3 Costco Perks You Aren't Taking Advantage of — but You Should

The cost of an annual Costco membership recently increased from $60 to $65 for a basic Gold Star membership, and from $120 to $130 for an Executive membership. Now that you’re paying more, it’s especially important to make sure you’re getting great value out of your membership — no matter which one you have.

With that in mind, here are a few Costco benefits you may not be taking advantage of. And if that’s the case, you’re missing out big time.

1. Inexpensive gas that outperforms other fuel

There’s a reason Costco members love filling their tanks at the store’s fuel stations. And it’s not just the convenience of being able to get gas in conjunction with buying groceries.

Not only is Costco’s gasoline known to be competitively priced, but it’s also TOP TIER certified. This means you’re likely to get better performance out of Costco gas than gas that doesn’t have that same designation.

Now, one downside of filling up your car at Costco is that you won’t be eligible for the 2% cash back that comes with an Executive membership. While most Costco purchases qualify for Executive member cash back, gas is an exception. But if you pay for your fuel using a credit card with bonus gas rewards, you can potentially earn more than 2% back each time you fill up.

2. Discounted gift cards

Costco is known for its bulk groceries and paper towels more so than its selection of gift cards. But if you’re not buying gift cards at Costco, you may be overpaying for them elsewhere.

Costco discounts its gift cards below their face value, which means you’re guaranteed to save money on whichever ones you decide to buy. As one example, right now, Costco is selling $100 worth of IHOP gift cards for $69.99. If you were to buy those gift cards from IHOP directly, you’d probably pay $100 unless you managed to snag some limited-time promotion.

3. An extremely flexible return policy

If you’ve ever kept a Costco purchase you ended up not wanting because you were afraid to take it back months after the fact, you cost yourself money for nothing. Don’t sweat it, though — just pledge to take advantage of the flexible returns Costco is known for in the future.

In a nutshell, Costco will let you bring back almost any product at any time for a full refund. There are some exceptions you should know about, though.

Electronics and appliances must be returned within 90 days if you want your money back. And certain items, like cigarettes, alcohol, and gift cards can’t be returned at all.

You should also know that you can return partially eaten food to Costco if there’s an issue with its taste, or if it spoils ahead of its printed sell-by date. But you need to be reasonable when returning opened food products.

The general rule is that if you’re bringing food back due to a quality issue, you have to return 50% of it or more. You can’t buy a giant carton of strawberries, eat most of them, and then bring back three tiny berries for a refund while claiming their taste was off.

The $65 or $130 you pay for a Costco membership gives you access to a world of benefits. It pays to familiarize yourself with the perks of joining Costco so you can get the maximum value.

Top credit card to use at Costco (and everywhere else!)

We love versatile credit cards that offer huge rewards everywhere, including Costco! This card is a standout among America’s favorite credit cards because it offers perhaps the easiest $200 cash bonus you could ever earn and an unlimited 2% cash rewards on purchases, even when you shop at Costco.

Add on the competitive 0% interest period and it’s no wonder we awarded this card Best No Annual Fee Credit Card.

Click here to read our full review for free and apply before the $200 welcome bonus offer ends!

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.Maurie Backman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale. The Motley Fool has a disclosure policy.

3 Costco Perks You Aren’t Taking Advantage of — but You Should was originally published by The Motley Fool

Qualcomm considering acquiring parts of Intel’s chip business

Qualcomm has reportedly considered the acquisition of certain segments of Intel’s chip design business to enhance its product offerings, reports Reuters, citing sources.

The mobile chipmaker has shown interest in Intel’s client PC design unit, among other divisions.

However, Qualcomm has not made any formal approach to Intel regarding a potential acquisition, according to an Intel spokesperson.

Intel, which recently faced financial challenges, including a second-quarter loss, staff reductions, and a pause on dividend payments, is said to be committed to its PC business.

The spokesperson emphasised that Intel remains “strongly dedicated to our PC business.”

The company is also planning to present a strategy to its board of directors that may include divesting non-core business units to streamline costs.

This includes potentially selling the programmable chip unit Altera.

Qualcomm, with a market value of $184bn and known for its smartphone chips, has been contemplating the acquisition for several months, although plans have not been finalised and may change.

The interest from Qualcomm comes at a time when Intel’s PC client business revenue has declined by 8% to $29.3bn last year, reflecting the broader weakness in the PC market.

Intel’s client group, once famed for its “Intel Inside” campaign, produces laptop and desktop chips that are widely used globally.

Intel executives believe that the advent of artificial intelligence in PCs will lead to increased consumer demand and sales.

In a recent setback for Intel, its contract manufacturing business failed tests with Broadcom, indicating that Intel’s advanced manufacturing process, known as 18A, is not ready for high-volume production.

The tests involved sending silicon wafers through the 18A process, with Broadcom receiving the wafers last month.

After evaluation, it was determined that the process requires further development.

A representative for Broadcom said the company is “evaluating the product and service offerings of Intel Foundry and have not concluded that evaluation.”

“Qualcomm considering acquiring parts of Intel’s chip business ” was originally created and published by Verdict, a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.

What happened when Spain ‘punished’ its millionaires

Martin Varsavsky is one of more than 12,000 multimillionaires living in Spain who were blindsided by a “solidarity” tax at the end of 2022.

Pedro Sánchez’s Socialist government introduced a temporary levy of 1.7pc on citizens whose net wealth exceeds €3m (£2.6m) rising to 3.5pc for those worth €10m or more.

The Argentine-born Varsavsky, who has founded five billion-dollar companies spanning telecoms to renewable energy, was hit by a significant tax bill.

“I felt cheated,” he says.

The 64-year-old, who now runs a network of fertility clinics in North America, says he’s thought about leaving Madrid ever since.

“I went to visit Portugal, Italy and also Florida, where I used to live,” Varsavsky says.

“What’s especially egregious in my case is that now I make all my money in the US. So Spain is making all this money out of me. So I have all the incentives in the world to move away, and I will.”

Some have already gone. The “impuesto de solidaridad a las grandes fortunas” raised just €632m in 2022, representing 0.1pc of all taxpayers in Spain.

Despite the relatively low yield, Labour’s union paymasters are already calling for the UK Government to follow suit. The Tax Justice Network claims as much as £24bn a year could be raised from the UK if it copied Spain’s model.

Sharon Graham, the leader of Unite, has urged Rachel Reeves, the Chancellor, to announce a 1pc tax on Britain’s richest 1pc. “It’s time for a wealth tax on the super-rich and a tax on excess profits. We don’t need more excuses about fiscal responsibility or talk of wealth creation,” Graham said last month.

The G20 is also exploring plans for a global minimum tax on the world’s 3,000 billionaires.

The drive is being led by Gabriel Zucman, the tax guru behind US senator Elizabeth Warren’s proposal of a 2pc levy on the world’s richest. He claims it could unlock $250bn (£189bn) a year.

However, the issue remains highly contentious, and revenues have usually disappointed.

Esther Villa, a lawyer at Osborne Clarke in Barcelona, says the levy had a chilling effect on Spain’s entrepreneurs.

“The initial response from many of my clients was a feeling of being punished for being successful.” But she also notes that initial revenues were disappointing.

“When the solidarity tax was adopted, the government made a big deal of what they expected to collect, but what was collected in 2023 is less than half what was anticipated,” adds Villa.

Still, Villa says one reason revenues flowed in in the first year was people had very little time to plan before being hit with their first bill.

But she says this is unlikely to be repeated.

“Feedback from clients suggests they are aware of the things they have to do in terms of how to structure their assets to make sure that the impact is as efficient as possible.”

Together with Spain’s existing wealth tax, the country raised €1.9bn from various levies in 2022.

While the figure is not to be sneered at, it’s also the equivalent of making all of Spain’s 1.2m dollar millionaires pay just over €1,500 each.

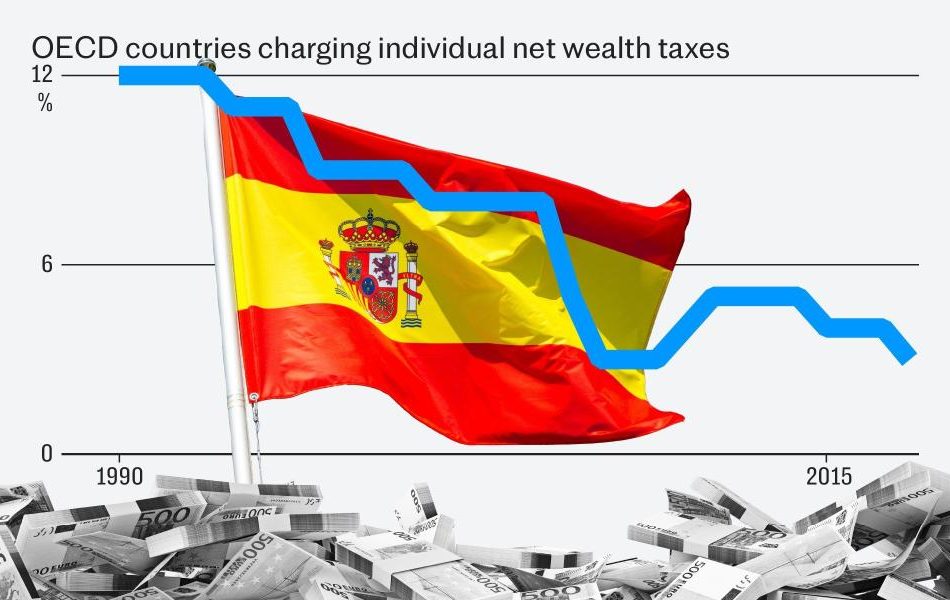

Meanwhile, the number of countries imposing a wealth tax has dwindled. Just over three decades ago in 1990, 12 countries had one. Today, only Norway, Spain, and Switzerland remain and the yields in these countries are low while the deterrents are high.

Emmanuel Macron ditched France’s wealth tax just over five years ago following an exodus of billionaires to destinations including the UK.

According to the OECD, countries have ditched them because they cost too much to administer, distort investment decisions and punish people who are asset-rich but cash-poor. The people it’s designed to target can also leave if they want to.

In short, wealth taxes don’t really raise much cash.

The closest the UK came to introducing an explicit wealth tax one was in the mid-1970s inflation strike that led to mass strike action.

Denis Healey, then-Labour chancellor, wrote in his memoirs: “We had committed ourselves to a wealth tax; but in five years I found it impossible to draft one which would yield enough revenue to be worth the administrative cost and political hassle.”

Chris Sanger, the global head of tax policy at EY, says the costs of administering a wealth tax should not be underestimated.

“The problem is the mechanism for calculating wealth. Because every year you’ve got to calculate the value of an asset that doesn’t always have a ready price,” says Sanger.

“It’s easy if it’s stocks and shares that are quoted, but if you’ve got a house that you’ve owned, how much has that increased in value? If it’s a painting sitting on the wall, has that gone up in value?

“Of course, people sometimes do this once upon death or for inheritance tax purposes where you actually have to go and get a valuation. But doing that once is very different from doing that every year for a wealth tax.”

Sanger says this can make getting wealth taxes in an arduous business, while the basic premise of a wealth tax sends out a signal that countries aren’t open for business.

“There are theoretical benefits for going for a wealth tax,” he adds. “The challenge with one is as the rate gets higher, it becomes more and more of a deterrent for people to actually have wealth. It’s also a tax that needs to be collected.”

Villa, at Osborne Clarke, admits that Spain’s tax grab has so far not led to billionaires leaving Spain in their droves.

“There has been no exodus. Lots of people took it in their stride the fact that it was supposed to be temporary. Having said that, I think there’s a high likelihood that it will be upheld for 2024, and subsequent years.”

For all his complaints, Varsavsky is also still living in Madrid.

“It’s a family thing,” he says. “My children are still at school here, and they have their friends and everything here. It’s difficult because of course taxes are not the only thing. I have seven children: two live in London, one lives in New York and then the other four in Madrid.”

However, he is leaving his options open. “There’s an issue of age. It’s not the same thing to tax a person who’s 30, who has many more years to make money, than to tax a person who is 70 and needs to have savings,” adds Varsavsky.

“If you start taking 3.5pc of their money year after year, then you end up having much less money at a time in your life when you can’t even go out and make more. So it’s pretty unattractive for anyone who has done moderately well in life to stay in Spain.”

Varsavsky says he’s banking on a change of administration, with Sanchez currently leading a precarious minority government.

“My hope here is that this will be short-lived, as the title of the tax is called, and they will go back to the way things used to be,” he adds.

“If not, eventually I will move out. Because it gets to a point where, in my sixties, it makes no sense to be in a place where my savings are taken away.

“It’s a pity, because Spain is a wonderful country to live in, but not if you are being forced to be impoverished year after year.”

SpaceX Bastrop Facility Touches 1M Starlink Hardware Production Milestone

SpaceX‘s factory in Bastrop, Texas has built a million Starlink standard hardware kits, the company announced on X on Monday.

What Happened: “Just 10 months after opening our factory in Bastrop, Texas, the Starlink team there has built 1 million Starlink Standard kits!,” the company wrote on the social media platform X while adding that the team is ramping production to meet surging demand.

Starlink is the satellite internet segment of Elon Musk‘s SpaceX. The company aims to provide low-latency internet to subscribers worldwide with a network of satellites in low-Earth orbit.

The standard hardware refers to the hardware ideal for residential use and everyday internet applications like streaming and video calls. It is currently priced at $299 in the U.S.

Why It Matters: SpaceX said in May that Starlink is connecting over 3 million people with high-speed internet. The facility is available over across 100 countries, territories, and other markets.

According to data from astronomer Jonathan McDowell, SpaceX has launched over 7000 Starlink satellites into space, of which 6337 are working, to provide the service.

Starlink achieved breakeven cash flow in November 2023, rekindling hopes for an IPO of the segment. In late 2020, Musk said that SpaceX would probably IPO Starlink when its revenue growth is ‘smooth and predictable.’

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read More:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

DIYer Builds Tiny Home For $17K That Brings In $50K A Year In 'Almost Completely Passive' Income

Tiny homes have become increasingly popular in recent years as many look for ways to cut costs and reduce the size of their carbon footprints. One young DIYer figured out a way to turn his tiny house into a giant moneymaker.

What To Know: According to a CNBC report, 34-year-old Ivan Ellis Nanney bought a parcel of land just outside of Boise, Idaho, for $17,000, and spent another $17,000 building a tiny home on it. The property now generates close to $50,000 in revenue a year.

He originally listed it on Airbnb Inc ABNB in 2019 with intentions to live in it for half of the year, but the overwhelming demand led him to move out for good and start listing the miniature home year-round.

“It became very popular. It just didn’t make sense for me to stay there at all. [The income] has become almost completely passive,” Nanney told CNBC.

The tiny home has been such a success for the Idaho native that he is working on two more rental homes. Here’s how he managed to build the first.

Check This Out: How This Millennial Generates $40K Per Month Working 30 Minutes A Day: ‘It’s About The Experience’

Piece By Piece: The lot, which he purchased back in 2015, came with an abandoned house. He spent close to three and a half years tearing down the old structure and then building the new one using secondhand building materials.

Nanney was also able to hook up water lines and wire the home for electricity himself, which is quite the cost saver.

Now he generates a majority of his income from the home and only works about two hours each week setting up bookings. He pays someone to clean the place for about $150 a week and he returns to the location at least a couple of times each year to perform routine maintenance.

Most of the rest of his time is spent traveling, although he also makes some extra money helping other nearby Airbnb hosts with upkeep for their properties.

And then there are the two additional properties he’s working on. One is a nearby house that he bought in 2021 with a down payment of less than $8,000. The other is in the mountains of Idaho, but he’s splitting that one with four members of his family.

“You can increase your income and reduce your debt while maximizing assets you already own. I don’t like having things sit around when someone could be benefiting from it,” Nanney told CNBC.

Read Next:

This story is part of a new series of features on the subject of success, Benzinga Inspire. Some elements of this story were previously reported by Benzinga and it has been updated.

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Implied Volatility Surging for Axos Financial Stock Options

Investors in Axos Financial, Inc. AX need to pay close attention to the stock based on moves in the options market lately. That is because the Oct 18, 2024 $37.50 Call had some of the highest implied volatility of all equity options today.

What is Implied Volatility?

Implied volatility shows how much movement the market is expecting in the future. Options with high levels of implied volatility suggest that investors in the underlying stocks are expecting a big move in one direction or the other. It could also mean there is an event coming up soon that may cause a big rally or a huge sell-off. However, implied volatility is only one piece of the puzzle when putting together an options trading strategy.

What do the Analysts Think?

Clearly, options traders are pricing in a big move for Axos Financial shares, but what is the fundamental picture for the company? Currently, Axos Financial is a Zacks Rank #3 (Hold) in the Financial – Miscellaneous Services industry that ranks in the Top 29% of our Zacks Industry Rank. Over the last 60 days, no analysts have increased their earnings estimates for the current quarter, while three analysts have revised their estimates downward. The net effect has taken our Zacks Consensus Estimate for the current quarter from $1.86 per share to $1.84 in that period.

Given the way analysts feel about Axos Financial right now, this huge implied volatility could mean there’s a trade developing. Oftentimes, options traders look for options with high levels of implied volatility to sell premium. This is a strategy many seasoned traders use because it captures decay. At expiration, the hope for these traders is that the underlying stock does not move as much as originally expected.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Are Options Traders Betting on a Big Move in TopBuild Stock?

Investors in TopBuild Corp. BLD need to pay close attention to the stock based on moves in the options market lately. That is because the Oct 18, 2024 $195 Call had some of the highest implied volatility of all equity options today.

What is Implied Volatility?

Implied volatility shows how much movement the market is expecting in the future. Options with high levels of implied volatility suggest that investors in the underlying stocks are expecting a big move in one direction or the other. It could also mean there is an event coming up soon that may cause a big rally or a huge sell-off. However, implied volatility is only one piece of the puzzle when putting together an options trading strategy.

What do the Analysts Think?

Clearly, options traders are pricing in a big move for TopBuild shares, but what is the fundamental picture for the company? Currently, TopBuild is a Zacks Rank #3 (Hold) in the Building Products – Miscellaneous industry that ranks in the Top 28% of our Zacks Industry Rank. Over the last 30 days, no analysts have increased their earnings estimates for the current quarter, while two analysts have revised their estimates downward. The net effect has taken our Zacks Consensus Estimate for the current quarter from $5.87 per share to $5.74 in that period.

Given the way analysts feel about TopBuild right now, this huge implied volatility could mean there’s a trade developing. Oftentimes, options traders look for options with high levels of implied volatility to sell premium. This is a strategy many seasoned traders use because it captures decay. At expiration, the hope for these traders is that the underlying stock does not move as much as originally expected.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Long-Dated Treasury ETFs Hit Yearly Highs Ahead Of August CPI Data: More 'Good News On Inflation' Expected

Exchange-traded funds (ETFs) investing in long-term U.S. Treasury bonds surged to their highest levels of the year as investors gear up for another benign inflation report due Wednesday.

The popular iShares 20+ Year Treasury Bond ETF TLT ended Monday’s session at $99.99 per share, its highest closing price since December 2023.

The U.S. Bureau of Labor Statistics is scheduled to release the Consumer Price Index (CPI) for August on Wednesday at 8:30 a.m. ET. Economists are predicting a 0.2% month-over-month increase in both headline and core inflation, the latter of which excludes food and energy prices.

The Cleveland Fed’s Inflation Nowcasting model projects similar results, with headline CPI at 2.56% year-over-year and core CPI at 3.21%.

Ed Yardeni, a well-known Wall Street veteran, said, “August’s CPI should continue to show progress in moderating inflation,” adding that the expected print would mark the lowest headline inflation since February 2021.

In a similar tone, Bank of America analysts predict that headline inflation will decline by 0.3 percentage points to 2.6% year-over-year, while core inflation is expected to hold at 3.2%.

“The August CPI report should continue the string of good news on inflation,” the bank said in a recent note.

Key Data and Expectations Summary

| Metric | August MoM (exp.) | August YoY (exp.) | July YoY |

|---|---|---|---|

| Headline CPI | +0.2% | 2.6% | 2.9% |

| Core CPI (ex-food and energy) | +0.2% | 3.2% | 3.2% |

Federal Reserve Rate Cut Speculation

Market participants are currently pricing in a 71% probability of a 25-basis-point rate cut at the Federal Reserve’s September meeting, and a 29% chance of a larger 50-basis-point cut.

Recent comments from Fed Governor Christopher Waller and New York Fed President John Williams indicate that a 25bp rate cut remains the baseline expectation, but larger cuts could be on the table if economic data, particularly from the labor market, worsens.

Waller, speaking at the University of Notre Dame, noted that the Fed could act “quickly and forcefully” if needed, and signaled openness to “front-loading cuts.”

Williams emphasized that the U.S. is “moving in the right direction” on inflation but warned, “we are not there yet on achieving 2% inflation.”

Williams also highlighted that the labor market remains strong, with the unemployment rate still “relatively low by historical standards.”

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wall Street Analysts Believe HealthEquity Could Rally 36.59%: Here's is How to Trade

HealthEquity HQY closed the last trading session at $76.24, gaining 7.1% over the past four weeks, but there could be plenty of upside left in the stock if short-term price targets set by Wall Street analysts are any guide. The mean price target of $104.14 indicates a 36.6% upside potential.

The average comprises 14 short-term price targets ranging from a low of $92 to a high of $115, with a standard deviation of $6.14. While the lowest estimate indicates an increase of 20.7% from the current price level, the most optimistic estimate points to a 50.8% upside. More than the range, one should note the standard deviation here, as it helps understand the variability of the estimates. The smaller the standard deviation, the greater the agreement among analysts.

While the consensus price target is a much-coveted metric for investors, solely banking on this metric to make an investment decision may not be wise at all. That’s because the ability and unbiasedness of analysts in setting price targets have long been questionable.

However, an impressive consensus price target is not the only factor that indicates a potential upside in HQY. This view is strengthened by the agreement among analysts that the company will report better earnings than what they estimated earlier. Though a positive trend in earnings estimate revisions doesn’t give any idea as to how much the stock could surge, it has proven effective in predicting an upside.

Here’s What You Should Know About Analysts’ Price Targets

According to researchers at several universities across the globe, a price target is one of many pieces of information about a stock that misleads investors far more often than it guides. In fact, empirical research shows that price targets set by several analysts, irrespective of the extent of agreement, rarely indicate where the price of a stock could actually be heading.

While Wall Street analysts have deep knowledge of a company’s fundamentals and the sensitivity of its business to economic and industry issues, many of them tend to set overly optimistic price targets. Are you wondering why?

They usually do that to drum up interest in shares of companies that their firms either have existing business relationships with or are looking to be associated with. In other words, business incentives of firms covering a stock often result in inflated price targets set by analysts.

However, a tight clustering of price targets, which is represented by a low standard deviation, indicates that analysts have a high degree of agreement about the direction and magnitude of a stock’s price movement. While that doesn’t necessarily mean the stock will hit the average price target, it could be a good starting point for further research aimed at identifying the potential fundamental driving forces.

That said, while investors should not entirely ignore price targets, making an investment decision solely based on them could lead to disappointing ROI. So, price targets should always be treated with a high degree of skepticism.

Why HQY Could Witness a Solid Upside

There has been increasing optimism among analysts lately about the company’s earnings prospects, as indicated by strong agreement among them in revising EPS estimates higher. And that could be a legitimate reason to expect an upside in the stock. After all, empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements.

The Zacks Consensus Estimate for the current year has increased 4.1% over the past month, as three estimates have gone higher compared to no negative revision.

Moreover, HQY currently has a Zacks Rank #2 (Buy), which means it is in the top 20% of more than the 4,000 stocks that we rank based on four factors related to earnings estimates. Given an impressive externally-audited track record, this is a more conclusive indication of the stock’s potential upside in the near term.

Therefore, while the consensus price target may not be a reliable indicator of how much HQY could gain, the direction of price movement it implies does appear to be a good guide.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Job Slowdown? Headhunters Are On A Roll, Revenue For Executive Searches Is Up

Last week’s jobs report sent the stock market into one of the worst weeks for Wall Street since the start of the year.

While hiring appears to be weakening, the trend is going in the opposite direction for executive-level positions.

That’s according to data shared by headhunting firm Korn Ferry KFY in its latest earnings call.

The talent acquisition service reported a 6% increase in revenue from its executive search arm in North America, as compared to the same period last year. The segment also accounted for 31% of its revenue during the latest quarter, as per earnings documents.

The trend is replicated globally, where the uptick was 3% when taking all territories into account. Korn Ferry is located in 53 countries across North America, Europe, Asia/Pacific and Latin America.

“The level of work that we’re doing these days in executive search is probably the highest that I’ve seen,” said Korn Ferry CEO Gary Burnison.

A lot of those searches are due to job succession, he added. As an unprecedented number of Americans retire, companies are in dire need of successors for high-level positions.

Read Also: The ‘Great Wait’ Economy: Jobs Data Paints Unique Picture, Analyst Says

Peak 65

This year, the U.S. experienced a trend that observers call “peak 65.” That means that the number of workers reaching the retirement age of 65 is at the highest it’s ever been.

The Alliance for Lifetime Income reports that an average of 11,000 Americans are entering retirement age each day this year. Through 2027, there will be an average of 4.1 million new retirees a year.

This demographic event is driving one of the largest executive renewal trends in U.S. history. And it goes against overall data on unemployment. The Labor Department showed consistent increases since March, with a 0.1% decrease between July and August.

“Over the next two to three years, the United States is probably going to lose 4 million, 5 million workers a year from the last of the baby boom retirements,” said Burnison.

Korn Ferry benefits. The firm beat analyst estimates on Thursday for the latest quarter, reporting $682.761 million in sales which beat the consensus of $663.937 million by 2.84%, as per data from Benzinga Pro.

Jobs Data: The U.S. economy added 142,000 nonfarm payrolls in August, an improvement from July, but below economist expectations of 160,000.

And a recent revision by the Labor Department found that the jobs market added 818,000 fewer jobs than originally reported in the year leading up to March 2024.

The silver lining is that the recent jobs data has pushed a majority of traders to price in a 25% rate cut in the upcoming FOMC meeting in what one analyst referred to as “the moment we’ve all been waiting for”.

Over the weekend, Treasury Secretary Janet Yellen reassured the public of the economy’s resilience, despite recent job reports.

“We’re seeing less frenzy in terms of hiring and job openings, but we’re not seeing meaningful layoffs,” said Yellen at a politics and policy event on Saturday.

Now Read:

Shutterstock image.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.