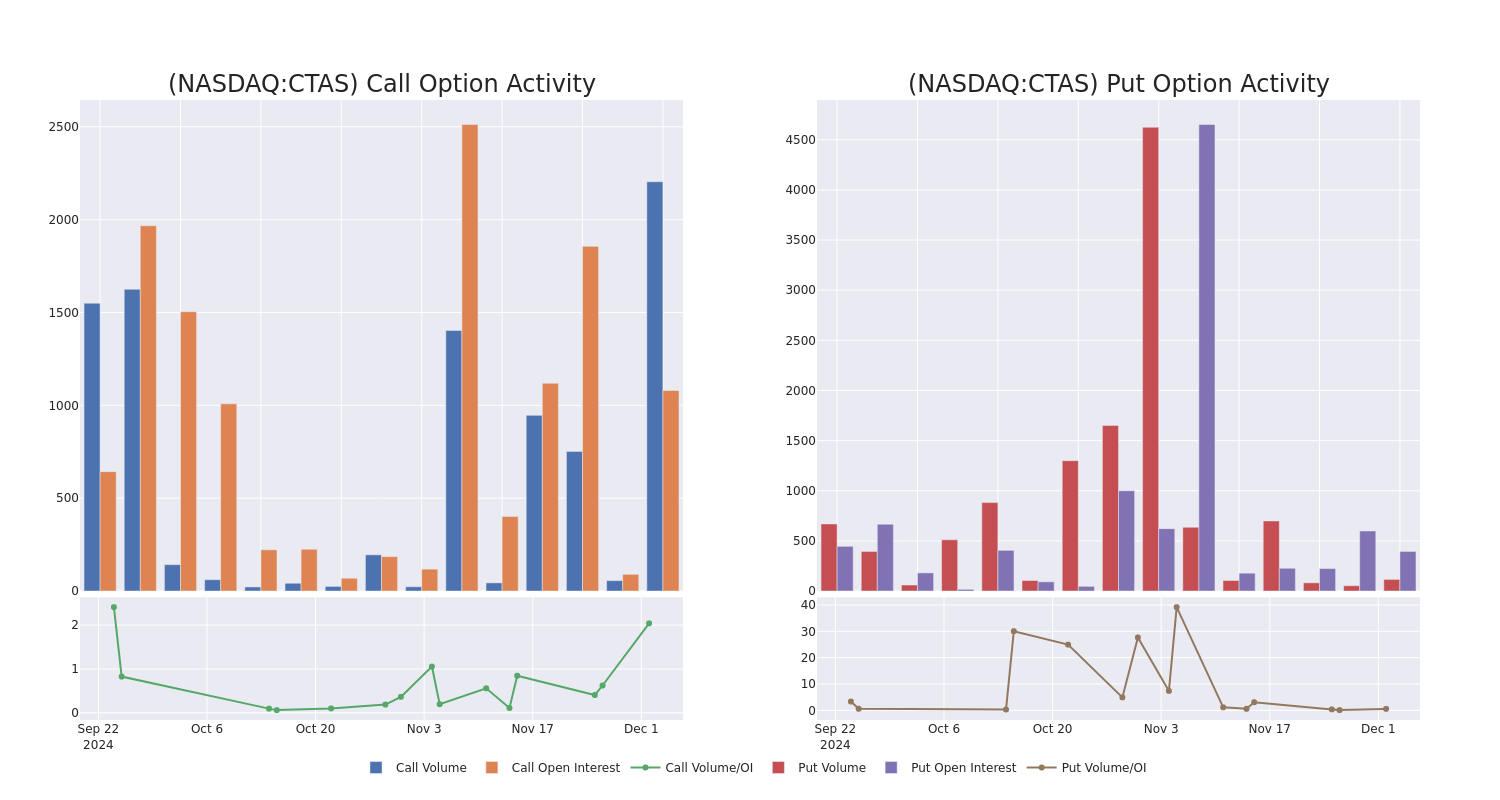

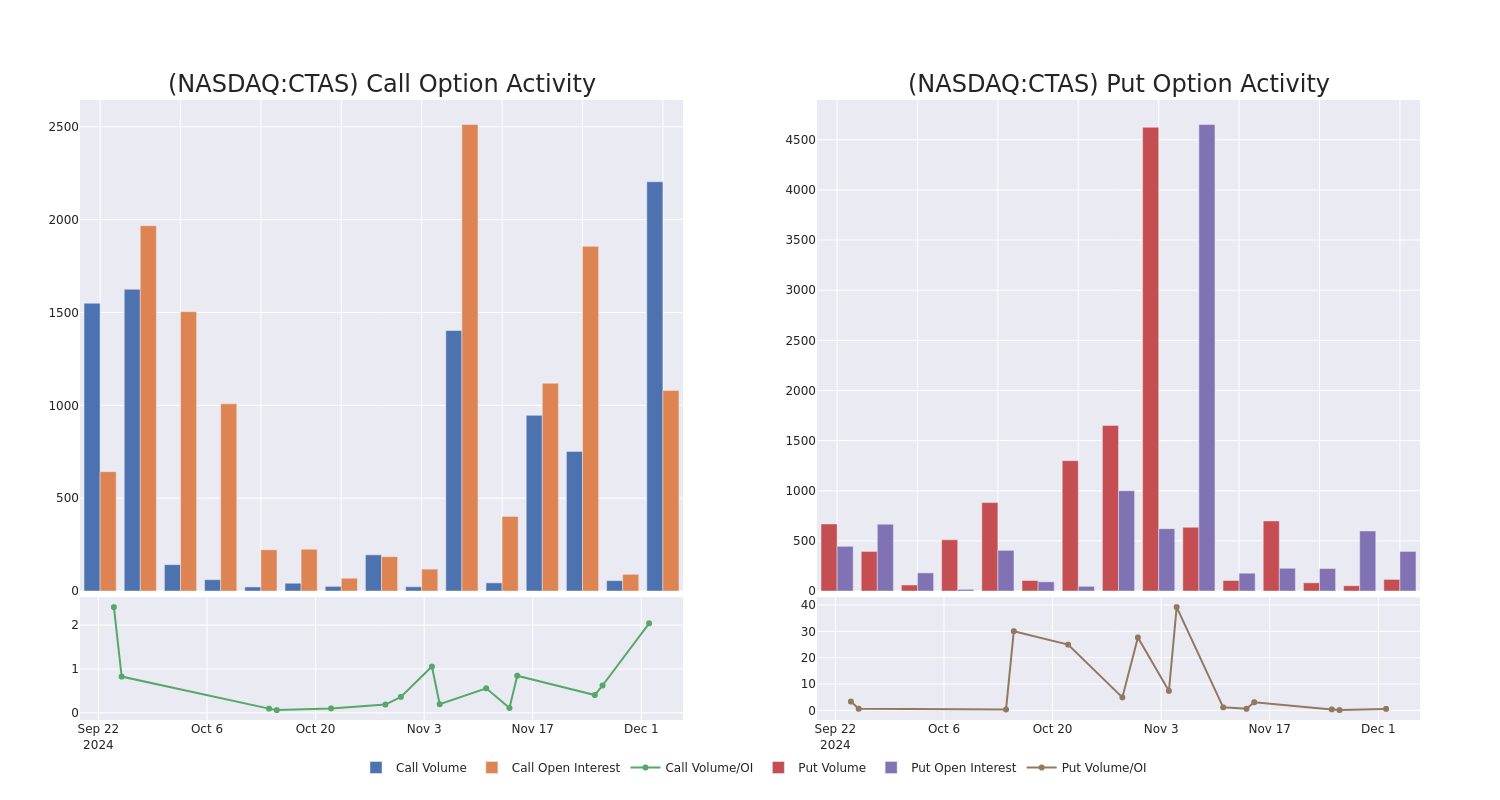

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Cintas's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Cintas's substantial trades, within a strike price spectrum from $155.0 to $225.0 over the preceding 30 days.

Cintas Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CTAS | PUT | TRADE | BULLISH | 01/17/25 | $12.0 | $10.6 | $11.0 | $195.00 | $2.3M | 6.1K | 4.9K |

| CTAS | PUT | TRADE | BULLISH | 01/17/25 | $9.9 | $6.0 | $6.8 | $195.00 | $1.9M | 6.1K | 2.8K |

| CTAS | PUT | SWEEP | BEARISH | 12/20/24 | $12.4 | $10.6 | $11.2 | $200.00 | $174.7K | 2.0K | 679 |

| CTAS | PUT | SWEEP | BEARISH | 12/20/24 | $11.0 | $10.9 | $11.0 | $200.00 | $134.2K | 2.0K | 378 |

| CTAS | PUT | SWEEP | BEARISH | 12/20/24 | $12.1 | $10.3 | $11.0 | $200.00 | $134.2K | 2.0K | 256 |

About Cintas

Cintas has roots tracing back to 1929, during which the Farmer family cleaned and re-sold dirty rags to manufacturing plants in Ohio. The firm has grown its business organically and through acquisitions, and today Cintas acts as a one-stop outsourcing partner for businesses. Cintas will design, manufacture, collect, and clean every employee uniform for a small weekly sum, taking on the upfront capital expense itself. In the same stop, Cintas can also replace soiled or depleted mats, mops, trash liners, towels, first aid, fire, and cleaning products. Businesses value an outsourcing partner like Cintas as it simplifies operations and leaves noncore tasks with high regulatory standards in the hands of professionals.

After a thorough review of the options trading surrounding Cintas, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Cintas Standing Right Now?

- Currently trading with a volume of 2,268,416, the CTAS's price is down by -9.88%, now at $184.19.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 0 days.

Professional Analyst Ratings for Cintas

In the last month, 1 experts released ratings on this stock with an average target price of $202.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Maintaining their stance, an analyst from Morgan Stanley continues to hold a Equal-Weight rating for Cintas, targeting a price of $202.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Cintas options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.