Nike Unusual Options Activity For September 06

Whales with a lot of money to spend have taken a noticeably bullish stance on Nike.

Looking at options history for Nike NKE we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 57% of the investors opened trades with bullish expectations and 28% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $335,365 and 8, calls, for a total amount of $581,526.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $50.0 and $97.5 for Nike, spanning the last three months.

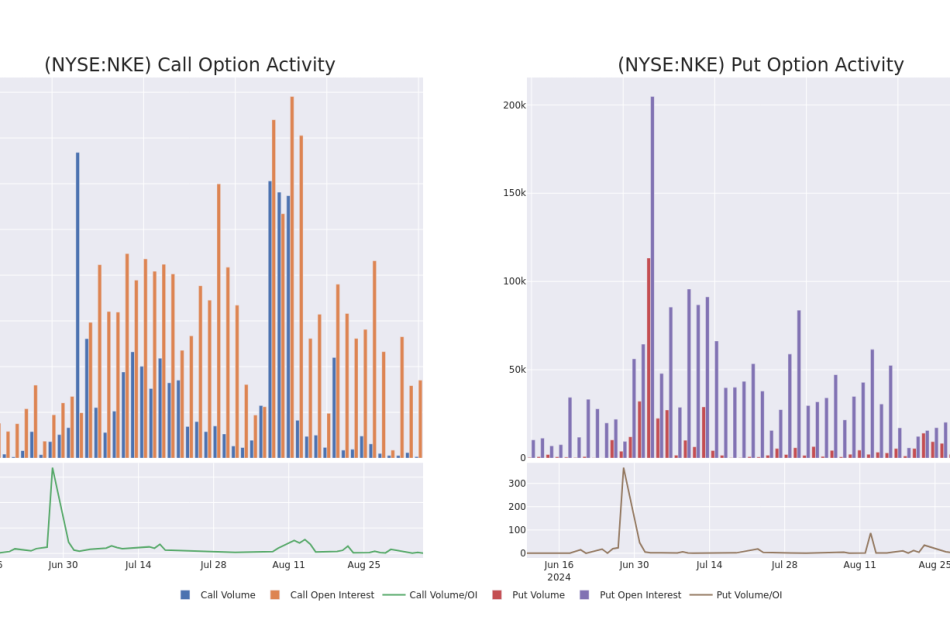

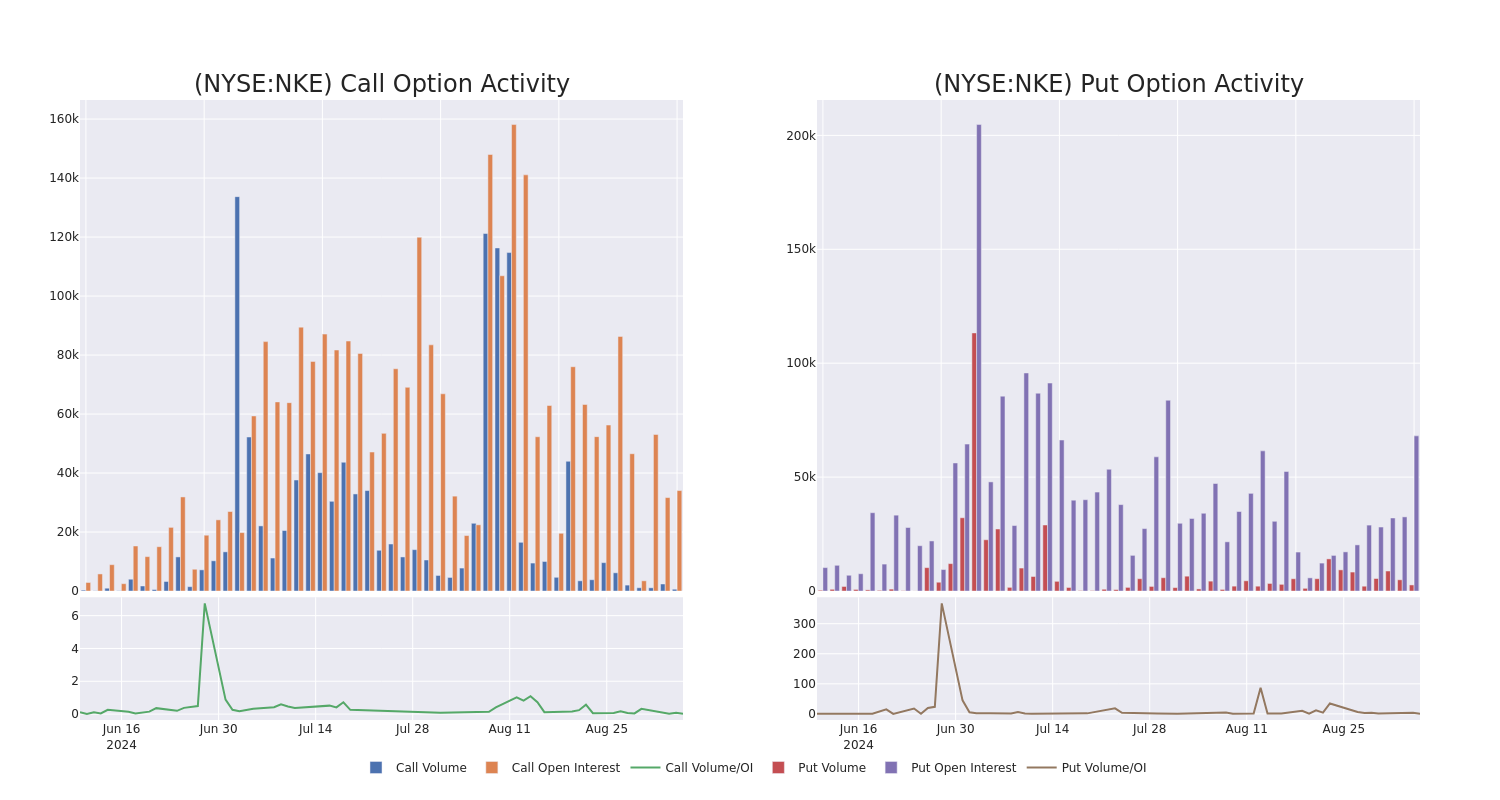

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Nike’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Nike’s significant trades, within a strike price range of $50.0 to $97.5, over the past month.

Nike Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NKE | CALL | SWEEP | BEARISH | 03/21/25 | $8.05 | $7.95 | $7.95 | $82.50 | $185.2K | 496 | 246 |

| NKE | CALL | SWEEP | BULLISH | 09/06/24 | $3.7 | $3.65 | $3.7 | $78.00 | $185.0K | 530 | 502 |

| NKE | PUT | SWEEP | BULLISH | 12/20/24 | $12.7 | $12.55 | $12.55 | $92.50 | $183.2K | 1.3K | 149 |

| NKE | CALL | TRADE | BULLISH | 10/18/24 | $2.69 | $2.64 | $2.69 | $85.00 | $52.1K | 8.3K | 449 |

| NKE | PUT | SWEEP | BEARISH | 11/15/24 | $2.27 | $2.2 | $2.27 | $75.00 | $34.0K | 4.8K | 156 |

About Nike

Nike is the largest athletic footwear and apparel brand in the world. Key categories include basketball, running, and football (soccer). Footwear generates about two thirds of its sales. Its brands include Nike, Jordan (premium athletic footwear and clothing), and Converse (casual footwear). Nike sells products worldwide through company-owned stores, franchised stores, and third-party retailers. The firm also operates e-commerce platforms in more than 40 countries. Nearly all its production is outsourced to contract manufacturers in more than 30 countries. Nike was founded in 1964 and is based in Beaverton, Oregon.

Nike’s Current Market Status

- Trading volume stands at 8,502,745, with NKE’s price down by -0.25%, positioned at $80.63.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 25 days.

What The Experts Say On Nike

3 market experts have recently issued ratings for this stock, with a consensus target price of $84.0.

- In a positive move, an analyst from Williams Trading has upgraded their rating to Buy and adjusted the price target to $93.

- An analyst from Stifel has decided to maintain their Hold rating on Nike, which currently sits at a price target of $79.

- An analyst from Piper Sandler has revised its rating downward to Neutral, adjusting the price target to $80.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Nike with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Project 2025: Will the rich ever pay tax again?

There’s pretty much nothing to like about Project 2025’s dystopian vision for America. Whether it’s the elimination of abortion rights or the elimination of the Department of Education, it’s all horrifying. Here’s just one of the many appalling declarations in Project 2025: “Our Constitution grants each of us the liberty to do not what we want, but what we ought.”

Given the radical overall thrust of Project 2025, it’s easy to lose sight of its more mundane contents, like its tax agenda. But the tax proposals of Project 2025, if ever enacted, would be no less dangerous to our happiness and well-being than the restrictions on individual freedom. They would practically guarantee the concentration of the country’s wealth in the hands of a group of billionaires and trillionaires who would be insulated from meaningful federal taxation. The resulting concentration of political power would destroy whatever is left of our democracy, clearing the way for the imposition of Project 2025’s extreme social agenda.

The most often discussed tax proposals of Project 2025—reducing the corporate tax rate to 18% or less, the individual income tax rate to 30%, the tax rate on dividends and capital gains to 15%, and the maximum estate tax rate to 20%—all obviously move us in that direction.

But a Project 2025 proposal that is receiving much less public attention, Universal Savings Accounts (USA), could do far more damage.

On the surface, Project 2025’s USA proposal seems like just one more misguided retirement savings incentive that favors the rich. It would allow any taxpayer to contribute up to $15,000 of after-tax earnings to a USA.

Functionally, USAs would be similar to Roth IRAs. A contribution to a USA, like a contribution to a Roth IRA, would not by itself reduce a person’s tax liability. And, as is the case with a Roth IRA, all the earnings of a USA would escape tax.

But USAs would not function merely as larger Roth IRAs. Their tax avoidance potential would be infinitely greater. They would have the potential to exempt multi-billion dollar gains, even trillion-dollar gains, from taxation.

Investigative journalists have shown that some of America’s wealthiest billionaires have gigantic Roth IRAs. But these big names grew their Roth IRA fortunes, at least technically, by savvy investing. And that’s where the tax avoidance potential of USAs will be far greater. The Project 2025 white paper calls for USAs to be “highly flexible and for taxpayers to be able to invest their USAs as they see fit, including, for example, in a closely held business.” Current rules applicable to Roth IRAs make investing in a closely held business virtually impossible, except as a purely passive investor.

That’s a huge difference. If USA holders are able to invest in their own closely held businesses, as Project 2025 contemplates, the potential income tax avoidance is unlimited. After all, although $15,000 is not a lot of money, it’s enough, and certainly, several years of $15,000 deposits into a USA are enough to start a business in one’s garage. This means that the growth of a garage-based business could be shielded entirely from federal income tax.

The list of businesses that started in the founder’s garage include, to name a few, Disney, Mattel, Microsoft, Amazon, Dell, and Google. Subway started as a single small shop and grew to its current size of approximately 37,000 locations. Had USAs been available to the founders of those now enormous companies, several of which now have market capitalizations in the trillions of dollars, the bulk of their lifetime gains would be entirely exempt from federal income tax.

Here’s how it would work: When the next Bill Gates or Jeff Bezos conceives an idea for a business, they will create a corporation by simply submitting documents to a state government office. The corporation’s value initially will be zero. Then, our future billionaire (or trillionaire) will cause the corporation to issue stock to their tax-free USA in exchange for the modest seed capital needed to start the business. The corporation then can borrow money, issue more stock to outside investors, and hire employees. Eventually, our future mogul will be sitting on a stupefying fortune, all held in a USA, and all entirely exempt from income tax.

The bottom line here is that Project 2025 would have the founders of future mega businesses that start small—and pretty much every business starts small—paying little or no tax on what could be a trillion dollars or more of income over the course of a lifetime. The resulting concentration of the country’s wealth will dwarf even the Gilded Age-like level of wealth concentration that exists today.

More must-read commentary published by Fortune:

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

This story was originally featured on Fortune.com

High Temperature Polyamides Market to Reach $4.1 Billion by 2030 | CAGR 5.5 %: AMR

Wilmington, Delaware , Sept. 06, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “High Temperature Polyamides Market by Type (Polyamide 6, Polyamide 6-6 and Others), Application (Fiber and Films, Engineering Plastics and Others), and End-Use Industry (Automotive, Textile, Consumer Goods, Electrical and Electronics, Construction and Others) : Global Opportunity Analysis and Industry Forecast, 2024-2030″. According to the report, the high temperature polyamides market was valued at $2.8 billion in 2023, and is estimated to reach $4.1 billion by 2030, growing at a CAGR of 5.5% from 2024 to 2030.

Prime determinants of High temperature polyamides Market growth

The global high temperature polyamides market is experiencing growth due to several factors such as an increase in demand for PA-6, and PA 6-6 in the electrical and electronics industry, an increase in demand for electric vehicles, and advancements in technology related to synthetic polyamides. However, fluctuating crude oil prices hinder market growth. Moreover, the favorable government policies encouraging electric vehicles in emerging markets are expected to provide opportunities for high temperature polyamides market growth.

Download Sample Pages of Research Overview: https://www.alliedmarketresearch.com/request-sample/A142041

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2030 |

| Base Year | 2023 |

| Market Size in 2023 | $2.8 billion |

| Market Size in 2033 | $4.7 billion |

| CAGR | 5.4% |

| No. of Pages in Report | 300 |

| Segments Covered | Type, Application, End-Use Industry, and Region |

| Drivers | Increase in demand for PA-6 in the electrical and electronics sector Increase in demand for electric vehicles |

| Opportunity | Favorable government policies encouraging electric vehicles |

| Restraint | Change in crude oil prices |

The PA66 segment is expected to grow faster than PA6 throughout the forecast period.

By type, the PA6 type high temperature polyamides dominate the market due to a surge in infrastructure projects, especially in emerging countries. Furthermore, the increase in the investment of developed and developing countries towards the construction of smart cities is driving the demand for electronic equipment, which has a positive impact on market growth. However, by 2033, the other type of polyamides is projected to grow faster due to technological advancements, increased demand for electronic devices and electric vehicles, and stricter safety regulations concerning short-circuits due to heat.

The motors and generators segment is expected to grow faster throughout the forecast period.

By application, fibers & film applications emerged as the dominant segment in the high temperature polyamides market in 2023, as there is a huge demand for fibers and film-based applications of polyamide in the textile and packaging industry. This trend is fueled by the demand for high-quality packaging from the food service sector and the demand for high-quality fibers in the textile industry for customized clothing. However, the motors and generators segment of the high temperature polyamides market is projected to grow rapidly due to increased demand driven by global electrification efforts and advancements in motor and generator technology. High temperature polyamides play a crucial role in ensuring the safety and reliability of consumer goods contributing to their dominance in their respective market segments.

Procure Complete Report (300 Pages PDF with Insights, Charts, Tables, and Figures) @ https://www.alliedmarketresearch.com/checkout-final/high-temperature-polyamides-market

The consumer goods segment is expected to grow faster throughout the forecast period.

By end-use industry, the automotive industry emerged as the dominant segment in the high temperature polyamides market in 2023. The demand for polyamide has increased in automobile engineering; automobiles parts such as fans, radiators, fuel tanks, speedometer gears, oil filtering houses, fuel tank, and others, are manufactured with the use of polyamide. Polyamide is the fast metal substitute in the automotive industry due to the ease of molding and mass production, hence there is an increase in the demand for polyamide creating new opportunities for the growth of the high temperature polyamide market. However, the consumer goods industry is expected to be the fastest growing market by 2033. Rise in demand for consumer goods such as kitchen appliances, sports items, artificial printed jewelry, leisure equipment, carpets, batteries, and others, is expected to drive the growth of the polyamide market during the forecast period.

North America is expected to dominate the market by 2033.

By region, North America’s dominated the high temperature polyamides market in 2023. In terms of consumer appliances and other electronic items, North America is one of the most technologically sophisticated regions in the world. The electrical and electronics segment in North America has seen tremendous growth as a result of recent breakthroughs. The expansion of this area is expected to boost the demand for polyamides. Furthermore, the rise in automotive sector in Mexico, as well as the increase in requirement in North America for vehicle weight reduction, has resulted in an increase in polyamide demand. However, by 2033, the LAMEA region is expected to emerge as the fastest-growing market. To accommodate the growing number of tourists, Saudi Arabia is witnessing growth in the building of hotels, recreational facilities, and other public infrastructure. Furthermore, government programs such as Saudi Arabia Vision 2030 are expected to promote a large increase in commercial construction activities in the future years.

Want to Access the Statistical Data and Graphs, Key Players’ Strategies: https://www.alliedmarketresearch.com/high-temperature-polyamides-market/purchase-options

Leading Market Players: –

- Koninklijke DSM N.V.

- Asahi Kasei Corporation

- Evonik Industries AG

- Dupont

- BASF SE

- Honeywell International Inc.

- Celanese Corporation

- LANXESS

- Gujarat State Fertilizers & Chemicals Limited

- Mitsubishi Chemical Holdings,

The report provides a detailed analysis of these key players in the high temperature polyamides market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others, to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog: https://blog.alliedmarketresearch.com

Blog: https://www.newsguards.com/

Follow Us on | Facebook | LinkedIn | YouTube |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Major Exercise Alert: Nicholas M. Westfall Exercises Options Worth $1.56M At Chemed

In a new SEC filing on September 6, it was revealed that Westfall, Executive Vice President at Chemed CHE, executed a significant exercise of company stock options.

What Happened: Westfall, Executive Vice President at Chemed, made a strategic move by exercising stock options for 15,333 shares of CHE as detailed in a Form 4 filing on Friday with the U.S. Securities and Exchange Commission. The transaction value amounted to $1,564,885.

The latest update on Friday morning shows Chemed shares down by 0.0%, trading at $573.8. At this price, Westfall’s 15,333 shares are worth $1,564,885.

About Chemed

Chemed Corp operates subsidiaries in two main segments: VITAS and Roto-Rooter. The VITAS segment generates the majority of the firm’s revenue. It provides hospice and palliative care services to patients with terminal illnesses through a network of physicians, registered nurses, home health aides, social workers, and volunteers. The vast majority of the segment’s revenue is received from the Medicare and Medicaid reimbursement programs. The Roto-Rooter segment provides plumbing, drain cleaning, water restoration, and related services to residential and commercial customers. Chemed generates the majority of its revenue from business in the United States.

Financial Insights: Chemed

Revenue Growth: Chemed’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 7.6%. This indicates a substantial increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Analyzing Profitability Metrics:

-

Gross Margin: The company sets a benchmark with a high gross margin of 34.59%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 4.7, Chemed showcases strong earnings per share.

Debt Management: Chemed’s debt-to-equity ratio is below the industry average. With a ratio of 0.12, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Valuation Metrics:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 29.08, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 3.75 is above industry norms, reflecting an elevated valuation for Chemed’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 18.9, Chemed’s EV/EBITDA ratio reflects a below-par valuation compared to industry averages signalling undervaluation

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Impact of Insider Transactions on Investments

Considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Transaction Codes Worth Your Attention

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Chemed’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

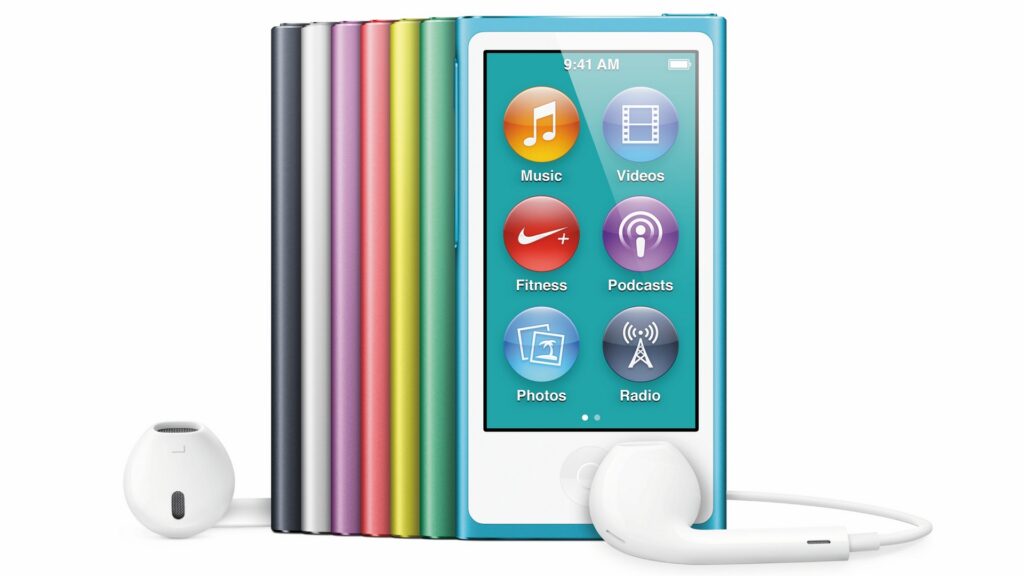

Apple Launched iPod Nano 19 Years Ago: If You Invested $1000 In Apple Stock When Steve Jobs Revealed His Vision For Music, Here's How Much You'd Have

19 years ago, on Sept. 7, legendary Apple Inc.’s AAPL co-founder and former CEO Steve Jobs made a move that would revolutionize the music industry and set Cupertino on a path to becoming the tech giant it is today.

He unveiled the iPod Nano – a sleek, compact music player that captured the imagination of consumers and investors alike. The product was launched four years after the original iPod.

But what if, instead of rushing to buy the latest gadget, you had invested in Apple stock? Let’s crunch the numbers and see how that $1000 would have fared.

First, let’s take a look at the iPod Nano’s journey:

The iPod Nano debuted as a replacement for the iPod Mini. It was notable for its flash storage, which made it smaller and more durable than its predecessors. Available in 2GB and 4GB models, it could hold up to 500 and 1,000 songs, respectively, and weighed 1.5 ounces.

The launch was famously presented by Jobs, who referred to the tiny watch pocket in his jeans and asked, “Ever wonder what this pocket is for?” He then showed the device.

In a press release shared by Apple, Jobs said, “iPod nano is the biggest revolution since the original iPod,” adding, “iPod nano is a full-featured iPod in an impossibly small size, and it’s going to change the rules for the entire portable music market.”

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

On July 27, 2017, in a low-key move without much fanfare, Apple quietly phased out these two iconic iPods from their product range — the iPod Nano and iPod Shuffle.

The iPod Nano was available for nearly 12 years and underwent seven distinct redesigns during its lifespan.

Its design evolved significantly over the years, with various iterations showcasing a range of colors, an integrated video camera, and a clip that appeared one year and was removed the next.

The design also shifted from tall and slim one year to short and compact the following year.

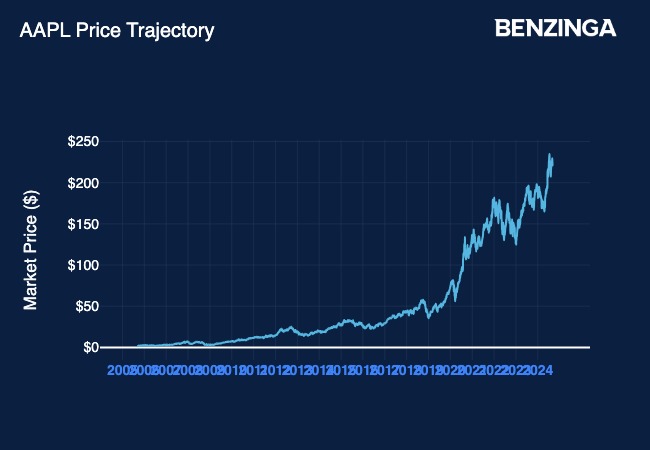

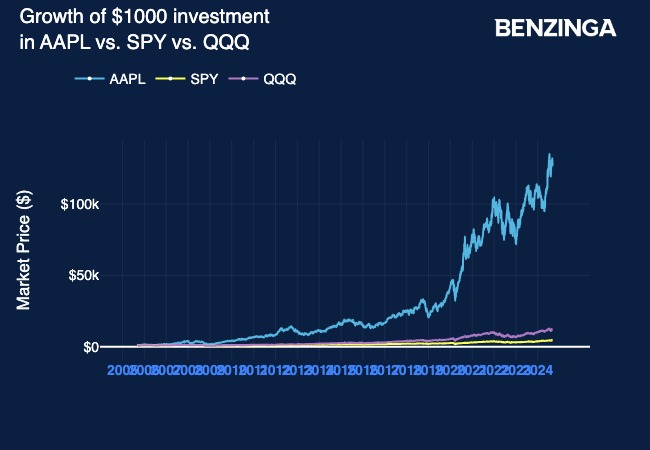

That being said, here’s what your $1,000 investment in Apple stock would have turned into at the time of the iPod Nano’s launch:

Apple’s stock, adjusted for stock splits and other corporate actions, was $1.7385 on Sept. 7, 2005.

Its stock price today is $220.82, which is an increase of 12,601% during this period.

If you had invested $1,000 in Apple stock on Sept. 7, 2005, today, you would have $120,017.

Likewise, if you had invested $1,000 in Invesco QQQ ETF, you would have $1,170.

A similar $1,000 investment in an index fund that replicates the S&P 500 would be worth $4,361.

What Happened To iPods

In 2022, over two decades after the launch of the original iPod, Apple officially ended production of its legendary portable music player line.

It was the end of the iPod Touch, which was the sole remaining model in the iPod lineup, after the discontinuation of the iPod Shuffle and iPod Nano.

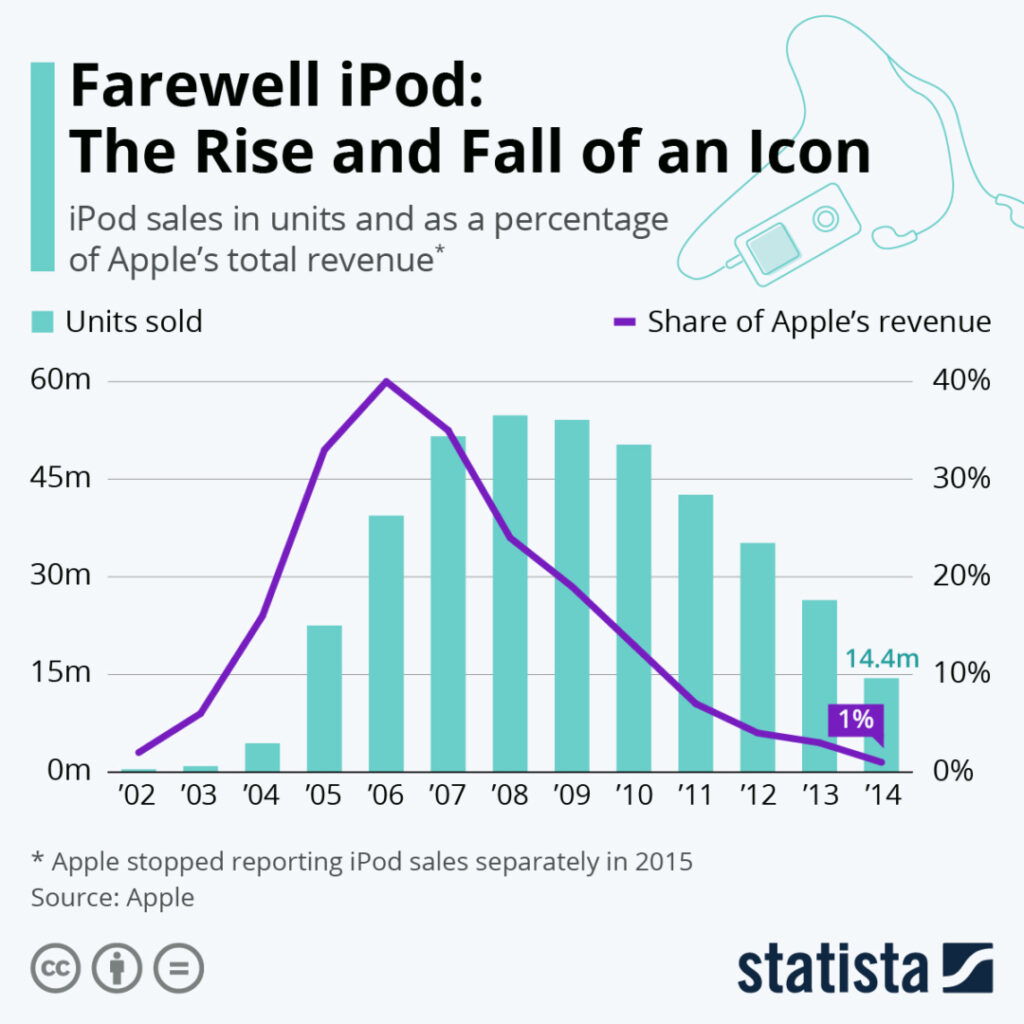

It may appear trivial today, but during its peak, the iPod was a major contributor to Apple’s revenue, often surpassing 50 million units sold each year.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Wikimedia

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

68-Year-Old Is Told To Take Out A Bigger Mortgage For Bills Rather Than Tap Into 401(k): Suze Orman Says 'Absolutely Not – Over My Dead Body!'

Imagine you’ve worked hard, saved up, and now you’re ready to enjoy retirement. You’re 68, debt-free, and living comfortably in a paid-off co-op. Sounds pretty good, right? But then, your financial advisor suggests something that makes you do a double-take – start taking Social Security early and take out a new mortgage just to avoid dipping into your 401(k). Wait, what?

Don’t Miss:

That’s the scenario Helene, a retiree, found herself in. She’s been living mortgage-free for over 30 years and plans to buy a home in a 55-plus community in New Jersey. But when her advisor told her to take out a bigger mortgage and start Social Security early, Helene decided to get a second opinion from none other than Suze Orman.

If you’ve ever heard Orman’s advice, you know she’s not one to bite her tongue. When Helene asked whether she should follow her advisor’s advice, her response was loud and clear: “Absolutely not – over my dead body!”

Trending: The number of ‘401(k)’ Millionaires is up 43% from last year — Here are three ways to join the club.

Orman didn’t hold back. She pointed out that if Helene truly trusted her advisor’s recommendation, she wouldn’t be asking for a second opinion in the first place. And let’s be real – taking out a mortgage just to cover bills when you’re already debt-free? Orman was having none of it.

Taking on new debt in retirement might seem like a big deal to some, but when you’ve been debt-free – going back into debt electively isn’t ideal. Having debt in retirement isn’t uncommon, though. A 2019 study found that 37% of homeowners aged 65 and older had mortgage debt, up from just 22% in 2001. Even more surprising? The median amount owed by these older homeowners more than doubled from $43,400 in 2001 to a whopping $95,000 in 2019. That’s a lot of stress to carry into your golden years, and Suze is all about avoiding unnecessary financial burdens.

See Also: Miami is expected to take New York’s place as the U.S. Financial Capital. Here’s how you can invest in the city before that happens.

“Why would you want to take on new debt at today’s interest rates to pay some bills?” Suze questioned. She reminded Helene that the whole point of saving and investing is to feel secure, not to create more financial stress. Owning your home outright is a huge part of that security.

But Suze didn’t just dismiss the idea without giving Helene solid advice. She encouraged her to think about what makes her most secure – starting Social Security now, waiting, or deciding when to dip into her 401(k). Suze emphasized Helene controlling her financial decisions: “You make that decision, girlfriend.”

And speaking of Social Security, it’s worth noting that delaying it until age 70 can bump up your monthly benefits by as much as 32% compared to claiming it at full retirement age. But guess what? Only about 10% of Americans wait until 70 to claim Social Security, according to a Schroder survey, even though the financial benefits are pretty clear. Suze wants Helene to think long and hard about what will make her feel the most secure in the long run.

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

Before making big financial decisions, especially in retirement, consider talking to a qualified financial advisor who understands your goals and situation. While Helene’s advisor might have given her questionable advice, it’s still worth getting an expert opinion. But remember, it’s your money and your future – make sure the advice you’re getting feels right for you.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article 68-Year-Old Is Told To Take Out A Bigger Mortgage For Bills Rather Than Tap Into 401(k): Suze Orman Says ‘Absolutely Not – Over My Dead Body!’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

There's Another Intel Deal Report Out There. This Time It's About Qualcomm

Costfoto / NurPhoto via Getty Images

Key Takeaways

-

Qualcomm is reportedly considering buying parts of Intel.

-

A Reuters story said company executives are especially interested in Intel’s PC chip design business.

-

It’s the latest report to detail possible deal activity for Intel as the chip giant looks to revive interest in its flagging shares.

Qualcomm (QCOM) shares fell following a report that the company has looked into buying segments of Intel (INTC), potentially including its PC chip design business.

Reuters on Friday the maker of semiconductors for mobile devices has explored the idea of purchasing different parts of Intel. One of its sources said that the PC design unit is of “significant interest,” although they are considering all of Intel’s design operations.

The report is the latest to describe possible deal activity for Intel, which is seeking to reinvigorate interest in its shares. One recent story indicated that it might sell some of its stake in MobilEye (MBLY); another discussed options regarding its foundry business. Intel’s shares were recently down about 2%, whileQualcomm’s were off more than 3%.

Reuters’ Friday story quoted an Intel spokesperson as saying Qualcomm has not approached the company about any acquisitions, and that Intel is “deeply committed” to its PC business. Qualcomm did not immediately respond to Investopedia’s request for comment.

Shares of Qualcomm are up some 9% year-to-date, while Intel shares have lost about 60% of their value.

Read the original article on Investopedia.

Ask an Advisor: Should I Keep Reinvesting My Dividends or Start Taking the Cash?

Is there a point at which I should stop reinvesting stock dividends and invest the money or save the cash?

-Anonymous

Many financial experts recommend that you reinvest dividends most of the time – and I’m inclined to agree. The process is typically automated, doesn’t incur any fees and gives your holdings a little (or a lot) of extra oomph.

For example, if you had invested in Microsoft stock 10 years ago and consistently reinvested your dividends since then, your holdings would be worth 63% more today than if you hadn’t reinvested. That’s a lot of oomph.

Still, there is hardly ever a one-size-fits-all answer to any investment question. Accordingly, it may be wiser in some situations to just take the money rather than reinvest it.

Here’s what investors should know about when it makes sense not to reinvest dividends.

A financial advisor can help you finetune your investment strategy. Find a fiduciary advisor today.

3 Good Reasons to Not Reinvest Dividends

While reinvesting dividends will almost always give your stock holdings a shot in the arm, sometimes your big-picture needs as an investor will trump those potential benefits.

Here are three common examples of situations in which it makes sense to not reinvest dividends:

-

Balancing your portfolio. Reinvesting dividends will increase your position in the company paying them. If that company already represents, say, 5% or more of your portfolio, it may be wise to avoid getting too concentrated and not reinvest your dividends.

-

Phasing out risk. In many cases, it’s a good idea to make your investments less aggressive over the years. If you’ve been reinvesting dividends, diverting that cash toward less aggressive assets (like bonds) can be a good way to “risk-off” smoothly.

-

Income. Remember: Money is ultimately for spending, and sometimes you just need the cash. There’s nothing wrong with that, especially if you’re in or approaching retirement when short-term income becomes a bigger priority than long-term growth.

1 Bad Reason to Not Reinvest Dividends

Some people will say that you shouldn’t reinvest dividends if the underlying stock isn’t performing well. Here, however, I completely disagree.

Remember, one of the main benefits of dividends is that they pay out regardless of the stock’s recent price movement. This indicates that the company paying them has an established track record of earning profits – a clear sign that the company is fundamentally worth investing in.

In other words, even if the share price is in a slump, odds are it will recover eventually. So if you’re going to hold onto the stock anyway, and therefore keep receiving dividends, why not keep getting the extra boost from reinvesting them?

As I like to remind my clients, we invest in companies, not stocks. The share price is only one indication of a company’s value, and sometimes a very unreliable one. That truth is often forgotten and always important. Consider consulting a financial advisor for more personalized advice on your portfolio.

What to Do Next

If you’re receiving dividends and are unsure of what to do with them, remember the fundamentals.

Deciding what to do with your dividends boils down to answering three questions:

-

Am I confident in the company’s underlying health?

-

Can I afford to reinvest the dividend income right now?

-

Is increasing my position in this company consistent with my overall portfolio strategy?

If the answer to any of these questions is “no” or “I’m not sure” then you may want to spend that dividend cash elsewhere.

If you can answer all of them with “yes,” however, then let the reinvestment machine keep doing its thing.

Investing and Retirement Planning Tips

-

If you have questions specific to your investing and retirement situation, a financial advisor can help. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

For more about dividend investing check out this article on the subject.

-

As you plan for income in retirement, keep an eye on Social Security. Use SmartAsset’s Social Security calculator to get an idea of what your benefits could look like in retirement.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Graham Miller, CFP® is a SmartAsset financial planning columnist and answers reader questions on personal finance topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Please note that Graham is not a participant in the SmartAsset AMP platform, nor is he an employee of SmartAsset. He was compensated for this article.

Photo credit: ©iStock.com/visualspace, ©iStock.com/gorodenkoff

The post Ask an Advisor: Should I Stop Reinvesting Dividends? appeared first on SmartAsset Blog.

Bio-coatings Market to Reach $17.4 Billion, Globally, by 2033 at 6.9% CAGR: Allied Market Research

The global bio-coating in the construction market is experiencing growth due to several factors such, Sept. 06, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Bio-coatings Market by Resin (Alkyd, Polyurethane, Acrylic, and Others) , and Application (Transportation, Construction, Woodworking, Packaging, and Other) : Global Opportunity Analysis and Industry Forecast, 2024-2033″. The global bio-coatings market was valued at $9.3 billion in 2023 and is estimated to reach $17.4 billion by 2033, exhibiting a CAGR of 6.9% from 2024 to 2033.

Prime determinants of growth

The global bio-coatings market is experiencing growth due to several factors such as a growing awareness of environmental issues and the need for sustainable solutions is a primary driving force behind the adoption of bio coatings. Furthermore, the rise in consumer awareness and preferences for eco-friendly products drive demand for bio coatings. However, the high cost of bio coatings hinders market growth to some extent. Moreover, industries such as construction, automotive, packaging, and consumer goods are increasingly adopting bio coatings to align with sustainability goals and meet consumer expectations offers remunerative opportunities for the expansion of the global bio-coatings market.

Download Sample Pages of Research Overview: https://www.alliedmarketresearch.com/request-sample/A323751

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $9.3 billion |

| Market Size in 2033 | $17.4 billion |

| CAGR | 6.9% |

| No. of Pages in Report | 288 |

| Segments Covered | Resin, Application and Region |

| Drivers | Technological advancements in the bio-coatings industry Increase in promotion of sustainability coating products Surge in construction activities in Asia-Pacific Surge in government incentives for environmental issues |

| Opportunities | Rapid industrialization and urbanization Surge in changing consumer preferences towards eco-friendly and sustainable products |

| Restraint | High-cost consideration |

The alkyd segment is expected to exhibit fastest growth throughout the forecast period.

Based on resin, the alkyd segment held the highest market share in 2023 and is likely to retain its dominance throughout the forecast period. Bio-based alkyd coatings, derived from renewable resources such as plant oils or bio-based resins, offer a more environmentally friendly option compared to petroleum-based alkyd coatings. Alkyd could be up to 100% bio-based and performing efficiently. The basic components used in the production of an alkyd are fatty acids, di-acids and polyol. The demand for alkyd in bio coatings is driven by packaging and construction industry. As construction activities expand globally, the need for bio-based alkyd rises to meet the escalating demands of the sector.

Procure Complete Report (288 Pages PDF with Insights, Charts, Tables, and Figures) @ https://www.alliedmarketresearch.com/checkout-final/bio-coatings-market

The construction segment is expected to exhibit fastest growth throughout the forecast period.

Based on application, the construction segment held the highest market share in 2023 and is likely to retain its dominance throughout the forecast period. Bio coatings offer durability, weather resistance, and other functional properties which meet the performance requirements of building materials. Advances in bio coating technologies have improved their performance characteristics, making them suitable for a wide range of applications in the construction and architectural industry. Moreover, the rising desire for bio coatings is propelled by urbanization, population expansion, and the necessity for infrastructure. As construction endeavors within the country escalate, it is expected to increase the demand for bio coatings in the construction sector.

Asia-Pacific to maintain its dominance by 2032.

Based on region, Asia-Pacific held the highest market share in terms of revenue in 2023 and is expected to rule the roost in terms of revenue throughout the forecast timeframe. The rapid industrialization in countries such as China and India have led to the establishment and expansion of manufacturing facilities, including automotive, construction, and packaging. These industries rely heavily on paint and coating products to maintain the quality of the product.

Players: –

- The Sherwin-Williams Company

- Axalta Coating Systems Ltd.

The report provides a detailed analysis of these key players in the global bio-coatings market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Want to Access the Statistical Data and Graphs, Key Players’ Strategies: https://www.alliedmarketresearch.com/bio-coatings-market/purchase-options

Recent industry development:

- On March 9, 2023, PPC industries decided to launch SIGMAGLIDE 2390 marine coating product. The coating is expected to help ship owners lower power consumption and carbon emissions, meeting the demand for higher performance with no adverse impact on the marine environment.

- On December 8, 2022, BASF company launches automotive coatings named “ColorBrite” using renewable raw materials according to a certified biomass balance approach. This development helps the company to increase the product portfolio and revenue in the near future.

- On November 21, 2022, Arkema announced a major step forward in its innovative sustainable offer with the certification of a range of bio-attributed acrylic monomer. The development of these bio-attributed acrylic materials is an important step on the sustainable development roadmap of Arkema and its Coating Solutions segment.

- On April 1, 2022, PPG industry announced that the company has completed the acquisition of the powder coatings manufacturing business of Arsonsisi, an industrial coatings company based in Milan, Italy. This development helped the company to increase the customer base and revenue.

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog: https://blog.alliedmarketresearch.com

Blog: https://www.newsguards.com/

Follow Us on | Facebook | LinkedIn | YouTube |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Positive Signal: David Michael Braner Shows Faith, Buying $299K In American Public Education Stock

A notable insider purchase on September 4, was reported by David Michael Braner, Director at American Public Education APEI, based on the most recent SEC filing.

What Happened: In a recent Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday, Braner increased their investment in American Public Education by purchasing 17,872 shares through open-market transactions, signaling confidence in the company’s potential. The total transaction value is $299,713.

American Public Education shares are trading up 1.58% at $15.73 at the time of this writing on Thursday morning.

All You Need to Know About American Public Education

American Public Education Inc provides online and on-campus postsecondary education including various undergraduate and graduate degree programs. The fields of study include business administration, health science, technology, criminal justice, education, liberal arts, national security, military studies, intelligence, and homeland security. There are three reporting segments: the American Public University segment which is the key revenue generator; the Rasmussen University Segment and the Hondros College of Nursing segment. The revenue is generated from net course registrations and enrollment, tuition rate, net tuition, and other fees.

Unraveling the Financial Story of American Public Education

Revenue Growth: Over the 3 months period, American Public Education showcased positive performance, achieving a revenue growth rate of 3.86% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Analyzing Profitability Metrics:

-

Gross Margin: Achieving a high gross margin of 50.15%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): American Public Education’s EPS is below the industry average. The company faced challenges with a current EPS of -0.07. This suggests a potential decline in earnings.

Debt Management: American Public Education’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.82, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: American Public Education’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 81.53.

-

Price to Sales (P/S) Ratio: The P/S ratio of 0.45 is lower than the industry average, implying a discounted valuation for American Public Education’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): American Public Education’s EV/EBITDA ratio at 7.46 suggests potential undervaluation, falling below industry averages.

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Impact of Insider Transactions on Investments

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

A Closer Look at Important Transaction Codes

When dissecting transactions, the focal point for investors is often those occurring in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of American Public Education’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.