All You Need to Know About Bunzl Rating Upgrade to Buy

Bunzl PLC BZLFY could be a solid choice for investors given its recent upgrade to a Zacks Rank #2 (Buy). This upgrade is essentially a reflection of an upward trend in earnings estimates — one of the most powerful forces impacting stock prices.

The sole determinant of the Zacks rating is a company’s changing earnings picture. The Zacks Consensus Estimate — the consensus of EPS estimates from the sell-side analysts covering the stock — for the current and following years is tracked by the system.

The power of a changing earnings picture in determining near-term stock price movements makes the Zacks rating system highly useful for individual investors, since it can be difficult to make decisions based on rating upgrades by Wall Street analysts. These are mostly driven by subjective factors that are hard to see and measure in real time.

Therefore, the Zacks rating upgrade for Bunzl basically reflects positivity about its earnings outlook that could translate into buying pressure and an increase in its stock price.

Most Powerful Force Impacting Stock Prices

The change in a company’s future earnings potential, as reflected in earnings estimate revisions, and the near-term price movement of its stock are proven to be strongly correlated. The influence of institutional investors has a partial contribution to this relationship, as these big professionals use earnings and earnings estimates to calculate the fair value of a company’s shares. An increase or decrease in earnings estimates in their valuation models simply results in higher or lower fair value for a stock, and institutional investors typically buy or sell it. Their bulk investment action then leads to price movement for the stock.

Fundamentally speaking, rising earnings estimates and the consequent rating upgrade for Bunzl imply an improvement in the company’s underlying business. Investors should show their appreciation for this improving business trend by pushing the stock higher.

Harnessing the Power of Earnings Estimate Revisions

Empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock movements, so it could be truly rewarding if such revisions are tracked for making an investment decision. Here is where the tried-and-tested Zacks Rank stock-rating system plays an important role, as it effectively harnesses the power of earnings estimate revisions.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Earnings Estimate Revisions for Bunzl

This company is expected to earn $2.47 per share for the fiscal year ending December 2024, which represents a year-over-year change of 3.8%.

Analysts have been steadily raising their estimates for Bunzl. Over the past three months, the Zacks Consensus Estimate for the company has increased 4.8%.

Bottom Line

Unlike the overly optimistic Wall Street analysts whose rating systems tend to be weighted toward favorable recommendations, the Zacks rating system maintains an equal proportion of ‘buy’ and ‘sell’ ratings for its entire universe of more than 4000 stocks at any point in time. Irrespective of market conditions, only the top 5% of the Zacks-covered stocks get a ‘Strong Buy’ rating and the next 15% get a ‘Buy’ rating. So, the placement of a stock in the top 20% of the Zacks-covered stocks indicates its superior earnings estimate revision feature, making it a solid candidate for producing market-beating returns in the near term.

The upgrade of Bunzl to a Zacks Rank #2 positions it in the top 20% of the Zacks-covered stocks in terms of estimate revisions, implying that the stock might move higher in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

These High-Yield Dividend Stocks Are Turning to Acquisitions to Supercharge Their Growth Engines

A wave of mergers and acquisitions (M&A) activity has washed over the oil patch in the last year. Big oil behemoth ExxonMobil kicked things off with its $60 billion deal for Pioneer Natural Resources. Several rivals followed its lead, including Chevron, which is trying to buy Hess in a nearly $60 billion transaction.

The oil industry’s M&A wave has spilled over into the pipeline sector. Several midstream companies have made acquisitions, while the rumor mill suggests others are on the prowl. These deals will give pipeline companies more fuel to grow their cash flow and high-yielding dividends.

Let’s make a deal

Energy Transfer (NYSE: ET) prides itself on being a consolidator in the midstream sector. The master limited partnership (MLP) has made several acquisitions over the years. However, it has quickened its pace in the past year. The company made two deals last year (buying Lotus Midstream for $1.5 billion last May and closing its $7.1 billion merger with fellow MLP Crestwood Equity Partners in November).

The MLP has continued to make deals this year, buying WTG Midstream for $3.1 billion in July. Meanwhile, its affiliated MLP Sunoco LP acquired NuStar Energy for $7.3 billion. It subsequently formed a strategic joint venture to combine its crude oil and produced water-gathering assets in the Permian Basin (which it acquired in the NuStar deal) with Energy Transfer’s assets in the region.

These transactions share two common themes. They are strong strategic fits that enhance Energy Transfer’s existing assets. The deals were also accretive to its cash flow per share and had a neutral impact on its balance sheet. Because of that, they enhance the MLP’s plan to grow its 8%-yielding distribution by 3%-5% annually.

Oneok (NYSE: OKE) has been just as active. The pipeline company closed its transformational $18.8 billion acquisition of MLP Magellan Midstream Partners last year. That deal enhanced its scale and diversification while being highly accretive (free cash flow per share accretion will average more than 20% through 2027). Oneok followed that deal with $5.9 billion of acquisitions last month.

It’s buying Medallion Midstream and a 43% interest in EnLink Midstream from the same private equity firm. After closing that deal, Oneok plans to buy the remaining interest in EnLink from outside shareholders. Those deals will be immediately accretive to its cash flow and capital return program, which includes increasing its more than 4%-yielding dividend by 3%-4% per year.

Enterprise Products Partners (NYSE: EPD) has also been fairly active this year. It recently agreed to buy Pinon Midstream in a $950 million deal. In addition, it bought $400 million of joint venture partner interests from fellow MLP Western Midstream Partners (NYSE: WES). Those deals will give Enterprise Products Partners more fuel to increase its more than 7%-yielding distribution, something it has done for 26 straight years.

More deals could be coming down the pipeline

The midstream sector’s consolidation wave is showing no signs of stopping. According to a Bloomberg report, natural gas pipeline giant Williams had some interest in buying midstream company Targa Resources. There’s some disagreement about the extent of the interest. Targa reportedly said it rejected the offer because it undervalued the company. Meanwhile, Reuters reported that Williams had never made an offer.

Either way, the rumors suggest that midstream companies are still searching for deals. Williams and Targa Resources have both been targets in the past. Energy Transfer had agreed to buy Williams in 2015, but that deal fell apart, which led Enterprise Products Partners to approach Williams with a deal the following year. Before that, Energy Transfer was interested in buying Targa.

Meanwhile, Western Midstream Partners’ largest investor, oil giant Occidental Petroleum, explored selling its stake in the MLP earlier this year. Occidental is selling non-core assets to repay debt following its $12 billion acquisition of CrownRock. While it did recently trim its interest in Western Midstream to raise some cash for debt reduction, it could eventually sell its entire remaining stake to another midstream company or a private equity fund. The buyer could then offer to acquire the rest of the company from outside shareholders, much like Oneok’s planned two-phased acquisition of EnLink.

In addition to deals between publicly traded midstream players, private equity companies have been cashing in on the M&A boom by selling their midstream holdings. Lotus, WTG, Pinon, and Medallion were all smaller midstream companies owned by private equity. Other financial investors will likely look to exit their positions while the window for deals is still wide open.

Adding more fuel to pay dividends

Pipeline companies prefer to grow organically by expanding their midstream infrastructure operations through expansion projects. However, many are turning to M&A to enhance their growth profiles. These accretive deals are increasing their cash flow, which will bolster their ability to increase their high-yielding dividends in the future. Because of that, income-focused investors could earn higher returns from the sector in the future as companies close additional accretive deals. That makes it a great place to collect a growing stream of passive income these days.

Should you invest $1,000 in Energy Transfer right now?

Before you buy stock in Energy Transfer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $656,938!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Matt DiLallo has positions in Chevron, Energy Transfer, and Enterprise Products Partners. The Motley Fool has positions in and recommends Chevron. The Motley Fool recommends Enterprise Products Partners, Occidental Petroleum, and Oneok. The Motley Fool has a disclosure policy.

These High-Yield Dividend Stocks Are Turning to Acquisitions to Supercharge Their Growth Engines was originally published by The Motley Fool

ROSEN, RECOGNIZED INVESTOR COUNSEL, Encourages STMicroelectronics N.V. Investors to Secure Counsel Before Important Deadline in Securities Class Action – STM

NEW YORK, Sept. 07, 2024 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of STMicroelectronics N.V. STM between January 25, 2024 and July 24, 2024, both dates inclusive (the “Class Period”), of the important October 22, 2024 lead plaintiff deadline.

SO WHAT: If you purchased STMicroelectronics securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the STMicroelectronics class action, go to https://rosenlegal.com/submit-form/?case_id=28219 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than October 22, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, during the Class Period, defendants made false and/or misleading statements and/or failed to disclose that: (1) contrary to prior representations, demand in ST’s automotive and industrial sectors continued to decline in the first half of 2024; (2) as a result, ST’s revenues and gross margins also continued to decline during this period; and (3) as a result, ST’s public statements were materially false and misleading at all relevant times. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the STMicroelectronics class action, go to https://rosenlegal.com/submit-form/?case_id=28219 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Positive Signal: Jack Hightower Shows Faith, Buying $834K In HighPeak Energy Stock

It was revealed in a recent SEC filing that Jack Hightower, Chief Executive Officer at HighPeak Energy HPK made a noteworthy insider purchase on September 5,.

What Happened: In a recent Form 4 filing with the U.S. Securities and Exchange Commission on Thursday, Hightower increased their investment in HighPeak Energy by purchasing 53,905 shares through open-market transactions, signaling confidence in the company’s potential. The total transaction value is $834,381.

During Thursday’s morning session, HighPeak Energy shares down by 0.45%, currently priced at $14.41.

Unveiling the Story Behind HighPeak Energy

HighPeak Energy Inc is an independent oil and natural gas company focused on the development of unconventional oil and natural gas reserves in Howard County of the Midland Basin. The company operates in a single segment, which is oil and natural gas development, exploration, and production.

Understanding the Numbers: HighPeak Energy’s Finances

Revenue Growth: Over the 3 months period, HighPeak Energy showcased positive performance, achieving a revenue growth rate of 14.33% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. When compared to others in the Energy sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Evaluating Earnings Performance:

-

Gross Margin: With a low gross margin of 35.67%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): HighPeak Energy’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 0.21.

Debt Management: With a high debt-to-equity ratio of 0.7, HighPeak Energy faces challenges in effectively managing its debt levels, indicating potential financial strain.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: HighPeak Energy’s P/E ratio of 12.17 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The P/S ratio of 1.55 is lower than the industry average, implying a discounted valuation for HighPeak Energy’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): HighPeak Energy’s EV/EBITDA ratio, lower than industry averages at 3.11, indicates attractively priced shares.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Illuminating the Importance of Insider Transactions

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Exploring Key Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of HighPeak Energy’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Can Palantir's Stock Live Up to Lofty Expectations?

Palantir Technologies (NYSE: PLTR) rose to the top as one of the premier artificial intelligence (AI) stocks. Its prowess in AI software application is almost unmatched, which is why investors are so excited.

However, alongside this excitement has come inflated expectations, and I’m worried that even if the business succeeds, the stock could fall flat on its face due to the run-up it already experienced.

Can Palantir live up to these high expectations? Or are investors in for a rude awakening?

Palantir’s software is just starting to be adopted

Palantir’s software has been integrating AI with decision-making for a long time. It started in 2003 as a company focused on providing software to the government and has since expanded into the commercial sector. Its software was developed to streamline data flows and give decision makers the best possible information.

This program is incredibly useful, especially in high-stakes scenarios (like those found in government). And Palantir’s latest product takes this to a whole new level.

Its Artificial Intelligence Platform (AIP) gives developers the tools to integrate AI throughout a business, whether it be in apps for certain purposes or using AI to drive workflows and improve productivity.

This is exactly what many companies are looking for because AI is mostly being used as a tool on the side rather than directly integrated into workflows.

AIP has been a hit on the U.S. commercial side of the business, driving a second-quarter revenue increase of 55% to $159 million among these clients. Perhaps even more impressive was that its U.S. commercial customer count rose 83% from a year ago to 295.

This shows that there have been relatively few adapters of Palantir’s software, but there’s a reason for that: its cost. If we annualize the revenue and divide it by customer count, that gives an annual contract value of around $2.16 million. That’s a very expensive software package, and it limits potential clientele.

Still, that’s only a fraction of Palantir’s business. Its total second-quarter revenue was $678 million, up 27% from last year.

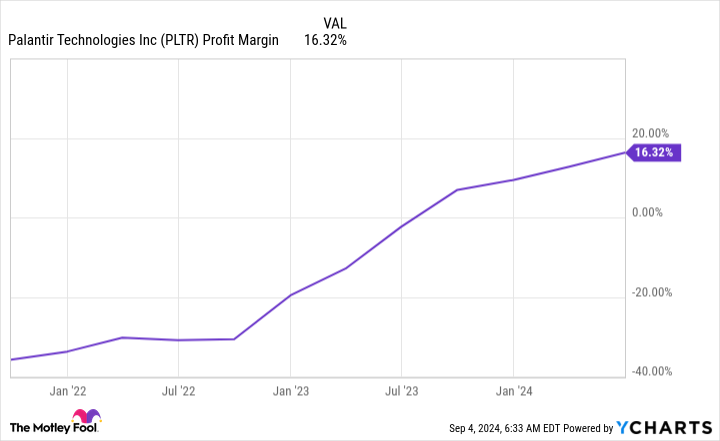

Although Palantir is a growing software company, it still knows how to turn a profit (a lesson it can teach some of its peers). The second quarter saw record profit margins, with earnings per share totaling $0.06.

But all of those great metrics come at a hefty price, which is why I’m not keen on buying Palantir’s stock right now.

Even if the business succeeds, the stock could struggle

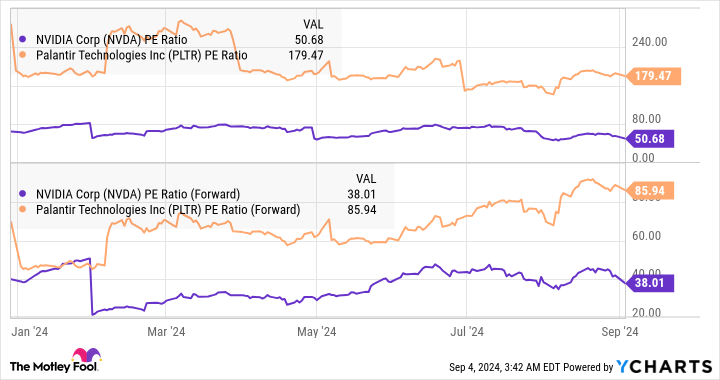

Palantir is still working on achieving maximum profitability, so using an earnings-based valuation metric doesn’t do it justice. (The stock trades at 86 times forward earnings.)

Instead, it’s better to project what Palantir’s valuation could be if it achieved margins similar to those of other mature software companies. Adobe is the industry standard for software companies, and its average profit margin over the past five years was 30%.

We need to establish a growth rate for the business. Wall Street analysts expect 24% growth in 2024 and 21% in 2025, but if we give Palantir the benefit of the doubt and say it can maintain its second-quarter growth rate of 27% for five years, that would give it annual revenue of $8.19 billion.

If it converts 30% of that into net income, it would generate $2.46 billion in profits. We get its ratio of price to five-year forward earnings by dividing its current market cap by this hypothetical profit.

This figure comes in at 27.8 times five-year forward earnings. What does Adobe trade for right now? It’s at 31.4 times forward earnings.

So Palantir must greatly exceed Wall Street expectations and achieve industry-leading profit margins for five years, and only then will it be valued at the same price another company is right now.

This just shows the extreme expectations built into the stock, which is why I’m not a buyer at these prices. There are too many other companies’ shares that can be bought for a reasonable price to justify buying Palantir right now, even if the underlying business will succeed over the same time period.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $656,938!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Keithen Drury has positions in Adobe. The Motley Fool has positions in and recommends Adobe and Palantir Technologies. The Motley Fool has a disclosure policy.

Can Palantir’s Stock Live Up to Lofty Expectations? was originally published by The Motley Fool

All You Need to Know About China Yuchai Rating Upgrade to Strong Buy

Investors might want to bet on China Yuchai CYD, as it has been recently upgraded to a Zacks Rank #1 (Strong Buy). This rating change essentially reflects an upward trend in earnings estimates — one of the most powerful forces impacting stock prices.

A company’s changing earnings picture is at the core of the Zacks rating. The system tracks the Zacks Consensus Estimate — the consensus measure of EPS estimates from the sell-side analysts covering the stock — for the current and following years.

The power of a changing earnings picture in determining near-term stock price movements makes the Zacks rating system highly useful for individual investors, since it can be difficult to make decisions based on rating upgrades by Wall Street analysts. These are mostly driven by subjective factors that are hard to see and measure in real time.

Therefore, the Zacks rating upgrade for China Yuchai basically reflects positivity about its earnings outlook that could translate into buying pressure and an increase in its stock price.

Most Powerful Force Impacting Stock Prices

The change in a company’s future earnings potential, as reflected in earnings estimate revisions, and the near-term price movement of its stock are proven to be strongly correlated. The influence of institutional investors has a partial contribution to this relationship, as these big professionals use earnings and earnings estimates to calculate the fair value of a company’s shares. An increase or decrease in earnings estimates in their valuation models simply results in higher or lower fair value for a stock, and institutional investors typically buy or sell it. Their transaction of large amounts of shares then leads to price movement for the stock.

For China Yuchai, rising earnings estimates and the consequent rating upgrade fundamentally mean an improvement in the company’s underlying business. And investors’ appreciation of this improving business trend should push the stock higher.

Harnessing the Power of Earnings Estimate Revisions

Empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock movements, so it could be truly rewarding if such revisions are tracked for making an investment decision. Here is where the tried-and-tested Zacks Rank stock-rating system plays an important role, as it effectively harnesses the power of earnings estimate revisions.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Earnings Estimate Revisions for China Yuchai

This diesel engine maker is expected to earn $1.42 per share for the fiscal year ending December 2024, which represents a year-over-year change of 43.4%.

Analysts have been steadily raising their estimates for China Yuchai. Over the past three months, the Zacks Consensus Estimate for the company has increased 30.3%.

Bottom Line

Unlike the overly optimistic Wall Street analysts whose rating systems tend to be weighted toward favorable recommendations, the Zacks rating system maintains an equal proportion of ‘buy’ and ‘sell’ ratings for its entire universe of more than 4000 stocks at any point in time. Irrespective of market conditions, only the top 5% of the Zacks-covered stocks get a ‘Strong Buy’ rating and the next 15% get a ‘Buy’ rating. So, the placement of a stock in the top 20% of the Zacks-covered stocks indicates its superior earnings estimate revision feature, making it a solid candidate for producing market-beating returns in the near term.

The upgrade of China Yuchai to a Zacks Rank #1 positions it in the top 5% of the Zacks-covered stocks in terms of estimate revisions, implying that the stock might move higher in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Want to Get 'Very Rich'? Charlie Munger and Warren Buffett Say You Only Need 3 Wonderful Businesses – Not 30 Stocks

During a Berkshire Hathaway shareholder meeting a few years ago, Warren Buffett and Charlie Munger were asked a straightforward yet revealing question: If someone in your local town owned three to five businesses, such as a cake shop and a dry cleaner, you’d probably think they were pretty well diversified. So why do financial experts often recommend holding 20 to 30 stocks in a portfolio? The questioner was curious about Buffett’s views on diversification and how he approaches concentrating his investments.

Don’t Miss:

Buffett didn’t hesitate to challenge the conventional wisdom. He made it clear that while owning a broad range of stocks is often recommended, it’s more of a safety net for those who don’t know how to evaluate businesses properly. “Diversification is a protection against ignorance,” Buffett said. “If you know how to analyze businesses and value businesses, it’s crazy to own 50 stocks or 40 stocks or 30 stocks.” In other words, if you’ve done your homework and truly understand a few outstanding companies, spreading your bets across dozens of stocks might dilute your returns.

Trending: The number of ‘401(k)’ Millionaires is up 43% from last year —Here are three ways to join the club.

Buffett isn’t just speaking theoretically. He practices what he preaches. At one point, he mentioned that he owns just one stock in his portfolio – the one he knows best. And when it comes to Berkshire Hathaway, he’s perfectly comfortable with concentrating investments in just a few stellar businesses. “I could pick out three of our businesses, and I would be very happy if they were the only businesses we owned and I had all my money in Berkshire,” he added.

Then Charlie Munger, never one to shy away from a blunt opinion, chimed in. He didn’t just challenge modern financial theories; he flat-out dismissed them. “Much of what is taught in modern corporate finance courses is twaddle,” Munger declared, eliciting laughter from the crowd. His point? Complex models and theories might sound impressive but often add little value to real-world investing.

See Also: Elon Musk and Jeff Bezos are bullish on one city that could dethrone New York and become the new financial capital of the US. Investing in its booming real estate market has never been more accessible.

Munger also emphasized the importance of sticking with what you know. “If you find three wonderful businesses in your life, you’ll get very rich,” he said. And unlike the intricate theories taught in finance classes, this approach is simple, straightforward, and, according to Munger, far more effective.

Buffett and Munger’s advice is clear: If you truly understand the businesses you’re investing in, you don’t need to spread your money across dozens of stocks. Instead, concentrate on a few outstanding companies that you know inside and out. Diversification can help you avoid major mistakes, but it might also prevent you from achieving the extraordinary results of deep, focused investments in just a few high-quality businesses.

Trending: Will the surge continue or decline on real estate prices? People are finding out about risk-free real estate investing that lets you cash out whenever you want.

So, the next time you’re building your portfolio, remember Buffett and Munger’s wisdom. Don’t let the fear of risk lead you to dilute your potential returns. Instead, focus on finding those few great companies you understand and believe in – and then, as Munger might say, ignore the twaddle.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Want to Get ‘Very Rich’? Charlie Munger and Warren Buffett Say You Only Need 3 Wonderful Businesses – Not 30 Stocks originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meet the Artificial Intelligence (AI) Stock That Could Become the Next Palantir, or Even Better

Palantir Technologies (NYSE: PLTR) is quickly becoming the go-to provider of artificial intelligence (AI) software platforms for companies and governments around the globe. Evidence of this can be seen in the recent acceleration in the company’s growth as well as its improving revenue pipeline. Both metrics point toward better times ahead.

Investors are noticing and have been buying Palantir stock hand over fist. The stock is up an impressive 76% so far in 2024, and the following discussion offers clues as to why that has been the case.

Palantir’s AI software platform has gained impressive traction

When Palantir released its second-quarter results last month, the company reported a year-over-year increase of 27% in revenue to $678 million. That was a solid improvement over the 13% year-over-year growth the company delivered in the same period last year, as well as an acceleration over its Q1 revenue growth of 21%.

There was a nice jump in the company’s customer base, as well as the size of the deals that it has been striking with customers. Palantir management credited its improving growth profile to the growing adoption of its Artificial Intelligence Platform (AIP). This is a software platform that helps enterprises and governments integrate generative AI into their processes to help improve operational efficiency.

From helping customers build their own large language model (LLM)-powered applications to helping them accelerate their daily workflows with the help of generative AI, the usefulness of Palantir’s AIP seems to have struck a chord with customers. This explains why the company raised its 2024 revenue growth forecast and expects its top line to increase by 24% this year to $2.75 billion.

More importantly, Palantir seems capable of sustaining its outstanding growth in the long term, considering that it ended the previous quarter with $4.3 billion in remaining deal value (RDV). The metric refers to the total remaining value of Palantir’s contracts at the end of a period, and it rose 26% year over year in Q2.

This AI hardware giant is making strides in the AI software market

So, Palantir seems well on its way to making the most of the huge end-market opportunity available in the generative AI software market. However, there is another way for investors to capitalize on the booming demand for AI software, and a closer look could lead investors to think that it may be a better AI software stock than Palantir.

Nvidia (NASDAQ: NVDA) has been the go-to choice for companies looking to purchase high-end AI hardware so that they can train AI models, resulting in outstanding growth in the company’s revenue and earnings in recent months. What’s interesting is that CFO Colette Kress’ comments on the recent earnings conference call suggest that Nvidia is starting to make a dent in the enterprise AI software market as well. According to Kress, “We expect our software, SaaS, and support revenue to approach a $2 billion annual run rate exiting this year, with Nvidia AI Enterprise notably contributing to growth.”

CEO Jensen Huang also commented, pointing out that customers can deploy Nvidia AI Enterprise software for $4,500 per graphics processing unit (GPU) per year. Given that Nvidia’s AI GPUs are priced at $30,000 or more for a single chip depending on the configuration, enterprise customers looking to build and deploy AI models are getting a good deal through Nvidia’s AI software platform.

Nvidia provides customers with multiple AI software offerings. For example, the company’s AI Foundry platform, which was launched in July this year, is an end-to-end solution with which customers can build and deploy custom generative AI models. Nvidia offers popular foundation models that can be tweaked by its customers and quickly move AI applications (including chatbots, content creation tools, and document processing tools) into the production phase.

Nvidia also provides pretrained customizable AI workflows that can be used for extracting data from PDFs or deployed for creating customer service workflows, accelerating drug discovery in the field of medicine, or building custom generative AI apps suited to an organization’s needs. What’s worth noting is that the adoption of Nvidia’s software solutions is increasing at a terrific pace thanks to AI.

In its February earnings conference call, Nvidia management pointed out that its software and services offerings reached an annual revenue run rate of $1 billion in the fourth quarter of fiscal 2024. So, the company’s software and services revenue run rate is set to double in the space of just one year. That’s significantly faster than the pace at which Palantir’s top line is set to grow this year.

Throw in the fact that Nvidia benefits big time from the booming demand for its AI chips, which led to 122% year-over-year growth in the company’s revenue in the second quarter of fiscal 2025 to $30 billion, and it is easy to see that the chipmaker is the more diversified play on AI. Another point worth noting here is that Nvidia stock trades at 28 times sales, which is lower than Palantir’s sales multiple of 29.

What’s more, Nvidia is the more attractive AI stock when we compare the earnings multiples of both companies.

So, investors looking for a cheaper alternative to Palantir to take advantage of the AI software market’s growth would do well to take a closer look at Nvidia, especially considering that the latter already has a flourishing AI hardware business that makes it a better growth stock to buy right now.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

Meet the Artificial Intelligence (AI) Stock That Could Become the Next Palantir, or Even Better was originally published by The Motley Fool

SmarFinancial Upgraded to Strong Buy: Here's Why

SmarFinancial SMBK could be a solid addition to your portfolio given its recent upgrade to a Zacks Rank #1 (Strong Buy). This rating change essentially reflects an upward trend in earnings estimates — one of the most powerful forces impacting stock prices.

The sole determinant of the Zacks rating is a company’s changing earnings picture. The Zacks Consensus Estimate — the consensus of EPS estimates from the sell-side analysts covering the stock — for the current and following years is tracked by the system.

Since a changing earnings picture is a powerful factor influencing near-term stock price movements, the Zacks rating system is very useful for individual investors. They may find it difficult to make decisions based on rating upgrades by Wall Street analysts, as these are mostly driven by subjective factors that are hard to see and measure in real time.

As such, the Zacks rating upgrade for SmarFinancial is essentially a positive comment on its earnings outlook that could have a favorable impact on its stock price.

Most Powerful Force Impacting Stock Prices

The change in a company’s future earnings potential, as reflected in earnings estimate revisions, has proven to be strongly correlated with the near-term price movement of its stock. The influence of institutional investors has a partial contribution to this relationship, as these big professionals use earnings and earnings estimates to calculate the fair value of a company’s shares. An increase or decrease in earnings estimates in their valuation models simply results in higher or lower fair value for a stock, and institutional investors typically buy or sell it. Their bulk investment action then leads to price movement for the stock.

Fundamentally speaking, rising earnings estimates and the consequent rating upgrade for SmarFinancial imply an improvement in the company’s underlying business. Investors should show their appreciation for this improving business trend by pushing the stock higher.

Harnessing the Power of Earnings Estimate Revisions

As empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock movements, tracking such revisions for making an investment decision could be truly rewarding. Here is where the tried-and-tested Zacks Rank stock-rating system plays an important role, as it effectively harnesses the power of earnings estimate revisions.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Earnings Estimate Revisions for SmarFinancial

For the fiscal year ending December 2024, this bank holding company is expected to earn $1.99 per share, which is a change of -2% from the year-ago reported number.

Analysts have been steadily raising their estimates for SmarFinancial. Over the past three months, the Zacks Consensus Estimate for the company has increased 7.6%.

Bottom Line

Unlike the overly optimistic Wall Street analysts whose rating systems tend to be weighted toward favorable recommendations, the Zacks rating system maintains an equal proportion of ‘buy’ and ‘sell’ ratings for its entire universe of more than 4000 stocks at any point in time. Irrespective of market conditions, only the top 5% of the Zacks-covered stocks get a ‘Strong Buy’ rating and the next 15% get a ‘Buy’ rating. So, the placement of a stock in the top 20% of the Zacks-covered stocks indicates its superior earnings estimate revision feature, making it a solid candidate for producing market-beating returns in the near term.

The upgrade of SmarFinancial to a Zacks Rank #1 positions it in the top 5% of the Zacks-covered stocks in terms of estimate revisions, implying that the stock might move higher in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Single-cell Analysis Market is projected to reach USD 14.8 Billion, advancing a 13.9% CAGR by 2034: Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Sept. 06, 2024 (GLOBE NEWSWIRE) — The global single-cell analysis market (단일 세포 분석 시장) was projected to attain US$ 3.4 billion in 2023. It is anticipated to garner a 13.9% CAGR from 2024 to 2034, and by 2034, the market is likely to attain US$ 14.8 billion.

To understand the fundamental concepts of molecular biology, single-cell analysis devices—also known as single-cell profiling devices—are employed. In multi-omics-based therapeutic research and development efforts, including proteomics, metabolomics, transcriptomics, and genomes, there is an increasing need for single-cell analysis.

Since single-cell amplification, microfluidics, high throughput assays, effective cell sorting and tagging, and sequencing are made possible by the latest developments, individual cell analysis is essential to understanding advances in drug development and disease diagnosis.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/single-cell-analysis-market.html

Key Findings of the Market Report

- In order to detect differential gene expression and track the growth of tumors, single-cell RNA sequencing methods are utilized in cancer research to examine complex tissues at the single-cell level and prevent future cellular deterioration.

- Accurate treatment planning is made possible by the important protein-level data provided by single-cell proteomic analysis of circulating tumor cells.

- This information is useful in determining the malignancy of the tumor and the activation of signaling pathways.

- New developments in single-cell sequencing technology include analytical algorithms and cDNA library preparation.

Market Trends for Single-cell Analysis

- Single-cell analysis has been the subject of much research due to the early diagnosis of chronic illnesses and the growing awareness of the significance of precision medicine. Amgen and Generate Biomedicines formed a partnership in January 2022 with the goal of finding and developing protein therapies for various modalities, with an initial investment of US$ 1.9 billion.

- Bruker Company Canopy Biosciences launched assay kits for ChipCytometry in December of 2021. To improve user experience using ChipCytometry, these kits are utilized to quantitatively image thousands of selected protein biomarkers simultaneously on a single tissue segment at single-cell spatial resolution.

- As of March 2021, there were around 23,358 active clinical studies in the field of cancer, according to clinicaltrials.gov. The single-cell analysis market is, therefore, being boosted by a rise in R&D efforts related to cancer research.

Global Market for Single-cell Analysis: Regional Outlook

- North America held the highest portion of the global landscape in 2023, according to a recent single-cell analysis market report. For the duration of the forecast period, the area is expected to continue to dominate. Growth in single-cell omics technology and an increase in cancer incidence are driving North America market statistics.

- Given the rise in cancer cases in the region over the past few years, Asia Pacific’s single-cell analysis market share has been growing quickly. Significant infrastructural advancements in the healthcare sector are also encouraging market growth in the area.

Global Single-Cell Analysis Market: Key Players

Companies involved in the global single-cell analysis market are concentrating on the introduction of new products in order to get a competitive advantage. For example, the PlexWell Single Cell Rapid Kit was introduced by SeqWell Inc. in February 2021 and is useful for single-cell RNA sequencing and NGS library preparation.

Prominent firms are focusing on inorganic expansion as a means of increasing their worldwide presence. For example, in order to expand its market share outside of the United States, SeqWell Inc. and CELLINK AB partnered to commercialize their products in February 2021. The following companies are well-known participants in the global single-cell analysis market:

- Thermo Fisher Scientific

- WaferGen Bio-systems

- Becton, Dickinson and Company

- Standard BioTools Inc.

- Eppendorf

- QIAGEN N.V.

- NewGEN Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- 10x Genomics

Key developments by the players in this market are:

- 10x Genomics announced in April 2022 the commercial feasibility of two new products aimed at streamlining the sample preparation process and increasing the number of people using its Chromium platform for single-cell analysis.

- Mission Bio Inc. unveiled the Tapestri solution for solid tumor research in March 2022. This end-to-end workflow for single-cell DNA sequencing includes an improved single-cell copy number variation (CNV) bioinformatics analysis tool, pre-designed research panels for glioblastoma multiforme and breast cancer, and a nuclei separation prep technique.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/single-cell-analysis-market.html

Global Single-cell Analysis Market (سوق تحليل الخلية الواحدة) Segmentation

Product

- Cell Counters

- Spectrophotometers

- Sequencers

- Imaging Systems

- Cytometers

- PCR

- Others

- Reagents & Kits

- Micropipettes & Microplates

- Others

End User

- Hospitals

- Diagnostic Centers

- Biotechnology & Biopharmaceutical Companies

- Research Laboratories

- Others

Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Have a Look at More Valuable Insights of Healthcare

Stethoscope Market (聴診器市場): The global stethoscope market is likely to expand at a CAGR of 5.5% from 2022 to 2032. People today are more willing to opt for physical examinations and undertake diagnoses with the inclination toward health and fitness.

Hybrid Operating Room Market (Mercato delle sale operatorie ibride): The global Hybrid Operating Room Market is expected to grow at a CAGR of 7.7% from 2022 to 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.