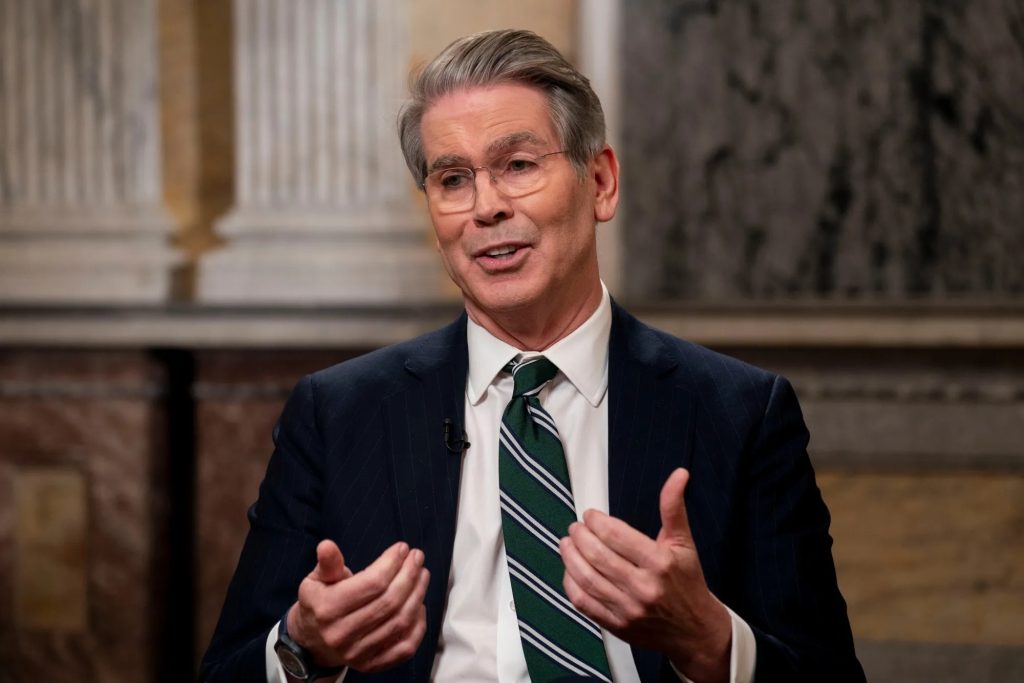

US Treasury Secretary Scott Bessent made a forceful call on Wednesday for the Federal Reserve to embark on a series of interest-rate cuts, suggesting the central bank’s benchmark rate should be at least 1.5 percentage points lower than current levels.

“I think we could go into a series of rate cuts here, starting with a 50 basis-point rate cut in September,” Bessent said in a Bloomberg Television interview. “If you look at any model, it suggests that we should probably be 150, 175 basis points lower.”

The Fed last month held its benchmark at 4.25% to 4.5%, where it has remained throughout 2025. Bessent noted that if policymakers had access to revised labor-market data—released after the meeting showing payroll gains for May and June were cut by 258,000—they may have moved sooner. “I suspect we could have had rate cuts in June and July,” he said.

Bessent’s push for a 150-basis-point reduction exceeds what the bond market currently anticipates. Such cuts would bring the midpoint of the Fed’s target range to roughly 2.88%, while futures markets reflect bets on rates falling to around 3% by September or October of next year. Two-year Treasury yields remain above that at 3.68%.

Treasury secretaries usually avoid commenting on potential Fed actions, and Bessent had previously stated he would only discuss past policy decisions. President Trump has criticized Fed Chair Jerome Powell for resisting rate cuts this year, while Powell and colleagues have said they prefer to observe the inflationary effects of tariffs before adjusting policy.

Bessent also provided updates on the Fed succession process. He said 10 or 11 candidates are being considered to succeed Powell when his term as chair ends in May 2026, without specifying names. “We’re working on the big list right now,” he said, adding that two more names might be “revealed” Wednesday.

CNBC has reported that Trump is considering candidates including Jefferies chief market strategist David Zervos, BlackRock global fixed income CIO Rick Rieder, and former Fed governor Larry Lindsey. Bessent indicated that Stephen Miran, nominated to the existing Fed vacancy, likely would not continue beyond January when that term ends, opening the door for a new 14-year appointment.

Powell’s replacement could come from either the January board vacancy or his own seat, though the latter is complicated because his governorship extends through 2028 and he has not confirmed whether he will leave the board when his chair term ends. Bessent expressed hope that Miran, who heads the White House Council of Economic Advisers, will be confirmed by the Senate before the Fed’s September 16–17 meeting.

Bessent also discussed international developments affecting Treasury yields. “There’s definitely leakage from — the Japanese have an inflation problem,” he said, noting conversations with Bank of Japan Governor Kazuo Ueda. “My opinion, not his — they’re behind the curve. So they’re going to be hiking.”

Germany’s yields are also climbing, with 30-year rates hitting a 14-year high. “Our 30-year is getting dragged along with that,” Bessent said. On whether the U.S. should adjust its own long-term debt issuance, he said, “our thoughts are evolving, and we’ll see where things go.” The Treasury has indicated no need to increase sales of longer-dated bonds in the near term, with asset managers showing the most interest in the “belly” of the yield curve—maturities between five and ten years.

Highlighting investor confidence in U.S. policy, Bessent noted that 10-year Treasury yields are lower than at the start of the year. “That tells me there’s credibility from investors in the Treasury and the Fed,” he said. “Inflation expectations are well-anchored.”