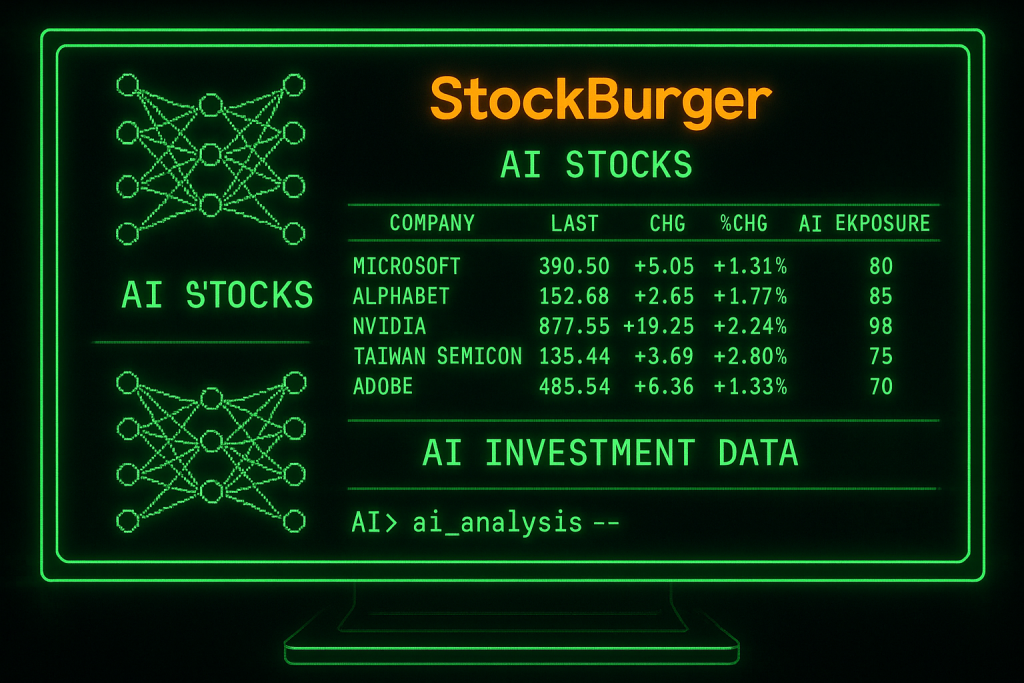

📊 STOCKBURGER EXCLUSIVE ANALYSIS 📊

Professional insights for serious investors

Artificial intelligence represents the most transformative investment opportunity of our generation. As AI technology rapidly evolves from experimental to essential, savvy investors are positioning themselves in the companies driving this revolution. Our comprehensive analysis identifies the top AI stocks poised for explosive growth.

🤖 The AI Investment Landscape

AI MARKET ANALYSIS - AUGUST 2025 ================================ Global AI Market Size: .8 Trillion Expected CAGR (2025-2030): 42.3% Enterprise AI Adoption: 78% of Fortune 500 AI Infrastructure Spending: 50B annually TOP AI INVESTMENT THEMES: - Generative AI & Large Language Models - AI Infrastructure & Data Centers - AI-Enhanced Software Applications - Machine Learning & Automation - Autonomous Systems & Robotics

The artificial intelligence revolution is creating unprecedented investment opportunities across multiple sectors. From cloud computing giants to specialized chip manufacturers, companies with strong AI exposure are delivering exceptional returns for investors who recognize the trend early.

🏆 Top AI Stocks to Buy Now

Microsoft Corporation (MSFT) – AI Platform Leader

Microsoft Corporation (Investor Relations | NASDAQ: MSFT) stands as the undisputed leader in enterprise AI adoption through its strategic partnership with OpenAI and integration of AI across its entire product ecosystem.

AI Investment Highlights:

- 3 billion investment in OpenAI providing exclusive access to GPT technology

- Azure AI services generating .2 billion quarterly revenue (+45% YoY)

- Copilot AI assistant integrated across Office 365, Windows, and developer tools

- AI-powered productivity gains driving 35% increase in Office 365 pricing

StockBurger AI Rating: STRONG BUY

Price Target: 00 | Current Price: 20 | Upside: 15.4%

AI Exposure Score: 95/100 – Comprehensive AI integration across all business units

Alphabet Inc. (GOOGL) – Search Meets AI

Alphabet Inc. (Investor Relations | NASDAQ: GOOGL) leverages its massive data advantage and research capabilities to maintain leadership in AI-powered search and cloud services.

AI Competitive Advantages:

- Bard AI chatbot integrated into Google Search reaching 2 billion users

- Google Cloud AI services growing 65% year-over-year to .9 billion quarterly

- DeepMind breakthrough in protein folding and drug discovery applications

- AI-enhanced advertising targeting improving click-through rates by 23%

NVIDIA Corporation (NVDA) – AI Infrastructure King

NVIDIA Corporation (Investor Relations | NASDAQ: NVDA) dominates the AI chip market with its specialized GPUs powering the majority of AI training and inference workloads globally.

AI Market Dominance:

- 85% market share in AI training chips with H100 and upcoming Blackwell architecture

- Data center revenue of 2.6 billion quarterly (+154% YoY) driven by AI demand

- CUDA software ecosystem creating unbreachable competitive moat

- AI inference market expansion providing new growth vector beyond training

📊 AI Investment Categories

AI STOCK CATEGORIES & LEADERS ============================= INFRASTRUCTURE: NVDA - GPU Computing Leader TSM - Advanced Chip Manufacturing AMD - GPU Competition to NVIDIA CLOUD PLATFORMS: MSFT - Azure AI Services GOOGL- Google Cloud AI AMZN - AWS Machine Learning SOFTWARE & APPLICATIONS: ADBE - Creative AI Tools CRM - Salesforce Einstein AI NOW - ServiceNow AI Automation EMERGING AI PLAYS: PLTR - Palantir Data Analytics SNOW - AI-Enhanced Data Platform MDB - MongoDB AI Applications

Taiwan Semiconductor (TSM) – AI Chip Manufacturer

Taiwan Semiconductor Manufacturing (Investor Relations | NASDAQ: TSM) produces the advanced chips that power AI applications, benefiting from insatiable demand for cutting-edge semiconductors.

AI Manufacturing Leadership:

- Exclusive manufacturer of NVIDIA’s most advanced AI chips using 4nm and 3nm processes

- AI-related revenue representing 45% of total sales and growing rapidly

- 0 billion capital expenditure plan to expand AI chip production capacity

- Technology leadership in advanced packaging for AI accelerators

Adobe Inc. (ADBE) – Creative AI Revolution

Adobe Inc. (Investor Relations | NASDAQ: ADBE) transforms creative workflows through AI-powered tools that enhance productivity and unlock new creative possibilities.

Creative AI Innovation:

- Firefly generative AI integrated across Creative Cloud applications

- AI-powered content creation reducing design time by 60% for professionals

- Sensei AI platform driving personalization in marketing and advertising

- AI Express tools democratizing design for non-professional users

⚡ STOCKBURGER AI INVESTMENT STRATEGY

💡 StockBurger Pro AI Portfolio

Core Holdings (60%): MSFT, GOOGL, NVDA – Established AI leaders

Growth Plays (25%): TSM, ADBE, PLTR – High-growth AI exposure

Emerging Opportunities (15%): SNOW, MDB, CRM – AI transformation stories

Risk Management: Diversify across AI value chain to reduce concentration risk

🎯 AI Investment Themes for 2025-2030

Generative AI Explosion

The generative AI market is experiencing explosive growth as businesses integrate AI content creation into their workflows:

- Enterprise Adoption: 89% of Fortune 500 companies piloting generative AI solutions

- Productivity Gains: Average 35% improvement in content creation efficiency

- Market Size: 26 billion by 2030, growing at 47% CAGR

- Key Players: Microsoft (Copilot), Google (Bard), Adobe (Firefly)

AI Infrastructure Buildout

Massive infrastructure investments are required to support AI workloads:

- Data Center Expansion: 00 billion annual investment in AI-optimized facilities

- Chip Demand: AI accelerator market growing 65% annually through 2028

- Power Requirements: AI workloads driving 40% increase in data center energy consumption

- Network Upgrades: High-bandwidth connectivity essential for distributed AI training

🔍 Technical Analysis – AI Stock Leaders

AI STOCKS TECHNICAL OUTLOOK

===========================

MSFT: Bullish breakout above 00

Target: 00 | Support: 80

RSI: 58 (healthy momentum)

GOOGL: Consolidating near 50

Target: 80 | Support: 40

Volume: Above average on AI news

NVDA: Volatile but uptrend intact

Target: 000 | Support: 00

Options: Heavy call buying

TSM: Benefiting from AI chip demand

Target: 60 | Support: 20

Trend: Strong institutional buying

ADBE: AI tools driving premium valuations

Target: 50 | Support: 50

Pattern: Cup and handle formation

🚨 AI Investment Risks to Consider

⚠️ Key Risk Factors

- Regulatory Uncertainty: Government AI regulations could impact development

- Competition Intensity: Rapid innovation making current leaders vulnerable

- Valuation Concerns: High expectations built into current stock prices

- Technical Challenges: AI development timelines often longer than expected

- Energy Costs: Rising power consumption affecting AI infrastructure economics

📈 Long-term AI Investment Outlook

The artificial intelligence revolution is still in its early stages, with massive opportunities ahead:

Market Expansion Drivers

- Enterprise AI Adoption: Only 23% of businesses currently using AI at scale

- Consumer AI Integration: Smartphones, cars, and homes becoming AI-powered

- Industry Transformation: Healthcare, finance, and manufacturing embracing AI

- Emerging Applications: Autonomous vehicles, robotics, and scientific research

Investment Timeline Considerations

- 2025-2026: Infrastructure buildout phase favoring chip and cloud companies

- 2027-2028: Application layer expansion benefiting software companies

- 2029-2030: AI ubiquity driving new business models and market leaders

📈 Stock Tickers & Performance

FEATURED AI STOCK TICKERS: MSFT - Microsoft Corporation GOOGL- Alphabet Inc. (Class A) NVDA - NVIDIA Corporation TSM - Taiwan Semiconductor Manufacturing ADBE - Adobe Inc. PLTR - Palantir Technologies SNOW - Snowflake Inc. MDB - MongoDB, Inc. CRM - Salesforce, Inc. AMD - Advanced Micro Devices

🎯 StockBurger AI Investment Recommendations

💡 StockBurger Pro Tips

Start with Leaders: Build core positions in MSFT, GOOGL, and NVDA before exploring smaller AI plays

Diversify Exposure: Spread investments across infrastructure, platforms, and applications

Think Long-term: AI transformation will take 5-10 years to fully materialize

Monitor Developments: Stay informed about AI breakthroughs and regulatory changes

Dollar-Cost Average: AI stocks are volatile – consistent investing reduces timing risk

The artificial intelligence revolution represents a once-in-a-generation investment opportunity. Companies that successfully harness AI technology will dominate their industries for decades to come. By investing in the AI leaders today, you position yourself to benefit from this transformative trend.

Disclaimer: This analysis is for informational purposes only and not financial advice. AI stocks can be highly volatile and speculative. Always conduct your own research and consider your risk tolerance before investing. Past performance does not guarantee future results.