Essex Property Rises 23.1% in 6 Months: Will the Trend Last?

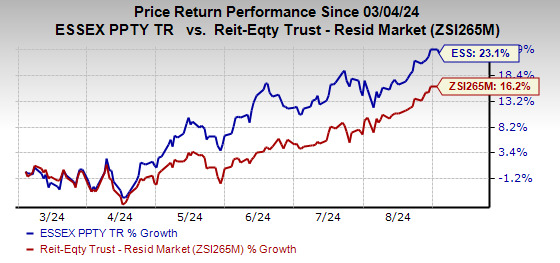

Shares of Essex Property Trust, Inc. ESS have rallied 23.1% in the past six months, outperforming the industry’s growth of 16.2%.

This residential REIT, which has a robust property base in the West Coast market, is poised to benefit from the healthy demand for its residential units. It is also banking on technology, scale and organizational capabilities to drive growth.

Analysts also seem bullish on this Zacks Rank #2 (Buy) stock. The Zacks Consensus Estimate for the company’s 2024 FFO per share has been revised two cents upward over the past week to $15.53.

Image Source: Zacks Investment Research

Let us now decipher the factors behind the surge in the stock price.

This residential REIT’s substantial exposure to the West Coast market has offered ample scope to enhance its top line. The West Coast is home to several innovation and technology companies that drive job creation and income growth. The West Coast region has higher median household incomes, an increased percentage of renters than owners and favorable demographics.

With layoffs in the tech industry slowing and return to office gaining momentum, the West Coast markets are likely to see an increase in renter demand in the near term. Also, due to the high cost of homeownership amid high interest rates, the transition from renter to homeowner is difficult in its markets, making renting apartment units a more flexible and viable option.

Essex Property is also banking on its technology, scale and organizational capabilities to drive margin expansion across its portfolio and bring about operational efficiency by lowering costs. It is making good progress on the technology front, and leasing agents are becoming more productive by leveraging these tools. These efforts are likely to have an incremental effect on the top-line and bottom-line growth, positioning Essex Property to ride the growth curve.

ESS’ Balance Sheet Position

Essex Property maintains a healthy balance sheet and enjoys financial flexibility. As of July 26, 2024, the company had $1.1 billion of liquidity through an undrawn capacity on its unsecured credit facilities, cash, cash equivalents and marketable securities.

In the second quarter of 2024, its net debt-to-adjusted EBITDAre remained unchanged at 5.4X from the prior quarter. Over the years, it has made efforts to increase its unencumbered net operating income (NOI) to an adjusted total NOI, which stood at 93% at the end of the second quarter of 2024. With a high percentage of such assets, the company can access secured and unsecured debt markets and maintain availability on the line. With a solid liquidity position, the company is well-poised to ride its growth curve.

In addition, its trailing 12-month return on equity is 9.14% compared with the industry’s average of 3.17%. This reflects that the company is more efficient in using shareholders’ funds than its peers.

ESS’ Dividend Payouts

Solid dividend payouts are arguably the biggest attraction for REIT investors, and Essex Property has been steadily raising its payout. ESS has increased its dividend five times in the last five years, and its five-year annualized dividend growth rate is 4.34%. With a low dividend payout ratio, a solid operating platform and decent balance sheet strength, the dividend payment is expected to be sustainable over the long run.

Negatives Likely to Affect ESS Stock

However, the elevated supply of apartment units in some of the company’s markets is likely to fuel competition and curb pricing power. A flexible working environment and high interest rates add to its woes.

Other Stocks to Consider

Some other top-ranked stocks from the retail REIT sector are Modiv Industrial, Inc. MDV and Equity Lifestyle Properties ELS. While Modiv Industrial sports a Zacks Rank #1 (Strong Buy) at present, Equity Lifestyle carries a Zacks Rank #2.

The Zacks Consensus Estimate for MDV’s current-year FFO per share has been raised 6.5% over the past month to $1.32.

The Zacks Consensus Estimate for ELS 2024 FFO per share has moved marginally northward over the past two months to $2.91.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Tumble Most Since August Selloff, Oil Slips: Markets Wrap

(Bloomberg) — US stock futures indicated a weaker open on Wall Street as traders awaited data on job openings to guide their outlook on the economy. Nvidia Corp. dropped 1.6% in pre-market trading.

Most Read from Bloomberg

Contracts on the S&P 500 dipped 0.3%, a sign that the decline may moderate after yesterday’s 2.1% selloff. Losses in Europe and Asia were deeper, with traders still rattled by the speed and severity of the US retreat. The Cboe Volatilty Index climbed above 23, while a gauge of the dollar weakened for the first time in six days.

Listen to the Bloomberg Daybreak Europe podcast on Apple, Spotify or anywhere you listen.

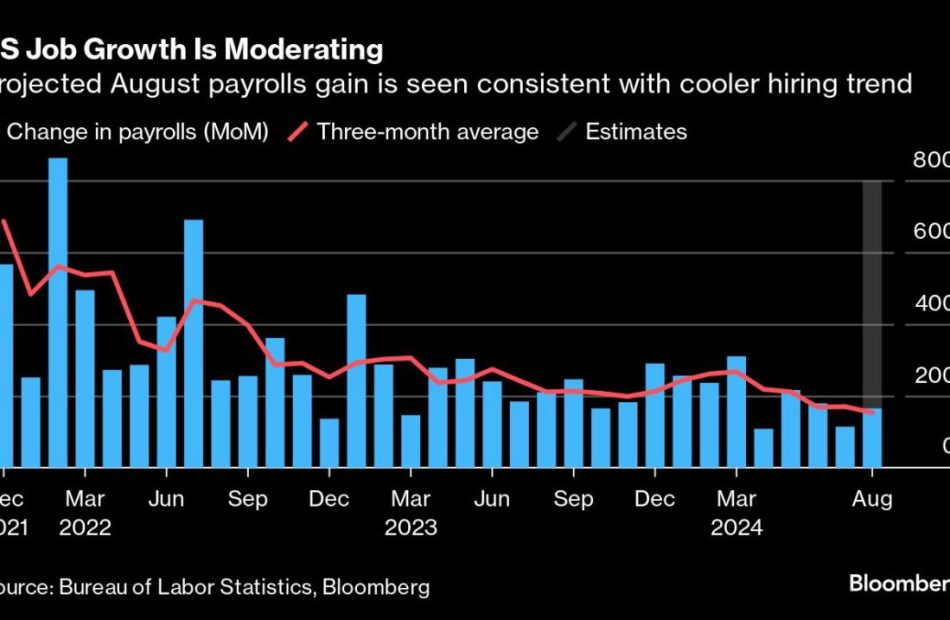

A US job openings report due on Wednesday is expected to show further cooling in the labor market, following yesterday’s data showing a fifth consecutive month of contraction in manufacturing activity. As the market’s focus shifts from inflation to concerns over economic growth, negative macro data is increasingly translating into pain for stocks and other risk assets.

For now, traders are anticipating the Federal Reserve will start easing policy in September and reduce rates by more than two full percentage points over the next 12 months — the steepest drop outside of a downturn since the 1980s. Payrolls data due on Friday is considered crucial in shaping the magnitude of the initial rate cut.

“A disappointing number will spook markets a little bit,” said Neil Birrell, chief investment officer at Premier Miton Investors. “There’s just a lack of certainty around. I’m not brave enough to say buy the dip on Wednesday when the numbers are out on Friday.”

Treasuries gained for a second day as traders added to bets on a jumbo cut from the Fed, with the yield on two-year notes down to 3.86%. The chance of a half-point reduction later this month has increased to about 30% from 20% last week, according to swaps.

Oil rose slightly after crashing to a nine-month low as OPEC+ discussed delaying its plans to increase supplies. Brent futures, the international benchmark, were trading near $74 a barrel following a near 5% meltdown on Tuesday. West Texas Intermediate rose 0.5%, after dropping under $70 for the first time since early January.

Corporate Highlights:

-

The Nordstrom family has offered to buy the Nordstrom department store chain for $23 per share in cash, according to a statement on Wednesday.

-

Volvo Car AB abandoned a target to sell only fully electric cars by the end of this decade, the latest manufacturer to walk back its EV ambitions due to waning demand.

-

US Steel would close mills and likely move its headquarters out of Pittsburgh if its planned sale to Nippon Steel falls apart, CEO David Burritt told the Wall Street Journal.

-

Volkswagen AG defended plans to consider unprecedented factory closures in Germany, saying flagging car sales have left the company with about two plants too many.

-

The US Justice Department sent subpoenas to Nvidia Corp. and other companies as it seeks evidence that the chipmaker violated antitrust laws.

Key events this week:

-

Eurozone HCOB services PMI, PPI, Wednesday

-

Canada rate decision, Wednesday

-

US job openings, factory orders, Beige Book, Wednesday

-

Eurozone retail sales, Thursday

-

US initial jobless claims, ADP employment, ISM services index, Thursday

-

Eurozone GDP, Friday

-

US nonfarm payrolls, Friday

-

Fed’s John Williams speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.3% as of 8:20 a.m. New York time

-

Nasdaq 100 futures fell 0.6%

-

Futures on the Dow Jones Industrial Average fell 0.1%

-

The Stoxx Europe 600 fell 1%

-

The MSCI World Index fell 0.4%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1046

-

The British pound was unchanged at $1.3114

-

The Japanese yen rose 0.3% to 145.09 per dollar

Cryptocurrencies

-

Bitcoin fell 2.8% to $56,575.39

-

Ether fell 2.6% to $2,399.7

Bonds

-

The yield on 10-year Treasuries was little changed at 3.83%

-

Germany’s 10-year yield declined four basis points to 2.24%

-

Britain’s 10-year yield declined four basis points to 3.95%

Commodities

-

West Texas Intermediate crude rose 0.5% to $70.66 a barrel

-

Spot gold fell 0.1% to $2,489.57 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Aline Oyamada and Joel Leon.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Departing Salesforce CFO pulled off an ‘extremely rare’ C-suite move

Good morning. Longtime Salesforce executive Amy Weaver is stepping down from her role as president and CFO after a three-and-a-half-year tenure in the position. Her CFO tenure coincided with a period of growth at the company, and came after Weaver undertook a very unusual C-suite shift—one that involved trading in the role of top legal officer for top financial officer.

In a LinkedIn post on Aug. 28, Weaver said she decided to step down “after nearly 11 wonderful years at Salesforce” and she’s “excited about my next chapter and the new opportunities ahead.” Weaver also pointed to a pivotal career move she made at the company.

“My time at Salesforce has been an incredible experience—from joining as general counsel to leading the legal and corporate affairs teams to taking the truly unprecedented step to jump over to become CFO,” Weaver wrote. She also noted Salesforce CEO Marc Benioff’s “expansive vision” of her career.

Weaver joined Salesforce, the cloud-based software giant, in 2013 as SVP and general counsel. In January 2020, she became president and chief legal officer. The company announced on Dec. 1, 2020, that Weaver would become president and CFO in February 2021, succeeding CFO Mark Hawkins, who was retiring. The same day in 2020 that Salesforce announced the CFO transition, it also reported it would acquire the workplace messaging app Slack for $27.7 billion.

Before joining Salesforce, Weaver was EVP and general counsel of Univar Solutions Inc., SVP and deputy general counsel at Expedia, Inc., and practiced as an attorney at Cravath, Swaine & Moore and at Perkins Coie. Before entering private practice, she served as a legislative aide for the Hong Kong Legislative Council and as a clerk in the U.S. Ninth Circuit Court of Appeals.

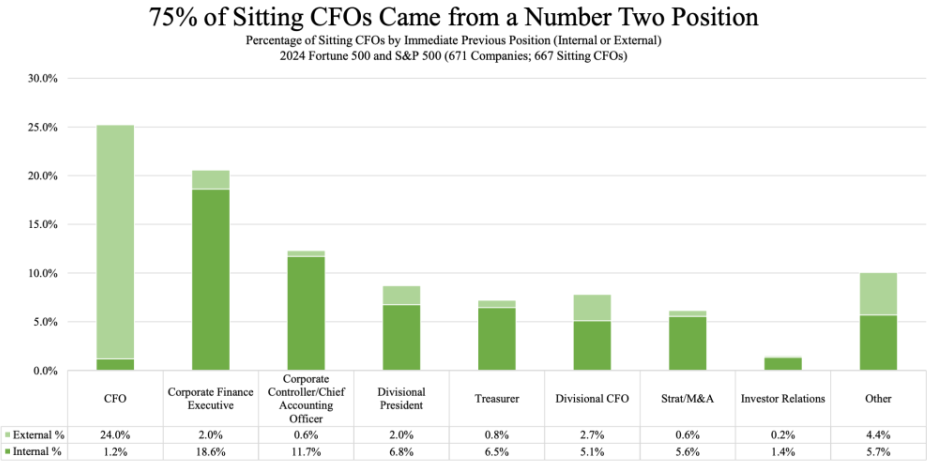

I asked Scott W. Simmons, co-managing partner of Crist Kolder Associates, a senior-level executive search firm, what he’s seen regarding general counsels moving into CFO roles. “It is not at all common,” Simmons told me. The legal route to CFO “doesn’t even register as a path” in the firm’s most recent Volatility Report,” he said.

The firm’s report is based on data from 671 Fortune 500 and S&P 500 companies through Aug. 1. The research finds that three-quarters of CFOs came directly from a number two finance position, such as a corporate finance executive, controller, and chief accounting officer.

Simmons also conducted a search on S&P Capital IQ of 1,478 publicly traded companies in the U.S. earning over $1 billion in revenue. Less than 3% of CFOs in that data set have a JD degree. Even taking into account a margin for error in this data, “it does prove the point that it is extremely rare for CFOs to also be lawyers,” he said.

However, Simmons noted that the most important trait for any CFO position is strong leadership.

“Amy has been an incredible executive at Salesforce, leading many of the company’s most important strategic and operational initiatives over the last decade,” Benioff said in a statement in the announcement. “And, she has been an amazing partner to me personally.”

Since Weaver began her tenure as finance chief in 2021, Salesforce has moved up 14 spots in the Fortune 500. The company’s annual revenue for its fiscal year 2023 was $31.4 billion, an 18% increase year over year. On Aug. 28, Salesforce reported revenue of $9.33 billion for the quarter ended July 31, up 8% year over year. “Operating margins closed at record highs with GAAP operating margin of 19.1%, up 190 basis points year over year, and Non-GAAP operating margin of 33.7%, up 210 basis points year over year,” Weaver said in a statement.

A successor for Weaver has not yet been appointed. “I’ll be at the company while we conduct an internal and external search, so no goodbyes for now,” she wrote on LinkedIn.

Sheryl Estrada

sheryl.estrada@fortune.com

This story was originally featured on Fortune.com

Ciena Q3 Earnings: Revenue And EPS Beat, Operating Margin Decline, CFO Retirement And More

Ciena Corp CIEN reported a fiscal third-quarter 2024 revenue decline of 11.8% year-on-year to $942.3 million, beating the analyst consensus estimate of $927.2 million.

The American telecommunications networking equipment and software services supplier reported an adjusted EPS of $0.35, beating the analyst consensus estimate of $0.26.

Segments: Total Networking Platforms revenue declined by 17.4% Y/Y to $699.5 million, and Total Global Services increased by 3.5% Y/Y to $133.8 million.

Margins: The adjusted gross margin climbed by 100 bps to 43.7%. Adjusted operating margin decreased by 400 bps to 8.0%.

Two 10%-plus customers represented a total of 26.6% of revenue.

Ciena held $1.2 billion in cash and equivalents and used $(159.4) million in operating cash flow.

“We delivered strong results for the fiscal third quarter that reflect growing momentum with cloud providers and continued gradual recovery with service providers,” CEO Gary Smith said.

CFO Transition: Ciena announced that CFO James E. Moylan, Jr., plans to retire in twelve months, effective August 28, 2025. The company will commence a search process to identify a successor. Moylan will continue to serve as CFO until a successor is in place and will assist in transitioning his responsibilities.

Ciena stock gained over 15% in the last 12 months.

Price Action: CIEN stock traded higher by 1.36% at $56.10 premarket at the last check on Wednesday.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hooker Furnishings Declares Quarterly Dividend

MARTINSVILLE, Va., Sept. 03, 2024 (GLOBE NEWSWIRE) — Hooker Furnishings Corporation (Nasdaq-GS: HOFT) announced that on September 3, 2024, its board of directors declared a quarterly cash dividend of $0.23 per share, payable on September 30, 2024, to shareholders of record on September 13, 2024.

Hooker Furnishings Corporation, in its 100th year of business, is a designer, marketer and importer of casegoods (wooden and metal furniture), leather furniture, fabric-upholstered furniture, lighting, accessories, and home décor for the residential, hospitality and contract markets. The Company also domestically manufactures premium residential custom leather and custom fabric-upholstered furniture and outdoor furniture. Major casegoods product categories include home entertainment, home office, accent, dining, and bedroom furniture in the upper-medium price points sold under the Hooker Furniture brand. Hooker’s residential upholstered seating product lines include Bradington-Young, a specialist in upscale motion and stationary leather furniture, HF Custom (formerly Sam Moore), a specialist in fashion forward custom upholstery offering a selection of chairs, sofas, sectionals, recliners and a variety of accent upholstery pieces, Hooker Upholstery, imported upholstered furniture targeted at the upper-medium price-range and Shenandoah Furniture, an upscale upholstered furniture company specializing in private label sectionals, modulars, sofas, chairs, ottomans, benches, beds and dining chairs in the upper-medium price points for lifestyle specialty retailers. The H Contract product line supplies upholstered seating and casegoods to upscale senior living facilities. The Home Meridian division addresses more moderate price points and channels of distribution not currently served by other Hooker Furnishings divisions or brands. Home Meridian’s brands include Pulaski Furniture, casegoods covering the complete design spectrum in a wide range of bedroom, dining room, accent and display cabinets at medium price points, Samuel Lawrence Furniture, value-conscious offerings in bedroom, dining room, home office and youth furnishings, Prime Resources International, value-conscious imported leather upholstered furniture, and Samuel Lawrence Hospitality, a designer and supplier of hotel furnishings. The Sunset West division is a designer and manufacturer of comfortable, stylish and high-quality outdoor furniture. Hooker Furnishings Corporation’s corporate offices and upholstery manufacturing facilities are located in Virginia, North Carolina and California, with showrooms in High Point, NC, Las Vegas, NV, Atlanta, GA and Ho Chi Minh City, Vietnam. The company operates distribution centers in Virginia, Georgia, and Vietnam. Please visit our websites hookerfurnishings.com, hookerfurniture.com, bradington-young.com, hfcustomfurniture.com, hcontractfurniture.com, homemeridian.com, pulaskifurniture.com, slh-co.com, and sunsetwestusa.com.

For more information, contact:

Paul A. Huckfeldt, Senior Vice President-Finance and CFO

Hooker Furnishings Corporation, 276.666.3949

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MAA Announces Regular Quarterly Preferred Dividend

GERMANTOWN, Tenn., Sept. 3, 2024 /PRNewswire/ — Mid-America Apartment Communities, Inc., or MAA MAA, today announced a full quarterly dividend of $1.0625 per outstanding share of its 8.50% Series I Cumulative Redeemable Preferred Stock. The dividend is payable on September 30, 2024, to shareholders of record on September 13, 2024.

About MAA

MAA is a self-administered real estate investment trust (REIT) and member of the S&P 500. MAA owns or has ownership interest in apartment communities primarily throughout the Southeast, Southwest and Mid-Atlantic regions of the U.S. focused on delivering strong, full-cycle investment performance. For further details, please refer to the “For Investors” page at www.maac.com or contact Investor Relations at investor.relations@maac.com.

Forward-Looking Statements

Certain matters in this press release may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended with respect to our expectations for future periods. Such statements include statements made about the payment of preferred dividends. The ability to meet the payment of preferred dividends in or contemplated by the forward-looking statements could differ materially from the projection due to a number of factors, including a downturn in general economic conditions or the capital markets, changes in interest rates and other items that are difficult to control such as increases in real estate taxes in many of our markets, as well as the other general risks inherent in the apartment and real estate businesses. Reference is hereby made to the filings of Mid-America Apartment Communities, Inc. with the Securities and Exchange Commission, including quarterly reports on Form 10-Q, reports on Form 8-K, and its annual report on Form 10-K, particularly including the risk factors contained in the latter filing.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/maa-announces-regular-quarterly-preferred-dividend-302237041.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/maa-announces-regular-quarterly-preferred-dividend-302237041.html

SOURCE MAA

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Dividend King Could Be a No-Brainer Buy If Kamala Harris Beats Donald Trump in November

Presidential elections matter. Candidates usually have competing visions for the country. Those visions can create winners in some areas — and losers in others. As a result, prudent investors watch elections closely.

It isn’t too soon to begin thinking about which stocks could be winners depending on which presidential candidate wins. And there’s one Dividend King that could be a no-brainer buy if Kamala Harris beats Donald Trump in November.

Go high, go Lowe’s

Most Americans are probably quite familiar with Lowe’s Companies (NYSE: LOW). The company ranks as the second-largest home improvement retailer in the world. Its market cap hovers around $140 billion.

Lowe’s operates more than 1,700 home improvement stores throughout the U.S. It serves individuals performing do-it-yourself fixer-upper projects. The company also targets professionals, including skilled tradespeople, remodelers, and property managers.

Although Lowe’s stock is lagging behind the S&P 500 so far in 2024, it’s beaten the market over the long term. For example, Lowe’s more than doubled the return of the S&P 500 over the last 10 years.

Lowe’s has also been a favorite for income investors. The company has paid a dividend every quarter since it went public in 1961. Lowe’s has increased its dividend for 51 consecutive years.

Why a Harris victory could benefit Lowe’s

In August, Vice President Harris unveiled her plan to lower housing costs. She wants to provide up to $25,000 to first-time homebuyers to help with their down payments. First-time homebuyers would also receive a $10,000 tax credit. Harris’ plan also features tax incentives to promote the construction of starter homes and affordable rental housing.

How could this plan help Lowe’s? For one thing, Lowe’s caters to homebuilders. It even has a strategic alliance with the National Association of Home Builders that offers discounts to the organization’s members. Lowe’s should have an opportunity to profit from any federal initiative that boosts the construction of new houses.

But Harris’ plan doesn’t just foster the building of new homes. It should also promote a frenzy of fixing up existing homes, especially those that are attractive to first-time homebuyers. Again, Lowe’s would likely be a key beneficiary from a surge in home improvement projects.

Of course, a Harris victory in November by itself might not be enough. If she’s elected as the next president, she’ll need support in Congress to pass her housing plan.

A good pick regardless of which candidate wins

Lowe’s could be a no-brainer buy if Harris beats Trump. However, the stock could be a good pick regardless of which candidate wins.

Over the short term, lower interest rates could provide a catalyst for Lowe’s stock. Federal Reserve Chairman Jerome Powell has strongly hinted that rate cuts will be coming soon. When interest rates fall, mortgage rates usually do too. This spurs home buying — and home improvement projects for existing homeowners looking to move into a new home.

Lowe’s should also have great long-term prospects. The median age of homes in the U.S. is over 40 years old. Home improvement projects will needed for decades to come. And Lowe’s will be there to meet those needs.

Should you invest $1,000 in Lowe’s Companies right now?

Before you buy stock in Lowe’s Companies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lowe’s Companies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Keith Speights has positions in Lowe’s Companies. The Motley Fool recommends Lowe’s Companies. The Motley Fool has a disclosure policy.

This Dividend King Could Be a No-Brainer Buy If Kamala Harris Beats Donald Trump in November was originally published by The Motley Fool

Toll Brothers Announces New Luxury Condominium Community Coming Soon to Chantilly, Virginia

CHANTILLY, Va., Sept. 03, 2024 (GLOBE NEWSWIRE) — Toll Brothers, Inc. TOL, the nation’s leading builder of luxury homes, today announced a new community, Commonwealth Place at Westfields – The Belle Haven Collection, is coming soon to Chantilly, Virginia. The newest collection at this exclusive Toll Brothers community will include townhome-style luxury condos ideally located within walking distance to Westfields Center. Site work is underway, and the community is anticipated to open for sale in late fall 2024.

The Belle Haven Collection at Commonwealth Place at Westfields will feature a selection of floor plans ranging from 1,342 to 1,767+ square feet with distinct architecture. One- and two-story condominium home designs will offer two bedrooms, open concept floor plans, balconies, 2-car tandem garages, and professionally selected finishes. Homes will be priced from the upper $500,000s.

“Our new collection at Commonwealth Place at Westfields will offer residents the rare opportunity to own a luxury condo in the highly desirable Chantilly area,” said Nimita Shah, Division President of Toll Brothers in D.C. Metro. “With meticulously designed floor plans and an unrivaled location just steps away from dining and shopping at Westfields Center, this community will set a new standard for luxury low-maintenance living in Chantilly.”

Chantilly was recently named among the top three 2024 Best Places to Live for Families by Fortune magazine. The community is conveniently located near highly ranked Fairfax County Public Schools and Dulles International Airport. Commuters will enjoy proximity to Routes 50 and 28, Interstate 66, and Dulles Toll Road/Route 267, offering easy access to the greater D.C. Metro area.

Shopping, dining, and entertainment at Westfields Center is within walking distance, offering Wegmans, Mellow Mushroom, Cava, Chipotle, South Block, and more. Nearby, residents can explore bountiful parks and golf courses including Chantilly National Golf & Country Club, Pleasant Valley Golf Club, Flatlick Stream Valley Park, Ellanor C. Lawrence Park, and Richard W. Jones Park.

Homeowners at Commonwealth Place at Westfields enjoy a relaxed low-maintenance lifestyle with snow removal, lawn mowing, and exterior maintenance included.

For more information and to join the Toll Brothers interest list for Commonwealth Place at Westfields – The Belle Haven Collection, call (855) 298-0316 or visit TollBrothers.com/Virginia.

About Toll Brothers

Toll Brothers, Inc., a Fortune 500 Company, is the nation’s leading builder of luxury homes. The Company was founded 57 years ago in 1967 and became a public company in 1986. Its common stock is listed on the New York Stock Exchange under the symbol “TOL.” The Company serves first-time, move-up, empty-nester, active-adult, and second-home buyers, as well as urban and suburban renters. Toll Brothers builds in over 60 markets in 24 states: Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Indiana, Maryland, Massachusetts, Michigan, Nevada, New Jersey, New York, North Carolina, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia, and Washington, as well as in the District of Columbia. The Company operates its own architectural, engineering, mortgage, title, land development, smart home technology, and landscape subsidiaries. The Company also develops master-planned and golf course communities as well as operates its own lumber distribution, house component assembly, and manufacturing operations.

In 2024, Toll Brothers marked 10 years in a row being named to the Fortune World’s Most Admired Companies™ list and the Company’s Chairman and CEO Douglas C. Yearley, Jr. was named one of 25 Top CEOs by Barron’s magazine. Toll Brothers has also been named Builder of the Year by Builder magazine and is the first two-time recipient of Builder of the Year from Professional Builder magazine. For more information visit TollBrothers.com.

From Fortune, ©2024 Fortune Media IP Limited. All rights reserved. Used under license.

Contact: Andrea Meck | Toll Brothers, Director, Public Relations & Social Media | 215-938-8169 | ameck@tollbrothers.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/be3e0e0d-80b0-40f6-b699-77f61d9375aa

Sent by Toll Brothers via Regional Globe Newswire (TOLL-REG)

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JPMorgan says Fed rate cuts won't be the rocket fuel for stocks some expect

-

Blowout equity momentum isn’t guaranteed after the Fed cuts rates, JPMorgan said.

-

If the Fed cuts in reaction to weaker growth, the positive impact may be muted, the firm wrote.

-

Other analysts are more bullish on the economy and the equity-positive effect of rate cuts.

Interest-rate cuts are on the horizon, but investors who think this will generate a fresh dose of equity momentum could be mistaken, JPMorgan said.

In a new research note, JPMorgan strategists led Mislav Matejka said the Federal Reserve’s eventual rate cuts will be at least partially in response to a slowing economy, which could neutralize the positive effect on stocks.

“Fed will start easing, but more in a reactive way and as a response to weakening growth — this might not be enough to drive a next leg higher,” strategists led by Mislav Matejka wrote on Monday.

Additionally, JPMorgan wrote: “We are not out of the woods yet, September has seasonally been a challenging month for equities.”

The firm’s view stands in contrast to more bullish forecasts held by those who think a post-rate-cut rally is in the cards.

For instance, one Wells Fargo analyst recently indicated that equities are bound for a rally not seen in three decades once Fed policy eases.

According to Paul Christopher, head of global investment strategy, today’s market has strong parallels with that of 1995 — and with the Fed cutting proactively amid stable GDP strength, further upside looks likely.

Meanwhile, veteran strategist Jim Paulson suggested that the Fed’s pivot would open the door to a “brand new bull market.”

“They opened up a lot more positive forces for the stock market that just haven’t been there,” he said, speaking after Fed Chairman Jerome Powell confirmed that interest rate cuts were likely during last month’s Jackson Hole Symposium.

Once the Fed cuts, these forces include accelerating monetary growth and falling bond yields, propelling private sector confidence higher, Paulson said.

Friday’s nonfarm payrolls report will be the next major input for the Fed, which is currently expected to cut rates by 25 basis points at its late-September policy meeting.

An especially weak report could revive cries for a deeper rate cut in September — possibly 50 basis points — as well as an accelerated pace of cuts heading into the November election and year-end.

Read the original article on Business Insider

Mystery Option Buyer Nets Fast $12 Million Gain on Stock Slide

(Bloomberg) — The sense of calm in the US stock market was disrupted Tuesday as the S&P 500 Index plunged more than 2% and the VIX exploded higher. That’s rewarded a late-Friday options buyer with some $12 million in paper gains.

Most Read from Bloomberg

The spike in volatility came as the S&P 500 index was dragged down by a selloff in technology stocks with AI giant Nvidia Corp.’s market capitalization dropping by the equivalent of Chevron Corp.

Late Friday, an investor or investors spent almost $9 million buying 350,000 call spreads on the Cboe Volatility Index, or VIX, to protect against a September jump in the gauge, which measures volatility on S&P 500 options.

At the time, those spreads — buying the 22 call, selling the 30 call expiring Sept. 18 — cost 25 cents each. On Tuesday, with the VIX jumping from less than 16 to almost 22 before the close, almost as many spreads traded, this time with many of them going for around 60 cents.

It appears that Friday’s buyer turned around and sold the position, according to market participants, though it’s hard to know for sure. In any case, the potential profit comes to about $12.25 million.

–With assistance from Alyce Andres.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.