FIVE DEADLINE REMINDER: Five Below, Inc. Investors who Lost Money are Reminded to Contact BFA Law before Upcoming Securities Litigation Deadline (Nasdaq:FIVE)

NEW YORK, Sept. 07, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces that a lawsuit has been filed against Five Below, Inc. FIVE and certain of the Company’s senior executives.

If you invested in Five Below, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/five-below-inc.

Investors have until September 30, 2024 to ask the Court to be appointed to lead the case. The complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in Five Below securities. The case is pending in the U.S. District Court for the Eastern District of Pennsylvania and is captioned Himes v. Five Below, Inc., No. 2:24-cv-3638.

What is the Lawsuit About?

The complaint alleges that Five Below operates specialty discount stores, and prices most of its products at $5 or less. The complaint further alleges that during the relevant period, the company misrepresented its accelerating store traffic, merchandising opportunities and store expansions that underpinned its long-term growth. In truth, Five Below had allegedly experienced macroeconomic pressures that dented its store traffic and interfered with the successful execution of the company’s business.

On June 5, 2024, Five Below is alleged to have revealed that macroeconomic pressures caused lower income customers to reduce their spending, leading to disappointing financial results for the company’s first quarter of 2024. Still, Five Below assured investors that “chasing trends has always been a strength of ours, and we will continue to quickly identify and capitalize on trends.” Despite the assurance, the news caused the price of Five Below stock to decline about 10%, from $132.79 per share on June 5, 2024 to $118.72 per share on June 6, 2024.

After the market closed on July 16, 2024, Five Below announced that CEO Joel Anderson resigned as President and CEO, and as a member of the Board of Directors, effective immediately. At the same time, the company reported that the quarter-to-date results for its second quarter of fiscal 2024 showed that comparable sales decreased 5% over the prior year. As a result, Five Below also announced that sales for the full quarter would be in the range of $820 million – $860 million and that comparable sales would decline approximately 6%-7%. This news caused a significant 25% decline in the price of Five Below stock, from $102.07 per share on July 16, 2024 to $76.50 per share on July 17, 2024.

Click here if you suffered losses: https://www.bfalaw.com/cases-investigations/five-below-inc.

What Can You Do?

If you invested in Five Below, you have rights and are encouraged to submit your information to speak with an attorney.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The Firm will seek court approval for any potential fees and expenses. Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/five-below-inc

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/five-below-inc

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The governments of Canada and Quebec and the City of Montréal officially open 26 new bachelor apartments for vulnerable women and at risk of homelessness

MONTRÉAL, Sept. 6, 2024 /CNW/ – The Government of Canada, the Government of Quebec, the City of Montréal, the Société d’habitation et de développement de Montréal (SHDM) and the non-profit organization Chez Doris are proud to officially open Résidence Marcelle and Jean Coutu, a new 26-unit bachelor apartment building for vulnerable women and at risk of homelessness.

For the past year, the new apartments on De Champlain Street in the borough of Ville-Marie have been welcoming vulnerable women who require supervision, but are independent enough to live in a community setting. This safe, modern living environment is adapted to the needs of its tenants and has a day staff of social workers. With a courtyard and a separate entrance for each apartment, this building will help female residents become more independent while offering social support as well as a common room for getting together.

This $7.2 million project was made possible thanks to 5.1 million from direct funding of SHDM and $800,000 in funding from the Government of Canada through the Affordable Housing Fund. In addition, through assistance from the Major Residential Renovation Program, the City of Montréal contributed an additional $1.17 million, of which $585,000 came from the Government of Quebec’s Programme visant le financement de programmes municipaux d’habitation de la Ville de Montréal. In fact, the Government of Quebec is also allocating funding so that rent supplements can be allocated to residents so that they will spend no more than 25% of their income on rent. The Government of Quebec is also contributing to the funding of psychosocial services for women, with an annual envelope of $52,938. The SHDM retains ownership of the building. The non-profit organization Chez Doris will manage it and provide psychosocial supervision and support to the women who live there.

Quotes

“The federal government will continue to work hard toward ensuring that everyone in Quebec and across Canada has a safe and stable place to call home. We’re quickly providing new affordable housing to those who need it most across the country, thanks to the Affordable Housing Fund and collaboration from all levels of government.”

The Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities

“Financial assistance from our government was not only used to build the apartments, but also to ensure they are affordable for their tenants. This new building, which is the result of collective work and our constant efforts in the area of housing, will greatly improve the quality of life of residents.”

France-Élaine Duranceau, Quebec Minister Responsible for Housing

“Women experiencing homelessness face particularly difficult realities and need resources adapted to their needs. The Résidence Marcelle and Jean Coutu is more than a roof over their heads; it’s a safe space where they can rebuild their lives, feel supported, and regain their independence. I would like to thank the Chez Doris organization for once again raising its hand to help them. Together, we must continue to develop solutions that protect and value our most vulnerable women.”

Lionel Carmant, Quebec Minister Responsible for Social Services

“The housing crisis is a complex issue that requires collaboration from all levels of government. I’m delighted that, thanks to this joint investment by the governments of Canada and Quebec and the City of Montréal, we have added 26 bachelor apartments for women facing housing insecurity or who are at risk of homelessness here in Laurier–Sainte-Marie. This demonstrates our shared commitment to supporting those who need it most.”

The Honourable Steven Guilbeault, Minister of Environment and Climate Change and Member of Parliament for Laurier–Sainte-Marie

“Our administration views housing as an essential part of a sustainable solution to the housing crisis and to supporting the vulnerable among us. Résidence Marcelle and Jean Coutu will provide a home for 26 women at risk of homelessness. Thanks to the work of our partner Chez Doris and the SHDM’s expertise and significant investments, 26 people have a roof over their heads and are getting the services they need. These complex issues call for tailored support. We welcome the participation of all government and community partners, which made this project possible. This initiative is vital to meeting the growing needs arising from the vulnerability crisis.”

Benoit Dorais, Executive committee vice-chair of Montréal and responsible for housing, real estate strategy, property valuation and legal affairs

“This residence is a great example of SHDM teams developing a real estate project that makes a real difference for vulnerable populations in Montréal. We invested more than $5 million from our own funds in this 26-unit building. It’s the latest of 168 housing units for vulnerable people that we have built in the borough of Ville-Marie over the past few months. I would like to thank all our partners, both public and private, as well as Chez Doris, who helped get this project off the ground. It shows that by working together and joining forces, we can find solutions to provide sustainable housing for people facing housing insecurity.”

Sophie Rousseau-Loiselle, Executive Director, SHDM

“We are extremely proud to officially open Résidence Marcelle and Jean Coutu. The addition of these 26 bachelor apartments to Chez Doris’s services makes it a major contributor to overall support for the homeless in Montréal. In addition to living in safe new housing, the 26 women residents receive support to help improve their lifestyle, their independence and, above all, their self-esteem. This housing is both an opportunity and a caring, reassuring community for them. It helps them avoid or get off the streets. We also applaud the support of all our partners, without whom this project would not have happened, including the SHDM and the Fondation Marcelle and Jean Coutu.”

Carole Croteau, Chair of the Board, Chez Doris

Résidence Marcelle and Jean Coutu at a glance

- 2233 De Champlain Street, borough of Ville-Marie

- 26 bachelor apartments for women facing housing insecurity or experiencing homelessness

- Owner: SHDM

- Managing organization: Chez Doris

- Architecture: Rayside Labossière

- Structural engineering: NCK Inc.

- Mechanical engineering and electricity: Rochon Experts-Conseils

- Environmental engineering consultants: Groupe Gesfor, Poirier, Pinchin inc.

- Contractor: Germano Construction Corporation

About Canada Mortgage and Housing Corporation

As Canada’s authority on housing, Canada Mortgage and Housing Corporation (CMHC) contributes to the stability of the housing market and financial system, provides support for Canadians in housing need, and offers unbiased housing research and advice to all levels of Canadian government, consumers and the housing industry. CMHC’s aim is that by 2030, everyone in Canada has a home they can afford, and that meets their needs. For more information, follow us on Twitter, Instagram, YouTube, LinkedIn and Facebook.

About the Société d’habitation du Québec

As a leader in housing, the SHQ’s mission is to meet the housing needs of Quebecers through its expertise and services to citizens. It does this by providing affordable and low-rental housing and offering a range of assistance programs to support the construction, renovation and adaptation of homes, and access to homeownership.

To find out more about its activities, visit www.habitation.gouv.qc.ca/english.html.

Facebook: SocietehabitationQuebec

X: HabitationSHQ

LinkedIn: LinkedIn

About the SHDM

The SHDM is a non-profit paramunicipal corporation that contributes to Montréal’s social and economic vitality by developing, managing and enhancing residential, institutional and cultural real estate assets. As the real estate arm of the City of Montréal, it plays a key role in creating and maintaining affordable and sustainable communities through the responsible management of its housing stock of over 5,000 units.

www.shdm.org/en

About Chez Doris

Founded in 1977 as a day shelter for women in difficulty, Chez Doris has grown to serve more than 1,500 vulnerable women every year, providing them with comprehensive support in a spirit of inclusion and respect. In addition to meals, Chez Doris provides clothing, financial management support, medical services, an overnight shelter and access to various housing solutions, including permanent residences. Chez Doris’s mission is to support and empower all women in precarious situations so that they can reach their full potential. We do this by offering a broad range of services in safe spaces where they can find non-judgmental help and personal comfort.

Source: City of Montréal

SOURCE Canada Mortgage and Housing Corporation (CMHC)

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/06/c4229.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/06/c4229.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gov. Newsom's Total Ban On Hemp THC Could Crush California's Billion-Dollar Industry, Say Stakeholders (UPDATED)

Editor’s note: This story has been updated to include reactions from California hemp industry stakeholders.

California Governor Gavin Newsom made a sudden move on Friday, proposing emergency regulations that would completely ban THC, the intoxicating compound found in cannabis, from all hemp products in the state.

The proposed regulations, released by the California Department of Public Health, would require that all industrial hemp food, beverage and dietary supplements produced for human consumption would need to be free of THC and other cannabinoids, reported the Hill.

Hemp products, which are essentially unregulated, can be easily bought online or at places like gas stations or convenience stores throughout the state. Newsom said in a statement that the emergency rules were necessary to protect children.

“We will not sit on our hands as drug peddlers target our children with dangerous and unregulated hemp products containing THC at our retail stores. We’re taking action to close loopholes and increase enforcement to prevent children from accessing these dangerous hemp and cannabis products,” Newsom said.

In addition to requiring that all hemp products in California have “no detectable amount of total THC,” the governor and health officials want customers be over 21 to purchase the products. The rules still need the approval of the California Office of Administrative Law before they go into effect, according to the outlet.

Industry Stakeholders Quick To Respond

“Today’s ’emergency action’ by Governor Newsom is a betrayal of California hemp farmers, small businesses, and adult consumers,” the Hemp Roudtable told Benzinga. “After having supported AB 45, which created a sound regulatory framework for the manufacture and sale of hemp products, Newsom’s Administration fell on the job and failed to take any steps to enforce it.”

The Roundtable took the governor to task for not establishing policies to keep intoxicating products away from children rather than punishing the entire industry. “And in the middle of massive California budget deficits, he is unnecessarily throwing away nearly a quarter billion dollars in tax revenue from legitimate small businesses.”

The Hemp Roundtable vowed to explore all legal options in the coming days “with California hemp farmers and businesses that comprise the multi-billion-dollar industry that this action would destroy.”

Case Mandel, CEO of Cannadips, also spoke out. “This will destroy our business,” Mandel told Benzinga. He explained that even though most Cannadips’ products are THC-free, they come in packages of 15 servings, which would make them illegal under the new rules, which require packages be limited to just five servings.

“This will also attack the full-spectrum CBD industry that has provided high-quality products that people rely on in the state of California,” Mandel said. “We can understand passing laws that affect what can be sold in CA. What we don’t understand is why they affect what can be manufactured and sold legally nationwide. We ask that Gavin Newsom wises up and looks for legislation that actually represents his objectives, not private interests.”

Read Gov. Newsom’s press release for more details and draft regulations.

Photo: Benzinga edit with images by Bureau of Reclamation via Wikimedia Commons and Rob Warner on Unsplash

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Palantir, Dell Among New S&P 500 Members as Index Rebalances

(Bloomberg) — Palantir Technologies Inc. (PLTR), Dell Technologies Inc (DELL). and Erie Indemnity Co. (ERIE) are set to join the S&P 500 as part of its latest quarterly weighting change.

Most Read from Bloomberg

The companies will replace American Airlines Group Inc., Etsy Inc. and Bio-Rad Laboratories Inc., according to a press release from S&P Dow Jones Indices Friday. The changes are set to go into effect prior to the open of trading on Sept. 23.

The additions of Palantir and Dell reflect how technology companies, and artificial intelligence-related names in particular, are reshaping the market. Palantir, the data-analysis software company co-founded by billionaire tech investor Peter Thiel, has grown from serving the US intelligence community to working with dozens of government agencies, and more recently expanding its commercial business.

Shares of the Denver-based company have risen over 75% this year as investors bet the software and surveillance firm will benefit from growing demand for its AI tools. Shares jumped as much as 8.4% in after-hours trading Friday.

Dell, the Round Rock, Texas-based company best know for personal computers and monitors, reported better-than-expected revenue last week as a result of an increase in sales of servers built for handling AI workloads.

Shares of the hardware giant jumped as much as 8.7% after the bell, while insurance company Erie Indemnity rose as much as 5.5%.

Companies must have a market capitalization of at least $18 billion and meet profitability, liquidity and share-float standards to qualify for the S&P 500, per August’s methodology.

Meanwhile, the removal of American Airlines from the US equity benchmark underscores the challenges the industry has faced of late, including delayed deliveries of planes and rising labor costs. The air carrier slashed its profit outlook in July after expectations for domestic demand proved too rosy. Its shares dropped 0.8% Friday post-market, adding to a 21% year-to-date decline.

Inclusion in the US equity benchmark can elevate a company’s profile and is becoming more important as passive investment funds grow. Expulsion from the benchmark can weigh on stock prices, as index funds sell shares to realign with the S&P 500’s new composition.

From June: KKR, CrowdStrike and GoDaddy to Join S&P 500 as Index Rebalances

—With assistance from Isabelle Lee.

(Updates with additional details throughout)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

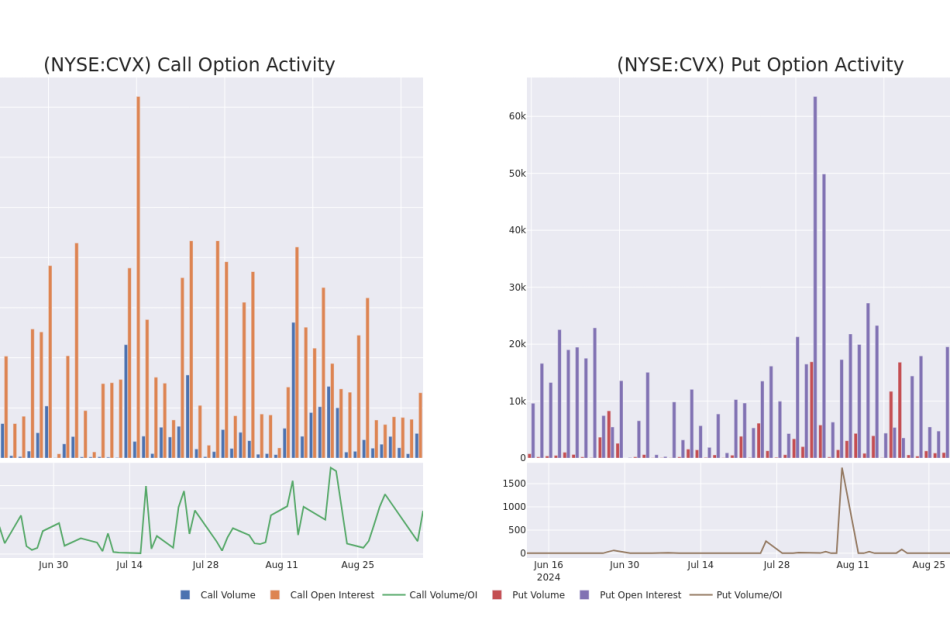

Decoding Chevron's Options Activity: What's the Big Picture?

Investors with a lot of money to spend have taken a bullish stance on Chevron CVX.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with CVX, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 28 uncommon options trades for Chevron.

This isn’t normal.

The overall sentiment of these big-money traders is split between 35% bullish and 28%, bearish.

Out of all of the special options we uncovered, 18 are puts, for a total amount of $1,626,319, and 10 are calls, for a total amount of $472,975.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $120.0 to $160.0 for Chevron during the past quarter.

Volume & Open Interest Trends

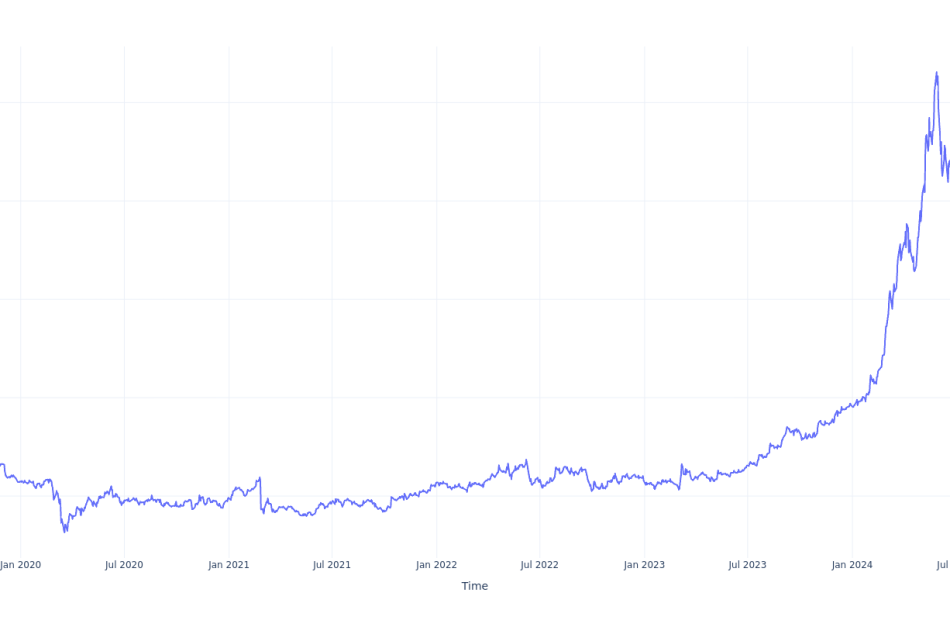

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Chevron’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Chevron’s whale trades within a strike price range from $120.0 to $160.0 in the last 30 days.

Chevron 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVX | PUT | SWEEP | BULLISH | 03/21/25 | $18.75 | $18.5 | $18.6 | $155.00 | $185.8K | 770 | 492 |

| CVX | PUT | SWEEP | BULLISH | 03/21/25 | $18.75 | $18.5 | $18.57 | $155.00 | $185.7K | 770 | 695 |

| CVX | PUT | SWEEP | BULLISH | 03/21/25 | $18.75 | $18.5 | $18.57 | $155.00 | $185.7K | 770 | 695 |

| CVX | PUT | SWEEP | BULLISH | 03/21/25 | $18.7 | $18.5 | $18.56 | $155.00 | $185.7K | 770 | 695 |

| CVX | PUT | SWEEP | BULLISH | 09/20/24 | $11.0 | $10.85 | $10.9 | $150.00 | $98.1K | 4.8K | 170 |

About Chevron

Chevron is an integrated energy company with exploration, production, and refining operations worldwide. It is the second-largest oil company in the United States with production of 3.1 million of barrels of oil equivalent a day, including 7.7 million cubic feet a day of natural gas and 1.8 million of barrels of liquids a day. Production activities take place in North America, South America, Europe, Africa, Asia, and Australia. Its refineries are in the US and Asia for total refining capacity of 1.8 million barrels of oil a day. Proven reserves at year-end 2023 stood at 11.1 billion barrels of oil equivalent, including 6.0 billion barrels of liquids and 30.4 trillion cubic feet of natural gas.

After a thorough review of the options trading surrounding Chevron, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Chevron’s Current Market Status

- With a volume of 7,804,635, the price of CVX is down -1.62% at $138.64.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 49 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Chevron, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: Kimco Realty Corp.

Summary

Kimco is a last-mile real estate investment trust specializing in the acquisition, development, and management of open-air shopping centers. The company’s portfolio consists of 567 U.S. shopping centers and mixed-use assets. Prior to the 1Q24 merger, New York and California accounted for about 28% of all properties.

Currently, about 80% of annual base rents come from the REIT’s top 18 metropolitan markets. Approximately 87% of GLA is leased to anchor stores and current anchor occupancy is 98%. Anchor stores also include discount clothing retailers, and T.J Maxx is the company’s top tenant, accounting for less than 4% of GLA. The REIT’s largest grocery tenant is Amazon/Whole Foods with 32 locations.

The company recognizes the value of multi-use retail destinations that include smaller tenants, and has maintained relationships with fast-food and coffee retailers. It has shopping centers in 39 states, with a focus on the last-mile suburbs of major metro coastal markets, as well as Sunbelt locations. In August 2021, it purchased Weingarten Realty for approximately $3.9 billion, becoming the largest grocery-anchored shopping REIT by market capitalization. The acquisition also gave the company a presence in Texas. In January, Kimco purchased RPT Realty in an al

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

Big Lots prepares bankruptcy filing with plans to sell stores, Bloomberg News reports

(Reuters) – Discount home goods retailer Big Lots is preparing to file for bankruptcy as early as this Sunday and plans to sell its chain of stores through a court-supervised process, Bloomberg News reported on Friday, citing people familiar with the situation.

The company will remain in operation under Chapter 11 protection, the report said, and is currently in the process of securing a stalking horse bid, which means that the bid could be outdone if better offers emerge.

Earlier in the day, the retailer announced the postponement of its second-quarter earnings release, which had been scheduled for Sept. 6. The company now expects to report results on Sept. 12.

The company has been collaborating with advisers from AlixPartners and Guggenheim Partners on the bankruptcy and sale process, according to the report.

Big Lots, a retailer operating around 1,400 stores and employing over 30,000 workers, has been grappling with declining sales over the past few quarters, putting pressure on its balance sheet.

Its stock has plunged more than 90% in the past year and dropped more than 22% in extended trading on Friday.

Last week, Bloomberg reported that Big Lots was mulling a potential bankruptcy filing and may seek court protection within the coming weeks.

The company did not immediately respond to a Reuters’ request for comment.

(Reporting by Savyata Mishra in Bengaluru; Editing by Mohammed Safi Shamsi)

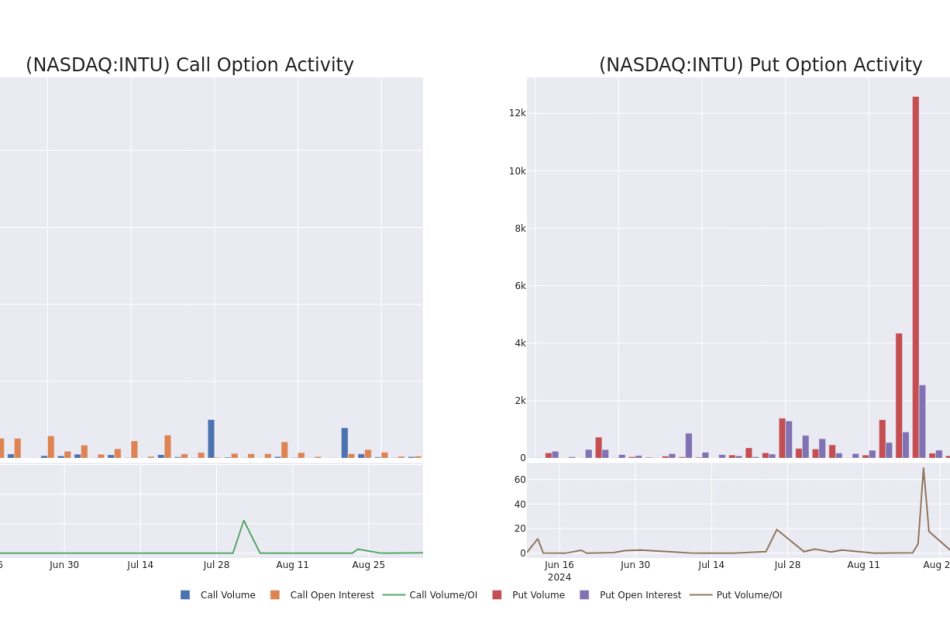

Intuit's Options: A Look at What the Big Money is Thinking

Whales with a lot of money to spend have taken a noticeably bearish stance on Intuit.

Looking at options history for Intuit INTU we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 18% of the investors opened trades with bullish expectations and 27% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $55,200 and 9, calls, for a total amount of $258,250.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $590.0 to $640.0 for Intuit during the past quarter.

Volume & Open Interest Development

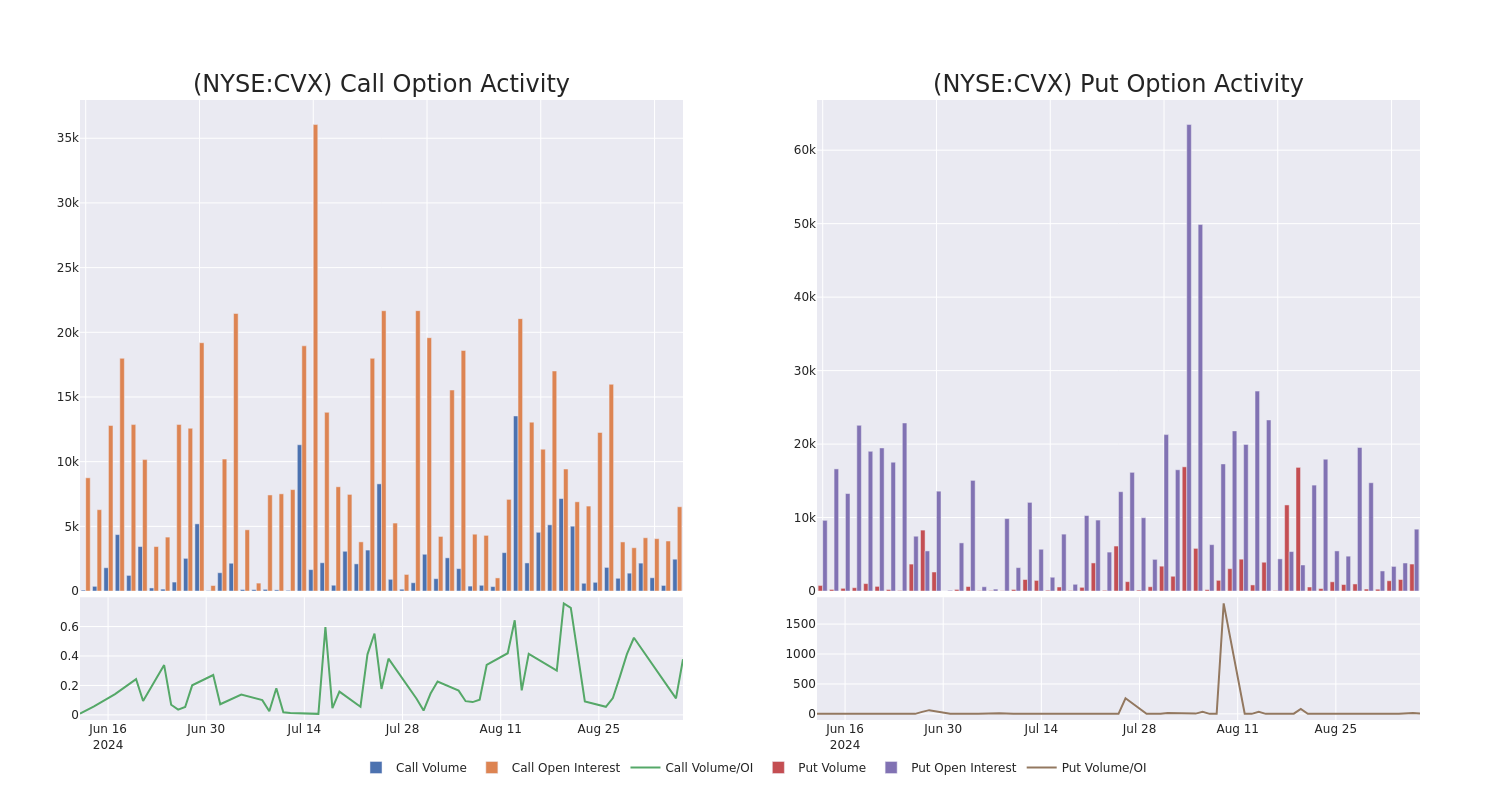

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Intuit’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Intuit’s substantial trades, within a strike price spectrum from $590.0 to $640.0 over the preceding 30 days.

Intuit Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTU | CALL | TRADE | NEUTRAL | 06/20/25 | $68.4 | $65.4 | $66.7 | $640.00 | $33.3K | 852 | 28 |

| INTU | CALL | TRADE | NEUTRAL | 06/20/25 | $69.7 | $63.2 | $66.2 | $640.00 | $33.1K | 852 | 5 |

| INTU | CALL | TRADE | NEUTRAL | 06/20/25 | $68.3 | $63.6 | $65.6 | $640.00 | $32.8K | 852 | 43 |

| INTU | PUT | TRADE | NEUTRAL | 12/20/24 | $30.6 | $29.4 | $30.0 | $600.00 | $30.0K | 204 | 11 |

| INTU | CALL | TRADE | NEUTRAL | 06/20/25 | $68.9 | $65.3 | $66.9 | $640.00 | $26.7K | 852 | 23 |

About Intuit

Intuit is a provider of small-business accounting software (QuickBooks), personal tax solutions (TurboTax), and professional tax offerings (Lacerte). Founded in the mid-1980s, Intuit controls the majority of US market share for small-business accounting and do-it-yourself tax-filing software.

Having examined the options trading patterns of Intuit, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Intuit

- Currently trading with a volume of 980,452, the INTU’s price is down by -0.99%, now at $615.33.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 81 days.

What The Experts Say On Intuit

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $734.4.

- An analyst from Barclays has decided to maintain their Overweight rating on Intuit, which currently sits at a price target of $740.

- An analyst from JP Morgan has decided to maintain their Neutral rating on Intuit, which currently sits at a price target of $600.

- An analyst from Susquehanna has decided to maintain their Positive rating on Intuit, which currently sits at a price target of $757.

- Maintaining their stance, an analyst from Stifel continues to hold a Buy rating for Intuit, targeting a price of $795.

- Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Intuit with a target price of $780.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Intuit options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Industrial Silica Market Size on Track to Surpass USD 18.4 Billion by 2034 with 4.3% CAGR Expansion| Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc., Sept. 06, 2024 (GLOBE NEWSWIRE) — The industrial silica market (산업용 실리카 시장) was worth US$11.6 billion in 2023. The market is expected to reach US$ 18.4 billion by 2034, progressing at a CAGR of 4.3%. Artificial intelligence will continue to be integrated into silica production to improve efficiency and automation and meet market demands.

As automation and AI technology increasingly drive operational improvements and meet market demands, this trend reflects the broader impact of AI on industrial manufacturing processes.

Electronics, automotive, construction, and the automotive industry will continue to need high-quality silica for their production processes. The extraction and purification methods of silica need to be improved even further to enable advanced manufacturing processes.

Photovoltaic cells, one of the main components of renewable energy, are made from silica. Solar power is one of the most environmentally friendly sources of energy.

As the world moves more and more toward renewable energy sources, there will be an increase in the need for industrial silica. Solar panel technology is constantly evolving, and new developments can require more specific silica, resulting in more research and development.

Gain Valuable Insights from Industry Experts to Shape Your Growth Strategies. Access our Sample PDF Report Now! https://www.transparencymarketresearch.com/industrial-silica-sands-market.html

Key Findings of the Market Report

● In order to fuel industrial silica with oil or gas, unconventional methods are required.

● Concrete’s durability is boosting the market for industrial silica

- A large share of the market in 2023 was dominated by fiberglass.

- In 2023, Asia Pacific dominated the industrial silica market.

Global Industrial Silica Market: Growth Drivers

- The use of silica in tires and other car parts is thought to increase the lifespan and fuel efficiency of vehicles. A wide variety of industries, such as electronics, chemicals, and coatings, use industrial silica continuously for research and development. Technology also facilitates the development of more effective methods for extraction and processing, which boost markets.

- Numerous industries have seen a movement toward eco-friendly products as a result of regulatory actions meant to reduce environmental damage. A growing number of sustainable alternatives, including coatings, paints, and adhesives, are using industrial silica, especially in colloidal form.

- Industrial silica is used in the oil and gas industry’s hydraulic fracturing (fracking) procedures to increase well production rates. The need for industrial silica used in the fracturing process will always be high as long as oil and gas development is going on, especially in unconventional reservoirs like shale formations.

- Due to its absorption and abrasive properties, industrial silica is used in medicines, cosmetics, and personal hygiene products. As a result of the increased demand for personal hygiene products and wellness products, the demand for industrial silica is increasing.

Global Industrial Silica Market: Regional Landscape

- The industrial silica market is expected to grow at a faster rate in Asia Pacific. As the Asia Pacific region urbanizes and develops its infrastructure, especially in countries like China, India, and Southeast Asia, infrastructure is being rapidly built. As the construction sector continues to grow, industrial silica production will increase, which will lead to an increase in demand for ceramics, glass, and concrete.

- Electronics production is dominated by nations such as South Korea, Taiwan, and China in the Asia-Pacific. A variety of electronic components are manufactured with industrial silica, including semiconductors, display panels, and other components.

- Consumption of consumer electronics is increasing the demand for industrial silica. Governments in the Asia-Pacific area are implementing stricter environmental laws in an effort to combat pollution and advance sustainable development. Various sectors, including electronics, automotive, and construction, benefit from the use of environmentally friendly materials.

- The Asia-Pacific region, particularly China and India, is investing heavily in oil and gas exploration to meet their expanding energy needs. Industrial silica is used in hydraulic fracturing processes to enhance oil and gas extraction from unconventional deposits.

- As a result of these exploration efforts, the region’s need for industrial silica is increasing. Asia-Pacific nations are making research and development investments to advance technical progress in various fields. Nanotechnology, innovative materials, and coatings are among the industries where industrial silica is finding new uses.

Global Industrial Silica Market: Competitive Landscape

To gain a strong foothold in the silica compounds market, companies in the global industrial silica industry are developing new products and expanding their manufacturing plants.

Key Players Profiled

- Premier Silica LLC

- International Silica Industries

- U.S. Silica

- SIL Industrial Minerals

- Adwan Chemical Industries

- Delmon Group

- Opta Group LP

- Asamco Group

- Saudi Emirates Pulverization Industries Company (SEPICO)

- Al-Rushaid Group

- FINETON

- Short Mountain Silica Co.

- AGSCO Corp

Key Developments

- In November 2023, U.S. Silica Holdings, Inc. informed stockholders that it raised prices for most of its non-contracted silica, perlite, diatomaceous earth, aplite, clay, and cellulose products used primarily in foundry, glass, filtration, paints, elastomers, coatings, roofing, chemicals, building products, recreation, renewable diesel, industrial oil, and other applications.

- Depending on the grade and product, price increases are up to 20% and will take effect for shipments to begin. As labor, transportation, material, and manufacturing costs continue to increase, price increases are necessary to offset their impacts.

Enhance Your Business Now! Acquire Vital Market Insights – Access the Report Now! https://www.transparencymarketresearch.com/checkout.php?rep_id=13502<ype=S

Global Industrial Silica Market: Segmentation

Application

- Sodium Silicate

- Fiberglass

- Cultured Marble

- Additive (Paints, etc.)

- Reinforcing Filler (Plastics, Rubber, etc.)

- Foundry Work (Metal Alloy, etc.)

- Ceramic Frits & Glaze

- Oilwell Cement

- Glass & Clay Production

- Others (Pharmaceutical)

Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Explore wide-ranging Coverage of TMR’s Chemicals and Materials Market Insights Landscape

- Braze Alloys Market – The global market for braze alloys (브레이징 합금 시장) was valued at US$ 2.5 billion in 2022. A CAGR of 4.3% is expected from 2023 to 2031. The market is expected to reach US$ 3.2 billion by 2031. Advances in brazing technology, including improved alloys, should lead to further market growth. As brazed joints become more efficient, stronger, and environmentally friendly, their adoption may increase.

- Aluminum Castings Market – The global aluminum castings market (알루미늄 주물 시장) is expected to grow at a CAGR of 6.6% from 2024 to 2034 and reach US$ 83.4 Billion by the end of 2034.

- Industrial Hand Tools Market – The global industrial hand tools market (산업용 수공구 시장) is estimated to grow at a CAGR of 4.3% from 2023 to 2031 and reach US$ 34.5 Billion by the end of 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's How Much $1000 Invested In Vistra 5 Years Ago Would Be Worth Today

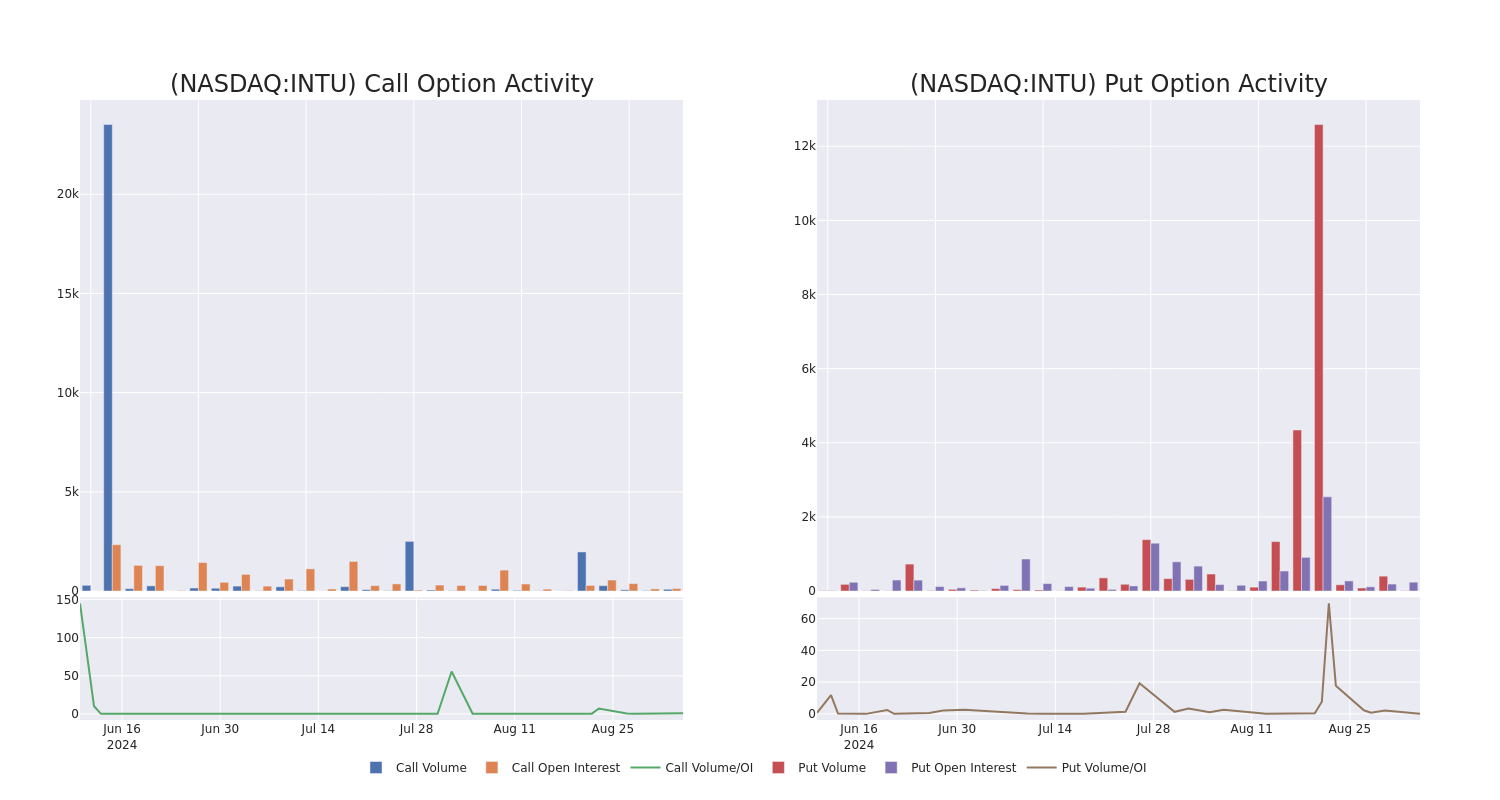

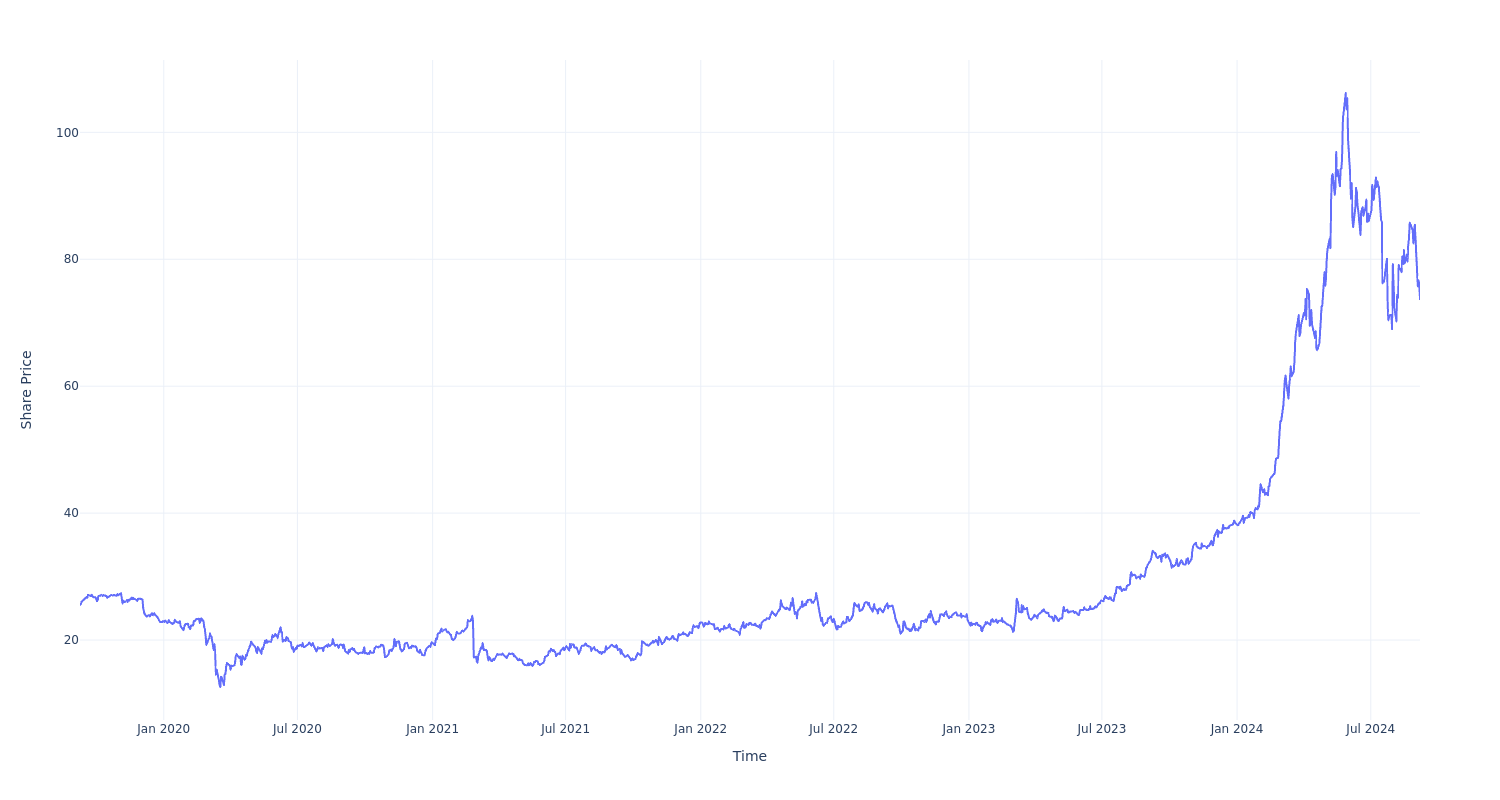

Vistra VST has outperformed the market over the past 5 years by 10.9% on an annualized basis producing an average annual return of 23.53%. Currently, Vistra has a market capitalization of $25.29 billion.

Buying $1000 In VST: If an investor had bought $1000 of VST stock 5 years ago, it would be worth $2,884.54 today based on a price of $73.60 for VST at the time of writing.

Vistra’s Performance Over Last 5 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.