Investigating Microsoft's Standing In Software Industry Compared To Competitors

In today’s rapidly changing and fiercely competitive business landscape, it is vital for investors and industry enthusiasts to carefully evaluate companies. In this article, we will perform a comprehensive industry comparison, evaluating Microsoft MSFT against its key competitors in the Software industry. By analyzing important financial metrics, market position, and growth prospects, we aim to provide valuable insights for investors and shed light on company’s performance within the industry.

Microsoft Background

Microsoft develops and licenses consumer and enterprise software. It is known for its Windows operating systems and Office productivity suite. The company is organized into three equally sized broad segments: productivity and business processes (legacy Microsoft Office, cloud-based Office 365, Exchange, SharePoint, Skype, LinkedIn, Dynamics), intelligence cloud (infrastructure- and platform-as-a-service offerings Azure, Windows Server OS, SQL Server), and more personal computing (Windows Client, Xbox, Bing search, display advertising, and Surface laptops, tablets, and desktops).

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Microsoft Corp | 35.01 | 11.44 | 12.59 | 8.45% | $34.33 | $45.04 | 15.2% |

| Oracle Corp | 37.58 | 44.14 | 7.43 | 43.89% | $6.21 | $10.36 | 3.26% |

| ServiceNow Inc | 150.59 | 19.75 | 17.29 | 3.12% | $0.48 | $2.08 | 22.19% |

| Palo Alto Networks Inc | 49.20 | 22.53 | 15.80 | 7.42% | $0.32 | $1.62 | 10.31% |

| CrowdStrike Holdings Inc | 393.72 | 23.34 | 19.18 | 1.75% | $0.12 | $0.73 | 31.74% |

| Fortinet Inc | 45.13 | 202.43 | 10.69 | 504.05% | $0.5 | $1.16 | 10.95% |

| Gen Digital Inc | 27.52 | 8.25 | 4.40 | 8.69% | $0.54 | $0.78 | 2.33% |

| Monday.Com Ltd | 321.89 | 14.46 | 15.74 | 1.62% | $0.0 | $0.21 | 34.4% |

| Dolby Laboratories Inc | 32.82 | 2.80 | 5.54 | 1.58% | $0.06 | $0.25 | -3.2% |

| CommVault Systems Inc | 39.34 | 23.67 | 7.95 | 6.62% | $0.02 | $0.18 | 13.38% |

| Qualys Inc | 27.75 | 10.82 | 8.14 | 10.52% | $0.05 | $0.12 | 8.38% |

| Teradata Corp | 44.19 | 36.24 | 1.58 | 57.36% | $0.09 | $0.27 | -5.63% |

| Progress Software Corp | 35.74 | 6.20 | 3.65 | 3.75% | $0.05 | $0.14 | -1.78% |

| N-able Inc | 71.67 | 3.30 | 5.38 | 1.32% | $0.03 | $0.1 | 12.6% |

| Average | 98.24 | 32.15 | 9.44 | 50.13% | $0.65 | $1.38 | 10.69% |

After examining Microsoft, the following trends can be inferred:

-

With a Price to Earnings ratio of 35.01, which is 0.36x less than the industry average, the stock shows potential for growth at a reasonable price, making it an interesting consideration for market participants.

-

Considering a Price to Book ratio of 11.44, which is well below the industry average by 0.36x, the stock may be undervalued based on its book value compared to its peers.

-

The stock’s relatively high Price to Sales ratio of 12.59, surpassing the industry average by 1.33x, may indicate an aspect of overvaluation in terms of sales performance.

-

The company has a lower Return on Equity (ROE) of 8.45%, which is 41.68% below the industry average. This indicates potential inefficiency in utilizing equity to generate profits, which could be attributed to various factors.

-

The company exhibits higher Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $34.33 Billion, which is 52.82x above the industry average, implying stronger profitability and robust cash flow generation.

-

The company has higher gross profit of $45.04 Billion, which indicates 32.64x above the industry average, indicating stronger profitability and higher earnings from its core operations.

-

The company’s revenue growth of 15.2% is notably higher compared to the industry average of 10.69%, showcasing exceptional sales performance and strong demand for its products or services.

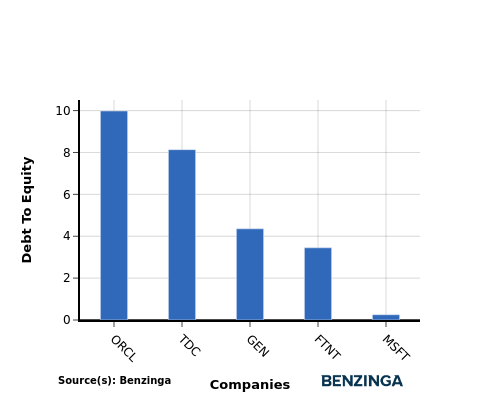

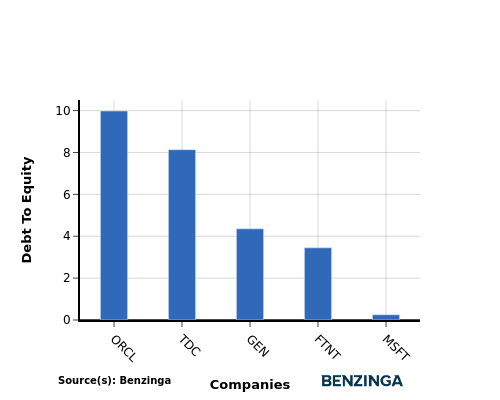

Debt To Equity Ratio

The debt-to-equity (D/E) ratio is a key indicator of a company’s financial health and its reliance on debt financing.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company’s financial health and risk profile, aiding in informed decision-making.

In light of the Debt-to-Equity ratio, a comparison between Microsoft and its top 4 peers reveals the following information:

-

Microsoft is in a relatively stronger financial position compared to its top 4 peers, as evidenced by its lower debt-to-equity ratio of 0.25.

-

This implies that the company relies less on debt financing and has a more favorable balance between debt and equity.

Key Takeaways

For Microsoft in the Software industry, the PE and PB ratios suggest the stock is undervalued compared to peers, indicating potential for growth. However, the high PS ratio implies the stock may be overvalued based on revenue. In terms of ROE, EBITDA, and gross profit, Microsoft shows strong performance, indicating efficient operations and profitability. The high revenue growth further supports Microsoft’s competitive position in the industry.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'The Time Has Come to Adjust' — Cheaper Mortgage Rates Could Be Just Weeks Away, But It All Hinges On This Data

The era of interest rates at two-decade highs may be drawing to a close, with Federal Reserve Chair Jerome Powell hinting at possible cuts as early as September. But for hopeful homebuyers eyeing cheaper mortgages, the path forward is still unclear.

Don’t Miss:

Last week, at the central bank’s annual gathering in Jackson Hole, Wyoming, Powell struck a cautiously optimistic tone. “The time has come for policy to adjust,” he said, confirming the Fed’s intention to begin easing its monetary stance.

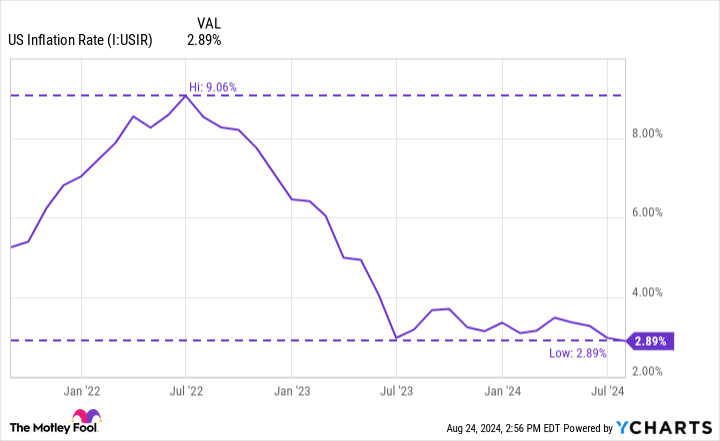

The shift departs from the aggressive rate-hiking campaign of the past two years, designed to tame runaway inflation. Now, with price increases cooling, the Fed faces the challenge of supporting economic growth without reigniting inflationary pressures.

Trending:

While Powell’s remarks clearly signaled that rate cuts are on the horizon, the timing and pace remain uncertain. “The direction of travel is clear,” he said, “but the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

The key variable in this is the labor market.

The Sept. 6 jobs report looms large on the Fed’s radar. A softer-than-expected report could push the central bank toward a more aggressive 50-basis point cut at its Sept. 18 meeting. A resilient job market, however, might prompt a more measured approach.

That uncertainty has left financial markets in a state of cautious optimism. Futures markets are currently split, with a two-thirds probability of a standard 25-basis point cut in September and a one-third chance of a bolder 50-basis point reduction.

See Also:

For potential homebuyers, that translates into a waiting game. While mortgage rates edged down in response to Powell’s remarks, steeper drops may not materialize immediately.

“Additional weak labor market data leading to a series of larger than 25 bps cuts will mean that mortgage rates will fall through the end of the year,” noted Chen Zhao, economics team lead at Redfin. “But a stable, or even falling, unemployment rate will allow the Fed to cut 25 bps at a time and may lead to mortgage rates ticking up a bit from today’s lows through the end of the year.”

Trending:

The Fed’s evolving stance reflects a growing confidence in its battle against inflation. Powell acknowledged that inflation, measured by the Fed’s preferred gauge, has fallen to 2.5%.

“My confidence has grown that inflation is on a sustainable path back to 2%,” he said during his speech, hinting at the possibility of achieving the much sought-after “soft landing.”

The Fed chair also said policymakers had miscalculated the inflationary threat when it emerged in 2020. “The good ship Transitory was a crowded one,” he said, referring to the widespread initial belief that price pressures would be short-lived.

Read Next:

As the Fed navigates the next phase, the housing market grapples with affordability challenges, even as the prospect of lower rates offers some hope.

For now, investors will turn to the upcoming jobs report.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 "Magnificent Seven" Stock That Could Go Parabolic if the Fed Cuts Rates in September

The “Magnificent Seven” is a moniker used to collectively describe the world’s largest technology businesses — Apple, Microsoft, Nvidia, Alphabet, Amazon (NASDAQ: AMZN), Meta, and Tesla.

An interesting characteristic of the Magnificent Seven is that each business is so diverse and spans so many different end markets that this megacap cohort can shed a lot of light on the overall health of the economy.

Investors know that two prominent themes of the macro environment over the last couple of years are lingering inflation and high interest rates. But just a couple of days ago at the Economic Policy Symposium in Jackson Hole, Wyoming, Federal Reserve Chair Jerome Powell said, “The time has come for policy to adjust.”

That sounds like interest rate cuts to me. Should the Fed begin tapering rates, I think there’s a good case to be made that each of the Magnificent Seven stocks will continue roaring.

However, I see Amazon as the candidate with the most upside. Let’s explore how changes in monetary policy could supercharge Amazon and assess why now looks like a lucrative opportunity to buy the stock.

A new spark for e-commerce

Amazon’s largest source of revenue stems from its e-commerce marketplace. The table below illustrates annual revenue growth trends related to Amazon’s online marketplace over the last year.

|

Category |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

|---|---|---|---|---|---|

|

Online stores |

5% |

6% |

8% |

7% |

6% |

|

Physical stores |

7% |

6% |

4% |

6% |

4% |

|

Third-party seller services |

18% |

18% |

19% |

16% |

13% |

|

Subscription services |

14% |

13% |

13% |

11% |

11% |

Data source: Investor Relations.

Notice any patterns? Growth over the last year among physical stores, commissions from third-party sellers, and subscriptions such as Amazon Prime have all decelerated. While sales from online sales have improved modestly, the quarterly results have been pretty inconsistent.

This shouldn’t come across as a surprise, though. Although inflation cooled dramatically in 2023, inflation still lingers. Goods and services are continuing to rise in price, just not as rapidly. When you layer abnormally high inflation with rising interest rates, it’s not entirely surprising to see a slowdown in online shopping and subscription services.

If the Fed does introduce a rate cut in September, I think such a move will be very well received. Even a modest reduction to borrowing costs can go a long way for consumer purchasing power. I think rate cuts will serve as a catalyst for Amazon’s e-commerce segment and ignite some newfound growth for the company’s largest business.

Moreover, I think Amazon’s e-commerce partnerships with social media powerhouses look all the more savvy now that rate cuts appear to be drawing closer.

More investments in artificial intelligence (AI)

Even though Amazon’s e-commerce business has faced an uphill battle over the last year, the company has been able to generate growth from other sources. Namely, cloud computing platform Amazon Web Services (AWS) has been a major beneficiary of the artificial intelligence (AI) revolution.

Similar to my e-commerce thesis, I think rate cuts will provide corporations of all sizes with some newfound financial flexibility. In turn, AWS looks poised for some acceleration as businesses continue to increase investments in AI applications.

Why Amazon stock looks primed to thrive right now

For the trailing 12 months ended June 30, Amazon generated $53 billion of free cash flow — an increase of 572% year over year. Considering Amazon’s total revenue is only growing 10% year over year, it’s incredible to see such a significant increase in profitability metrics.

Over the last 10 years, Amazon’s market capitalization has risen about 1,140%. Over this same time frame, the company’s free cash flow has grown roughly fourfold.

Amazon’s current price to free cash flow (P/FCF) ratio is 38.9. By comparison, the company’s 10-year average P/FCF ratio is about 84. This means that Amazon stock is technically more reasonably priced today than it was a decade ago, despite evolving into a much larger, complex enterprise spanning a multitude of new market opportunities.

To me, investors are really overlooking Amazon stock right now and not entirely capturing just how quickly the company can mint new levels of profitability. Amazon has managed to grow free cash flow exponentially even during a time of unpredictable sales growth, but I don’t think the current valuation fully reflects this dynamic.

With loads of cash on the balance sheet and the possibility of interest rate cuts looming, I think Amazon’s business is about to be supercharged by rejuvenated consumers and corporations alike, and see now as a terrific time to load up on shares.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 “Magnificent Seven” Stock That Could Go Parabolic if the Fed Cuts Rates in September was originally published by The Motley Fool

Market rises into Labor Day, but falls well short of Fourth of July

This week’s FreightWaves Supply Chain Pricing Power Index: 35 (Shippers)

Last week’s FreightWaves Supply Chain Pricing Power Index: 35 (Shippers)

Three-month FreightWaves Supply Chain Pricing Power Index Outlook: 35 (Shippers)

The FreightWaves Supply Chain Pricing Power Index uses the analytics and data in FreightWaves SONAR to analyze the market and estimate the negotiating power for rates between shippers and carriers.

This week’s Pricing Power Index is based on the following indicators:

Tender volumes close August higher than where they began

After the sluggish start to August, tender volumes have been trending higher throughout the month. August will follow a trend similar to last year when tender volumes will close the month higher than they began the month. With import levels still being extremely elevated, eventually the freight will move to the truckload market, it is more a matter of timing of when that happens.

To learn more about FreightWaves SONAR, click here.

The Outbound Tender Volume Index, a measure of national freight demand that tracks shippers’ requests for trucking capacity, is 1.87% higher week over week, the largest increase since the impacts of Fourth of July. The gap with year-ago levels rebounded over the past week as volumes continued to inch higher. Volumes are currently 3.13% higher year over year.

To learn more about FreightWaves SONAR, click here.

Contract Load Accepted Volume (CLAV) is an index that measures accepted load volumes moving under contracted agreements. In short, it is similar to OTVI but without the rejected tenders. Looking at accepted tender volumes, we see an increase of 1.39% w/w, a slightly smaller increase than OTVI as tender rejection rates moved higher over the past week. Accepted tender volumes are up 1.41% y/y.

Earnings reports in the retail space have continued to show that comp sales remain challenged, but retailers have been able to control costs extremely well. A prime example of this was at Best Buy, a company that needs strong discretionary spending for electronic purchases. In the company’s second quarter earnings release, comparable sales declined by 2.3%, but the company’s non-GAAP diluted EPS was 9.8% higher y/y.

With the increase in imports, it appears that retailers, especially big box retailers, are expecting a strong fourth quarter from a consumer spending perspective.

To learn more about FreightWaves SONAR, click here.

Volume increases took hold across the majority of the country as 74 of the 135 freight markets tracked within FreightWaves SONAR showed week-over-week increases in volumes.

Even with the uptick in volumes over the past week, the largest freight markets in the country experienced tender volumes decline. Tender volumes in Ontario, California fell by 0.69% w/w. Moving east into Dallas, tender volumes were 1.37% lower w/w. In the southeast, the decline was even more severe as tender volumes in Atlanta fell by 4.04% w/w.

To learn more about FreightWaves SONAR, click here.

By mode: Dry volumes are now almost up to Fourth of July volumes, which is a positive as August comes to a close. The Van Outbound Tender Volume Index increased by 2.76% w/w. Dry van volumes are 3.93% higher y/y, as the gap with 2023 levels continues to widen after coming in line with 2023 levels in early August.

The reefer market continues to show that it is trending higher, but with more hiccups along the way. Over the past week, the Reefer Outbound Tender Volume Index increased by 2.31%. Despite the weekly increase, reefer volumes are still down 3.82% y/y.

Rejection rates inch higher for Labor Day weekend

Tender rejection rates have reacted to the Labor Day holiday weekend, but the reaction has been fairly muted in comparison to the Fourth of July holiday week. Tender rejection rates moved higher over the past week, approaching 5%, but that’s over 200 basis points lower than the Fourth of July peak.

To learn more about FreightWaves SONAR, click here.

Within the past week, the Outbound Tender Reject Index (OTRI), which measures relative capacity in the market, increased by 45 basis points to 4.86%. The increase was the largest weekly increase since the Fourth of July holiday and very similar to the increase leading into Labor Day last year. Tender rejection rates continue to run slightly higher than they were this time last year, currently 47 basis points higher y/y. Compared to 2019, the year in which the current direction aligns with the most, tender rejection rates are currently 18 bps higher.

To learn more about FreightWaves SONAR, click here.

The map above shows the Outbound Tender Reject Index — Weekly Change for the 135 markets across the country. Markets shaded in blue are those where tender rejection rates have increased over the past week, while those in red have seen rejection rates decline. The bolder the color, the more significant the change.

Of the 135 markets, 96 reported higher rejection rates over the past week, an increase from 76 in last week’s report.

The Detroit, Michigan market experienced the largest increase in tender rejection rates of the largest freight markets. Tender rejection rates in Detroit increased by 169 bps w/w.

The Pacific Northwest is seeing rejection rates increase over the past week, including Seattle where rejection rates were 204 bps higher w/w.

To learn more about FreightWaves SONAR, click here.

By mode: Dry van rejection rates did move higher over the past week, but haven’t eclipsed the levels experienced earlier in August. Over the past week, the Van Outbound Tender Reject Index rose by 18 bps to 4.47%. Dry van rejection rates are 62 bps higher than they were this time last year.

The reefer market is being far more volatile than the dry van market as reefer rejection rates are on the rise. The Reefer Outbound Tender Reject Index has increased by 230 basis points to 10.73%. Reefer rejection rates are 57 basis points higher than they were this time last year.

Flatbed rejection rates continue to be under pressure, largely due to the higher interest rate environment. With interest rate cuts on the horizon, it is likely that the last four months of the year will see some muted activity until industrial and manufacturing companies deploy capital that has been on the sidelines. Over the past week, the Flatbed Outbound Tender Reject Index fell by 87 basis points to 6%. Flatbed tender rejection rates are 68 basis points lower y/y, as the higher interest rate environment had a lagging impact to the market.

Spot rates have limited movement into Labor Day

Spot rates have leveled out at Memorial Day holiday levels, which is a positive sign for the market moving into the final stanza of the year. At the same time, contract rates have been moving higher since late June, which signals that significant cost savings have already been realized.

To learn more about FreightWaves SONAR, click here.

This week, the National Truckload Index (NTI) — which includes fuel surcharge and various accessorials — was unchanged over the past week at $2.27 per mile. Compared to this time last year, the NTI is up 1 cent per mile. The linehaul variant of the NTI (NTIL) — which excludes fuel surcharges and other accessorials — was up 1 cent per mile this week at $1.70. The NTIL is 12 cents per mile higher than it was at this time last year. The discrepancy in the NTIL and NTI is solely the changes in fuel, which was far more expensive in 2023 than currently. The average diesel truck spot price per gallon is 73 cents per gallon, or 16.4%, lower than it was last year.

Initially reported dry van contract rates remain in a fairly tight range, increased by 5 cents per mile over the past week at $2.33. Throughout 2024, contract rates have been in a tight range, an indication that the extreme cost savings are in the rearview mirror and service is now coming to the forefront. Initially reported contract rates are down 5 cents per mile from this time last year, about a 2% decline.

To learn more about FreightWaves SONAR, click here.

The chart above shows the spread between the NTIL and dry van contract rates is trending back to pre-pandemic levels. The spread widened over the past week as van contract rates increased while spot rates were fairly stable. If spot rates move higher over the next week as any disruption from the Labor Day holiday works itself out, it will narrow the spread.

To learn more about FreightWaves TRAC, click here.

The FreightWaves Trusted Rate Assessment Consortium spot rate from Los Angeles to Dallas fell by 2 cents per mile over the past week to $2.22 per mile.

To learn more about FreightWaves TRAC, click here.

From Chicago to Atlanta, the TRAC rate was stable over the past week, remaining at $2.44 per mile. Contract rates along this lane increased at the start of the week, widening the spread to nearly 50 cents.

The post Market rises into Labor Day, but falls well short of Fourth of July appeared first on FreightWaves.

HP confirms it will pursue Mike Lynch’s grieving family for $4 billion

Hewlett Packard has confirmed it will continue to pursue Mike Lynch’s family for up to $4 billion as it seeks to conclude a 13-year legal battle.

The Silicon Valley-based tech group has been at odds with Lynch since 2011, when its $11.7 billion acquisition of his Autonomy group turned sour. Hewlett Packard Enterprise (HPE) wrote down the deal’s value by $8.8 billion, citing “accounting irregularities.”

HPE, formerly known as HP, won a civil trial against Lynch in the U.K. in 2022 after a judge ruled that he was likely aware of accounting fraud at the company.

He was acquitted of fraud charges in a U.S. criminal trial in June and intended to use this verdict to appeal the civil ruling.

However, Lynch died on his wife Angela Bacares’s Bayesian superyacht in August after the boat ran into a storm. Bacares is now expected to inherit her late husband’s battle with the tech group.

There was speculation that HPE would be deterred from pursuing Lynch’s family for damages owing to the negative publicity such a move could create.

Robin Henry, partner and head of dispute resolution services at Collyer Bristow, told Fortune that HPE was stuck “on the horns of a dilemma” over whether it would be willing to face criticism for continuing with the proceedings.

However, HPE has now confirmed it will carry forward with the final stages of the trial.

“In 2022, an English High Court judge ruled that HPE had substantially succeeded in its civil fraud claims against Dr Lynch and Mr Hussain,” an HPE spokesperson told Fortune.

“A damages hearing was held in February 2024 and the judge’s decision regarding damages due to HPE will arrive in due course. It is HPE’s intention to follow the proceedings through to their conclusion.”

After ruling in HPE’s favor in the U.K. civil trial, the judge indicated that damages would be considerably less than the $4 billion HPE sought.

The total value of Lynch’s estate is unknown, but it isn’t likely to be anywhere near $4 billion. He reportedly collected £500 million (then around $800 million) for the Autonomy deal. He set up the venture capital fund Invoke Capital in 2012 and held a 3% stake in the British cybersecurity group Darktrace at the time of his death.

As a U.S.-listed company, HPE has a fiduciary duty to act in the best interests of its shareholders. The company will be mindful of this after being sued by shareholders in the wake of its Autonomy acquisition.

The process of pursuing a defendant’s family after they die is a macabre subject, but legally, it’s very straightforward.

“Following Mike Lynch’s tragic death, his executors ‘step into his shoes,’” Oliver Embley, a partner at Wedlake Bell, told Fortune last week.

“In the UK, all legal actions against a person survive against their estate following their death. Any judgment already made, as in the case of HPE’s High Court claim against Mr Lynch, is binding on his estate.”

It means Bacares, who is grieving both Lynch and their late 18-year-old daughter, Hannah, will likely take the wheel when the judge returns to conclude damages later this year.

This story was originally featured on Fortune.com

Global benchmarks are mixed in cautious trading ahead of US holiday and jobs report

TOKYO (AP) — Global shares were mixed in cautious trading Monday ahead of the Labor Day holiday in the U.S., when stock exchanges are closed.

France’s CAC 40 slipped 0.3% in early trading to 7,611.64, while Germany’s DAX fell 0.1% to 18,881.14. Britain’s FTSE 100 was little changed, down less than 0.1% at 8,370.39. U.S. shares were set to drift lower with Dow futures down 0.1% at 41,613.00. S&P 500 futures fell 0.1% to 5,654.25.

Investors were also looking ahead to the U.S. employment report set for release Friday for an indication of the strength of the American economy.

In Asia, Japan’s Nikkei 225 gained 0.1% to finish at 38,700.87, after the Finance Ministry reported capital spending by Japanese companies in the April-June quarter increased 7.4% from the previous year.

After a period of stagnation, Japan’s economy is showing signs of a recovery. Next week, Japan will release revised gross domestic product, or GDP, data, a measure of the value of a nation’s goods and services. The preliminary data released earlier showed the first growth in two quarters.

Australia’s S&P/ASX 200 rose 0.2% to 8,109.90, while South Korea’s Kospi gained nearly 0.3% to 2,681.00. Hong Kong’s Hang Seng slipped 1.7% to 17,691.97. The Shanghai Composite dipped 1.1% to 2,811.04.

A bit of pessimism rolled in over China’s growth prospects over the weekend, as its National Bureau of Statistics reported that August manufacturing PMI, a barometer of industrial output, fell from 49.4 to 49.1. That was weaker than market forecasts.

Recent reports on the U.S. economy, including inflation, consumer spending and income, have been encouraging. The Commerce Department said its personal consumption and expenditures report showed prices rose 0.2% from June to July, up slightly from the previous month’s 0.1% increase.

That means price rises are slowing down, and that’s likely to lead to the Federal Reserve cutting interest rates for the first time in more than four years. The market expects the Fed will start cutting rates later this month.

In other encouraging news, Friday’s Commerce Department report showed Americans stepped up their spending by 0.5% from June to July and incomes rose 0.3%, faster in July than the previous month.

In energy trading, benchmark U.S. crude rose 5 cents to $73.60 a barrel. Brent crude, the international standard, added 6 cents to $76.99 a barrel.

In currency trading, the U.S. dollar edged up to 146.68 Japanese yen from 146.18 yen. The euro cost $1.1071, up from $1.1053.

___

Yuri Kageyama is on X: https://x.com/yurikageyama

Despite Being Down Between 22% and 64% From Their Peaks, These 3 Dividend Stocks Are Worth Buying in September

The S&P 500 and Dow Jones Industrial Average are less than 1% off their all-time highs, while the Nasdaq Composite is off by less than 5% from its peak. And yet, there are still plenty of stocks that are trading far below their peak prices, and many that have lost ground so far this year.

Among those stocks are oil and gas exploration and production company Devon Energy (NYSE: DVN), package delivery giant United Parcel Service (NYSE: UPS), and electrification technology company nVent Electric (NYSE: NVT). But these fool.com contributors think all three of these dividend stocks are worth buying now.

Devon Energy offers a high yield and takes a conservative approach to its payout

Scott Levine (Devon Energy): When a stock tumbles, investors naturally want to know if there’s something fundamentally wrong with the business that underpins the market’s skepticism. That’s certainly a question worth asking about Devon Energy, as its shares are currently trading about 19% below their 52-week high and down 64% from their all-time high. But even a cursory look at the exploration and production company shows that it’s performing well, and the stock’s decline is not predicated on something catastrophically wrong. Consequently, investors with longer investing horizons can sit back patiently while the stock recovers — collecting the passive income provided by a dividend that yields 4.5% at the current share price.

The sharp decline in Devon Energy’s stock belies the strong second-quarter financial results it recently shared. Surpassing its guidance, Devon Energy achieved daily oil production of 355,000 barrels, thanks to unexpectedly good results in the Delaware Basin. Moreover, thanks to the company’s strong performance in the first half of the year and its planned acquisition of Grayson Mill in the third quarter, management upwardly revised its 2024 production guidance to more than 680,000 barrels of oil equivalent per day — a 5% increase from the original forecast.

Devon divides its dividend payouts into fixed and variable distributions. In general, management aims for the fixed amount to equal about 10% of the company’s operating cash flow with the variable amount based on a variety of other factors. Broadly speaking, though, management aims to return about 70% of free cash flow to investors — a cautious approach that won’t jeopardize the company’s financial well-being.

For investors who are looking for dividend payments that come at a steady rate, Devon Energy isn’t the best choice since its payouts are based on its performance. However, those who are comfortable reaping the rewards when it’s strong — and weathering the temporary downturns during which it’s not — should consider picking up shares.

UPS has an enticing dividend

Daniel Foelber (UPS): Shares of the package delivery giant surged during the pandemic as vast numbers of consumers shifted much of their purchasing from in-store shopping to online ordering. But the stock is now down 45% from its all-time high and hovering around a four-year low.

UPS thought that the growth in demand for its services would last. It did not.

Earlier this year, UPS cut its once-optimistic forecast and charted a more realistic path forward based on a gradual rise in package delivery demand and a new three-year plan. Now, UPS must deliver on its promises. So far, it hasn’t done so.

The logistics giant’s just half a year into this new plan, and its results have already been disappointing. The good news is that UPS expects to return to earnings growth in the second half of the year. On its second-quarter earnings call, management also made a point of noting that its performance so far this year was heavily impacted by front-loading certain costs of the new labor contract it signed about a year ago with its largest union. But given the company’s consecutive earnings misses, investors are understandably not giving it the benefit of the doubt — hence the abysmal performance of the stock.

There’s no sugarcoating that UPS faces an identity crisis. It still hasn’t found a balance for what its new normal will look like, and investors have lost faith in management’s ability to forecast demand trends — which is a problem, given that poor forecasting can result in major excess labor and fuel costs or missed opportunities.

Despite the uncertainty, there is reason to believe that UPS stock has fallen far enough. The stock trades at a price-to-earnings ratio of just 20.9 — which is already reasonable. But that’s an especially attractive valuation considering that its earnings have been falling for over two years now, and its 12-month trailing earnings are now roughly the same as they were five years ago.

If UPS can return to growth in the coming years, we could look back at this time as an excellent buying opportunity. Some investors may want to wait for concrete signs that UPS is turning the corner. But those who are willing to take a stake in UPS now will benefit from a dividend that yields 5.1% at the current share price — which is a worthwhile incentive to hold the stock and endure this volatile period.

nVent’s electrifying future

Lee Samaha (nVent Electric): This electrical connection and protection solutions company’s stock is down 22.7% from its recent all-time high, and I think its sell-off has created a decent buying opportunity for an attractive long-term story.

nVent’s products (enclosures, electrical, and fastening solutions) are a pick-and-shovel way to play the “electrification of everything” megatrend. There are no data centers, renewable energy, industrial automation, 5G communications, or smart buildings/infrastructure without electrical infrastructure, and that means investments in the type of solutions sold by nVent.

As such, the stock represents a backdoor way to play an exciting thematic trend. Moreover, management is strengthening the company’s exposure to the theme through acquisition and divestitures. Over the last month, nVent completed the $695 million acquisition of custom-engineered control building solutions company Trachte. In addition, nVent announced the $1.7 billion divestiture of its mission-critical electrical thermal management solutions business.

As CEO Beth Wozniak noted on the company’s second-quarter earnings call, “The addition of Trachte further strengthens our solutions in high-growth verticals with approximately 85% of its sales in power utilities, data centers and renewables.”

nVent’s second quarter results were solid enough, and management continues to expect full-year organic sales growth of 3% to 5%, with adjusted earnings per share in the range of $3.23 to $3.29. Based on that, it trades at slightly more than 20 times estimated earnings.

While the dividend yield of 1.2% isn’t anything to write home about, its payout of $0.76 per share is well covered and gives management plenty of room for significant increases in the future.

Should you invest $1,000 in Devon Energy right now?

Before you buy stock in Devon Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Devon Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Daniel Foelber has no position in any of the stocks mentioned. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.

Despite Being Down Between 22% and 64% From Their Peaks, These 3 Dividend Stocks Are Worth Buying in September was originally published by The Motley Fool

Ambarella, Bill Holdings And Box Are Among Top 7 Mid Cap Gainers Last Week (Aug 25-Aug 31): Are The Others In Your Portfolio?

These seven mid-cap stocks were the best performers in the last week. Are they in your portfolio?

- Semtech Corporation SMTC shares jumped 19.43% after the company reported better-than-expected second-quarter financial results. A couple of analysts raised the price target on the stock.

- Stevanato Group STVN stock gained 17.89% in the last week.

- Ambarella, Inc. AMBA stock escalated 17.29% after the company posted better-than-expected second-quarter results. Several analysts raised the price target.

- Ardent Health Partners, Inc. ARDT stock was up 15.16%.

- BILL Holdings, Inc. BILL shares increased 13.98% after the company’s CEO and CFO disclosed share purchases.

- Box, Inc. BOX shares increased 12.88% after the company reported better-than-expected second-quarter results and issued three-quarter and FY25 guidance above estimates. Some analysts raised the price target on the stock.

- Grupo Financiero Galicia S.A. GGAL shares are up 11.91% after JP Morgan upgraded the stock from Underweight to Overweight and announced a $54 price target.

Also Read:

Photo by Sundry Photography via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Ridiculously Easy Way to Beat the Stock Market Experts

Individual investors love looking at the trading moves of legends in the industry, like Warren Buffett, Bill Ackman, Stanley Druckenmiller, or Cathie Wood. These professionals are in their positions for a reason. And maybe it’s best to follow what they do for your own portfolio.

While there are certainly some fund managers out there who deserve a ton of credit for putting up impressive track records, the truth is that the vast majority of them actually lose to the S&P 500. This is a troubling statistic.

But all hope isn’t lost for the individual investor. If you want to beat these so-called experts, here’s one ridiculously easy way of doing so.

Keep it simple

If most fund managers lose to the market over a long time horizon, then it makes sense that owning an exchange-traded fund that tracks the performance of the S&P 500, like the Vanguard S&P 500 ETF (NYSEMKT: VOO), is a no-brainer method of outperforming the experts. In the past decade, this ETF has produced a total return of 237%, turning a $10,000 initial cash outlay into almost $34,000 today.

That’s certainly a respectable gain that could’ve been achieved by doing absolutely nothing. It didn’t require someone to pore over financial statements or stock reports or to obtain a fancy MBA.

Besides being very low maintenance, perhaps even more notable is the fact that buying and holding the Vanguard S&P 500 ETF is cheap. The expense ratio of 0.03% means that for every $10,000 invested, only $3 goes toward the fee each year. Compare that to professional money managers who can charge substantially more than that for what’s usually poor performance.

Investing in the stock market is a unique playing field where the pros can severely underperform the average person out there, as well as the overall market. It could be due to overconfidence and trading too often, following the herd and owning what everyone else does, or simply over-diversifying and not focusing on the best ideas. There could be many reasons for the disappointing results.

At the end of the day, the simplest option is typically the best, particularly when dealing with your hard-earned savings and investments. In my opinion, that choice is the Vanguard S&P 500 ETF.

Behavior matters

Knowing what investment vehicle to put money into is only half the battle. Now that investors understand that they can do much better than the experts by simply buying and holding the Vanguard S&P 500 ETF, another critical factor to think about is behavior.

I don’t think anyone believes that professional fund managers aren’t smart. These are well-educated people who know how markets work and how to analyze companies and stocks. But even they, too, must deal with their own biases and emotions.

Here’s where the individual investor can try to gain an edge. There’s no need to try and time the market, even though it sounds like a smart idea to trade in and out of stocks to avoid the down days and capture the up days. The best course of action is to adopt a dollar-cost average strategy, regularly adding savings into the ETF on a monthly or quarterly basis. Staying focused over the longer term, such as 10 years or more, is key, while also recognizing that volatility is inevitable.

Next time you turn on the financial news and watch so-called experts sitting around a table discussing the market and their stock picks, you can rest assured knowing that your portfolio is likely to perform better than theirs over the long term. And all thanks go to the Vanguard S&P 500 ETF.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Neil Patel and his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

1 Ridiculously Easy Way to Beat the Stock Market Experts was originally published by The Motley Fool

Billionaire Bill Gates Has 54% of His Trust Invested in 2 Brilliant Stocks

The Bill & Melinda Gates Foundation (BMGF) engages in various philanthropic activities around the world, everything from improving healthcare systems and promoting education to fighting poverty and inequalities. Since its inception, the organization had paid out more than $77 billion in grants.

The foundation’s charitable giving is funded by the BMGF Trust, which holds and invests donated money. As of June 2024, the trust had $48 billion spread across 23 positions, but 54% of the portfolio was allocated to two stocks: 33% in Microsoft (NASDAQ: MSFT) and 21% in the Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.A).

Incidentally, the BMGF Trust beat the S&P 500 (SNPINDEX: ^GSPC) by 10 percentage points in the last three years. That outperformance was due in large part to its substantial positions in Microsoft and Berkshire Hathaway. Moreover, current asset allocation suggests Bill Gates (Co-Chair of the Board of Trustees) still has confidence in both stocks.

Here’s what investors should know.

Microsoft: 33% of the Bill & Melinda Gates Foundation Trust

Microsoft is the largest software company in the world. It has a particularly strong presence in the business productivity and enterprise resource planning verticals with its Office and Dynamics products, respectively. Microsoft has added generative artificial intelligence (AI) copilots to both ecosystems to create new monetization opportunities. Copilot customers increased more than 60% sequentially in the June quarter.

Additionally, Microsoft Azure is the second-largest public cloud. The company has a strong presence in several cloud verticals, including cybersecurity, database management systems, and hybrid computing. Additionally, research company Gartner recently named Microsoft a leader in data science and machine learning platforms, and Azure has secured early momentum in generative AI developer services due to its partnership with OpenAI.

Given those strengths, Morgan Stanley analysts think Azure could overtake Amazon Web Services (AWS) as the leading public cloud by 2027. Microsoft actually lost two percentage points of market share (sequentially) in the June quarter, while AWS and Alphabet‘s Google Cloud gained a percentage point a piece. But Microsoft CFO Amy Hood noted that demand for AI services exceeded capacity, so market share losses could be temporary while the company builds out its infrastructure.

Microsoft reported better-than-expected financial results in the fourth quarter of fiscal 2024 (ended June 30). Revenue increased 15% to $64.7 billion and GAAP net income rose 10% to $2.95 per diluted share. The top line grew faster than the bottom line because the recent Activision acquisition added about three points to revenue growth and subtracted about two points from operating income growth.

On a less optimistic note, Azure revenue missed estimates in the fourth quarter, and management provided worse-than-expected guidance for the first quarter of fiscal 2025. That caused the stock to tumble about 5% following the report, and shares have yet to fully recover.

Going forward, Wall Street expects Microsoft’s earnings to grow at 15% annually through 2027. That makes the current valuation of 35.3 times earnings look relatively expensive. Investors should be cautious right here. Personally, I would feel more comfortable buying Microsoft stock if it was 15% cheaper, somewhere around $360 per share.

Berkshire Hathaway: 21% of the Bill & Melinda Gates Foundation Trust

Berkshire Hathaway is a holding company that owns a diverse group of subsidiaries, the most important of which are its insurance businesses. Berkshire first entered the insurance industry when it purchased National Indemnity in 1967, pivoting away from its core textile business. The company has since become the world leader in insurance float, a term that refers to insurance premiums paid to Berkshire that have not yet been paid out in claims.

CEO Warren Buffett says the company has paid “less than nothing” to accumulate float due to its disciplined underwriting, meaning earned premiums have generally exceeded the cost of paying claims. In fact, Berkshire achieved a combined ratio of 87% in the second quarter, well below the industry average of 101.5%. Values under 100% correspond to profitable underwriting, so Berkshire’s underwriting is much better than average.

Warren Buffett and his fellow investment managers Todd Combs and Ted Weschler have invested that float to great effect over the years. Berkshire had $235 billion in U.S. Treasury bills and $285 billion in equity securities (stocks) on its balance sheet as of the second quarter. That sizable investment portfolio has helped drive book value per share growth of 10.4% annually over the last three years, outpacing the 8.3% annual gain in the S&P 500.

Berkshire Hathaway delivered a solid financial performance in the second quarter. Revenue increased 1.2% to $93.7 billion and operating earnings (which exclude gains and losses on stocks) increased 16% to $11.6 billion.

Going forward, Wall Street expects operating earnings to increase at 17% annually through 2027. That consensus estimate makes the current valuation of 24 times operating earnings look reasonable. Investors should consider buying a small position, especially if they are looking for an excellent defensive stock. Berkshire outperformed the S&P 500 during the last six recessions by a median of 4.4 percentage points, according to Bespoke Investment Group.

Should you invest $1,000 in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Berkshire Hathaway, and Microsoft. The Motley Fool recommends Gartner and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Billionaire Bill Gates Has 54% of His Trust Invested in 2 Brilliant Stocks was originally published by The Motley Fool