Rubrik Shares Dip After Q2 Results: Earnings Beat, Revenues Beat, Guidance Above Estimates

Rubrik Inc. RBRK reported its second-quarter financial results after Monday’s closing bell. Here’s a look at the details from the report.

The Details: Rubrik reported quarterly losses of 40 cents per share which beat the analyst consensus estimate of losses of 49 cents. Quarterly sales came in at $204.951 million, which beat the analyst consensus estimate of $196.209 million by 4.46%.

- Subscription ARR was up 40% year-over-year, growing to $919.1 million.

- Subscription revenue was $191.3 million, a 50% increase, compared to $127.5 million in the second quarter of fiscal 2024.

- GAAP gross margin was 73.1%, compared to 76.6% in the second quarter.

- Rubrik reported 1,969 customers with $100K or more in Subscription ARR, up 35% year-over-year.

“The long list of recent successful cyber attacks and IT outages is driving organizations to increasingly recognize the need for a robust cyber resilience plan to ensure business continuity in the face of cyber disruptions. Our Subscription ARR up 40% year-over-year in the second quarter to $919 million showcases the value we provide to enterprises in delivering complete cyber resilience, which combines cyber recovery and data security posture management,” said Bipul Sinha, Rubrik’s CEO.

Read Next: What’s Going On With GameStop Stock Ahead Of Earnings?

Outlook: Rubrik sees third-quarter losses of between 41 cents and 39 cents per share, versus the estimate of losses of 43 cents, and quarterly revenue in a range of $216.5 million to $218.5 million, versus the $215.15 million estimate. The company expects fiscal year losses of between $2.12 and $2.06 per share, versus the estimate of losses of $2.28 per share, and full-year revenue in a range of $830 million to $838 million, versus the $818.45 million estimate.

The company will host a conference call at 5 p.m. ET to discuss the results.

RBRK Price Action: According to Benzinga Pro, Rubrik shares are down 4.05% after-hours at $30.76 at the time of publication Monday.

Read Also:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Check Out What Whales Are Doing With FIVE

Deep-pocketed investors have adopted a bullish approach towards Five Below FIVE, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in FIVE usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 10 extraordinary options activities for Five Below. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 40% bearish. Among these notable options, 5 are puts, totaling $171,010, and 5 are calls, amounting to $341,624.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $70.0 to $120.0 for Five Below during the past quarter.

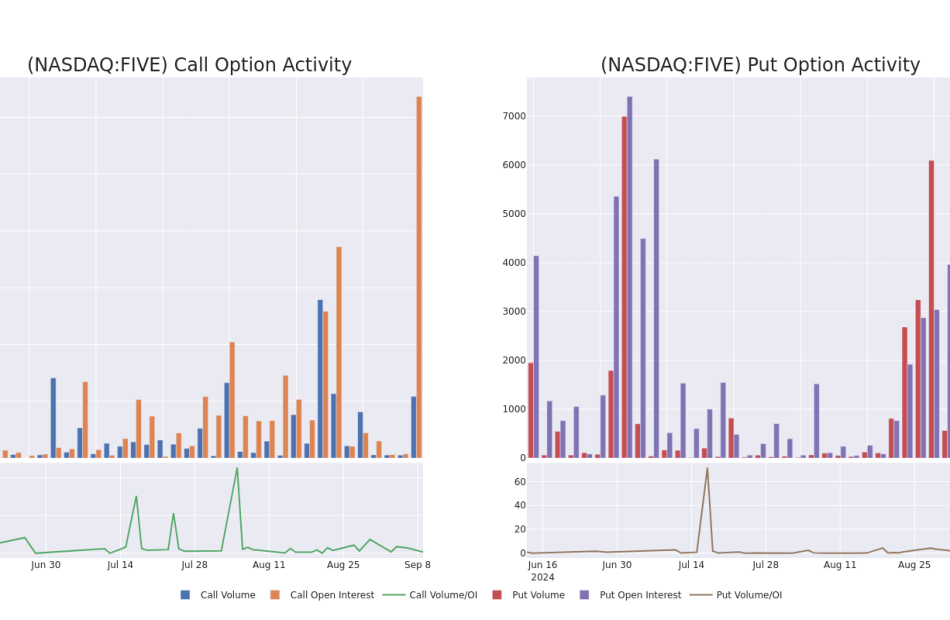

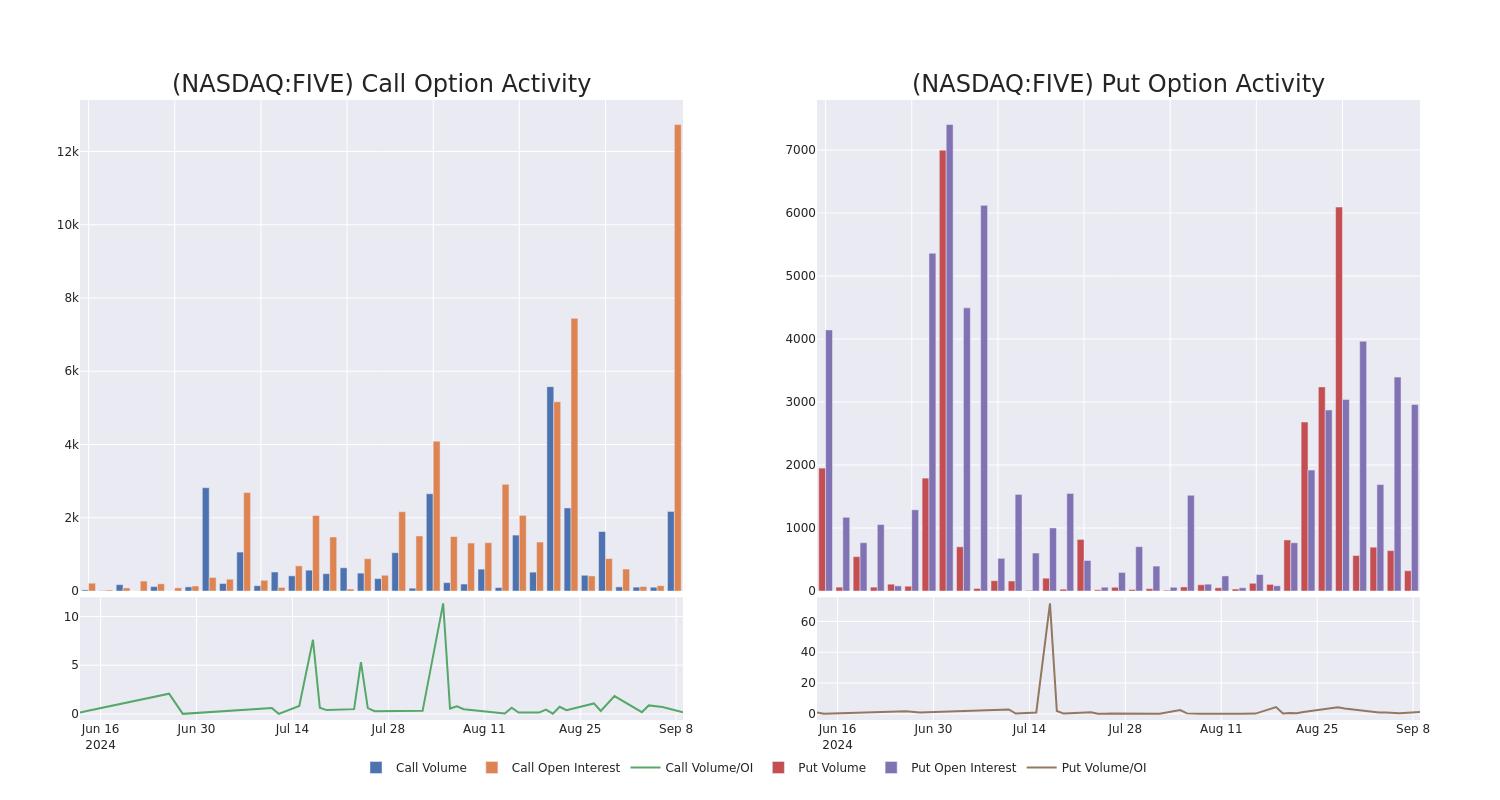

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Five Below’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Five Below’s significant trades, within a strike price range of $70.0 to $120.0, over the past month.

Five Below Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FIVE | CALL | SWEEP | NEUTRAL | 09/20/24 | $2.25 | $2.1 | $2.18 | $85.00 | $123.6K | 5.5K | 595 |

| FIVE | CALL | SWEEP | BEARISH | 09/20/24 | $0.9 | $0.75 | $0.79 | $90.00 | $89.9K | 3.7K | 1.1K |

| FIVE | CALL | TRADE | BULLISH | 01/17/25 | $2.95 | $2.75 | $2.9 | $120.00 | $58.0K | 412 | 273 |

| FIVE | PUT | SWEEP | BEARISH | 01/17/25 | $4.8 | $4.6 | $4.7 | $70.00 | $48.8K | 685 | 115 |

| FIVE | CALL | TRADE | BEARISH | 09/20/24 | $10.2 | $9.9 | $10.0 | $75.00 | $40.0K | 2.7K | 96 |

About Five Below

Five Below Inc is a specialty value retailer offering merchandise targeted at the tween and teen demographic. The Company’s edited assortment of products includes select brands and licensed merchandise.

Having examined the options trading patterns of Five Below, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Five Below Standing Right Now?

- With a volume of 2,720,342, the price of FIVE is up 6.19% at $84.07.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 79 days.

What Analysts Are Saying About Five Below

5 market experts have recently issued ratings for this stock, with a consensus target price of $98.0.

- Maintaining their stance, an analyst from JP Morgan continues to hold a Neutral rating for Five Below, targeting a price of $89.

- Maintaining their stance, an analyst from Telsey Advisory Group continues to hold a Outperform rating for Five Below, targeting a price of $102.

- Maintaining their stance, an analyst from UBS continues to hold a Buy rating for Five Below, targeting a price of $108.

- Consistent in their evaluation, an analyst from Goldman Sachs keeps a Buy rating on Five Below with a target price of $106.

- An analyst from Citigroup persists with their Neutral rating on Five Below, maintaining a target price of $85.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Five Below, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The 'Great Wait' Economy: Jobs Data Paints Unique Picture, Analyst Says

It is usually considered good news when businesses are hiring instead of firing, but they aren’t doing either, according to an analyst.

“We’re stuck in the ‘great wait’ economy,” Callie Cox, chief marketing strategist with Ritholtz Wealth Management, wrote on X on Monday.

“Companies aren’t hiring or firing. People aren’t leaving their jobs or making big financial decisions.”

Cox wrote in her newsletter “Optimist Callie” that only 2% of American workers have quit their jobs, while 81% of workers aged 25 to 54 years old have a job.

“We seem to be at the point where rates are high enough and the economic outlook is dour enough that both average Americans and corporate America have decided to do nothing,” she said.

Unemployment fell from 4.3% in July to 4.2% in August, the U.S. Bureau of Labor Statistics reported on Friday. Inflation is at 2.5% as the Federal Reserve is expected to the key interest rate ranging from 5.25% to 5.5% by either 25 or 50 basis points when in meets on Sept. 18.

“This particular economic state isn’t necessarily bad,” Cox said.

Read Also: Job Creation Falls Short Of Expectations In August, Unemployment Rate Ticks Lower, Wage Growth Soars

“It’s not the desperate penny-pinching or job-slashing you typically see in a recession. People are still employed and earning money at a pace noticeably faster than inflation.”

She said employers are finding ways to do more with the workers that they have, and the Fed believes rates need to be two percentage points lower than they are now to entice consumers to spend and businesses to hire.

“How low rates need to go to pull America out of the great wait?” she wrote.

“Three percentage points of cuts would get us to the point where the current Fed funds rate is in line with price growth, as measured by personal consumption expenditures data.”

She also noted homebuyers are waiting for mortgage rates to go expectedly lower, having fallen from 8% last October to 6.4% currently, possibly making the waiting game last longer.

“We might be stuck in a vicious cycle, though. If enough of us delay big financial moves in hopes of lower rates down the road, we may never make it out of this rut,” she said.

“For what it’s worth, Wall Street seems sick of waiting. They’ve skipped straight to the recession, punishing every economic report that looks somewhat ominous.”

Read Now:

Photo: Unsplash

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CUSTOMERS BANCORP, INC. ANNOUNCEMENT: If You Have Suffered Losses in Customers Bancorp, Inc. (NYSE: CUBI), You Are Encouraged to Contact The Rosen Law Firm About Your Rights

NEW YORK, Sept. 09, 2024 (GLOBE NEWSWIRE) —

Why: Rosen Law Firm, a global investor rights law firm, continues to investigate potential securities claims on behalf of shareholders of Customers Bancorp, Inc. CUBI resulting from allegations that Customers Bancorp may have issued materially misleading business information to the investing public.

So what: If you purchased Customers Bancorp securities you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement. The Rosen Law Firm is preparing a class action seeking recovery of investor losses.

What to do next: To join the prospective class action, go to https://rosenlegal.com/submit-form/?case_id=28067 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

What is this about: On August 8, 2024, during market hours, the Federal Reserve Board of Governors issued an announcement entitled “Federal Reserve Board issues enforcement action with Customers Bancorp, Inc. and Customers Bank.” Attached to the announcement was a written agreement between the Federal Reserve Bank of Philadelphia, Customers Bancorp, Inc., and Customers Bank. The agreement stated “the most recent examinations and inspection of [Customers Bancorp and Customers Bank] conducted by the Federal Reserve Bank of Philadelphia [. . .] identified significant deficiencies related to the Bank’s risk management practices and compliance with the applicable laws, rules, and regulations relating to anti-money laundering (“AML”), including the Bank Secrecy Act [. . .], including the rules and regulations issued thereunder by the U.S. Department of the Treasury [. . .], and the AML requirements of Regulation H of the Board of Governors [of the Federal Reserve System] [. . .]; and the regulations issued by the Office of Foreign Assets Control of the United States Department of the Treasury[.]”

On this news, Customers Bancorp’s stock fell $7.22 per share, or 13.3%, to close at $47.01 per share on August 8, 2024.

Why Rosen Law: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SolaREIT Announces New Debt Facility for Solar and Battery Energy Storage System Real Estate Lease Financing

Repeatable and Scalable Long Term Debt Structure Expands Real Estate Solutions for Developers

VIENNA, Va., Sept. 9, 2024 /PRNewswire/ — SolaREIT™, a renewable energy real estate investment company, announced today the successful closing of a long-term facility with MetLife Investment Management (MIM), the institutional asset management business of MetLife, Inc. The new debt facility represents a strategic milestone for SolaREIT as the company expands accessibility to real estate lease financing solutions for solar and battery storage (BESS) developers. This facility is repeatable and scalable, allowing SolaREIT to optimize its capital structure and deliver competitive options to developers nationwide. SolaREIT’s innovative model provides developers and landowners with competitive financing solutions for solar and BESS project real estate, including land purchases, lease purchases, and land loans.

“This is a significant milestone for SolaREIT. Our debt facility with MIM allows us to rapidly expand our real estate financing solutions to clean energy developers, improving underlying project economics,” said Laura Pagliarulo, CEO of SolaREIT. “The solar and BESS markets are growing exponentially, demanding ever-expanding access to real estate financing solutions. Now more than ever, developers need the financial flexibilities that SolaREIT offers.”

“This facility represents a strategic step for SolaREIT. We look forward to a sustained partnership with MIM that maximizes the efficiency of our capital structure, allowing us to work with developers to bring more clean energy to the grid,” said Laura Klein, Chief Financial Officer of SolaREIT.

Solar and BESS development are increasingly capital-intensive. SolaREIT partners with developers and landowners to provide targeted capital solutions that maximize project profitability. Since its founding in 2020, SolaREIT has provided real estate financing solutions for more than $2.5 billion of solar and BESS projects across the country.

For more information: https://www.solareit.com

About SolaREIT

SolaREIT™, based in Virginia, is an innovative real estate company focused on delivering financing solutions for solar and battery energy storage developers. SolaREIT, a minority and women-owned business, was founded in 2020 as a Real Estate Investment Trust (REIT) by clean energy industry veterans with a proven track record in finance, project development, real estate, and community solar. The team is passionate about renewable energy and believes that solar and battery energy storage land financing plays a critical role in expanding the clean energy economy.

For more information, please visit www.solareit.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/solareit-announces-new-debt-facility-for-solar-and-battery-energy-storage-system-real-estate-lease-financing-302242143.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/solareit-announces-new-debt-facility-for-solar-and-battery-energy-storage-system-real-estate-lease-financing-302242143.html

SOURCE SolaREIT

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Executives Buying BJ's Restaurants And 2 Other Stocks

Although U.S. stocks closed lower on Friday, there were a few notable insider trades.

When insiders purchase shares, it indicates their confidence in the company’s prospects or that they view the stock as a bargain. Either way, this signals an opportunity to go long on the stock. Insider purchases should not be taken as the only indicator for making an investment or trading decision. At best, it can lend conviction to a buying decision.

Below is a look at a few recent notable insider purchases. For more, check out Benzinga’s insider transactions platform.

Domo

- The Trade: Domo, Inc. DOMO CFO David R Jolley acquired a total of 10,000 shares at an average price of $6.99. To acquire these shares, it cost around $69,875.

- What’s Happening: On Aug. 29, Domo posted better-than-expected quarterly results.

- What Domo Does: Domo Inc provides a cloud-based platform that digitally connects all the data, systems and people in an organization, giving them access to real-time data and insights and allowing them to manage their business from their smartphones.

Phibro Animal Health

- The Trade: Phibro Animal Health Corporation PAHC Director E Thomas Corcoran acquired a total of 5,000 shares at an average price of $20.02. To acquire these shares, it cost around $100,100.

- What’s Happening: On Aug. 28, Phibro Animal Health posted upbeat quarterly earnings.

- What Phibro Animal Health Does: Phibro Animal Health Corp operates as a diversified animal health and mineral nutrition company.

BJ’s Restaurants

- The Trade: BJ’s Restaurants, Inc. BJRI Interim CEO C Bradford Richmond bought a total of 2,500 shares at an average price of $29.40. To acquire these shares, it cost around $73,500.

- What’s Happening: On Sept. 3, BJ’s Restaurants announced appointment of President & Chief Concept Officer.

- What BJ’s Restaurants Does: BJ’s Restaurants Inc is involved in the business of owning and operating restaurants.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EZGO ANNOUNCES FINANCIAL RESULTS FOR THE SIX MONTHS ENDED MARCH 31, 2024

CHANGZHOU, China, Sept. 9, 2024 /PRNewswire/ — EZGO Technologies Ltd. EZGO (“EZGO” or “we”, “our”, or the “Company”), a leading short-distance transportation solutions provider in China, today announced its unaudited financial results for the six months ended March 31, 2024.

Financial Highlights (all results compared to the prior fiscal year period unless otherwise noted)

- Revenues were $8.6 million, an increase of 66.1%

- Units sold of e-bicycle reached 4,766, a decrease of 76.7%

- Units sold of batteries and battery packs reached 243,336, an increase of 2614.6%

- Gross margin was 5.7%, compared with 3.5%

- Net loss was $4.7 million, compared with $5.0 million

- The Company has cash and cash equivalents of approximately $0.7 million at March 31, 2024, compared to approximately $17.3 million at September 30, 2023

Management Commentary

During the six months ending on March 31, 2024, due to the continuous decline in upstream raw materials price of lithium batteries, the penetration rate of lithium batteries in the e-bicycle industry gradually increased, and the sales volume of lithium batteries through various channels expanded significantly. The Company’s management promptly seized this opportunity to expand its business, including increasing the models of e-bicycle batteries and expanding energy storage lithium battery products, appropriately shortening the supplier payment terms, and extending customer payment terms. The additional of ordinary shares and accompanying warrants issuance completed in September 2023 also provided a solid financial foundation for the Company’s lithium battery business expansion. However, during the same period, the Company’s production and sales volume of e-bicycles experienced a significant decline due to intensified market competition, hindered new product launches, and the sales of Tianjin Jiahao Bicycles Co., Ltd. (“Tianjin Jiahao”).

Although the downward trend in e-bicycles production and sales has significantly slowed down, and sales are expected to rebound in the second half-year with the introduction of new products, in the medium term, the competition in the e-bicycles market in mainland China remains fierce, industry capacity clearance is still accelerating, and going overseas remains the main direction for breakthroughs. In addition, the smart electronic control subsidiary, Changzhou Higgs Intelligent Technology Co., Ltd. (“Changzhou Higgs”), acquired at the beginning of 2023 has partially increased the Company’s sales volume and product gross margin through its production of smart electronic control modules. Moreover, with the advancement of the government-led industrial equipment upgrade plan, the sales revenue and profits of the subsidiary’s main products are expected to experience considerable growth.

Based on management’s assessment of macroeconomics and industrial competition, along with our own resource endowment, management has adjusted our business strategies as follows: (i) we halted the production of low and middle-end products and focused on the design, development, and production of mid-to-high-speed electric motorcycles through joint ventures or partnerships; (ii) we further enhanced the development and market promotion of lithium battery products for low-speed vehicles (including e-bicycle, e-tricycle and low-speed four-wheeled scooters ); (iii) we have actively expanded overseas sales channels for our products, in the hope of alleviating our dependency on current domestic sales channels; and (iv) we also made equity investments in some of the high-quality suppliers in the electric motorcycles and lithium battery industry.

Financial Review for the Six Months Ended March 31, 2024

Net Revenues

Net revenues from continuing operations for the six months ended March 31, 2024 were approximately $8.6 million, a 66.1% increase from approximately $5.2 million for the six months ended March 31, 2023. The increase in revenues was mainly driven by the increase in sales of batteries and battery packs and sales of electronic control system, and partially offset by the decrease of sales of e-bicycles.

The following table identifies revenue from continuing operations and discontinued operations, as well as reportable segments for the six months ended March 31, 2024 and 2023:

|

For the six months ended March 31, |

Change |

|||||||||||||||||||||||||

|

Segment |

2023 |

% |

2024 |

% |

Amount |

% |

||||||||||||||||||||

|

Sales of batteries |

Battery cells and |

$ |

1,732,871 |

33.6 |

5,847,751 |

68.2 |

$ |

4,114,880 |

237.5 |

|||||||||||||||||

|

Sales of e- |

E-bicycle sales |

3,001,709 |

58.2 |

1,755,485 |

20.5 |

(1,246,224) |

(41.5) |

|||||||||||||||||||

|

Sales of |

Electronic control |

– |

– |

739,390 |

8.6 |

739,390 |

N/A |

|||||||||||||||||||

|

Others |

427,118 |

8.2 |

232,667 |

2.7 |

(194,451) |

(45.5) |

||||||||||||||||||||

|

Subtotal |

Net revenue |

5,161,698 |

100.0 |

8,575,293 |

100.0 |

3,413,595 |

66.1 |

|||||||||||||||||||

|

Rental of lithium |

Rental segment |

120 |

0.0 |

8 |

0.0 |

(112) |

(93.3) |

|||||||||||||||||||

|

Subtotal |

Net revenue |

120 |

0.0 |

8 |

0.0 |

(112) |

(93.3) |

|||||||||||||||||||

|

Total |

Net revenues |

$ |

5,161,818 |

100.0 |

8,575,301 |

100.0 |

$ |

3,413,483 |

66.1 |

|||||||||||||||||

The revenue from sales of batteries and battery packs for six months ended March 31, 2024 was $5,847,751, compared to $1,732,871 for six months ended March 31, 2023, representing an increase of 237.5%, which was mainly due to the increase in sales volume supported by several new large orders of major customers. Such increase resulted from the increased acceptance of our lithium battery packs in the market and the development of the lead-acid battery market in Sichuan. Overall, our sales volume of lithium battery packs increased by 719.1% for the six months ended March 31, 2024 compared with the same period in the fiscal year ended September 30, 2023. The revenue generated from the sales of the lead-acid battery packs was $931,801 for the six months ended March 31,2024 compared $162,552 for the six months ended March 31, 2023.

The sales of e-bicycles decreased by 41.5% or $1,246,224 to $1,755,485 for six months ended March 31, 2024 from $3,001,709 for six months ended March 31, 2023 due to the decreased sales volume of the e-bicycles resulted from the fierce competition of the e-bicycle industry. The leading companies were forced to penetrate into the middle and low-end e-bicycles market due to the performance pressure and the small and middle companies had to reduced sales price in response to the competition. Overall, our sales volume decreased by 76.7% for the six months ended March 31, 2024 compared with the same period in the fiscal year ended September 30, 2023. Furthermore, the increase in the unit price of e-bicycles can be attributed to a shift in our product offerings. Initially, our sales focused on naked e-bicycles without batteries, whereas our current sales encompass complete e-bicycle packages, inclusive of batteries. For the six months ended March 31, 2024, we acquired a major customer, a shared travel service provider, and 93.6% of our revenue in sales of e-bicycle was attributable to the customer.

The revenue from sales of electronic control system and intelligent robots for six months ended March 31, 2024 was $739,390, a new business segment established during the fiscal year ended September 30, 2023.

Cost of Revenue

Cost of revenues consists primarily of manufacturing and purchase cost of e-bicycles, purchase cost of battery packs, purchase of components of the electronic control system, commission processing expenses for intelligent robots, depreciation, maintenance, and other overhead expenses.

Our cost of revenues increased by $3,107,809, or 62.4%, to $8,087,494 for six months ended March 31,2024 from $4,979,685 for six months ended March 31, 2023, which was primarily due to the increased sales of batteries and battery packs and partially offset by the decrease of manufacturing and purchase cost for sales of e-bicycles. The change in cost of revenue directly corresponded with the change in revenue from the sales of batteries and battery packs segment and e-bicycle sales segment.

Gross Profit

Gross profit for the six months ended March 31, 2023 and 2024 was $182,013 and $487,799, or 3.5% and 5.7% of net revenues, respectively.

Gross profit margin for six months ended March 31, 2024 increased from 3.5% to 5.7%, primarily due to the higher margin of sales of electronic control system and sales of batteries and battery packs. The electronic control system developed and manufactured by Changzhou Higgs was embedded with highly complex software and the limited competition in the market results in a relatively high gross profit margin of 43.7% for electronic control system sales, which accounts for 8.6% of our total revenue. The gross profit margin from sales of batteries and battery packs was increased from 3.9% to 4.4% for six months ended March 31, 2024, which was primarily due to the decrease in purchase cost of battery packs resulted from the management’s wise decision to purchase more lithium batteries during the prices decline.

Selling and Marketing Expenses

Our selling and marketing expenses increased by $21,481, or approximately 7.5%, to $307,127 for the six months ended March 31, 2024 from $285,646 for the six months ended March 31, 2023, which was attributable to an increase in employee benefits expense.

General and Administrative Expenses

Our general and administrative expenses increased by $952,142, or approximately 45.1%, to $3,064,960 for the six months ended March 31, 2024 from $2,112,818 for the six months ended March 31, 2023. The increase was primarily due to the addition of credit losses for accounts receivable of $934,146, which mainly resulted from the operational difficulties of several e-bicycle customers, especially individual dealers.

Research and Development Expenses

Our research and development expenses increased by $130,089, or 48.1%, to $400,596 for the six months ended March 31, 2024 from $270,507 for the six months ended March 31, 2023, which was primarily attributed to the increased amortization expenses of patents and software copyright which were considered as important underlying assets in the business acquisition of Changzhou Sixun Technology Co., Ltd. (“Changzhou Sixun”), which was acquired on January 25, 2023.

Other Expense/(income), Net

We recorded other expense, net of $2,549,807 and $1,459,048 for the six months ended March 31, 2023 and 2024, respectively, representing a decrease of 42.8%. The significant decrease in other expense, net is primarily attributable to the loss from disposal of Tianjin Jiahao for the six months ended March 31, 2023, which was approximately $2.6 million. For the six months ended March 31, 2024, the impairment loss of goodwill was recognized of US$1.4 million, compared to nil for the six months ended March 31, 2023.

Income Tax Benefits, Net

Income tax benefits, net was $41,276 and $79,488 for the six months ended March 31, 2023 and 2024, respectively. The reason is the increased deferred tax assets for six months ended March 31, 2024, due to the increase in temporary deductible difference.

Net Loss

Net loss for the six months ended March 31, 2024 was approximately $4.7 million, compared to approximately $5.0 million for the same period in 2023, as a result of the explanations provided above.

About EZGO Technologies Ltd.

EZGO’s vision is to build a leading short-distance transportation solution provider and intelligent manufacturer in China. Leveraging an Internet of Things (IoT) management platform, EZGO has established a business model centered on the sale of battery packs, e-bicycles, electronic control system and intelligent robots. EZGO also conducts the design and manufacturing of e-bicycles, electronic control system and intelligent robots to deliver tailored products in accordance with customer requirements. For additional information, please visit EZGO’s website at www.ezgotech.com.cn. Investors can visit the “Investor Relations” section of EZGO’s website at www.ezgotech.com.cn/Investor.

Exchange Rate

This press release contains translations of certain Chinese Renminbi (“RMB”) amounts into U.S. dollars (“US$”) at specified rates solely for the convenience of the readers. Unless otherwise stated, all translations from RMB to US$ were made at the rate of RMB7.2203 to US$1.00 for the items in balance sheets, the exchange rate in effect as of March 29, 2024, as set forth in the H.10 Statistical release of the Board of Governors of the Federal Reserve System. All translations from RMB to US$ were made at the rate of RMB7.2064 to US$1.00 for the items in statements of operations and comprehensive loss, which is the average exchange rate for the six months ended March 31, 2024, according to the H.10 Statistical release of the Board of Governors of the Federal Reserve System. The Company makes no representation that the RMB or US$ amounts referred could be converted into US$ or RMB, as the case may be, at any particular rate or at all.

Safe Harbor Statement

This press release contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical facts. When the Company uses words such as “may,” “will,” “intend,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate” or similar expressions that do not relate solely to historical matters, it is making forward-looking statements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from the Company’s expectations discussed in the forward-looking statements. These statements are subject to uncertainties and risks including, but not limited to, the following: the Company’s goals and strategies; the Company’s future business development; product and service demand and acceptance; changes in technology; economic conditions; the growth of the short-distance transportation solutions market in China and the other international markets the Company plans to serve; reputation and brand; the impact of competition and pricing; government regulations; fluctuations in general economic and business conditions in China and the international markets the Company plans to serve and assumptions underlying or related to any of the foregoing and other risks contained in reports filed by the Company with the Securities and Exchange Commission (“SEC”). For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release. Additional factors are discussed in the Company’s filings with the SEC, which are available for review at www.sec.gov. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof.

For more information, please contact:

Ascent Investor Relations LLC

Tina Xiao

Email: investors@ascent-ir.com

Phone: +1 646-932-7242

|

EZGO TECHNOLOGIES LTD. |

||||||||

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE SHEET |

||||||||

|

(In U.S. dollars except for number of shares) |

||||||||

|

As of |

As of |

|||||||

|

(Unaudited) |

||||||||

|

ASSETS |

||||||||

|

Current assets: |

||||||||

|

Cash and cash equivalents |

$ |

17,253,120 |

$ |

656,468 |

||||

|

Restricted cash |

875 |

851 |

||||||

|

Short-term investments |

685,307 |

1,500,000 |

||||||

|

Accounts receivable, net |

3,780,073 |

4,259,933 |

||||||

|

Notes receivable |

10,965 |

55,830 |

||||||

|

Inventories, net |

828,878 |

4,217,946 |

||||||

|

Advances to suppliers, net |

18,756,368 |

23,836,085 |

||||||

|

Amount due from related parties, current |

8,257,211 |

11,471,188 |

||||||

|

Prepaid expenses and other current assets |

3,322,302 |

6,216,085 |

||||||

|

Total current assets |

52,895,099 |

52,214,386 |

||||||

|

Non-current assets: |

||||||||

|

Property, plant and equipment, net |

3,839,943 |

6,704,839 |

||||||

|

Intangible assets, net |

2,572,844 |

2,299,840 |

||||||

|

Land use right, net |

1,646,446 |

1,646,818 |

||||||

|

Right-of-use assets, net |

46,652 |

63,342 |

||||||

|

Goodwill |

3,057,943 |

1,730,582 |

||||||

|

Deferred tax assets, net |

160,825 |

241,846 |

||||||

|

Long-term investments |

12,190,534 |

14,988,167 |

||||||

|

Other non-current assets |

5,497,233 |

2,704,198 |

||||||

|

Total non-current assets |

29,012,420 |

30,379,632 |

||||||

|

Total assets |

$ |

81,907,519 |

$ |

82,594,018 |

||||

|

LIABILITIES |

||||||||

|

Current liabilities: |

||||||||

|

Short-term borrowings |

$ |

1,000,548 |

$ |

2,853,067 |

||||

|

Accounts payable |

898,685 |

432,402 |

||||||

|

Advances from customers |

1,039,310 |

813,268 |

||||||

|

Income tax payable |

395,433 |

390,935 |

||||||

|

Lease liabilities, current |

41,570 |

29,218 |

||||||

|

Amount due to related parties |

850,213 |

1,972,352 |

||||||

|

Accrued expenses and other payables |

6,119,355 |

5,796,090 |

||||||

|

Current liabilities of discontinued operation |

693,843 |

708,773 |

||||||

|

Total current liabilities |

11,038,957 |

12,996,105 |

||||||

|

Non-current liabilities: |

||||||||

|

Long-term borrowings |

4,385,965 |

6,911,070 |

||||||

|

Lease liabilities, non-current |

– |

32,356 |

||||||

|

Total non-current liabilities |

4,385,965 |

6,943,426 |

||||||

|

Total liabilities |

15,424,922 |

19,939,531 |

||||||

|

Commitments and contingencies (Note 21) |

||||||||

|

EQUITY |

||||||||

|

Ordinary shares (par value of $0.04 per share; 12,510,000 shares |

102,103 |

102,141 |

||||||

|

Subscription receivable |

(7,800) |

(7,800) |

||||||

|

Additional paid-in capital |

81,801,967 |

82,162,666 |

||||||

|

Statutory reserve |

335,477 |

335,477 |

||||||

|

Accumulated deficits |

(14,772,562) |

(18,825,119) |

||||||

|

Accumulated other comprehensive loss |

(4,066,713) |

(3,650,601) |

||||||

|

Total EZGO Technologies Ltd.’s shareholders’ equity |

63,392,472 |

60,116,764 |

||||||

|

Non-controlling interests |

3,090,125 |

2,537,723 |

||||||

|

Total equity |

66,482,597 |

62,654,487 |

||||||

|

Total liabilities and equity |

$ |

81,907,519 |

$ |

82,594,018 |

||||

|

* |

The shares data are presented on a retroactive basis to reflect the 40 to 1 reverse share split. |

|

EZGO TECHNOLOGIES LTD. AND SUBSIDIARIES |

||||||||

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

||||||||

|

(In U.S. dollars except for number of shares) |

||||||||

|

Six Months Ended March 31, |

||||||||

|

2023 |

2024 |

|||||||

|

Net revenues |

$ |

5,161,698 |

$ |

8,575,293 |

||||

|

Cost of revenues |

(4,979,685) |

(8,087,494) |

||||||

|

Gross profit |

182,013 |

487,799 |

||||||

|

Operating expenses: |

||||||||

|

Selling and marketing |

(285,646) |

(307,127) |

||||||

|

General and administrative |

(2,112,818) |

(3,064,960) |

||||||

|

Research and development |

(270,507) |

(400,596) |

||||||

|

Total operating expenses |

(2,668,971) |

(3,772,683) |

||||||

|

Loss from operations |

(2,486,958) |

(3,284,884) |

||||||

|

Other income (expenses): |

||||||||

|

Financial (expense) income, net |

(26,338) |

248,802 |

||||||

|

Non-operating income (expenses), net |

38,387 |

(35,139) |

||||||

|

Fair value changes in contingent asset |

– |

(310,667) |

||||||

|

Impairment loss of goodwill |

– |

(1,362,044) |

||||||

|

Loss from disposal of a subsidiary |

(2,561,856) |

– |

||||||

|

Total other expenses, net |

(2,549,807) |

(1,459,048) |

||||||

|

Loss from continuing operations before income taxes |

(5,036,765) |

(4,743,932) |

||||||

|

Income tax benefit, net |

41,276 |

79,488 |

||||||

|

Net loss from continuing operations |

(4,995,489) |

(4,664,444) |

||||||

|

Income from discontinued operation, net of tax |

131 |

30 |

||||||

|

Net loss |

$ |

(4,995,358) |

$ |

(4,664,414) |

||||

|

Net loss from continuing operations |

$ |

(4,995,489) |

$ |

(4,664,444) |

||||

|

Less: Net loss attributable to non-controlling interests from continuing |

(201,048) |

(611,857) |

||||||

|

Net loss attributable to EZGO Technologies Ltd.’s shareholders from |

(4,794,441) |

(4,052,587) |

||||||

|

Income from discontinued operation, net of tax |

131 |

30 |

||||||

|

Net income attributable to EZGO Technologies Ltd.’s shareholders from |

131 |

30 |

||||||

|

Net loss attributable to EZGO Technologies Ltd.’s shareholders |

$ |

(4,794,310) |

$ |

(4,052,557) |

||||

|

Net loss from continuing operations per ordinary share: |

||||||||

|

Basic and diluted |

$ |

(6.54) |

$ |

(1.59) |

||||

|

Net loss from discontinued operation per ordinary share: |

||||||||

|

Basic and diluted |

$ |

– |

$ |

– |

||||

|

Net loss per ordinary share: |

||||||||

|

Basic and diluted |

$ |

(6.54) |

$ |

(1.59) |

||||

|

Weighted average shares outstanding |

||||||||

|

Basic and diluted* |

733,386 |

2,552,576 |

||||||

|

* |

The shares data are presented on a retroactive basis to reflect the 40 to 1 reverse share split. |

|

EZGO TECHNOLOGIES LTD. |

||||||||

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF |

||||||||

|

(In U.S. dollars except for number of shares) |

||||||||

|

Six Months Ended March 31, |

||||||||

|

2023 |

2024 |

|||||||

|

Loss from continuing operations before non-controlling interests |

$ |

(4,995,489) |

$ |

(4,664,444) |

||||

|

Income from discontinued operation, net of tax |

131 |

30 |

||||||

|

Net loss |

(4,995,358) |

(4,664,414) |

||||||

|

Other comprehensive income |

||||||||

|

Foreign currency translation adjustment |

1,067,488 |

475,567 |

||||||

|

Comprehensive loss |

(3,927,870) |

(4,188,847) |

||||||

|

Less: Comprehensive loss attributable to non-controlling interests |

(295,168) |

(552,402) |

||||||

|

Comprehensive loss attributable to EZGO Technologies Ltd.’s |

$ |

(3,632,702) |

$ |

(3,636,445) |

||||

|

EZGO TECHNOLOGIES LTD. |

||||||||

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||||

|

(In U.S. dollars) |

||||||||

|

Six Months Ended March 31, |

||||||||

|

2023 |

2024 |

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

||||||||

|

Net loss from continuing operation |

$ |

(4,995,489) |

$ |

(4,664,444) |

||||

|

Net income from discontinued operation, net of tax |

131 |

30 |

||||||

|

Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||

|

Allowance for credit losses |

300,266 |

1,025,366 |

||||||

|

Provision for inventories |

(39,711) |

42,971 |

||||||

|

Depreciation and amortization |

555,918 |

532,950 |

||||||

|

Share-based compensation |

151,875 |

360,737 |

||||||

|

Fair value changes in contingent asset |

– |

310,667 |

||||||

|

Loss from disposal of a subsidiary |

2,561,856 |

– |

||||||

|

Loss from long-term investment |

110,789 |

102,419 |

||||||

|

Impairment loss of goodwill |

– |

1,362,044 |

||||||

|

Deferred tax benefits |

(49,375) |

(79,488) |

||||||

|

Changes in operating assets and liabilities: |

||||||||

|

Accounts receivable |

1,954,599 |

(1,466,444) |

||||||

|

Notes receivable |

(18,635) |

(44,837) |

||||||

|

Advances to suppliers |

(5,137,730) |

(3,562,143) |

||||||

|

Inventories |

(3,258,216) |

(3,429,869) |

||||||

|

Amount due from related parties, current |

(1,717,313) |

606,011 |

||||||

|

Prepaid expenses and other current assets |

(180,560) |

(616,233) |

||||||

|

Accounts payable |

(168,069) |

(476,623) |

||||||

|

Advances from customers |

1,035,271 |

(237,395) |

||||||

|

Income tax payable |

5,587 |

(8,660) |

||||||

|

Lease liabilities |

– |

(51,081) |

||||||

|

Accrued expenses and other payables |

701,730 |

(416,184) |

||||||

|

Net cash used in operating activities from continuing operations |

(8,187,076) |

(10,710,206) |

||||||

|

Net cash used in operating activities |

(8,187,076) |

(10,710,206) |

||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

||||||||

|

Purchase of property, plant and equipment |

(26,808) |

(3,342,151) |

||||||

|

Purchase of land use right |

(1,748,169) |

– |

||||||

|

Purchase of short-term investments |

– |

(1,500,000) |

||||||

|

Purchase of long-term investments |

(7,174,496) |

(29,104) |

||||||

|

Prepayment for intent long-term investment |

(1,318,788) |

(3,219,361) |

||||||

|

Loans to related parties |

(1,569,072) |

(2,778,965) |

||||||

|

Collection of loans to related parties |

1,540,976 |

– |

||||||

|

Net cash inflow from disposal of subsidiaries |

2,579,717 |

457,094 |

||||||

|

Net cash outflow due to acquisition of Changzhou Sixun |

(578,629) |

– |

||||||

|

Net cash used in investing activities from continuing operations |

(8,295,269) |

(10,412,487) |

||||||

|

Net cash used in investing activities |

(8,295,269) |

(10,412,487) |

||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

||||||||

|

Proceeds from short-term borrowings |

759,737 |

2,581,039 |

||||||

|

Repayments of short-term borrowings |

(2,580,238) |

(735,457) |

||||||

|

Proceeds from long-term borrowings |

– |

2,483,903 |

||||||

|

Loans from related parties |

1,053,057 |

653,962 |

||||||

|

Repayments of loans from related parties |

(130,176) |

(460,702) |

||||||

|

Collection of receivable from a shareholder |

100,737 |

– |

||||||

|

Cash receipts from equity issuance, net of issuance cost |

14,400,000 |

– |

||||||

|

Net cash provided by financing activities from continuing operations |

13,603,117 |

4,522,745 |

||||||

|

Net cash provided by financing activities |

13,603,117 |

4,522,745 |

||||||

|

Effect of exchange rate changes |

749,738 |

3,272 |

||||||

|

Net decrease in cash, cash equivalents and restricted cash |

(2,129,490) |

(16,596,676) |

||||||

|

Cash, cash equivalents and restricted cash, at beginning of the period |

4,413,218 |

17,253,995 |

||||||

|

Cash, cash equivalents and restricted cash, at end of the period |

$ |

2,283,728 |

$ |

657,319 |

||||

|

Reconciliation of cash, cash equivalents, and restricted cash to the |

||||||||

|

Cash and cash equivalents |

$ |

2,280,198 |

$ |

656,468 |

||||

|

Restricted cash |

3,530 |

851 |

||||||

|

Total cash, cash equivalents, and restricted cash |

$ |

2,283,728 |

$ |

657,319 |

||||

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW |

||||||||

|

Income tax paid |

$ |

2,512 |

$ |

12,450 |

||||

|

Interest paid |

$ |

40,450 |

$ |

35,663 |

||||

|

SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING |

||||||||

|

Shares issued for acquisition of Changzhou Sixun |

$ |

8,080,448 |

$ |

– |

||||

|

Increase of non-controlling interests from acquisition of Changzhou Sixun |

$ |

273,698 |

$ |

– |

||||

|

Recognition of right-of use assets and lease liabilities |

$ |

– |

$ |

70,688 |

||||

![]() View original content:https://www.prnewswire.com/news-releases/ezgo-announces-financial-results-for-the-six-months-ended-march-31-2024-302242645.html

View original content:https://www.prnewswire.com/news-releases/ezgo-announces-financial-results-for-the-six-months-ended-march-31-2024-302242645.html

SOURCE EZGO Technologies Ltd.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Use Rose Among US Adults Over 10 Years, But Kept Steady In Teens, Finds New Study

A new study published in Drug and Alcohol Dependence Reports found that usage among adults has surged, but teenage cannabis use maintained its yearly levels.

The study, which analyzed data from over 543,000 people between 2013 and 2022, offers a closer look at how legalization and shifting attitudes have reshaped the social adoption of cannabis, reported The Guardian.

Another notable finding is the rise in cannabis consumption among adults with higher incomes and college degrees. Researchers crunched the numbers coming from the National Survey on Drug Use and Health (NSDUH) to examine trends across various demographics.

Teen Use Holds Steady

Despite concerns that cannabis legalization might drive increased use among teenagers, the data shows otherwise. The outcome is strong, since it coincides with a previous study on the matter.

In fact, while use among teens has remained between 6% and 7% over the last decade according to the new study, previous studies have even showed a decrease among this demographic group.

“We expected to see an increase, especially with the broader legalization and availability,” said Dr. Delvon Mattingly, lead author of the study and a behavioral science professor at the University of Kentucky. “But the data show that teen use has remained surprisingly flat.”

Experts believe that strict regulations preventing dispensaries from selling to minors have played a role. Dispensaries often enforce age verification using ID scans, which reduces the chances of illegal access.

Read Also: Daily Cannabis Consumption Outpaces Daily Alcohol Use In The US For The First Time, New Study Shows

Cannabis Use Climbs Among Rich And Educated Adults

Overall cannabis consumption has increased among adults, particularly those with higher incomes and college degrees. Individuals in households earning $75,000 or more per year nearly doubled their usage, from 5.89% in 2013 to 13.20% in 2022. Likewise, usage among college graduates rose sharply from 4.48% to 12.42% during the same period.

This increase highlights how legalization has led to the normalization of cannabis. Experts suggest that changing public attitudes have fueled this increase, especially among wealthier, educated Americans.

“With legalization, cannabis has become more normalized, especially among higher-income groups,” Mattingly noted. “People are using it recreationally and for medical reasons, particularly for managing pain and anxiety.”

Shifting Public Perception

Jordan Gette, a postdoctoral fellow at the Rutgers Center of Alcohol and Substance Use Studies, noted, “We see celebrities and professional athletes endorsing cannabis products, which has helped shed its stigma.”

This shift has also been aided by dispensaries opening in affluent areas, making cannabis more accessible to wealthier demographics.

Medical cannabis also played a role in this shift. In states where medical cannabis is legal, many older adults now turn to it to treat chronic conditions. “Higher income is often correlated with access to healthcare, and medical cannabis is increasingly being used to manage chronic conditions like pain,” Mattingly added.

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Racial And Ethnic Patterns

The study also brought to light notable racial and ethnic trends.

Statistics show a higher prevalence among non-Hispanic multiracial individuals, with over 25% reporting having used in 2022. This group had the highest rate of cannabis consumption compared to other racial and ethnic categories.

Mattingly emphasized the importance of continuing research that includes multiracial individuals. “These findings underscore the importance of including multiracial populations in future research,” Mattingly said.

Cannabis And Hallucinogen At Record Highs

In addition to these findings, another recent study from the University of Michigan’s Monitoring the Future (MTF) survey showed that cannabis and hallucinogen among U.S. adults reached a historically high level in 2023.

According to the survey, 42% of young adults aged 19 to 30 reported using cannabis in the past year, with 10% engaging in daily consumption. Similarly, among adults aged 35 to 50, 29% reported having consumed in the past year, with 8% using it daily.

The MTF survey also noted an increase in hallucinogen use.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nuclear Waste Management Market to hit $5.79 billion, Globally, by 2031 at 2.1% CAGR, says Coherent Market Insights

Burlingame, Sept. 09, 2024 (GLOBE NEWSWIRE) — The global Nuclear Waste Management Market is estimated to be valued at USD 5.00 Bn in 2024 and is expected to reach USD 5.79 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 2.1% from 2024 to 2031. as highlighted in a new report published by Coherent Market Insights. Growing adoption of reprocessing technologies to recover fissile materials from spent nuclear fuel is further fueling the market growth. Reprocessing not only helps in waste volume reduction but also supports sustainable utilization of nuclear resources.

Request Sample Report: https://www.coherentmarketinsights.com/insight/request-sample/7162

Market Dynamics:

The nuclear waste management market is primarily driven by the rising production of radioactive waste from nuclear power plants and increasing nuclear proliferation globally. About 250,000 metric tons of spent fuel is generated worldwide each year from nuclear power plants, and radioactive waste production is directly proportional to the operation of nuclear reactors. According to World Nuclear Association, there are around 450 operational nuclear power reactors globally which produce a significant amount of radioactive waste annually. Moreover, growing investment in research activities related to nuclear energy is also contributing to the market growth.

Nuclear Waste Management Market Report Coverage

| Report Coverage | Details |

| Market Revenue in 2023 | $5.00 billion |

| Estimated Value by 2031 | $5.79 billion |

| Growth Rate | Poised to grow at a CAGR of 2.1% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Waste Type, By Reactor Type, By Disposal Method |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Expanding nuclear power generation • Evolving regulations and standards |

| Restraints & Challenges | • High costs involved • Lack of permanent disposal facilities |

Market Trends:

One of the key trends observed in the nuclear waste management market is growing investment in reprocessing and recycling of spent nuclear fuel. Reprocessing spent fuel helps in recovering recyclable uranium and plutonium that can be used to manufacture fresh fuel. Countries such as France, Russia, India, and China have established large-scale facilities to reprocess nuclear waste. Another trend gaining traction is final geological disposal of high-level radioactive waste. Finland and Sweden have successfully developed underground repositories and have started disposing of canisters containing vitrified high-level nuclear waste.

Immediate Delivery Available | Buy This Premium Research Report: https://www.coherentmarketinsights.com/insight/buy-now/7162

Market Opportunities:

The global nuclear waste management market size was valued at USD 5.00 Bn in 2024 and is anticipated to witness a CAGR of 2.1% during the forecast period. With increasing nuclear power generation activities across the globe, the demand for proper nuclear waste storage and disposal is also on the rise.

Low-Level Waste (LLW) accounted for the largest share of over 60% in the global nuclear waste management market in 2024. LLW includes items that have become contaminated with radioactive material or have become radioactive through exposure to neutron radiation. Paper, rags, tools, clothing, filters, and other disposable materials which may contain small amounts of radioactive material are classified as LLW. Temporary storage of LLW is done either on-site or at centralized facilities until it has decayed to levels low enough to be disposed of in a landfill.

Intermediate-Level Waste (ILW) is expected to be the fastest growing segment during the forecast period. ILW contains higher levels of radioactivity than LLW but less than High-Level Waste. It requires shielding during handling and transport but not cooling. Examples include resins, chemical sludges, and metal reactor components which can be safely stored for shorter periods of time than high-level waste. Cementation, bituminization, and vitrification are the common techniques used to immobilize ILW for safe transportation and storage.

The storage of High-Level Waste (HLW) from used nuclear fuel is one of the most challenging aspects of the nuclear fuel cycle. HLW accounts for over 95% of the total radioactivity from used fuel. Pressurized Water Reactors generate bulk of HLW globally. Temporary storage of HLW is done in water-filled spent fuel pools or dry cask storage systems. Deep geological disposal involving multiple engineered and natural barriers is considered the safest option for the long-term isolation of HLW from the environment.

Key Market Takeaways

The global nuclear waste management market is anticipated to witness a CAGR of 2.1% during the forecast period 2024-2031, owing to increasing nuclear energy production worldwide.

On the basis of waste type, low-level waste segment is expected to hold a dominant position, accounting for over 60% of the market share owing to ease of handling and disposal of LLW.

On the basis of reactor type, pressurized water reactors dominate the nuclear industry globally and produce bulk of nuclear waste.

Regionally, North America is expected to hold the largest market share over the forecast period, due to large number of operating nuclear power plants in the US.

Key players operating in the nuclear waste management market include Enercon, Veolia, US Ecology Inc. Spend fuel reprocessing is expected to gain more prominence in the coming years to reduce the burden of high-level waste disposal.

Request For Customization: https://www.coherentmarketinsights.com/insight/request-customization/7162

Recent Developments:

In December 2018, Magnox Ltd has given Wood a significant contract for the removal, processing, and disposal of radioactive waste from a decommissioned nuclear power plant in the UK. 47m3 of radioactive wet waste that has been kept in tanks at Dungeness A in Kent will be removed as part of the project.

In November 2022, the Biden administration had planned for raising the funding in projects to recycle nuclear waste from power plants including through reprocessing, a technology that has not been practiced in the United States for decades because of concerns about costs and proliferation.

Detailed Segmentation-

By Waste Type:

- Low-Level Radioactive Waste

- Intermediate-Level Radioactive Waste

- High-Level Radioactive Waste

By Reactor Type:

- Pressurized Water Reactor

- Boiling Water Reactor

- Gas Cooled Reactor

- Pressurized Heavy Water Reactor

By Disposal Method:

- Incineration

- Storage

- Deep Geological Disposal

- Others

By Region:

North America:

Latin America:

- Brazil

- Argentina

- Mexico

- Rest of Latin America

Europe:

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

Asia Pacific:

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

Middle East:

- GCC Countries

- Israel

- Rest of Middle East

Africa:

- South Africa

- North Africa

- Central Africa

Have a Look at Trending Research Reports on Energy Domain:

Power Grid System Market: The Global Power Grid System Market is estimated to be valued at USD 11.67 Bn in 2024 and is expected to reach USD 24.78 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 11.4% from 2024 to 2031.

Renewable Natural Gas Market: The global renewable natural gas market is estimated to be valued at USD 14.03 Bn in 2024 and is expected to reach USD 24.23 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 12.1% from 2024 to 2031.

Nuclear Fusion Market: The Nuclear Fusion Market is estimated to be valued at USD 331.26 Bn in 2024 and is expected to reach USD 491.55 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 5.8% from 2024 to 2031.

Wave Energy Converter Market: The wave energy converter Market size is valued US$ 19.52 Bn in 2024 and is expected to reach US$ 26.15 Bn by 2031, growing at a compound annual growth rate (CAGR) of 4.3% from 2024 to 2031.

Author Bio:

Ravina Pandya, PR Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. With an MBA in E-commerce, she has an expertise in SEO-optimized content that resonates with industry professionals.

About Us:

Coherent Market Insights is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including aerospace and defense, agriculture, food and beverages, automotive, chemicals and materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports. We are also committed in playing a leading role in offering insights in various sectors post-COVID-19 and continue to deliver measurable, sustainable results for our clients.

Mr. Shah Senior Client Partner – Business Development Coherent Market Insights Phone: US: +1-650-918-5898 UK: +44-020-8133-4027 AUS: +61-2-4786-0457 India: +91-848-285-0837 Email: sales@coherentmarketinsights.com Website: https://www.coherentmarketinsights.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock market today: Dow, S&P 500 surge as stocks mount a comeback from deep losses

US stocks rebounded on Monday on the heels of the S&P 500’s worst week since early 2023, as inflation came back into focus for investors gauging pressures that could influence the size of interest rate cuts.

The S&P 500 (^GSPC) climbed about 1%, coming off a hefty weekly loss. The Dow Jones Industrial Average (^DJI) jumped nearly 500 points, or 1%, while the tech-heavy Nasdaq Composite (^IXIC) rose about 0.7%.

Financials (XLF), Industrials (XLI), and Energy (XLE) stocks led the market rebound.

The major averages were on pace to regain some of the ground they lost after the August jobs report failed to settle a key question: How aggressively will the Federal Reserve lower interest rates? The neither-hot-nor-cold data left Wall Street guessing whether a cut of 25 or 50 basis points is likely at this month’s policy meeting.

Read more: Fed predictions for 2024: What experts say about the possibility of a rate cut

At the same time, comments by Fed officials appeared to tilt the market in favor of a 0.25% cut by suggesting that incoming data would have to support the need for larger and further easing.

Focus is now on a fresh consumer inflation print due Wednesday to provide clues to the path of rates. The reading on price pressures will be followed by a producer inflation report on Thursday, the last inflation inputs before the Fed’s policy decision on Sept. 18.

Apple’s (AAPL) annual iPhone event kicked off on Monday. The tech giant debuted its iPhone 16 smartphone, updates to its entire Apple Watch lineup, and AirPods Pro 2 which include new hearing protection features.

Live12 updates

-

-

-

-

-

-

Dow gains 600 points, S&P 500, Nasdaq near session highs amid rebound

Stocks rose to hover near session highs on Monday afternoon amid a market rebound following last week’s sharp losses.

Industrials (XLI), Financials (XLF), and Consumer Discretionary (XLY) led the gains as the Dow Jones Industrial Average (^DJI) soared more than 600 points, or 1.6%.

The S&P 500 (^GSPC) also gained more than 1% while the tech-heavy Nasdaq Composite (^IXIC) increased roughly 1.3%.

Stocks were rebounding on Monday following their worst week of the year.

All of the S&P 500 sectors were in green territory on Monday during a broad market rebound. -

-

-

-

-

-