2 Ultra-High-Yield Real Estate Stocks to Buy Hand Over Fist and 1 to Avoid

Real estate investment trusts (REITs) can be great income-producing investments. They tend to offer much higher dividend yields (4% on average these days compared to a sub-1.5% dividend yield on the S&P 500). Meanwhile, the best ones aim to consistently increase their payments.

W.P. Carey (NYSE: WPC) and EPR Properties (NYSE: EPR) are ideal REITs for those seeking a sustainable and growing income stream. They’re much better options than the much higher-yielding Annaly Capital Management (NYSE: NLY), which might need to cut its dividend once again.

A high-risk, high-yield dividend stock

Annaly Capital Management currently offers a jaw-dropping dividend yield of nearly 13%. That’s almost 10 times higher than the S&P 500. While mortgage REITs like Annaly tend to have higher yields, this one seems to be at a higher risk of reduction than others in the sector.

The concern is the continued decline in Annaly’s earnings available for distribution (EAD). The REIT’s EAD was $0.68 per share in the second quarter, only slightly above its dividend payment. On a positive note, that was an improvement from the first-quarter level when EAD fell below the payout at $0.64 per share. However, it’s well below the year-ago level ($0.72 per share) and where it was at the end of 2022 ($0.89 per share). The company’s declining EAD forced it to cut its dividend by 26% in early 2023.

That wasn’t Annaly’s first dividend reduction. It likely won’t be its last, given the continued decline in its EAD. Because of that, income-focused investors should avoid this REIT.

Back on a growth trajectory

W.P. Carey is a diversified REIT focused on owning operationally critical properties net leased to high-quality tenants. It owns nearly 1,300 single-tenant industrial, warehouse, and retail properties across North America and Europe. It also owns 89 self-storage operating properties. The REIT’s net leases provide it with stable income that grows each year due to built-in rental escalation clauses that either raise rents at a fixed rate or one linked to inflation. That stable income supports the REIT’s nearly 6%-yielding dividend.

Until last year, W.P. Carey had a sterling record of increasing its dividend. However, it made the strategic decision to exit the office sector by spinning off and selling all its office properties. As a result, it also reset its dividend to reflect its lower income level and a desire to have a more conservative dividend payout ratio.

W.P. Carey has been steadily rebuilding its portfolio since then, focusing on property sectors with better long-term fundamentals, like industrial real estate. It expects to invest $1.25 billion to $1.75 billion in new properties this year (it had already secured $641 million of new investments by the end of July), which puts it on track to start growing its cash flow per share in the second half of the year. These new investments have enabled the REIT to already start rebuilding its payout, raising it twice this year. That steady upward trend should continue in the future as it acquires more income-generating properties.

An exciting income stream

EPR Properties is a specialty REIT focused on experiential real estate like theaters, attractions, fitness and wellness facilities, and experiential lodging properties. It also has a small portfolio of educational properties (early childhood education centers and private schools). It net leases these properties back to their operators. Those leases supply it with steady income to cover its more than 7%-yielding monthly dividend.

Like W.P. Carey, EPR Properties had to reset its dividend in recent years (it suspended its payout during the pandemic and then reinstated it at a lower rate). That lower payment level allows the REIT to retain more cash to fund new investments. It expects to invest about $200 million to $300 million per year, which it can fund through retained cash flow, property sales, and its strong balance sheet. EPR Properties had completed $132.7 million of investments by the end of the first half and has $180 million of development and redevelopment projects under construction that it expects to fund over the next two years. It also selectively acquires experiential properties when the right opportunities arise.

EPR Properties’ growing portfolio and cash flow will allow it to increase its dividend. It has already raised its payout a few times since the great reset following the pandemic, including by 3.6% earlier this year.

Better options for a sustainable and growing income stream

While Annaly Capital Management offers an eye-popping dividend yield, that payout doesn’t seem sustainable. Because of that, income-seeking investors should avoid that REIT and buy W.P. Carey or EPR Properties instead. While their yields aren’t quite as high, they’re well above average. Further, those REITs will likely continue increasing their payouts, making them better options for those seeking a sustainable and steadily rising passive income stream.

Should you invest $1,000 in Annaly Capital Management right now?

Before you buy stock in Annaly Capital Management, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Annaly Capital Management wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Matt DiLallo has positions in EPR Properties and W. P. Carey. The Motley Fool recommends EPR Properties. The Motley Fool has a disclosure policy.

2 Ultra-High-Yield Real Estate Stocks to Buy Hand Over Fist and 1 to Avoid was originally published by The Motley Fool

Nvidia earnings 'absolutely key to the AI infrastructure trade'

Nvidia stock (NVDA) is back. But it’s about to be put to the test again.

The next big event for the market is the chip darling’s earnings report, set for after the bell Wednesday.

And it’s not just Nvidia stock that’s on the line: Nvidia’s results will set the pace for other AI players.

“Nvidia’s report and guidance will be absolutely key to the AI infrastructure trade,” tech investor Paul Meeks told Yahoo Finance.

The past several weeks have been a roller-coaster ride for tech investors. Shares of AI giants Amazon (AMZN), Microsoft (MSFT) and Alphabet (GOOGL) are down over the past three months, with Alphabet falling more than 6% and both Amazon and Microsoft down more than 3%.

And second-tier AI players are struggling to regain traction as well. AMD (AMD) has fallen more than 16% since mid-July while Marvell Technology (MRVL) is off nearly 6% in the same period.

But strong results from Nvidia could reignite some of that lost momentum, according to Wedbush’s Dan Ives.

“Nvidia is the heart and lungs of this bullish tech trade as the AI Revolution takes hold,” Ives told Yahoo Finance.

Ives, who expects a “shock and awe” quarter from Nvidia, says continued strong demand for the company’s chips will have ripple effects across the industry. In a recent note to clients, Ives estimated that for every dollar spent on a Nvidia GPU chip, there is an $8 to $10 multiplier across the tech sector.

Bernstein’s Mark Shmulik, who covers many of Nvidia’s biggest customers including Meta, Amazon, and Google, told me the chip giant’s results will be a critical driver of Big Tech’s next move.

“Nvidia is a bellwether of the Magnificent Seven and AI trade,” Shmulik explained. “If there is any softness, maybe rotation out of the Mag 7 picks up a little bit of steam, but listening to other tech earnings, core fundamentals keep delivering.”

So far this year, Nvidia’s stock has soared. Shares are up 180% over the past year and up nearly 2,900% over the past five years — setting the bar very high for earnings this quarter.

Estimates are for Nvidia’s revenue to grow 112% in its latest quarter, marking a dramatic slowdown from over 250% growth one year ago. For Wall Street, consensus remains bullish. KeyBanc, Citi, and Goldman Sachs were among those on the street who reiterated their Buy ratings on the stock this week ahead of results.

While only time will tell whether Nvidia lives up to the hype this earnings season, it’s safe to say the stakes are high.

Seana Smith is an anchor at Yahoo Finance. Follow Smith on Twitter @SeanaNSmith. Tips on deals, mergers, activist situations, or anything else? Email seanasmith@yahooinc.com.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance

Want $2,000 in Annual Dividends? Invest $30,000 in These 3 High-Yielding Stocks

Dividend stocks can be a great source of cash flow for your portfolio. You don’t need to settle for stocks that pay just a few percentage points, either. Some fairly safe, high-yielding stocks pay far more than the S&P 500 average of 1.3%.

Pfizer (NYSE: PFE), BCE (NYSE: BCE), and AT&T (NYSE: T) could all make for good income investments to add to your portfolio right now, as they all pay more than 5% and are fairly safe buys. Here’s how investing $30,000 across these stocks could generate $2,000 in annual dividends for your portfolio.

1. Pfizer

Healthcare giant Pfizer pays an attractive dividend that yields 5.9%. If you were to invest $10,000 into the stock, it would generate more than $590 in dividends over the course of a full year. Investors have been bearish on Pfizer of late, seeing it as a business that got a boost due to its COVID vaccine and pill but whose future is much less certain.

While it’s true that its COVID revenue is declining, the stock is arguably worth more than the 11 times estimated future earnings (based on analyst projections) it’s trading at right now. It has been loading up on acquisitions to enhance its growth prospects.

Its $43 billion acquisition of Seagen last year has the potential to be transformative for the company, making oncology a much larger part of its operations in the years ahead. It also has an underrated opportunity in the promising weight loss market as it works on developing a daily pill to help people lose weight.

Pfizer is in cost-cutting mode, and while it has incurred losses in recent quarters due to restructuring and impairment charges, investors shouldn’t discount it as a top dividend stock to own.

2. BCE

Canadian media and telecom company BCE makes for another stable dividend stock to buy and hold. It likely won’t generate significant capital gains for investors, but given its dominance and leadership position in the Canadian telecom industry, it’s not a stock you’ll have to worry about over the long haul.

At 8.4%, its yield is abnormally high as investors have been bearish on telecom stocks this year due to rising interest rates. But as those rates start to come down, BCE and similar stocks may start to rally. In the meantime, investing $10,000 into the stock could help net you $840 in annual dividends while the payout remains high.

The company is expecting minimal growth this year (between 0% and 4%). Still, its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) will also expand by up to 4.5%, a great sign the business is still moving forward despite less-than-ideal economic conditions. The stock trades at just 16 times its estimated future earnings and could make for another solid income investment to buy and hold.

3. AT&T

Rounding out this list of high-yielding dividend stocks is AT&T. Its 5.8% yield is the lowest on this list, but it wasn’t all that long ago that the payout was even higher. Investors have been more bullish on the telecom provider of late as it has been generating strong results, putting to rest many fears investors had about its operations and high dividend.

As with BCE, you’re getting another fairly slow-growing business in AT&T. This year, it projects its wireless service revenue to grow by 3%, but it expects a higher 7% growth rate in its broadband operations. Adjusted EBITDA growth is also expected to be at around 3%.

Despite its recent rally, investors are still arguably discounting the stock a bit too much as AT&T trades at a forward price-to-earnings multiple of 9. The company is slowly winning investors over with its results and proving it is not a value trap, but it’s still a cheap-looking investment to own right now.

Another $10,000 invested in the company would give you $580 in annual dividends. When combined with the other payouts on this list, that would put your total annual dividend at approximately $2,010 from a total investment of $30,000.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool has a disclosure policy.

Want $2,000 in Annual Dividends? Invest $30,000 in These 3 High-Yielding Stocks was originally published by The Motley Fool

Meet the Supercharged Growth Stock That Could Join Apple, Microsoft, and Nvidia in the $3 Trillion Club by 2031

One of the most notable transitions in recent decades has been the ascent of technology purveyors among the world’s most valuable companies. It was just two decades ago that industrial and energy stalwarts General Electric and ExxonMobil topped the list in terms of market cap, valued at $319 billion and $283 billion, respectively. Now, just 20 years later, it’s technology that dominates the list.

Leading the way are three of the most recognizable tech companies in the world. Apple currently tops the list at $3.4 trillion. Microsoft and Nvidia are close behind, each valued of $3 trillion.

With a market cap of just $1.3 trillion, it might seem premature to suggest that Meta Platforms (NASDAQ: META) is on track to join the $3 trillion club. However, the stock has gained 163% over the past year and 495% over the past five years (as of this writing), driven by strong operating results that should continue.

Meta has several distinct advantages, and its ever-expanding social media empire, market dominance, and strategic adoption of AI could drive its membership in this elite fraternity.

An ongoing and robust recovery

While Meta Platforms was punished during the economic downturn, the stock has come roaring back, propelled higher by impressive financial results. In the second quarter, revenue of $39 billion climbed 22% year over year, while diluted earnings per share (EPS) of $5.16 jumped 73%.

The financial results were driven by solid user metrics. The number of people who paid daily visits one of Meta’s family of social media sites — which includes Facebook, Instagram, Threads, and WhatsApp — grew to 3.27 billion, up 7% year over year.

Helping fuel the robust results was the ongoing rebound in online marketing, which is improving thanks to gains in the overall economy. Meta’s social media ecosystem plays host to the company’s digital advertising.

The online ad arena is dominated by the industry’s two leading players. In 2023, Alphabet‘s Google controlled an estimated 39% of the worldwide digital ad revenue, followed by Meta with 18%, according to data compiled by business intelligence platform Statista.

As the world’s second-largest digital advertiser, Meta Platforms is well positioned to reap the benefits of the rebound, which could be substantial.

Multiple growth drivers

Worldwide ad spending is expected to rise by 8% to more than $1 trillion in 2024, according to ad industry researcher WARC Media. Social media is expected to be the fastest-growing medium in digital advertising, capturing nearly 22% of total ad spending, according to the report. It goes on to say that Meta is “on course to record oversized gains in the coming months.”

Beyond advertising, however, is Meta’s strategy to profit from the windfall of artificial intelligence (AI). The company has leveraged the data it captures from the billions of users on its social media platforms to develop its own state-of-the-art large language models, which forms the foundation of generative AI.

The result is Llama (Large Language Model Meta AI), which feeds its flagship Meta AI chatbot. Earlier this year, the company unveiled Llama 3, declaring Meta AI as “one of the world’s leading AI assistants.” The company made this system free to individual users (collecting even more data) while it charges the largest cloud infrastructure providers for the privilege of including it in their offerings.

While there’s a great deal of emphasis on AI, it isn’t the only growth driver that could push Meta higher. Meta’s Reality Labs — home of its Oculus virtual reality (VR) business, Quest VR headsets, and its ever-changing metaverse blueprint — has had little to show for its efforts thus far. However, CEO Mark Zuckerberg is convinced these investments will bear fruit, ultimately boosting Meta’s profits.

Given the rebounding ad market, multiple growth drivers, and the tailwinds driving generative AI, it shouldn’t take long for Meta Platforms to earn its membership in the $3 trillion club.

The path to $3 trillion

Meta currently boasts a market cap of roughly $1.35 trillion, which means it will take stock price gains of roughly 123% to drive its value to $3 trillion. According to Wall Street, Meta is expected to generate revenue of $161.6 billion in 2024, giving it a forward price-to-sales (P/S) ratio of roughly 8.3. Assuming its P/S remains constant, Meta would have to grow its revenue to roughly $360 billion annually to support a $3 trillion market cap.

Wall Street is currently forecasting revenue growth for Meta of 14% annually over the next five years. If the company achieves that benchmark, it could achieve a $3 trillion market cap as soon as 2031. It’s worth noting that Meta has grown its annual revenue by nearly 1,000% over the past decade, so those expectations could well be conservative.

Furthermore, at 27 times earnings, Meta is selling for a discount compared to a multiple of 29 for the S&P 500. That’s an attractive price to pay for a company with a dominant market share, strong momentum, and multiple ways to win.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Danny Vena has positions in Alphabet, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Meet the Supercharged Growth Stock That Could Join Apple, Microsoft, and Nvidia in the $3 Trillion Club by 2031 was originally published by The Motley Fool

3 Struggling Stocks That Aren't Worth Buying on the Dip

Should you buy the dip? It’s a popular but potentially dangerous strategy, especially for less experienced investors. That’s because a struggling stock that’s near its 52-week low can dip further to new lows and continue trending down indefinitely.

So before buying a stock that has fallen deeply in value, you should do your due diligence and be fairly confident in its ability to rebound. Otherwise, you could just be setting yourself up for losses as the stock potentially falls further into a tailspin.

Three stocks that have fallen more than 30% in just the past three months are Walgreens Boots Alliance (NASDAQ: WBA), Trump Media & Technology Group (NASDAQ: DJT), and Intel (NASDAQ: INTC). But despite their seemingly low valuations, these aren’t stocks you should rush out to buy.

Walgreens Boots Alliance

In the past three months, shares of pharmacy retailer Walgreens Boots Alliance have crashed by nearly 40%. The healthcare stock has been hitting new lows this year as concerns are rising about the safety of both its dividend and its business.

New CEO Tim Wentworth came aboard less than a year ago to fix the struggling healthcare company, but it’s no easy task as Walgreens continues to struggle with profitability. In two of the past three quarters, it has even burned through cash just from its day-to-day operating activities. This is before even factoring in its dividend payments, which it’s still making after Wentworth reduced the payout earlier this year rather than outright suspending it — a move the company still may need to end up making.

Walgreens may look cheap, trading at just 6 times its trailing earnings. But this is what I’d call a classic value trap. The business is on shaky ground right now, and that valuation could look expensive in a year or two if Walgreens’ financials deteriorate. Its low valuation could make it an intriguing stock to track, but without an exceptionally high risk tolerance, it won’t be a suitable investment option for most investors.

Trump Media & Technology Group

A stock that may be even riskier than Walgreens is Trump Media & Technology Group. That’s because the company generates minimal revenue, long-term profitability is a huge question mark, and it is largely just a highly volatile, risky meme stock to own. It has effectively become a way for speculators to bet on who will win the presidency later this year.

But there isn’t much of a case to invest in the stock beyond that. It is down 56% over the past three months. This is largely a speculative buy, as its Truth Social platform isn’t generating much in revenue. While Trump Media may be optimistic about its opportunities in the streaming industry, bigger and more established media companies have struggled in that realm.

Intel

Computer giant Intel is another struggling stock that can’t seem to catch a break. The tech stock went over a cliff after reporting earnings earlier this month, as its numbers were dreadful. Not only did the company report a significant $1.6 billion net loss during the period ending June 29, but its sales also declined from the prior-year period, and Intel announced it was suspending its dividend and looking to cut costs.

Investors are having doubts about the company’s foundry business and Intel’s ability to be a leading chipmaker, and these latest results don’t inspire any confidence that it’s going in the right direction. Intel’s stock is trading at a price-to-book multiple of less than 0.8 as it has recently hit a new 52-week low, and it, too, may look like a cheap buy.

But with an uncertain path ahead, investors shouldn’t assume the worst is behind the business. There’s still plenty of risk for investors who buy Intel stock. Without some sign of an improvement in future quarters, it wouldn’t be surprising to see its shares fall even lower in the months ahead.

Should you invest $1,000 in Walgreens Boots Alliance right now?

Before you buy stock in Walgreens Boots Alliance, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walgreens Boots Alliance wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

3 Struggling Stocks That Aren’t Worth Buying on the Dip was originally published by The Motley Fool

Is This 13%-Yielding Stock Due for a Dividend Cut?

A divided yield of more than 10% can appear enticing for investors who are seeking a high level of recurring income. And while a stock that pays that much can generate a lot of income for you, it may not be the safest option to put in your portfolio. Stocks with yields that high often come with inherent risks. If they were safe investments, investors wouldn’t hesitate to buy up such high-yielding payouts, which, in turn, would likely boost their share prices and shrink their yields. When a stock’s yield remains high, that usually means there’s ample reason to remain cautious about the investment.

One high-yielding stock that isn’t getting much love these days is Medical Properties Trust (NYSE: MPW), which pays investors nearly 13% in dividends. But the real estate investment trust (REIT) has been one of the riskier income stocks to own this year, and its shares are down about 5% so far this year. Could investors simply be bracing for another dividend cut?

Medical Properties Trust’s focus has been on raising liquidity

The problem with Medical Properties Trust (MPT) is that the company has been selling off assets in order to improve its cash flow position. That’s not a great sign for a dividend stock. It effectively tells investors that it isn’t generating sufficient cash to maintain its day-to-day operations and pay its dividend.

Last week, the REIT announced the sales of 11 healthcare facilities in Colorado, which will net it $86 million. The company is going to use that money “to reduce debt and for general corporate purposes.” And when the REIT announced its latest quarterly results on Aug. 8, it led with the news that it had executed $2.5 billion in liquidity transactions thus far in 2024. While that may be positive news for the business, highlighting the importance of raising liquidity isn’t what dividend investors want to see, as it underscores the perilous condition of the company’s financial results.

Earlier this year, one of MPT’s key tenants, Steward Health, entered bankruptcy protection and announced it was going to try to sell all of its hospitals in an effort to pay down $9 billion in liabilities on its books. The problems and uncertainty relating to Steward have weighed on MPT’s share price in recent years.

Medical Properties Trust’s financials haven’t been strong

MPT has been incurring losses in recent quarters and through the first six months of the year, its funds from operations (FFO) per share have totaled a negative $1.45 versus the previous year, when it was a positive $0.88. Its normalized FFO, which excludes the impact of impairment charges, total $0.47 for the year thus far. While that is positive, it’s down significantly from $0.85 in the same period last year.

The good news for investors is that the rate is higher than the $0.30 per share that MPT has paid out during the first two quarters in dividends. That does suggest that the dividend may be sustainable, at least for the immediate future. But the danger is that with the company selling off assets and the future relating to Steward Health remaining unclear, it still may not offer investors much comfort.

Investors shouldn’t rely on this dividend

MPT’s dividend isn’t safe. Although the recent FFO numbers may suggest there’s a bit of safety there, the REIT is going through a tumultuous time, and as it sells off more assets, its numbers could deteriorate further, and a dividend reduction could be in the cards.

There are many better dividend stocks to own than MPT, and unless you have an extremely high risk tolerance, you’re better off avoiding it as things can still get worse before they get better for the stock.

Should you invest $1,000 in Medical Properties Trust right now?

Before you buy stock in Medical Properties Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Medical Properties Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is This 13%-Yielding Stock Due for a Dividend Cut? was originally published by The Motley Fool

This Growth Stock Is Down 83%, but Billionaire Investors Are Scooping It Up. Is It a Buy?

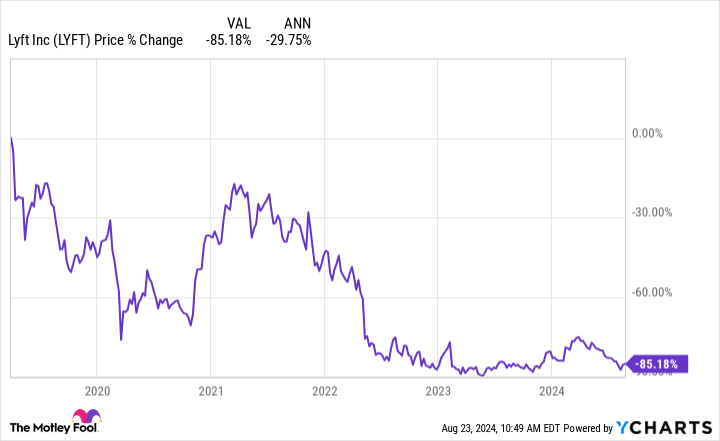

Lyft (NASDAQ: LYFT), the No. 2 ride-sharing operator behind Uber Technologies, has burned nearly every investor who has bought the stock.

As you can see from the chart below, the stock is down sharply from its 2019 initial public offering (IPO).

Lyft stock has fallen in three separate episodes. First, the stock crashed after a successful IPO as investors believed the money-losing company was overvalued in 2019. The following year, it fell along with the rest of the stock market when the pandemic started, and after a recovery in 2021, the stock faded again in the bear market as its growth rates slowed.

However, there are signs that the stock is finally making a genuine turnaround. In the second quarter, the company reported its first-ever profit on a generally accepted accounting principles (GAAP) basis at $5 million and also reported surging revenue growth of 41% up to $1.4 billion on 17% gross bookings growth to $4 billion. That discrepancy is driven in part by growth in Lyft Media, its advertising business that delivered revenue growth of more than 70% in the quarter. New initiatives to increase its driver pool, speed up arrival time, and reduce the impact of prime time, or surge, pricing, are paying off.

Now, a number of billionaire investors seem to be taking notice as 13-F filings revealed some well-known investors bought shares of Lyft in the second quarter.

The smart money likes Lyft

David Tepper‘s Appaloosa Management is one of the most successful hedge funds in the world. The fund currently manages about $14 billion and counts Alibaba as its biggest holding.

Tepper is known for investing in distressed debt and deep-value stocks, which seems to explain his current interest in Chinese stocks like Alibaba, as well as Lyft, which is arguably a value stock. In fact, Lyft was Tepper’s biggest purchase during Q2 as Appaloosa bought 7.5 million shares of the stock in the quarter, bringing its stake in the company to nearly 8 million, which is worth roughly $100 million today.

Tepper hasn’t made public remarks on his Lyft purchase, but it’s worth noting that he added to his stake in Uber as well, buying 140,000 shares of that to bring his holdings of the ride-sharing leader to 1.5 million shares. Tepper has roughly equal stakes in Lyft and Uber, and he began buying shares of Uber in the second quarter of 2021, anticipating the turnaround in the ride-sharing leader. Tepper seems to be betting on a similar turnaround in Lyft.

Another billionaire who’s taken a shine to Lyft is Ken Griffin, whose Citadel Advisors hedge fund is one of the biggest hedge funds in the world, with assets under management of roughly $400 billion.

Griffin is known for using quantitative analysis and data-driven decision-making, and the company has thousands of positions in its fund. Lyft is a high-risk stock, but Citadel’s track record is impeccable as it’s considered the most profitable hedge fund of all time.

Citadel bought 4.4 million shares of Lyft in the second quarter, bringing its stake to 6.5 million shares, or roughly $75 million worth of the stock. Citadel had originally taken a stake in Lyft in the first quarter of 2019, so the company is sitting on some losses from that initial investment, but now looks like a better time to buy the stock.

Is Lyft a buy?

Lyft expects solid growth over the rest of the year, calling for a mid-teens increase in rides and gross bookings to grow slightly faster.

With the company finally shifting into profitability, tapping into new businesses like advertising, improving its product in a way that pleases both riders and drivers, and adding new features, the business looks to be headed in the right direction.

It’s rare to see two high-profile billionaire investors going after a beaten-down stock like Lyft, but the ride-sharing company has a lot of the hallmarks of a turnaround opportunity, including the beaten-down share price. If its current momentum continues, the stock looks likely to pay off.

Should you invest $1,000 in Lyft right now?

Before you buy stock in Lyft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lyft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Uber Technologies. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.

This Growth Stock Is Down 83%, but Billionaire Investors Are Scooping It Up. Is It a Buy? was originally published by The Motley Fool

Wall Street Analysts Are Bearish on This Artificial Intelligence (AI) Stock. Here's Why I'm Not.

Artificial intelligence (AI) stocks have been all the rage on Wall Street, and it’s easy to see why.

Stocks like Nvidia have surged since the launch of ChatGPT nearly two years ago, creating trillions of dollars in market value for investors. However, Wall Street isn’t so fond of every AI stock on the market.

Take Upstart (NASDAQ: UPST), for example. The AI-based consumer loan provider has struggled recently, and Wall Street looks downright bearish on it. Of the 18 analysts covering the stock (as tracked by The Wall Street Journal), just one rates it a buy, and eight recommend selling. The average price target on the stock is $23.47, implying about 40% downside from its value as of this writing.

However, the stock has been surging since its second-quarter earnings report went out on Aug. 6, and the stock looks poised for more gains. Here are two reasons why.

1. Interest rates are set to come down

Upstart’s business is highly sensitive to interest rates, much like most lending companies. In 2021, shortly after the company went public, business was soaring as interest rates were at rock bottom, and demand for consumer loans during the pandemic was high. Not only was the company growing rapidly with revenue jumping triple digits, but its operating margins were also strong, in the teens.

However, as interest rates rose and fears of a recession swept the market and the economy, the business froze, and the stock plunged.

Now, the company has an opportunity to reverse some of those losses. The Federal Reserve is highly likely to begin lowering interest rates at its next meeting in September, easing pressure on companies like Upstart and stoking demand for loans again.

It will take time for falling interest rates to juice demand, but the Fed sees interest rates falling to less than 3% over the long term, down from 5.25% to 5.50% currently, which should give a significant boost to borrowers.

The stock should move higher as rates start to come down.

2. Its technology is still an advantage

Upstart stock soared on its recent earnings report, even as revenue is still falling and losses mount.

However, conversion on rate requests improved from 9% in the year-ago quarter to 15%, showing more applicants are getting loans. It also expects revenue growth to return in the second half of the year.

Beyond that, Upstart’s technology still holds a lot of promise. The company claims its AI-based lending model is more accurate than traditional models like the FICO score. For example, as of the second quarter, loan approval rates were twice as high as traditional models, and it was able to achieve a 38% lower APR than competing models.

The company has also expanded significantly since the boom in 2021. At the time, it did not offer a home loan product, and it now offers a home equity line of credit in 30 states and the District of Columbia.

Finally, its own Upstart macro index shows conditions improving, which will lower default rates and support increased loan approvals.

Why Upstart is a buy

Upstart’s struggles aren’t due to fundamental problems with its product. The business is just highly cyclical, and poor macroeconomic conditions in the form of higher interest rates have suppressed demand.

However, the reversal of the Fed’s monetary policy is likely to unleash pent-up demand for consumer loans, much like it’s expected to do the same for mortgages in the housing market.

In better market conditions, Upstart has the potential to deliver the kind of profits investors saw back in 2021, when it finished the year with a generally accepted accounting principles (GAAP) net income of $135 million and adjusted net income of $224 million. A return to those levels would give the company a price-to-earnings ratio of 16 at the current stock price (based on adjusted earnings).

Once the company returns to revenue growth and profitability, the stock has the potential to move a lot higher from here.

Should you invest $1,000 in Upstart right now?

Before you buy stock in Upstart, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Upstart wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Jeremy Bowman has positions in Upstart. The Motley Fool has positions in and recommends Nvidia and Upstart. The Motley Fool has a disclosure policy.

Wall Street Analysts Are Bearish on This Artificial Intelligence (AI) Stock. Here’s Why I’m Not. was originally published by The Motley Fool

Ask an Advisor: What's My Tax Liability with $800k in a 401(k) and $5k/Month Between Pension and Social Security?

My monthly Social Security is $3,178, my pension will be $2,090 per month and my 401(k) has $800,000. If I use the 4% rule, where do I stand tax-wise?

– Reggie

This is a great question. I hope it goes without saying, but without having all of your information and completing a full tax return I can’t give you an exact number. What we discuss here will cover the major items to help you estimate a rough ballpark figure of your tax liability. I still encourage you to do your research and modify the estimate to fit your unique circumstances or work with a tax professional.

Do you need help calculating your tax liability in retirement? Speak with a financial advisor today.

Add Up Your Taxable Income

Start by adding up the components of your income that are taxed as ordinary income. In your case, that would be your pension and 401(k) withdrawals.

Since you have $800,000 in your 401(k) and plan to withdraw 4% in your first year, you’ll have $32,000 in income from your 401(k). Your pension will pay you $2,090 per month or $25,080 for the year. These two items together add up to $57,080. (And if you need more help managing your taxes in retirement, consider speaking with a financial advisor.)

Include the Taxable Portion of Your Social Security

You may have to include a portion of your Social Security in your taxable income. Unfortunately, calculating how much isn’t as straightforward as adding up your other types of income. But there’s good news: you’ll never have to pay taxes on 100% of your benefits.

You’ll need to calculate what the Social Security Administration (SSA) calls your “combined income.” To do this, you’ll add your adjusted gross income (AGI), any tax-exempt interest that you’ve collected and one-half of your Social Security benefits together.

For you, I’m assuming you have no above-the-line deductions or adjustments to income (though you may) so your AGI is $57,080 (reference form 1040). You didn’t mention any tax-exempt interest and half of your Social Security benefit is $19,068. So, your combined income is $76,148 under these assumptions. (Planning for Social Security is critically important and a financial advisor can help.)

Calculate How Much of Your Benefits Are Taxable

Admittedly this next part is complicated, so buckle up. Assuming you’re single since you didn’t mention any spousal benefits, the following income thresholds will determine how much of your Social Security benefits are taxable:

-

If your combined income is between $25,000 and $34,000, up to 50% of your benefits may be taxable.

-

If your combined income is more than $34,000, up to 85% of your benefits may be taxable.

Calculating how much of your particular benefit is taxable is relatively straightforward. Since your combined income exceeds the $34,000 limit by more than your total benefit, you can simply multiply your Social Security payment by 0.85. As a result, $32,416 of your benefits are taxable.

Keep in mind that just because a person’s combined income exceeds the $34,000 limit, that doesn’t mean 85% of their benefit is automatically taxable. Instead, it depends on how much their combined income exceeds the $34,000 threshold.

Consider a hypothetical retiree named Jim who has a full benefit of $30,000 and a combined income of $40,000. Although his combined income exceeds the upper limit, only $9,600 of his Social Security would be taxable. So how’d he get there?

First, he would multiply $9,000 by 0.5 and get $4,500. That’s because his combined income fills up the first tax bracket ($25,000-$34,000). And since Jim’s combined income is $6,000 over the $34,000 limit, he’d then multiply that number by 0.85 and get $5,100. Adding those two figures together – $4,500 + $5,100 – gives Jim the total amount of his Social Security that’s subject to taxes: $9,600.

If you need additional help calculating how much of your benefits are taxable, speak with a financial advisor.

Your Total Income Subject to Taxation

Now we can put it all together and calculate how much you’ll roughly pay in taxes based on the assumptions we’ve made.

Just add your $57,080 taxable income to your $32,416 of taxable Social Security benefits and you get $89,496. We still get to take some deductions. You may have itemized deductions, but rather than guess what those might be we’ll assume you are single and at least 65 years old and you are taking the 2023 standard deduction of $15,700 (people 65 and older can take a higher standard deduction):

$89,496 – $15,700 = $73,796

This is the amount that your tax bill will be based on. Now, let’s review the federal income tax brackets for 2023 to see where you stand. Remember, the federal income tax is progressive, meaning you’ll pay higher rates as your income increases.

-

Your first $11,000 of income is taxed at 10%, so you’ll owe $1,100.

-

Income that falls between $11,000 and $44,725 is taxed at 12%. You fill that bracket up, so you’ll owe $4,047 in taxes on this segment of your income ($33,725 x 0.12).

-

The remaining portion of your income ($73,796 – 44,725 = $29,071) is taxed at 22%, so you’ll owe another $6,396.

Add it all up to get a total tax bill of $11,543. Remember, this figure is based on the information you provided and the assumptions we made. This likely won’t be your actual tax bill, but it’s far closer than a random guess and should at least give you an idea of how to calculate it. (Calculating and managing your taxes in retirement can be complicated, but a financial advisor can help.)

Bottom Line

This gives you a rough idea of where you stand with some basic assumptions. However, there are several things not present here that may impact your tax liability. You may have state and local taxes depending on where you live. Not only do these create additional tax liability, but they may provide you with a deduction on your federal return. Other items may also be relevant, such as deductible mortgage or student loan interest for example.

Retirement Planning Tips

-

Retirement planning can be complex and overwhelming, but a financial advisor can helpful. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Building a retirement income plan starts with estimating your expenses and figuring out how much income you’ll to meet them. Experts recommend replacing anywhere from 55% to 80% of your pre-retirement income with Social Security, retirement account withdrawals and other sources. T. Rowe Price, meanwhile, recommends you aim to replace 75% of your pre-retirement income and then adjust your replacement rate up or down rate based on your savings and spending expectations.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Brandon Renfro, CFP®, is a SmartAsset financial planning columnist and answers reader questions on personal finance and tax topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Please note that Brandon is not a participant in the SmartAsset AMP platform, nor is he an employee of SmartAsset, and he has been compensated for this article. Questions may be edited for clarity or length.

Photo credit: ©iStock.com/Inside Creative Housel, ©iStock.com/Thapana Onphalai

The post Ask an Advisor: I Have $800k in a 401(k) and $5,270 in Monthly Income From Social Security and My Pension. How Much Will I Pay in Taxes in Retirement? appeared first on SmartReads by SmartAsset.

Forget NextEra Energy Partners: Buy This Top-Notch Ultra-High-Yield Stock Instead

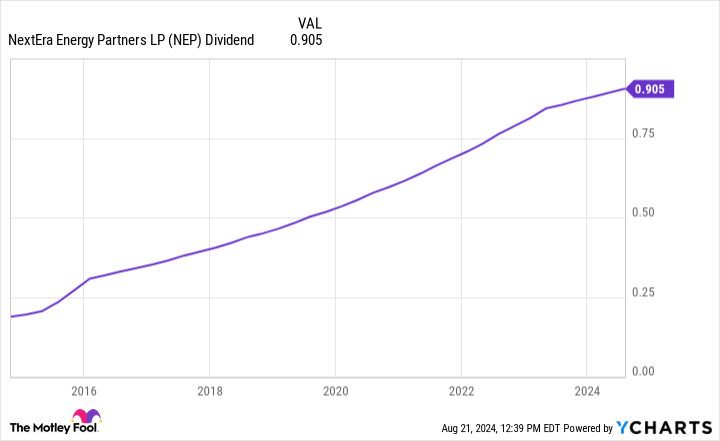

NextEra Energy Partners (NYSE: NEP) currently offers a monster dividend yield. The renewable energy company’s payout yields more than 14%, which is about 10 times higher than the S&P 500‘s dividend yield. Further, the company plans to continue growing its payout in the future.

However, as attractive as this renewable energy dividend stock might seem, those seeking a sustainable income stream should forget about it right now. Instead, income-focused investors should buy Brookfield Renewable (NYSE: BEPC)(NYSE: BEP). While it offers a lower yield (over 5%), it’s on a much more sustainable foundation.

Running low on power

NextEra Energy Partners currently has a terrific record of paying dividends. The renewable power producer has increased its payout every single quarter since it came public over a decade ago.

The company expects that steady upward trend to continue. It plans to increase its payment by 5% to 8% per year through 2026, with a target of 6% annually. While that is a much slower pace than initially expected (12% to 15% annually), it’s a solid rate, especially for such a high-yielding dividend stock.

NextEra Energy Partners had to tap on the brakes with its growth plans due to its surging cost of capital. Rising interest rates and its plummeting stock price have made it too expensive to borrow money to refinance maturing funding and finance new acquisitions at attractive rates due to its junk-rated credit. That forced the company to pivot is strategy. It’s selling its natural gas pipeline operations to cover its upcoming funding buyouts. It’s also relying on organic expansion projects (primarily wind repowering projects) to boost its cash flow in support of its dividend growth plan.

The company expects its dividend payout ratio will be in the mid-90% range through 2026, which is way too high. Because of that, there’s a high risk that the company will need to cut its payout in the coming years. That makes it too risky for income-seeking investors right now.

Ample power to continue growing

Brookfield Renewable’s financial profile is on a much more sustainable foundation these days. Unlike NextEra Energy Partners, Brookfield Renewable has a strong investment-grade credit rating. Meanwhile, the company doesn’t rely on short-term financing to fund acquisitions. It primarily uses equity and low-cost, long-term, fixed-rate debt. Because of that, higher interest rates haven’t had any impact on its growth strategy.

Instead of tapping the brakes, Brookfield Renewable has stomped on the accelerator. The company expects to grow its funds from operations (FFO) per share at a more than 10% annual rate through at least 2028. It sees several factors driving its growth, including inflation-linked contractual rate increases, margin enhancement activities, its development pipeline, and acquisitions.

Whereas NextEra Energy Partners has primarily relied on acquisitions to power its growth (mainly drop-down transactions from its parent, NextEra Energy), Brookfield focuses on higher-return organic development projects. The company has a massive backlog of projects that should power its growth for years to come.

Meanwhile, the company has a much different acquisition funding strategy: capital recycling. Brookfield routinely sells mature assets to fund higher-returning new investments. For example, the company expects to generate $1.3 billion from capital recycling activities this year, which will help it fund the $970 million it has committed to invest across several accretive acquisitions.

Brookfield expects its growing cash flows to support 5% to 9% annual dividend growth, which aligns with its expected 6% to 9% organic growth rate. That would continue its trend of increasing its payout by at least 5% per year, something it has accomplished for 13 straight years. Meanwhile, with earnings growing faster than its dividend, Brookfield’s payout ratio will steadily decline from its already comfy sub-75% level.

A much more sustainable income stream

NextEra Energy Partners’ double-digit dividend yield might seem alluring. However, that payout isn’t on a solid foundation these days due to its weak financial profile. Because of that, income-focused investors should forget about it until the company fixes its issues.

They should buy Brookfield Renewable instead. The company has a long history of growing its high-yielding payout, which should continue. It backs its dividend with a much stronger financial profile and highly visible growth prospects. Because of that, it offers a much more sustainable income stream that should steadily rise in the future.

Should you invest $1,000 in NextEra Energy Partners right now?

Before you buy stock in NextEra Energy Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and NextEra Energy Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Matt DiLallo has positions in Brookfield Renewable, Brookfield Renewable Partners, NextEra Energy, and NextEra Energy Partners. The Motley Fool has positions in and recommends Brookfield Renewable and NextEra Energy. The Motley Fool recommends Brookfield Renewable Partners. The Motley Fool has a disclosure policy.

Forget NextEra Energy Partners: Buy This Top-Notch Ultra-High-Yield Stock Instead was originally published by The Motley Fool