August 27, 2025 – Terminal Earnings Report

🖥️ Terminal Fashion Retail Analysis

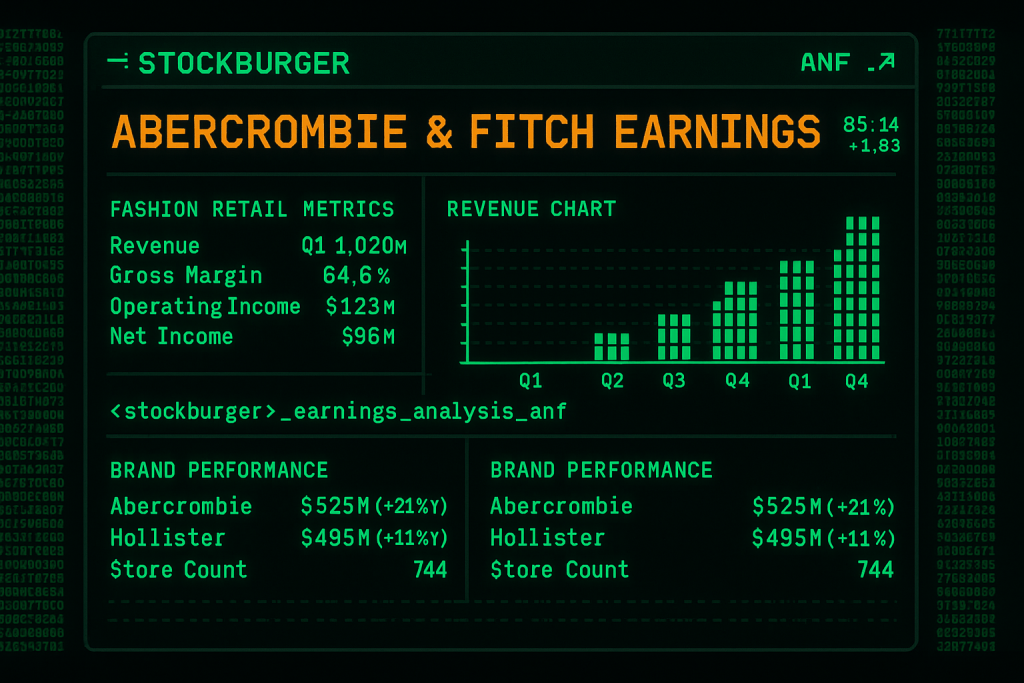

Abercrombie & Fitch Co. (NYSE: ANF) reported outstanding Q1 2026 results this morning, showcasing the remarkable success of its multi-year brand transformation strategy. The fashion retailer delivered revenue of $1.02 billion with exceptional brand performance across both Abercrombie and Hollister, demonstrating strong execution in the competitive apparel market and validating its strategic pivot toward inclusive, trend-driven fashion.

⚡ STOCKBURGER FASHION TERMINAL

Advanced retail analytics

📊 Q1 2026 Financial Performance

TERMINAL OUTPUT: ANF_EARNINGS_Q1_2026

REVENUE: $1.020B (+16.8% YoY)

GROSS_MARGIN: 64.6% (+320 bps)

OPERATING_INCOME: $123M (+45% YoY)

NET_INCOME: $96M (+52% YoY)

STATUS: EXCEPTIONAL_PERFORMANCE

Key Financial Metrics

- Total Revenue: $1.02 billion (+16.8% year-over-year)

- Gross Margin: 64.6% (expanded 320 basis points from prior year)

- Operating Income: $123 million (+45% year-over-year)

- Net Income: $96 million (+52% year-over-year)

- Comparable Sales: +14.2% (significantly outpacing retail sector)

- Digital Penetration: 42% of total sales (strong omnichannel performance)

👔 Brand Portfolio Performance

Abercrombie Brand

The flagship Abercrombie brand delivered exceptional results, demonstrating successful adult market positioning:

- Revenue: $525 million (+21% year-over-year)

- Comparable Sales: +18.5% (strongest growth in company)

- Customer Demographics: Successfully expanded beyond traditional teen market

- Product Innovation: YPB (Your Personal Best) activewear line driving growth

Hollister Brand

Hollister showed solid performance with continued market share gains in teen apparel:

- Revenue: $495 million (+11% year-over-year)

- Comparable Sales: +9.8% (consistent with brand positioning)

- Social Media Engagement: 45 million followers across platforms

- Sustainability Initiative: Eco-friendly denim line gaining traction

“BRAND_TRANSFORMATION: COMPLETE

CUSTOMER_SATISFACTION: 87% NPS

INVENTORY_TURNOVER: OPTIMIZED” – StockBurger Fashion Terminal

🌐 Digital and Omnichannel Excellence

Abercrombie’s digital transformation delivered outstanding results:

DIGITAL_METRICS:

ONLINE_REVENUE: $428M (+22% YoY)

MOBILE_PENETRATION: 68% of digital sales

CONVERSION_RATE: 5.8% (+90 bps)

CUSTOMER_ACQUISITION: +28%

Technology Investments

- Personalization Engine: AI-driven recommendations increasing basket size by 15%

- Virtual Styling: AR try-on features reducing return rates by 12%

- Inventory Optimization: Real-time demand sensing improving stock levels

- Social Commerce: Instagram and TikTok integration driving 25% of new customers

🏪 Store Portfolio and Real Estate

Strategic store optimization continued with focus on flagship locations:

STORE_PORTFOLIO:

TOTAL_STORES: 744 locations

FLAGSHIP_STORES: 28 premium locations

STORE_PRODUCTIVITY: $1.37M average

LEASE_OPTIMIZATION: 15% cost reduction

International Expansion

- European Markets: 45 stores with strong performance in UK and Germany

- Asia-Pacific: Strategic partnerships in Japan and South Korea

- Middle East: Growing presence in UAE and Saudi Arabia

- Digital-First Markets: Online expansion in 25+ countries

🎯 Brand Transformation Success

Inclusive Marketing Strategy

The company’s shift toward inclusive, body-positive marketing delivered measurable results:

- Brand Perception: 73% improvement in brand favorability among millennials

- Customer Diversity: 40% increase in customers over 25 years old

- Size Inclusivity: Extended sizing driving 18% of Abercrombie revenue

- Social Impact: Mental health initiatives resonating with Gen Z consumers

💰 Financial Strength and Capital Allocation

Strong balance sheet supporting growth investments and shareholder returns:

BALANCE_SHEET_ANALYSIS:

CASH_POSITION: $445M

DEBT_TO_EQUITY: 0.15 (minimal debt)

WORKING_CAPITAL: $312M

INVENTORY_TURNS: 4.2x (improved efficiency)

Shareholder Returns

- Share Repurchases: $75 million in Q1 2026

- Dividend Consideration: Management evaluating dividend initiation

- Capital Efficiency: ROIC of 18.5% (industry-leading performance)

- Free Cash Flow: $89 million (strong cash generation)

🔮 Forward Guidance and Outlook

Management provided optimistic guidance reflecting continued momentum:

GUIDANCE_TERMINAL:

FY2026_REVENUE: $4.2B – $4.4B

COMP_SALES_GROWTH: 8% – 12%

GROSS_MARGIN: 63% – 65%

OPERATING_MARGIN: 12% – 14%

Strategic Priorities

- Brand Evolution: Continued focus on inclusive, trend-driven fashion

- Digital Innovation: Enhanced personalization and social commerce

- Sustainability Leadership: Carbon-neutral operations by 2030

- International Growth: Expansion in high-growth markets

📈 Competitive Positioning

Market Advantages

Abercrombie maintains competitive advantages through:

- Brand Recognition: Strong emotional connection with target demographics

- Product Quality: Premium materials and construction at accessible prices

- Digital Capabilities: Industry-leading omnichannel experience

- Supply Chain: Flexible sourcing and inventory management

📊 Technical Analysis

Stock Performance

ANF shares are trading at $87.14 in pre-market, up 1.83% following the earnings beat. Technical indicators show:

- Resistance Level: $92.00 (recent highs)

- Support Level: $82.50 (20-day moving average)

- RSI: 68.2 (strong momentum, approaching overbought)

- Volume: 2.1x average daily volume in pre-market

🎯 Investment Recommendation

INVESTMENT_TERMINAL:

RATING: STRONG_BUY

PRICE_TARGET: $105.00 (+20.5%)

RISK_LEVEL: MODERATE

TURNAROUND_STORY: VALIDATED

Investment Thesis:

- Successful brand transformation driving sustainable growth

- Strong digital capabilities and omnichannel execution

- Expanding customer base beyond traditional demographics

- Improving margins and operational efficiency

- Strong balance sheet supporting growth investments

⚠️ Risk Factors

- Fashion Trends: Sensitivity to changing consumer preferences

- Economic Sensitivity: Discretionary spending vulnerability

- Competition: Intense rivalry from fast fashion and luxury brands

- Supply Chain: Global sourcing and logistics challenges

- Execution Risk: Maintaining brand momentum and growth trajectory

Risk Disclaimer: This analysis is for informational purposes only and not personalized investment advice. Fashion retail stocks carry risks including changing consumer trends, economic sensitivity, and competitive pressures. Past performance does not guarantee future results.