Better AI Stock: Nvidia vs. Super Micro Computer

Nvidia (NASDAQ: NVDA) and Super Micro Computer (NASDAQ: SMCI) have been two of the market’s hottest artificial intelligence (AI) stocks. Nvidia is the world’s largest producer of high-end data center GPUs for processing machine learning and AI tasks. Super Micro Computer, more commonly known as Supermicro, is a rapidly growing supplier of dedicated AI servers. Most of those systems are powered by Nvidia’s GPUs.

Over the past two years, Nvidia’s stock surged more than 640% as Supermicro’s stock rallied nearly 550%. Both stocks soared as the rapid expansion of the generative AI market drove more companies to upgrade their data centers with new AI chips and servers. But should investors chase either of these high-flying AI stocks right now?

Nvidia is still firing on all cylinders

Nvidia once generated most of its revenue from gaming GPUs for PCs. But the rapid expansion of the AI market turned its data center unit, which accounted for 87% of its top line in its latest quarter, into its largest and fastest-growing business.

That’s why Nvidia’s revenue surged 126% in fiscal 2024, which ended in January 2024, and 171% year over year in the first half of fiscal 2025. Analysts expect its revenue and adjusted earnings per share (EPS) to grow 123% and 137%, respectively, for the full year.

Those growth rates are incredible, but Nvidia still faces some unpredictable challenges. It controlled 98% of the data center GPU market last year, according to TechInsights, but it faces stiff competition from AMD‘s cheaper GPUs. Nvidia has also been struggling to ramp up its production of its latest Blackwell GPUs, and several of its top AI customers — including Microsoft, OpenAI, and Alphabet‘s Google — have been developing their own first-party AI accelerator chips.

Nvidia’s red-hot data center chip sales are also gradually cooling off. Its 16% sequential sales growth in the second quarter of fiscal 2025 actually marked a deceleration from its 23% growth in the first quarter and 27% growth in the fourth quarter of fiscal 2024. Its yield issues with Blackwell also reduced its gross margin sequentially in the second quarter.

Analysts expect Nvidia’s revenue and adjusted EPS to both grow 41% in fiscal 2026. Its stock doesn’t look that pricey at 44 times forward earnings, but it might shed its premium valuation if companies start to scrutinize and rein in their AI spending.

Supermicro faces some major challenges

Supermicro is an underdog in the server market, but it carved out a niche by producing high-performance liquid-cooled servers. That made it an ideal partner for Nvidia, which provided it with a steady supply of GPUs for its high-end AI servers.

Supermicro’s revenue rose 37% in fiscal 2023, which ended last June, and surged 110% in fiscal 2024. Its soaring sales of AI servers, which now account for over half of its top line, offset its slower sales of traditional servers. Bank of America expects the company to expand its share of the AI server market from 10% to 17% over the next three years.

But in the fourth quarter of fiscal 2024, Supermicro’s gross margin shrank sequentially and year over year as it grappled with supply chain issues, ramped up its spending on new liquid-cooling technologies, and faced more pricing pressure from Dell Technologies and Hewlett-Packard Enterprise in the AI server market.

On Aug. 27, prolific short seller Hindenburg Research accused Supermicro of stuffing its sales channels with partial orders of defective products and inflating its revenues. It also said Supermicro hadn’t resolved all of the accounting issues that previously caused its stock to be delisted from the Nasdaq in 2018. A day later, Supermicro postponed its 10-K filing for fiscal 2024 and said it needed “additional time” to assess its “internal controls over financial reporting.”

Analysts still expect Supermicro’s revenue and earnings to grow 90% and 58%, respectively, in fiscal 2025 as it ramps up its shipments of AI servers. For fiscal 2026, they expect its revenue and earnings to rise 19% and 30%, respectively. Those growth rates seem impressive for a stock that trades at just 13 times forward earnings, but its recent problems could drive away the bulls and compress its valuations for the foreseeable future.

The better buy: Nvidia

Nvidia remains the linchpin of the booming AI market, and its market dominance still gives it plenty of pricing power. We can’t say the same about Supermicro, which is a lot smaller than Dell and HPE. Supermicro’s delayed 10-K filing could also contain some nasty surprises that provide more fuel for Hindenburg’s bearish thesis against the company. I once thought Supermicro had a shot at outperforming Nvidia this year, but its shrinking gross margin, Hindenburg’s allegations, and its postponed 10-K filing raise too many red flags. That’s why I’d stick with Nvidia instead of Supermicro as my top AI play.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Leo Sun has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Bank of America, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Better AI Stock: Nvidia vs. Super Micro Computer was originally published by The Motley Fool

Insiders Pour Million-Plus Dollars Into These 2 Stocks — Here’s Why You Should Take Notice

After bouncing back from the early August dip, the stock market opened September with another round of losses. In volatile times, investors need a clear signal, something to suggest a particular stock is ready to climb.

Insider buying is one of the clearest signs available. The insiders are corporate officers, company officials responsible to both Boards of Directors and stockholders of all stripes for ensuring profits and returns – and their positions give them access to the inner workings of their companies. The key point to remember: insiders may sell shares in their own companies for any number of reasons, but they only buy when they believe the stock is on track to gain. And when the insiders start spending millions on their shares, investors should take notice.

To keep things fair, financial regulatory authorities require that insiders publish their trades – and we can use the Insiders’ Hot Stocks tool, from TipRanks, to follow the trends of the insiders’ trades. The data aggregated by the tool points out the stocks that the insiders like, and we can follow those shares, dipping into the details to find out just what makes them so compelling.

Bill.com Holdings (BILL)

The first stock on our radar, Bill.com, is a cloud software provider focused on the small- and medium-sized business niche, where it offers customers solutions for the accounting and paperwork requirements of the business world. With Bill.com’s platform, small business managers can automate, digitize, and simplify the back-office financial issues and processes that come up, whether they occur every day or once a year. The company’s platform lets its users find greater efficiency in their billing, payment processing, and invoicing activities.

Small and medium businesses are always looking for efficient solutions to smooth out their paperwork, and Bill.com, which lets them put all of this into one place, has leveraged that fact into a successful business model of its own. The company has created a one-stop-shop for its customers, small entrepreneurs looking to save costs on some of their world’s most time-consuming requirements. Some of the platform’s features include allowing the creation and payment of bills for accounts receivable and payable, and management of expenses and budgets.

In the last reported quarter, covering fiscal 4Q24 (June quarter), Bill.com had a top line of $343.7 million for the quarter, gaining over 16% year-over-year and beating the forecast by almost $15.7 million. The company’s bottom line, 57 cents per share by non-GAAP measures, was 10 cents per share better than had been anticipated. And, looking forward, the company’s fiscal Q1 revenue guidance, in the range of $346 million to $351 million, was well ahead of the $336.95 million consensus.

The guide wasn’t an all-out success, however, as for FY25, revenue is expected in the range between $1.41 to $1.45 billion, at the midpoint below consensus at $1.44 billion, while non-GAAP EPS is expected to come in between $1.36 to $1.61, some distance below the Street’s $2.21 estimate.

Meanwhile, shares have been drifting lower this year, and evidently those in the know have been thinking the time is right for loading up. When we turn to the insider trades on BILL, we find several recent informative buys of more than $1 million each. John Rettig, CFO, picked up 21,124 shares for $1.04 million; Brian Jacobs, of the company Board, bought 25,000 shares for $1.338 million; and Rene Lacerte, CEO and Board member, spent an impressive $2.095 million on 42,248 shares of BILL. Currently, Jacobs and Rettig’s holdings are worth $12.25 million and $7.7 million, respectively; Lacerte’s holding is valued at almost $146 million.

This stock is covered by analyst Joseph Vafi, from Canaccord Genuity. Vafi is rated among the upper 3% of his peers by TipRanks, and he sees Bill.com as a good option under current conditions. He writes, “Against a macro backdrop that remains tough, Bill’s fintech value proposition for SMB’s continues to resonate. At a high level, we note that even though Bill’s SMB target market is more economically sensitive than large enterprises, most of the company’s KPIs and financial metrics are still sector wide standouts. We attribute this continued relative outperformance to what remains a still relative greenfield in SMB FPA/payments combined, strong channel partnerships and what is a great service set of service offerings.”

Vafi goes on to put a Buy rating on the shares, while his $100 price target suggests a one-year gain of 87.5%. (To watch Vafi’s track record, click here)

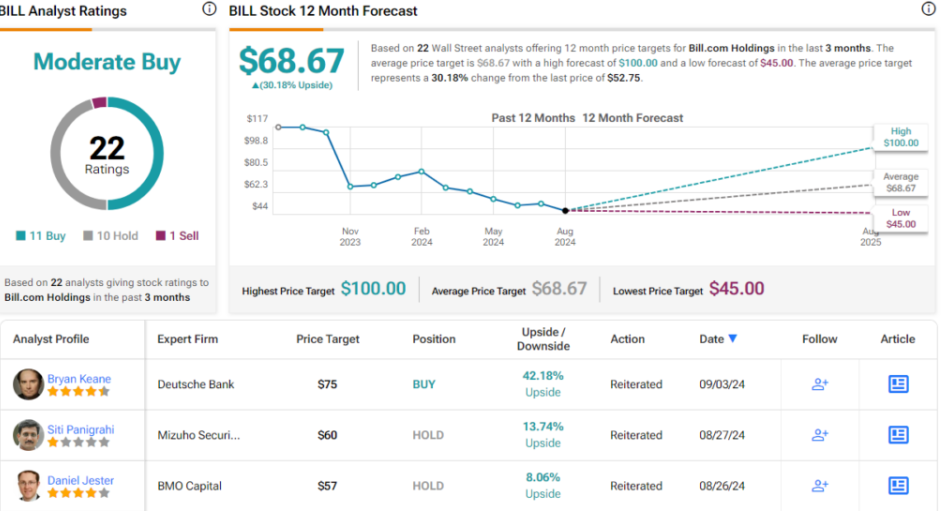

Overall, BILL shares get a Moderate Buy consensus rating from the Street, based on 22 recent recommendations that include 11 Buys, 10 Holds, and 1 Sell. The stock is priced at $52.75 and its average target price implies a gain of 30% on the one-year horizon. (See BILL stock forecast)

Butterfly Network (BFLY)

One of the greatest advances of medical technology was the development of medical imaging. Starting with the discovery of X-rays in 1895, and the application of that discovery to diagnostically important images of a patient’s hand one year later, medical imaging has grown to become a vital specialty in the health care profession, with a powerful impact on improved patient outcomes. Butterfly Network has taken upon itself the goal of ‘democratizing medical imaging,’ by making it accessible to everyone, no matter where in the world they are. The company has developed a groundbreaking technology, dubbed Ultrasound-on-Chip, that can integrate into hospital and clinic networks and transform the delivery of care – by allowing a single-probe, whole-body, ultrasound imaging solution at the point-of-care.

In short, this is portable ultrasound imaging tech at the next level, using handheld scanner technology and miniaturized components. Butterfly’s portable systems cost less than older ultrasound systems, are more accessible, and are easier to use. Ultrasound is a long-known niche within the medical imaging field, and large numbers of providers are experienced in interpreting the images, making it a good choice for a technology company that aims to expand the base of medical imaging users.

In 2Q24, revenues reached a record $21.5 million, a figure that was up more than 16% year-over-year and $1.9 million better than had been forecast. At the bottom-line, the 7-cent per share net loss came in 3 cents per share better than the estimates.

There is only one recent ‘informative buy’ insider purchase on BFLY shares, and it’s something of a doozy. Larry Robbins, of the Board of Directors, bought 1,676,869 shares of the stock – and paid just over $1.675 million for the shares. Robbins now holds company stock worth $15.85 million.

Joshua Jennings, in his coverage of Butterfly for TD Cowen, is impressed by the company’s product line, especially its new iQ3, which was launched earlier this year. Jennings sees the product as just one of several potential growth engines for Butterfly, and writes of the company, “Although the 3Q guide implies a slight deceleration from 2Q, we think the setup for BFLY in the back half of 2024 is intriguing as the company will have multiple growth channels (especially iQ3) which will continue to ramp through the remainder of the year and could provide upside to current guidance. Following its launch in February, BFLY’s iQ3 device is already seeing significant commercial demand from customers… We’re encouraged by the iQ3 commercial progress and will look for more updates on the launch in the quarters ahead.”

For Jennings, all of this adds up to a Buy rating for this stock. His price target, currently set at $3 per share, implies an impressive 12-month upside of 152%. (To watch Jennings’ track record, click here)

While there are only 2 recent reviews of this stock on file, they are both positive – giving the stock a Moderate Buy consensus rating. The shares are trading for $1.19, and the average target, at $3.38, is even more bullish than Jennings allows, suggesting a strong upside of 184% for the coming year. (See BFLY stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Headwall Investments Continues Expansion Efforts with Latest Acquisition in Houston Market

SAN ANTONIO, Sept. 4, 2024 /PRNewswire/ — Headwall Investments, a Texas-based commercial real estate development and investment firm, announces its inaugural acquisition in the Houston MSA. The acquisition of Fairmont Crossing Retail Center, located in Pasadena, TX, was finalized on Thursday, August 29, 2024. This acquisition marks a significant milestone for Headwall’s unanchored convenience retail platform, further solidifying its presence in the major metros of the Texas Triangle and reinforcing its role as a key player in the unanchored strip center market. The strategic move elevates the Headwall shopping center portfolio to fifteen properties, now encompassing a total of 568,871 square feet of gross leasable area and expanding across the Austin, San Antonio, Dallas-Fort Worth, and Houston MSAs.

Major Tenants Include:

- Red Wing Shoes

- Thriveworks

- Just Love Coffee

- Kirkwood Medical Associates

- Fidelity National Title

The Fairmont Crossing Retail Center is set on a 3.33-acre parcel of land and was constructed in two phases, completed in 2008 and 2012. The center offers 29,114 square feet of gross leasable area and exhibits the essential qualities Headwall seeks in its acquisitions, including prime visibility and easy accessibility. The property is well-positioned to capitalize on the robust demographics in its vicinity, with a tenant mix that includes an array of food, service-oriented, and medical businesses, which align seamlessly with Headwall’s focus on convenience retail.

Amid a challenging economic climate, Headwall has effectively maneuvered through the complexities of the high interest rate environment by securing high-quality unanchored shopping centers that demonstrate strong potential for value appreciation in key Texas metros. The ongoing population growth in these target markets, coupled with a unique supply-demand imbalance within this increasingly compelling sector, continues to drive significant value creation for Headwall’s investors. The unanchored convenience retail sector has consistently outperformed the broader commercial real estate market in recent years, a trend largely fueled by rising rents as tenants face a scarcity of leasable space amidst record-high occupancy rates. This trend is further compounded by a slowdown in new shopping center developments in growth markets, a consequence of elevated interest rates, soaring construction costs, and the limited availability of construction financing.

“We are pleased to welcome Fairmont Crossing Retail Center to our portfolio, marking our entry into the Houston market. This acquisition is in line with our strategy to enhance our presence in major Texas metros and supports our ongoing efforts to acquire high-quality shopping centers in regions with significant job, population and wage growth potential.” said George J. Wommack, Founder, President & CEO of Headwall Investments. “As our team continues to grow and we acquire additional convenience retail assets, our commitment remains in providing an exceptional shopping experience for our visitors while delivering outstanding value to our investors. We are confident in the continued strong performance of our target sub-sector and eagerly anticipate future growth opportunities.”

ABOUT HEADWALL

Headwall Investments, LLC is a San Antonio based real estate investment and development firm. The company was founded in 2019 by George J. Wommack and focuses on acquiring, developing and redeveloping commercial real estate in Texas. Headwall operates a series of investment funds targeting niche strategies in the commercial real estate sector. For more information on Headwall please visit https://headwallinvestments.com or call 210-343-2186.

Media Contact:

Henry Vaughan

210-343-2186

henry@headwallinvestments.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/headwall-investments-continues-expansion-efforts-with-latest-acquisition-in-houston-market-302238519.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/headwall-investments-continues-expansion-efforts-with-latest-acquisition-in-houston-market-302238519.html

SOURCE Headwall Investments, LLC

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Harris Calls for 28% Capital Gains Tax, Breaking With Biden

As she continues to fill in the details of her economic platform, Vice President Kamala Harris on Wednesday called for raising the capital gains tax to 28% for those earning more than $1 million a year, offering a smaller increase than the one proposed by President Joe Biden.

The current capital gains tax rate is 20%, which Biden has proposed raising to 39.6% for top earners. There is an additional 3.8% investment tax for those with high incomes, which Biden wants to raise to 5%, producing a potential top rate of 44.6%. Harris did not say what she wants to do with the investment tax, but The Wall Street Journal reports that she favors raising it along the lines Biden has proposed, producing an all-in top rate of 33% for her proposal – more than 10 points lower than Biden’s all-in top rate.

Harris said her proposal strikes a balance between encouraging investment and ensuring that wealthy investors pay enough in taxes overall. “While we ensure that the wealthy and big corporations pay their fair share, we will tax capital gains at a rate that rewards investment in America’s innovators, founders and small businesses,” Harris said at a campaign event in Portsmouth, New Hampshire.

In addition to the capital gains tax proposal, Harris called for providing more support for small businesses and entrepreneurs. Harris wants to raise the small business tax deduction from $5,000 to $50,000, and create a standard deduction that can be used by all small firms.

Harris said she will set a goal of 25 million new small businesses in her first term, surpassing the record 19 million seen under Biden. “As president one of my highest priorities will be to strengthen America’s small businesses,” she said.

Morning Bid: Markets hit tentative pause on selloff

A look at the day ahead in European and global markets from Ankur Banerjee

Markets hit the pause button after a selloff in equities since the start of the week but sentiment remained fragile, as worries re-emerged over the prospects for the U.S. economy and investors focused squarely on this week’s job reports.

Labour data on Wednesday suggested the U.S. jobs market was losing steam, raising expectations the Federal Reserve may resort to large interest rate cuts, while additional reports including Friday’s non-farm payrolls data are keeping sentiment on edge.

Futures indicated European bourses were set for a subdued open after Asian shares rose 0.4% on Thursday, clawing back some of the week’s losses, although the MSCI’s broadest index of Asia-Pacific shares outside Japan is still down 2.2% so far this week.

Risk sentiment remained frail, with the yen holding on to its gains for the week as traders seek safe assets while the dollar was steady in Asian hours after weakness overnight.

Hawkish rhetoric from the Bank of Japan also supported the yen after BOJ board member Hajime Takata hinted the central bank should stay on course to raise interest rates.

While the spotlight this week will be on Friday’s U.S. non-farm payrolls report, in the meantime Thursday’s U.S. jobless claims reading and euro zone retail sales data will keep investors busy.

The markets are keen for clues on whether data will dictate that the Fed cut interest rates by 25 basis points (bps) or 50 bps when it meets later this month. Traders added to wagers of a 50 bps cut following the job openings data and are now pricing in a 44% chance, up from 38% a day earlier.

Investors are also pricing in 110 bps of cuts from the remaining three Fed meetings this year, and when you factor in the Fed’s focus on the labour market, it looks like economic data in the next few weeks will be put under the microscope by increasingly skittish investors.

Key developments that could influence markets on Thursday:

Economic events: Euro zone August retail sales; August construction PMI data for Germany, France and euro zone

(By Ankur Banerjee; Editing by Edmund Klamann)

Time to Pounce: 2 Electrifying Ultra-High-Yield Dividend Stocks That Are Begging to Be Bought in September

For well over a century, Wall Street has been a wealth-building machine. Although other asset classes have delivered positive nominal returns, including bonds, housing, and various commodities, such as gold, none have come close to matching the annualized total return of stocks, including dividends, over the last century.

While there are thousands of publicly traded companies and exchange-traded funds (ETFs) to choose from, certain investment strategies have, historically, worked better than others. One such approach that’s been documented as a long-term winner is buying and holding time-tested dividend stocks.

Companies that regularly share a percentage of their earnings with investors are almost always profitable on a recurring basis, and they’ve typically demonstrated to Wall Street their ability to navigate challenging economic climates. What’s more, income stocks have a knack for providing transparent long-term growth outlooks. In other words, it’s not a surprise that dividend stocks have, as a whole, increased in value over time.

What may come as a shock is by how much dividend stocks have outperformed non-payers over the long run.

Last year, the investment advisors at Hartford Funds released a report — The Power of Dividends: Past, Present and Future — that compared the performance of income stocks to non-payers over the last half-century (1973-2023), as well as analyzed their relative volatility to the benchmark S&P 500. Whereas non-payers generated a modest 4.27% annualized return and were, on average, 18% more volatile than the S&P 500, dividend stocks delivered a 9.17% annualized return with 6% less volatility than the broad-market index.

Despite the S&P 500 sitting just a stone’s throw from an all-time high, amazing deals can still be found among dividend stocks. As we move forward into September, two electrifying ultra-high-yield dividend stocks — sporting an average yield of 9.02% — are begging to be bought by opportunistic income seekers.

Time to pounce: Enterprise Products Partners (7.16% yield)

The first high-octane dividend stock that income investors can pounce on with confidence in September is energy juggernaut Enterprise Products Partners (NYSE: EPD). Enterprise has raised its base annual payout for 26 consecutive years.

To be upfront and transparent, investing in the oil and gas industry isn’t for everyone. The memory of the demand cliff for energy commodities that occurred during the COVID-19 pandemic is likely still fresh in the minds of most investors. Thankfully, Enterprise was able to avoid the lion’s share of this operating turmoil, which is what makes it such a solid income-generating investment.

Unlike drillers, which tend to sport high margins but can be easily whipsawed by vacillations in the spot price of crude oil, Enterprise Products Partners is one of America’s largest midstream energy companies. Midstream providers are effectively energy sector middlemen that own and operate pipelines, storage, and fractionation facilities.

The great thing about midstream oil and gas stocks is they tend to produce highly predictable operating cash flow in any economic climate.

Enterprise’s not-so-subtle secret to transparent and predictable operating cash flow is that its signs long-term and predominantly fixed-fee contracts with drilling companies. The “fixed-fee” aspect of these contracts removes the effects of inflation and spot-price volatility from the equation. In turn, this allows Enterprise’s management team to accurately forecast the company’s cash flow multiple quarters, if not years, in advance.

Being able to know ahead of time, with accuracy, how much cash flow Enterprise Products Partners will generate in a given year is critical to management’s decision-making process. For example, it’s given management the confidence to put $6.7 billion to work in various major projects, most of which are tied to increasing its natural gas liquids exposure.

Furthermore, cash flow transparency has fueled Enterprise Products Partners’ bolt-on acquisition strategy. Just two weeks ago, Enterprise announced its intention to acquire Pinion Midstream for $950 million in cash. Pinion is a natural gas gathering and treatment company in the Delaware Basin of New Mexico and Texas. This deal is expected to add $0.03 per unit in distributable cash flow next year.

A multiple of 7.5 times next year’s cash flow, based on Wall Street’s consensus, is a fair price to pay for a company that consistently fires on all cylinders.

Time to pounce: PennantPark Floating Rate Capital (10.88% yield)

A second electrifying ultra-high-yield dividend stock that income-seeking investors should strongly consider pouncing on in September is little-known business development company (BDC) PennantPark Floating Rate Capital (NYSE: PFLT). PennantPark pays its dividend on a monthly basis and its yield is closing in on 11%!

BDCs are businesses that aim to generate income by investing in the equity (common/preferred stock) and/or debt of middle-market companies — i.e., typically small and unproven businesses.

Although it ended June with nearly $209 million of common and preferred stock in its portfolio, the $1.45 billion in debt securities PennantPark Floating Rate Capital holds makes it a decisively debt-focused BDC.

One of the clearest advantages of being a debt-focused BDC for middle-market companies is yield. Unproven businesses usually have limited access to traditional credit markets and basic financial services. When they can access capital, they’re typically going to pay an above-market yield on what they borrow. As of June 30, PennantPark’s $1.45 billion debt-securities portfolio had a weighted-average yield of 12.1%.

Another advantage to this debt-driven investment portfolio is that it’s 100% variable rate. The steepest rate-hiking cycle executed by the Federal Reserve in four decades sent PennantPark’s weighted-average yield on debt investments from 7.4%, as of Sept. 30, 2021, to the 12.1% reported on June 30, 2024. Even with the nation’s central bank expected to kick off a rate-easing cycle later this month, this will be a slow-stepped dropdown in rates. In short, PennantPark’s weighted average yield on debt investments should remain robust.

PennantPark’s management team also deserves a tip of the cap for the ways it’s mitigated risk. Even though PennantPark is investing in smaller, speculative companies, its non-accrual (delinquency) rate in the June-ended quarter amounted to just 1.5% of the cost basis of the company’s portfolio.

Investment diversity is one way the company has avoided trouble. Inclusive of its equity investments, it has roughly $1.66 billion spread across 151 companies, which works out to an average investment size of $11 million. No single investment is large enough to sink the proverbial ship.

Likewise, 99.9% of its debt is held in first-lien secured notes. If one or more of the company’s borrowers were to seek bankruptcy protection, first-lien secured debtholders stand at the front of the line for repayment.

A forward price-to-earnings ratio of 9, coupled with an almost 11% yield, is a recipe for success for patient income seekers.

Should you invest $1,000 in Enterprise Products Partners right now?

Before you buy stock in Enterprise Products Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enterprise Products Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Sean Williams has positions in PennantPark Floating Rate Capital. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Time to Pounce: 2 Electrifying Ultra-High-Yield Dividend Stocks That Are Begging to Be Bought in September was originally published by The Motley Fool

Super Micro Computer Stock Plunged 37.6% in August: Here's Why

Shares of Super Micro Computer (NASDAQ: SMCI) fell 37.6% in August, according to data from S&P Global Market Intelligence. The server systems builder took two heavy hits last month, and shares are now trading 64% below the peak they reached in March.

Market-moving news

First, Supermicro reported its fiscal 2024 fourth-quarter results on Aug. 6. Earnings came up far short of both Wall Street’s consensus estimates and management’s guidance as Supermicro’s cost of sales grew faster than revenues. Soaring operating expenses also weighed on its net profits. Furthermore, earnings guidance for the next quarter came in below the average analyst’s projections.

Management also announced plans for a 10-for-1 stock split that day, but investors focused on the soft bottom-line result. The stock closed 20.1% lower the next day.

The second big drop came near the end of the month. A popular short-selling service posted a negative review of the company on the same day that Supermicro announced that the filing of its full-year 10-K report would be delayed. It’s hard to say which event hit the stock harder, but the overall effect was a single-session price drop of 19%.

Supermicro’s long-term shareholders are still doing great

The triple whammy of disappointing earnings, late financial filings, and a critical analyst report took the shine off Supermicro, but its long-term performance has still been impressive. There are 3,692 stocks on the U.S. market with at least five years of trading history. Supermicro leads the whole pack with a five-year compound annual growth rate of 95.1%.

So don’t cry for long-term Supermicro investors at this point — more recent trend chasers are the ones who have been left holding the bag.

Moreover, the stock looks reasonably affordable now, trading at 4.9 times trailing sales and 9.5 times forward earnings estimates. The artificial intelligence (AI) boom has created sustained high demand for powerful number-crunching computer systems, and Supermicro remains well positioned to exploit that trend. If you were keeping your hands off Supermicro’s soaring stock earlier this year, this steep price drop just might have created the buying opportunity you were looking for all along.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Anders Bylund has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Super Micro Computer Stock Plunged 37.6% in August: Here’s Why was originally published by The Motley Fool

Verizon Is in Talks to Buy Frontier Communications

(Bloomberg) — Verizon Communications Inc. is in advanced talks to acquire rival telecommunications operator Frontier Communications Parent Inc., according to a person familiar with the negotiations.

Most Read from Bloomberg

An all-cash deal between the two companies could be announced as soon as Thursday, the person said, asking not to be named discussing non-public information. A representative for Frontier declined to comment. A spokesperson for Verizon didn’t immediately respond to a request for comment.

The Wall Street Journal earlier reported on the talks. Frontier shares jumped as much as 38%, the most since emerging from bankruptcy in 2021, to $38.62. That gives the company a market value of $9.3 billion.

Dallas-based Frontier bills itself as the “largest pure-play fiber internet company in the US.” It reported sales of $5.8 billion in 2023, with about 52% of total revenue from activities related to its fiber-optic products.

With demand for data usage expected to continue to grow, telecommunications providers have been bulking up their broadband offerings. In July, for example, T-Mobile US Inc. said it would invest $4.9 billion in a joint venture with private equity firm KKR & Co. to buy fiber-optic internet service provider Metronet.

Sowmyanarayan Sampath, the head of the Verizon’s consumer group, told investors at a Bank of America Corp. conference on Wednesday morning that the company had a 20-year history offering internet access over fiber-optic lines and would continue to build on that.

“We like the space and we think the business is good,” he said.

In 2015, Verizon sold parts of its landline phone business in California, Florida and Texas to Frontier for $10.54 billion in cash. Frontier later declared bankruptcy, emerging in 2021 with about $11 billion less debt.

Frontier initiated an internal review of its business earlier this year. The company has faced pressure from activist investor Jana Partners to improve its returns.

–With assistance from Christopher Palmeri.

(Updates with industry details beginning in fifth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Age Of Mythology: Retold Leads Xbox Game Pass September 2024 Lineup

Microsoft Corp. MSFT unveiled the first wave of games for Xbox Game Pass in September 2024 and it’s packed with a diverse lineup that promises something for everyone.

- Age of Mythology: Retold (Cloud, Xbox Series X|S and PC) – Sept. 4

- A real-time strategy game that blends historical warfare with global mythologies, allowing players to battle both nations and mythical creatures.

- Expeditions: A MudRunner Game (Cloud, Console and PC) – Sept. 5

- An action-packed off-road adventure that combines vehicle exploration with camp and crew management in untamed wildernesses.

- Riders Republic (Cloud, Console and PC) – Sept. 11

- An extreme sports sandbox featuring mountain biking, snowboarding, skiing and gliding in a vast open-world environment, supporting both single-player and multiplayer modes.

- Train Sim World 5 (Cloud, Console and PC) – Sept. 17

- A detailed train simulation experience that lets players master iconic routes and operate various trains across new cities with enhanced realism.

See Also: Xbox Game Pass Update: Core, Standard Tiers Face Up To 12-Month Wait For New Releases

As new games enter the Xbox Game Pass library, others must make their exit. On Sept. 15, a handful of titles will leave the service, including:

- Ashes of Singularity: Escalation (PC)

- FIFA 23 (Cloud, Console and PC via EA Play)

- Payday 3 (Cloud, Console and PC)

- Slime Rancher 2 (Cloud, Console and PC)

- SpiderHeck (Cloud, Console and PC)

- You Suck At Parking (Cloud, Console and PC)

Players who wish to continue enjoying these games can purchase them at a 20% discount while they remain available on Xbox Game Pass.

Read Next:

Image credits: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Simon® to Present at BofA Securities 2024 Global Real Estate Conference

INDIANAPOLIS, Sept. 4, 2024 /PRNewswire/ — Simon®, a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations, announced today that the Company will present at the BofA Securities 2024 Global Real Estate Conference on Tuesday, September 10, 2024 at 10:20 a.m. Eastern Time.

A live audio webcast of the presentation will be accessible from the Investors section of the Company’s website at investors.simon.com. An online replay will be available following the presentation at the same location.

About Simon

Simon® is a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations and an S&P 100 company (Simon Property Group, NYSE: SPG). Our properties across North America, Europe and Asia provide community gathering places for millions of people every day and generate billions in annual sales.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/simon-to-present-at-bofa-securities-2024-global-real-estate-conference-302238170.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/simon-to-present-at-bofa-securities-2024-global-real-estate-conference-302238170.html

SOURCE Simon

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.