Billionaire Bill Gates Has 54% of His Trust Invested in 2 Brilliant Stocks

The Bill & Melinda Gates Foundation (BMGF) engages in various philanthropic activities around the world, everything from improving healthcare systems and promoting education to fighting poverty and inequalities. Since its inception, the organization had paid out more than $77 billion in grants.

The foundation’s charitable giving is funded by the BMGF Trust, which holds and invests donated money. As of June 2024, the trust had $48 billion spread across 23 positions, but 54% of the portfolio was allocated to two stocks: 33% in Microsoft (NASDAQ: MSFT) and 21% in the Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.A).

Incidentally, the BMGF Trust beat the S&P 500 (SNPINDEX: ^GSPC) by 10 percentage points in the last three years. That outperformance was due in large part to its substantial positions in Microsoft and Berkshire Hathaway. Moreover, current asset allocation suggests Bill Gates (Co-Chair of the Board of Trustees) still has confidence in both stocks.

Here’s what investors should know.

Microsoft: 33% of the Bill & Melinda Gates Foundation Trust

Microsoft is the largest software company in the world. It has a particularly strong presence in the business productivity and enterprise resource planning verticals with its Office and Dynamics products, respectively. Microsoft has added generative artificial intelligence (AI) copilots to both ecosystems to create new monetization opportunities. Copilot customers increased more than 60% sequentially in the June quarter.

Additionally, Microsoft Azure is the second-largest public cloud. The company has a strong presence in several cloud verticals, including cybersecurity, database management systems, and hybrid computing. Additionally, research company Gartner recently named Microsoft a leader in data science and machine learning platforms, and Azure has secured early momentum in generative AI developer services due to its partnership with OpenAI.

Given those strengths, Morgan Stanley analysts think Azure could overtake Amazon Web Services (AWS) as the leading public cloud by 2027. Microsoft actually lost two percentage points of market share (sequentially) in the June quarter, while AWS and Alphabet‘s Google Cloud gained a percentage point a piece. But Microsoft CFO Amy Hood noted that demand for AI services exceeded capacity, so market share losses could be temporary while the company builds out its infrastructure.

Microsoft reported better-than-expected financial results in the fourth quarter of fiscal 2024 (ended June 30). Revenue increased 15% to $64.7 billion and GAAP net income rose 10% to $2.95 per diluted share. The top line grew faster than the bottom line because the recent Activision acquisition added about three points to revenue growth and subtracted about two points from operating income growth.

On a less optimistic note, Azure revenue missed estimates in the fourth quarter, and management provided worse-than-expected guidance for the first quarter of fiscal 2025. That caused the stock to tumble about 5% following the report, and shares have yet to fully recover.

Going forward, Wall Street expects Microsoft’s earnings to grow at 15% annually through 2027. That makes the current valuation of 35.3 times earnings look relatively expensive. Investors should be cautious right here. Personally, I would feel more comfortable buying Microsoft stock if it was 15% cheaper, somewhere around $360 per share.

Berkshire Hathaway: 21% of the Bill & Melinda Gates Foundation Trust

Berkshire Hathaway is a holding company that owns a diverse group of subsidiaries, the most important of which are its insurance businesses. Berkshire first entered the insurance industry when it purchased National Indemnity in 1967, pivoting away from its core textile business. The company has since become the world leader in insurance float, a term that refers to insurance premiums paid to Berkshire that have not yet been paid out in claims.

CEO Warren Buffett says the company has paid “less than nothing” to accumulate float due to its disciplined underwriting, meaning earned premiums have generally exceeded the cost of paying claims. In fact, Berkshire achieved a combined ratio of 87% in the second quarter, well below the industry average of 101.5%. Values under 100% correspond to profitable underwriting, so Berkshire’s underwriting is much better than average.

Warren Buffett and his fellow investment managers Todd Combs and Ted Weschler have invested that float to great effect over the years. Berkshire had $235 billion in U.S. Treasury bills and $285 billion in equity securities (stocks) on its balance sheet as of the second quarter. That sizable investment portfolio has helped drive book value per share growth of 10.4% annually over the last three years, outpacing the 8.3% annual gain in the S&P 500.

Berkshire Hathaway delivered a solid financial performance in the second quarter. Revenue increased 1.2% to $93.7 billion and operating earnings (which exclude gains and losses on stocks) increased 16% to $11.6 billion.

Going forward, Wall Street expects operating earnings to increase at 17% annually through 2027. That consensus estimate makes the current valuation of 24 times operating earnings look reasonable. Investors should consider buying a small position, especially if they are looking for an excellent defensive stock. Berkshire outperformed the S&P 500 during the last six recessions by a median of 4.4 percentage points, according to Bespoke Investment Group.

Should you invest $1,000 in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Berkshire Hathaway, and Microsoft. The Motley Fool recommends Gartner and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Billionaire Bill Gates Has 54% of His Trust Invested in 2 Brilliant Stocks was originally published by The Motley Fool

BOLT Investors Have the Opportunity to Lead Bolt Biotherapeutics, Inc. Securities Fraud Lawsuit with the Schall Law Firm

LOS ANGELES, Sept. 02, 2024 (GLOBE NEWSWIRE) — The Schall Law Firm, a national shareholder rights litigation firm, reminds investors of a class action lawsuit against Bolt Biotherapeutics, Inc. (“Bolt” or “the Company”) BOLT for violations of §§10(b) and 20(a) of the Securities Exchange Act of 1934 and Rule 10b-5 promulgated thereunder by the U.S. Securities and Exchange Commission.

Investors who purchased the Company’s securities between February 5, 2021 through May 14, 2024, inclusive (the “Class Period”), are encouraged to contact the firm before September 3, 2024.

If you are a shareholder who suffered a loss, click here to participate.

We also encourage you to contact Brian Schall of the Schall Law Firm, 2049 Century Park East, Suite 2460, Los Angeles, CA 90067, at 310-301-3335, to discuss your rights free of charge. You can also reach us through the firm’s website at www.schallfirm.com, or by email at bschall@schallfirm.com.

The class, in this case, has not yet been certified, and until certification occurs, you are not represented by an attorney. If you choose to take no action, you can remain an absent class member.

According to the Complaint, the Company made false and misleading statements to the market. Bolt’s immune-stimulating antibody conjugate (“ISAC”), known as BDC-1001, was less effective in the treatment of certain cancers than it had represented to the market. The Company overstated the commercial prospects of its drug pipeline. Based on these facts, the Company’s public statements were false and materially misleading throughout the class period. When the market learned the truth about Bolt, investors suffered damages.

Join the case to recover your losses.

The Schall Law Firm represents investors around the world and specializes in securities class action lawsuits and shareholder rights litigation.

This press release may be considered Attorney Advertising in some jurisdictions under the applicable law and rules of ethics.

CONTACT:

The Schall Law Firm

Brian Schall, Esq.,

Office: 310-301-3335

SOURCE:

The Schall Law Firm

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Your Landlord Might Be Raising Rent Using Algorithms — And Kamala Harris Plans To Ban It. Will She Succeed? Here's What's At Stake

In a new, ambitious housing plan, Democratic presidential nominee Vice President Kamala Harris has just introduced a measure that could fundamentally shift how rents are set in many parts of the country.

Perhaps the most striking feature of her proposal is to ban landlords from using algorithms that some claim allow them to coordinate rent increases with other property owners. This bill, entitled the Preventing the Algorithmic Facilitation of Rental Housing Cartels Act, aims to prevent landlords from using such algorithms to increase rental prices. This approach has been receiving increasing legal and public attention.

Don’t Miss:

“Some corporate landlords collude with each other to set artificially high rental prices, often using algorithms and price-fixing software to do it,” Harris recently said. “It’s anticompetitive, and it drives up costs.”

Rents have surged in recent years, partly because of an acute housing shortage. Since 2019, U.S. rents are up by about 19%, and more people than ever are struggling to afford their housing. According to recent surveys, most Americans — 83% of Democrats and 68% of Republicans — agree that the lack of affordable housing is a major problem.

Trending:

- If there was a new fund backed by Jeff Bezos offering a 7-9% target yield with monthly dividends would you invest in it?

This new proposed legislation targets RealPage, a technology company that deals in real estate, which was accused of using its algorithm YieldStar to inflate rents above the market range. YieldStar analyzes private data from multiple markets and suggests rental prices to landlords. This has piqued law enforcement agencies’ interest amid claims of price-fixing and collusion, with attorneys general of Arizona and Washington, D.C., filing lawsuits against RealPage.

“Landlords using RealPage are not just taking the market price for rent — they’re setting the market price,” said Arizona Attorney General Kris Mayes. She estimated that 70% of rental homes in Phoenix and 50% in Tucson are owned by firms using RealPage’s software. In Washington, D.C., the attorney general has sued RealPage and its clients similarly, alleging they have created a “housing cartel” controlling over 30% of the city’s multifamily units.

See Also:

Maurice Stucke, a former antitrust prosecutor with the Department of Justice, said, “When you start seeing prices going up and demand dropping, that quite often is a red flag for collusion.” RealPage has not commented publicly on these accusations.

Trending:

In addition to suppressing algorithmic rent-setting, Harris is pushing the passage of legislation that will hamstring Wall Street investors from buying houses in bulk. But critics argue these merely alleviate the most egregious abuses and don’t take on the larger issue of housing affordability head-on. The real test, they say, is embedded in the thicket of supply and demand.

“People think the big landlords have more power than they do,” said Jenny Schuetz, an expert in urban economics with the Brookings Institution. Even as she called for scrutiny of the practices, Ms. Schuetz questioned whether they would do much to ease renters’ pain. The concern is that too much regulation would discourage investment in new housing, worsening the supply problem.

Read Next:

“If you hit private equity too hard, you risk reducing the capital available for building new homes,” noted Ben Metcalf, managing director at UC Berkeley’s Terner Center for Housing Innovation.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

If I Could Only Buy 1 Dividend Stock in September, This Would Be My Top Choice

I buy a lot of dividend stocks. I focus on dividends because they have proven to be powerful wealth creators. Over the past 50 years, dividend payers have outperformed the average stock in the S&P 500 — their 9.2% average annual total return beats the 7.7% produced by an equal-weighted S&P 500 index. Dividend growers and initiators have done most of the heavy lifting, posting a 10.2% annual return compared to 6.7% for companies with no change in their dividend policy.

Given the power of dividends, I tend to invest in several dividend stocks each month. However, if I had to choose just one to buy this September, it would be Brookfield Infrastructure (NYSE: BIPC)(NYSE: BIP). Here’s why.

A history of dividend growth and wealth creation

Brookfield Infrastructure formed about 15 years ago as a spinoff from the company now known as Brookfield. It has been a phenomenal wealth creator over that period. The global infrastructure giant has increased its dividend every single year, growing its payout at a 9% compound annual rate. Not only has the stock outperformed the S&P 500 over that period, with a 14.9% average annual total return compared to the index’s average return of 10.8%, but its dividend yields roughly three times as much today, coming in just short of 4% at Friday’s closing price.

Several factors have helped drive the company’s ability to produce such powerful dividend growth and returns. A major one is the overall stability of its portfolio. Brookfield Infrastructure’s businesses generate stable cash flow backed by long-term contracts and government-regulated rate structures. The company says 85% of its funds from operations (FFO) are either protected from or indexed to inflation. That provides it with a stable stream of cash flow that tends to rise by 3% to 4% annually.

Brookfield Infrastructure also benefits from having a strong financial profile. It has a reasonable dividend payout ratio (60% to 70% of its stable cash flows), a strong investment-grade balance sheet, and lots of liquidity that it routinely replenishes by recycling capital. The company uses its financial flexibility to invest in expansion projects and make acquisitions. Those catalysts and other organic drivers have enabled Brookfield Infrastructure to grow its FFO per share at a 15% compound annual rate since its formation.

Multiple growth catalysts

The company expects to continue growing briskly in the future. It has positioned its portfolio to capitalize on three major investment megatrends: digitalization, decarbonization, and deglobalization. Each one has a long growth runway ahead.

Brookfield Infrastructure has built a large data infrastructure platform to capitalize on the digitalization megatrend. It has acquired several data center development platforms, cell tower operators, and fiber-optic networks. The company has also partnered with Intel to build two new semiconductor fabrication plants in the U.S.

The company has also acquired several companies in the transportation, energy midstream, and utility sectors to capitalize on the other two major megatrends. It tends to acquire expandable platforms that it can grow by investing in capital projects and making bolt-on acquisitions. It currently has a record $7.6 billion capital backlog that it expects to complete over the next two to three years. Meanwhile, it expects merger and acquisition activity to pick up in the second half of this year, adding a potential growth accelerant for 2025 and beyond.

Brookfield Infrastructure estimates that its platforms can organically grow its FFO per share by 6% to 9% per year through a combination of inflation-driven rate growth, volume growth as the global economy expands, and development projects. Meanwhile, it sees accretive acquisitions funded by recycling capital boosting its FFO growth rate into the double digits. This forecast easily supports the company’s plan to increase its dividend (which already yields 4%) by 5% to 9% per year.

Powerful total return potential

Brookfield Infrastructure has an exceptional record of growing its dividend and shareholder value. That should continue in the future. It expects to increase its dividend payout by 5% to 9% annually while growing its cash flow per share at a more than double-digit annual rate. That should give it the fuel to produce average annual total returns in the mid-teens. That robust total return potential from such a low-risk company is why I would pick Brookfield Infrastructure above all others if I could only buy one dividend stock this September.

Should you invest $1,000 in Brookfield Infrastructure Corporation right now?

Before you buy stock in Brookfield Infrastructure Corporation, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Brookfield Infrastructure Corporation wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Matt DiLallo has positions in Brookfield Infrastructure Corporation, Brookfield Infrastructure Partners, and Intel and has the following options: long January 2025 $30 calls on Intel, short January 2025 $30 puts on Intel, short November 2024 $45 calls on Intel, and short October 2024 $45 calls on Intel. The Motley Fool recommends Brookfield Infrastructure Partners and Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

If I Could Only Buy 1 Dividend Stock in September, This Would Be My Top Choice was originally published by The Motley Fool

CrowdStrike Lowers Guidance Due to Outage Impact. Is The Worst Over for the Stock?

A lot of eyes were on CrowdStrike (NASDAQ: CRWD) when the cybersecurity company reported its fiscal second-quarter results, as investors looked to get a better sense of what the fallout would be from its well-covered outage this summer.

Despite losing more than a quarter of its value since the beginning of July, the stock has nearly doubled over the past year.

Let’s take a closer look at the company’s most recent results and whether the worst appears to be behind the stock.

Lowered guidance

With the outage coming late in the quarter, the incident had little impact on CrowdStrike’s financial results. For the second quarter, the company grew its revenue 32% to $963.9 million. That was ahead of its earlier forecast for revenue of between $958.3 million to $961.2 million. Subscription revenue jumped 33% to $918.3 million.

Its annual recurring revenue (ARR), which is the annualized value of its customer subscription contracts, increased 32% to $3.86 billion. Net new ARR in the quarter was $217.6 million.

The company’s adjusted earnings per share (EPS) jumped from $0.74 a year ago to $1.04. Its prior guidance was for adjusted EPS of between $0.98 to $0.99.

It generated operating cash flow of $326.6 million, while free cash flow was $272.2 million. The company ended the quarter with about $3 billion in net cash and short-term investments.

Among its modules seeing strong growth were cloud security, up more than 80% to an ARR of more than $515 million; Identity Security, up over 70% to an ARR of over $350 million; and LogScale Next-Gen SIEM, which saw its ARR surge more than 140% to over $220 million.

More than 65% of CrowdStrike’s customers have five or more modules, while 29% have seven or more. Meanwhile, the number of deals with eight or more modules jumped by 48%.

Looking ahead, CrowdStrike forecasts Q3 revenue between $979.2 million and $984.7 million, with adjusted EPS between $0.80 and $0.81.

The company’s management lowered its fiscal year guidance, as displayed in the table below.

|

Full Fiscal Year Metrics |

||

|---|---|---|

|

Revenue |

$3.98 billion to $4.01 billion |

$3.89 billion to $3.90 billion |

|

Adjusted EPS |

$3.93 to $4.03 |

$3.61 to $3.65 |

Table by Author. Data Source: CrowdStrike filings.

CrowdStrike said the outage toward the end of its quarter caused many deals to be delayed, as it typically closes deals in the last two weeks of the quarter. However, it added that the “vast majority” were still in its pipeline. The company highlighted two large post-outage wins but said it has more than $60 million in deals that it has a line of sight on in the quarter that remain open. It expects them to close in future quarters.

However, the company expects to see extended sales cycles and more deal scrutiny moving forward. It is also looking to get customers to commit to its Falcon platform for longer periods of time, which it thinks will lead to less upselling in the near term and some higher levels of contraction. It thinks this will impact ARR and subscription revenue by about $60 million. It will also shift some planned sales and marketing expenses to R&D, quality assurance, and customer support.

Overall, it is looking for these headwinds to last about a year.

Is it time to buy the dip?

Before the outage, CrowdStrike was widely considered to be the best of breed in cybersecurity, but with the outage, its reputation has taken a hit. Not surprisingly, potential customers are taking more time to decide whether to adopt the company’s platform, while current customers are putting more thought into adding modules.

Overall, the fallout from the outage appears manageable, and the lasting impact should fade if there are no more incidents. That said, the stock still trades at a pretty large premium to the cybersecurity group with a forward price-to-sales (P/S) multiple of about 14 times next year’s analyst estimates. Those estimates also likely haven’t been fully adjusted lower to take into consideration its latest guidance.

Thus, while the stock and its valuation multiples are much lower than a few months ago, the stock is by no means cheap. In the longer term, CrowdStrike’s story likely doesn’t change much because of this hiccup, and the worst could indeed be over for the stock. However, investors do need to weigh the stock’s valuation against its long-term prospects, and that appears to be in balance at the moment.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,104!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,321!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,232!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of August 26, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike and Palo Alto Networks. The Motley Fool has a disclosure policy.

CrowdStrike Lowers Guidance Due to Outage Impact. Is The Worst Over for the Stock? was originally published by The Motley Fool

This Analyst With 87% Accuracy Rate Sees Over 24% Upside In Nvidia – Here Are 5 Stock Picks For Last Week From Wall Street's Most Accurate Analysts

U.S. stocks settled higher on Friday, with the Dow Jones index notching a new record high during the session.

Wall Street analysts make new stock picks on a daily basis. Unfortunately for investors, not all analysts have particularly impressive track records at predicting market movements. Even when it comes to one single stock, analyst ratings and price targets can vary widely, leaving investors confused about which analyst’s opinion to trust.

Benzinga’s Analyst Ratings API is a collection of the highest-quality stock ratings curated by the Benzinga news desk via direct partnerships with major sell-side banks. Benzinga displays overnight ratings changes on a daily basis three hours prior to the U.S. equity market opening. Data specialists at investment dashboard provider Toggle.ai recently uncovered that the analyst insights Benzinga Pro subscribers and Benzinga readers regularly receive can successfully be used as trading indicators to outperform the stock market.

Top Analyst Picks: Fortunately, any Benzinga reader can access the latest analyst ratings on the Analyst Stock Ratings page. One of the ways traders can sort through Benzinga’s extensive database of analyst ratings is by analyst accuracy. Here’s a look at the most recent stock picks from each of the five most accurate Wall Street analysts, according to Benzinga Analyst Stock Ratings.

Analyst: Leo Mariani

- Analyst Firm: Roth MKM

- Ratings Accuracy: 88%

- Latest Rating: Upgraded rating on Coterra Energy Inc. CTRA from Hold to Buy and raised the price target from $25 to $29 on Aug. 27. This analyst sees around 19% upside in the stock.

- Recent News: On Aug. 1, Coterra Energy reported worse-than-expected second-quarter financial results.

Analyst: Richard Davis

- Analyst Firm: Canaccord Genuity

- Ratings Accuracy: 88%

- Latest Rating: Maintained a Hold rating on Okta, Inc. OKTA and slashed the price target from $95 to $90 on Aug. 29. This analyst sees around 14% upside in the stock.

- Recent News: On Aug. 28, Okta reported quarterly earnings of 72 cents per share, which beat the analyst consensus estimate of 61 cents per share.

Analyst: Zachary Fadem

- Analyst Firm: Wells Fargo

- Ratings Accuracy: 87%

- Latest Rating: Maintained an Equal-Weight rating on Best Buy Co., Inc. BBY and increased the price target from $80 to $95 on Aug. 30. This analyst sees around 5% downside in the stock.

- Recent News: On Aug. 29, Best Buy reported better-than-expected second-quarter financial results raised its FY25 earnings guidance.

Analyst: William Stein

- Analyst Firm: Truist Securities

- Ratings Accuracy: 87%

- Latest Rating: Maintained a Buy rating on NVIDIA Corporation NVDA and increased the price target from $145 to $148 on Aug. 29. This analyst sees about 24% gain in the stock.

- Recent News: On Aug. 28, Nvidia reported better-than-expected earnings and sales results for its second quarter.

Analyst: Trevor Walsh

- Analyst Firm: JMP Securities

- Ratings Accuracy: 86%

- Latest Rating: Reiterated a Market Outperform rating on SentinelOne, Inc. S with a price target of $33 on Aug. 28. This analyst sees around 40% upside in the stock.

- Recent News: On Aug. 27, SentinelOne reported quarterly GAAP losses of 22 cents per share, in-line with the analyst consensus estimate.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Unsold Homes Surge, Eight States Have More Unsold Homes Than Five Years Ago

The U.S. housing market is currently experiencing an unexpected surge in unsold inventory. Eight states now have more unsold homes than in 2019, indicating a significant shift in the market dynamics. The increase in unsold homes, however, is not evenly distributed across the country.

What Happened: Research firm Altos Research reported a 40% increase in homes on the market at the end of August 2024 compared to the same period last year. This equates to over 700,000 unsold single-family homes, with about 10% going into contract each week.

The rise in inventory is not uniform across the country. States like Florida and Arizona have seen a 70% increase in unsold homes compared to last year, while New York has only a 10% increase, reports Housingwire.

Eight states – Alabama, Arkansas, Florida, Idaho, Oklahoma, Tennessee, Texas and Utah – have more unsold inventory than in 2019.

John Burns Real Estate Consulting attributes these inventory trends to migration patterns during the pandemic. Many of these states were popular destinations for inbound migration, leading to increased home construction.

Also Read: Warren Buffett’s Real Estate Firm Coughs Up $250M To Avoid Bigger Payout Over Commissions

However, the rise in mortgage rates since 2022 has slowed down migration, contributing to the inventory build-up.

Other factors, such as increased costs of homeownership, including taxes and insurance, have also contributed to the rise in unsold inventory. For instance, homeowners in Texas and Florida are grappling with higher taxes and insurance costs, respectively.

Why It Matters: The trend of unsold inventory could be a sign of a return to “normal” markets, offering more selection for homebuyers. However, it could also indicate potential price adjustments in areas with a greater supply of unsold homes.

The housing market dynamics are influenced by a variety of factors, including migration patterns, mortgage rates, and costs of homeownership.

Understanding these factors can help potential buyers and sellers make informed decisions.

Read Next:

Americans Face Historic Lack Of Affordability In Housing Market, Data Shows

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tech market values fall on AI costs and recession fears; Eli Lilly, Berkshire gain

(Reuters) – Market values of major tech firms declined in August amid concerns over escalating artificial intelligence infrastructure costs and rising recession risks that would make the stocks particularly vulnerable during a market correction.

Last month, Alphabet Inc’s lost 4.7% of its market value as a slowdown in YouTube’s advertising sales fuelled concerns about its earnings. A U.S. judge’s ruling that Google had violated antitrust laws and the emergence of new competition from OpenAI, which is developing an AI-based search engine prototype, also contributed to its shares’ decline.

Amazon.com Inc’s market value fell 4.5%, affected by slowing online sales.

Tesla’s market capitalisation fell 7.7% last month after weaker Q2 earnings and following the news that Canada planned a new 100% tariff on Chinese-made electric vehicles.

The world’s most valuable automaker started shipping Shanghai-made EV’s to Canada last year and Ottawa’s plans raised concerns about the potential profit impact of exporting from its higher-cost U.S. production base.

Meanwhile, Nvidia’s market value fell in the last week of August by 7.7% to $2.92 trillion, after it projected third-quarter gross margins below market estimates and reported revenues that only met expectations, disappointing investors who were expecting a stronger performance.

Nvidia, which commands more than 80% of the AI chip market, stands in a unique position as both the largest enabler as well as beneficiary of surging AI development.

On a positive note, U.S. drugmaker Eli Lilly’s market value surged nearly 20%, leading market gainers, driven by robust sales and the launch of a weight-loss drug that significantly reduces the risk of developing type 2 diabetes in overweight adults.

Berkshire Hathaway’s market value closed above $1 trillion for the first time at the end of August, reflecting investor confidence in the conglomerate that Warren Buffett built over nearly six decades into what many consider a proxy for the U.S. economy.

Meta’s market value also climbed nearly 10% after it beat market expectations for its second-quarter revenues and forecast strong revenue growth in the July-September quarter, indicating that strong digital ad spending on its platforms could offset the costs of its AI investments.

(Reporting By Patturaja Murugaboopathy and Gaurav Dogra in Bengaluru; Editing by Tomasz Janowski)

If I Could Only Buy 1 Stock in the Last Half of 2024, I'd Pick This

After a short-lived dip that started in the second half of July, the S&P 500 quickly bounced back and is now flirting with a new record high. Investors looking to put some money to work might be discouraged because they believe there aren’t many compelling opportunities in today’s market.

But that’s a flawed perspective. In fact, I believe one company looks like a no-brainer portfolio addition right now.

If I could buy only one stock in the last half of 2024, I’d pick Walt Disney (NYSE: DIS). Here’s why.

Disney’s transition

One of the most notable secular shifts happening across the economy has been the rise of streaming entertainment at the expense of traditional cable TV. The monster success of Netflix propelled this change. Now, Disney is in the middle of a major transition to its business model.

The company’s once-thriving linear networks, like ABC and ESPN, are still generating loads of profits. However, they are in secular decline as more households cut the cord. Consequently, revenue will remain under pressure here.

At the same time, to keep up with the shifting industry, Disney has had to invest aggressively in technology and content to build out its streaming operations, which include Disney+, Hulu, and ESPN+. Direct-to-consumer (DTC) services have so far posted billions in operating losses, which is a key factor that has weighed on the stock.

Disney’s latest financial update, though, reveals solid improvements in the DTC segment. Combined, the streaming services generated a positive operating income of $47 million in the fiscal 2024 third quarter (ended June 29). That’s not anything to write home about, but executives believe the company will improve in this area going forward.

However, it’s not all encouraging news. The experiences segment, which is where results for parks, cruises, and consumer products are included, is facing some challenges. Revenue was up just 2% in Q3, with operating income down 3%. “The demand moderation we saw in our domestic businesses in Q3 could impact the next few quarters,” the press release reads.

I will adopt a more upbeat perspective as it pertains to the long term. My view is that the experiences segment is a lucrative one that’s essential to Disney’s competitive standing. That’s why the company is planning to invest $60 billion over the next decade to bolster its offerings here, forcing my confidence that the segment will be stronger in the future.

Disney’s valuation

The market hates uncertainty. That’s the best word to describe Disney’s situation over the past few years as the media landscape shifts to streaming.

Consequently, Disney shares are cheap. They trade at a forward price-to-earnings (P/E) ratio of 17 based on fiscal 2025’s consensus earnings per share estimate. If you believe the bottom line will expand meaningfully in the years ahead, like I do, then valuation is only going to get more attractive the further out you look. For what it’s worth, the S&P 500 trades at a forward P/E multiple of over 23, so Disney goes for a significant discount to the overall market.

In my opinion, that valuation creates a wonderful opportunity to buy shares. Investors can purchase a business that has an economic moat that discourages new entrants from coming in and adds durability over the long term.

Disney’s intellectual property, including its characters, storylines, and franchises, many of which were created decades ago, holds a special place in the minds and hearts of consumers across the globe. I think it’s impossible for any business to match or replace this type of position.

Of course, investors looking to buy the stock must have the patience to wait for solid improvements to happen, particularly around the view that earnings will soar. However, I believe that over the next three to five years, Disney will prove to be a successful investment.

Should you invest $1,000 in Walt Disney right now?

Before you buy stock in Walt Disney, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walt Disney wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Neil Patel and his clients have positions in Walt Disney. The Motley Fool has positions in and recommends Netflix and Walt Disney. The Motley Fool has a disclosure policy.

If I Could Only Buy 1 Stock in the Last Half of 2024, I’d Pick This was originally published by The Motley Fool

First Mover Americas: Bitcoin Sits Around $58.5K at Start of Historically Bearish September

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

CoinDesk 20 Index: 1,843.91 +0.88%

Bitcoin (BTC): $58,458 +0.67%

Ether (ETH): $2,519 +1.89%

S&P 500: 5,658 +1%

Gold: $2400 −0.15%

Nikkei 225: 38,700.87 +0.14%

Top Stories

Bitcoin fluctuated around the $58,000 mark amid a generally sedate market on Labor Day in the U.S. The largest cryptocurrency was trading around $58,600 at the time of writing, about 1% higher in 24 hours. The broader digital asset market has risen 0.9%%, according to CoinDesk Indices data, with ETH and SOL gaining around 1.9% and 0.5%, respectively. U.S.-listed exchange-traded funds (ETFs) tracking BTC posted total net outflows of $175 million on Friday, extending a losing streak to four days. Ether ETFs had zero net inflows or outflows despite $173 million in trading volume, data tracked by SoSoValue shows.

Some traders noted that September is generally one of bitcoin’s most bearish months, but said that an interest-rate cut by the Fed could break the trend. “September is a historically negative month for bitcoin, as data shows it has an average value depletion rate of 6.56%,” Innokenty Isers, founder of crypto exchange Paybis, said. “Should the Feds cut the interest rate in September, it might help bitcoin rewrite its negative history as rate cuts generally lead to excessive US dollar flow in the economy – further strengthening the outlook of bitcoin as a store of value.”

Election punters on Polymarket are favoring Republican candidate Donald Trump again as Democrat Kamala Harris’ odds slipped to 47% over the weekend from even odds earlier. Harris’ appeal has drifted lower in the past weeks among traders on Polymarket, while Trump’s has gradually climbed back over 50%. He is again in the lead after nearly two weeks of even odds. Traders have placed $99 million in on-chain bets on Trump winning the election, with over $95 million put on Harris. Harris’ odds have slipped amid outcry for a proposal to tax unrealized gains for people worth over $100 million. Meanwhile, Trump’s odds have increased as he promotes a forthcoming decentralized finance project that could offer “high yields” for crypto users.

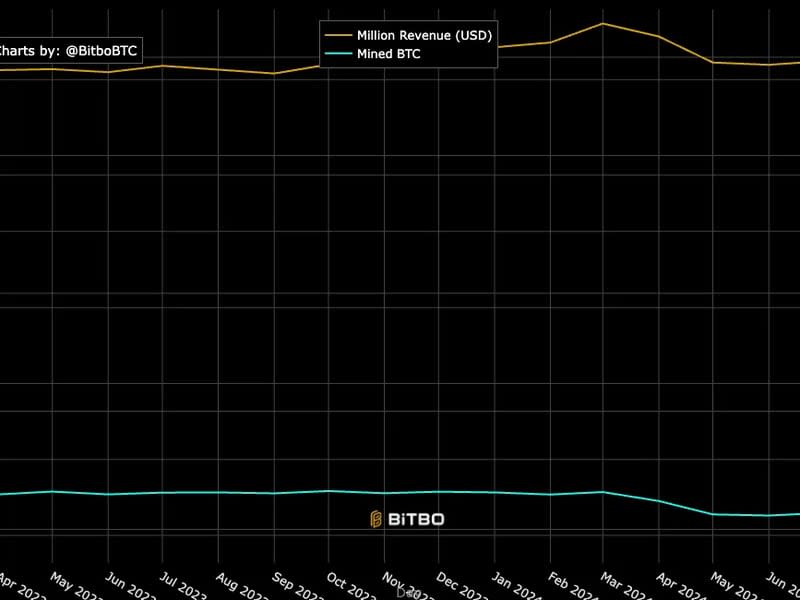

Chart of the Day

-

The chart shows that bitcoin miners’ revenue fell in August to the lowest level since September 2023.

-

This was accompanied by an increase in the bitcoin mining difficulty and decrease in the number of BTC mined.

-

This highlights the challenge that miners face in adapting to the post-halving world.

-

Source: Bitbo

– Jamie Crawley