Nvidia's 15% stock slide has created a compelling buying opportunity, BofA says

-

Nvidia stock has tumbled since it reported earnings last week.

-

Bank of America says the slide opens up an attractive buying opportunity.

-

The chip maker’s stock is trading near its lowest valuation in five years, the bank said.

Nvidia bulls may feel paralyzed by the sudden onslaught of headwinds blowing against the company, but to Bank of America, the move down in the stock price in the last week offers an attractive buying opportunity.

On Tuesday, shares of the semiconductor kingpin tanked, wrenching down its market value by $279 billion for the largest one-day decline in US corporate history.

The pullback came after the firm’s recent earnings report failed to meet the market’s most bullish expectations, adding to fears that the artificial intelligence rally may be losing steam.

The stock briefly continued its retreat on Wednesday, following a report that the firm received a subpoena from the Department of Justice. In all, the stock has fallen by as much as 15% since Nvidia released its second-quarter earnings in late August.

To Bank of America, the post-earnings skid marks a buying opportunity.

In a note released Thursday, the bank said that Nvidia is now hovering around its cheapest valuation in the past five years.

“While market forces could enhance near-term stock volatility, we continue to find NVDA valuation compelling at 27x CY25/FY26E consensus PE (or only ~20x PE at high-end of $5+ CY25 eps estimate),” analyst Vivek Arya wrote.

Compared to this, Nvidia price-to-earnings have ranged between the mid-20s to mid-60s over the past half-decade.

Investors who buy the stock now could be facing 54% upside, according to BofA’s price target of $165 per share.

This looks achievable, as Nvidia will remain a key beneficiary of AI investing and won’t always be pressured down by headwinds, the bank said. For instance, weak supply-side fundamentals should subside in the near term, the analysts noted.

While investors are disappointed by delays in the firm’s next-gen Blackwell chip, shipments should be confirmed over the next several weeks, BofA estimates.

In any case, the bank doesn’t anticipate demand for prior-gen Hopper chips to disappear, given how strong AI demand is.

Concerning regulatory headwinds, Nvidia has since denied receiving a subpoena from the DOJ.

Bloomberg — which first reported on the subpoena — later reported that the DOJ sent a civil investigative demand, citing a source close to the matter.

Though BofA assumes no impact from these developments, it noted that government cases are not uncommon against large US tech companies.

Finally, skepticism about AI’s potential remains a non-issue, the bank said, at least until 2026. Those concerned that the AI spending wave has yet to show results must simply be patient, the analysts wrote.

“The tech industry will give itself at least another 1-2 years of intense buildout of NVDA Blackwell chip with its 4x lift in AI training and 25x+ lift in inference. Efforts thus far with the first wave of large language models (LLM), using NVDA Hopper was just the teaser,” BofA wrote, anticipating that real AI capabilities will be unlocked by upcoming LLMs.

Read the original article on Business Insider

Glancy Prongay & Murray LLP Reminds Investors of Looming Deadline in the Class Action Lawsuit Against Indivior PLC (INDV)

LOS ANGELES, Sept. 05, 2024 (GLOBE NEWSWIRE) — Glancy Prongay & Murray LLP (“GPM”) reminds investors of the upcoming October 1, 2024 deadline to file a lead plaintiff motion in the class action filed on behalf of investors who purchased or otherwise acquired Indivior PLC (“Indivior” or the “Company”) INDV securities between February 22, 2024 and July 8, 2024, inclusive (the “Class Period”).

If you suffered a loss on your Indivior investments or would like to inquire about potentially pursuing claims to recover your loss under the federal securities laws, you can submit your contact information at www.glancylaw.com/cases/Indivior-PLC-1/. You can also contact Charles H. Linehan, of GPM at 310-201-9150, Toll-Free at 888-773-9224, or via email at shareholders@glancylaw.com to learn more about your rights.

On July 9, 2024, Indivior disclosed that it would be immediately ceasing all sales and marketing activities related to its schizophrenia treatment, PERSERIS due to the highly competitive market “and impending changes that are expected to intensify payor management in the treatment category in which PERSERIS participates.” Additionally, the Company significantly reduced its 2024 net revenue guidance.

On this news, Indivior’s stock price fell $5.15, or 33.6%, to close at $10.19 per share on July 9, 2024, thereby injuring investors.

The complaint filed in this class action alleges that throughout the Class Period, Defendants made materially false and/or misleading statements, as well as failed to disclose material adverse facts about the Company’s business, operations, and prospects. Specifically, Defendants: (1) grossly overstated their ability to forecast the negative impact of certain legislation on the financial prospects of Indivior products, which forecasting ability was far less capable and effective than Defendants had led investors and analysts to believe; (2) overstated the financial prospects of SUBLOCADE, PERSERIS and OPVEE, and thus overstated the Company’s anticipated revenue and other financial metrics; (3) knew or recklessly disregarded that because of the negative impact of certain legislation on the financial prospects of Indivior’s products, Indivior was unlikely to meet its own previously issued and repeatedly reaffirmed FY 2024 net revenue guidance, including its FY 2024 net revenue guidance for SUBLOCADE, PERSERIS and OPVEE; (4) knew or recklessly disregarded that Indivior was at a significant risk of, and/or was likely to, cease all sales and marketing activities related to PERSERIS; and (5) as a result, Defendants’ positive statements about the Company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis at all relevant times.

Follow us for updates on LinkedIn, Twitter, or Facebook.

If you purchased or otherwise acquired Indivior securities during the Class Period, you may move the Court no later than October 1, 2024 to request appointment as lead plaintiff in this putative class action lawsuit. To be a member of the class action you need not take any action at this time; you may retain counsel of your choice or take no action and remain an absent member of the class action. If you wish to learn more about this class action, or if you have any questions concerning this announcement or your rights or interests with respect to the pending class action lawsuit, please contact Charles Linehan, Esquire, of GPM, 1925 Century Park East, Suite 2100, Los Angeles, California 90067 at 310-201-9150, Toll-Free at 888-773-9224, by email to shareholders@glancylaw.com, or visit our website at www.glancylaw.com. If you inquire by email please include your mailing address, telephone number and number of shares purchased.

This press release may be considered Attorney Advertising in some jurisdictions under the applicable law and ethical rules.

Contacts

Glancy Prongay & Murray LLP, Los Angeles

Charles Linehan, 310-201-9150 or 888-773-9224

shareholders@glancylaw.com

www.glancylaw.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

These Ultra-High Dividend Stocks Are Soaring: Is It Too Late to Buy Shares?

The Federal Reserve has officially signaled that interest rate hikes have peaked and that interest rate cuts will begin this year. Since the start of 2022, the Federal Reserve in the United States has increased the interest rate it charges banks, which leads to increasing interest rates paid to customers for banks and savings products.

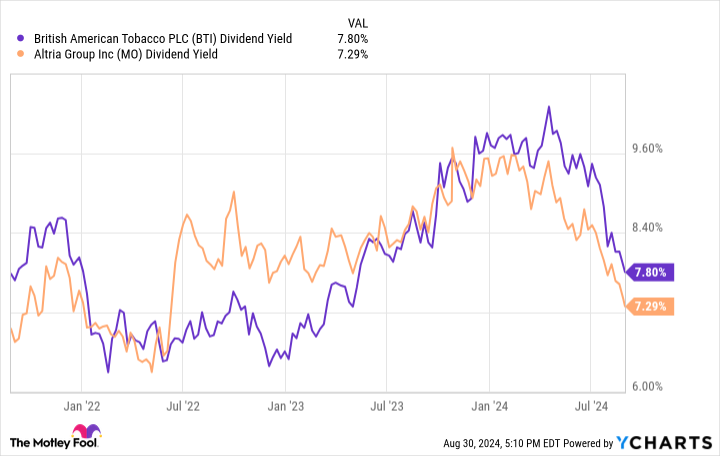

Higher interest rates make slow-growth dividend stocks less attractive, all else equal. The logic goes that if you can get the yield in a savings account, why take the risk with a dividend stock that may fall in value? This is why ultra-high-yielding tobacco stocks British American Tobacco (NYSE: BTI) and Altria Group (NYSE: MO) went nowhere for a few years. This summer, everything changed. Both stocks have soared in the past three months, crushing the returns of the broad market S&P 500 over this time.

Is it too late to buy these two high-yielding tobacco stocks? Or is the party just getting started with interest rates set to decline shortly?

Altria Group: 7.3% dividend yield in a tough customer environment

Altria Group owns the leading premium cigarette brand in the United States: Marlboro. Along with Marlboro, it owns the NJOY nicotine vaping brand, Middleton Cigars, On! nicotine pouches, and a large stake in Anheuser Busch. It currently has a 7.29% dividend yield, down from over 9% earlier this year.

Investors have concerns about declining volumes for Marlboro in the United States. To put it simply, people are smoking less and less in the country. So far this year, Marlboro shipment volumes have declined by more than 10% with no signs of slowing down. They have declined for many years. And yet, Altria’s operating income is up 51.8% in the last 10 years. Why? Because of the pricing power it is able to pass on for cigarette packs. This is a dynamic that can continue for many years.

On top of this, there are a lot of other segments that can drive earnings growth for Altria Group. Cigars are not seeing nearly as quick of a volume decline and also have pricing power. Vaping and nicotine pouches are growth markets and should replace volumes from Marlboro in the coming years. Add it all together, and I think that the concerns about Marlboro’s volume declines are overblown.

Let’s not forget the company’s repurchase program, either. Shares outstanding are down by 13.7% in the last 10 years, which makes it easier for Altria to grow its dividend per share. Free cash flow per share — the fuel for dividend payments — is up 125% in the last 10 years. As long as the company can keep raising prices and transition some consumers to new products while decreasing its share count, I think free cash flow per share can continue to grow.

British American Tobacco: Higher yield and higher upside?

The other ultra-high dividend payer is British American Tobacco. It has some similarities and differences to Altria Group and an even higher dividend yield of 7.8%.

British American Tobacco is similar to Altria in that it has exposure to the fast-declining U.S. market. It owns brands such as Dunhill and Lucky Strike. As discussed above, the company will need to raise prices and improve its profit margin in order to keep profits up in the United States.

Unlike Altria Group, British American Tobacco has exposure to international markets. In general, these markets are seeing slower volume declines compared to the United States, which is a benefit for the company. However, it still has foreign currency risk, which can impact U.S. investors. If the U.S. dollar rises in value relative to other currencies, that can be an earnings headwind to British American Tobacco. The international segment is a mixed bag, but I think it can drive profit growth for many years as long as the U.S. dollar isn’t too strong.

British American Tobacco is doing much better than Altria in new tobacco-free nicotine products. It has strong brands like Vuse (vaping) and Velo (nicotine pouches) that are becoming a much larger part of its business. In fiscal 2023, these smokeless products were 16.5% of revenue and finally flipped from losing money to positive profitability. There is no sign that these divisions are slowing down, either. This can drive cash-flow growth and therefore maintain or grow the British American Tobacco dividend.

Is it too late to buy these dividend payers?

Depending on your tax profile (which can be important for dividend stocks), dividend stocks are great to own if they have a higher yield than a savings account or U.S. Treasury bond. This is especially true if Treasury rates are about to fall. Altria and British American Tobacco both have dividend yields above 7%, which is much higher than what you can get in a savings account.

The only question is: Are the dividend yields safe? I think they clearly are. Both companies are seeing declining volumes in the United States but can counteract these effects with price increases and more profit contributions from new divisions. This is why it shouldn’t be surprising that Altria just raised its quarterly dividend payout by 4% to $1.02.

In fact, I think that both stocks have a good chance to grow their dividend-per-share payouts at a consistent rate over the next five to 10 years. If that happens, income-focused investors will be happy to have bought shares at today’s prices.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.

These Ultra-High Dividend Stocks Are Soaring: Is It Too Late to Buy Shares? was originally published by The Motley Fool

Prediction: This Biotech Stock Will Outperform Nvidia in the Second Half of the Year

Nvidia (NASDAQ: NVDA) is a tough one to beat when it comes to share-price performance. The technology giant has seen its shares soar 2,500% over the past five years, and this year, it’s heading for a 118% increase.

There’s a good reason for this incredible run. Nvidia dominates one of today’s biggest growth areas — the artificial intelligence (AI) chip market — holding an 80% share. As a result, Nvidia’s earnings have been climbing in the triple digits to new records, quarter after quarter.

Though Nvidia makes a great buy, this stock isn’t the only potential winner for your portfolio in the second half of 2024. My prediction is that a biotech stock operating in a particularly dynamic field will outperform the tech giant during this period. (It already beat Nvidia’s performance in the first half.)

This biotech has fallen behind over the past six months, but major advancements in its pipeline may give the stock the boost it needs to jump ahead, once again. Read on to find out more.

The billion-dollar obesity drug market

Which biotech company are we talking about? Viking Therapeutics (NASDAQ: VKTX), a player that’s making significant progress in the obesity drug market, which Goldman Sachs Research predicts may reach $100 billion by the end of the decade. Viking is developing candidates known as dual GIP/GLP-1 receptor agonists, much like the already commercialized drugs of Eli Lilly and Novo Nordisk.

These types of drugs work by acting on hormones involved in the digestion process, controlling blood sugar levels and appetite. They’ve been immensely popular, leading to shortages in the market and pushing Lilly and Novo Nordisk to expand their production capabilities.

Viking’s candidates have produced promising data in clinical trials. For example, the phase 2 trial of injectable candidate VK2735 met its primary endpoint and all secondary endpoints, with patients achieving as much as a 15% reduction in body weight after 13 weeks. And in the phase 1 trial of the tablet version of the candidate, patients showed as much as 5.3% reduction in weight in just 28 days. The announcement of these results earlier in the year wowed investors, prompting the stock to take off.

In the second half of 2024, Viking is planning an end-of-phase 2 meeting with the U.S. Food and Drug Administration for VK2735. Following that, it aims to launch a phase 3 trial. The company also expects to start a phase 2 trial for the oral version later this year. This progression may offer the stock fuel to rocket higher in the coming months.

A potential takeover target?

Investors also have speculated that a bigger biotech or pharma company may consider Viking as a takeover target to get in on the booming weight loss drug market. Further speculation or concrete developments here also could keep Viking stock flying high in the later months of the year.

Meanwhile, Nvidia could advance, as well, especially considering the company’s upcoming launch of its new architecture Blackwell, its most powerful chip ever. But Viking’s share performance following pipeline developments has proven to be better than that of Nvidia following good news. When Viking reported positive VK2735 data earlier this year, the stock surged more than 120% in one trading session. Nvidia, after announcing the launch of a stock split — news investors generally welcome — climbed about 9% in one session.

Any positive news from Viking could result in outsized gains. With programs advancing in the coming months, more news could be on the horizon.

Long-term investing

Of course, this is just short-term performance. Before buying a stock, it’s important to consider its long-term potential because holding on to solid companies for at least five years is the way to truly boost your portfolio.

I expect Eli Lilly to dominate the weight loss drug market, thanks to its position today and candidates in the pipeline. However, considering the great demand in this market, Viking could carve out share down the road — or potentially join forces with another company.

Viking comes with some risk since it’s an up-and-coming player and not an established one like Eli Lilly. But it also carries significant growth potential if pipeline programs continue to advance successfully. That’s why this stock — which I predict will beat Nvidia in the second half — also may score a long-term win for investors.

Should you invest $1,000 in Viking Therapeutics right now?

Before you buy stock in Viking Therapeutics, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Viking Therapeutics wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group and Nvidia. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.

Prediction: This Biotech Stock Will Outperform Nvidia in the Second Half of the Year was originally published by The Motley Fool

SPIR Lawsuit Reminder: Robbins LLP Encourages Spire Global, Inc. Stockholders to Seek Counsel for the Class Action Lawsuit

SAN DIEGO, Sept. 05, 2024 (GLOBE NEWSWIRE) — Robbins LLP reminds investors that a shareholder filed a class action on behalf of all persons and entities that purchased or otherwise acquired Spire Global, Inc. SPIR securities between March 6, 2024 and August 14, 2024. Spire Global is a provider of satellite data, analytics, and services.

For more information, submit a form, email attorney Aaron Dumas, Jr., or give us a call at (800) 350-6003.

The Allegations: Robbins LLP is Investigating Allegations that Spire Global, Inc. (SPIR) Misled Investors Regarding Revenue Recognition Related to its Space Services Contracts

According to the complaint, during the class period, defendants failed to disclose to investors: (1) that there were embedded leases of identifiable assets and pre-space mission activities for certain Space Services contracts; (2) that Spire Global lacked effective internal controls regarding revenue recognition for these contracts; and (3) that, as a result, the Company overstated revenue for certain Space Services contracts.

Plaintiff alleges that on August 14, 2024, after the market closed, the Company announced it would be unable to timely file its second quarter 2024 financial report as the Company was “reviewing its accounting practices and procedures with respect to revenue recognition” regarding certain Space Services contracts and “related internal control matters.” The Company disclosed the “type of Contracts that the Company has identified for re-evaluation resulted in recognized revenue of $10 to $15 million on an annual basis” and “additional financial measures such as gross profit could also be impacted.” On this news, the Company’s share price fell $3.41 or 33.56%, to close at $6.75 per share on August 15, 2024.

What Now: You may be eligible to participate in the class action against Spire Global, Inc. Shareholders who want to serve as lead plaintiff for the class must submit their application to the court by October 21, 2024. A lead plaintiff is a representative party who acts on behalf of other class members in directing the litigation. You do not have to participate in the case to be eligible for a recovery. If you choose to take no action, you can remain an absent class member. For more information, click here.

All representation is on a contingency fee basis. Shareholders pay no fees or expenses.

About Robbins LLP: Some law firms issuing releases about this matter do not actually litigate securities class actions; Robbins LLP does. A recognized leader in shareholder rights litigation, the attorneys and staff of Robbins LLP have been dedicated to helping shareholders recover losses, improve corporate governance structures, and hold company executives accountable for their wrongdoing since 2002. Since our inception, we have obtained over $1 billion for shareholders.

To be notified if a class action against Spire Global, Inc. settles or to receive free alerts when corporate executives engage in wrongdoing, sign up for Stock Watch today.

Attorney Advertising. Past results do not guarantee a similar outcome.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/759b39ef-c66f-419f-acd4-94c5a679c07c

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MEDIA ADVISORY – GOVERNMENTS OF CANADA, QUEBEC AND THE CITY OF MONTRÉAL TO MAKE HOUSING ANNOUNCEMENT IN MONTRÉAL

MONTRÉAL, Sept. 5, 2024 /CNW/ – Media are invited to join the Honourable Steven Guilbeault, Minister of Environment and Climate Change and Member of Parliament for Laurier–Sainte-Marie, on behalf of the Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities, Karine Boivin Roy, MNA for Anjou–Louis-Riel and Temporary Chair, and Benoît Dorais, Executive committee vice-chair of Montréal and responsible for housing, real estate strategy, property valuation and legal affairs, for the announcement.

Journalists, photographers and cameramen are required to register at relationsmedias@montreal.ca before September 6, at 8 am (ET).

|

Date: |

September 6, 2024 |

|

Time: |

10:00 am (ET) |

|

Location: |

The address will be confirmed |

SOURCE Canada Mortgage and Housing Corporation (CMHC)

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/05/c2373.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/05/c2373.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Gen Xer who grew her savings from $50k to $350k in 10 years shares the FIRE methods she's using to get to $1 million

-

A Gen Xer has grown her savings from $50,000 to $375,000 over the past decade.

-

Her goal is to grow her savings to at least $1 million and retire by age 55.

-

“Trimming” purchases and paying down debt have helped her boost her wealth.

Miriam wants to retire by age 55, and she thinks she’d need at least $1 million in savings to do so comfortably. At age 43, she’s confident her financial strategies will get her to that milestone.

Miriam’s retirement savings journey began around 2007 — when she said she had nearly nothing in savings and started contributing to a 401(k) for the first time. By 2014, her savings had grown to about $50,000, according to a document viewed by Business Insider.

It was around this time that Miriam, who said she makes roughly $80,000 a year working as an associate director at Georgetown University’s financial services office, began to get even more serious about boosting her finances. She said she started learning about the FIRE (financial independence, retire early) movement and sought out every personal finance book and blog she could find.

“I got really motivated to save and invest more in my retirement accounts,” Miriam, who asked for her last name to be excluded for privacy reasons, told BI via email.

The strategies she’s adopted over the past decade have started to pay off: She’s grown her savings from about $50,000 in 2014 to nearly $375,000 as of July. If she continues to save at the same rate (as much as $1,000 a month) and sees similar stock market returns, she’ll reach her $1 million goal over the next decade, according to her calculations — before her target retirement age of 55.

“Once I reached over $300,000, I knew I had the capability to reach my goal,” she said.

While many Americans are having trouble saving for retirement, some are putting themselves in a position to stop working ahead of schedule. Many of these people consider themselves members of the FIRE community, but they’ve used a wide variety of savings and investment strategies to grow their wealth — including taking on side hustles, investing in real estate, and finding creative ways to reduce their living expenses.

Miriam shared her top savings and investment tips that have been key to growing her wealth — and that she hopes will help her reach her retirement goal.

“Trimming” purchases and paying down debt have boosted her wealth

When Miriam was a teenager, she worked as a waitress and earned $2.65 an hour plus tips, she said. It was during these years that she developed a desire for the “sweet taste of freedom” that having her own money provided.

She hasn’t always known the best way to fulfill this desire, but over the years, she’s developed a financial approach that works for her.

One of Miriam’s top strategies for boosting her savings and investments is “trimming” purchases. When she plans to make a significant purchase, she said she estimates roughly how much it will cost — and then tries to reduce or “trim” that number by 10%.

“If a trip costs $2,000, then I reduce costs by $200 to $1,800 and invest the difference, she said. “It’s a simple way to invest more.”

Focusing on reducing her debt levels has also gone a long way. Miriam said paying off her $450 monthly car payment 15 years ago was one of the biggest developments that helped grow her wealth. She took the money she was putting toward her car and started investing it in the stock market — she said she hasn’t had a car payment since.

Miriam also began taking advantage of her employer’s 401(k) match — “you can’t beat free money” — cutting back on subscriptions, and started a personal finance blog that has helped hold herself accountable, she said.

To develop her savings goals, Miriam experimented with various online retirement calculators, which helped her find the right number.

When it comes to investing her money, Miriam said she tends to gravitate toward diversified investment funds, though she’s also made individual investments in companies such as Apple, Alphabet, Amazon, and Nvidia.

To be sure, the stock market is notoriously difficult to forecast, and Miriam knows that she can’t bank on her prior investment success continuing in the years to come.

This is among the reasons that, despite her savings success, she hasn’t stopped seeking out financial advice. She said she regularly reads books by personal finance authors such as Suze Orman and the autobiographies of wealthy people, like Mark Cuban.

“I feel like if you want to be wealthy, your house should look like a Barnes & Noble,” she said.

While she’s disciplined about sticking to her savings plans, Miriam said she tries to splurge from time to time on things like trips, restaurants, and concert tickets — she was thrilled to score tickets for Beyoncé’s Renaissance Tour last year.

“When I hit money milestones, I like to go on adventures and reward myself for maintaining my focus,” she said.

Additionally, while she tries to invest much of her savings, she said she also tries to ensure she has a sufficient emergency savings fund.

Overall, Miriam credits her financial success to the personal finance knowledge she’s accumulated over the years.

“Becoming financially literate was my secret weapon against debt and to instead build wealth,” she said.

Have your savings and wealth grown significantly in recent years? Are you willing to share your top financial strategies? Reach out to this reporter at jzinkula@businessinsider.com.

Read the original article on Business Insider

Broadcom Slides After Sluggish Non-AI Sales Hurt Forecast

(Bloomberg) — Broadcom Inc., a chip supplier for Apple Inc. and other big tech companies, fell in late trading after delivering a disappointing sales forecast, hurt by the portion of its business that isn’t tied to artificial intelligence.

Most Read from Bloomberg

Sales will be roughly $14 billion in the fiscal fourth quarter, which runs through October, the company said in a statement Thursday. Analysts had projected about $14.1 billion.

The forecast suggests that Broadcom’s non-AI operations are growing more slowly than anticipated. Though the company has benefited from a surge in artificial intelligence spending, its other divisions aren’t as connected to this bonanza. The company has a wide variety of offerings, including mainframe products, security and data center software, mobile-phone chips and data storage gear.

Broadcom shares declined about 6% in extended trading following the announcement. The stock closed at $152.82 in regular New York trading, leaving it up 37% for the year.

The company is projecting $12 billion of revenue from AI-related products for the full year, beating the average analyst projection of $11.8 billion. That suggests that the shortfall in the total quarterly sales forecast came from other areas.

Chief Executive Officer Hock Tan said that most of his non-AI chip businesses are at or through their worst point. Revenue in some of those markets has begun to grow again sequentially even though it remains well below where it was a year go. Bookings — an indicator of future sales — are up 20%, he said. There’s no reason why those markets can’t return to previously high levels, he said.

“In aggregate, we have reached bottom in our non-AI markets, and we’re expecting recovery in the fourth quarter,” he said on a conference call with analysts. “AI demand remains strong.”

Third-quarter profit was $1.24 a share, excluding some items. That compared with an average estimate of $1.22. Revenue rose to $13.07 billion, compared with a projection of $13.03 billion. The company is much larger than it was a year ago, partly because of its acquisition of VMware Inc., which it bought for roughly $69 billion.

Broadcom’s semiconductor division had revenue of $7.27 billion in the three months ended Aug. 4. Software sales were $5.8 billion.

For next year, Tan said he remains confident that AI will continue to be strong.

The CEO turned Broadcom into one of the largest players in the chip industry through a series of acquisitions. His strategy is to find businesses that are dominant in certain fields, purchase those companies, and then refocus them exclusively on those areas. Tan also has used that formula to expand into software.

The AI spending boom has turned Broadcom’s chip peer Nvidia Corp. into the biggest, most valuable company in the industry. Nvidia sells so-called AI accelerators that help develop tools such as ChatGPT, but Broadcom has benefited as well by supplying related components and software.

Data center providers rely on Broadcom’s custom-chip design and networking semiconductors to build their AI systems. The company also sells components for cars, smartphones and internet access gear. Its push into software, meanwhile, includes products for mainframe computers, cybersecurity and data center optimization.

Over the long term, Tan believes that the AI chip market will move to custom, in-house designs. That would mean shifting away from Nvidia components — a change that could benefit Broadcom, since it helps customers produce their own chips. He declined to provide a precise prediction of when this might happen and admitted it could take several years.

Apple is a top customer as well: Broadcom provides key components for the iPhone. During earnings calls, Tan typically gives updates on Broadcom’s often-contentious relationship with that company, which he refers to obliquely as his “North American customer.”

On that point, Tan said on Thursday’s call that he expects next-generation devices to help drive Broadcom’s wireless revenue up 20% sequentially in the fourth quarter — though it would still be flat compared with a year earlier.

Broadcom’s CEO — when asked what he called a “beautiful question” about whether he might look for a new acquisition in the semiconductor area — told his audience not to expect anything soon. The executive said he was focused on integrating VMware, a process that could take two years.

“Right now, I’m having my hands really full,” Tan said.

(Updates with more from conference call in final five paragraphs.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Missed Out on Broadcom? Buy This Artificial Intelligence (AI) Semiconductor Stock Before It Skyrockets

Shares of Broadcom (NASDAQ: AVGO) delivered impressive gains of 82% in the past year thanks to the company’s solid position in the market for custom artificial intelligence (AI) chips, which led to robust growth in the company’s semiconductor business. It also helped that Broadcom was named the second-most important AI chip company after Nvidia by JPMorgan analyst Harlan Sur.

That designation is not surprising, as the company is the dominant player in the market for application-specific integrated circuits (ASICs) with an estimated share of 55% to 60%. More importantly, the company’s dominance in this area is paying off nicely.

Broadcom’s strong rally in the past year is the reason why it now trades at an expensive 17 times sales and 70 times trailing earnings. This expensive valuation may deter investors from buying more Broadcom stock and have them looking for alternatives.

Another way to capitalize on the growing demand for custom AI chips is Marvell Technology (NASDAQ: MRVL). Let’s look at the reasons why.

AI is giving Marvell Technology a nice lift

Marvell Technology released fiscal 2025 second-quarter results (for the three months ended Aug. 3, 2024) on Aug. 29. The company’s revenue fell 5% year over year to $1.27 billion, while non-GAAP earnings fell 9% to $0.30 per share. However, Marvell stock surged more than 9% following its results. That may seem surprising at first, considering the contraction in its top and bottom lines, as well as the fact that its numbers were almost in line with consensus estimates. Wall Street was expecting earnings of $0.30 per share on revenue of $1.25 billion.

However, a closer look at the company’s data center business helps explain why investors gave its results the thumbs up. Marvell sold $881 million worth of data center chips last quarter, an increase of 92% from the same period last year. This segment produced 69% of the company’s top line in fiscal Q2, and the good part is that Marvell’s data center growth could accelerate as it is ramping up production ramp of its AI chips.

In the words of CEO Matthew Murphy on the latest earnings conference call:

Our AI custom silicon programs are progressing very well with our first two chips now ramping into volume production. Development for new custom programs we have already won, including projects with the new Tier 1 AI customer we announced earlier this year, are also tracking well to key milestones.

Murphy added that he expects data center “revenue growth to accelerate into the high teens sequentially on a percentage basis” in fiscal Q3, which would be an improvement over the 8% sequential growth this segment clocked last quarter. More importantly, Marvell management believes that the company is on track to exceed the $1.5 billion in fiscal 2025 AI-related revenue it forecast earlier this year.

The company anticipates that the ramp-up in the production of its custom AI chips, a strong order book, and the fact that it has secured enough supply to meet the end market demand should allow it to sustain the healthy growth of its AI-related revenue in the current fiscal year and the next one. More importantly, the custom AI chip market presents a healthy long-term growth opportunity for Marvell.

JPMorgan analysts estimate that the custom AI chip market presents a cumulative revenue opportunity of $150 billion over the next four to five years. While the investment bank points out that Broadcom is in a great position to capitalize on this opportunity, investors should note that Marvell is the second-largest player in the ASIC market, with an estimated share of 15%.

That share is translating into impressive growth in the company’s data center business, as we saw earlier, and the guidance indicates that the trend is here to stay. Marvell guided for $1.45 billion in revenue and $0.40 per share in adjusted earnings for the current quarter. That’s going to mark a return to top-line growth for the company, as it recorded $1.42 billion in revenue in the same period last year. The company’s earnings decline would almost come to a halt as it reported $0.41 per share in earnings in the same quarter last year.

Additionally, Marvell expects all of its end markets to return to sequential growth in the current quarter. Again, that’s not surprising as the weakness prevailing in its other business segments was gradually waning.

Strong earnings growth and a reasonable valuation make Marvell stock worth buying

Marvell’s earnings in fiscal 2025 are expected to decline slightly from the previous fiscal year’s reading of $1.51 per share. But as the chart below indicates, its earnings growth is set to kick into a higher gear beginning in fiscal 2026.

The market could reward this impressive acceleration in Marvell’s earnings with more upside. That’s the reason why investors looking for an alternative to Broadcom should consider buying Marvell hand over fist. It sports a relatively cheaper price-to-sales ratio of 12.5 and has a forward earnings multiple of 30, almost in line with the Nasdaq-100 index’s forward earnings multiple (using the index as a proxy for tech stocks).

Assuming Marvell manages to generate $3.41 per share in earnings after a couple of years and it trades at 30 times earnings at that time, its stock price could jump to $102. That would be a 34% increase from current levels, though the possibility of more gains cannot be ruled out, considering the massive AI chip opportunity that this semiconductor company is sitting on.

Should you invest $1,000 in Marvell Technology right now?

Before you buy stock in Marvell Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Marvell Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase and Nvidia. The Motley Fool recommends Broadcom and Marvell Technology. The Motley Fool has a disclosure policy.

Missed Out on Broadcom? Buy This Artificial Intelligence (AI) Semiconductor Stock Before It Skyrockets was originally published by The Motley Fool