If You Like Eli Lilly, Then You'll Love This Little-Known Specialty Manufacturing Stock

Mark Twain is rumored to have said: “During the gold rush, it’s a good time to be in the pick and shovel business.”

Whether he did in fact say these words or not isn’t really all that important. The bigger idea here is that there tend to be less obvious ways to profit from situations whenever a hot new product hits the shelves.

A great example of this is found in the pharmaceutical industry. Over the last couple of years, glucagon-like peptide 1 (GLP-1) agonists such as Mounjaro and Zepbound have revolutionized the way care is provided to diabetes and obesity patients. Eli Lilly is the manufacturer of these blockbuster drugs, and investors have sent the stock soaring over the last two years.

However, the investment opportunity surrounding the GLP-1 realm goes much deeper than pharma stocks. One company that is benefiting big time from rising demand for GLP-1 drugs is Jacobs Solutions (NYSE: J).

Let’s break down what Jacobs Solutions does, and explore why now looks like a lucrative opportunity to scoop up some shares.

What does Jacobs Solutions do?

Jacobs Solutions is in the construction business, but not in the way you might think. Instead of building houses, Jacobs specializes in extremely sophisticated and time-consuming infrastructure projects, such as data centers, spacecraft, city planning, and life sciences facilities.

Some of the company’s customers include NASA, Procter & Gamble, and Bristol Myers Squibb.

What makes Jacobs Solutions so unique?

During a recent interview with CNBC’s Jim Cramer, Jacobs’ CEO Bob Pragada shared a really interesting perspective on how the company is playing a key role in the future of GLP-1 development working alongside Lilly.

Big news! 📺🚨

CEO Bob Pragada stopped by @CNBC to discuss end-to-end lifecycle solutions in consulting & advisory across infrastructure, advanced facilities, life sciences, water & more.

Watch here ➡️ https://t.co/AFXnQ0LgB0

— Jacobs (@JacobsConnects) Aug. 16, 2024

There are a couple of important ideas to unpack from the video shared above.

Pragada explains just how complicated Lilly’s GLP-1 facilities are. He makes it clear that these projects are not simply up for grabs and available for a variety of builders to bid on. Since competition is extremely limited and the need for Jacobs’ expertise is high, the company is in a good position to command pricing power for its services.

Given these dynamics, I’d argue that Jacobs has built a relative competitive moat. Furthermore, the subtle opportunity with Jacobs is that the company tends to win repeat business from its customers during expansion phases.

As Cramer alludes, it’s entirely possible for Lilly to build additional factories in Asia and Europe should demand for its GLP-1 medications warrant the investment. If this happens, Jacobs looks well-positioned to win this business in the future and be a tangential beneficiary of various themes fueling its customers.

Why now looks like a great opportunity to buy Jacobs Solutions stock

I see a few reasons to buy Jacobs stock right now.

First, the company recently announced that it is spinning off its Critical Mission Solutions (CMS) business, as well as segments of its Divergent Solutions business — specifically the Cyber & Intelligence business.

Pragada notes that divesting these non-core assets will help make Jacobs “a more focused, higher-margin company more closely aligned with key global mega trends.”

I find these remarks encouraging and see the spin-off as a sign that Jacobs understands where its growth is coming from, and where the company wants to continue investing.

According to JP Morgan, the total addressable market (TAM) for GLP-1 treatments could reach $100 billion by 2030 just in the U.S.

To me, these forecasts imply that GLP-1 demand will be here for quite some time. Therefore, I am bullish that Lilly will need to continue investing in infrastructure in order to meet supply and demand capacities. For these reasons, I think Jacobs’ relationship with Lilly could be transformative.

Outside of the weight loss space, Jacobs is also playing a quiet role in various areas of artificial intelligence (AI), including data centers and electric vehicle production.

As of the time of this article, Jacobs trades at a forward price-to-earnings (P/E) multiple of 16.1. In comparison, the forward P/E of the S&P 500 is around 21.7.

The company’s discounted valuation relative to the broader market could suggest that investors are overlooking Jacobs Solutions. While the company itself may not be selling breakthrough medications or AI software, these opportunities still represent major bellwethers for Jacobs as it helps leading players in the background.

The long-run secular tailwinds fueling many of the markets in which Jacobs operates, combined with the company’s competitive edge and reasonable valuation, make it a compelling investment opportunity in my eyes.

Should you invest $1,000 in Jacobs Solutions right now?

Before you buy stock in Jacobs Solutions, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Jacobs Solutions wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Adam Spatacco has positions in Eli Lilly. The Motley Fool has positions in and recommends Bristol Myers Squibb and JPMorgan Chase. The Motley Fool has a disclosure policy.

If You Like Eli Lilly, Then You’ll Love This Little-Known Specialty Manufacturing Stock was originally published by The Motley Fool

Up 69% in 2024, This Red-Hot Artificial Intelligence (AI) Growth Stock Could Keep Soaring

Semiconductor specialist Cirrus Logic (NASDAQ: CRUS) may not be a household name like some of its industry peers, but the company has done impressively well on the market so far this year with gains of 69% as of this writing.

Cirrus, which is known for supplying chips for Apple‘s (NASDAQ: AAPL) products, has outpaced the broader Nasdaq-100 Technology Sector index’s gains of 10% by a big margin. The good news is that Cirrus’ outstanding growth is here to stay, and the company could finish the year strongly thanks to its largest customer. What’s more, the arrival of artificial intelligence (AI)-enabled smartphones is likely to unlock a massive long-term growth opportunity for Cirrus Logic.

Let’s take a closer look at the reasons why investors should consider buying Cirrus Logic stock hand over fist before it’s too late.

Cirrus Logic’s recent results point toward a bright future

Cirrus Logic released fiscal 2025 first-quarter results (for the three months ended June 29) on Aug. 6. The company’s revenue increased 18% year over year to $374 million and was well ahead of the consensus estimate of $318 million. What’s more, Cirrus’ adjusted earnings jumped a solid 67% year over year to $1.12 per share, crushing Wall Street’s $0.61 per share estimate.

The positive news didn’t end here, as Cirrus expects its fiscal Q2 revenue to land between $490 million and $550 million. The midpoint of the guidance range stands at $520 million, and that’s well above the Wall Street estimate of $485 million. Cirrus clocked revenue of $481 million in the same quarter last year, indicating that its top line is on track to increase by 8% on a year-over-year basis.

Cirrus’ top line could land closer to the higher end of its guidance range thanks to its largest customer, Apple, which accounted for a whopping 88% of its top line last quarter. Cirrus management pointed out on the recent earnings conference call that its revenue exceeded the top end of its original guidance range thanks to “stronger than expected shipments into smartphones.”

Because Apple is Cirrus’ largest customer, the stronger-than-expected performance means that Cirrus got more orders for its chips last quarter. That’s not surprising, as Apple seems to be preparing for an aggressive rollout of its next-generation iPhones that are all set to support generative AI features.

Apple’s rumored iPhone 16 is expected to hit the market next month and the tech giant is expected to ship 90 million units of its updated smartphone lineup this year. That would be a 10% increase over last year. But at the same time, supply chain reports indicate that Apple is stocking up on 120 million display panels, suggesting that it may end up manufacturing more units than what the market is currently anticipating.

If that’s indeed the case, Cirrus Logic’s growth in the current quarter is likely to exceed expectations once again. But more importantly, the integration of the Apple Intelligence suite of generative AI features into the tech giant’s upcoming smartphones is expected to trigger a solid upgrade cycle. Apple’s smartphone shipments are expected to increase by 10% in fiscal years 2025 and 2026, according to JPMorgan‘s estimates.

Cirrus is expected to land more dollar content in the next generation of iPhones, which means that it should be able to receive more revenue from each unit of the iPhone that Apple produces. So, the stage seems set for Cirrus Logic to end the year strongly, and it should be able to sustain its newly found momentum in the future as well thanks to Apple’s entry into the AI smartphone market, a space that’s currently in its early phases of growth.

A couple more reasons to buy the stock

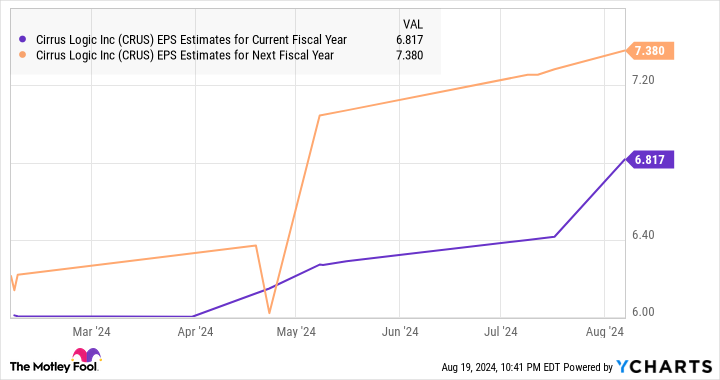

Analysts have been quick to raise their earnings growth expectations for Cirrus Logic, as is evident from the chart below.

Cirrus Logic finished fiscal 2024 (ended on March 30) with non-GAAP earnings of $6.59 per share. The above chart tells us that analysts weren’t expecting an increase in Cirrus’ earnings in the current fiscal year, but that has changed of late. Additionally, the company’s bottom-line growth forecast for the next fiscal year points toward an improvement in its growth rate.

However, if Apple indeed decides to ramp up the production of its upcoming iPhones and Cirrus ends up supplying more content to the tech giant, there is a good chance of Cirrus’ earnings easily outpacing analysts’ expectations going forward.

That’s why now would be a good time for investors to buy this semiconductor stock. It’s trading at just 26 times trailing earnings, a discount to the Nasdaq-100 index’s earnings multiple of 31. And the AI-driven growth in the smartphone market and Cirrus’ tight relationship with one of the largest players in this space could lead to better-than-expected growth going forward.

Should you invest $1,000 in Cirrus Logic right now?

Before you buy stock in Cirrus Logic, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Cirrus Logic wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and JPMorgan Chase. The Motley Fool recommends Cirrus Logic. The Motley Fool has a disclosure policy.

Up 69% in 2024, This Red-Hot Artificial Intelligence (AI) Growth Stock Could Keep Soaring was originally published by The Motley Fool

Flight Attendant Hasn't Paid Rent For 10 Years, Tax-Free Salary Helps Her Live 'Dream Life'

The idea of not having to pay rent while working a job might sound like a great perk. One flight attendant did just that and now lives a “dream life” thanks to the airline industry.

What Happened: To be able to travel around the world is a dream come true.

Thirty-three-year-old Alexandra Cosoff has done just that, leaving Queensland, Australia, to serve as a flight attendant for Emirates. Cosoff lives in Dubai but hasn’t paid rent in ten years.

Don’t Miss:

Cosoff enjoys a “generous benefit package” working as a cabin supervisor for Emirates, as reported by news.com.au in 2023.

“Our accommodation is provides and salary is tax free — and not just that, we have a lot of other things taken care of like transport, laundry, we have full medical and dental coverage,” Cosoff told news.com.au. “We are very well looked after.”

Cosoff said that a large portion of her salary used to go to rent and bills while working in Australia. Working for Emirates, a United Arab Emirates airline, Cosoff is now able to save more of her income and travel the world.

Trending: Don’t miss out on the next Nvidia – you can invest in the future of AI for only $10.

“What was very attractive to me was also not paying tax on top of my salary,” she said.

Cosoff said she lives in an apartment provided by the airline.

“You can either get company-provided accommodation or opt for accommodation allowance,” she said.

Cosoff, who was formerly a makeup artist, said she is now living the “dream life.”

“I have been so lucky. I’ve had the most amazing time,” she said.

Cosoff told the outlet that training to be a flight attendant with Emirates can be intense and takes eight weeks.

“It’s such a rigorous training, but you will keep that with you for life – it give you cultural awareness, how to maintain calm and composure, and once you have all those skills no one can take that away from you,” she said.

Did You Know?

Why It’s Important:

The report states that new Emirates flight attendants receive a base salary of approximately $1,236 per month, along with an hourly rate of about $17.86. They typically work between 80 to 100 flight hours each month and also receive meal allowances.

On average, economy class flight attendants earn around $3,435 per month, while cabin attendants tend to earn more.

Cosoff, who holds a degree in marketing and public relations, mentioned that a career in aviation had always appealed to them.

“Ever since I was a young girl I wanted to be a flight attendant. I remember seeing Emirates cabin crew on TV with their red hats and striking red lipstick and thinking, ‘Wow, they’re so beautiful,'” she said.

Cosoff told the outlet that she recommends those interested in becoming flight attendants to apply for what she called “a dream come true.”

Read Next:

For more inspiring stories about people around the world, check out Benzinga Inspire.

This article was previously published by Benzinga and has been updated.

Photo: Yaroslav Astakhov/Shutterstock.com

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Flight Attendant Hasn’t Paid Rent For 10 Years, Tax-Free Salary Helps Her Live ‘Dream Life’ originally appeared on Benzinga.com

Nvidia Is Next Week's Top Stock, Market Strategist Says: Why Best Long-Term Idea Is 'Just Buy Nvidia And Put It Away'

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

An earnings report from NVIDIA Corporation (NASDAQ:NVDA) will be closely watched by investors and could be a market-leading indicator, a market strategist tells Benzinga ahead of the results coming Aug. 28 after market close.

Nvidia Earnings on Watch: Analysts expect Nvidia to report second-quarter revenue of $28.46 billion, up from $13.51 billion in last year’s second quarter, according to data from Benzinga Pro.

Estimates call for Nvidia to report second-quarter earnings pre share of 64 cents, compared to 27 cents per share in last year’s second quarter.

Trending Now:

-

Don’t miss out on the next NVIDIA – you can invest in the future of AI for only $10.

**This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Innovation Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Nvidia has beaten revenue estimates in seven straight quarters and nine of the last 10 quarters. The company has also beaten earnings per share estimates in six straight quarters and eight of the last 10 quarters.

Freedom Capital Markets Chief Global Strategist Jay Woods emphasized the importance of Nvidia’s earnings report on the market during an interview on Benzinga’s “PreMarket Prep.”

Woods said there’s been a pause in Magnificent 7 stocks, including Nvidia.

“We’re seeing consolidation in those Mag 7 names now,” Woods said.

The market strategist said Nvidia was the tell to the market changing last August.

On Aug. 23, 2023, the stock gapped up at the open, filled the gap, and closed slightly higher after reporting earnings. In the months that followed, the stock declined from $480 (now split-adjusted to $48) to $400 (now split-adjusted to $40) before breaking out in January 2024.

Woods said Nvidia is the one stock to watch next week and the $140 level could be a key metric ahead of earnings, a level the market strategist does not see the stock hitting before Wednesday.

Why It’s Important: Woods calls Nvidia a market leader and as a top stock, one that could move the markets.

The market strategist said the stock could take a lot of boats with it, depending on how investors react to the earnings.

As one of the most valuable companies in the world, Nvidia has a large weighting in many indexes and ETFs, Woods warned.

The SPDR S&P 500 ETF Trust SPY lists Nvidia as the third-largest holding at 6.5%, trailing only Apple Inc AAPL at 6.9% and Microsoft Corporation MSFT at 6.6%.

Read More:

-

When today’s AI startups go public, most of the rapid growth will be behind them — here’s how not to get left out.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Innovation Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Woods warned that investors should be aware that a new rebalancing of the SPDR Select Technology ETF XLK has made Nvidia more important than Apple. The current weightings for the fund have Microsoft first at 21.2%, Nvidia second at 20.9% and Apple third at 4.9%.

“You better know that Nvidia [is] now more important than Apple is.”

Although Woods is cautious about Nvidia’s momentum ahead of its second-quarter results, he still considers the stock one of the best long-term picks.

“My best idea is just buy Nvidia and put it away and don’t look at it.”

Woods recalled his father buying shares of Nvidia after hearing him talk about it on TV in 2019. His father put the stock away and forgot about it, before asking Woods what a 10-for-1 stock split meant for his stake. Woods said the investment went from $3,000 to over $100,000.

The example could perfectly illustrate Benzinga’s “if you invested $1,000” story series on how a small investment could pay off over time based on key catalysts and events.

Lock In High Rates Now With A Short-Term Commitment

Leaving your cash where it is earning nothing is like wasting money. There are ways you can take advantage of the current high interest rate environment through private market real estate investments.

EquityMultiple’s Basecamp Alpine Notes is the perfect solution for first-time investors. It offers a target APY of 9% with a term of only three months, making it a powerful short-term cash management tool with incredible flexibility. EquityMultiple has issued 61 Alpine Notes Series and has met all payment and funding obligations with no missed or late interest payments. With a low minimum investment of just $1,000, Basecamp Alpine Notes makes it easier than ever to start building a high-yield portfolio.

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

This article Nvidia Is Next Week’s Top Stock, Market Strategist Says: Why Best Long-Term Idea Is ‘Just Buy Nvidia And Put It Away’ originally appeared on Benzinga.com

asdasdadasd

asdasdasdasdasd

Berkshire Hathaway Now Owns 27 Million Shares of This Stock. Should You Follow Warren Buffett's Lead?

Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) sold off several stock positions during the second quarter, but Chubb (NYSE: CB) was one of the few stocks that Warren Buffett and his team kept accumulating, adding another 1.1 million shares in the second quarter.

This marks the fourth consecutive quarter that Berkshire added shares of the global insurer to its portfolio. The conglomerate now owns 27 million shares, or $7.4 billion in Chubb stock. Here’s why it could be wise for investors to follow Buffett’s lead today.

Why Buffett loves investing in insurance businesses

The insurance business has many attributes that appeal to long-term investors like Warren Buffett. For one, these companies enjoy consistent demand for their products. Chubb, for example, is one of the world’s largest property and casualty insurers, covering risk categories that include personal automotive, homeowners, accident and health, agriculture, and reinsurance.

Another appealing aspect of the business is the cash flow it can generate. Insurers operate differently from traditional businesses by collecting their revenue (premiums) up front and paying out claims costs later. Because it doesn’t pay until a customer files a claim, insurers sit on a pile of money they can hold and invest but don’t own, called “float.”

For Buffett, insurance companies and the cash flow they generate are a considerable portion of Berkshire’s value, partly because, as he said in Berkshire Hathaway’s 2021 letter to shareholders, insurance products “will never be obsolete, and sales volume will generally increase along with both economic growth and inflation.”

Berkshire Hathaway owns several insurance companies under its umbrella, including GEICO, General Re, Berkshire Hathaway Reinsurance, and Alleghany, which it acquired two years ago for $11.6 billion.

Chubb has provided excellent returns for investors

Chubb’s business has several advantages. It is one of the world’s largest property and casualty insurers covering various risks. It has displayed excellent underwriting discipline in the highly competitive insurance industry and consistently beats its peers when it comes to writing profitable policies.

Thanks to its strong underwriting and steady demand, Chubb has steadily grown its top and bottom lines. Over the past decade, Chubb’s revenue and net income have increased by about 11% compounded annually. In the last year, the insurer has delivered a record $15.2 billion in free cash flow, representing capital it can reinvest in the business, pay out in dividends, or use to buy back shares of its stock.

With its disciplined underwriting and steady demand, it’s no surprise that Chubb has delivered excellent returns for long-term investors. The company has steadily raised its dividend over the past 31 years. Over that same period, Chubb’s total compound annual return (including reinvested dividends) of 12.9% has outpaced the S&P 500‘s 10.4% return.

Here’s why Chubb can continue to deliver

JPMorgan Chase CEO Jamie Dimon recently warned that “there are still multiple inflationary forces in front of us” due to fiscal deficits, rising interest rates, and stubbornly high inflation. If Dimon is correct, Chubb can continue to deliver for investors for several reasons.

For one, the company enjoys steady demand, and the industry’s backdrop favors insurers. Insurers have faced rising claims costs over the past several years due to weather-related events, economic and social inflation, and less availability of reinsurance coverage.

This is known as a “hard market” in insurance, and risks related to geopolitical conflict, cybersecurity, climate-related catastrophes, and unrest will likely stick around. As a result, insurers can raise premiums and be more selective about the policies they are willing to cover — which can help investors stay ahead of any inflationary pressures should they reemerge.

Not only that, but Chubb has a $113 billion investment portfolio mainly invested in fixed-income securities. Last year, the insurer earned $4.9 billion in investment income, up 32% year over year. Through the first six months of 2024, its net investment income has increased another 27% from last year.

Chubb has a proven track record of growth in an expanding economy. However, if inflationary pressures persist, it has the pricing power to adapt to rising costs and the investment portfolio to take advantage of higher interest rates — giving it excellent potential for the next decade and beyond.

Should you invest $1,000 in Chubb right now?

Before you buy stock in Chubb, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chubb wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

Berkshire Hathaway Now Owns 27 Million Shares of This Stock. Should You Follow Warren Buffett’s Lead? was originally published by The Motley Fool

2 "Magnificent Seven" Stocks That Could Create Lasting Generational Wealth

Historically, the stock market has helped create huge amounts of generational wealth. However, all stock investments are not created equal.

Investors keen on building lasting generational wealth should opt for stocks of companies with strong fundamentals, robust financials, and sustainable growth strategies.

Apple, Amazon, Nvidia, Microsoft (NASDAQ: MSFT), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), Tesla, and Meta Platforms, collectively known as the “Magnificent Seven,” are the seven technology stocks that have demonstrated impressive performance in the past year. Of these, Microsoft and Alphabet are well positioned to continue generating robust returns even in the coming years — wealth that can be passed down through generations.

Here’s why.

Microsoft

Microsoft stock is nearly 10% below its 52-week high of $468.35 in early July 2024. The stock failed to take off after the fourth-quarter fiscal 2024 earnings results (ending June 30) despite surpassing revenue and earnings estimates. This was mainly due to slower-than-expected growth in its Azure cloud business.

Yet, the long-term growth story of this prominent player in the $5.06 trillion global IT market is intact thanks to its well-diversified business model and large client base spread across verticals and geographies. Azure is still the cornerstone of the company’s long-term growth strategy. It accounted for a 20% share of the global cloud infrastructure services market in Q2 (ending June 30, 2024), up 3 percentage points from two years ago.

AI workloads have been a major growth catalyst for Azure and accounted for nearly 8 percentage points of the cloud-computing business’s year-over-year revenue growth in Q4. Microsoft also noted a 60% year-over-year increase in the number of Azure AI customers to 60,000, as well as an increase in average spend per customer at the end of Q4. Furthermore, the number of Azure AI customers using the company’s data and analytics tools also grew 50% year over year in Q4.

Microsoft is also seeing increased adoption of the AI-powered CoPilot assistants across its core offerings, with the number of CoPilot customers growing 60% sequentially and existing enterprise customers significantly increasing usage in Q4. The company’s partnership with ChatGPT developer OpenAI has proved transformational for the company, and increasing monetization of its AI services will be a major tailwind in the coming years.

Microsoft produced a net income of $88.1 billion on $245.1 billion of revenue in fiscal 2024. Microsoft’s cash flow from operations reached $119 billion in fiscal 2024, which implies that the company has substantial resources to continue with its AI capex investments in the coming years.

Considering these factors, Microsoft can be an impressive pick for long-term investors based on its strong economic moat, resilient and diversified business model, multiple AI-powered tailwinds, and robust financials.

Alphabet

Alphabet, the digital advertising giant and parent of Google, YouTube, and the Android operating system, Alphabet, reported Q2 earnings results on July 23. Its shares dropped despite strong revenues and an earnings beat. Management’s remarks about increasing pressures on Q3 operating income margins seem to have unnerved many investors. Share prices have further slid down after a recent Bloomberg report claimed that the U.S. Department of Justice may be considering breaking up the company for monopolizing the internet search market through exclusive deals with smartphone makers such as Apple and Samsung.

While the impending uncertainty is worrisome, the long-term impact on the stock will be minimal. Google accounts for 91% of the global internet search market. Hence, even without exclusive deals with mobile phone makers, Google will maintain a dominant position in the Internet search market and the U.S. digital advertising market at least for the next few years. According to Statista Research Department, Google’s share of U.S. digital advertising revenue is expected to decline from 26.8% in 2023 to 23.9% in 2026. Google is projected to be the largest digital-ad publisher in the U.S. till 2026.

To tackle increasing competition from the likes of Microsoft’s Bing and AI-powered search engines such as Perplexity.ai and OpenAI’s new search engine called SearchGPT, Alphabet is incorporating advanced AI and machine learning capabilities in its Google search engine to provide more contextual and relevant results. The company is leveraging its large user base and immense data pool to effectively train its own generative artificial intelligence-based family of Gemini models. More than 1.5 million developers were using Gemini by the end of Q2.

Alphabet’s Google Cloud business is also picking up momentum and crossed $10 billion in quarterly revenues for the first time in Q2. The company’s diversified product portfolio has ensured that the company is not excessively dependent only on a single product or service.

Alphabet is also cash-rich, with $101 billion in cash and marketable securities at the end of Q2, giving it the financial flexibility to invest in AI initiatives. Yet, the company trades at only 6.2 times trailing 12-month sales, far lower than many other AI-powered technology titans. Considering its outstanding qualities and reasonable valuation, Alphabet seems a no-brainer, long-term pick for the astute investor.

Should you invest $1,000 in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Manali Pradhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 “Magnificent Seven” Stocks That Could Create Lasting Generational Wealth was originally published by The Motley Fool

AMD's Leapfrog Moment Has Arrived. Here's Why Now May Be a Once-in-a-Lifetime Opportunity to Buy the Stock.

Over the past couple of years investors haven’t been able to buy semiconductor stocks fast enough. A big reason for this is because sophisticated chips known as graphics processing units (GPUs) are one of the core power sources of artificial intelligence (AI) applications such as machine learning and even autonomous driving.

As the AI narrative continues to push the markets higher, chip stocks will likely remain in high demand. As it stands today, Nvidia is widely considered to be the market leader among AI-powered chip companies. However, Nvidia just told investors that the company’s new Blackwell series GPUs are going to be delayed due to a design flaw.

While I’m no supporter of schadenfreude, I see this setback at Nvidia as a once-in-a-lifetime moment for the company’s biggest competitor, Advanced Micro Devices (NASDAQ: AMD). Let’s examine the full situation at hand and assess how AMD could take advantage of Nvidia’s hiccup.

A tale of two chip companies

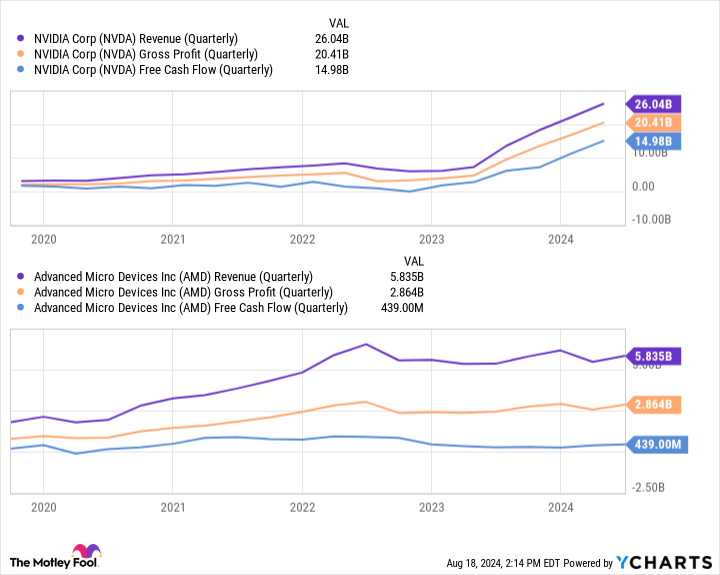

The charts below illustrate a number of important financial metrics for Nvidia and AMD.

On one side of the equation, Nvidia’s sales and profits are consistently soaring — leading to an increasingly steeper slope among the colored lines depicted below. Yet on the other side, Nvidia’s chief rival is demonstrating noticeable inconsistencies in its operation.

The dynamics illustrated above clearly indicate that chip buyers not only prefer Nvidia, but are also willing to pay top dollar. Although Nvidia has remained the supreme semiconductor company since the inception of the AI revolution, AMD has an incredible opportunity to leapfrog Nvidia right now.

Why this might be AMD’s defining moment

Wall Street analysts estimate that Nvidia has nearly 80% of the AI-powered chip market. While AMD has done what it can to compete with Nvidia’s stunning pace of innovation, I think the company has largely attempted to distract investors from Nvidia’s overwhelming lead through a series of questionable acquisitions.

To me, AMD’s time is close to running out and it can’t afford to rely on acquisitions as a source of product development and inorganic growth. One silver lining for AMD right now is that the company’s MI300X accelerator GPU is the fastest product to reach $1 billion in sales over the company’s history.

Clearly, there is a lot of demand for AMD’s GPUs, but it’s just not even in the same breadth as Nvidia’s demand. Now with Blackwell shipments delayed until possibly sometime next year, AMD has a chance to seize the moment.

It’s important to stay grounded

While the Blackwell delays are by no means good news, investors need to be real here. I surmise some companies will opt for alternative solutions to Blackwell in the interim, but I don’t think Nvidia will have a hard time selling these chips once it finally repairs its design flaw.

So even though AMD likely isn’t going to suddenly capture an overwhelming amount of market share and outright dethrone Nvidia, I think the company has a chance to enhance its profile by disrupting Nvidia’s momentum.

For now, it’ll be almost impossible for investors to know if AMD is penetrating the market while Nvidia focuses on righting the Blackwell ship. I think some prudent actions could be to monitor press releases among major AI developers such as Microsoft, Amazon, Alphabet, or Oracle and see if any of them are striking new partnerships with AMD or buying more MI300X chips.

Although I don’t own AMD stock at the moment, I am intrigued by the current dynamics of the chip market and see the company as both a hedge to Nvidia and similar to a long-term call option on the AI market more broadly.

Investors with a higher tolerance for risk, however, may consider buying AMD now. Given the company is playing second fiddle to Nvidia, it’s hard to imagine a scenario where AMD falls behind in the midst of this Blackwell situation.

Another strategy could be to wait a couple of months until AMD publishes its next earnings report and see if the company generated abnormal growth compared to prior periods. Investors should also listen to management’s commentary regarding the source of new business.

In either case, I am bullish that AMD will take advantage of Nvidia’s stumble and perhaps ignite the catalyst needed for longer-term sustained growth as the two companies continue going head to head in the chip realm.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Microsoft, Nvidia, and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

AMD’s Leapfrog Moment Has Arrived. Here’s Why Now May Be a Once-in-a-Lifetime Opportunity to Buy the Stock. was originally published by The Motley Fool

A Few Years From Now, You'll Wish You'd Bought This Undervalued Stock

Are you looking for an undervalued long-term pick you don’t need to continually watch? That’s actually a tall order these days. Many of the most compelling stocks either don’t have an obviously bullish distant future, or they require constant monitoring, or both.

There’s a handful of prospects, however, that fit this bill and would also be at home in most people’s portfolios. One of the best of these names is hiding in plain sight. That’s carmaker Toyota Motor (NYSE: TM), which Wall Street says is more than 30% undervalued where it’s priced right now.

Standing up to the headwind

Surprised? It would be a little surprising if you weren’t. The brand was a titan within the automobile industry from the 1980s into the 2000s. Then the business changed. Competitors stepped up their games. Cars — including Toyota’s — began lasting longer, recently reaching a record-breaking average age of 12.6 years in the United States, according to numbers from S&P Global Mobility. The advent of the electric vehicle further disrupted the global automobile market. These are all reasons that Toyota Motor just isn’t the head-turner it used to be.

That doesn’t necessarily have to be a permanent condition, however. This car company can restore its former stature, and deservedly so. Indeed, it’s already doing so. For the fiscal year ending in March, Toyota manufactured a record-breaking 10.3 million cars just to keep up with growing demand. For the three-month stretch ending in June, the automobile giant reported a record-breaking (for that particular quarter of the fiscal year) bottom line of $8.9 billion.

Granted, circumstances helped. The yen is weak, for instance, exaggerating the Japanese company’s overseas revenue and earnings. And for many people all over the world, the purchase of a car just can’t be postponed any longer.

On balance, though, Toyota’s recent performance overcomes more challenges than not. New-car prices remain at sky-high levels, and Toyota doesn’t make any purely battery-powered electric vehicles in the United States despite consumer interest in them. Toyota’s still heavily invested in traditional combustion engines, in fact — in the U.S. and abroad — with only around one-third of its production not being combustion-powered automobiles.

The thing is, in retrospect, being slow to embrace battery-powered automobiles seems to have been the smart choice for Toyota.

Hybrids, not pure EVs, are the actual future

There’s no denying that EVs have their place in the automobile landscape. But it’s not quite the one initially imagined.

Regarding the logistical and cost-based challenges of owning battery-powered vehicles, a poll recently performed by the NORC Center for Public Affairs Research and the Energy Policy Institute at the University of Chicago suggests that only four out of 10 U.S. drivers are likely to purchase an electric vehicle when they’re looking for their next car. In a similar vein, McKinsey reports that 46% of Global EV owners are likely to buy a gas-powered car the next time they’re in the market for a new vehicle.

Their chief complaints? Globally, a lack of understanding of how EVs work, and their net-cost of ownership. A lack of driving range and the inability to charge their vehicles at home were also high on the list of drivers’ worries.

Against this backdrop, Toyota’s commitment to hybrid electric vehicles — which run on batteries but can also be powered by gasoline — makes sense. In fact, the company’s tentative plans to make and market a hybrid version (and maybe even only a hybrid version) of every single one of its cars within the United States is arguably brilliant. It’s a happy-medium option that most consumers can embrace.

And they already are. During the first fiscal quarter ending in June, sales of the hybrid version of Toyota’s Camry jumped by nearly 143% year over year, compared to only 18.6% growth in overall Camry sales. That surge follows 2023’s 65% uptick in hybrid sales in the United States alone, versus a more modest 46% increase in non-hybrid EV sales. We’re seeing the same dynamic overseas as well.

Look for more of the same going forward, too. Market research outfit Prescient and Strategic Intelligence predicts that the global hybrid market is set to grow at an annualized pace of 14.9% through 2030.

It’s difficult to imagine a powerhouse brand like Toyota not leading this charge, now that it’s mastered the art of making and marketing hybrid vehicles.

Then there’s the hydrogen-powered engine Toyota’s been developing for years now. It’s a potentially cleaner replacement for hybrid powertrains. But, first things first.

Plenty of lasting value

The backdrop is bullish to be sure, but is Toyota stock actually undervalued and ripe for long-term gains? It is.

That’s Wall Street’s take, anyway. Analysts’ current consensus price target stands at $240.81, which is more than 30% better than the stock’s present price. The majority of these analysts also consider Toyota stock a strong buy right now, with several of these pros upping their rating in the wake of the stock’s pullback from its March peak.

Even without analysts’ bullish backing, however, Toyota is an attractive investment here. The stock — an American Depository Receipt, or ADR, to be more precise — is priced at just over eight times its forward-looking earnings. That’s dirt cheap. The stock’s also sporting a forward-looking dividend yield of 2.2%. You can find higher yields. But you won’t find them with stocks of a similar risk and long-term growth profile.

So, don’t overthink this one. Shares of this terrific car company are down nearly 30% in just the past five months, despite still doing well, and despite every reason to believe its future is at least as bright as its past.

Should you invest $1,000 in Toyota Motor right now?

Before you buy stock in Toyota Motor, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Toyota Motor wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

A Few Years From Now, You’ll Wish You’d Bought This Undervalued Stock was originally published by The Motley Fool

Prediction: Energy Transfer Stock Will Nearly Double in 5 Years

Most investors interested in Energy Transfer (NYSE: ET) are attracted to its high yield, which currently sits around 7.9%. The company currently pays a $0.32 quarterly distribution and is looking to increase that by between 3% to 5% a year moving forward.

That is attractive in and of itself, but I also think the pipeline operator’s stock could nearly double over the next five years.

This would happen through a combination of growth projects, as well as modest multiple expansion, which is when investors assign a higher valuation metric to a stock.

Let’s look at why I think Energy Transfer’s stock can more than double in the next five years.

Growth opportunities

Energy Transfer is one of the largest midstream companies in the U.S., with an expansive integrated system that traverses the country. It’s involved in nearly all aspects of the midstream sector, transporting, storing, and processing various hydrocarbons across its systems. The size and breadth of its systems give it many expansion project opportunities.

This year, the company plans to spend between $3 billion to $3.2 billion in growth capital expenditures (capex) on new projects. Moving forward, spending between $2.5 billion to $3.5 billion in growth capex a year would allow it to pay its distribution while having money left over from its cash flow to pay down debt and/or buy back stock.

Given this, and the early opportunities that Energy Transfer is seeing in power generation due to increased power needs from data centers stemming from the rise in artificial intelligence (AI), it’s probably safe to say that the company could spend about $3 billion in growth capex a year over the next five years.

Most companies in the midstream space are looking for at least 8x build multiples on new projects. This means that the projects would pay for themselves in about eight years. For example, a $100 million project with an 8x multiple would generate an average return of $12.5 million in EBITDA (earnings before interest, taxes, depreciation, and amortization) a year.

Based on that type of return on growth projects, Energy Transfer should be about able to see its adjusted EBITDA rise from $15.5 billion in 2024 to about $17.4 billion in 2029 if it continues to spend $3 billion a year on growth projects.

Multiple expansion opportunities

From a valuation perspective, Energy Transfer is the cheapest stock among its master limited partnership (MLP) midstream peers, trading at 8x on a forward enterprise value-to-adjusted EBITDA basis. This metric takes into consideration a company’s net debt while taking out non-cash items and is the most widely used way to value midstream companies. At the same time, it trades at a much lower valuation than it has historically.

MLP midstream stocks averaged a 13.7x EV/EBITDA multiple between 2011 and 2016, so the industry as a whole has seen its multiple come down. However, with demand for natural gas on the rise due to AI and electric vehicle demand waning, the transition to renewables looks like it may take much longer than expected. If this is the case, these stocks should be able to command a higher multiple than they currently do, as this reduces the fear that hydrocarbon demand will start to materially decline in the years ahead.

How Energy Transfer stock nearly doubles

If Energy Transfer grows its EBITDA as expected, the stock could reach $30 in 2029 if it can command a 10x EV/EBITDA multiple. That is up from the 8x forward and 8.7x trailing multiple it currently commands, but it’s still well below where the MLP midstream space has traded in the past.

|

|

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

|---|---|---|---|---|---|---|

|

Adjusted EBITDA |

$15.5 billion |

$15.88 billion |

$16.25 billion |

$16.63 billion |

$17.0 billion |

$17.38 billion |

|

Price at 8x multiple |

|

$17 |

$18 |

$19 |

$20 |

$21 |

|

Price at 9x multiple |

|

$21.50 |

$22.50 |

$23.50 |

$24.50 |

$25.50 |

|

Price at 10x multiple |

|

$26 |

$27 |

$28 |

$29 |

$30 |

* Enterprise value is based on 3.42 billion shares outstanding, $57.6 billion in debt, $3.9 billion in preferred equity, $3.9 billion in investments in unconsolidated affiliates and cash, and $11.6 billion in minority interest.

However, Energy Transfer and several other midstream companies appear to be very well positioned to be stealth AI winners due to increasing natural gas power demand. Power companies and data centers have already been approaching Energy Transfer about natural gas transmission projects, and there could be a natural gas volume boom coming. Given this growth opportunity, together with the company’s strengthened balance sheet and consistent distribution growth, I could see Energy Transfer’s multiple expand modestly over the next five years and the stock nearly doubling.

However, even if its multiple doesn’t expand, investors can still get a very solid return on their investment through a combination of distributions (currently $0.32 per unit a quarter) and more modest price appreciation. With no multiple expansion and over $7 in distributions between now and the end of 2029 (assuming a 4% increase a year), the stock would still generate an over 75% return during that stretch.

Should you invest $1,000 in Energy Transfer right now?

Before you buy stock in Energy Transfer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Geoffrey Seiler has positions in Energy Transfer, Enterprise Products Partners, and Western Midstream Partners. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Prediction: Energy Transfer Stock Will Nearly Double in 5 Years was originally published by The Motley Fool