Advanced Micro Devices (AMD) stock fell more than 6% in early trading Wednesday after the company’s second-quarter Data Center revenue underwhelmed investors, even as total revenue topped expectations and guidance came in strong. The Data Center segment reported $3.2 billion in revenue—in line with Wall Street forecasts but seen as lackluster given competitive pressures.

For Q2, AMD posted adjusted earnings per share of $0.48 on $7.6 billion in revenue. That compares to analyst estimates of $0.49 EPS on $7.4 billion in revenue, according to Bloomberg consensus data.

Despite the miss on earnings, AMD offered upbeat Q3 guidance, projecting revenue between $8.4 billion and $9 billion, ahead of the $8.3 billion expected by analysts.

However, AMD noted it faced an $800 million hit from the Trump administration’s ban on selling its MI308 AI chips to China, contributing to a $155 million operating loss for the quarter. In contrast, Nvidia (NVDA) reported a $4.5 billion write-down related to the same ban in its Q1 results and anticipates an $8 billion impact in Q2.

Trump reversed course on the chip ban last month, which could help offset future losses for AMD and other affected firms.

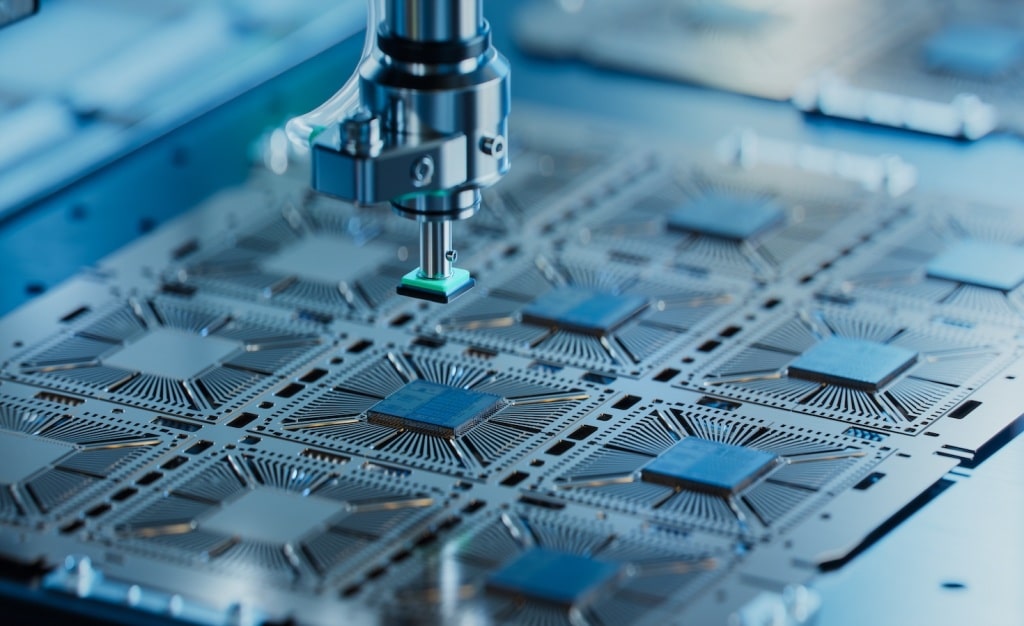

Looking ahead, AMD is expected to benefit from the upcoming launch of its MI350 AI chip line, including the MI350X and MI355X models. The company claims these chips offer four times the AI compute performance and a 35x improvement in inferencing capabilities compared to prior generations—designed to compete directly with Nvidia’s Blackwell-powered chips.

Outside of its Data Center division, AMD’s Client segment—which includes CPUs for desktops and laptops—delivered a strong performance, generating $3.6 billion in revenue, far above the $2.5 billion analysts had projected.

“We delivered strong revenue growth in the second quarter led by record server and PC processor sales,” said Dr. Lisa Su, AMD Chair and CEO. “We are seeing robust demand across our computing and AI product portfolio and are well positioned to deliver significant growth in the second half of the year, driven by the ramp of our AMD Instinct MI350 series accelerators and ongoing EPYC and Ryzen processor share gains.”

“We achieved 32% year-over-year revenue growth and generated record free cash flow this quarter, reflecting our disciplined execution,” said Jean Hu, AMD EVP, CFO and Treasurer. “Our strategic investments across hardware, software and systems position us well to support robust future growth and drive long-term shareholder value.”