BRI deeply integrated into African development; more pragmatic cooperation expected in FOCAC

BEIJING, Sept. 2, 2024 /PRNewswire/ — The joint construction of the Belt and Road Initiative (BRI) by China and Africa has provided a high-level cooperation platform for Africa’s development.

From Uganda and Egypt to Senegal and Nigeria, infrastructure, industrial parks and economic zones built by Chinese companies have mushroomed and become a strong engine driving Africa’s integration into the global industrial chain.

China and Africa will renew their friendship and discuss plans for further pragmatic cooperation during the upcoming Forum on China-Africa Cooperation (FOCAC) to be held in Beijing from September 4 to 6. Chinese President Xi Jinping will attend the opening ceremony of FOCAC and deliver a keynote speech on September 5.

The cooperation between China and Africa under the BRI framework emphasizes precise alignment with Africa’s shared strategic framework – the African Union 2063 Agenda – one of whose priorities is the realization of industrialization in Africa.

In its issue of May 13, 2000, The Economist boldly described Africa as “the hopeless continent.” In the very same year, FOCAC was established.

The narrative on Africa now has shifted to “a rise in the continent.” When tracking momentum projects that have contributed to unlocking Africa’s development, you can trace the progress back to China’s flagship projects through BRI, Paul Frimpong, the executive director and senior research fellow of the Ghana-based Africa-China Centre for Policy and Advisory, told the Global Times.

As of 2023, a total of 52 African countries as well as the African Union have signed a memorandum of understanding with China to jointly build BRI cooperation.

For instance, the integrated steel manufacturing plant set up in Zimbabwe’s Midlands Province by Chinese firm Dinson Iron and Steel Company draws on upstream and downstream supply chains that go beyond Zimbabwe, benefiting its neighbors in areas such as employment generation, and also helps to meet the Southern African Development Community (SADC) region’s infrastructure construction needs, Munetsi Madakufamba, executive director of the Zimbabwe-based Southern African Research and Documentation Centre, told the Global Times.

Madakufamba also emphasized the driving role of green development in energy cooperation within the BRI. Media reports said that investment in the energy sector accounts for about 40 percent of Chinese investment in BRI partner countries and regions.

“China brings its modern technology while taking into account potential negative impacts on the environment. The clean-energy project, like the power generation of the Kariba South Hydroelectric Power Station, meets the sustainable development aspirations of African countries,” Madakufamba said.

African industrialization also requires the connection of facilities, which is where BRI is most visibly present in Africa.

“Most of the current tangible infrastructure, such as rails and ports, that you see in many countries, including my own country Ghana, has been built by China,” Frimpong said. “It is all part of the BRI.”

An early result of BRI, the Mombasa-Nairobi Standard Gauge Railway (SGR), is a flagship project.

Song Wei, a professor from the School of International Relations and Diplomacy at Beijing Foreign Studies University, said that “through the connection from the capital Nairobi to the port of Mombasa, Kenya will be further integrated into the global value chain. A lot of local workers have been absorbed to solve the local employment issue, and to promote the real improvement of local people’s living standards.”

In addition, a core focus on how China is actively promoting the realization of industrialization in Africa is the nurturing of talents required by the continent throughout this process, Song said.

For instance, we have established Luban Workshops in Africa to train the talents that African countries greatly require, Song noted.

China also supports Africa’s development through providing more opportunities in trade, which experts consider the most crucial tool for unlocking progress in the continent.

Song listed examples such as the China International Import Expo (CIIE), which has offered complimentary standard booths to less-developed countries, while some Chinese e-commerce companies have also helped train online shopkeepers in Africa, boosting local cross-border e-commerce.

“Mutual understanding, not based on imposition” – This is the sentence that Frimpong, the scholar from Ghana, used to describe China–Africa cooperation.

Echoing Frimpong, Rana Mohamed Abd El Aal Mazid, the head and associate professor of political science at Suez Canal University in Egypt, told the Global Times that the Chinese perspective is very different, with the keywords of “friends,” “let’s go together” and “Global South.”

China insists on not interfering in any country’s internal affairs and does not attach any conditions. When China cooperates with Africa, African countries are able to gain a level of respect and equality. This equal partnership has formed a model for how countries engage, Song concluded.

![]() View original content:https://www.prnewswire.com/news-releases/bri-deeply-integrated-into-african-development-more-pragmatic-cooperation-expected-in-focac-302235822.html

View original content:https://www.prnewswire.com/news-releases/bri-deeply-integrated-into-african-development-more-pragmatic-cooperation-expected-in-focac-302235822.html

SOURCE Global Times

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

U.S. Elections Market Impact: What Does History Show?

Economy

The relationship between the party affiliations of the U.S. presidents and economic growth has been a topic of extensive research and debate. Historically, some studies have suggested a correlation between the party in power and economic performance. For instance, data from the post-World War II era often shows that the U.S. economy has grown faster under Democratic presidents than Republican presidents. However, this correlation does not necessarily imply causation.

Kar Yong Ang, the Octa analyst, said: ‘Economic growth is a function of numerous variables, including global economic conditions, technological advancements, fiscal and monetary policies, and unforeseen events like natural disasters or pandemics. Therefore, attributing economic performance solely to the president’s party affiliation can be overly simplistic and potentially misleading.’

Indeed, the legislative branch also plays a crucial role in shaping economic policy. A president’s ability to implement their economic agenda often depends on the composition of Congress. For example, a president facing a divided government may struggle to pass significant economic reforms, regardless of party affiliation.

Still, there is widespread belief that Democratic administrations tend to focus more on fiscal stimulus and social welfare programs, which can boost consumer spending and economic growth in the short term. On the other hand, Republican administrations often emphasize tax cuts and deregulation, which can stimulate business investment and long-term economic growth.

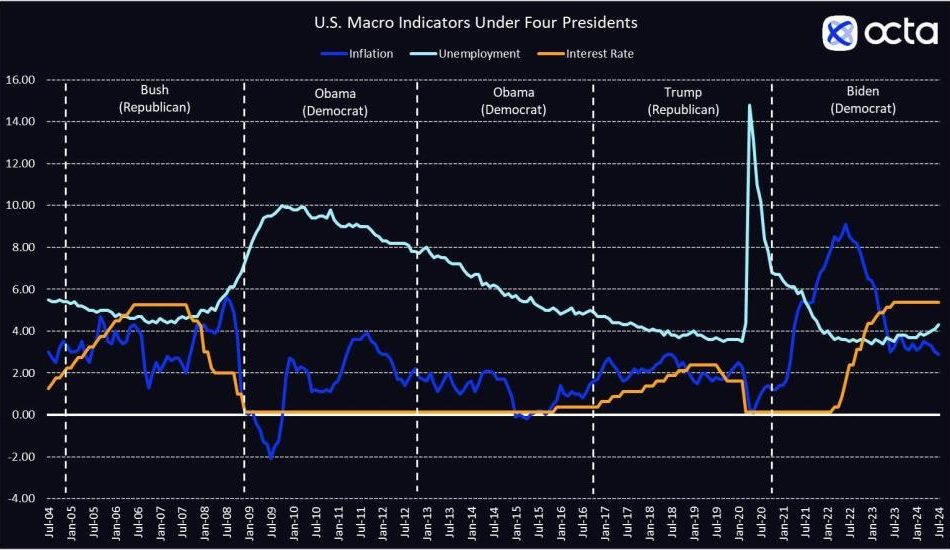

The U.S. Key macro indicators under four presidents (2004–2024)

Source: Octa

At the same time, both bad and good events happen, regardless of who is in the White House. ‘Quite frankly, sometimes it’s just pure luck that defines Presidents’ track record on the economy. For example, Obama entered the White House when the U.S. economy was just about to start recovering following the great financial crisis of 2007–2008, whereas Trump may be said to be less fortunate as he faced the unprecedented Covid crisis during the final year of his presidency’, says Kar Yong Ang, Octa’s analyst. Overall, judging by historical macro indicators, there is no definite conclusion to make about which President is better for the economy.

U.S. Stocks

The U.S. stocks tend to experience increased volatility in the months leading up to an election. This is largely due to the uncertainty surrounding potential policy changes that could affect international trade, economic growth, and geopolitical stability. Therefore, market participants often engage in ‘wait-and-see’ behaviour, holding off on major investment decisions until the election outcome is clear. Historically, the stock market tends to perform better in the year following an election, particularly if the incumbent party wins, as this suggests policy continuity.

While elections can certainly stir immediate reactions, historical data reveals that their long-term impact on financial markets tends to be limited. Market performance over the medium to long term is more often influenced by broader economic parameters like inflation trends rather than who wins the election.

Dow Jones Industrial Average (DJIA) performance under four presidents (2004–2024)

Source: Octa

Historically, sectors like healthcare, energy, technology, and finance react differently to election results due to their sensitivity to legislative changes. The 2016 U.S. election serves as a notable example of markets reacting strongly to the election results, anticipating tax cuts and regulatory reforms that boosted market sentiment.

U.S. Dollar

Both domestic and international perceptions of the candidates’ economic policies influence the U.S. dollar’s performance during the election years. A candidate perceived as fiscally conservative might strengthen the dollar due to expectations of reduced government spending and lower inflation. Conversely, a candidate favouring expansive fiscal policies could lead to a weaker dollar due to concerns over increased debt.

Trade policies are another crucial factor. A candidate with a protectionist stance might introduce tariffs or renegotiate trade deals, which can affect the dollar’s value. Protectionist policies can lead to a stronger dollar in the short term due to reduced imports, but they might also result in retaliatory measures from trade partners, which could weaken the dollar in the long run.

Geopolitical stability and foreign relations are additional aspects that can affect the dollar during the election periods. A candidate perceived as more stable and predictable in foreign policy might boost the investors’ confidence, leading to a stronger dollar. On the other hand, a candidate whose policies are seen as potentially destabilizing could lead to a weaker dollar as investors seek alternative assets.

The U.S Dollar Index (DXY) performance under four presidents (2004–2024)

Source: Octa

Over the past 20 years, the U.S. Dollar Index (DXY) has performed better under Democratic Presidents and had negative returns under Republican leadership. However, as with the U.S. stock indices, it’s crucial not to oversimplify this trend. The U.S. dollar is a global reserve currency influenced by a myriad of factors beyond just presidential policies.

Gold

Gold, considered a safe-haven asset, typically sees increased demand during election periods marked by uncertainty. Historical data indicates that on a micro level, gold prices tend to rise in the months leading up to an election and may continue to do so if the election results are contested or lead to significant policy shifts.

However, Kar Yong Ang, an Octa analyst, notes: ‘If we look at the bigger picture, we see that gold price just generally tends to increase in the long-term and the ideological stance of an incumbent U.S. President has very little or no impact on its performance’. Indeed, the value of gold almost doubled during President Obama’s first term in office but experienced a 30% decline during his second term.

The U.S Dollar Index (DXY) performance under four residents (2004–2024)

Source: Octa

According to a study by the World Gold Council (WGC), gold typically performs slightly better in the six months leading up to a Republican president’s election and stays flat afterwards. On the other hand, it tends to underperform before a Democratic president’s election and performs just below its long-term average in the six months post-election period.[1] However, WGC admits that these results are statistically insignificant and that gold is responding not to the party affiliation of an elected President but, more likely, to the expected effect of specific policies.

About Octa

Octa is an international broker that has been providing online trading services worldwide since 2011.

This article was originally posted on FX Empire

More From FXEMPIRE:

67% Of Investors Say Trump Is Better For Stocks Than Biden, But Market Predictions Are All Over The Map

In a landscape where economic policy and market performance often intersect, a CNBC survey found that investors prefer former President Donald Trump’s potential impact on the stock market.

The poll, which surveyed 400 investors, traders, and money managers, found that 67% believe Trump would benefit stocks more.

Don’t Miss:

CNBC said the sentiment appears to be rooted in historical performance. During Trump’s four-year tenure, the S&P 500 surged 68%, while the Nasdaq saw a 137% climb. In contrast, under Biden’s administration thus far, the same indexes have gained 44% and 34%, respectively.

However, the investment community is divided on the market’s near-term trajectory. The survey found an even split among respondents; a third anticipate a drop, another third expect gains, while the remaining third see a rangebound market.

Trending:

That uncertainty reflects the factors influencing today’s economic landscape. While presidential policies can sway market sentiment, other elements often play a more important role. As Kristina Hooper, chief global market strategist at Invesco, told the New York Times, “Markets are politically agnostic. With good reason: it doesn’t matter.”

See Also:

The recent market rally has been largely attributed to investor enthusiasm surrounding artificial intelligence (AI) rather than political developments. CNBC noted that Microsoft emerged as the front-runner in the AI race, with 50% of survey respondents viewing it as best positioned to capitalize on the tech. Surprisingly, Nvidia did not make the top of that list.

The Federal Reserve’s monetary policy decisions continue to be a factor. Two-thirds of those polled expect the Fed to cut interest rates before year’s end (with many seeing a rate cut as soon as September), a move that could impact the market.

Interestingly, despite the clear preference for Trump regarding market performance, investors showed concerns about the current state of the major indexes. Eighty percent of respondents admitted feeling uneasy about the heavy concentration of tech stocks in the benchmarks.

Trending:

Looking beyond equities, the survey highlighted India as the most attractive overseas market, followed by Japan and Europe. Corporate bonds emerged as the preferred investment vehicle in the absence of stocks.

As the 2024 election approaches, investors are reminded that while presidential rhetoric often ties market performance to administration policies, the reality is far more nuanced. Historical data shows that markets have generally trended upward regardless of which party occupies the White House.

Ultimately, as the survey results indicate, while investor sentiment may lean toward Trump for potential market gains, the road ahead for stocks appears as unpredictable as ever.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article 67% Of Investors Say Trump Is Better For Stocks Than Biden, But Market Predictions Are All Over The Map originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Sweet Dividend Stocks to Buy for a Satisfying Passive Income Stream

The U.S. has a sweet tooth. Americans consume 34 teaspoons of sugar each day, according to the U.S. Department of Agriculture. That adds up to more than 100 pounds every year.

That much sugar consumption isn’t healthy. However, this sugar addiction is great for the bottom lines of companies focused on making sugary drinks, desserts, and snacks. They generate billions of dollars in profits each year. Many pay a large portion of their earnings to investors via dividend income.

Because of that, sugar stocks can be a great way to generate passive income. Coca-Cola (NYSE: KO), Hershey (NYSE: HSY), and Mondelez (NASDAQ: MDLZ) offer sweet dividends that can help satisfy any investor’s desire for passive income.

Add some pop to your passive income

Coca-Cola has an elite record of paying dividends. The beverage giant delivered its 62nd consecutive annual dividend increase in early 2024, raising its payout by 5.4% compared to the prior year’s level. That kept Coca-Cola in the elite group of Dividend Kings, companies with 50 or more years of consecutive dividend increases.

Coca-Cola paid $8 billion in dividends to its investors last year alone, boosting its total to $84.7 billion since January 2010. The beverage behemoth currently offers a dividend yield of around 2.7%. That’s more than double the S&P 500‘s dividend yield (recently around 1.3%).

The company is in a strong position to continue growing its dividend. Coca-Cola generates robust free cash flow ($9.2 billion expected in 2024 after covering capital expenditures) and has a cash-rich balance sheet ($17.4 billion of cash, equivalents, and short-term investments).

Meanwhile, the company expects its earnings to continue rising, driven by consumers’ sugar addiction and investments to grow its business. Its long-term target is to organically grow its revenue by 4% to 6% annually and deliver 7% to 9% earnings-per-share growth each year. That growing income stream should enable Coca-Cola to continue increasing its satisfying dividend.

A sweet income stream

Hershey has a long history of paying dividends. The chocolatier has increased its payout for 15 straight years, including giving investors a 15% raise earlier this year. Hershey currently offers a tasty dividend yield of 2.8%.

The iconic chocolate company owns top brands like its namesake, Reese’s, and KitKat. These brands generate billions of dollars in annual revenue and cash flow for the company. It has rung up more than $5 billion in sales during the first half of this year and nearly $1 billion in income.

Hershey has been investing heavily in growing its business, including adding more salty snacks to its growing mix of sweets. These investments are helping grow the company’s earnings and cash flow. Its long-term target is to grow net sales by 2% to 4% per year and deliver 6% to 8% adjusted earnings-per-share growth. Meanwhile, Hershey hopes to increase its dividend in line with its earnings over the long term.

This dividend hits the spot

Mondelez has delivered dividend increases for the past dozen years. The global snacking giant gave its investors an 11% raise in June and delivered double-digit dividend-per-share growth in each of the last five years. It now yields around 2.6%.

The company has a knack for satisfying consumers’ desire for a snack. About 88% of consumers have a snack each day, with most of them (76%) loyal to specific brands. Mondelez owns many beloved brands, including Oreo, Milka, Cadbury, Ritz, Chips Ahoy!, and Clif. It’s the world’s leading cookie/biscuit seller and the second-largest chocolate company.

Mondelez aims to grow its revenue by 3% to 5% per year, putting it on track to deliver high single-digit earnings-per-share growth and strong free cash flow ($3+ billion annually). The company plans to use its free cash flow to make acquisitions, repurchase shares, and continue paying a growing dividend.

These sweet payouts should continue rising

For better or worse, sugar is a big part of the American diet. That’s enabling companies that produce sugary drinks, snacks, and treats to earn huge profits each year. They’re returning some of that money to investors via dividends. That makes them great options for investors seeking to satisfy their craving for more passive income.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Matt DiLallo has positions in Coca-Cola and Hershey. The Motley Fool has positions in and recommends Hershey. The Motley Fool has a disclosure policy.

3 Sweet Dividend Stocks to Buy for a Satisfying Passive Income Stream was originally published by The Motley Fool

CD rates today, September 1, 2024 (up to 4.70% APY)

Today’s certificate of deposit (CD) interest rates are some of the highest we’ve seen in more than a decade thanks to several rate hikes by the Federal Reserve. Still, CD rates vary widely across financial institutions, so it’s important to ensure you’re getting the best rate possible when shopping around for a CD. The following is a breakdown of CD rates today and where to find the best offers.

Overview of CD rates today

Historically, longer-term CDs offered higher interest rates than shorter-term CDs. Generally, this is because banks would pay better rates to encourage savers to keep their money on deposit longer. However, in today’s economic climate, the opposite is true.

See our picks for the best CD accounts available today>>

As of September 1, 2024, CD rates remain competitive across the board. However, the highest CD rates can be found for shorter terms of around one year or less; the best rates stand at about 4% to 5% APY. The best CD rate today comes from Marcus by Goldman Sachs on its 1-year CD. Account holders can earn 4.70% APY with a minimum deposit of $500.

It’s certainly possible to find CDs with longer terms of two years or more that offer competitive rates, though they are closer to about 4% to 4.5% APY.

Here is a look at some of the best CD rates available today from our verified partners:

How much interest can I earn with a CD?

The amount of interest you can earn from a CD depends on the annual percentage rate (APY). This is a measure of your total earnings after one year when considering the base interest rate and how often interest compounds (CD interest typically compounds daily or monthly).

Say you invest $1,000 in a one-year CD at 1.85% APY (the current national average CD rate for a one-year term). At the end of that year, your balance would grow to $1,018.50 — your initial $1,000 deposit, plus $18.50 in interest.

Now let’s say you choose a one-year CD that offers 5% APY instead. In this case, your balance would grow to $1,051.16 over the same period, which includes $51.16 in interest.

The more you deposit in a CD, the more you stand to earn. If we took our same example of a one-year CD at 5% APY, but deposit $10,000, your total balance when the CD matures would be $10,511.62, meaning you’d earn $511.62 in interest.

Read more: What is a good CD rate?

Types of CDs

When choosing a CD, the interest rate is usually top of mind. However, the rate isn’t the only factor you should consider. There are several types of CDs that offer different benefits, though you may need to accept a slightly lower interest rate in exchange for more flexibility. Here’s a look at some of the common types of CDs you can consider beyond traditional CDs:

-

Bump-up CD: This type of CD allows you to request a higher interest rate if your bank’s rates go up during the account’s term. However, you’re usually allowed to “bump up” your rate just once.

-

No-penalty CD: Also known as a liquid CD, type of CD gives you the option to withdraw your funds before maturity without paying a penalty.

-

Jumbo CD: These CDs require a higher minimum deposit (usually $100,000 or more), and often offer higher interest rate in return. In today’s CD rate environment, however, the difference between traditional and jumbo CD rates may not be much.

-

Brokered CD: As the name suggests, these CDs are purchased through a brokerage rather than directly from a bank. Brokered CDs can sometimes offer higher rates or more flexible terms, but they also carry more risk and might not be FDIC-insured.

Stocks Decline as China Shows No Sign of Revival: Markets Wrap

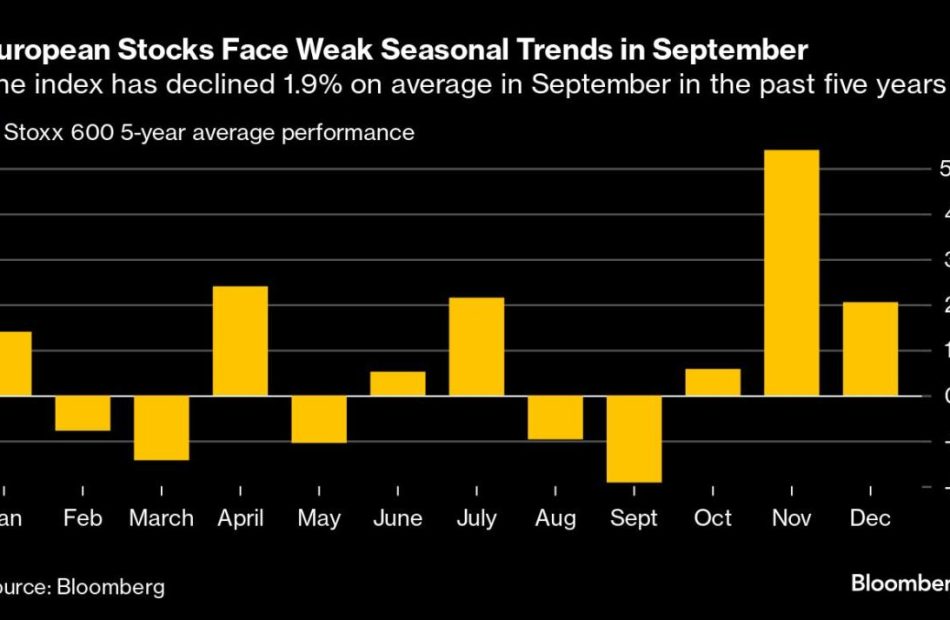

(Bloomberg) — Global equities began September on the back foot as investors prepared for what’s typically considered the most challenging month for stocks.

Most Read from Bloomberg

Europe’s Stoxx 600 fell 0.4% from Friday’s record high, with the automotive and consumer goods sectors particularly affected. This downturn followed data showing a fourth consecutive month of contraction in Chinese manufacturing activity, alongside a deepening slump in the country’s residential property market.

Similarly, mining giants such as Rio Tinto Plc and BHP Group Ltd. saw declines after iron ore prices dropped. In London, Rightmove Plc surged more than 20% after Rupert Murdoch’s REA Group Ltd. said it’s exploring a possible cash and share offer.

US equity futures softened after the S&P 500 came close to an all-time high on Friday. The dollar was steady, while cash Treasuries were closed for the US Labor Day holiday.

September has been a notably poor month for stocks over the past four years, while the dollar typically outperforms, according to data compiled by Bloomberg. Wall Street’s fear gauge – the Cboe Volatility Index, or VIX – has risen each September since 2021.

The trend may continue, especially with the upcoming US jobs report on Friday, serving as a guide to how quick, or slow, the Federal Reserve will cut rates and as the US election campaign gets into full swing. Traders are pricing the US easing cycle will begin this month, with a roughly one-in-four chance of a 50 basis-point cut, according to data compiled by Bloomberg.

“I think the market is pretty well versed with what it thinks is going to happen — there will be some kind of cut,” Fiona Boal, global head of equities at S&P Dow Jones Indices, told Bloomberg Television. “As we move through autumn, we will see the VIX move more to thinking about the markets, thinking about political issues.”

Two days before Friday’s report, the government will issue figures on July job vacancies. The number of open positions, a measure of labor demand, is seen easing to a three-month low of 8.1 million — just above a more than three-year low.

The equity-market rally may stall even if the Federal Reserve starts its rate-cutting cycle, according to JPMorgan Chase & Co. strategists.

Any policy easing would be in response to slowing growth, while the seasonal trend for September would be another impediment, the team led by Mislav Matejka wrote in a note.

“We are not out of the woods yet,” Matejka said, reiterating his preference for defensive sectors against the backdrop of a pullback in bond yields. “Sentiment and positioning indicators look far from attractive, political and geopolitical uncertainty is elevated, and seasonals are more challenging.”

Elsewhere, German Chancellor Olaf Scholz’s ruling coalition was punished in two regional elections on Sunday, with the far right clinching its first triumph in a state ballot since World War II. Still, political parties moved to block the Alternative for Germany from power in the eastern states of Thuringia and Saxony.

China Woes

In Asian markets, multiple rounds of stimulus have failed to revive growth in China, where a prolonged property market slump is curbing domestic demand in the world’s second-largest economy.

“I think there’s a huge problem — by now everybody recognizes that,” Hao Ong, chief economist at Grow Investment Group, told Bloomberg’s David Ingles and Yvonne Man in an interview. “The government needs to do substantially more.”

In commodities, oil steadied as traders weigh a planned production increase from OPEC+ next month against currently lower output in Libya, while staying mindful of economic headwinds in China.

Key events this week:

-

US markets closed for Labor Day holiday, Monday

-

South Korea CPI, Tuesday

-

Switzerland GDP, CPI, Tuesday

-

South Africa GDP, Tuesday

-

US construction spending, ISM Manufacturing index, Tuesday

-

Mexico unemployment, Tuesday

-

Brazil GDP, Tuesday

-

Chile rate decision, Tuesday

-

Australia GDP, Wednesday

-

China Caixin services PMI, Wednesday

-

Bloomberg CEO Forum in Jakarta, Wednesday

-

Eurozone HCOB services PMI, PPI, Wednesday

-

Poland rate decision, Wednesday

-

Fed’s Beige Book, Wednesday

-

Canada rate decision, Wednesday

-

South Korea GDP, Thursday

-

Malaysia rate decision, Thursday

-

Philippines CPI, Thursday

-

Taiwan CPI, Thursday

-

Thailand CPI, Thursday

-

Eurozone retail sales, Thursday

-

Germany factory orders, Thursday

-

US initial jobless claims, ADP employment, ISM services index, Thursday

-

Eurozone GDP, Friday

-

US nonfarm payrolls, Friday

-

Canada unemployment, Friday

-

Chile CPI, Friday

-

Colombia CPI, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.1% as of 6:47 a.m. New York time

-

Nasdaq 100 futures fell 0.2%

-

Futures on the Dow Jones Industrial Average fell 0.1%

-

The Stoxx Europe 600 fell 0.4%

-

The MSCI World Index fell 0.1%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro rose 0.1% to $1.1063

-

The British pound was little changed at $1.3133

-

The Japanese yen fell 0.4% to 146.77 per dollar

Cryptocurrencies

-

Bitcoin was little changed at $58,400.65

-

Ether rose 0.8% to $2,521.39

Bonds

-

The yield on 10-year Treasuries was little changed at 3.90%

-

Germany’s 10-year yield advanced three basis points to 2.33%

-

Britain’s 10-year yield advanced four basis points to 4.06%

Commodities

-

West Texas Intermediate crude fell 0.1% to $73.44 a barrel

-

Spot gold fell 0.2% to $2,499.19 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Catherine Bosley and Sagarika Jaisinghani.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Redfin Reveals The Real Estate 'Lock In' Effect Is Easing, That Means More Inventory Is Coming — Will Prices Come Down Soon?

According to a new Redfin report, about 86% of U.S. homeowners with mortgages now have interest rates below 6%. That’s down from 91% at the start of 2023 and a peak of 93% in mid-2022.

Trending:

It’s a small shift, but a significant one. For months, economists have pointed to this “lock-in effect” as a key factor in the housing shortage. Homeowners, reluctant to give up rock-bottom rates, have been staying put rather than selling and buying at today’s higher rates.

“I have a dozen or so homeowners who would like to sell, but aren’t willing to give up their 3% interest rate for one that’s more than twice as high,” says Blakely Minton, a Redfin agent in Philadelphia. “Many of those sellers will list if rates get back down to 5%.”

The current average 30-year fixed mortgage rate sits at 6.44%, according to Mortgage News Daily. While that’s the lowest in 15 months, it’s still more than double the pandemic-era lows that many homeowners locked in.

Don’t Miss:

So why the change? For some, life gets in the way, according to Redfin. Job transfers, growing families or divorces can force a move regardless of rate considerations. Others are finally deciding that built-up equity outweighs the sting of a higher rate, especially if they’re downsizing or relocating to a cheaper area.

The gradual easing of the lock-in effect offers some hope for buyers facing the lowest level of home listings in a year. But Lawrence Yun, chief economist at the National Association of Realtors, cautions against expecting bargains.

“Will some markets see a price decline? Yes. [But] with the supply not being there, the repeat of a 30 percent price decline is highly, highly unlikely,” Yun said. He points to persistent demand as a counterbalance to a surge in supply.

See Also:

Home prices hit a new record in June, according to Bankrate, with the median existing home sale price reaching $426,900. July saw a slight dip to $422,600, but that was still an all-time high for the month.

The question now is whether the Federal Reserve’s expected interest rate cuts, which are expected to start as soon as September, will accelerate the trend. Lower rates could tempt more owners to sell, but they might also unleash pent-up buyer demand, potentially pushing prices even higher.

More owners may be willing to list, but a true return to “normal” inventory levels is likely still a long way off. Buyers hoping for a replay of the 2008 crash shouldn’t hold their breath, Bankrate says.

“The fundamental reason for the run-up in price is heightened demand and a lack of supply,” Greg McBride, Bankrate’s chief financial analyst, was quoted in the report. “As builders bring more available homes to market and more homeowners decide to sell, supply and demand can come back into balance. It won’t happen overnight.”

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Exclusive-Intel CEO to pitch board on plans to shed assets, cut costs, source says

(Reuters) — Intel (INTC) CEO Pat Gelsinger and key executives are expected to present a plan later this month to the company’s board of directors to slice off unnecessary businesses and revamp capital spending, according to a source familiar with the matter, as they try to revive the once-dominant chipmaker’s fortunes.

The plan will include ideas on how to shave overall costs by selling businesses, including its programmable chip unit Altera, that Intel can no longer afford to fund from the company’s once-sizeable profit.

Gelsinger and other high-ranking executives at Intel are expected to present the plan at a mid-September board meeting, the same source said.

Details of Gelsinger’s proposal is reported here for the first time.

Intel declined to comment.

The proposal does not yet include plans to split Intel and sell off its contract manufacturing operation, or foundry, to a buyer such as Taiwan Semiconductor Manufacturing Co. (TSM, 2330.TW), according to the source and another person familiar with the matter.

The presentation, including the plans around its manufacturing operations, are not yet finalized and could change ahead of the meeting.

Intel has already broken off its foundry business from its design business, and has been reporting its financial results separately since the first calendar quarter of this year.

The company has erected a wall between the design and manufacturing businesses to assure that potential customers of the design division would have no access to technology secrets of customers using Intel’s factories, known as fabs, to manufacture their chips.

Intel is suffering through one of its worst periods as it attempts to play catchup in the AI era against the likes of Nvidia (NVDA), the dominant AI chipmaker with a $3 trillion market capitalization. In contrast, Intel’s has now sunk to below $100 billion after a disastrous second-quarter earnings report in August.

The proposal Gelsinger and others will present is likely to include plans to further reduce the company’s capital spending on factory expansion. The pitch may include plans to pause or altogether halt its $32 billion factory in Germany, a project that has reportedly been delayed, the source said.

In August, Intel said it expects to cut capital spending to $21.5 billion in 2025, down 17% from this year, and issued a weaker-than-expected third-quarter forecast.

In addition to the CEO and executive plans, Intel has retained Morgan Stanley and Goldman Sachs to advise the board on what businesses Intel can sell and what it needs to retain, according to two sources with knowledge of the company’s advisory plans.

Intel has not yet asked for bids on the product units, but will likely do so once the board endorses a plan, according to the two sources familiar with the company’s advisory plans.

Altera spin-out

The mid-September board meeting is pivotal for the one-time chipmaking king. Intel reported a disastrous second quarter in August, which included pausing the company’s dividend payments and a 15% staff cut, aimed at saving $10 billion.

Weeks later, chip industry veteran Lip-Bu Tan resigned from the board after months of debate over the company’s future, Reuters reported, creating a vacuum of deep semiconductor business experience on the board.

Last Thursday, after the Reuters report, Gelsinger sought to reassure investors about the company’s weak financial performance.

“It’s been a difficult few weeks,” Gelsinger said at a Deutsche Bank conference. “And we’ve been working hard to address the issues.”

Gelsinger said the company is “taking seriously” what investors have said and that Intel is focused on phase two of the company’s turnaround plan.

Part of those plans will remain unresolved until the mid-September meeting. Then, the company’s directors will likely make crucial decisions about which businesses Intel will keep and which it will shed.

One potential unit the company may look to unload is its programmable chip business, Altera, which Intel acquired for $16.7 billion in 2015. Intel has already taken steps to spin it out as a separate but still wholly owned subsidiary and has said it planned to sell a portion of its stake in an initial public offering in the future, though it has not set a date.

But Altera could also be sold entirely to another chipmaker interested in growing its portfolio, and the company has quietly begun exploring whether a sale would be possible, according to one source familiar with its advisory plans and one of the sources familiar with the plans to cut businesses.

Infrastructure chipmaker Marvell is one potential buyer for such a transaction, according to one of the sources.

Bloomberg earlier reported various options for Intel including a potential split of Intel’s product design and manufacturing businesses that is expected to be discussed at the board meeting.

(Reporting by Max A. Cherney in San Francisco and Milana Vinn in New York; Editing by Kenneth Li, Anirban Sen, Paritosh Bansal, Deepa Babington and Mark Porter)

Saudi Arabia seeks Chinese tech as it reinvents itself as car and automation hub

Saudi Arabia is seeking cooperation with Chinese companies in the car sector and automation as a top industrial official kicks off a tour of East Asia this week.

Saudi industry and mineral resources minister Bandar Alkhorayef is leading a delegation to visit Guangzhou, Hong Kong and Singapore from Sunday until September 8, according to a statement from his office. The trip is aimed at improving relations and exploring joint venture opportunities.

China and Saudi Arabia have strengthened ties in recent years while their relations with the United States have soured. Riyadh is looking to diversify its economy and become an industrial hub in the Middle East, while the region is gaining appeal for Chinese companies that want to explore overseas markets in the face of growing containment by the US.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

“The visit of the delegation to China aligns with [the country’s] objective to become a key automotive hub in the region and a leader in innovative [and] eco-friendly vehicle solutions,” Alkhorayef’s office said.

Key meetings in Guangzhou, capital of the southern Chinese province of Guangdong, will include discussions with GAC Group, a major electric vehicle (EV) maker, as well as lithium battery producer General Lithium and communication tech giant Huawei, the statement said.

Saudi Arabian industry and mineral resources minister Bandar Alkhorayef’s visit to Guangzhou, Hong Kong and Singapore is aimed at improving relations and exploring joint venture opportunities. Photo: Handout alt=Saudi Arabian industry and mineral resources minister Bandar Alkhorayef’s visit to Guangzhou, Hong Kong and Singapore is aimed at improving relations and exploring joint venture opportunities. Photo: Handout>

Chinese EV makers are facing punitive tariffs from the European Union and the US, which have accused China of flooding their markets with subsidised EVs that pose a national security risk with their “connected” car technology.

According to Alkhorayef’s office, the automotive sector is a key focus of Saudi Arabia’s national industrial strategy, which emphasises developing the car industry and incorporating innovative technologies.

It added that the talks with Huawei will discuss opportunities for collaboration in “innovative smart solutions” and leveraging technologies for the “Fourth Industrial Revolution”, referring to a 21st century wave of hi-tech progress aided by advancements in artificial intelligence, robotics and the Internet of Things.

“Saudi Arabia aims to attract high-quality investments in 12 promising industrial sectors, including automotive, pharmaceuticals, and food, supported by a stimulating investment environment,” the statement said.

“The visit is expected to result in partnerships that [focus] on mutual growth through high-quality investments, sustainable development, and economic diversification, particularly in strategic industrial sectors.”

According to figures from Saudi Arabia’s Ministry of Industry and Mineral Resources, China is the Middle Eastern kingdom’s biggest trading partner, with trade exceeding US$100 billion in 2023.

The data also shows that Chinese investment in Saudi Arabia last year included US$5.6 billion in original equipment manufacturing for the automotive industry and US$5.26 billion in the minerals sector, with semiconductor investment amounting to US$4.26 billion.

According to official Chinese data, the total value of goods exported to Saudi Arabia from January to July was US$27.55 billion, an increase of nearly 12 per cent compared to the same period last year. Meanwhile, the total value of goods imported from Saudi Arabia decreased by 7.3 per cent compared to the same period last year to US$34.97 billion.

In Hong Kong, the delegation will meet the city’s chief executive as well as officials in charge of technology and industry development.

In Singapore, the Saudi delegation will meet the deputy prime minister and senior trade and science officials.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP’s Facebook and Twitter pages. Copyright © 2024 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2024. South China Morning Post Publishers Ltd. All rights reserved.

Trump Vs. Harris: New Poll Shows Vice President Preserves Pre-DNC Lead, But Needs To Address 3 Key Issues Ahead Of November Election

Vice President Kamala Harris has won over voters with her campaign style, although she will have to address a few issues ahead of the November election, according to the results of poll results published Sunday.

The Tally: Harris had a four-point lead over her Republican rival Donald Trump, among Americans who plan to vote in the Nov. 5 election, in the latest ABC News/Ipsos poll conducted between Aug. 23 and 27. The findings are based on 2,496 completed interviews.

The pollster noted that the four-point lead is roughly in line with the ABC News Washington Post/Ipsos poll conducted before the Democratic National Convention that was held in Chicago on Aug. 19-22.

Further probing of Harris’ supporters showed that while 64% strongly supported her, 18% supported her with reservations, and 19% supported her because they disliked the other candidates. A similar break-up of Trump supporters showed that 60% strongly supported him, 31% supported him with reservations, and 9% supported him because they disliked the other candidates.

Following the DNC, 56% said Harris is handling her campaign well, while 42% rated her handling as poor. This proportion was at 41% and 57%, respectively, for Trump

On the Sept. 10 debate, 43% picked Harris as the potential winner compared to 37% who said they expect Trump to win. On the other hand, 18% said they either expect a tie or don’t expect either of them to win.

Harris outdoes Trump in terms of voters’ view on who is better qualified to serve as president, with the tally at 53%-47% in her favor. This was, however, unchanged from the tally seen before the DNC.

Kennedy’s Impact: Robert F. Kennedy Jr., who has suspended his campaign as an independent and has endorsed Trump, hasn’t made much of a difference with his move, the poll found. Seventy-nine percent of Americans said neither Kennedy’s suspension nor his endorsement of the former president made any difference to her choice.

While 12% said Kennedy’s backing of Trump made them more likely to throw their weight behind the latter, about 9% said they were now less likely to support him.

The Trust Factor: Trump holds an edge when it concerns issues like economy, inflation, and immigration, with the former president leading Harris by 9% on the perceived ability to handle the situation at the U.S.-Mexico border, by 8% on the economy, and 8% on inflation.

That said, Americans backed Harris as more trustworthy for protecting democracy (+7 points) and for appointments to the Supreme Court (+5 points.)

The vice president also has a decisive advantage over Trump on perceived mental and physical fitness, edging out the former by a 57%-25% margin on physical health and by a 47%-37% margin on mental sharpness. This is a sharp contrast from the position when President Joe Biden was still in contention, and he trailed Trump on both aspects.

Did You Know?

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.