Meet the Artificial Intelligence (AI) Stock That Could Become the Next Palantir, or Even Better

Palantir Technologies (NYSE: PLTR) is quickly becoming the go-to provider of artificial intelligence (AI) software platforms for companies and governments around the globe. Evidence of this can be seen in the recent acceleration in the company’s growth as well as its improving revenue pipeline. Both metrics point toward better times ahead.

Investors are noticing and have been buying Palantir stock hand over fist. The stock is up an impressive 76% so far in 2024, and the following discussion offers clues as to why that has been the case.

Palantir’s AI software platform has gained impressive traction

When Palantir released its second-quarter results last month, the company reported a year-over-year increase of 27% in revenue to $678 million. That was a solid improvement over the 13% year-over-year growth the company delivered in the same period last year, as well as an acceleration over its Q1 revenue growth of 21%.

There was a nice jump in the company’s customer base, as well as the size of the deals that it has been striking with customers. Palantir management credited its improving growth profile to the growing adoption of its Artificial Intelligence Platform (AIP). This is a software platform that helps enterprises and governments integrate generative AI into their processes to help improve operational efficiency.

From helping customers build their own large language model (LLM)-powered applications to helping them accelerate their daily workflows with the help of generative AI, the usefulness of Palantir’s AIP seems to have struck a chord with customers. This explains why the company raised its 2024 revenue growth forecast and expects its top line to increase by 24% this year to $2.75 billion.

More importantly, Palantir seems capable of sustaining its outstanding growth in the long term, considering that it ended the previous quarter with $4.3 billion in remaining deal value (RDV). The metric refers to the total remaining value of Palantir’s contracts at the end of a period, and it rose 26% year over year in Q2.

This AI hardware giant is making strides in the AI software market

So, Palantir seems well on its way to making the most of the huge end-market opportunity available in the generative AI software market. However, there is another way for investors to capitalize on the booming demand for AI software, and a closer look could lead investors to think that it may be a better AI software stock than Palantir.

Nvidia (NASDAQ: NVDA) has been the go-to choice for companies looking to purchase high-end AI hardware so that they can train AI models, resulting in outstanding growth in the company’s revenue and earnings in recent months. What’s interesting is that CFO Colette Kress’ comments on the recent earnings conference call suggest that Nvidia is starting to make a dent in the enterprise AI software market as well. According to Kress, “We expect our software, SaaS, and support revenue to approach a $2 billion annual run rate exiting this year, with Nvidia AI Enterprise notably contributing to growth.”

CEO Jensen Huang also commented, pointing out that customers can deploy Nvidia AI Enterprise software for $4,500 per graphics processing unit (GPU) per year. Given that Nvidia’s AI GPUs are priced at $30,000 or more for a single chip depending on the configuration, enterprise customers looking to build and deploy AI models are getting a good deal through Nvidia’s AI software platform.

Nvidia provides customers with multiple AI software offerings. For example, the company’s AI Foundry platform, which was launched in July this year, is an end-to-end solution with which customers can build and deploy custom generative AI models. Nvidia offers popular foundation models that can be tweaked by its customers and quickly move AI applications (including chatbots, content creation tools, and document processing tools) into the production phase.

Nvidia also provides pretrained customizable AI workflows that can be used for extracting data from PDFs or deployed for creating customer service workflows, accelerating drug discovery in the field of medicine, or building custom generative AI apps suited to an organization’s needs. What’s worth noting is that the adoption of Nvidia’s software solutions is increasing at a terrific pace thanks to AI.

In its February earnings conference call, Nvidia management pointed out that its software and services offerings reached an annual revenue run rate of $1 billion in the fourth quarter of fiscal 2024. So, the company’s software and services revenue run rate is set to double in the space of just one year. That’s significantly faster than the pace at which Palantir’s top line is set to grow this year.

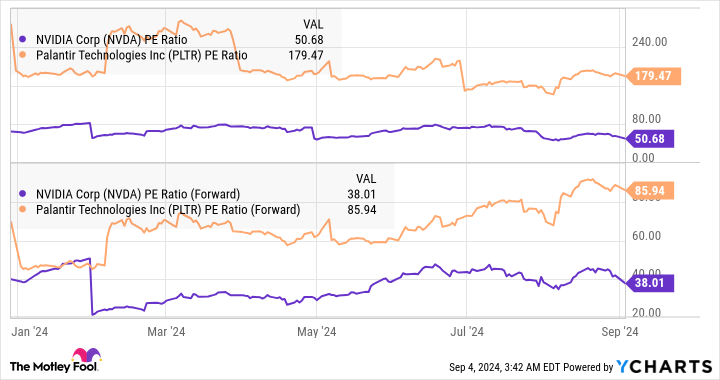

Throw in the fact that Nvidia benefits big time from the booming demand for its AI chips, which led to 122% year-over-year growth in the company’s revenue in the second quarter of fiscal 2025 to $30 billion, and it is easy to see that the chipmaker is the more diversified play on AI. Another point worth noting here is that Nvidia stock trades at 28 times sales, which is lower than Palantir’s sales multiple of 29.

What’s more, Nvidia is the more attractive AI stock when we compare the earnings multiples of both companies.

So, investors looking for a cheaper alternative to Palantir to take advantage of the AI software market’s growth would do well to take a closer look at Nvidia, especially considering that the latter already has a flourishing AI hardware business that makes it a better growth stock to buy right now.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

Meet the Artificial Intelligence (AI) Stock That Could Become the Next Palantir, or Even Better was originally published by The Motley Fool

SmarFinancial Upgraded to Strong Buy: Here's Why

SmarFinancial SMBK could be a solid addition to your portfolio given its recent upgrade to a Zacks Rank #1 (Strong Buy). This rating change essentially reflects an upward trend in earnings estimates — one of the most powerful forces impacting stock prices.

The sole determinant of the Zacks rating is a company’s changing earnings picture. The Zacks Consensus Estimate — the consensus of EPS estimates from the sell-side analysts covering the stock — for the current and following years is tracked by the system.

Since a changing earnings picture is a powerful factor influencing near-term stock price movements, the Zacks rating system is very useful for individual investors. They may find it difficult to make decisions based on rating upgrades by Wall Street analysts, as these are mostly driven by subjective factors that are hard to see and measure in real time.

As such, the Zacks rating upgrade for SmarFinancial is essentially a positive comment on its earnings outlook that could have a favorable impact on its stock price.

Most Powerful Force Impacting Stock Prices

The change in a company’s future earnings potential, as reflected in earnings estimate revisions, has proven to be strongly correlated with the near-term price movement of its stock. The influence of institutional investors has a partial contribution to this relationship, as these big professionals use earnings and earnings estimates to calculate the fair value of a company’s shares. An increase or decrease in earnings estimates in their valuation models simply results in higher or lower fair value for a stock, and institutional investors typically buy or sell it. Their bulk investment action then leads to price movement for the stock.

Fundamentally speaking, rising earnings estimates and the consequent rating upgrade for SmarFinancial imply an improvement in the company’s underlying business. Investors should show their appreciation for this improving business trend by pushing the stock higher.

Harnessing the Power of Earnings Estimate Revisions

As empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock movements, tracking such revisions for making an investment decision could be truly rewarding. Here is where the tried-and-tested Zacks Rank stock-rating system plays an important role, as it effectively harnesses the power of earnings estimate revisions.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Earnings Estimate Revisions for SmarFinancial

For the fiscal year ending December 2024, this bank holding company is expected to earn $1.99 per share, which is a change of -2% from the year-ago reported number.

Analysts have been steadily raising their estimates for SmarFinancial. Over the past three months, the Zacks Consensus Estimate for the company has increased 7.6%.

Bottom Line

Unlike the overly optimistic Wall Street analysts whose rating systems tend to be weighted toward favorable recommendations, the Zacks rating system maintains an equal proportion of ‘buy’ and ‘sell’ ratings for its entire universe of more than 4000 stocks at any point in time. Irrespective of market conditions, only the top 5% of the Zacks-covered stocks get a ‘Strong Buy’ rating and the next 15% get a ‘Buy’ rating. So, the placement of a stock in the top 20% of the Zacks-covered stocks indicates its superior earnings estimate revision feature, making it a solid candidate for producing market-beating returns in the near term.

The upgrade of SmarFinancial to a Zacks Rank #1 positions it in the top 5% of the Zacks-covered stocks in terms of estimate revisions, implying that the stock might move higher in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Single-cell Analysis Market is projected to reach USD 14.8 Billion, advancing a 13.9% CAGR by 2034: Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Sept. 06, 2024 (GLOBE NEWSWIRE) — The global single-cell analysis market (단일 세포 분석 시장) was projected to attain US$ 3.4 billion in 2023. It is anticipated to garner a 13.9% CAGR from 2024 to 2034, and by 2034, the market is likely to attain US$ 14.8 billion.

To understand the fundamental concepts of molecular biology, single-cell analysis devices—also known as single-cell profiling devices—are employed. In multi-omics-based therapeutic research and development efforts, including proteomics, metabolomics, transcriptomics, and genomes, there is an increasing need for single-cell analysis.

Since single-cell amplification, microfluidics, high throughput assays, effective cell sorting and tagging, and sequencing are made possible by the latest developments, individual cell analysis is essential to understanding advances in drug development and disease diagnosis.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/single-cell-analysis-market.html

Key Findings of the Market Report

- In order to detect differential gene expression and track the growth of tumors, single-cell RNA sequencing methods are utilized in cancer research to examine complex tissues at the single-cell level and prevent future cellular deterioration.

- Accurate treatment planning is made possible by the important protein-level data provided by single-cell proteomic analysis of circulating tumor cells.

- This information is useful in determining the malignancy of the tumor and the activation of signaling pathways.

- New developments in single-cell sequencing technology include analytical algorithms and cDNA library preparation.

Market Trends for Single-cell Analysis

- Single-cell analysis has been the subject of much research due to the early diagnosis of chronic illnesses and the growing awareness of the significance of precision medicine. Amgen and Generate Biomedicines formed a partnership in January 2022 with the goal of finding and developing protein therapies for various modalities, with an initial investment of US$ 1.9 billion.

- Bruker Company Canopy Biosciences launched assay kits for ChipCytometry in December of 2021. To improve user experience using ChipCytometry, these kits are utilized to quantitatively image thousands of selected protein biomarkers simultaneously on a single tissue segment at single-cell spatial resolution.

- As of March 2021, there were around 23,358 active clinical studies in the field of cancer, according to clinicaltrials.gov. The single-cell analysis market is, therefore, being boosted by a rise in R&D efforts related to cancer research.

Global Market for Single-cell Analysis: Regional Outlook

- North America held the highest portion of the global landscape in 2023, according to a recent single-cell analysis market report. For the duration of the forecast period, the area is expected to continue to dominate. Growth in single-cell omics technology and an increase in cancer incidence are driving North America market statistics.

- Given the rise in cancer cases in the region over the past few years, Asia Pacific’s single-cell analysis market share has been growing quickly. Significant infrastructural advancements in the healthcare sector are also encouraging market growth in the area.

Global Single-Cell Analysis Market: Key Players

Companies involved in the global single-cell analysis market are concentrating on the introduction of new products in order to get a competitive advantage. For example, the PlexWell Single Cell Rapid Kit was introduced by SeqWell Inc. in February 2021 and is useful for single-cell RNA sequencing and NGS library preparation.

Prominent firms are focusing on inorganic expansion as a means of increasing their worldwide presence. For example, in order to expand its market share outside of the United States, SeqWell Inc. and CELLINK AB partnered to commercialize their products in February 2021. The following companies are well-known participants in the global single-cell analysis market:

- Thermo Fisher Scientific

- WaferGen Bio-systems

- Becton, Dickinson and Company

- Standard BioTools Inc.

- Eppendorf

- QIAGEN N.V.

- NewGEN Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- 10x Genomics

Key developments by the players in this market are:

- 10x Genomics announced in April 2022 the commercial feasibility of two new products aimed at streamlining the sample preparation process and increasing the number of people using its Chromium platform for single-cell analysis.

- Mission Bio Inc. unveiled the Tapestri solution for solid tumor research in March 2022. This end-to-end workflow for single-cell DNA sequencing includes an improved single-cell copy number variation (CNV) bioinformatics analysis tool, pre-designed research panels for glioblastoma multiforme and breast cancer, and a nuclei separation prep technique.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/single-cell-analysis-market.html

Global Single-cell Analysis Market (سوق تحليل الخلية الواحدة) Segmentation

Product

- Cell Counters

- Spectrophotometers

- Sequencers

- Imaging Systems

- Cytometers

- PCR

- Others

- Reagents & Kits

- Micropipettes & Microplates

- Others

End User

- Hospitals

- Diagnostic Centers

- Biotechnology & Biopharmaceutical Companies

- Research Laboratories

- Others

Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Have a Look at More Valuable Insights of Healthcare

Stethoscope Market (聴診器市場): The global stethoscope market is likely to expand at a CAGR of 5.5% from 2022 to 2032. People today are more willing to opt for physical examinations and undertake diagnoses with the inclination toward health and fitness.

Hybrid Operating Room Market (Mercato delle sale operatorie ibride): The global Hybrid Operating Room Market is expected to grow at a CAGR of 7.7% from 2022 to 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ARS Pharmaceuticals, Inc. Upgraded to Buy: Here's Why

ARS Pharmaceuticals, Inc. SPRY could be a solid choice for investors given its recent upgrade to a Zacks Rank #2 (Buy). This rating change essentially reflects an upward trend in earnings estimates — one of the most powerful forces impacting stock prices.

A company’s changing earnings picture is at the core of the Zacks rating. The system tracks the Zacks Consensus Estimate — the consensus measure of EPS estimates from the sell-side analysts covering the stock — for the current and following years.

Individual investors often find it hard to make decisions based on rating upgrades by Wall Street analysts, since these are mostly driven by subjective factors that are hard to see and measure in real time. In these situations, the Zacks rating system comes in handy because of the power of a changing earnings picture in determining near-term stock price movements.

Therefore, the Zacks rating upgrade for ARS Pharmaceuticals, Inc. basically reflects positivity about its earnings outlook that could translate into buying pressure and an increase in its stock price.

Most Powerful Force Impacting Stock Prices

The change in a company’s future earnings potential, as reflected in earnings estimate revisions, and the near-term price movement of its stock are proven to be strongly correlated. That’s partly because of the influence of institutional investors that use earnings and earnings estimates for calculating the fair value of a company’s shares. An increase or decrease in earnings estimates in their valuation models simply results in higher or lower fair value for a stock, and institutional investors typically buy or sell it. Their bulk investment action then leads to price movement for the stock.

Fundamentally speaking, rising earnings estimates and the consequent rating upgrade for ARS Pharmaceuticals, Inc. imply an improvement in the company’s underlying business. Investors should show their appreciation for this improving business trend by pushing the stock higher.

Harnessing the Power of Earnings Estimate Revisions

As empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock movements, tracking such revisions for making an investment decision could be truly rewarding. Here is where the tried-and-tested Zacks Rank stock-rating system plays an important role, as it effectively harnesses the power of earnings estimate revisions.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Earnings Estimate Revisions for ARS Pharmaceuticals, Inc.

For the fiscal year ending December 2024, this company is expected to earn -$0.65 per share, which is a change of -14% from the year-ago reported number.

Analysts have been steadily raising their estimates for ARS Pharmaceuticals, Inc. Over the past three months, the Zacks Consensus Estimate for the company has increased 0.5%.

Bottom Line

Unlike the overly optimistic Wall Street analysts whose rating systems tend to be weighted toward favorable recommendations, the Zacks rating system maintains an equal proportion of ‘buy’ and ‘sell’ ratings for its entire universe of more than 4000 stocks at any point in time. Irrespective of market conditions, only the top 5% of the Zacks-covered stocks get a ‘Strong Buy’ rating and the next 15% get a ‘Buy’ rating. So, the placement of a stock in the top 20% of the Zacks-covered stocks indicates its superior earnings estimate revision feature, making it a solid candidate for producing market-beating returns in the near term.

The upgrade of ARS Pharmaceuticals, Inc. to a Zacks Rank #2 positions it in the top 20% of the Zacks-covered stocks in terms of estimate revisions, implying that the stock might move higher in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fuel Management Systems (FMS) Market Size is Expected to Exceed USD 1.0 Billion by 2034, Growing at 4.6% CAGR: Transparency Market Research Report

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Sept. 06, 2024 (GLOBE NEWSWIRE) — The global fuel management systems (FMS) market (연료 관리 시스템(FMS) 시장) is estimated to surge at a CAGR of 4.6% from 2024 to 2034. Transparency Market Research projects that the overall sales revenue for fuel management is estimated to reach US$ 1.0 billion by the end of 2034.

Heightened concerns over energy security, geopolitical tensions, and supply chain disruptions drive the demand for FMS solutions to ensure fuel availability and resilience. The implementation of carbon pricing mechanisms and emissions trading schemes incentivizes businesses to invest in FMS technologies to monitor and reduce carbon emissions.

Increasing adoption of alternative fuels such as biodiesel, LNG, and hydrogen creates new challenges in fuel management, driving the need for specialized FMS solutions tailored to diverse fuel types. Rising instances of fuel theft and fraudulent activities necessitate advanced FMS technologies for accurate fuel tracking, theft detection, and prevention in various industries.

The proliferation of remote operations and unmanned vehicles in industries like mining, agriculture, and construction fuels the demand for FMS solutions with remote monitoring and control capabilities.

Download Sample Copy of the Report: https://www.transparencymarketresearch.com/fuel-management-system-market.html

Fuel Management Market: Competitive Landscape

The fuel management systems market thrives amidst a competitive landscape shaped by technological advancements and industry consolidation. Leading players like Dover Corporation and Franklin Fueling Systems dominate with comprehensive product portfolios and global presence.

Emerson Electric Co. and Gilbarco Veeder-Root offer innovative solutions tailored to diverse industry needs. Emerging players such as OPW Fuel Management Systems and Triscan Group challenge incumbents with specialized offerings and niche market focus. Strategic partnerships, mergers, and acquisitions are common strategies, driving market consolidation and fostering innovation within the fuel management systems market, catering to the evolving needs of businesses worldwide. Some prominent players are as follows:

- Omnitracs LLC

- E-Drive Technology

- The Veeder-Root Company

- ESI Total Fuel Management

- SCI Distribution, LLC

- Fluid Management Technology Pty Ltd.

- SmartFlow Technologies

- Emerson

- Guduza System Technologies

- Fleetmatics Group PLC

- Telenav Inc.

- TomTom International BV

- Trimble Inc.

Product Portfolio

- Omnitracs LLC offers cutting-edge fleet management solutions, empowering transportation companies to optimize operations, enhance safety, and maximize efficiency across their fleets.

- E-Drive Technology specializes in innovative electric propulsion systems, providing eco-friendly and high-performance solutions for electric vehicles and hybrid vehicles in various industries.

- The Veeder-Root Company delivers industry-leading fuel management systems and solutions, enabling businesses to monitor, control, and optimize fuel usage for enhanced efficiency and cost savings.

Key Findings of the Market Report

- Monitoring is leading the fuel management systems market, enabling real-time tracking of fuel usage, inventory levels, and operational performance for businesses.

- Fleet management emerges as the leading application segment in the fuel management systems market due to its widespread adoption and impact.

- Road transportation leads the fuel management systems market due to the extensive use of vehicles and the need for efficient fuel monitoring.

Fuel Management Market Growth Drivers & Trends

- Stringent environmental regulations drive demand for fuel management systems to ensure compliance, reducing emissions and minimizing fuel wastage.

- Increasing focus on fleet efficiency and cost reduction fuels adoption of fuel management systems for better monitoring and optimization.

- Advancements in sensor technology, data analytics, and cloud-based solutions enhance the functionality and effectiveness of fuel management systems.

- Growing awareness of environmental sustainability encourages businesses to invest in fuel management systems to track and reduce carbon footprint.

- Integration of fuel management systems with Internet of Things (IoT) platforms enables real-time monitoring, remote management, and predictive maintenance capabilities.

Global Fuel Management Market: Regional Profile

- North America leads the FMS market with a robust regulatory environment and a strong emphasis on fuel efficiency and environmental sustainability. The United States, in particular, boasts a mature market driven by stringent compliance requirements and technological advancements. Leading players like Dover Corporation and OPW Fuel Management Systems dominate, offering comprehensive solutions for fleet operators and fuel retailers.

- Europe maintains a dynamic FMS market characterized by diverse industry regulations and a focus on reducing carbon emissions. Countries like the UK, Germany, and France lead in fuel management technology adoption, with companies like Gilbarco Veeder-Root and Tokheim Group driving innovation. The region’s commitment to renewable energy sources spurs demand for integrated fuel management solutions.

- In the Asia Pacific region, rapid urbanization and industrialization drive fuel consumption, fueling demand for FMS solutions. China and India lead market growth, propelled by increasing investments in transportation infrastructure and logistics. Local players like Triscan Group and Tatsuno Corporation cater to regional needs, offering customized solutions for fleet management and fuel monitoring.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=12308<ype=S

Fuel Management Market: Key Segments

By Process

- Measuring

- Monitoring

- Reporting

- Others

By Application

- Fuel Consumption

- Efficiency Level

- Fleet Management

- Viscosity Control

- Others

By End User

- Road Transportation

- Railway Transportation

- Aircraft

- Marine

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Explore More Trending Report by Transparency Market Research:

- Waste-to-Energy Market – The global waste-to-energy market (폐기물 에너지 시장) is Projected to Attain a Valuation of US$ 43.1 billion by 2031 | TMR Report Analysis

- Wave and Tidal Energy Market – The global wave and tidal energy market (파력 및 조력 에너지 시장) to Grow at a CAGR of 23.5% from 2022 to 2031, Reaching USD 40.8 Billion: As per TMR Study

- Offshore Wind Turbines Market – The global offshore wind turbines market (해상 풍력 터빈 시장) is estimated to grow at a CAGR of 8.9% from 2024 to 2034 and reach US$ 166.5 Billion by the end of 2034.

- Metal-air Battery Market – The global metal-air battery market (금속공기전지 시장) is estimated to advance at a CAGR of 12.4% from 2024 to 2034 and reach US$ 2.1 Billion by the end of 2034.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Stock Movers For September 6, 2024

GAINERS:

LOSERS:

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

Why Super Micro Computer Stock Is Plummeting Today

Super Micro Computer (NASDAQ: SMCI) is getting hit with another round of big sell-offs Friday. The company’s share price was down 5.5% as of 3:15 p.m. ET, according to data from S&P Global Market Intelligence.

Supermicro, as the company is sometimes called, saw its stock pull back following another bearish piece of coverage from a big name on Wall Street. Adding another source of selling pressure, today’s jobs report from the U.S. Department of Labor arrived with weaker-than-expected results.

J.P. Morgan no longer has a bullish rating on Supermicro stock

In a report published before the market opened today, J.P. Morgan lowered its rating on Super Micro Computer from overweight to neutral. J.P. Morgan’s analysts also lowered their one-year price target on Supermicro stock from $950 per share to $500 per share. Despite the downgrade, the new target would still suggest upside of roughly 28% based on the stock’s current price.

J.P. Morgan’s analysts said that the decision to downgrade the stock was not directly related to the short report that was published by Hindenburg Research earlier this month. They also said that the downward revision was not driven by concerns that Supermicro would have trouble getting back into compliance with Securities and Exchange Commission (SEC) regulations, following the delayed filing of its annual 10-K report. Instead, the rating and price-target cuts were driven by a seeming lack of near-term catalysts for new investors to jump into the stock, and concerns about sales and pricing pressures from competition.

The latest jobs data is also dragging Supermicro stock lower

Investors were looking to today’s jobs report from the Labor Department for indicators about the health of the U.S. economy, and they weren’t happy with the results. Analysts and economists had already started to lower their expectations for August’s jobs numbers; the average estimate was that 160,000 jobs were added last month. But the report showed that only 142,000 jobs were actually added in the period.

The August jobs numbers have added to concerns that the U.S. economy could be on track for a recession. The Federal Reserve is expected to cut interest rates later this month, which should be a positive catalyst for economic activity, but some observers are worried it may not be enough to avoid economic contraction. Investors have been looking to interest-rate cuts as a key bullish catalyst for the stock market, but the specter of a possible recession has taken the shine off of the Fed’s anticipated policy shift.

As a result, Super Micro Computer and other growth stocks are seeing outsized sell-offs today. But if you’re risk-tolerant, Supermicro stock could be a worthwhile addition to your portfolio.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $656,938!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why Super Micro Computer Stock Is Plummeting Today was originally published by The Motley Fool

All You Need to Know About M/I Homes Rating Upgrade to Strong Buy

M/I Homes MHO appears an attractive pick, as it has been recently upgraded to a Zacks Rank #1 (Strong Buy). This upgrade is essentially a reflection of an upward trend in earnings estimates — one of the most powerful forces impacting stock prices.

A company’s changing earnings picture is at the core of the Zacks rating. The system tracks the Zacks Consensus Estimate — the consensus measure of EPS estimates from the sell-side analysts covering the stock — for the current and following years.

Since a changing earnings picture is a powerful factor influencing near-term stock price movements, the Zacks rating system is very useful for individual investors. They may find it difficult to make decisions based on rating upgrades by Wall Street analysts, as these are mostly driven by subjective factors that are hard to see and measure in real time.

As such, the Zacks rating upgrade for M/I Homes is essentially a positive comment on its earnings outlook that could have a favorable impact on its stock price.

Most Powerful Force Impacting Stock Prices

The change in a company’s future earnings potential, as reflected in earnings estimate revisions, has proven to be strongly correlated with the near-term price movement of its stock. That’s partly because of the influence of institutional investors that use earnings and earnings estimates for calculating the fair value of a company’s shares. An increase or decrease in earnings estimates in their valuation models simply results in higher or lower fair value for a stock, and institutional investors typically buy or sell it. Their bulk investment action then leads to price movement for the stock.

Fundamentally speaking, rising earnings estimates and the consequent rating upgrade for M/I Homes imply an improvement in the company’s underlying business. Investors should show their appreciation for this improving business trend by pushing the stock higher.

Harnessing the Power of Earnings Estimate Revisions

As empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock movements, tracking such revisions for making an investment decision could be truly rewarding. Here is where the tried-and-tested Zacks Rank stock-rating system plays an important role, as it effectively harnesses the power of earnings estimate revisions.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Earnings Estimate Revisions for M/I Homes

For the fiscal year ending December 2024, this homebuilder is expected to earn $19.76 per share, which is a change of 21.9% from the year-ago reported number.

Analysts have been steadily raising their estimates for M/I Homes. Over the past three months, the Zacks Consensus Estimate for the company has increased 8.7%.

Bottom Line

Unlike the overly optimistic Wall Street analysts whose rating systems tend to be weighted toward favorable recommendations, the Zacks rating system maintains an equal proportion of ‘buy’ and ‘sell’ ratings for its entire universe of more than 4000 stocks at any point in time. Irrespective of market conditions, only the top 5% of the Zacks-covered stocks get a ‘Strong Buy’ rating and the next 15% get a ‘Buy’ rating. So, the placement of a stock in the top 20% of the Zacks-covered stocks indicates its superior earnings estimate revision feature, making it a solid candidate for producing market-beating returns in the near term.

The upgrade of M/I Homes to a Zacks Rank #1 positions it in the top 5% of the Zacks-covered stocks in terms of estimate revisions, implying that the stock might move higher in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Treasury Yields Plunge, TLT ETF Tops $100, VIX Spikes As 50-Basis-Point Rate Cut Odds Soar In Response To Jobs Data

The U.S. Treasury market rallied sharply on Friday after August labor data showed weaker-than-expected job growth, bolstering bets on Federal Reserve interest rate cuts.

The U.S. economy added 142,000 nonfarm payrolls last month, an increase from 89,000 in July but missing the expected increase to 160,000. The unemployment rate ticked down by 0.1% to 4.3% as expected, while wages displayed higher-than-forecasted growth.

Market-implied odds of a 50-basis-point rate cut in September surged to 61% as of 11:05 a.m. in New York, overtaking the 39% probability of a 25-basis-point cut, according to the CME Group‘s FedWatch data.

September Rate-Cut Probabilities After August Jobs Data

| September Rate Cut | Now* | 1 day ago (Sept. 5, 2024) | 1 Week ago (Aug. 30, 2024) |

| 50 basis points (0.5%) | 61% | 40% | 30% |

| 25 basis points (0.25%) | 39% | 60% | 70% |

Traders poured into bonds amid growing expectations of declining interest rates, driving yields sharply lower across the Treasury curve.

The policy-sensitive two-year yield dropped over 10 basis points, reaching 3.59% at 11:15 a.m. in New York, its lowest level since March 2023.

The 10-year Treasury yield fell 6 basis points to 3.67%, marking its lowest point since June 2023.

This movement has led to a positive slope in the Treasury yield curve from the 10-year onward, effectively ending the more than two-year period of yield curve inversion.

Chart: US Yield Curve Normalizes, Ending 2-Year Inversion

Market Reactions

Rate-cut expectations and falling Treasury yields triggered sharp moves across asset classes, with bonds rallying, the dollar weakening against the yen and equity markets sliding.

“No sooner than the payroll print hit, the algorithms marched into high gear, pushing Treasury yields lower as the disappointing headline number, coupled with a series of downward revisions, suggested a more dire economic backdrop perhaps requiring a heavier dose of Fed medicine on Sept. 18,” said Quincy Krosby, chief global strategist for LPL Financial.

Markets are wrestling with whether the August payroll data signals a labor market returning to pre-COVID norms or an economy losing critical momentum, Krosby said.

- Treasury-related ETFs surged, with the iShares 20+ Year Treasury Bond ETF TLT rising 1.1% to $100.65, on pace for its highest close since late July 2023.

- The Japanese yen strengthened as well, with the Invesco CurrencyShares Japanese Yen Trust FXY gaining over 1%, poised to close at its highest level since early January 2024.

- Volatility spiked, as the CBOE Volatility Index (VIX) jumped 14% to 23.

- Wall Street flipped to the red, with the SPDR S&P 500 ETF Trust SPY dropping 1.5% on Friday, extending its weekly decline to 3.9%, on track for the worst weekly performance since March 2023.

- Tech stocks were hit hardest, with the Invesco QQQ Trust QQQ down 2.4%, pushing its weekly loss past 5%.

- Nvidia Corp. NVDA tumbled 4%, extending its weekly loss to 14%, its worst performance in two years.

Read Next:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MasHash Introduces Accessible Cloud Mining Solutions for Cryptocurrency Enthusiasts

Los Angeles, CA, Sept. 06, 2024 (GLOBE NEWSWIRE) — As the cryptocurrency landscape continues to evolve, cloud mining has emerged as a popular method for individuals to participate in crypto mining without substantial upfront costs. By renting processing power from platforms like MasHash, you can engage in Bitcoin mining and potentially receive daily rewards in various cryptocurrencies. MasHash stands out with its free cloud mining program, making it easier than ever to explore crypto mining and its potential for passive income.

What is Cloud Mining?

Cloud mining provides an accessible route to cryptocurrency mining, eliminating the need for expensive hardware and specialized knowledge. Users rent hashing power from data centers, contributing computational resources to verify blockchain transactions and earning cryptocurrency rewards in return. It’s like having a stake in a digital mine without the hassle of managing equipment or complex setups.

How to Start Cloud Mining?

Here’s a simple three-step guide to getting started with cloud mining using MasHash:

Step 1: Choose a Reliable Platform

Choosing a reliable cloud mining platform is crucial. Key factors to consider include a strong track record, a user-friendly interface, and an active community. Established in 2019, MasHash meets these criteria with a large user base, making it an ideal choice for beginners.

MasHash offers a free cloud mining tier, enabling users to test the platform and potentially earn cryptocurrency without any initial investment. For those looking to maximize earnings, MasHash provides a range of paid mining plans with varying levels of hashing power and potential rewards, supporting popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

Advantages

– Sign up and get a $50 bonus instantly.

– High profitability levels and daily payouts.

– McAfee® security protection and Cloudflare® security protection.

– The affiliate program allows you to refer friends and earn up to $10,000 in referral bonuses.

– Users can generate more than 6 other cryptocurrencies using the platform.

– No additional service or administrative fees.

– Backed by a 100% uptime guarantee and excellent 24/7 technical support.

Step 2: Select Your Mining Plan

Once you’ve chosen your platform, explore the different available mining plans. Consider your budget and risk tolerance when making your selection. MasHash offers plans for various budgets, so you can find one that suits your needs.

| Contract Price | Contract Term | Fixed Return | Daily Rate |

| $50 | 1 Day | $50 + $1 | 2% |

| $200 | 1 Day | $200 + $6 | 3% |

| $600 | 3 Days | $600 + $31.5 | 1.75% |

| $1200 | 3 Days | $1200 + $114 | 1.9% |

| $3600 | 6 Days | $3600 + $453.6 | 2.1% |

Step 3: Start Mining and Earn Rewards

After selecting your plan, MasHash takes care of the technical aspects of mining. You don’t need to worry about maintaining hardware or managing complex software. Simply sit back, relax, and potentially earn daily rewards in your chosen cryptocurrency.

MasHash goes beyond just cloud mining. They also offer a lucrative referral program that provides an opportunity to earn additional income. By sharing your unique referral link, you can earn a commission for every person who signs up and actively uses MasHash. There’s even the potential to score a one-time bonus of up to $5,000 for reaching a specific number of active referrals!

Conclusion

Cloud mining with MasHash offers a beginner-friendly way to explore the world of cryptocurrency and potentially generate passive income. With its free tier, flexible plans, and referral program, MasHash is a great platform to kickstart your crypto journey!

For more information about MasHash, please visit their website at: [MasHash Official Site](https://mashash.com)

KOMANDURI Sridevi director MasHash support at mashash.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.