A Bull Market Is Here: 2 Artificial Intelligence (AI) Stocks Down 18% and 41% to Buy Right Now

Even with a few stretches of volatility, stocks are seeing strong bullish momentum in 2024. The S&P 500 index is already up roughly 18% year to date, and much of the impressive rally continues to be driven by gains for high-profile artificial intelligence (AI) players.

But while mega-cap companies including Nvidia, Microsoft, and Apple have surged to new valuation highs this year, there are still some fantastic AI stocks trading at substantial discounts compared to previous valuation peaks.

With that in mind, read on to see why two Motley Fool contributors think you should pounce on these tech companies that have what it takes to be winners.

Palantir’s growth engine is only getting stronger

Keith Noonan: A quick jump in interest rates and some slowed growth caused Palantir Technologies (NYSE: PLTR) stock to fall to a low of roughly $6 per share in December 2022, but it has since come roaring back. The share price is up 86% across this year’s trading alone, and it’s far from low risk, trading at 90 times this year’s expected earnings.

On the other hand, Palantir stock is still down 18% from its peak, and the stage could be set for the analytics and intelligence software company to hit new highs.

Palantir has posted reliable profits since 2023, and the company’s sales growth returned to accelerating at an eye-catching pace. With its second-quarter report, the business delivered 27% year-over-year sales growth and an 80% jump in adjusted earnings per share (EPS).

The big-data analytics leader has been racking up wins in both the government and private sector, and it looks like the business will continue to post impressive margins and see its growth climb even higher.

Palantir got its start as a provider of analytics and information software services to government customers, but the company’s private-sector business has been a rising star over the last couple of years. Revenue from commercial customers rose 33% in the second quarter, and the segment accounted for 45% of total sales in the period.

Aided by strong demand for the company’s Artificial Intelligence Platform (AIP) software suite, the commercial segment will soon be Palantir’s largest. Given that private-sector growth has consistently outpaced public-sector customers in recent years, that paints an encouraging outlook. And it’s even better when you break down trends within the commercial-customer segment.

Sales to U.S. commercial customers grew 55% year over year to hit $159 million in the second quarter, accounting for roughly 52% of total commercial segment revenue. Sales to U.S. businesses now make up more than half of overall segment revenue and are growing at a rate far above the overall category. In other words, growth for the commercial segment should continue to accelerate and help push overall revenue higher.

And as exciting as things look for the private sector, Palantir’s public sector growth is strong as well. Sales to government customers increased 23% year over year last quarter, up from 16% in this year’s first quarter.

The company’s growth engine has never looked stronger. With the business posting impressive margins and still managing to expand rapidly, Palantir stock has real potential to outperform.

The market is underestimating Trimble’s growth potential

Lee Samaha: Workflow technology company Trimble (NASDAQ: TRMB) posted second-quarter earnings recently that were well received, but the stock continues to trade almost 41% off its all-time high. The company provides the hardware for precise positioning and the software and services to plan and model daily workflows while using advanced data analytics to optimize operations.

The productivity improvement provided by its technology makes it attractive to customers at any stage of the cycle. Still, it has faced some challenging end markets this year, not least in transportation, where significant overcapacity in the freight market is slowing down end demand.

It’s a different story in its core architects, engineers, construction, and owners (AECO) segment, where its annualized recurring revenue (ARR) grew 18% year over year in the second quarter. Two-thirds of the growth came from existing customers, and one-third came from new customers, as its solutions help reduce waste and maximize execution in construction projects.

With Trimble increasingly selling software and subscription services on a recurring basis, the company’s profit margins and cash flow conversion keep growing. This trend is highly likely to continue as data analytics improvements (Trimble is incorporating AI capability into its products, for example) mean more value added for its customers.

As such, it’s becoming an increasingly important part of its customers’ daily workflows, which should provide the opportunity to sell more services to them. Trimble is set to grow its ARR by 11% to 13% in 2024, and with a potentially more robust economy in 2025, that could increase even more for a company with a bright future.

Trading at a significant discount, Trimble stock looks like a smart buy right now.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Keith Noonan has no position in any of the stocks mentioned. Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, and Palantir Technologies. The Motley Fool recommends Trimble and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

A Bull Market Is Here: 2 Artificial Intelligence (AI) Stocks Down 18% and 41% to Buy Right Now was originally published by The Motley Fool

Trump will soon be free to tank his own stock

Donald Trump will soon be free to start selling off more than $2 billion in shares he holds in the company that controls his social media platform, Truth Social—but doing so could send the stock price plummeting.

When Truth Social’s parent company, Trump Media & Technology Group, went public in March by merging with a special purpose acquisition company, the former president was granted about 114.75 million shares, which amounts to about 59% ownership. That stake makes up over half of his $4.5 billion net worth, according to Forbes, but so far he hasn’t been able to profit from his shares.

This is due to a lockup period that prevents company insiders from off-loading shares for approximately 180 days. While he hasn’t said that he intends on selling any of his Trump Media (DJT) stock, he will get the green light to do so as early as Sept. 20, when the lockup period is set to expire. If Trump sells shares, he will have to report it in a filing with the SEC within two days.

The Trump campaign and Trump Media & Technology Group did not immediately respond to a request for comment. When asked about Trump selling his shares, a Trump Media spokesperson told Bloomberg on Tuesday that there’s no “conceivable sign anywhere that he plans to do so.”

The opportunity to off-load shares could be a boon for Trump, whose mounting legal costs have set him back by about $100 million, according to the New York Times. The lockup period will expire right around the time when Trump is set to be sentenced by a judge after being found guilty of 34 criminal counts in a much publicized hush-money trial. Trump could also use the proceeds of his stock sale to fund his campaign, which he previously said he might be willing to do.

If he does start off-loading his shares, Trump Media’s stock could sink thanks to the dilutive effect of increased supply. The company’s stock price closed up less than 1% at $22.81 on Friday.

The stock has already been on a wild ride this year. Shares skyrocketed 30% after the former president survived an assassination attempt in July. Yet Trump Media shares have plummeted about 70% from their high of nearly $80 in March, owing in part to the company’s falling revenue and a $16 million loss in its most recent quarter.

Trump’s return to rival social media platform X also hasn’t helped the stock. After being suspended indefinitely in 2021, when X was known as Twitter, Trump has since been invited back by new owner and supporter Elon Musk.

Financial experts have said DJT shares serve as a way for investors to bet on Trump’s chances of winning the presidential election in November. But the stock has fallen consistently since President Joe Biden ended his reelection campaign and Vice President Kamala Harris stepped up as the nominee. Harris accepted the Democratic nomination for president Thursday. She is closing the gap with Trump in national polls and prediction markets.

This story was originally featured on Fortune.com

Nvidia's Stock Has Soared 30% Since It Announced Its 10-for-1 Stock Split. History Says This Will Happen Next.

The artificial intelligence (AI) craze has powered the stock market higher this year, and few companies have benefited from that more than Nvidia (NASDAQ: NVDA). In the months since ChatGPT launched in November 2022, eliciting a tidal wave of demand for AI-capable hardware, the chipmaker’s share price has surged by 800%

Nvidia was the best-performing stock in the S&P 500 in 2023, and it could deliver a repeat performance in 2024. It is once again leading the S&P 500, and its gains year-to-date exceed those of second-place Vistra by 34 percentage points.

Nvidia announced a 10-for-1 stock split in May and completed it in June to “make stock ownership more accessible for employees and investors.” But based on historical patterns, Nvidia shares could decline in the coming months.

Historically, stock-split stocks have outperformed the S&P 500

Stocks that split typically outperform the S&P 500, at least temporarily. Since 2010, such companies’ shares have appreciated by 18% on average during the 12-month period after their stock split announcements, according to Bank of America. Meanwhile, the S&P 500 returned an average of 13% annually during the same period.

We can apply that information to Nvidia to speculate about its future performance. Specifically, its shares have advanced by 30% since Nvidia announced in May that a stock split was coming. So based on the broad averages, that leaves it with implied downside of 12% through May 2025. However, the outlook is considerably worse if we use company-specific data.

Historically, Nvidia shares have performed poorly following stock splits

Prior to the most recent one, Nvidia conducted five stock splits since it went public at $12 per share on Jan. 22, 1999. Generally speaking, those events were bad news for shareholders in the short term, as detailed in the table below.

|

Stock Split Date |

12-Month Return |

24-Month Return |

|---|---|---|

|

June 2000 |

28% |

(52%) |

|

September 2001 |

(72%) |

(49%) |

|

April 2006 |

1% |

(6%) |

|

September 2007 |

(70%) |

(53%) |

|

July 2021 |

(4%) |

145% |

|

Average |

(23%) |

(3%) |

Data source: YCharts.

Nvidia shares have declined by an average of 23% during the 12-month periods following past stock splits, and shares were still down by 3% on average 24 months after.

The chipmaker completed its most recent split after the market closed on June 7, and shares began trading at a split-adjusted price of $120.37 on June 10. The stock has returned 2% since then, leaving it with an implied downside of 25% through June 2025, and implied downside of 5% through June 2026.

Past performance is never a guarantee of future results, but investors should be especially cautious about extrapolating historical data in this situation. I say that because most of Nvidia’s past stock splits took place within 12 months of a recession, and all of them took place within 24 months of a recession. Few stocks generate positive returns during economic downturns.

Nvidia’s second-quarter earnings release will be a high-stakes event

Nvidia is best known for its graphics processing units (GPUs), powerful chips that can perform many types of calculations faster and more efficiently than central processing units (CPUs). GPUs are particularly well suited to computing tasks like rendering graphics, training machine learning models, and running artificial intelligence (AI) applications.

Nvidia dominates those markets. According to a study by the analysts at TechInsights, it accounted for 98% of data center GPU shipments last year, and its market share in AI processors ranges from 70% to 95%, according to analysts. But the company is truly formidable because it offers a full-stack computing platform that spans hardware, software, and services. That makes Nvidia a one-stop shop for AI.

It reported excellent financial results in its fiscal 2025 first quarter (which ended April 28). Revenue increased 262% year over year to $26 billion amid unprecedented demand for generative AI chips and networking hardware. Meanwhile, non-GAAP earnings surged by 461% to $6.12 per diluted share. Those numbers soundly beat Wall Street’s estimates.

The company will report second-quarter results on Aug. 28, and Wall Street’s expectations are sky-high. Analysts anticipate revenue and non-GAAP earnings increases of 112% and 137%, respectively. That would make Q2 its fifth consecutive quarter of triple-digit percentage growth on the top and bottom lines. Additionally, management will likely address rumors that shipments of its next-generation Blackwell GPUs will be delayed.

The combination of elevated expectations and uncertainty surrounding the Blackwell GPUs means the upcoming earnings release will be a high-stakes event for Nvidia shareholders. Indeed, options pricing data implies 11% price action, meaning that data suggests the share price could increase or decrease by that much in the trading session that follows the report.

That puts investors in a tricky position. Would they be smarter to buy shares now and risk losses, or buy shares later and risk missing gains? The most prudent course of action would be to split the difference. Investors interested in adding Nvidia shares to their portfolios can buy a small position today, provided they are comfortable with volatility. Then, if shares decline substantially post-earnings, they can consider adding to their position.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Trevor Jennewine has positions in Nvidia. The Motley Fool has positions in and recommends Bank of America and Nvidia. The Motley Fool has a disclosure policy.

Nvidia’s Stock Has Soared 30% Since It Announced Its 10-for-1 Stock Split. History Says This Will Happen Next. was originally published by The Motley Fool

Nvidia Stock Surges as Earnings Expectations Grow

Chipmaker Could Give ‘Another Drop the Mic Performance,’ Wedbush Analysts Say

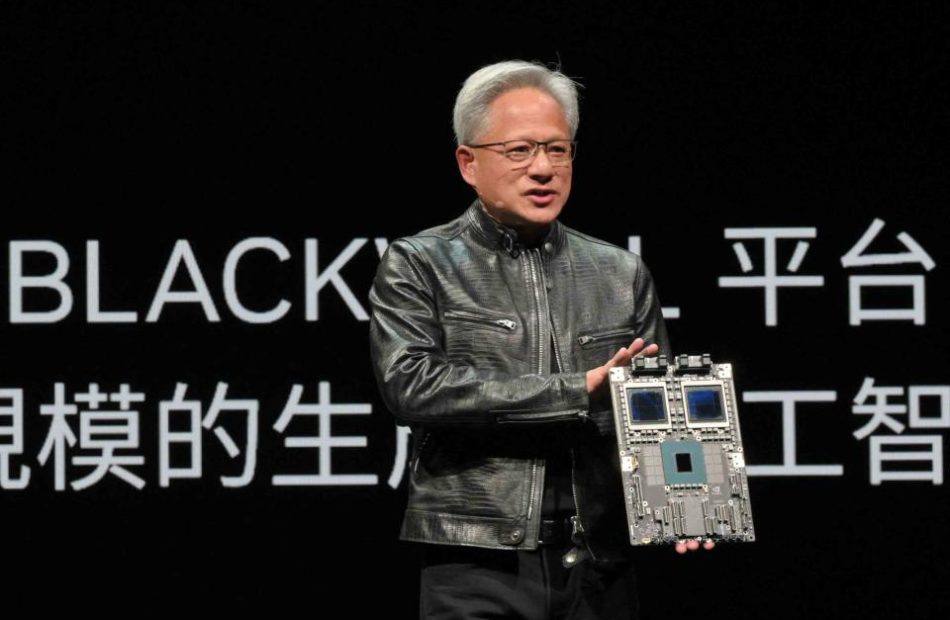

Sam Yeh / AFP / Getty Images

Nvidia CEO Jensen Huang delivers his keystone speech ahead of Computex 2024 in Taipei on June 2, 2024.

Key Takeaways

-

Expectations for Nvidia’s earnings release Wednesday are on the rise, in what could make it harder for the AI chipmaker to impress investors.

-

Consensus estimates for Nvidia’s second-quarter revenue and earnings climbed by hundreds of millions of dollars within the last 48 hours alone.

-

Nvidia shares gained more than 4% Friday and have risen about 160% since the start of the year.

Expectations for Nvidia’s (NVDA) earnings release Wednesday are on the rise, in what could make it harder for the artificial intelligence (AI) darling to impress investors.

Consensus estimates for Nvidia’s second-quarter revenue rose by $170 million to $28.84 billion in the last 48 hours alone, according to estimates compiled by Visible Alpha, while net income projections rose $120 million to $14.95 billion.

Whisper numbers could be even higher, with some analysts having long voiced concerns about investors’ expectations exceeding Wall Street projections.

Expecting Another ‘Drop the Mic Performance’

Wedbush analysts said Thursday they expect “another drop the mic performance from Nvidia,” citing signs of “massive enterprise AI demand” and spending by cloud giants such as Amazon (AMZN) and Alphabet’s Google (GOOGL), all trends that would benefit the chipmaker.

They’re not alone, as analysts from Raymond James, KeyBanc, and elsewhere recently said they expect a strong quarter from the chipmaker as well, despite concerns about a reported delay in Nvidia’s Blackwell AI chip.

Over 95% of analysts tracked by Visible Alpha have a “buy” rating for the stock, with a consensus price target of $144.83, 12% above Friday’s closing price.

Nvidia shares gained 4.6% Friday to close at $129.37. The stock has gained about 160% since beginning of the year.

Read the original article on Investopedia.

Why Altcoins Surged Ahead by Double Digits This Week

As we entered the last weeks of summer, the crypto market began to heat up as if it was mid-July. Numerous news developments and trends that have powered rallies in digital coins and tokens in the past started to boost the market again. As a result, many were rising at comfortable, double-digit rates over the course of this week.

There was plenty of variety in that surge, too, data compiled by S&P Global Market Intelligence reveal. Smart contract platform anchor coin Tron (CRYPTO: TRX) was up by almost 19% across the period, with utility token Chainlink (CRYPTO: LINK) not far behind with a 17% gain. Everything-but-the-kitchen-sink chain BNB‘s (CRYPTO: BNB) native cryptocurrency advanced by nearly 13%, and holders of meme crypto Pepe (CRYPTO: PEPE) were surely pleased with its almost 18% rise.

A very pleasant late summer bounce-back

Cryptocurrencies experienced a slide — well, let’s call it a “correction” — at the beginning of this month. U.S. economic data releases brought on fears of a looming recession, and that kind of environment isn’t good for most financial assets. It’s especially threatening for assets considered to be high risk, and even after all this time most cryptos (save for possibly Bitcoin and, at a stretch, Ethereum) are slotted into this category.

Compounding this growing fear, the Federal Reserve (Fed) resolutely stuck to its policy of leaving interest rates unchanged. All things being equal, lower rates tend to encourage market players to chase riskier investments, hence the crypto world’s thirst for a Fed rate cut or several.

The situation changed notably in the middle of the month. Last week the inflation readout showed that the current macroeconomic bogeyman seemed to be fading considerably. The year-over-year rise in the consumer price index (CPI) was 2.9%, which was the first time it’s landed below 3% since the pandemic month of March 2021. That figure was also well below many economists’ projections.

That good news was compounded by this week’s analysis from influential research organization the Conference Board. Its leading economic indicators (LEI), considered by many to be reliable signals of potential economic distress, fell by 2.1% over the six months ending in July. This compared favorably to the drop of 3.1% in the preceding half-year stretch. According to the board, this sort of trajectory “no longer signals recession ahead.” While economic growth is expected to slow, this shouldn’t be as drastic as some worry it might be.

It’s almost time for cuts!

Meanwhile, on Friday crypto investors — and the rest of the financial world — received their surest signal yet that the Fed is about to grab the scissors. Chair Jerome Powell talked about rate cuts as if they were an event soon to be realized, rather than a hazy possibility or rank speculation.

“The time has come for policy to adjust,” he said in his keynote speech at the organization’s annual retreat. “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

Should you invest $1,000 in TRON right now?

Before you buy stock in TRON, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and TRON wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Eric Volkman has positions in Bitcoin and Ethereum. The Motley Fool has positions in and recommends Bitcoin, Chainlink, and Ethereum. The Motley Fool has a disclosure policy.

Why Altcoins Surged Ahead by Double Digits This Week was originally published by The Motley Fool

These 5 Social Security Changes Are Coming in 2025 No Matter Who Wins the Election

With an election coming up in November, all eyes are on the presidential candidates and how they could shape the future of Social Security if they claim the Oval Office. However, no matter who wins the White House or control of Congress, some changes are going to happen to Social Security in 2025.

Here are five aspects of the program that will be affected regardless of who rules.

1. The size of retirees’ checks

The first big change will impact current retirees. Seniors who are receiving Social Security will see their payments get bigger next year. This is happening because automatic cost-of-living adjustments are built into the benefits program to help offset the erosion of buying power.

As prices go up, benefits do, too. A formula looks at changes to a consumer price index to determine how big the COLA will be. Pundits are currently projecting a 2.6% increase, although seniors won’t know for sure until October as the formula looks at data from the third quarter.

2. The amount you must earn to qualify for a work credit

Social Security is an “earned benefits” program. You must earn 40 work credits to become eligible for benefits, and can earn up to four credits per year. You accumulate work credits by earning and paying taxes on the income you earn. In 2024, you must earn $1,730 to qualify for one work credit. So, if you make $6,920 this year, you’ll max out the four credits you’re eligible for.

The amount you must earn to get a work credit increases each year to account for wage growth. In 2023, for example, you could earn a work credit by making just $1,640.

For those who are working but not earning a ton, it’s worth paying attention to this change that’s coming next year. You don’t want to find yourself with too few work credits to collect retirement benefits when you get older.

3. How much money you can make without affecting your Social Security benefit

If you have reached your full retirement age, you are allowed to work as much as you’d like with no impact on your benefits. That’s not changing.

However, if you’re under your full retirement age, that’s not the case. As soon as you hit a certain earnings threshold, you start to forfeit some of your Social Security payments. Eventually, the money comes back to you when your benefits are recalculated at full retirement age, but in the meantime, you could find your Social Security checks disappear if your salary is too high.

The amount you can earn before this happens is changing in 2025 (likely going up) because it’s indexed to inflation. This is good news, as it means people will be able to bring home more in a paycheck and still get benefits.

The wage limit in 2024 is $22,320. The 2025 limit has not been announced.

4. How old you must be to claim your benefit without any penalties

Near retirees will be impacted by another pretty major change in 2025, which is baked in and happening automatically.

The age at which they can claim full benefits is moving later. While those who turn 66 in 2024 can claim their full, unreduced benefits at 66 and 8 months, anyone who is not turning 66 until 2025 must wait to start their payments until 66 and 10 months. Otherwise, they will face monthly early filing penalties that apply to those who claim benefits before full retirement age.

This change was set in motion in 1983 when lawmakers passed a law requiring full retirement age to gradually move later to help improve Social Security’s struggling finances.

5. The amount of income subject to Social Security tax

This change is one that high earners may be unhappy about. The maximum income subject to Social Security tax will be higher in 2025.

Social Security caps the amount of income you pay taxes on and get credit for when benefits are calculated. The cap is $168,600 in 2024 but is indexed to inflation, so it will climb higher next year. If you make more than $168,600 in 2025, you can expect a higher Social Security tax bill next year once this limit is increased.

These changes happen because Social Security has provisions to deal with inflation and because of laws passed a long time ago. No matter who wins the election, seniors and future retirees will have to cope with the modifications, so it’s worth planning now.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” ›

The Motley Fool has a disclosure policy.

These 5 Social Security Changes Are Coming in 2025 No Matter Who Wins the Election was originally published by The Motley Fool

Kamala Harris Supports Tax on Unrealized Capital Gains: What It Means for Wealthy Households

The Kamala Harris campaign has made one of its first concrete policy proposals this week with a tax plan. The centerpiece of the plan is a series of high-end tax increases on corporations and wealthy households worth approximately $5 trillion over 10 years. Specifically, Harris has proposed enacting the tax increases detailed in President Biden’s budget released earlier this spring.

One issue in this plan has captured specific attention: a new tax on unrealized capital gains. Biden, and now Harris, have proposed levying an annual tax on the static wealth of households worth more than $100 million. Specifically, households worth more than $100 million would pay an annual minimum tax worth 25% of their combined income and unrealized capital gains.

This is known as a “wealth tax,” and the goal is to tax wealthy households that increasingly avoid taxation by living off unsold and unrealized assets. However, unrealized capital gains means that the asset has not been sold, and thus a price has not been locked in for the benefit of the asset-holder. This means that taxes may be paid on value that is never received by the owner, ultimately disincentivizing long-term investments by wealthy households. Here’s what to know.

A financial advisor can help you navigate the nuances of changing tax legislation and build a plan that suits your goals.

What Are Unrealized Capital Gains?

Unrealized capital gains occur when the value of an asset increases over its cost basis (typically the purchase price) while it is held unsold. This can be thought of as theoretical profits. For example, say that you purchase an equity for $10 per share. The next day, the price increases to $12 but you do not sell. That $2 difference is an unrealized capital gain. While your net worth may have increased by $2, it remains at risk to change further unless you sell the equity.

Realized capital gains occur when an asset is actively sold for more than its cost basis. The resulting profits from the sale are considered the realized gains.

Realized capital gains have a final, known value. They are the recorded amount of a fixed transaction, while unrealized capital gains fluctuate. They reflect the state of an asset at any given time while it is held unsold. So, in our example above, say your equity is worth $12 per share on July 1, and you sell it for $14 per share on August 1. You would have a $2 unrealized capital gain on July 1, and a $4 realized capital gain on August 1.

Capital gains apply to all capital assets. This is a broad category that most commonly includes financial securities and real estate

What Are Realized Capital Gains Taxes?

Capital gains taxes are taxes that apply any time a capital asset is sold for a profit. Currently, there are no taxes on unrealized capital gains. The taxable event requires a transaction. It occurs at the time of the sale and is based on the realized gains or losses relative to the cost basis (in general, the purchase price of the asset).

This tax has long been a contested issue in American politics and economics, as capital gains (generally the income generated from passive investment) are taxed at a significantly lower rate than earned income (the income generated from labor and work).

Specifically, capital gains are taxed at 0%, 15% and 20%, and the highest bracket begins at profits over $500,000. By contrast, earned income is taxed at up to 37%, depending on your annual income level. For example, the 22% income tax bracket for 2024 begins at $47,150 of annual income.

Proponents of this system argue that it encourages investment and growth. By reducing taxes on investments, the government can incentivize business creation, land development and other economically productive activities. Proponents also argue that this system constitute double-taxation as it is, since investors use money they earned (and therefore was taxed) to buy the underlying securities.

Critics argue that this system encourages rent-seeking behavior rather than productive investment, since investors are incentivized toward passive returns on investment assets. They argue that there is no double taxation since investors only pay taxes on their profits, and that the special status for capital gains creates an unfair system in which millionaire investors pay less in taxes than low-income workers.

A financial advisor can help you build a tax-efficient strategy based on your goals and circumstances. Get matched with a fiduciary advisor today.

How Would an Unrealized Capital Gains Tax Work?

Alongside the debate over realized capital gains, some policymakers and some economists have begun to suggest a tax on unrealized capital gains. This is a tax on the value of a portfolio’s unrealized gains. Each year, eligible households would calculate the growth of their portfolio and would owe a portion of that increased value in taxes.

This is otherwise known as a “wealth tax.”

Under the Harris/Biden proposal, all households with more than $100 million in net assets would pay a minimum tax of 25% on their combined income and unrealized capital gains. This would most likely be assessed as of the end of the year.

So, for example, say that a household holds a portfolio of stocks with a $50 million tax basis. On December 31, those shares are now worth $125 million. They also have an annual income of $1 million in cash and $10 million worth of stock options.

As a household worth more than $100 million, this proposed minimum tax would apply. They would have unrealized capital gains of $75 million ($125 million current price – $50 million cost basis). They would have another $1 million of income, with their stock options likely exempted from income taxes. As a result, they might owe up to $19 million in taxes (0.25 * $76 million). However, one problem with this is that as unrealized gains, the value of that $125 million securities investment may go back down to the original $50 million value – or even below it – at any given time. This would mean the household paid a 25% tax rate on value it may have never received.

The details of this proposal remain speculative. Neither the Biden Administration nor the Harris campaign have said exactly how they would like to enact or enforce this policy. Since no jurisdiction has passed a wealth tax on securities, there is no working template to work from. This would particularly raise valuation and enforcement questions when it comes to taxing private and illiquid assets, in which pricing is more speculative than with high-volume public assets like public stocks and bonds.

Consider matching with a financial advisor for professional help with tax management and beyond.

The Debate Around Wealth Taxes

The idea of a wealth tax has gained increasing traction in recent years.

The perceived problem that these policymakers are trying to solve is that, increasingly, very wealthy households operate without ever selling their assets. They are frequently paid in stock and options, often untaxed. They access cash and property through loans secured by those assets, which are again untaxed, and asset swaps.

This practice, known as “buy, borrow, die,” means that the very wealthy may be able to circumvent some taxes, operating without ever triggering a taxable event. It also means that ever-more wealth keeps being effectively locked up indefinitely, idling in portfolios to be used as collateral.

Some economists have proposed solving this with the estate tax. There are two main criticisms of that approach however: First, while not a dead letter, the estate tax collects less and less revenue every year. Second, the estate tax offers much less flexibility than a revenue-based tax, as it only allows taxation after the semi-unpredictable event of an individual’s death.

This has lead to a growing embrace of taxing unrealized capital gains. Proponents argue that a wealth tax will is the only way to tax ultrawealthy households, which would otherwise continue their current practice of indefinitely holding untaxed assets. This would generate revenue and, by forcing a liquidity event, return many of those assets to the market.

There is significant criticism around the idea of a wealth tax, however. One of the most significant question remains a legal one. Critics argue that the federal government does not have the authority to tax individual assets outside of a transaction. This argument is primarily based on the Fifth Amendment Taking’s clause, which reads in relevant part “nor shall private property be taken for public use, without just compensation” and on the Direct Taxation Clause of the Constitution which reads, in relevant part, “No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or enumeration herein before directed to be taken.”

Most Constitutional scholars believe that these arguments are weak, and political more than legal.

Anti-tax advocates have attempted to the Takings Clause to argue against the constitutionality of many taxes, including the income tax, for years without success. The Direct Taxation Clause is more ambiguous. The Supreme Court has never defined what actually constitutes a “direct” vs. an “indirect” tax. There is no clear authority to argue that a wealth tax would trigger this clause, and any such holding would likely come in conflict with many other areas of the tax code. The closest modern authority on this issue comes from a 2024 case Moore vs. USA in which the Court upheld a tax on undistributed foreign assets.

Beyond the legal criticisms, there are significant questions about the implementation and enforcement of a wealth tax. As noted in the example in the previous section, unrealized gains can quickly become unrealized losses, meaning taxes could be imposed even though a household does not actually receive the full benefit or ownership of the money they are taxed on.

And as the Tax Policy Center notes, any wealth tax would have to address complicated assets including businesses and real estate holdings, and tax-avoidance strategies such as trusts and corporations. These are not necessarily fatal problems for a wealth tax, as any tax scheme must address complex assets and avoidance, but they must be addressed in order for this idea to become a mature proposal.

For more information on how you can best plan your tax strategy and navigate any legislative changes, consider consulting a financial advisor.

The Bottom Line

The Harris campaign has fully endorsed a tax plan put forth by President Biden’s administration. This plan proposes to raise revenues by around $5 trillion, in part by levying taxes on unrealized capital gains for households worth more than $100 million. This is known as a wealth tax, and it has become an increasingly debated topic in recent years.

Tips On Managing Your Taxes

-

You don’t need to own your own yacht to want to save on taxes. Heck, minimizing your taxes might even help you buy that boat someday. So let’s start talking about smart ways to reduce your taxes, strategies you can use right now.

-

A financial advisor can help you build a comprehensive retirement plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now. You can also check out SmartAsset reviews.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: Grok, ©iStock.com/JoeyCheung, ©iStock.com/courtneyk

The post Kamala Harris Supports Tax on Unrealized Capital Gains: What It Means for Wealthy Households appeared first on SmartReads by SmartAsset.

Prediction: These Will Be the Best-Performing S&P 500 Stocks of 2024

You’ve likely heard some form of the disclaimer, “Past performance is no guarantee of future results.” And the statement is true. However, I’d add something to the disclaimer: “But a big head start is nearly always a good thing.”

Several large-cap stocks have a big head start that could enable them to finish the year strong. I predict these will be the three best-performing S&P 500 (SNPINDEX: ^GSPC) stocks of 2024.

1. Nvidia

Nvidia (NASDAQ: NVDA) currently ranks as the biggest year-to-date winner in the S&P 500. Shares of the GPU maker have skyrocketed over 150%. I don’t think Nvidia will give up its top spot by the end of 2024.

On Aug. 12, I predicted that Nvidia stock would jump another 20% or more by year-end. My prediction has almost come true already. One reason why is that some of the factors weighing on Nvidia aren’t as worrisome now.

More importantly, though, Nvidia has yet to announce its fiscal 2025 second-quarter results. The company is scheduled to provide its Q2 update on Aug. 28. I fully expect another blow-out quarter for Nvidia, which will fuel investor optimism.

I also think the company will reassure investors about the timing of the launch of its Blackwell-based chips. Blackwell is Nvidia’s newest GPU architecture that CEO Jensen Huang believes will be the most successful product in the company’s history.

2. Super Micro Computer

Super Micro Computer (NASDAQ: SMCI), commonly referred to as Supermicro, ranks as the S&P 500’s second-best stock so far this year. Shares of the information technology infrastructure company have soared around 115%. I expect Supermicro will add to that gain over the next few months.

Will Supermicro’s upcoming 10-for-1 stock split on Oct. 1 provide a big catalyst? Maybe, but I wouldn’t count on it. Even if there is a boost from the split, it could only be a temporary one.

The smarter reason to look for a continued strong performance from Supermicro is the tailwind generated by artificial intelligence (AI). In the fourth quarter of Supermicro’s fiscal 2024, the company generated revenue of $5.31 billion. It projects revenue of between $6 billion and $7 billion in fiscal 2025 Q1. That’s a 22% increase in just three months — and much of it stems from AI-related demand.

Supermicro could also benefit from Nvidia’s launch of its Blackwell chips. Even if there’s a worse-than-expected delay with this launch, though, Supermicro CEO Charles Liang doesn’t think his company will be affected too much because of the overall demand for its liquid-cooling solutions.

3. Eli Lilly

I’m going out on a limb with my next pick. Three S&P 500 stocks are currently performing better than Eli Lilly (NYSE: LLY) in addition to Nvidia and Supermicro. However, I have a hunch this big pharma stock could leap past them to end the year as the No. 3 stock in the S&P.

My bullish view about Lilly is based largely on my great expectations for the company’s tirzepatide franchise. In the U.S., the drug is marketed under the brand name Mounjaro for treating type 2 diabetes and under the brand name Zepbound for treating obesity. Outside the U.S., it’s marketed as Mounjaro for both indications. Whatever you call it, tirzepatide is already an enormously successful blockbuster drug. Mounjaro raked in $3.09 billion in sales in Q2, while Zepbound made $1.24 billion.

Investors also know that Lilly could have more indications for tirzepatide on the way. The U.S. Food and Drug Administration (FDA) could make an approval decision on the drug in treating obstructive sleep apnea and obesity by the end of 2024. Lilly plans to file for regulatory approvals of tirzepatide in treating heart failure with preserved ejection fraction (HFpEF) and obesity later this year.

We can’t overlook Lilly’s recently FDA-approved Alzheimer’s disease drug, Kisunla. I don’t look for jaw-dropping sales numbers from the therapy in the second half of the year. However, more regulatory approvals outside the U.S. are possible by the end of 2024. And if U.S. sales are better than expected, Kisunla could provide more reason for investors to be excited about Lilly’s growth prospects.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Keith Speights has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Prediction: These Will Be the Best-Performing S&P 500 Stocks of 2024 was originally published by The Motley Fool

If Warren Buffett's Son Didn't Sell His 90K Berkshire Hathaway Inheritance 47 Years Ago To 'Buy Time,' He Would Have This Much Today

Peter Buffett, the son of legendary investor Warren Buffett, made a life-altering decision 47 years ago when he traded his inheritance “to buy time.” Although he missed out on what could have been hundreds of millions of dollars in profit, he stands by his choice, confident that his father would agree.

Don’t Miss:

Finding His Path: At 19, Buffett received a portion of the proceeds from the sale of his grandfather’s farm, which his father invested in Berkshire Hathaway Inc. (NYSE:BRK) (NYSE:BRK), amounting to $90,000, according to CNBC. His father made it clear that this was all the financial support he would receive for personal use. Despite knowing it was his entire inheritance, Peter sold his Berkshire stock to fund his passion for music.

See Also: Don’t miss out on the next Nvidia – you can invest in the future of AI for only $10.

Buffett dropped out of Stanford University, purchased a modest studio apartment in San Francisco, and invested in upgrading his recording equipment. He dedicated his time to honing his piano and music production skills.

His big break came unexpectedly when a neighbor asked him about his profession, setting him on the path to a successful career in music.

Trending: Mark Cuban believes “the next wave of revenue generation is around real estate and entertainment” — this new real estate fund allows you to get started with just $100.

He told the neighbor that he was a “struggling composer” and the neighbor offered to introduce him to his son-in-law who was an animator looking for ad tunes for a new cable station — it turned out to be MTV.

Buffett is now 66 years of age and has released around 15 studio albums over his successful career.

Trending: This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

The Path Not Taken: If the son of the legendary investor would have stayed in college and held onto his $90,000 investment in Berkshire Hathaway, it would be worth over $400 million today.

“But I didn’t make that choice and I don’t regret it for a second. I used my nest egg to buy something infinitely more valuable than money: I used it to buy time,” Buffett said.

That’s a decision that his father would be proud of, he noted. The billionaire taught his son that work isn’t about making as much money as possible, instead it’s about doing something that you love to do.

Trending: How do billionaires pay less in income tax than you? Tax deferring is their number one strategy.

Buffett acknowledged that the money was a privilege, calling it a gift that he had not earned.

“Without those hundreds of unpaid hours spent fiddling with my recording gear, I would not have found my sound or approach,” Buffett said.

The musician used the money to buy time to pursue something that he enjoys waking up and doing each day, which is exactly what his father tells young people to do. The billionaire has previously recommended that people pursue careers they would want even if money was not part of the decision-making process.

Check This Out:

This story is part of a new series of features on the subject of success, Benzinga Inspire. Some elements of this story were previously reported by Benzinga and it has been updated.

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article If Warren Buffett’s Son Didn’t Sell His 90K Berkshire Hathaway Inheritance 47 Years Ago To ‘Buy Time,’ He Would Have This Much Today originally appeared on Benzinga.com

2 High-Yield Energy Stocks to Buy Hand Over Fist and 1 to Avoid

For dividend investors, one of the most important things to know about the energy sector is that it is very volatile. That means that dividend-paying energy stocks should go through a little extra scrutiny before being added to your portfolio.

A great example of the problem income investors face when looking for energy investments is Devon Energy (NYSE: DVN). Meanwhile, Chevron (NYSE: CVX) and Enterprise Products Partners (NYSE: EPD) are solid examples of the gems that you can unearth in the energy sector when you dig in just a little bit.

Devon Energy’s dividend history isn’t shocking

Devon Energy is what is known as an upstream company, which means that it produces oil and natural gas. In this case, the company operates exclusively in the onshore U.S. space, but that’s not the most salient factor here.

What is important to understand is that its top and bottom lines are driven almost entirely by energy prices. Oil and natural gas prices are highly volatile, and so Devon’s financial results are also highly variable.

This isn’t a bad thing, per se. It is pretty much par for the course when you are looking at an upstream company. For dividend investors, however, there’s an added wrinkle. Devon’s dividend is variable, with the final payment tied to the company’s financial results.

Even though the dividend yield is listed at 4.4% on major online quote services, investors should expect the actual income received to vary greatly over time. In some ways, the variable dividend policy is a good way to ensure that shareholders are rewarded when energy prices are high, but the downside is that dividend cuts are inevitable.

For most income investors Devon Energy isn’t going to be a good stock to own.

Chevron is a reliable dividend payer

If you are looking for a reliable dividend payer with a long history of annual increases behind it, you’ll probably be better off with Chevron. For starters, it is much more diversified. Its business encompasses the upstream, the midstream (pipelines), and all the way to the downstream (chemicals and refining).

The company’s energy portfolio is also globally diversified. And it happens to be one of the largest energy companies on the planet with a $260 billion market cap. Chevron’s dividend yield is also around 4.4%.

The energy company has increased its dividend annually for 37 consecutive years despite the inherent volatility of the sector. A big part of the story here is its rock-solid balance sheet, with a debt-to-equity ratio of just 0.14 times.

That would be strong for any company, but it gives Chevron the leeway to take on debt during industry downturns so it can support its business and dividend. When energy prices recover, as they always have historically, it pays down the debt in preparation for the next energy sell-off.

If you are looking for an energy producer with a reliable dividend, Chevron is one of the best options you’ll find.

Enterprise is a boring high yielder

If Chevron’s exposure to oil and natural gas production is a bit too troubling for you, there are still some energy options out there. One of the most reliable is Enterprise Products Partners, a master limited partnership (MLP) that operates a large portfolio of midstream infrastructure assets.

Generally speaking, it charges fees for the use of these assets so the price of the oil and natural gas that flows through its system isn’t really that important to its financial results.

This is highlighted by the fact that the company has increased its distribution annually for 26 consecutive years. And there’s more to like here. Specifically, the balance sheet is investment-grade, and cash flow covers the distribution by a strong 1.7 times. There is a lot of room for adversity before a distribution cut would be on the table.

That said, Enterprise’s hefty 7% or so distribution yield is likely to make up the lion’s share of returns over time. This is because there are limited growth prospects in the midstream sector.

But bolt-on acquisitions, expansions of existing assets, small ground-up capital projects, and regular rate increases within its existing portfolio will likely lead to slow and steady growth over time. And that, in turn, should support ongoing distribution growth.

The best options for income in energy

Dividend investors need to understand the impact that the energy sector’s high volatility will have on their investments. Both Chevron and Enterprise have proved they know how to handle the industry’s ups and downs while continuing to reward investors well over time.

That said, Devon Energy isn’t a bad company, but it has chosen a very different dividend approach that inherently means shareholders will see dividend cuts. If you are looking for a reliable income stream in the energy sector, Chevron and Enterprise will be much better choices.

Should you invest $1,000 in Devon Energy right now?

Before you buy stock in Devon Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Devon Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

2 High-Yield Energy Stocks to Buy Hand Over Fist and 1 to Avoid was originally published by The Motley Fool